| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

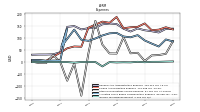

| Weighted Average Number Of Diluted Shares Outstanding | 303.84 | NA | 297.20 | 293.68 | 290.93 | NA | 285.64 | 281.53 | 271.68 | NA | 233.31 | 70.80 | 68.26 | NA | 47.44 | 48.08 | |

| Weighted Average Number Of Shares Outstanding Basic | 303.84 | NA | 297.20 | 293.68 | 290.93 | NA | 285.64 | 281.53 | 271.68 | NA | 233.31 | 70.80 | 64.78 | NA | 47.44 | 48.08 | |

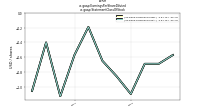

| Earnings Per Share Basic | -0.57 | -0.69 | -0.69 | -1.10 | -0.86 | -0.65 | -0.19 | -0.57 | -1.13 | -0.45 | -1.06 | -0.45 | -0.06 | 0.72 | -1.80 | -0.92 | |

| Earnings Per Share Diluted | -0.57 | -0.69 | -0.69 | -1.10 | -0.86 | -0.65 | -0.19 | -0.57 | -1.13 | -0.40 | -1.06 | -0.45 | -0.47 | 0.72 | -1.80 | -0.92 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

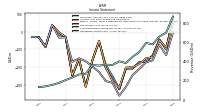

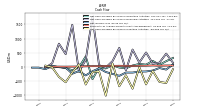

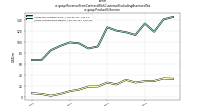

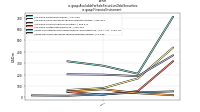

| Revenue From Contract With Customer Excluding Assessed Tax | 179.43 | 175.46 | 148.48 | 163.14 | 139.86 | 149.70 | 144.22 | 153.65 | 111.64 | 107.92 | 111.81 | 110.45 | 99.22 | 87.95 | 73.28 | 129.98 | |

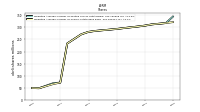

| Revenues | 496.55 | 445.82 | 380.98 | 399.56 | 361.62 | 364.13 | 354.76 | 361.01 | 269.38 | 261.78 | 230.66 | 204.04 | 173.98 | 153.33 | 138.27 | 129.98 | |

| Interest And Fee Income Loans And Leases | 226.16 | 181.44 | 147.76 | 125.86 | 106.14 | 99.12 | 95.25 | 88.67 | 82.94 | 74.86 | 65.92 | 54.24 | 42.50 | 42.20 | 46.44 | 39.75 | |

| Costs And Expenses | 705.99 | 689.65 | 691.01 | 759.09 | 649.09 | 641.36 | 581.31 | 557.21 | 435.46 | 411.45 | 400.12 | 235.76 | 207.27 | 114.01 | 219.78 | 162.61 | |

| General And Administrative Expense | 140.33 | 127.52 | 139.27 | 158.64 | 160.97 | 157.53 | 142.47 | 141.29 | 136.20 | 150.21 | 146.85 | 40.92 | 32.27 | 31.44 | 31.40 | 30.69 | |

| Selling And Marketing Expense | 146.87 | 145.13 | 140.94 | 188.33 | 163.87 | 168.69 | 156.21 | 143.48 | 63.96 | 65.04 | 57.55 | 39.11 | 22.58 | 5.07 | 7.11 | 7.65 | |

| Operating Income Loss | -209.45 | -243.83 | -310.04 | -359.53 | -287.47 | -277.23 | -226.55 | -196.20 | -166.07 | -149.67 | -169.46 | -31.72 | -33.29 | 39.32 | -81.50 | -32.63 | |

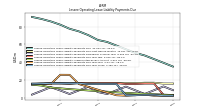

| Interest Expense Debt | 73.93 | 63.01 | 51.19 | 43.75 | 25.07 | 19.42 | 15.82 | 17.70 | 16.75 | 15.62 | 14.66 | 12.06 | 10.35 | 7.82 | 8.20 | 8.17 | |

| Interest Paid Net | 64.87 | 58.27 | 49.02 | 33.08 | 22.82 | 17.20 | 11.18 | 12.95 | 10.20 | 13.12 | 11.86 | 9.78 | 6.93 | 6.01 | 8.15 | NA | |

| Gains Losses On Extinguishment Of Debt | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 112.36 | 103.34 | 106.79 | 121.78 | 119.81 | 110.87 | 98.39 | 88.54 | 93.19 | 135.56 | 139.75 | 6.52 | 6.20 | 5.40 | 7.97 | 8.29 | |

| Income Tax Expense Benefit | 1.04 | -1.32 | -0.84 | -1.57 | -0.18 | -18.12 | 0.26 | 0.28 | 0.17 | -2.45 | -0.07 | 0.08 | 0.10 | 0.09 | 0.09 | 0.09 | |

| Income Taxes Paid | 0.31 | 0.43 | 0.17 | 0.07 | 0.14 | 0.12 | 0.02 | 0.01 | 0.07 | 0.14 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -171.78 | -205.96 | -205.68 | -322.44 | -251.27 | -186.40 | -54.67 | -159.74 | -306.62 | -153.21 | -247.16 | -31.56 | -15.28 | 34.81 | -85.62 | -31.00 | |

| Comprehensive Income Net Of Tax | -181.56 | -199.05 | -201.38 | -314.85 | -278.34 | -201.22 | -51.37 | -158.05 | -310.70 | -151.19 | -244.33 | -29.72 | -3.54 | 35.38 | -86.49 | -31.01 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

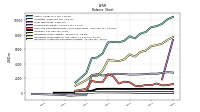

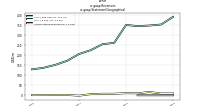

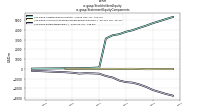

| Assets | 8407.15 | 8155.61 | 7507.85 | 7804.75 | 7165.06 | 6973.79 | 7031.73 | 6952.45 | 5402.10 | 4866.97 | 4766.39 | 2708.12 | NA | 1402.25 | NA | NA | |

| Liabilities | 5840.35 | 5621.43 | 4996.71 | 5294.60 | 4601.62 | 4355.54 | 4455.67 | 4484.13 | 3024.74 | 2285.81 | 2362.37 | 1730.43 | NA | 965.18 | NA | NA | |

| Liabilities And Stockholders Equity | 8407.15 | 8155.61 | 7507.85 | 7804.75 | 7165.06 | 6973.79 | 7031.73 | 6952.45 | 5402.10 | 4866.97 | 4766.39 | 2708.12 | NA | 1402.25 | NA | NA | |

| Stockholders Equity | 2566.80 | 2534.18 | 2511.14 | 2510.15 | 2563.44 | 2618.26 | 2576.05 | 2468.32 | 2377.36 | 2581.15 | 2404.02 | -349.58 | -348.11 | -367.10 | -415.04 | -337.16 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

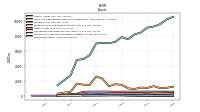

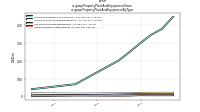

| Cash And Cash Equivalents At Carrying Value | 1079.26 | 892.03 | 972.48 | 1440.33 | 1530.13 | 1255.17 | 2261.94 | 2567.40 | 1439.53 | 1466.56 | 1623.67 | 520.74 | NA | 267.06 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 1488.49 | 1259.94 | 1381.49 | 1864.79 | 1913.54 | 1550.81 | 2675.57 | 2814.80 | 1675.81 | 1692.63 | 1807.00 | 636.79 | 785.87 | 328.13 | 256.53 | 254.78 | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | 1899.21 | 691.57 | 674.96 | 694.76 | 16.17 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

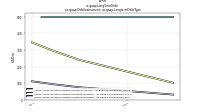

| Property Plant And Equipment Gross | 481.11 | 414.20 | 381.86 | 337.10 | 281.37 | 231.82 | NA | NA | NA | 95.40 | NA | NA | NA | 65.79 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 142.36 | 124.07 | 104.70 | 88.16 | 72.91 | 60.34 | NA | NA | NA | 32.90 | NA | NA | NA | 17.65 | NA | NA | |

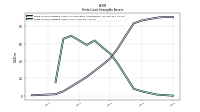

| Amortization Of Intangible Assets | 14.20 | 14.10 | 23.60 | 7.40 | 7.40 | 7.10 | 5.50 | 5.50 | 5.50 | 3.40 | 1.20 | 2.20 | 2.60 | NA | NA | NA | |

| Property Plant And Equipment Net | 338.75 | 290.13 | 277.16 | 248.94 | 208.46 | 171.48 | 141.66 | 113.57 | 84.92 | 62.50 | 53.44 | 49.36 | NA | 48.14 | NA | NA | |

| Goodwill | 536.42 | 542.57 | 537.13 | 527.63 | 525.00 | 539.53 | 547.39 | 541.40 | 540.77 | 516.51 | 261.05 | NA | NA | 1.25 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 19.83 | 34.43 | 48.27 | 63.76 | 71.04 | 78.94 | 60.89 | 66.19 | 71.38 | 67.93 | 18.15 | NA | NA | 2.50 | NA | NA | |

| Finite Lived Intangible Assets Net | 8.18 | 22.46 | 36.49 | 48.33 | 55.62 | 63.52 | 58.39 | 63.69 | 68.88 | 65.43 | 15.65 | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | NA | NA | NA | NA | NA | 43.17 | 33.17 | 30.17 | 11.28 | 11.28 | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | 1907.26 | 694.74 | 675.92 | 695.01 | 16.14 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

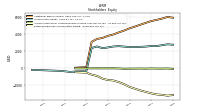

| Stockholders Equity | 2566.80 | 2534.18 | 2511.14 | 2510.15 | 2563.44 | 2618.26 | 2576.05 | 2468.32 | 2377.36 | 2581.15 | 2404.02 | -349.58 | -348.11 | -367.10 | -415.04 | -337.16 | |

| Additional Paid In Capital | 5355.03 | 5140.85 | 4918.76 | 4716.39 | 4454.83 | 4231.30 | 3987.88 | 3828.78 | 3579.76 | 3462.76 | 3134.14 | 142.48 | NA | 80.37 | NA | NA | |

| Retained Earnings Accumulated Deficit | -2763.03 | -2591.25 | -2385.28 | -2179.61 | -1857.17 | -1605.90 | -1419.51 | -1364.84 | -1205.10 | -888.38 | -734.87 | -494.00 | NA | -447.17 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -25.20 | -15.42 | -22.34 | -26.63 | -34.22 | -7.15 | 7.68 | 4.38 | 2.69 | 6.77 | 4.75 | 1.94 | NA | -0.30 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 151.16 | NA | 125.90 | 144.22 | 141.01 | NA | 113.00 | 101.92 | 104.88 | NA | 146.31 | 6.77 | 7.17 | NA | 8.46 | 9.15 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

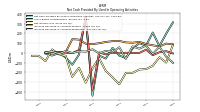

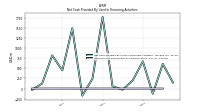

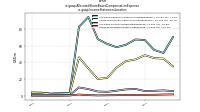

| Net Cash Provided By Used In Operating Activities | 98.90 | 43.79 | -54.27 | -28.55 | 51.22 | -59.11 | -27.98 | -440.25 | 365.15 | -19.91 | -123.26 | -47.66 | -2.30 | -28.45 | -8.21 | NA | |

| Net Cash Provided By Used In Investing Activities | -15.86 | -777.17 | -300.96 | -692.21 | 117.27 | -1025.72 | -166.05 | -190.06 | -629.51 | 84.34 | -199.67 | -548.95 | -357.76 | -20.67 | 40.41 | NA | |

| Net Cash Provided By Used In Financing Activities | 148.81 | 609.55 | -128.96 | 669.81 | 199.54 | -28.88 | 55.79 | 1766.26 | 243.95 | -176.13 | 1488.63 | 447.52 | 817.81 | 120.72 | -30.45 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 98.90 | 43.79 | -54.27 | -28.55 | 51.22 | -59.11 | -27.98 | -440.25 | 365.15 | -19.91 | -123.26 | -47.66 | -2.30 | -28.45 | -8.21 | NA | |

| Net Income Loss | -171.78 | -205.96 | -205.68 | -322.44 | -251.27 | -186.40 | -54.67 | -159.74 | -306.62 | -153.21 | -247.16 | -31.56 | -15.28 | 34.81 | -85.62 | -31.00 | |

| Depreciation Depletion And Amortization | 40.13 | 43.28 | 47.47 | 23.00 | 20.88 | 17.11 | 13.10 | 11.96 | 10.54 | 7.89 | 5.02 | 3.35 | 3.72 | 2.02 | 2.88 | NA | |

| Increase Decrease In Accounts Receivable | 42.21 | 65.91 | -61.63 | 56.77 | 6.65 | 20.23 | -5.65 | 36.04 | 12.08 | 16.47 | -2.62 | 19.25 | -10.18 | 15.04 | 0.95 | NA | |

| Increase Decrease In Accounts Payable | -1.26 | -1.42 | 0.48 | -5.56 | 1.46 | -15.91 | 3.40 | -380.26 | 368.10 | 28.16 | -3.80 | 1.75 | 6.11 | 5.95 | -0.43 | NA | |

| Share Based Compensation | 112.36 | 103.34 | 106.79 | 121.78 | 119.81 | 110.87 | 98.39 | 88.54 | 93.19 | 135.56 | 139.75 | 6.52 | 6.20 | 5.04 | 7.79 | NA | |

| Amortization Of Financing Costs | 5.53 | 7.34 | 11.45 | 0.68 | 1.08 | 2.94 | 3.65 | 4.34 | 5.23 | 2.74 | 1.31 | 1.28 | 1.08 | 0.65 | 0.52 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

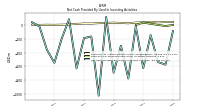

| Net Cash Provided By Used In Investing Activities | -15.86 | -777.17 | -300.96 | -692.21 | 117.27 | -1025.72 | -166.05 | -190.06 | -629.51 | 84.34 | -199.67 | -548.95 | -357.76 | -20.67 | 40.41 | NA | |

| Payments To Acquire Property Plant And Equipment | 35.82 | 24.86 | 30.52 | 34.25 | 31.15 | 27.04 | 21.09 | 21.81 | 16.35 | 7.84 | 5.35 | 2.89 | 4.17 | 2.31 | 5.20 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 148.81 | 609.55 | -128.96 | 669.81 | 199.54 | -28.88 | 55.79 | 1766.26 | 243.95 | -176.13 | 1488.63 | 447.52 | 817.81 | 120.72 | -30.45 | NA | |

| Payments For Repurchase Of Common Stock | NA | 0.00 | 0.00 | 0.00 | 0.11 | 0.00 | 0.08 | 0.00 | 0.00 | 0.01 | 0.00 | 0.20 | 0.58 | 0.00 | 0.40 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 496.55 | 445.82 | 380.98 | 399.56 | 361.62 | 364.13 | 354.76 | 361.01 | 269.38 | 261.78 | 230.66 | 204.04 | 173.98 | 153.33 | 138.27 | 129.98 | |

| NA | NA | NA | 9.12 | 9.01 | 16.57 | 9.97 | 10.53 | 7.78 | 7.61 | 5.80 | -1.90 | 1.74 | 1.51 | 1.07 | 0.73 | ||

| US | NA | NA | NA | 390.39 | 352.58 | 347.51 | 344.73 | 350.49 | 261.60 | 254.17 | 224.86 | 205.94 | 172.24 | 151.82 | 137.20 | 129.25 | |

| Other Geographical | NA | NA | NA | 0.05 | 0.03 | 0.05 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 179.43 | 175.46 | 148.48 | 163.14 | 139.86 | 149.70 | 144.22 | 153.65 | 111.64 | 107.92 | 111.81 | 110.45 | 99.22 | 87.95 | 73.28 | 129.98 | |

| Merchant Network | 145.95 | 141.42 | 119.01 | 134.02 | 113.15 | 118.13 | 121.05 | 127.09 | 92.24 | 88.66 | 98.00 | 99.63 | 93.27 | 85.25 | 67.35 | 67.76 | |

| Virtual Card Network | 33.48 | 34.04 | 29.47 | 29.12 | 26.71 | 31.57 | 23.17 | 26.56 | 19.39 | 19.26 | 13.81 | 10.82 | 5.96 | 2.70 | 5.93 | 7.11 |