| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

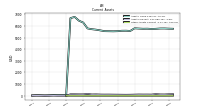

| Common Stock Value | 4.80 | 4.80 | 4.80 | 4.79 | 4.79 | 4.78 | 4.78 | 4.78 | 4.78 | 4.78 | 4.77 | 4.77 | 4.77 | 4.77 | 4.76 | 4.79 | 4.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic | 0.20 | 0.20 | 0.18 | 0.18 | 0.17 | 0.18 | 0.17 | 0.17 | 0.16 | 0.19 | 0.17 | 0.17 | 0.16 | 0.22 | 0.19 | -0.81 | -0.29 | -0.57 | 0.14 | 0.04 | 0.10 | 0.09 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.21 | 0.20 | 0.18 | 0.18 | 0.17 | 0.17 | 0.17 | 0.17 | 0.16 | 0.19 | 0.17 | 0.17 | 0.16 | 0.22 | 0.18 | -0.81 | -0.29 | -0.57 | 0.14 | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

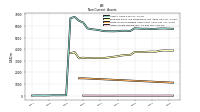

| Revenue From Contract With Customer Including Assessed Tax | 260.17 | 263.84 | 258.29 | 259.48 | 241.55 | 231.03 | 228.91 | 218.49 | 216.49 | 224.80 | 232.79 | 224.12 | 203.86 | 233.41 | 219.74 | 243.71 | 239.07 | 243.79 | 255.62 | 54.11 | 43.49 | 37.82 | 33.15 | 28.45 | 23.77 | 19.07 | 15.33 | 11.55 | 7.56 | 4.81 | 2.73 | 1.85 | |

| Revenues | 260.17 | 263.84 | 258.29 | 259.48 | 241.55 | 231.03 | 228.91 | 218.49 | 216.49 | 224.80 | 232.79 | 224.12 | 203.86 | 233.41 | 219.74 | 243.71 | 239.07 | 243.79 | 255.62 | 54.11 | 43.49 | 37.82 | 33.15 | 28.45 | 23.77 | 19.07 | 15.33 | 11.55 | 7.56 | 4.81 | 2.73 | 1.85 | |

| Operating Expenses | 104.49 | 101.53 | 112.76 | 111.13 | 97.41 | 93.26 | 100.51 | 89.34 | 87.97 | 82.98 | 81.39 | 90.53 | 88.88 | 81.60 | 85.01 | 762.87 | 431.67 | 577.88 | 138.03 | 43.50 | 11.98 | 10.80 | 11.51 | 9.56 | 8.94 | 8.93 | 12.83 | 10.43 | 0.42 | 0.20 | 0.14 | 0.04 | |

| General And Administrative Expense | 17.93 | 17.63 | 18.16 | 17.35 | 14.53 | 13.59 | 16.08 | 17.93 | 16.85 | 14.81 | 14.25 | 17.93 | 13.02 | 13.23 | 12.42 | 13.54 | 33.09 | 30.59 | 34.62 | 19.81 | 3.18 | 2.23 | 2.40 | 0.93 | 0.28 | 0.61 | 3.20 | 2.10 | 0.42 | 0.20 | 0.14 | 0.04 | |

| Operating Income Loss | 155.68 | 162.31 | 145.52 | 148.34 | 144.15 | 137.77 | 128.40 | 129.15 | 128.52 | 141.82 | 151.40 | 133.59 | 114.98 | 151.82 | 134.73 | -519.16 | -192.60 | -334.09 | 117.59 | 10.61 | 31.52 | 27.01 | 21.64 | -9.56 | 14.83 | 10.13 | 2.49 | NA | NA | NA | NA | NA | |

| Interest Income Expense Net | -52.00 | -55.23 | -55.39 | -54.62 | -52.41 | -47.84 | -45.43 | -44.28 | -44.37 | -44.54 | -43.51 | -42.87 | -39.56 | -34.50 | -35.31 | -37.63 | -36.53 | -36.13 | -31.52 | -6.22 | -0.05 | -0.07 | -0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 54.94 | 51.41 | 57.27 | 50.34 | 52.84 | 43.55 | 46.01 | 40.68 | 47.12 | 41.02 | 32.87 | 58.74 | 5.31 | 60.76 | 7.06 | 67.61 | 7.95 | 43.92 | 11.90 | 19.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 8.43 | 8.35 | 8.50 | 6.33 | 5.63 | 5.55 | 5.64 | 2.83 | 3.20 | 3.25 | 3.06 | 4.01 | 3.06 | 3.68 | 2.70 | 3.34 | 20.42 | 20.13 | 21.54 | 11.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 30.86 | 36.66 | 29.09 | 31.67 | 32.70 | 30.33 | 26.40 | 28.07 | 28.58 | 32.04 | 28.48 | 28.02 | 22.19 | 34.98 | 31.92 | -144.78 | -68.24 | -62.27 | 30.42 | 2.38 | 10.07 | 8.92 | 7.23 | 6.09 | 8.92 | 7.16 | 5.75 | 4.42 | 2.86 | 1.82 | 1.04 | 0.70 | |

| Profit Loss | 100.45 | 97.82 | 87.01 | 86.51 | 82.79 | 84.01 | 79.39 | 80.04 | 78.63 | 89.33 | 80.22 | 83.44 | 76.46 | 105.51 | 88.44 | -392.93 | -144.56 | -289.48 | 69.27 | 9.65 | 21.39 | 18.03 | 14.39 | 12.80 | 5.91 | 2.98 | -3.26 | -3.30 | 4.28 | NA | NA | NA | |

| Preferred Stock Dividends Income Statement Impact | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 100.31 | 97.68 | 86.88 | 86.37 | 82.66 | 83.88 | 79.26 | 79.90 | 78.49 | 89.19 | 80.09 | 83.30 | 76.32 | 105.37 | 88.30 | -393.07 | -144.70 | -289.62 | 69.14 | 9.62 | 17.67 | 17.43 | 13.88 | 12.39 | 5.12 | 2.98 | -1.62 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 5737.62 | 5758.71 | 5752.88 | 5770.53 | 5791.32 | 5563.82 | 5585.50 | 5580.59 | 5544.00 | 5533.63 | 5540.74 | 5546.76 | 5610.91 | 5673.50 | 5715.06 | 5781.36 | 6282.88 | 6445.50 | 6769.01 | 6668.43 | 47.70 | 42.26 | 39.41 | 43.09 | 29.76 | 21.54 | 27.08 | 28.59 | 17.37 | NA | NA | NA | |

| Liabilities | 3585.89 | 3607.57 | 3599.84 | 3595.04 | 3599.00 | 3351.97 | 3355.38 | 3320.64 | 3257.30 | 3221.04 | 3212.31 | 3189.89 | 3192.63 | 3188.01 | 3191.87 | 3192.40 | 3139.46 | 2922.47 | 2796.65 | 2632.88 | 16.84 | 17.13 | 16.32 | 21.65 | 14.15 | 12.86 | 8.14 | 13.94 | 7.10 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 5737.62 | 5758.71 | 5752.88 | 5770.53 | 5791.32 | 5563.82 | 5585.50 | 5580.59 | 5544.00 | 5533.63 | 5540.74 | 5546.76 | 5610.91 | 5673.50 | 5715.06 | 5781.36 | 6282.88 | 6445.50 | 6769.01 | 6668.43 | 47.70 | 42.26 | 39.41 | 43.09 | 29.76 | 21.54 | 27.08 | 28.59 | 17.37 | NA | NA | NA | |

| Stockholders Equity | 2151.73 | 2151.14 | 2153.04 | 2175.48 | 2192.32 | 2211.86 | 2230.12 | 2259.95 | 2286.70 | 2312.59 | 2328.44 | 2356.87 | 2418.29 | 2485.49 | 2523.18 | 2588.95 | 3143.41 | 3523.03 | 3972.36 | 4035.55 | 30.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 91.13 | 95.53 | 93.91 | 98.41 | 88.99 | 80.78 | 77.06 | 80.29 | 83.80 | 87.49 | 92.44 | 91.17 | 93.93 | 108.01 | 100.67 | 151.37 | 108.56 | 109.22 | 115.37 | 116.72 | 2.91 | 4.44 | 6.27 | 14.64 | 5.99 | 2.47 | 11.75 | 17.04 | 9.83 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.68 | 0.26 | 0.64 | 2.39 | 3.00 | NA | 1.24 | NA | 7.79 | 1.97 | 2.82 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.68 | 0.26 | 0.64 | 2.39 | 3.00 | 1.24 | 1.24 | NA | 7.79 | 1.97 | 2.82 | 4.25 | 5.30 | 14.48 | 5.99 | NA | NA | NA | 9.61 | NA | NA | NA | |

| Other Assets Current | 1.50 | 0.81 | 0.80 | 1.74 | 1.33 | 0.56 | 0.59 | 0.88 | 0.92 | 0.54 | 0.36 | 0.97 | 1.48 | 0.52 | 0.65 | 1.25 | 1.72 | 3.10 | 3.09 | 3.52 | 0.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

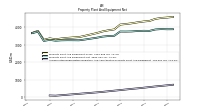

| Property Plant And Equipment Gross | 4326.10 | 4280.25 | 4223.44 | 4181.41 | 4148.70 | 3871.70 | 3821.97 | 3755.34 | 3660.68 | 3583.95 | 3504.97 | 3434.28 | 3411.75 | 3386.73 | 3353.69 | 3304.90 | 3361.06 | 3276.66 | 3788.13 | 3667.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 532.58 | 497.69 | 466.95 | 432.19 | 397.27 | 363.69 | 329.48 | 294.24 | 265.94 | 238.10 | 211.18 | 184.56 | 157.71 | 130.84 | 104.05 | 76.64 | 87.65 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.67 | 17.66 | 17.80 | 17.61 | 17.61 | 17.83 | 28.86 | 8.53 | 1.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 3793.52 | 3782.55 | 3756.50 | 3749.22 | 3751.43 | 3508.01 | 3492.49 | 3461.10 | 3394.75 | 3345.84 | 3293.79 | 3249.73 | 3254.04 | 3255.89 | 3249.64 | 3228.26 | 3273.41 | 3215.98 | 3744.34 | 3659.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 626.65 | 635.95 | 639.89 | 643.12 | 652.77 | 659.01 | 681.56 | 688.11 | 696.01 | 703.78 | 707.52 | 712.07 | 722.48 | 728.33 | 729.82 | 716.78 | 709.64 | 672.31 | 1186.16 | 1153.94 | 43.49 | NA | NA | NA | 23.77 | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 1215.43 | 1233.10 | 1250.77 | 1268.43 | 1286.10 | 1303.77 | 1321.44 | 1339.11 | 1356.78 | 1374.44 | 1392.11 | 1409.78 | 1427.45 | 1445.11 | 1462.91 | 1480.51 | 1498.12 | 1496.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 10.89 | 11.57 | 11.83 | 11.34 | 12.03 | 12.25 | 12.96 | 11.99 | 12.67 | 7.22 | 7.99 | 8.64 | 9.61 | 10.58 | 11.43 | 11.93 | 14.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

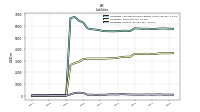

| Liabilities Current | 96.42 | 110.65 | 96.61 | 96.22 | 102.08 | 106.38 | 123.77 | 139.13 | 114.01 | 118.69 | 117.84 | 79.75 | 94.00 | 61.26 | 98.14 | 83.56 | 242.08 | 259.63 | 237.50 | 118.06 | 16.84 | 14.16 | 14.13 | 20.79 | 14.15 | 9.51 | 5.41 | 13.30 | 7.10 | NA | NA | NA | |

| Other Accrued Liabilities Current | 2.29 | 1.73 | 2.04 | 2.39 | 1.39 | 2.67 | 2.41 | 6.68 | 3.33 | 2.74 | 3.32 | 3.38 | 4.03 | 4.85 | 5.64 | 5.92 | 7.34 | 4.11 | 6.76 | 3.79 | 0.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 80.63 | 81.63 | 74.92 | 69.37 | 72.72 | 72.95 | 90.66 | 97.02 | 80.84 | 85.58 | 83.62 | 56.60 | 74.95 | 36.53 | 72.28 | 57.14 | 104.19 | 96.94 | 82.08 | 73.45 | 0.41 | NA | NA | 0.84 | 0.29 | 0.61 | 1.48 | 1.60 | 0.43 | NA | NA | NA | |

| Other Liabilities Current | 0.83 | 0.67 | 0.82 | 1.06 | 1.06 | 6.66 | 6.38 | 4.14 | 4.62 | 5.01 | 5.19 | 5.33 | 5.70 | 2.38 | 3.33 | 3.08 | 3.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 3213.22 | 3258.54 | 3306.67 | 3331.32 | 3361.28 | 3143.17 | 3157.97 | 3133.18 | 3122.91 | 3095.56 | 3087.73 | 3103.43 | 3091.63 | 3121.82 | 3088.78 | 3103.76 | 2892.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 3213.22 | 3258.54 | 3306.67 | 3331.32 | 3361.28 | 3143.17 | 3157.97 | 3133.18 | 3122.91 | 3095.56 | 3087.73 | 3103.43 | 3091.63 | 3121.82 | 3088.78 | 3103.76 | 2892.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 265.88 | 228.64 | 191.98 | 162.88 | 131.22 | 98.52 | 68.19 | 41.79 | 13.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 10.38 | 9.75 | 4.59 | 4.62 | 4.43 | 3.90 | 5.46 | 6.54 | 6.66 | 6.79 | 6.74 | 6.72 | 7.00 | 4.94 | 4.94 | 5.08 | 5.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2151.73 | 2151.14 | 2153.04 | 2175.48 | 2192.32 | 2211.86 | 2230.12 | 2259.95 | 2286.70 | 2312.59 | 2328.44 | 2356.87 | 2418.29 | 2485.49 | 2523.18 | 2588.95 | 3143.41 | 3523.03 | 3972.36 | 4035.55 | 30.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 4.80 | 4.80 | 4.80 | 4.79 | 4.79 | 4.78 | 4.78 | 4.78 | 4.78 | 4.78 | 4.77 | 4.77 | 4.77 | 4.77 | 4.76 | 4.79 | 4.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Additional Paid In Capital | 2046.49 | 2048.52 | 2061.23 | 2084.19 | 2104.74 | 2123.06 | 2198.38 | 2307.61 | 2414.40 | 2518.92 | 2624.09 | 2732.75 | 2877.61 | 3021.28 | 3164.47 | 3318.66 | 3480.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 100.45 | 97.82 | 87.01 | 86.51 | 82.79 | 84.01 | 26.96 | -52.44 | -132.47 | -211.10 | -300.43 | -380.65 | -464.09 | -540.55 | -646.06 | -734.50 | -341.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 208.32 | 202.44 | 185.59 | 182.72 | 168.63 | 176.79 | 169.52 | 184.66 | 164.26 | 185.12 | 194.67 | 165.70 | 206.49 | 184.74 | 241.43 | 120.72 | 192.51 | 177.71 | 182.58 | 69.59 | 25.99 | 22.94 | 11.36 | 23.24 | 14.55 | 11.74 | -5.36 | 7.15 | 4.42 | 2.71 | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -53.70 | -45.30 | -42.06 | -42.15 | -277.87 | -53.26 | -78.55 | -84.15 | -75.88 | -83.66 | -46.05 | -27.65 | -31.23 | -44.66 | -65.96 | -77.38 | -169.38 | -134.89 | -160.22 | -61.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -154.56 | -157.14 | -143.53 | -140.57 | 109.24 | -123.53 | -90.97 | -100.52 | -88.39 | -102.13 | -148.21 | -138.43 | -177.02 | -140.68 | -172.47 | -44.58 | -21.90 | -50.61 | -16.53 | -9.26 | -27.41 | -24.00 | -20.54 | -14.75 | -10.98 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 208.32 | 202.44 | 185.59 | 182.72 | 168.63 | 176.79 | 169.52 | 184.66 | 164.26 | 185.12 | 194.67 | 165.70 | 206.49 | 184.74 | 241.43 | 120.72 | 192.51 | 177.71 | 182.58 | 69.59 | 25.99 | 22.94 | 11.36 | 23.24 | 14.55 | 11.74 | -5.36 | 7.15 | 4.42 | 2.71 | NA | NA | |

| Profit Loss | 100.45 | 97.82 | 87.01 | 86.51 | 82.79 | 84.01 | 79.39 | 80.04 | 78.63 | 89.33 | 80.22 | 83.44 | 76.46 | 105.51 | 88.44 | -392.93 | -144.56 | -289.48 | 69.27 | 9.65 | 21.39 | 18.03 | 14.39 | 12.80 | 5.91 | 2.98 | -3.26 | -3.30 | 4.28 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 0.08 | 0.04 | -0.05 | -0.43 | -1.54 | 1.34 | -0.06 | -0.46 | -0.31 | 0.18 | 0.03 | -0.81 | -0.29 | -0.05 | -0.09 | -1.00 | -0.17 | -0.00 | -0.03 | 0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | -8.98 | 2.10 | -2.95 | 2.06 | -4.25 | 2.75 | -4.28 | 13.76 | -10.36 | 5.69 | 0.58 | 4.79 | -5.04 | 0.74 | -1.12 | 6.61 | -6.13 | 0.99 | -3.17 | -1.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | 37.24 | 36.66 | 29.09 | 31.67 | 32.70 | 30.33 | 26.40 | 28.07 | 28.58 | 32.04 | 28.48 | 28.02 | 21.25 | 34.98 | 31.92 | -88.33 | -67.70 | -62.27 | 30.42 | -2.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 8.43 | 8.35 | 8.50 | 6.33 | 5.63 | 5.55 | 5.64 | 2.83 | 3.20 | 3.25 | 3.06 | 4.01 | 3.06 | 3.68 | 2.70 | 3.34 | 20.42 | 20.13 | 21.54 | 11.42 | 8.79 | 8.57 | 9.11 | 8.63 | 8.66 | 8.32 | 9.63 | 8.32 | NA | NA | NA | NA | |

| Amortization Of Financing Costs | 1.52 | 1.51 | 1.48 | 1.47 | 1.45 | 1.44 | 1.42 | 1.41 | 1.40 | 1.42 | 1.34 | 1.39 | 1.20 | 1.11 | 1.10 | 1.09 | 1.06 | 1.02 | 0.85 | 0.25 | 0.06 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -53.70 | -45.30 | -42.06 | -42.15 | -277.87 | -53.26 | -78.55 | -84.15 | -75.88 | -83.66 | -46.05 | -27.65 | -31.23 | -44.66 | -65.96 | -77.38 | -169.38 | -134.89 | -160.22 | -61.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Productive Assets | 0.00 | 0.00 | 0.00 | 0.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -154.56 | -157.14 | -143.53 | -140.57 | 109.24 | -123.53 | -90.97 | -100.52 | -88.39 | -102.13 | -148.21 | -138.43 | -177.02 | -140.68 | -172.47 | -44.58 | -21.90 | -50.61 | -16.53 | -9.26 | -27.41 | -24.00 | -20.54 | -14.75 | -10.98 | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 107.97 | 107.90 | 110.61 | 108.36 | 107.70 | 107.67 | 109.30 | 108.15 | 107.46 | 107.72 | 108.80 | 147.19 | 146.58 | 146.66 | 147.52 | 148.88 | 155.33 | 154.15 | 152.08 | 30.54 | 26.82 | 23.28 | 20.11 | 13.96 | 10.98 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 260.17 | 263.84 | 258.29 | 259.48 | 241.55 | 231.03 | 228.91 | 218.49 | 216.49 | 224.80 | 232.79 | 224.12 | 203.86 | 233.41 | 219.74 | 243.71 | 239.07 | 243.79 | 255.62 | 54.11 | 43.49 | 37.82 | 33.15 | 28.45 | 23.77 | 19.07 | 15.33 | 11.55 | 7.56 | 4.81 | 2.73 | 1.85 | |

| Operating, Gathering And Compression | 207.45 | 205.72 | 201.80 | 190.31 | 181.84 | 176.37 | 174.80 | 173.17 | 173.92 | 179.44 | 183.40 | 175.89 | 174.86 | 180.87 | 164.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Water Handling | 52.72 | 58.12 | 56.49 | 69.17 | 59.71 | 54.66 | 54.11 | 45.32 | 42.57 | 45.36 | 49.39 | 48.23 | 29.00 | 52.54 | 54.98 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Including Assessed Tax | 260.17 | 263.84 | 258.29 | 259.48 | 241.55 | 231.03 | 228.91 | 218.49 | 216.49 | 224.80 | 232.79 | 224.12 | 203.86 | 233.41 | 219.74 | 243.71 | 239.07 | 243.79 | 255.62 | 54.11 | 43.49 | 37.82 | 33.15 | 28.45 | 23.77 | 19.07 | 15.33 | 11.55 | 7.56 | 4.81 | 2.73 | 1.85 | |

| Operating, Antero Resources Corporation, Gathering And Compression | 216.73 | 214.99 | 211.07 | 199.58 | 191.11 | 185.64 | 184.07 | 182.44 | 183.19 | 188.72 | 192.67 | 185.16 | 184.12 | 190.21 | 173.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Antero Resources Corporation, Water Handling | 60.63 | 66.13 | 64.61 | 77.30 | 67.78 | 61.41 | 62.26 | 53.32 | 50.79 | 53.51 | 57.72 | 56.60 | 37.40 | 61.00 | 63.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Third Party Customers, Water Handling | 0.48 | 0.38 | 0.27 | 0.27 | 0.33 | 1.65 | 0.24 | 0.40 | 0.18 | 0.24 | 0.07 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Service Fee Contract, Water Handling | 6.11 | 5.36 | 5.42 | 6.02 | 5.73 | 4.79 | 4.74 | 5.64 | 5.52 | 3.80 | 3.61 | 3.92 | 3.76 | 2.86 | 2.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fixed Price Contract, Gathering And Compression | 232.23 | 226.99 | 223.07 | 211.58 | 203.11 | 197.64 | 196.07 | 194.44 | 195.19 | 188.72 | 192.67 | 185.16 | 196.12 | 202.21 | 185.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fixed Price Contract, Water Handling | 36.91 | 41.37 | 40.67 | 47.10 | 42.27 | 38.92 | 41.36 | 32.44 | 29.16 | 33.00 | 37.75 | 37.36 | 15.59 | 40.40 | 36.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Time And Materials Contract, Water Handling | 18.09 | 19.79 | 18.80 | 24.45 | 20.11 | 19.35 | 16.40 | 15.64 | 16.28 | 16.95 | 16.43 | 15.35 | 18.05 | 17.74 | 23.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Antero Resources Corporation | 277.35 | 281.12 | 275.68 | 276.87 | 258.89 | 247.05 | 246.33 | 235.76 | 233.98 | 242.23 | 250.38 | 241.76 | 221.52 | 251.22 | 237.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Third Party Customers | 0.48 | 0.38 | 0.27 | 0.27 | 0.33 | 1.65 | 0.24 | 0.40 | 0.18 | 0.24 | 0.07 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Gathering Transportation Marketing And Processing Affiliate | 216.73 | 214.99 | 211.07 | 199.58 | 191.11 | 185.64 | 184.07 | 182.44 | 183.19 | 188.72 | 192.67 | 185.16 | 184.12 | 190.21 | 173.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Water Handling And Treatment | 0.48 | 0.38 | 0.27 | 0.27 | 0.33 | 1.65 | 0.24 | 0.40 | 0.18 | 0.24 | 0.07 | 0.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Natural Gas Water Handling And Treatment Affiliate | 60.63 | 66.13 | 64.61 | 77.30 | 67.78 | 61.41 | 62.26 | 53.32 | 50.79 | 53.51 | 57.72 | 56.60 | 37.40 | 61.00 | 63.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Compression, Gathering And Compression | 64.09 | 62.90 | 61.56 | 58.39 | 54.87 | 52.36 | 51.49 | 51.61 | 51.72 | 49.77 | 49.37 | 48.14 | 49.58 | 51.88 | 48.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Fresh Water Delivery, Water Handling | 36.43 | 40.99 | 40.40 | 46.83 | 41.94 | 38.45 | 41.12 | 32.04 | 29.16 | 33.00 | 37.75 | 37.36 | 15.59 | 40.40 | 36.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gathering High Pressure, Gathering And Compression | 59.54 | 57.36 | 56.46 | 53.55 | 52.44 | 53.19 | 52.92 | 53.39 | 53.74 | 51.81 | 51.53 | 50.72 | 52.67 | 57.66 | 51.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gathering Low Pressure, Gathering And Compression | 108.59 | 106.73 | 105.04 | 99.64 | 95.81 | 92.09 | 91.66 | 89.44 | 89.73 | 87.14 | 91.76 | 86.31 | 93.88 | 92.67 | 85.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gathering Low Pressure Fee Reduction, Gathering And Compression | -15.50 | -12.00 | -12.00 | -12.00 | -12.00 | -12.00 | -12.00 | -12.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Fluid Handling, Water Handling | 24.68 | 25.53 | 24.49 | 30.74 | 26.17 | 24.62 | 21.38 | 21.67 | 21.80 | 20.75 | 20.04 | 19.27 | 21.80 | 20.60 | 26.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |