| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

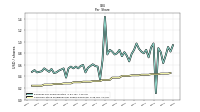

| Earnings Per Share Basic | 0.63 | 0.82 | 0.90 | 0.11 | |

| Earnings Per Share Diluted | 0.63 | 0.82 | 0.89 | 0.11 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

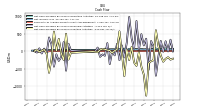

| Interest And Fee Income Loans And Leases | 122.39 | 115.14 | 107.28 | 100.36 | |

| Interest Expense | 37.14 | 29.77 | 22.34 | 14.85 | |

| Interest Income Expense Net | 109.19 | 107.79 | 109.28 | 111.03 | |

| Interest Paid Net | 35.89 | 27.74 | 21.59 | 14.81 | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | 0.00 | 0.24 | |

| Income Tax Expense Benefit | 10.09 | 11.86 | 13.18 | 1.18 | |

| Income Taxes Paid | 12.46 | 10.72 | 17.41 | 1.06 | |

| Net Income Loss | 33.71 | 44.13 | 48.29 | 5.80 | |

| Comprehensive Income Net Of Tax | 168.51 | -35.86 | 14.67 | 114.15 | |

| Net Income Loss Available To Common Stockholders Basic | 33.59 | 43.97 | 48.10 | 5.78 | |

| Interest Income Expense After Provision For Loan Loss | 105.12 | 104.91 | 108.53 | 107.53 | |

| Noninterest Expense | 129.09 | 116.50 | 113.04 | 114.05 | |

| Noninterest Income | 67.77 | 67.59 | 65.98 | 13.49 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Assets | 15555.75 | 15386.32 | 15108.05 | 15255.95 | |

| Liabilities | 13857.82 | 13831.38 | 13490.64 | 13621.94 | |

| Liabilities And Stockholders Equity | 15555.75 | 15386.32 | 15108.05 | 15255.95 | |

| Stockholders Equity | 1697.94 | 1554.94 | 1617.41 | 1634.01 | |

| Tier One Risk Based Capital | 1402.19 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 190.96 | 455.81 | 222.78 | 189.30 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 190.96 | 455.81 | 222.78 | 189.30 | |

| Equity Securities Fv Ni | 0.37 | 0.32 | 0.37 | 0.42 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 1379.78 | NA | NA | NA | |

| Deposits | 12928.12 | 13030.79 | 12871.79 | 13110.67 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Stockholders Equity | 1697.94 | 1554.94 | 1617.41 | 1634.01 | |

| Additional Paid In Capital | 1060.29 | 1057.43 | 1054.87 | 1052.80 | |

| Retained Earnings Accumulated Deficit | 1188.87 | 1179.20 | 1159.13 | 1134.53 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -556.89 | -691.69 | -611.70 | -578.09 | |

| Treasury Stock Value | 55.59 | 51.20 | 46.04 | 36.33 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.56 | 2.52 | 1.92 | 2.27 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

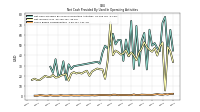

| Net Cash Provided By Used In Operating Activities | 44.71 | 64.86 | 41.48 | 77.37 | |

| Net Cash Provided By Used In Investing Activities | -296.87 | -123.23 | 159.80 | 596.07 | |

| Net Cash Provided By Used In Financing Activities | -12.69 | 291.40 | -167.80 | -694.04 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 44.71 | 64.86 | 41.48 | 77.37 | |

| Net Income Loss | 33.71 | 44.13 | 48.29 | 5.80 | |

| Increase Decrease In Other Operating Capital Net | -3.86 | -6.95 | 16.70 | -6.99 | |

| Share Based Compensation | 2.56 | 2.52 | 1.92 | 2.27 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -296.87 | -123.23 | 159.80 | 596.07 | |

| Payments To Acquire Property Plant And Equipment | 4.70 | 6.95 | 2.87 | 4.07 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

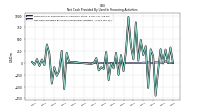

| Net Cash Provided By Used In Financing Activities | -12.69 | 291.40 | -167.80 | -694.04 | |

| Payments Of Dividends Common Stock | 24.05 | 23.61 | 23.73 | 23.71 | |

| Payments For Repurchase Of Common Stock | 4.39 | 5.16 | 9.71 | 10.97 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | ||

|---|---|---|---|---|---|

| Axiom | 0.40 | 0.30 | 0.00 | 0.10 | |

| Elmira Savings Bank | 3.90 | 3.90 | 3.50 | 4.70 |