| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

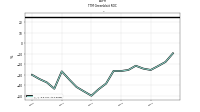

| Weighted Average Number Of Diluted Shares Outstanding | 142.85 | 142.78 | 142.64 | NA | 141.86 | 141.73 | 141.68 | NA | 128.44 | 128.22 | 127.40 | NA | 122.36 | 112.58 | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 142.85 | 142.78 | 142.64 | NA | 141.86 | 141.73 | 141.68 | NA | 128.44 | 128.22 | 127.40 | NA | 122.36 | 112.58 | NA | NA | NA | NA | NA | |

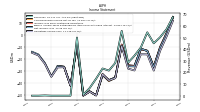

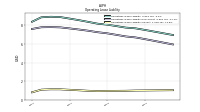

| Earnings Per Share Basic | -0.09 | -0.08 | -0.18 | -0.18 | -0.06 | -0.25 | -0.27 | -0.25 | -0.39 | -0.37 | -0.40 | -0.06 | -0.34 | -0.24 | -0.23 | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.09 | -0.08 | -0.18 | -0.18 | -0.06 | -0.25 | -0.27 | -0.25 | -0.39 | -0.37 | -0.40 | -0.06 | -0.34 | -0.24 | -0.23 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

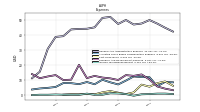

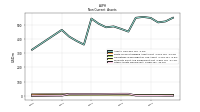

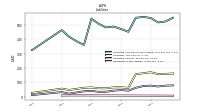

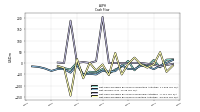

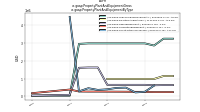

| Revenue From Contract With Customer Excluding Assessed Tax | 54.52 | 41.49 | 34.41 | 28.43 | 55.78 | 28.19 | 21.62 | 23.40 | 14.67 | 6.62 | 0.91 | 50.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.23 | 0.03 | 0.03 | |

| Revenues | 54.52 | 41.49 | 34.41 | 28.43 | 55.78 | 28.19 | 21.62 | 23.40 | 14.67 | 6.62 | 0.91 | 50.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.23 | 0.03 | 0.03 | |

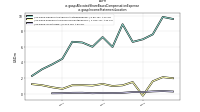

| Cost Of Revenue | 6.77 | 1.56 | 0.42 | 1.36 | 2.45 | 1.60 | 0.26 | 0.48 | 0.25 | 0.31 | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | |

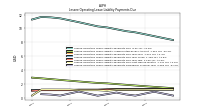

| Operating Expenses | NA | NA | NA | 56.53 | 65.28 | 64.18 | 59.51 | 56.11 | 65.02 | 53.75 | 51.46 | 58.08 | 42.34 | 26.89 | 27.09 | 34.87 | 24.30 | 17.17 | 14.92 | |

| Costs And Expenses | 70.78 | 57.66 | 63.99 | 56.53 | 65.28 | 64.18 | 59.51 | 56.11 | 65.02 | 53.75 | 51.46 | 58.08 | 42.34 | 26.89 | 27.09 | NA | NA | NA | NA | |

| Research And Development Expense | 13.61 | 12.65 | 13.16 | 9.87 | 10.97 | 11.53 | 12.62 | 11.15 | 20.07 | 10.09 | 9.83 | 13.17 | 12.24 | 11.08 | 13.84 | NA | NA | NA | NA | |

| General And Administrative Expense | 47.76 | 47.08 | 50.12 | 47.47 | 52.17 | 51.53 | 45.20 | 44.24 | 44.13 | 43.79 | 39.28 | 38.78 | 30.70 | 15.45 | 11.05 | NA | NA | NA | NA | |

| Operating Income Loss | -16.26 | -16.17 | -29.58 | -28.10 | -9.50 | -35.99 | -37.88 | -32.70 | -50.35 | -47.13 | -50.54 | -8.05 | -42.31 | -26.86 | -27.06 | -34.84 | -24.07 | -17.14 | -14.89 | |

| Interest Expense | 1.40 | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense Nonoperating Net | 4.51 | 4.10 | 3.81 | 2.91 | 1.46 | 0.48 | 0.26 | 0.11 | 0.11 | 0.14 | 0.17 | 0.14 | 0.17 | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 11.81 | 12.27 | 9.47 | 6.90 | 8.32 | 10.05 | 7.02 | 8.53 | 7.09 | 7.75 | 7.82 | 5.19 | 4.61 | 4.20 | 3.50 | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.30 | -0.64 | 0.44 | 0.85 | 0.95 | 0.01 | 0.01 | 0.73 | 0.01 | 0.02 | 0.01 | 0.16 | -0.01 | 0.00 | -0.24 | NA | NA | NA | NA | |

| Income Taxes Paid Net | 0.06 | 0.28 | 0.00 | NA | 0.00 | NA | NA | NA | 0.47 | NA | NA | NA | 0.11 | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | NA | NA | NA | 0.47 | 0.33 | -0.23 | -0.77 | -0.06 | -0.00 | 0.01 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -13.45 | -11.49 | -26.21 | -26.05 | -8.99 | -35.52 | -37.63 | -33.32 | -50.26 | -47.01 | -50.38 | -8.07 | -42.13 | -26.54 | -25.93 | -34.46 | -23.45 | -16.38 | -14.10 | |

| Comprehensive Income Net Of Tax | -13.37 | -11.52 | -26.13 | -25.58 | -8.66 | -35.75 | -38.40 | -33.38 | -50.26 | -47.00 | -50.37 | -8.07 | -42.13 | -26.54 | -25.93 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

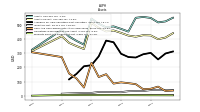

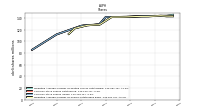

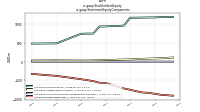

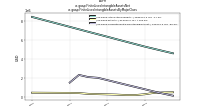

| Assets | 555.01 | 548.90 | 451.76 | 470.86 | 488.29 | 482.15 | 506.90 | 543.37 | 360.07 | 386.27 | 417.08 | 463.66 | NA | NA | NA | 324.30 | NA | NA | NA | |

| Liabilities | 163.14 | 156.61 | 61.35 | 65.42 | 64.87 | 58.38 | 58.78 | 64.28 | 61.89 | 54.01 | 46.85 | 55.91 | NA | NA | NA | 25.70 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 555.01 | 548.90 | 451.76 | 470.86 | 488.29 | 482.15 | 506.90 | 543.37 | 360.07 | 386.27 | 417.08 | 463.66 | NA | NA | NA | 324.30 | NA | NA | NA | |

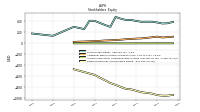

| Stockholders Equity | 391.88 | 392.29 | 390.41 | 405.44 | 423.43 | 423.77 | 448.12 | 479.09 | 298.17 | 332.26 | 370.23 | 407.75 | 409.44 | 257.70 | 279.09 | 298.60 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

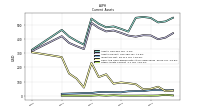

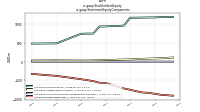

| Assets Current | 426.47 | 415.91 | 423.65 | 442.54 | 459.70 | 453.19 | 477.62 | 513.32 | 329.22 | 349.69 | 372.25 | 419.43 | NA | NA | NA | 315.14 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 45.56 | 81.39 | 88.33 | 94.09 | 85.34 | 151.41 | 131.64 | 231.64 | 57.59 | 121.56 | 156.59 | 272.35 | NA | NA | NA | 306.02 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 46.40 | 81.71 | 89.00 | 94.17 | 86.05 | 151.63 | 132.54 | 231.90 | 57.59 | 121.56 | 156.59 | 272.35 | 248.76 | 232.41 | 274.21 | 306.02 | NA | NA | NA | |

| Inventory Net | 32.82 | 33.16 | 31.75 | 24.75 | 25.32 | 25.86 | 26.27 | 19.33 | 19.29 | 17.38 | 15.94 | 13.93 | NA | NA | NA | NA | NA | NA | NA | |

| Inventory Finished Goods | 1.10 | 2.30 | 3.90 | 3.90 | 2.70 | 1.40 | NA | NA | NA | 3.58 | 1.57 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Current | 1.65 | 1.21 | 1.23 | 1.33 | 3.81 | 1.09 | 3.97 | 0.80 | 0.73 | 0.89 | 1.18 | 1.02 | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | NA | NA | NA | NA | NA | 17.42 | 12.20 | 12.51 | 13.71 | 9.16 | 6.86 | 7.17 | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 292.10 | 269.00 | 272.50 | 295.50 | 376.60 | 388.40 | 277.40 | 214.90 | 207.30 | 153.60 | 115.20 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

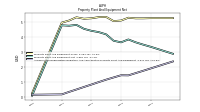

| Property Plant And Equipment Gross | 5.25 | 5.25 | 5.29 | 5.11 | 5.07 | 5.34 | 5.33 | 5.25 | 5.22 | 5.32 | 5.10 | 4.96 | NA | NA | NA | 0.25 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 1.75 | 1.60 | 1.45 | 1.46 | 1.31 | 1.16 | 1.00 | 0.84 | 0.67 | 0.51 | 0.35 | 0.18 | NA | NA | NA | 0.16 | NA | NA | NA | |

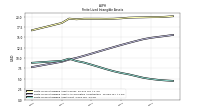

| Amortization Of Intangible Assets | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.52 | 0.52 | 0.54 | 0.52 | 0.39 | 0.32 | 0.30 | 0.29 | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 3.50 | 3.65 | 3.84 | 3.65 | 3.76 | 4.18 | 4.33 | 4.42 | 4.55 | 4.81 | 4.76 | 4.79 | NA | NA | NA | 0.09 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 5.26 | 5.68 | 6.10 | 6.42 | 6.84 | 7.34 | 7.88 | 8.40 | 8.93 | 9.29 | 9.85 | 9.33 | NA | NA | NA | 8.86 | NA | NA | NA | |

| Other Assets Noncurrent | 1.52 | 1.52 | 13.36 | 13.34 | 13.05 | 12.36 | 11.84 | 11.84 | 11.84 | 11.86 | 11.86 | 0.25 | NA | NA | NA | 0.21 | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 0.14 | 0.22 | 0.18 | 0.26 | 0.73 | 1.05 | NA | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 337.90 | 350.71 | 361.53 | 389.39 | 376.64 | 388.37 | NA | 446.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | 338.04 | 350.93 | 361.72 | 389.65 | 377.37 | 389.42 | 8.80 | 19.20 | 21.50 | 48.50 | 89.10 | 150.40 | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.00 | 0.01 | 0.00 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 0.14 | 0.22 | 0.18 | 0.26 | 0.73 | 1.05 | NA | 0.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

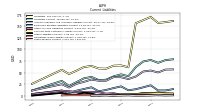

| Liabilities Current | 73.89 | 61.66 | 42.05 | 46.11 | 41.77 | 34.63 | 33.84 | 40.65 | 37.54 | 29.32 | 21.15 | 32.00 | NA | NA | NA | 11.29 | NA | NA | NA | |

| Accounts Payable And Accrued Liabilities Current | 52.31 | 41.38 | 35.97 | 39.99 | 40.12 | 32.38 | 32.33 | 34.95 | 29.97 | 25.83 | 17.69 | 24.80 | NA | NA | NA | 11.18 | NA | NA | NA | |

| Other Accrued Liabilities Current | 5.94 | 3.22 | 3.19 | 2.15 | 5.41 | 4.50 | 7.29 | 8.44 | 8.32 | 8.00 | 9.73 | 10.86 | NA | NA | NA | 3.28 | NA | NA | NA | |

| Taxes Payable Current | 0.23 | 0.14 | 1.06 | 0.62 | 0.07 | 0.82 | NA | 0.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Current | 2.61 | 2.09 | 1.98 | 2.03 | 0.72 | 1.29 | 0.50 | 4.64 | 6.46 | 2.37 | 2.38 | 6.12 | NA | NA | NA | 0.12 | NA | NA | NA | |

| Contract With Customer Liability Current | 4.66 | 3.23 | 3.16 | 3.15 | NA | NA | NA | 0.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Liabilities Noncurrent | 10.34 | 8.71 | 12.32 | 12.17 | 15.83 | 16.32 | 17.38 | 15.95 | 16.56 | 16.87 | 17.89 | 1.59 | NA | NA | NA | 6.21 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 6.71 | 6.81 | 6.99 | 7.15 | 7.27 | 7.43 | 7.56 | 7.68 | 7.79 | 7.82 | 7.81 | 7.62 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 391.88 | 392.29 | 390.41 | 405.44 | 423.43 | 423.77 | 448.12 | 479.09 | 298.17 | 332.26 | 370.23 | 407.75 | 409.44 | 257.70 | 279.09 | 298.60 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 109.71 | 98.83 | 88.89 | 85.49 | 79.19 | 74.00 | 64.69 | 59.01 | 54.61 | 51.02 | 43.89 | 39.38 | NA | NA | NA | 25.39 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -915.45 | -902.00 | -890.51 | -864.30 | -838.26 | -829.27 | -793.75 | -756.12 | -722.80 | -672.54 | -625.53 | -575.16 | NA | NA | NA | -472.48 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.95 | -1.02 | -0.99 | -1.06 | -1.53 | -1.85 | -1.62 | -0.85 | -0.79 | -0.79 | -0.80 | -0.81 | NA | NA | NA | -0.81 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 11.81 | 12.27 | 9.47 | 6.90 | 8.32 | 10.05 | 7.02 | 8.58 | 7.09 | 7.75 | 7.82 | 5.14 | 4.61 | 4.20 | 3.50 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

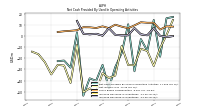

| Net Cash Provided By Used In Operating Activities | -13.28 | -2.83 | -31.67 | 10.45 | -15.36 | -27.87 | -46.75 | -25.92 | -40.25 | -37.98 | -53.54 | 3.20 | -28.42 | -22.04 | -22.61 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -19.70 | -5.61 | 24.86 | -3.02 | -50.22 | 45.62 | -53.02 | -5.49 | -32.81 | 1.67 | -67.25 | 19.15 | -144.50 | -20.71 | -12.13 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -2.33 | 1.14 | 1.64 | 0.69 | 0.00 | 1.34 | 0.41 | 205.72 | 9.08 | 1.28 | 5.03 | 1.24 | 189.26 | 0.95 | 2.92 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -13.28 | -2.83 | -31.67 | 10.45 | -15.36 | -27.87 | -46.75 | -25.92 | -40.25 | -37.98 | -53.54 | 3.20 | -28.42 | -22.04 | -22.61 | NA | NA | NA | NA | |

| Net Income Loss | -13.45 | -11.49 | -26.21 | -26.05 | -8.99 | -35.52 | -37.63 | -33.32 | -50.26 | -47.01 | -50.38 | -8.07 | -42.13 | -26.54 | -25.93 | -34.46 | -23.45 | -16.38 | -14.10 | |

| Increase Decrease In Inventories | 0.58 | 1.41 | 6.99 | 0.61 | 0.51 | 1.01 | 6.94 | 0.28 | 1.92 | 1.44 | 2.01 | 13.46 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 11.81 | 12.27 | 9.47 | 6.90 | 8.32 | 10.05 | 7.02 | 8.58 | 7.09 | 7.75 | 7.82 | 5.14 | 4.61 | 4.20 | 3.50 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -19.70 | -5.61 | 24.86 | -3.02 | -50.22 | 45.62 | -53.02 | -5.49 | -32.81 | 1.67 | -67.25 | 19.15 | -144.50 | -20.71 | -12.13 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -2.33 | 1.14 | 1.64 | 0.69 | 0.00 | 1.34 | 0.41 | 205.72 | 9.08 | 1.28 | 5.03 | 1.24 | 189.26 | 0.95 | 2.92 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

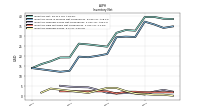

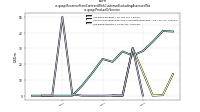

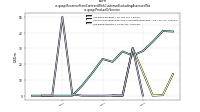

| Revenues | 54.52 | 41.49 | 34.41 | 28.43 | 55.78 | 28.19 | 21.62 | 23.40 | 14.67 | 6.62 | 0.91 | 50.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.23 | 0.03 | 0.03 | |

| Otuska Pharmaceutical Co Ltd, Service, License Agreement Terms | 12.70 | 0.39 | 0.10 | 0.10 | 0.20 | 0.01 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Otuska Pharmaceutical Co Ltd, License Agreement Terms | 10.00 | NA | NA | NA | NA | 0.01 | 0.10 | NA | NA | NA | NA | 50.00 | NA | NA | NA | NA | NA | NA | NA | |

| License Royalty And Collaboration Revenue | 13.73 | 0.39 | 0.07 | NA | 30.28 | 0.04 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| License | NA | NA | NA | 0.11 | 30.28 | 0.04 | 0.13 | 0.03 | 0.03 | 0.03 | 0.88 | 50.03 | 0.03 | 0.03 | NA | NA | NA | NA | NA | |

| Product | 40.78 | 41.10 | 34.34 | 28.33 | 25.50 | 28.15 | 21.49 | 23.38 | 14.64 | 6.59 | 0.03 | NA | NA | NA | 0.03 | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 54.52 | 41.49 | 34.41 | 28.43 | 55.78 | 28.19 | 21.62 | 23.40 | 14.67 | 6.62 | 0.91 | 50.03 | 0.03 | 0.03 | 0.03 | 0.03 | 0.23 | 0.03 | 0.03 | |

| Otuska Pharmaceutical Co Ltd, Service, License Agreement Terms | 12.70 | 0.39 | 0.10 | 0.10 | 0.20 | 0.01 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Otuska Pharmaceutical Co Ltd, License Agreement Terms | 10.00 | NA | NA | NA | NA | 0.01 | 0.10 | NA | NA | NA | NA | 50.00 | NA | NA | NA | NA | NA | NA | NA | |

| License Royalty And Collaboration Revenue | 13.73 | 0.39 | 0.07 | NA | 30.28 | 0.04 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| License | NA | NA | NA | 0.11 | 30.28 | 0.04 | 0.13 | 0.03 | 0.03 | 0.03 | 0.88 | 50.03 | 0.03 | 0.03 | NA | NA | NA | NA | NA | |

| Product | 40.78 | 41.10 | 34.34 | 28.33 | 25.50 | 28.15 | 21.49 | 23.38 | 14.64 | 6.59 | 0.03 | NA | NA | NA | 0.03 | NA | NA | NA | NA |