| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | NA | NA | 0.05 | 0.05 | 0.05 | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | NA | NA | NA | NA | NA | NA | NA | |

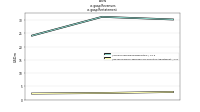

| Weighted Average Number Of Diluted Shares Outstanding | 54.10 | 53.40 | 53.30 | NA | 53.20 | 53.20 | 53.00 | NA | 49.80 | 48.90 | 48.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 54.10 | 53.40 | 53.30 | NA | 53.20 | 53.20 | 53.00 | NA | 49.80 | 48.90 | 48.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic | -1.18 | -1.25 | -1.54 | -1.55 | -1.24 | -1.32 | -1.20 | -1.01 | -0.94 | -1.03 | -0.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -1.18 | -1.25 | -1.54 | -1.55 | -1.24 | -1.32 | -1.20 | -1.01 | -0.94 | -1.03 | -0.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

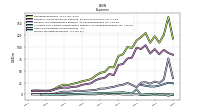

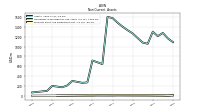

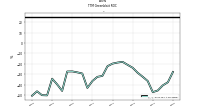

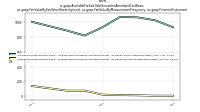

| Revenue From Contract With Customer Excluding Assessed Tax | 34.60 | 54.50 | 32.50 | 45.60 | 30.30 | 31.30 | 24.20 | 26.40 | 9.28 | 5.54 | 5.50 | 2.30 | 7.60 | 5.75 | 6.24 | 4.89 | 30.05 | 4.02 | 4.02 | 3.44 | 3.38 | 3.40 | 4.11 | 2.57 | 1.67 | 1.67 | 1.67 | |

| Revenues | 34.60 | 54.50 | 32.50 | 45.60 | 30.30 | 31.30 | 24.20 | 26.33 | 9.28 | 5.54 | 5.54 | 2.22 | 7.60 | 5.75 | 6.24 | 4.89 | 30.05 | 4.02 | 4.02 | 3.44 | 3.38 | 3.40 | 4.11 | 2.57 | 1.67 | 1.67 | 1.67 | |

| Operating Expenses | 108.50 | 129.10 | 120.20 | 113.40 | 97.50 | 99.60 | 84.20 | 80.78 | 56.62 | 57.42 | 47.19 | 45.43 | 39.34 | 32.23 | 29.65 | 27.68 | 24.55 | 22.44 | 19.83 | 20.38 | 17.43 | 11.92 | 8.39 | 7.88 | 8.08 | 8.39 | 7.99 | |

| Research And Development Expense | 85.90 | 103.40 | 95.30 | 98.30 | 77.50 | 75.30 | 64.00 | 61.92 | 40.60 | 43.01 | 34.87 | 33.20 | 30.01 | 23.42 | 21.73 | 20.41 | 16.59 | 16.00 | 14.19 | 14.56 | 13.15 | 10.34 | 7.14 | 6.69 | 7.22 | 7.82 | 7.06 | |

| General And Administrative Expense | 22.60 | 25.70 | 24.90 | 15.10 | 20.00 | 24.30 | 20.20 | 18.86 | 16.01 | 14.41 | 12.32 | 12.23 | 9.33 | 8.82 | 7.93 | 7.27 | 7.96 | 6.44 | 5.64 | 5.82 | 4.28 | 1.58 | 1.25 | 1.19 | 0.86 | 0.57 | 0.93 | |

| Operating Income Loss | -73.90 | -74.60 | -87.70 | -67.80 | -67.20 | -68.30 | -60.00 | -54.45 | -47.33 | -51.88 | -41.65 | -43.21 | -31.75 | -26.48 | -23.41 | -22.79 | 5.50 | -18.42 | -15.81 | -16.94 | -14.06 | -8.52 | -4.28 | -5.31 | -6.41 | -6.72 | -6.32 | |

| Interest Income Expense Net | NA | NA | NA | NA | 3.40 | 1.80 | 1.20 | NA | 0.30 | 0.40 | 0.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | -63.90 | -65.60 | -81.20 | -69.30 | -61.10 | -64.10 | -56.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.00 | -0.30 | -0.40 | 10.80 | 2.20 | 3.40 | 4.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | 0.00 | 0.00 | NA | NA | |

| Income Taxes Paid Net | 0.10 | NA | NA | 3.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | NA | NA | NA | NA | -66.20 | -70.00 | -63.40 | -53.00 | -46.75 | -50.29 | -40.96 | -41.55 | -30.82 | -25.23 | -21.74 | -21.05 | -17.68 | -17.16 | -14.40 | -16.09 | -13.39 | -7.85 | -4.15 | -4.73 | NA | NA | NA | |

| Net Income Loss | -64.00 | -66.60 | -81.90 | -82.90 | -66.20 | -70.00 | -63.40 | -53.00 | -46.75 | -50.29 | -40.96 | -41.55 | -30.82 | -25.23 | -21.74 | -21.05 | -17.68 | -17.16 | -14.40 | -16.09 | -13.39 | -7.85 | -4.15 | -4.73 | -6.40 | -6.68 | -6.25 | |

| Comprehensive Income Net Of Tax | -61.00 | -66.20 | -75.30 | -77.20 | -69.00 | -73.30 | -77.50 | -56.96 | -46.94 | -50.53 | -41.77 | -42.07 | -31.40 | -22.96 | -22.45 | -21.14 | -17.78 | -16.94 | -14.11 | -16.26 | -13.34 | -7.88 | -4.21 | -4.73 | -6.39 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

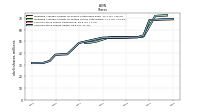

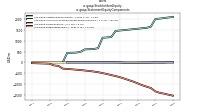

| Assets | 1058.30 | 1083.50 | 1175.80 | 1268.80 | 1334.80 | 1407.00 | 1488.30 | 1581.60 | 1604.87 | 644.03 | 681.77 | 717.37 | 271.95 | 262.58 | 282.45 | 301.64 | 209.09 | 172.05 | 186.57 | 199.28 | 98.89 | NA | NA | 66.85 | NA | NA | NA | |

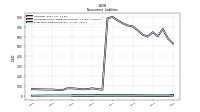

| Liabilities | 601.10 | 619.90 | 664.80 | 703.90 | 713.30 | 736.40 | 765.00 | 799.90 | 787.13 | 61.08 | 66.47 | 75.11 | 66.83 | 64.80 | 70.74 | 74.96 | 74.93 | 55.54 | 58.83 | 62.61 | 62.56 | NA | NA | 66.60 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1058.30 | 1083.50 | 1175.80 | 1268.80 | 1334.80 | 1407.00 | 1488.30 | 1581.60 | 1604.87 | 644.03 | 681.77 | 717.37 | 271.95 | 262.58 | 282.45 | 301.64 | 209.09 | 172.05 | 186.57 | 199.28 | 98.89 | NA | NA | 66.85 | NA | NA | NA | |

| Stockholders Equity | 457.20 | 463.60 | 511.00 | 564.90 | 621.50 | 670.60 | 723.30 | 781.70 | 817.74 | 582.95 | 615.30 | 642.26 | 205.12 | 197.78 | 211.71 | 226.69 | 134.16 | 116.51 | 127.74 | 136.67 | -278.84 | -158.52 | -136.78 | -61.23 | -52.02 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

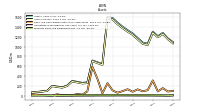

| Assets Current | 1033.00 | 1056.70 | 1148.20 | 1240.20 | 1304.70 | 1376.40 | 1457.00 | 1552.50 | 1576.15 | 627.73 | 664.66 | 703.09 | 257.98 | 249.58 | 270.20 | 290.88 | 199.66 | 163.26 | 179.74 | 195.68 | 95.52 | NA | NA | 65.53 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 113.70 | 90.60 | 130.20 | 81.30 | 132.60 | 93.20 | 62.30 | 108.30 | 255.66 | 48.73 | 346.07 | 588.37 | 88.99 | 21.59 | 36.11 | 9.21 | 12.14 | 11.34 | 28.79 | 3.19 | 6.19 | NA | NA | 30.91 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 119.20 | 96.10 | 135.70 | 86.80 | 138.10 | 97.70 | 66.80 | 112.80 | 260.16 | 53.23 | 346.07 | 588.37 | 88.99 | 21.59 | 36.11 | 9.21 | 12.14 | 11.34 | 28.79 | 3.19 | 6.19 | 3.35 | 60.83 | 30.91 | 2.46 | NA | NA | |

| Marketable Securities Current | 884.80 | 948.20 | 993.30 | 1124.00 | 1138.10 | 1250.00 | 1366.10 | 1394.30 | 1288.81 | 551.85 | 305.20 | 100.16 | 159.57 | 221.10 | 226.73 | 271.66 | 178.38 | 147.83 | 146.18 | 184.64 | 83.60 | NA | NA | 8.26 | NA | NA | NA | |

| Accounts Receivable Net Current | 15.70 | 0.10 | NA | 1.00 | 1.00 | 1.40 | NA | 15.00 | 1.88 | NA | NA | 1.00 | 2.44 | NA | NA | NA | 0.06 | NA | NA | 2.78 | NA | NA | NA | 25.00 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 8.40 | 7.60 | 14.50 | 21.40 | 21.70 | 20.60 | 17.40 | 19.70 | 18.54 | 15.24 | 8.21 | 6.11 | 3.46 | 3.32 | 3.48 | 3.73 | 3.95 | 2.69 | 2.30 | 2.82 | 3.55 | NA | NA | 0.32 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

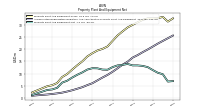

| Property Plant And Equipment Gross | 32.60 | 32.00 | 31.00 | 30.00 | 28.90 | 27.30 | 25.60 | 23.40 | 21.14 | 20.13 | 19.48 | 18.39 | 17.07 | 15.05 | 13.45 | 11.72 | 9.89 | 8.64 | 6.21 | 5.32 | 4.86 | NA | NA | 2.33 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 19.90 | 18.80 | 17.60 | 16.60 | 14.90 | 13.70 | 12.20 | 10.80 | 9.51 | 8.43 | 7.27 | 6.13 | 5.36 | 4.51 | 3.88 | 3.26 | 2.74 | 2.28 | 1.98 | 1.73 | 1.51 | NA | NA | 1.03 | NA | NA | NA | |

| Property Plant And Equipment Net | 12.70 | 13.20 | 13.40 | 13.40 | 14.00 | 13.60 | 13.40 | 12.70 | 11.63 | 11.70 | 12.21 | 12.26 | 11.71 | 10.54 | 9.58 | 8.46 | 7.15 | 6.37 | 4.23 | 3.58 | 3.35 | NA | NA | 1.30 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

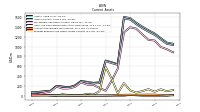

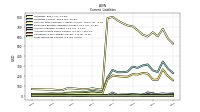

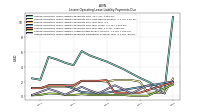

| Liabilities Current | 317.30 | 306.90 | 282.90 | 295.10 | 244.60 | 238.20 | 238.00 | 261.70 | 182.51 | 41.82 | 40.37 | 49.09 | 39.53 | 33.72 | 33.17 | 32.81 | 29.40 | 20.95 | 20.60 | 22.98 | 19.85 | NA | NA | 17.85 | NA | NA | NA | |

| Long Term Debt Current | 0.20 | 0.10 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.07 | 0.11 | 0.15 | 0.19 | NA | NA | 0.16 | NA | NA | NA | |

| Accounts Payable Current | 34.30 | 6.70 | 12.30 | 5.70 | 7.90 | 12.30 | 8.60 | 31.30 | 4.67 | 4.98 | 9.00 | 7.12 | 5.09 | 2.43 | 3.02 | 4.56 | 2.28 | 1.41 | 1.56 | 2.76 | 1.30 | NA | NA | 0.60 | NA | NA | NA | |

| Accounts Payable And Accrued Liabilities Current | 91.00 | 74.80 | 66.00 | 74.70 | 49.70 | 42.10 | NA | 54.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Income Taxes Current | 1.10 | 1.00 | 10.10 | 10.30 | 2.00 | NA | 4.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | NA | NA | NA | NA | NA | NA | 30.20 | 23.10 | 13.77 | 13.47 | 8.00 | 18.86 | 12.14 | 7.40 | 6.78 | 7.60 | 6.23 | 4.00 | 2.95 | 4.00 | 4.85 | NA | NA | 3.55 | NA | NA | NA | |

| Contract With Customer Liability Current | 224.20 | 230.10 | 214.90 | 218.60 | 193.10 | 194.40 | 197.50 | 206.20 | 162.94 | 22.15 | 22.15 | 22.15 | 21.36 | 22.96 | 22.46 | 19.98 | 20.29 | 14.82 | 15.44 | 16.07 | 13.50 | NA | NA | 13.55 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 | 2.00 | 2.00 | NA | NA | 2.00 | 2.00 | 2.08 | 2.12 | 2.17 | 2.21 | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 0.80 | 0.90 | 0.90 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | NA | NA | 0.15 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 1.10 | 1.60 | 2.10 | 2.70 | 3.10 | 3.60 | 4.10 | 2.90 | 3.19 | 3.40 | 3.70 | 1.09 | 1.35 | 1.59 | 1.84 | 1.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

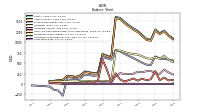

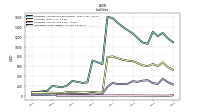

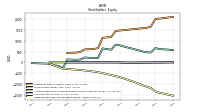

| Stockholders Equity | 457.20 | 463.60 | 511.00 | 564.90 | 621.50 | 670.60 | 723.30 | 781.70 | 817.74 | 582.95 | 615.30 | 642.26 | 205.12 | 197.78 | 211.71 | 226.69 | 134.16 | 116.51 | 127.74 | 136.67 | -278.84 | -158.52 | -136.78 | -61.23 | -52.02 | NA | NA | |

| Common Stock Value | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | NA | NA | 0.05 | 0.05 | 0.05 | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 | 0.03 | 0.03 | 0.03 | 0.03 | NA | NA | NA | NA | NA | NA | NA | |

| Additional Paid In Capital | 1644.20 | 1589.60 | 1570.80 | 1549.40 | 1528.70 | 1508.80 | 1488.30 | 1469.20 | 1448.25 | 1166.53 | 1148.35 | 1133.54 | 654.34 | 615.60 | 606.57 | 599.10 | 485.44 | 450.01 | 444.30 | 439.12 | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1177.90 | -1113.90 | -1047.30 | -965.40 | -882.50 | -816.30 | -746.30 | -682.90 | -629.89 | -583.14 | -532.85 | -491.89 | -450.34 | -419.52 | -394.30 | -372.56 | -351.51 | -333.83 | -316.67 | -302.26 | -286.18 | NA | NA | -62.42 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -9.20 | -12.20 | -12.60 | -19.20 | -24.80 | -22.00 | -18.70 | -4.60 | -0.68 | -0.49 | -0.24 | 0.56 | 1.08 | 1.66 | -0.60 | 0.11 | 0.20 | 0.30 | 0.08 | -0.22 | -0.05 | NA | NA | -0.01 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 36.00 | NA | NA | NA | NA | NA | NA | -0.04 | 259.94 | NA | NA | NA | NA | NA | NA | 107.63 | 29.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 16.70 | 18.30 | 19.90 | 20.10 | 18.80 | 20.00 | 16.60 | 16.98 | 15.22 | 14.57 | 10.33 | 8.11 | 8.25 | 7.75 | 6.12 | 4.98 | 4.60 | 5.31 | 5.18 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

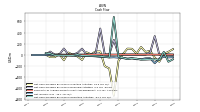

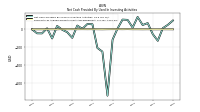

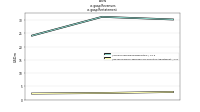

| Net Cash Provided By Used In Operating Activities | -84.80 | -88.70 | -91.20 | -71.20 | -66.60 | -78.60 | -57.10 | -35.75 | 681.53 | -47.40 | -38.97 | -29.02 | -22.38 | -21.40 | -16.95 | -16.18 | 1.85 | -13.57 | -12.73 | -12.25 | -10.99 | -12.18 | 19.30 | 28.16 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 70.00 | 48.60 | 138.60 | 19.40 | 105.80 | 109.00 | 8.60 | -115.63 | -741.10 | -249.05 | -207.82 | 56.86 | 59.28 | 5.61 | 42.49 | -95.43 | -31.81 | -4.23 | 38.37 | -101.86 | 11.80 | -45.26 | -44.34 | 0.34 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 37.90 | 0.50 | 1.50 | 0.50 | 1.20 | 0.50 | 2.50 | 4.00 | 266.51 | 3.61 | 4.48 | 471.54 | 30.50 | 1.28 | 1.35 | 108.68 | 30.75 | 0.35 | -0.05 | 111.11 | 2.03 | -0.04 | 54.96 | -0.04 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -84.80 | -88.70 | -91.20 | -71.20 | -66.60 | -78.60 | -57.10 | -35.75 | 681.53 | -47.40 | -38.97 | -29.02 | -22.38 | -21.40 | -16.95 | -16.18 | 1.85 | -13.57 | -12.73 | -12.25 | -10.99 | -12.18 | 19.30 | 28.16 | NA | NA | NA | |

| Net Income Loss | -64.00 | -66.60 | -81.90 | -82.90 | -66.20 | -70.00 | -63.40 | -53.00 | -46.75 | -50.29 | -40.96 | -41.55 | -30.82 | -25.23 | -21.74 | -21.05 | -17.68 | -17.16 | -14.40 | -16.09 | -13.39 | -7.85 | -4.15 | -4.73 | -6.40 | -6.68 | -6.25 | |

| Profit Loss | NA | NA | NA | NA | -66.20 | -70.00 | -63.40 | -53.00 | -46.75 | -50.29 | -40.96 | -41.55 | -30.82 | -25.23 | -21.74 | -21.05 | -17.68 | -17.16 | -14.40 | -16.09 | -13.39 | -7.85 | -4.15 | -4.73 | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 15.60 | 0.10 | -1.00 | 0.00 | -0.40 | 1.40 | -15.00 | 13.12 | 1.88 | 0.00 | -1.00 | -1.44 | 2.44 | 0.00 | 0.00 | -0.06 | 0.06 | 0.00 | -2.78 | 2.78 | 0.00 | 0.00 | -25.00 | 25.00 | NA | NA | NA | |

| Increase Decrease In Accounts Payable | NA | NA | NA | NA | NA | NA | -22.60 | 26.23 | -0.08 | -4.22 | 1.77 | 2.29 | 2.03 | -0.37 | -1.91 | 2.23 | 0.80 | 0.28 | -1.70 | 1.30 | -0.36 | -0.31 | 1.37 | -0.32 | NA | NA | NA | |

| Share Based Compensation | 16.70 | 18.30 | 19.90 | 20.10 | 18.80 | 20.00 | 16.60 | 16.98 | 15.22 | 14.57 | 10.33 | 8.11 | 8.25 | 7.75 | 6.12 | 4.98 | 4.60 | 5.31 | 5.18 | 5.44 | 5.06 | 0.98 | 0.15 | 0.08 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 70.00 | 48.60 | 138.60 | 19.40 | 105.80 | 109.00 | 8.60 | -115.63 | -741.10 | -249.05 | -207.82 | 56.86 | 59.28 | 5.61 | 42.49 | -95.43 | -31.81 | -4.23 | 38.37 | -101.86 | 11.80 | -45.26 | -44.34 | 0.34 | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 1.10 | 0.60 | 1.10 | 1.10 | 2.20 | 1.40 | 2.10 | 1.89 | 1.35 | 0.47 | 0.99 | 1.85 | 1.41 | 1.82 | 1.36 | 1.79 | 1.19 | 2.89 | 0.38 | 0.62 | 0.94 | 0.63 | 0.64 | 0.43 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 37.90 | 0.50 | 1.50 | 0.50 | 1.20 | 0.50 | 2.50 | 4.00 | 266.51 | 3.61 | 4.48 | 471.54 | 30.50 | 1.28 | 1.35 | 108.68 | 30.75 | 0.35 | -0.05 | 111.11 | 2.03 | -0.04 | 54.96 | -0.04 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 34.60 | 54.50 | 32.50 | 45.60 | 30.30 | 31.30 | 24.20 | 26.33 | 9.28 | 5.54 | 5.54 | 2.22 | 7.60 | 5.75 | 6.24 | 4.89 | 30.05 | 4.02 | 4.02 | 3.44 | 3.38 | 3.40 | 4.11 | 2.57 | 1.67 | 1.67 | 1.67 | |

| NA | NA | NA | NA | 2.90 | 2.50 | 2.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| NA | NA | NA | NA | 30.30 | 31.30 | 24.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| Revenue From Contract With Customer Excluding Assessed Tax | 34.60 | 54.50 | 32.50 | 45.60 | 30.30 | 31.30 | 24.20 | 26.40 | 9.28 | 5.54 | 5.50 | 2.30 | 7.60 | 5.75 | 6.24 | 4.89 | 30.05 | 4.02 | 4.02 | 3.44 | 3.38 | 3.40 | 4.11 | 2.57 | 1.67 | 1.67 | 1.67 |