| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.73 | 1.72 | 1.72 | 1.72 | 1.72 | 1.71 | 1.70 | 1.70 | 1.68 | 1.57 | 1.47 | 1.47 | 1.47 | 1.46 | 1.46 | 1.35 | 1.35 | 1.34 | 1.34 | 1.26 | 1.23 | 1.20 | 1.11 | 1.08 | 1.08 | 0.95 | 0.95 | 0.95 | 0.94 | 0.94 | NA | NA | 0.94 | NA | NA | 0.58 | 0.58 | 0.57 | 0.48 | 0.39 | 0.29 | 0.29 | 0.29 | 0.29 | 0.29 | 0.23 | 0.23 | NA | 0.22 | NA | NA | NA | |

| Earnings Per Share Basic | -0.01 | 0.17 | 0.59 | 0.68 | -0.28 | 0.60 | 0.55 | 0.59 | 0.77 | 0.56 | 0.89 | 0.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.60 | 0.37 | 0.45 | 0.70 | 0.34 | 0.24 | 0.29 | 0.22 | -1.03 | 4.22 | 0.30 | 0.10 | 2.91 | -0.37 | 0.60 | -0.08 | 0.44 | |

| Earnings Per Share Diluted | -0.01 | 0.17 | 0.58 | 0.67 | -0.25 | 0.59 | 0.54 | 0.58 | 0.77 | 0.56 | 0.89 | 0.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.60 | 0.37 | 0.45 | 0.70 | 0.34 | 0.24 | 0.29 | 0.22 | -1.03 | 4.06 | 0.28 | 0.09 | 2.74 | -0.37 | 0.57 | -0.08 | 0.44 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| General And Administrative Expense | 13.26 | 12.00 | 13.02 | 12.87 | 14.49 | 12.93 | 12.41 | 12.36 | 11.06 | 10.84 | 10.67 | 10.60 | 11.55 | 11.24 | 11.29 | 11.79 | 9.90 | 9.74 | 9.90 | 9.31 | 9.63 | 8.44 | 8.75 | 8.71 | 7.70 | 7.42 | 7.37 | 7.43 | 6.73 | 7.41 | 6.78 | 6.79 | 8.05 | 5.29 | 15.70 | 7.66 | 5.88 | 3.37 | 15.36 | 3.20 | 1.99 | 4.05 | 3.43 | 2.04 | -5.82 | 7.14 | 4.74 | 4.31 | 4.00 | 4.94 | 4.65 | 4.40 | |

| Interest Expense | 351.24 | 353.97 | 344.55 | 317.20 | 271.20 | 202.38 | 136.62 | 100.71 | 96.81 | 82.69 | 82.35 | 78.37 | 79.40 | 78.98 | 84.85 | 104.24 | 110.97 | 111.96 | 116.89 | 118.69 | 103.95 | 97.95 | 87.73 | 69.99 | 65.95 | 67.89 | 54.35 | 46.67 | 44.45 | 45.37 | 49.06 | 45.38 | 46.29 | 51.33 | 30.63 | 24.16 | 21.45 | 19.90 | 15.72 | 12.07 | 11.53 | 4.41 | 1.31 | 0.78 | 4.24 | 5.15 | 5.41 | 23.34 | 16.59 | 21.84 | 32.30 | 29.50 | |

| Interest Income Expense Net | 153.76 | 165.37 | 177.34 | 174.19 | 191.08 | 156.18 | 147.07 | 133.72 | 173.94 | 117.42 | 113.95 | 109.15 | 109.45 | 114.96 | 107.13 | 100.64 | 109.71 | 101.92 | 106.48 | 106.07 | 102.15 | 105.15 | 103.75 | 85.44 | 80.17 | 78.56 | 72.47 | 71.84 | 71.84 | 82.82 | 81.41 | 77.64 | 82.09 | 87.03 | 49.85 | 39.25 | 36.81 | 30.48 | 26.75 | 21.58 | 15.31 | 14.45 | 4.71 | 0.68 | 2.28 | 1.80 | 1.35 | -8.63 | 5.38 | 3.80 | 0.26 | 9.51 | |

| Interest Paid Net | 311.01 | 342.86 | 320.90 | 318.19 | 233.61 | 186.03 | 106.63 | 81.98 | 80.42 | 66.69 | 73.19 | 67.41 | 69.53 | 69.52 | 81.70 | 91.34 | 101.79 | 104.44 | 111.60 | 107.97 | 94.60 | 85.87 | 82.87 | 55.58 | 65.84 | 52.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.07 | 4.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | 0.00 | 0.00 | 0.04 | NA | NA | NA | NA | NA | 0.00 | 20.05 | 0.94 | 2.49 | |

| Allocated Share Based Compensation Expense | 0.17 | 0.17 | 0.17 | 0.16 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.17 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.04 | 0.04 | 0.68 | 0.47 | 0.08 | 0.13 | 0.09 | 0.09 | NA | NA | |

| Income Tax Expense Benefit | 0.70 | 1.57 | 1.20 | 1.89 | 0.94 | 1.17 | 0.75 | 0.15 | 0.08 | 0.07 | 0.17 | 0.10 | 0.13 | 0.02 | 0.02 | 0.15 | 0.07 | -0.72 | 0.05 | 0.10 | 0.04 | 0.05 | 0.10 | 0.12 | 0.05 | 0.08 | 0.09 | 0.09 | -0.09 | 0.19 | -0.15 | 0.24 | 0.07 | 0.08 | 0.10 | 0.24 | 0.11 | -0.12 | -0.00 | 0.53 | 0.67 | -0.26 | 0.55 | 0.04 | -1.61 | 0.72 | 0.14 | 0.92 | 1.33 | -0.24 | 1.06 | 1.25 | |

| Income Taxes Paid Net | 1.44 | 0.94 | 3.39 | 0.90 | -0.05 | 0.32 | 0.25 | 0.16 | 0.03 | 0.03 | 0.12 | -0.26 | 0.09 | -0.00 | 0.03 | 0.12 | -0.31 | 0.11 | 0.03 | 0.07 | 0.01 | 0.28 | 0.13 | 0.14 | 0.08 | 0.08 | 0.09 | 0.05 | 0.15 | -0.07 | 0.05 | 0.15 | 0.00 | -0.00 | -0.00 | 0.13 | 2.87 | -0.24 | 0.00 | -1.16 | -0.23 | -0.19 | 0.37 | 0.04 | 1.91 | -0.31 | -0.10 | 1.20 | 2.40 | 1.99 | NA | NA | |

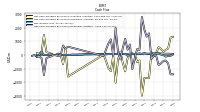

| Profit Loss | -1.72 | 30.56 | 102.50 | 118.56 | -46.99 | 103.92 | 93.86 | 100.26 | 124.86 | 84.40 | 132.47 | 80.54 | 84.42 | 90.77 | 18.50 | -53.28 | 79.58 | 75.39 | 75.55 | 76.87 | 73.90 | 78.29 | 72.51 | 61.12 | 58.14 | 57.81 | 50.61 | 51.41 | 53.40 | 66.39 | 69.45 | 57.20 | 65.60 | 67.78 | 32.42 | 46.09 | 25.34 | 23.60 | 38.44 | 13.12 | 9.73 | 10.53 | 6.77 | -1.60 | 122.93 | 12.90 | 3.35 | 140.62 | -16.08 | 8.26 | 6.22 | 9.91 | |

| Other Comprehensive Income Loss Net Of Tax | -1.15 | -0.13 | 2.91 | -2.19 | 6.19 | -3.25 | -1.52 | 0.29 | -1.56 | -0.87 | -0.54 | 0.11 | 1.52 | 0.72 | -9.32 | 34.48 | 17.16 | -3.97 | 1.34 | 3.47 | -1.37 | -0.71 | -10.23 | 7.80 | 2.66 | 8.15 | 11.85 | 3.85 | -9.81 | -4.25 | -8.70 | -0.69 | -5.17 | -8.26 | 12.42 | -16.73 | -8.82 | -8.93 | 1.89 | 0.04 | NA | NA | NA | NA | 2.78 | 2.31 | 1.78 | 3.84 | -2.28 | 1.27 | 2.02 | NA | |

| Net Income Loss | -2.38 | 29.52 | 101.65 | 117.76 | -47.54 | 103.25 | 93.25 | 99.69 | 123.94 | 83.76 | 131.59 | 79.90 | 83.62 | 89.86 | 17.54 | -53.35 | 78.93 | 74.90 | 75.17 | 76.56 | 73.64 | 78.17 | 72.31 | 60.96 | 57.89 | 57.72 | 50.61 | 51.41 | 53.38 | 64.79 | 63.08 | 57.05 | 65.26 | 66.89 | 29.28 | 35.39 | 21.49 | 22.02 | 33.47 | 13.06 | 7.08 | 8.32 | 2.75 | -3.12 | 105.19 | 7.00 | 2.28 | 66.55 | -8.32 | 13.72 | -1.84 | 9.91 | |

| Comprehensive Income Net Of Tax | -3.53 | 29.39 | 104.56 | 115.56 | -41.35 | 100.00 | 91.73 | 99.98 | 122.37 | 82.89 | 131.05 | 80.02 | 85.14 | 90.58 | 8.22 | -18.87 | 96.09 | 70.92 | 76.51 | 80.03 | 72.27 | 77.45 | 62.08 | 68.76 | 60.55 | 65.87 | 62.46 | 55.25 | 43.56 | 60.55 | 54.38 | 56.36 | 60.09 | 58.63 | 41.71 | 18.66 | 12.67 | 13.09 | 35.36 | 13.10 | 7.88 | 8.32 | 2.75 | -3.12 | 107.97 | 9.30 | 4.07 | 70.38 | -10.41 | 14.99 | 0.17 | NA | |

| Noninterest Expense | 39.60 | 40.88 | 45.84 | 43.91 | 48.32 | 38.84 | 39.47 | 35.85 | 39.43 | 30.18 | 32.21 | 29.80 | 30.71 | 30.23 | 31.78 | 31.07 | 30.06 | 27.24 | 30.88 | 29.10 | 28.22 | 26.81 | 31.14 | 24.20 | 21.99 | 20.66 | 21.77 | 20.35 | 19.52 | 21.11 | 22.63 | 20.41 | 22.41 | 19.11 | 23.75 | 14.33 | 12.15 | 8.78 | 19.77 | 6.60 | 7.93 | 4.05 | 3.43 | 2.04 | -5.82 | 7.14 | 4.74 | 4.31 | 4.00 | 4.94 | 4.65 | 4.40 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 24036.18 | 24043.42 | 24862.64 | 25385.67 | 25353.99 | 24798.63 | 25443.25 | 24068.84 | 22703.29 | 20705.87 | 17901.75 | 17354.71 | 16958.96 | 16876.80 | 17663.12 | 16758.09 | 16551.87 | 15082.42 | 14565.00 | 14796.22 | 14467.38 | 12419.48 | 12382.35 | 11211.29 | 10258.83 | 9776.92 | 9719.09 | 8954.66 | 8812.61 | 8510.94 | 9488.46 | 9554.77 | 9376.57 | 9851.87 | 10466.06 | 5085.70 | 4588.52 | 4098.47 | 3754.77 | 2894.39 | 2212.78 | 1577.31 | 1087.11 | 365.15 | 322.34 | 581.20 | 584.24 | 605.56 | 1366.32 | 1539.89 | 2365.40 | 4120.69 | |

| Liabilities | 19648.67 | 19549.90 | 20296.45 | 20824.97 | 20809.78 | 20114.72 | 20780.26 | 19399.00 | 18084.58 | 16435.32 | 13944.79 | 13450.62 | 13054.72 | 12972.85 | 13767.34 | 13083.66 | 12767.19 | 11321.80 | 10788.58 | 11344.63 | 11092.77 | 9111.48 | 9353.68 | 8284.78 | 7341.42 | 7251.12 | 7212.61 | 6458.68 | 6319.01 | 6006.14 | 6979.37 | 7052.93 | 6870.84 | 7351.71 | 7970.57 | 3583.00 | 3087.64 | 2588.61 | 2472.74 | 1885.99 | 1456.03 | 773.77 | 285.44 | 202.71 | 168.89 | 543.23 | 562.00 | 588.56 | 1495.26 | 1650.74 | 2481.57 | 4531.88 | |

| Liabilities And Stockholders Equity | 24036.18 | 24043.42 | 24862.64 | 25385.67 | 25353.99 | 24798.63 | 25443.25 | 24068.84 | 22703.29 | 20705.87 | 17901.75 | 17354.71 | 16958.96 | 16876.80 | 17663.12 | 16758.09 | 16551.87 | 15082.42 | 14565.00 | 14796.22 | 14467.38 | 12419.48 | 12382.35 | 11211.29 | 10258.83 | 9776.92 | 9719.09 | 8954.66 | 8812.61 | 8510.94 | 9488.46 | 9554.77 | 9376.57 | 9851.87 | 10466.06 | 5085.70 | 4588.52 | 4098.47 | 3754.77 | 2894.39 | 2212.78 | 1577.31 | 1087.11 | 365.15 | 322.34 | 581.20 | 584.24 | 605.56 | 1366.32 | 1539.89 | 2365.40 | 4120.69 | |

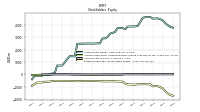

| Stockholders Equity | 4367.71 | 4470.87 | 4540.66 | 4535.23 | 4518.79 | 4658.41 | 4637.59 | 4642.94 | 4588.19 | 4236.55 | 3930.96 | 3883.02 | 3886.07 | 3883.36 | 3874.76 | 3650.92 | 3762.58 | 3742.79 | 3747.36 | 3439.40 | 3364.12 | 3300.77 | 3023.48 | 2921.21 | 2911.07 | 2519.61 | NA | NA | 2493.60 | 2503.69 | 2496.42 | 2495.42 | 2492.59 | 2487.12 | 2483.12 | 1456.93 | 1465.37 | 1477.74 | 1239.31 | 970.08 | 717.91 | 713.33 | 712.69 | 76.09 | 73.44 | -24.56 | -34.38 | -38.57 | -110.42 | -100.17 | -110.95 | -411.19 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 350.01 | 421.50 | 482.86 | 515.81 | 291.34 | 271.90 | 283.58 | 309.43 | 551.15 | 211.18 | 289.55 | 280.13 | 289.97 | 427.03 | 1259.84 | 355.02 | 150.09 | 84.29 | 80.58 | 79.44 | 105.66 | 86.99 | 107.06 | 57.40 | 69.65 | 61.22 | 33.52 | 64.28 | 75.57 | 94.06 | 181.80 | 110.62 | 96.45 | 138.60 | 104.25 | 18.47 | 51.81 | 63.34 | 120.46 | 70.83 | 52.34 | 10.28 | 59.75 | 15.36 | 15.42 | 38.87 | 34.60 | 37.20 | 34.82 | 28.22 | 28.43 | 24.45 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 350.01 | 421.50 | 482.86 | 515.81 | 291.34 | 271.90 | 283.58 | 309.43 | 551.15 | 236.18 | 339.55 | 280.13 | 289.97 | 427.03 | 1259.84 | 355.02 | 150.09 | 84.29 | NA | 79.44 | 105.66 | 86.99 | 107.06 | 74.48 | 102.52 | 94.08 | 67.80 | 64.28 | 75.57 | 94.94 | 182.27 | NA | 106.01 | NA | NA | NA | 63.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 16502.47 | 16552.66 | 17173.26 | 17726.03 | 17577.24 | 16930.69 | 17565.52 | 16190.70 | 15072.05 | 13492.13 | 11007.52 | 10463.24 | 9981.83 | 10688.23 | 11407.09 | 10734.78 | 11453.32 | 9937.82 | 9406.11 | 9857.86 | 9618.98 | 7657.08 | 7839.38 | 6813.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Secured Long Term Debt | 2101.63 | 2104.82 | 2108.01 | 2111.23 | 2114.55 | 1807.02 | 1809.94 | 1325.22 | 1327.41 | 1352.71 | 1356.14 | 1259.58 | 1062.77 | 1065.45 | 1068.13 | 745.01 | 746.88 | 498.75 | 500.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Senior Notes | 362.76 | 362.98 | 395.76 | 395.46 | 395.17 | 394.86 | 394.56 | 394.30 | 394.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 19.79 | 22.65 | 25.53 | 25.47 | 25.41 | 25.50 | 25.40 | 26.90 | 30.52 | 34.00 | 25.99 | 21.07 | 18.16 | 20.59 | 21.02 | 23.51 | 22.10 | 17.82 | 29.06 | 12.19 | 10.48 | 7.22 | 5.18 | 5.30 | 6.34 | NA | NA | NA | NA | 1.10 | 12.68 | 6.42 | 13.14 | 13.04 | 12.36 | 45.76 | 35.52 | 32.12 | 42.72 | 38.32 | 38.84 | 90.22 | 88.98 | 86.35 | 80.01 | 62.52 | 56.62 | 55.56 | -18.52 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 4367.71 | 4470.87 | 4540.66 | 4535.23 | 4518.79 | 4658.41 | 4637.59 | 4642.94 | 4588.19 | 4236.55 | 3930.96 | 3883.02 | 3886.07 | 3883.36 | 3874.76 | 3650.92 | 3762.58 | 3742.79 | 3747.36 | 3439.40 | 3364.12 | 3300.77 | 3023.48 | 2921.21 | 2911.07 | 2519.61 | NA | NA | 2493.60 | 2503.69 | 2496.42 | 2495.42 | 2492.59 | 2487.12 | 2483.12 | 1456.93 | 1465.37 | 1477.74 | 1239.31 | 970.08 | 717.91 | 713.33 | 712.69 | 76.09 | 73.44 | -24.56 | -34.38 | -38.57 | -110.42 | -100.17 | -110.95 | -411.19 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 4387.50 | 4493.52 | 4566.19 | 4560.70 | 4544.20 | 4683.91 | 4662.99 | 4669.84 | 4618.71 | 4270.55 | 3956.95 | 3904.09 | 3904.23 | 3903.95 | 3895.78 | 3674.43 | 3784.68 | 3760.62 | 3776.43 | 3451.59 | 3374.61 | 3307.99 | 3028.66 | 2926.51 | 2917.41 | 2525.79 | 2506.47 | 2495.98 | 2493.60 | 2504.80 | 2509.09 | 2501.83 | 2505.73 | 2500.16 | 2495.49 | 1502.70 | 1500.89 | 1509.86 | 1282.03 | 1008.40 | 756.75 | 803.54 | 801.67 | 162.44 | 153.45 | 37.97 | 22.24 | 17.00 | -128.94 | -110.85 | -116.17 | -411.19 | |

| Common Stock Value | 1.73 | 1.72 | 1.72 | 1.72 | 1.72 | 1.71 | 1.70 | 1.70 | 1.68 | 1.57 | 1.47 | 1.47 | 1.47 | 1.46 | 1.46 | 1.35 | 1.35 | 1.34 | 1.34 | 1.26 | 1.23 | 1.20 | 1.11 | 1.08 | 1.08 | 0.95 | 0.95 | 0.95 | 0.94 | 0.94 | NA | NA | 0.94 | NA | NA | 0.58 | 0.58 | 0.57 | 0.48 | 0.39 | 0.29 | 0.29 | 0.29 | 0.29 | 0.29 | 0.23 | 0.23 | NA | 0.22 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 5507.46 | 5499.49 | 5491.64 | 5483.74 | 5475.80 | 5467.37 | 5440.36 | 5431.63 | 5373.03 | 5039.38 | 4719.20 | 4710.99 | 4702.71 | 4693.98 | 4685.16 | 4378.85 | 4370.01 | 4362.48 | 4354.57 | 4039.80 | 3966.54 | 3898.84 | 3624.77 | 3515.42 | 3506.86 | 3109.09 | 3102.93 | 3096.01 | 3090.00 | 3084.95 | 3079.90 | 3074.97 | 3070.20 | 3066.66 | 3063.43 | 2030.76 | 2027.40 | 2022.09 | 1767.95 | 1510.86 | 1252.99 | 1242.99 | 1242.89 | 609.04 | 609.00 | 597.87 | 597.34 | NA | 597.05 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1150.93 | -1040.95 | -963.44 | -958.06 | -968.75 | -814.50 | -811.55 | -798.99 | -794.83 | -814.28 | -800.46 | -840.72 | -829.28 | -821.73 | -820.78 | -747.53 | -592.55 | -587.63 | -579.13 | -570.91 | -569.43 | -566.42 | -570.26 | -573.38 | -567.17 | -558.07 | -556.90 | -548.62 | -541.14 | -535.80 | -542.28 | -547.05 | -545.79 | -552.88 | -561.90 | -542.65 | -547.59 | -538.73 | -531.86 | -542.00 | -536.17 | -529.95 | -530.49 | -533.24 | -535.85 | -591.28 | -598.27 | -600.56 | -667.11 | -658.79 | -667.62 | -920.36 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 9.45 | 10.61 | 10.74 | 7.83 | 10.02 | 3.83 | 7.08 | 8.60 | 8.31 | 9.87 | 10.74 | 11.28 | 11.17 | 9.64 | 8.93 | 18.25 | -16.23 | -33.39 | -29.42 | -30.76 | -34.22 | -32.85 | -32.14 | -21.90 | -29.71 | -32.36 | -40.51 | -52.36 | -56.20 | -46.39 | -42.14 | -33.45 | -32.76 | -27.59 | -19.33 | -31.76 | -15.02 | -6.21 | 2.73 | 0.83 | 0.80 | 0.00 | 0.00 | 0.00 | NA | -31.37 | -33.68 | -35.46 | -40.58 | -38.50 | -40.30 | -50.46 | |

| Minority Interest | 19.79 | 22.65 | 25.53 | 25.47 | 25.41 | 25.50 | 25.40 | 26.90 | 30.52 | 34.00 | 25.99 | 21.07 | 18.16 | 20.59 | 21.02 | 23.51 | 22.10 | 17.82 | 29.06 | 12.19 | 10.48 | 7.22 | 5.18 | 5.30 | 6.34 | NA | NA | NA | NA | 1.10 | 12.68 | 6.42 | 13.14 | 13.04 | 12.36 | 45.76 | 35.52 | 32.12 | 42.72 | 38.32 | 38.84 | 90.22 | 88.98 | 86.35 | 80.01 | 62.52 | 56.62 | 55.56 | -18.52 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

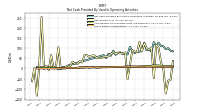

| Net Cash Provided By Used In Operating Activities | 109.79 | 110.99 | 127.89 | 110.17 | 130.22 | 83.01 | 93.50 | 90.10 | 127.46 | 89.65 | 82.33 | 83.05 | 75.31 | 85.59 | 107.09 | 68.62 | 75.45 | 71.41 | 79.61 | 77.57 | 67.27 | 87.72 | 62.43 | 72.58 | 50.92 | 65.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 14.25 | 5.84 | 7.85 | 0.76 | -4.83 | 5.09 | 5.23 | 1.28 | 8.73 | 6.90 | 8.17 | 8.21 | |

| Net Cash Provided By Used In Investing Activities | 256.99 | 448.43 | 582.13 | 156.53 | -53.47 | 204.39 | -1715.71 | -1688.75 | -1701.42 | -3001.07 | -401.38 | -523.59 | 17.48 | 129.00 | 14.54 | -249.27 | -1202.53 | -578.19 | 243.02 | -333.45 | -2040.19 | -57.21 | -1186.76 | -967.50 | -461.06 | 26.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -1586.80 | 471.77 | -670.13 | 2.66 | 63.55 | 20.48 | 0.24 | 105.32 | 147.44 | 234.85 | 1477.42 | 90.20 | |

| Net Cash Provided By Used In Financing Activities | -440.48 | -618.96 | -744.77 | -43.73 | -64.41 | -292.60 | 1604.14 | 1360.09 | 1891.58 | 2810.53 | 374.43 | 431.69 | -231.55 | -1048.99 | 780.70 | 389.08 | 1193.00 | 511.38 | -321.51 | 229.68 | 1992.75 | -51.69 | 1158.97 | 857.68 | 417.64 | -67.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 614.61 | 472.92 | 706.67 | -3.48 | -82.17 | -21.31 | -8.07 | -104.22 | -149.58 | -241.96 | -1484.94 | -98.11 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 109.79 | 110.99 | 127.89 | 110.17 | 130.22 | 83.01 | 93.50 | 90.10 | 127.46 | 89.65 | 82.33 | 83.05 | 75.31 | 85.59 | 107.09 | 68.62 | 75.45 | 71.41 | 79.61 | 77.57 | 67.27 | 87.72 | 62.43 | 72.58 | 50.92 | 65.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 14.25 | 5.84 | 7.85 | 0.76 | -4.83 | 5.09 | 5.23 | 1.28 | 8.73 | 6.90 | 8.17 | 8.21 | |

| Net Income Loss | -2.38 | 29.52 | 101.65 | 117.76 | -47.54 | 103.25 | 93.25 | 99.69 | 123.94 | 83.76 | 131.59 | 79.90 | 83.62 | 89.86 | 17.54 | -53.35 | 78.93 | 74.90 | 75.17 | 76.56 | 73.64 | 78.17 | 72.31 | 60.96 | 57.89 | 57.72 | 50.61 | 51.41 | 53.38 | 64.79 | 63.08 | 57.05 | 65.26 | 66.89 | 29.28 | 35.39 | 21.49 | 22.02 | 33.47 | 13.06 | 7.08 | 8.32 | 2.75 | -3.12 | 105.19 | 7.00 | 2.28 | 66.55 | -8.32 | 13.72 | -1.84 | 9.91 | |

| Profit Loss | -1.72 | 30.56 | 102.50 | 118.56 | -46.99 | 103.92 | 93.86 | 100.26 | 124.86 | 84.40 | 132.47 | 80.54 | 84.42 | 90.77 | 18.50 | -53.28 | 79.58 | 75.39 | 75.55 | 76.87 | 73.90 | 78.29 | 72.51 | 61.12 | 58.14 | 57.81 | 50.61 | 51.41 | 53.40 | 66.39 | 69.45 | 57.20 | 65.60 | 67.78 | 32.42 | 46.09 | 25.34 | 23.60 | 38.44 | 13.12 | 9.73 | 10.53 | 6.77 | -1.60 | 122.93 | 12.90 | 3.35 | 140.62 | -16.08 | 8.26 | 6.22 | 9.91 | |

| Share Based Compensation | 7.73 | 7.61 | 7.67 | 7.66 | 8.13 | 8.22 | 8.42 | 8.65 | 7.46 | 8.08 | 8.02 | 8.09 | 8.55 | 8.65 | 8.65 | 8.68 | 7.38 | 7.75 | 7.75 | 7.77 | 7.67 | 6.73 | 6.78 | 6.98 | 6.22 | 5.94 | 5.96 | 5.91 | 5.38 | 6.20 | 5.46 | 4.85 | 6.25 | 3.29 | 5.08 | 6.10 | 2.89 | 2.06 | 2.80 | 1.97 | 4.10 | 0.55 | 0.58 | 1.00 | 0.68 | 0.47 | 0.08 | 0.13 | 0.09 | 0.09 | 0.09 | 0.03 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 256.99 | 448.43 | 582.13 | 156.53 | -53.47 | 204.39 | -1715.71 | -1688.75 | -1701.42 | -3001.07 | -401.38 | -523.59 | 17.48 | 129.00 | 14.54 | -249.27 | -1202.53 | -578.19 | 243.02 | -333.45 | -2040.19 | -57.21 | -1186.76 | -967.50 | -461.06 | 26.34 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -1586.80 | 471.77 | -670.13 | 2.66 | 63.55 | 20.48 | 0.24 | 105.32 | 147.44 | 234.85 | 1477.42 | 90.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -440.48 | -618.96 | -744.77 | -43.73 | -64.41 | -292.60 | 1604.14 | 1360.09 | 1891.58 | 2810.53 | 374.43 | 431.69 | -231.55 | -1048.99 | 780.70 | 389.08 | 1193.00 | 511.38 | -321.51 | 229.68 | 1992.75 | -51.69 | 1158.97 | 857.68 | 417.64 | -67.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 614.61 | 472.92 | 706.67 | -3.48 | -82.17 | -21.31 | -8.07 | -104.22 | -149.58 | -241.96 | -1484.94 | -98.11 | |

| Payments Of Dividends Common Stock | 106.82 | 106.83 | 106.82 | 106.45 | 105.96 | 105.58 | 105.58 | 104.27 | 97.35 | 91.15 | 91.16 | 91.00 | 90.64 | 90.64 | 83.92 | 83.70 | 83.26 | 83.26 | 77.91 | 76.53 | 74.19 | 69.10 | 67.08 | 66.89 | 58.79 | 58.79 | 58.79 | 58.62 | 58.23 | 58.23 | 58.23 | 58.10 | 57.80 | 48.48 | 30.39 | 30.30 | 28.84 | 23.27 | 18.85 | 13.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 107.61 | 107.03 | 107.03 | 107.07 | 106.70 | 106.20 | 105.81 | 105.80 | 287.44 | 97.55 | 91.35 | 91.35 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |