| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

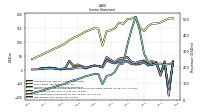

| Earnings Per Share Basic | -0.21 | 0.20 | 0.14 | 0.14 | 1.35 | 0.90 | -0.09 | -0.53 | -0.68 | 0.25 | 0.24 | 0.19 | 0.23 | 0.29 | 0.06 | 0.11 | 0.12 | 0.09 | 0.05 | 0.11 | 0.11 | 0.11 | 0.29 | 0.03 | 0.02 | 0.02 | 0.04 | 0.04 | -0.66 | 0.02 | 0.00 | 0.00 | |

| Earnings Per Share Diluted | -0.20 | 0.17 | 0.12 | 0.10 | 0.34 | 0.14 | -0.09 | -0.53 | -0.66 | 0.24 | 0.23 | 0.19 | 0.22 | 0.29 | 0.06 | 0.11 | 0.12 | 0.09 | 0.05 | 0.11 | 0.11 | 0.11 | 0.28 | 0.03 | 0.02 | 0.02 | 0.04 | 0.04 | -0.66 | 0.02 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

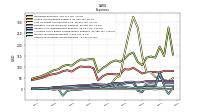

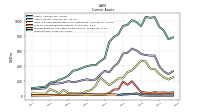

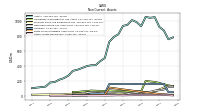

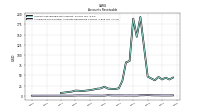

| Revenue From Contract With Customer Excluding Assessed Tax | 223.12 | 219.42 | 239.74 | 231.96 | 286.74 | 426.45 | 511.23 | 430.61 | 339.34 | 222.91 | 217.75 | 171.37 | 151.55 | 147.47 | 94.74 | 157.69 | 158.15 | 150.46 | 145.03 | 135.27 | 126.09 | 119.12 | 110.30 | 98.58 | 90.60 | 82.99 | 76.24 | 67.03 | 60.76 | 53.14 | 45.63 | 38.61 | |

| Revenues | 223.12 | 219.42 | 239.74 | 231.96 | 286.74 | 426.45 | 511.23 | 430.61 | 339.34 | 222.91 | 217.75 | 171.37 | 151.55 | 147.47 | 94.74 | 157.69 | 158.15 | 150.46 | 145.03 | 135.27 | 126.09 | 119.04 | 110.33 | 98.70 | 90.60 | 82.99 | 76.24 | 67.03 | 60.76 | 53.14 | 45.63 | 38.61 | |

| Cost Of Goods And Services Sold | 55.09 | 55.12 | 75.60 | 76.98 | 149.70 | 275.67 | 323.38 | 248.73 | 159.61 | 60.03 | 50.32 | 24.06 | 11.45 | 9.76 | 9.88 | 11.61 | 10.56 | 9.39 | 8.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gross Profit | 168.03 | 164.30 | 164.14 | 154.98 | 137.04 | 150.78 | 187.85 | 181.88 | 179.74 | 162.88 | 167.43 | 147.31 | 140.10 | 137.71 | 84.86 | 146.08 | 147.59 | 141.07 | 136.40 | 127.55 | 119.22 | 112.63 | 104.37 | 93.13 | 85.36 | 78.27 | 71.92 | 63.71 | 57.86 | 50.28 | 43.49 | 36.94 | |

| Operating Expenses | 190.30 | 141.20 | 146.40 | 140.92 | 107.42 | 122.13 | 164.31 | 155.22 | 135.81 | 122.81 | 128.95 | 121.52 | 106.64 | 94.14 | 76.15 | 134.06 | 133.96 | 131.37 | 132.85 | 120.11 | 104.96 | 109.00 | 102.92 | 89.21 | 85.32 | 75.41 | 65.92 | 57.33 | 53.25 | 47.03 | NA | NA | |

| Research And Development Expense | 36.74 | 35.43 | 37.39 | 36.61 | 31.55 | 30.21 | 31.35 | 30.65 | 27.09 | 26.54 | 27.63 | 25.16 | 20.00 | 20.76 | 21.89 | 23.08 | 18.40 | 17.75 | 17.35 | 15.97 | 14.15 | 12.77 | 11.84 | 9.10 | 8.32 | 5.80 | 4.71 | 3.65 | 3.32 | 2.98 | NA | NA | |

| General And Administrative Expense | 75.67 | 24.90 | 27.27 | 24.92 | 1.72 | 4.76 | 33.51 | 33.12 | 30.58 | 20.41 | 26.17 | 20.51 | 17.87 | 14.28 | 14.16 | 15.86 | 13.81 | 12.32 | 12.54 | 11.76 | 11.43 | 10.63 | 9.54 | 7.87 | 8.59 | 5.01 | 5.03 | 4.06 | 4.06 | 3.10 | NA | NA | |

| Selling And Marketing Expense | 73.83 | 76.83 | 77.84 | 75.58 | 70.20 | 83.32 | 95.61 | 87.58 | 89.64 | 66.63 | 66.14 | 68.17 | 67.18 | 57.62 | 38.58 | 93.59 | 100.61 | 100.13 | 101.79 | 91.32 | 78.63 | 84.87 | 80.93 | 71.51 | 67.67 | 63.89 | 55.53 | 49.07 | 45.30 | 40.51 | NA | NA | |

| Operating Income Loss | -22.27 | 23.09 | 17.74 | 14.06 | 29.62 | 28.66 | 23.54 | 26.66 | 43.92 | 40.08 | 38.48 | 25.79 | 33.46 | 43.57 | 8.71 | 12.02 | 13.63 | 9.70 | 3.55 | 7.43 | 6.90 | 3.63 | 1.44 | 3.92 | 0.03 | 2.86 | 6.00 | 6.38 | 4.61 | 3.26 | NA | NA | |

| Interest Paid Net | 0.15 | 0.13 | 0.14 | 0.14 | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 69.61 | 13.04 | 15.83 | 14.98 | -13.67 | -6.95 | 26.46 | 27.84 | 24.61 | 15.17 | 22.54 | 15.39 | 10.69 | 11.03 | 11.92 | 11.68 | 8.91 | 8.76 | 8.94 | 7.69 | 5.84 | 5.53 | 5.61 | 3.82 | 4.80 | 0.07 | 0.07 | 0.08 | 0.09 | 0.09 | NA | NA | |

| Income Tax Expense Benefit | 6.21 | 8.29 | 8.60 | 6.53 | 9.35 | 10.03 | 5.33 | 7.70 | 10.43 | 10.95 | 11.14 | 6.46 | 8.24 | 11.21 | 2.05 | 0.05 | 1.34 | 0.33 | -1.61 | -3.50 | -3.22 | -7.90 | -29.12 | 0.55 | -2.00 | 0.59 | 1.70 | 2.34 | 0.88 | 1.23 | NA | NA | |

| Income Taxes Paid | 25.85 | 12.63 | 33.89 | 2.41 | 7.75 | 12.09 | 40.09 | 1.07 | 5.72 | 13.58 | 8.14 | 0.08 | 1.96 | 0.85 | 0.01 | 0.02 | 0.15 | 0.07 | 0.07 | 0.01 | -0.01 | 0.04 | 2.27 | 0.01 | 0.17 | 3.57 | 0.60 | 0.05 | 2.04 | NA | NA | NA | |

| Profit Loss | -22.60 | 18.97 | 13.82 | 11.87 | 23.23 | 18.82 | 18.06 | 18.84 | 34.16 | 29.27 | 27.40 | 19.55 | 25.16 | 32.56 | 7.13 | 12.70 | 13.17 | 10.38 | 6.01 | 12.58 | 18.12 | 12.13 | 29.42 | 5.50 | 2.27 | 2.38 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -17.91 | 22.30 | 16.41 | 16.13 | 24.79 | 20.40 | 19.28 | 19.91 | 29.63 | 29.20 | 28.05 | 22.36 | 25.16 | 32.56 | 7.13 | 12.70 | 13.17 | 10.38 | 6.01 | 12.58 | 12.45 | 12.13 | 31.27 | 3.65 | 2.27 | 2.38 | 4.35 | 4.21 | 3.84 | 2.14 | 0.27 | 0.25 | |

| Comprehensive Income Net Of Tax | -16.69 | 21.52 | 16.30 | 16.55 | 27.15 | 18.88 | 17.70 | 19.42 | 28.92 | 28.46 | 28.30 | 21.28 | 26.39 | 33.58 | 7.61 | 12.20 | 13.75 | 9.46 | 6.36 | 12.16 | 18.05 | 12.12 | 31.11 | 3.72 | 2.30 | 2.45 | 4.48 | 4.23 | 3.83 | 2.14 | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | -23.74 | 22.30 | 16.41 | 16.13 | 159.25 | 106.96 | -10.34 | -62.09 | -79.77 | 29.20 | 28.05 | 22.36 | 25.16 | 32.56 | 7.13 | NA | NA | NA | NA | NA | 18.12 | 12.13 | 31.27 | 3.65 | 2.62 | 0.98 | 1.78 | 1.73 | -26.70 | 0.88 | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | -22.60 | 18.97 | 13.82 | 11.87 | 44.42 | 18.82 | -10.34 | -62.09 | -79.18 | 29.27 | 27.40 | NA | 25.16 | 32.56 | 7.13 | NA | NA | NA | NA | NA | 18.12 | 12.13 | 31.27 | 3.65 | 2.64 | 1.03 | 1.88 | 1.82 | -26.74 | 0.92 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

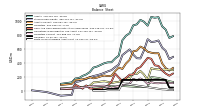

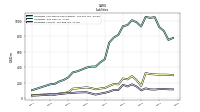

| Assets | 918.93 | 1048.72 | 1040.32 | 1051.58 | 927.10 | 982.86 | 1009.71 | 945.80 | 931.57 | 819.92 | 784.21 | 719.39 | 502.30 | 460.55 | 407.44 | 406.44 | 393.62 | 369.38 | 346.16 | 331.93 | 268.29 | 234.04 | 213.30 | 182.54 | 176.59 | 121.66 | NA | NA | 100.33 | NA | NA | NA | |

| Liabilities | 302.07 | 305.19 | 309.60 | 323.30 | 155.74 | 232.31 | 283.37 | 241.19 | 251.93 | 176.03 | 180.46 | 155.52 | 128.71 | 122.29 | 111.58 | 128.47 | 136.77 | 132.28 | 123.78 | 120.92 | 74.18 | 63.62 | 56.91 | 47.74 | 49.57 | 45.26 | NA | NA | 35.60 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 918.93 | 1048.72 | 1040.32 | 1051.58 | 927.10 | 982.86 | 1009.71 | 945.80 | 931.57 | 819.92 | 784.21 | 719.39 | 502.30 | 460.55 | 407.44 | 406.44 | 393.62 | 369.38 | 346.16 | 331.93 | 268.29 | 234.04 | 213.30 | 182.54 | 176.59 | NA | NA | NA | 100.33 | NA | NA | NA | |

| Stockholders Equity | 616.85 | 716.99 | 700.85 | 695.81 | 734.61 | 577.93 | 461.83 | 464.87 | 516.84 | 589.26 | 549.18 | 508.65 | 373.59 | 338.26 | 295.86 | 277.97 | 256.86 | 237.10 | 222.39 | 211.01 | 194.11 | 170.43 | 156.39 | 134.79 | 127.03 | -56.30 | NA | NA | -67.97 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 391.19 | 535.37 | 535.29 | 543.21 | 557.37 | 603.85 | 629.51 | 572.72 | 563.11 | 441.51 | 388.78 | 311.78 | 331.98 | 281.42 | 216.08 | 210.24 | 218.95 | 206.18 | 188.84 | 179.41 | 194.86 | 175.63 | 164.28 | 161.50 | 157.20 | 99.24 | NA | NA | 85.51 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 291.36 | 355.33 | 363.06 | 456.70 | 469.52 | 404.43 | 338.24 | 315.00 | 231.94 | 231.09 | 184.64 | 140.67 | 190.30 | 245.94 | 133.20 | 74.45 | 59.92 | 29.51 | 27.84 | 29.94 | 34.89 | 77.64 | 31.76 | 62.00 | 87.71 | 25.64 | NA | NA | 29.48 | NA | NA | NA | |

| Short Term Investments | 20.72 | 91.82 | 90.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 80.00 | 50.00 | 60.00 | NA | NA | 44.77 | NA | NA | NA | |

| Accounts Receivable Net Current | 39.96 | 46.11 | 37.82 | 42.40 | 46.82 | 120.06 | 193.43 | 144.72 | 189.32 | 85.18 | 81.86 | 36.36 | 18.23 | 16.32 | 16.84 | 17.54 | 22.12 | 17.89 | 17.08 | 15.11 | 13.61 | 12.56 | 11.43 | 12.20 | 12.58 | 10.12 | NA | NA | 6.65 | NA | NA | NA | |

| Inventory Net | 0.33 | 0.32 | 0.54 | 1.64 | 5.28 | 28.17 | 21.68 | 20.99 | 19.66 | 6.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 25.15 | 19.70 | 21.74 | 18.11 | 21.97 | 29.65 | 24.60 | 17.41 | 16.43 | 13.18 | 17.74 | 17.17 | 12.38 | NA | NA | NA | 15.42 | NA | NA | NA | NA | NA | 11.09 | 7.30 | 5.38 | 3.48 | NA | NA | 2.79 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

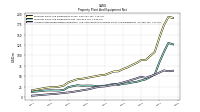

| Property Plant And Equipment Gross | 142.34 | 108.53 | 98.71 | 89.09 | 89.10 | 82.05 | 77.17 | 71.48 | 67.53 | 62.06 | 61.59 | 57.64 | 53.48 | 52.62 | 50.31 | 48.47 | 46.10 | 44.07 | 43.25 | 39.48 | 35.74 | 27.99 | 25.31 | 24.05 | 23.86 | 22.49 | NA | NA | 16.50 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 58.97 | 53.83 | 50.47 | 46.34 | 48.97 | 45.22 | 41.82 | 38.38 | 35.32 | 32.49 | 29.95 | 27.82 | 25.99 | 25.34 | 23.43 | 20.57 | 18.16 | 16.50 | 14.61 | 12.93 | 11.47 | 10.36 | 9.09 | 7.87 | 7.30 | 6.39 | NA | NA | 3.72 | NA | NA | NA | |

| Property Plant And Equipment Net | 83.37 | 54.70 | 48.24 | 42.75 | 40.13 | 36.83 | 35.34 | 33.10 | 32.21 | 29.57 | 31.64 | 29.82 | 27.48 | 27.28 | 26.88 | 27.90 | 27.95 | 27.57 | 28.64 | 26.55 | 24.27 | 17.63 | 16.22 | 16.18 | 16.56 | 16.10 | NA | NA | 12.78 | NA | NA | NA | |

| Goodwill | 157.90 | 157.27 | 157.64 | 157.69 | 157.47 | 156.22 | 157.07 | 158.00 | 158.29 | 155.71 | 156.10 | 157.15 | 29.13 | 28.36 | 27.62 | 27.30 | 15.21 | 14.83 | 15.45 | 15.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 23.06 | 30.48 | 38.04 | 45.55 | 53.05 | 60.53 | 68.34 | 76.16 | 83.92 | 92.42 | 100.35 | 108.17 | 10.86 | 10.26 | 10.60 | 11.01 | 3.92 | 3.98 | 4.32 | 4.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 7.38 | 7.55 | 7.83 | 8.13 | 8.50 | 8.95 | 7.14 | 6.07 | 4.57 | 5.89 | 4.46 | 3.16 | 2.67 | 3.31 | 3.51 | 3.72 | 3.83 | 4.33 | 3.23 | 1.89 | 1.10 | 0.14 | 0.14 | 0.15 | 0.16 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

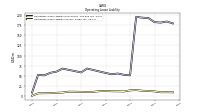

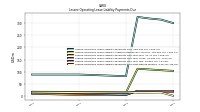

| Liabilities Current | 115.18 | 108.64 | 110.76 | 124.00 | 98.73 | 148.88 | 175.97 | 148.91 | 170.71 | 102.45 | 103.55 | 81.72 | 66.54 | 55.87 | 43.15 | 58.33 | 73.76 | 72.38 | 70.39 | 65.47 | 63.50 | 55.43 | 50.55 | 41.22 | 42.97 | 38.59 | NA | NA | 29.05 | NA | NA | NA | |

| Accounts Payable Current | 47.85 | 37.48 | 39.26 | 42.70 | 32.53 | 67.15 | 74.17 | 61.87 | 66.15 | 55.34 | 45.88 | 36.29 | 21.56 | 16.84 | 10.44 | 29.84 | 36.73 | 42.75 | 39.37 | 35.25 | 34.34 | 34.05 | 30.48 | 23.27 | 23.91 | 22.74 | NA | NA | 16.43 | NA | NA | NA | |

| Contract With Customer Liability Current | 21.32 | 21.04 | 21.27 | 20.81 | 12.25 | 12.74 | 15.07 | 12.78 | 12.78 | 12.52 | 13.12 | 11.99 | 9.14 | 9.68 | 8.20 | 5.04 | 9.98 | 7.78 | 8.48 | 8.94 | 8.81 | NA | NA | NA | 4.30 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | 0.06 | 0.06 | 0.04 | 0.03 | 0.05 | 0.02 | 0.03 | 0.03 | 0.06 | 0.02 | 0.29 | 0.29 | 0.29 | 0.30 | 0.31 | NA | 0.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 4.73 | 4.39 | 5.61 | 4.34 | 5.30 | 30.47 | 51.25 | 37.90 | 23.64 | 12.55 | 11.90 | 5.22 | 3.08 | 4.11 | 3.05 | 1.73 | 1.91 | 1.81 | 1.61 | 1.49 | 1.28 | 1.24 | 1.16 | 1.09 | 0.95 | 0.97 | NA | NA | 0.59 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 182.11 | 192.11 | 193.18 | 194.93 | 51.66 | 52.94 | 56.11 | 54.36 | 57.52 | 61.01 | 64.72 | 68.28 | 58.81 | 62.02 | 65.07 | 68.08 | 60.82 | 57.81 | 51.49 | 52.96 | 9.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

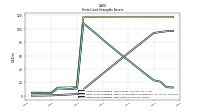

| Stockholders Equity | 616.85 | 716.99 | 700.85 | 695.81 | 734.61 | 577.93 | 461.83 | 464.87 | 516.84 | 589.26 | 549.18 | 508.65 | 373.59 | 338.26 | 295.86 | 277.97 | 256.86 | 237.10 | 222.39 | 211.01 | 194.11 | 170.43 | 156.39 | 134.79 | 127.03 | -56.30 | NA | NA | -67.97 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 263.50 | 341.11 | 346.49 | 357.75 | 413.09 | 418.01 | 407.36 | 398.47 | 387.87 | 379.81 | 368.19 | 355.97 | 242.18 | 233.25 | 224.42 | 214.14 | 205.23 | 199.23 | 193.97 | 188.95 | 184.22 | 181.63 | 179.72 | 189.24 | 185.19 | 4.22 | NA | NA | 3.71 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 354.15 | 377.89 | 355.59 | 339.18 | 323.04 | 163.80 | 56.83 | 67.17 | 129.26 | 209.02 | 179.82 | 151.77 | 129.41 | 104.25 | 71.69 | 64.56 | 51.86 | 38.69 | 28.30 | 22.30 | 9.71 | -11.45 | -23.58 | -54.85 | -58.50 | -60.77 | NA | NA | -71.70 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.90 | -2.12 | -1.34 | -1.23 | -1.64 | -4.00 | -2.48 | -0.89 | -0.40 | 0.31 | 1.04 | 0.80 | 1.88 | 0.65 | -0.36 | -0.84 | -0.35 | -0.93 | 0.00 | -0.35 | 0.07 | 0.14 | 0.15 | 0.30 | 0.23 | 0.20 | NA | NA | -0.03 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

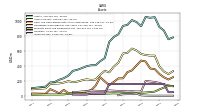

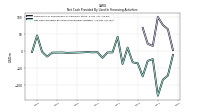

| Net Cash Provided By Used In Operating Activities | 2.50 | 26.35 | 29.34 | 66.34 | 95.30 | 73.21 | -5.46 | 93.06 | -36.77 | 53.73 | 37.47 | 43.86 | 47.94 | 73.88 | 24.79 | 10.14 | 20.57 | 23.82 | 16.04 | 9.69 | 17.12 | 10.75 | 17.47 | 6.37 | 7.15 | 8.45 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 53.45 | -10.68 | -98.45 | -5.89 | -4.83 | 25.72 | 25.57 | 26.26 | -4.80 | -7.30 | 12.04 | -68.09 | -101.75 | 41.44 | 35.90 | 7.53 | 21.73 | -18.21 | -14.43 | -11.35 | -57.43 | 38.85 | -30.69 | -31.02 | 8.36 | -14.81 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -129.96 | -22.62 | -27.83 | -73.24 | -34.93 | -32.05 | 11.25 | -36.89 | 42.86 | -2.98 | -3.03 | -19.04 | -2.34 | -2.87 | -1.98 | -2.89 | -3.35 | -3.83 | -4.25 | -3.26 | -3.45 | -3.70 | -15.18 | -1.06 | 46.62 | -1.70 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 2.50 | 26.35 | 29.34 | 66.34 | 95.30 | 73.21 | -5.46 | 93.06 | -36.77 | 53.73 | 37.47 | 43.86 | 47.94 | 73.88 | 24.79 | 10.14 | 20.57 | 23.82 | 16.04 | 9.69 | 17.12 | 10.75 | 17.47 | 6.37 | 7.15 | 8.45 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | -17.91 | 22.30 | 16.41 | 16.13 | 24.79 | 20.40 | 19.28 | 19.91 | 29.63 | 29.20 | 28.05 | 22.36 | 25.16 | 32.56 | 7.13 | 12.70 | 13.17 | 10.38 | 6.01 | 12.58 | 12.45 | 12.13 | 31.27 | 3.65 | 2.27 | 2.38 | 4.35 | 4.21 | 3.84 | 2.14 | 0.27 | 0.25 | |

| Profit Loss | -22.60 | 18.97 | 13.82 | 11.87 | 23.23 | 18.82 | 18.06 | 18.84 | 34.16 | 29.27 | 27.40 | 19.55 | 25.16 | 32.56 | 7.13 | 12.70 | 13.17 | 10.38 | 6.01 | 12.58 | 18.12 | 12.13 | 29.42 | 5.50 | 2.27 | 2.38 | NA | NA | NA | NA | NA | NA | |

| Depreciation Depletion And Amortization | 12.76 | 12.47 | 11.67 | 11.58 | 11.73 | 11.18 | 11.23 | 11.19 | 10.99 | 10.66 | 10.16 | 8.67 | 2.56 | 2.43 | 3.36 | 2.99 | 2.16 | 2.12 | 1.91 | 1.63 | 1.26 | 1.31 | 1.22 | 1.24 | 1.12 | 1.08 | 0.92 | 0.67 | 0.69 | 0.55 | NA | NA | |

| Increase Decrease In Accounts Receivable | -10.64 | 12.90 | -6.38 | -6.86 | -89.47 | -75.51 | 51.99 | -39.97 | 123.18 | 3.61 | 45.56 | 2.42 | 2.06 | -0.30 | -0.25 | -5.40 | 4.62 | 1.15 | 2.32 | 1.52 | 0.67 | 1.66 | -0.41 | -0.01 | 3.03 | 1.29 | 1.69 | 1.03 | 0.86 | NA | NA | NA | |

| Increase Decrease In Inventories | 3.00 | -0.22 | -1.09 | -3.65 | -22.88 | 6.48 | 0.69 | 1.34 | 13.26 | 1.52 | 1.97 | 0.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 0.90 | -2.96 | -6.13 | 10.27 | -36.36 | -6.86 | 12.23 | -4.06 | 10.85 | 9.21 | 10.46 | 4.88 | 4.67 | 6.17 | -18.48 | -7.44 | -6.47 | 4.71 | 2.81 | 3.23 | -2.12 | 4.12 | 6.69 | 0.65 | -0.17 | 5.21 | 1.16 | 0.04 | -5.67 | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | -5.74 | -15.72 | -4.49 | -11.92 | 8.55 | -7.20 | -10.37 | -13.09 | 0.39 | 3.44 | 2.28 | 0.06 | 7.47 | 10.07 | -0.77 | 5.46 | 1.29 | 0.29 | -1.62 | -3.69 | -2.88 | -7.94 | -26.21 | -2.01 | -0.45 | -1.07 | 0.43 | -0.03 | 0.58 | NA | NA | NA | |

| Share Based Compensation | 19.97 | 14.26 | 14.60 | 14.90 | 13.23 | 13.97 | 13.43 | 14.15 | 10.97 | 13.80 | 14.39 | 14.36 | 10.69 | 11.03 | 11.77 | 11.61 | 8.91 | 8.76 | 8.94 | 7.69 | 5.84 | 5.53 | 5.61 | 3.82 | 4.80 | 0.07 | 0.07 | 0.08 | 0.09 | NA | NA | NA | |

| Amortization Of Financing Costs | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 53.45 | -10.68 | -98.45 | -5.89 | -4.83 | 25.72 | 25.57 | 26.26 | -4.80 | -7.30 | 12.04 | -68.09 | -101.75 | 41.44 | 35.90 | 7.53 | 21.73 | -18.21 | -14.43 | -11.35 | -57.43 | 38.85 | -30.69 | -31.02 | 8.36 | -14.81 | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 15.52 | 4.79 | 1.86 | 2.40 | 1.76 | 1.51 | 1.43 | 1.23 | 2.78 | 0.26 | 3.44 | 1.23 | 0.22 | 0.16 | 1.36 | 1.21 | 0.44 | 2.18 | 2.88 | 5.70 | 4.08 | 0.89 | 0.55 | 0.43 | 0.91 | 2.27 | 1.82 | 0.16 | 1.84 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -129.96 | -22.62 | -27.83 | -73.24 | -34.93 | -32.05 | 11.25 | -36.89 | 42.86 | -2.98 | -3.03 | -19.04 | -2.34 | -2.87 | -1.98 | -2.89 | -3.35 | -3.83 | -4.25 | -3.26 | -3.45 | -3.70 | -15.18 | -1.06 | 46.62 | -1.70 | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 101.11 | 15.95 | 22.43 | 69.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 223.12 | 219.42 | 239.74 | 231.96 | 286.74 | 426.45 | 511.23 | 430.61 | 339.34 | 222.91 | 217.75 | 171.37 | 151.55 | 147.47 | 94.74 | 157.69 | 158.15 | 150.46 | 145.03 | 135.27 | 126.09 | 119.04 | 110.33 | 98.70 | 90.60 | 82.99 | 76.24 | 67.03 | 60.76 | 53.14 | 45.63 | 38.61 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 223.12 | 219.42 | 239.74 | 231.96 | 286.74 | 426.45 | 511.23 | 430.61 | 339.34 | 222.91 | 217.75 | 171.37 | 151.55 | 147.47 | 94.74 | 157.69 | 158.15 | 150.46 | 145.03 | 135.27 | 126.09 | 119.12 | 110.30 | 98.58 | 90.60 | 82.99 | 76.24 | 67.03 | 60.76 | 53.14 | 45.63 | 38.61 | |

| Dealer To Dealer | 24.86 | 23.29 | 32.95 | 28.70 | 46.82 | 70.74 | 97.06 | 105.49 | 94.35 | 57.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Marketplace | 182.25 | 177.91 | 170.95 | 167.13 | 166.25 | 165.31 | 163.93 | 163.29 | 160.76 | 159.93 | 160.46 | 155.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Wholesale | 22.04 | 21.73 | 31.95 | 25.19 | 23.66 | 47.05 | 75.94 | 90.99 | 82.59 | 45.22 | 53.51 | 13.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Product | 18.84 | 19.77 | 36.84 | 39.65 | 96.84 | 214.10 | 271.37 | 176.32 | 95.99 | 17.77 | 3.78 | 1.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Digital Wholesale | 40.87 | 41.51 | 68.79 | 64.84 | 120.50 | 261.14 | 347.30 | 267.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| United States Marketplace | 168.90 | 164.32 | 158.44 | 155.62 | 155.09 | 154.40 | 152.75 | 151.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| All Other | 13.35 | 13.59 | 12.51 | 11.51 | 11.15 | 10.91 | 11.17 | 11.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| US | 209.77 | 205.83 | 227.23 | 220.46 | 275.59 | 415.55 | 500.06 | 419.21 | 327.88 | 211.55 | 206.58 | 163.01 | 143.67 | 138.41 | 89.75 | 148.01 | 147.96 | 141.64 | 137.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Non Us | 13.35 | 13.59 | 12.51 | 11.51 | 11.15 | 10.91 | 11.17 | 11.40 | 11.46 | 11.36 | 11.16 | 8.36 | 7.88 | 9.06 | 4.99 | 9.68 | 10.20 | 8.82 | 8.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |