| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

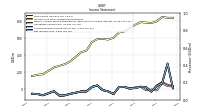

| Earnings Per Share Basic | 0.08 | -0.08 | 0.04 | 0.05 | 0.02 | 0.01 | 0.05 | 0.04 | -0.16 | -0.08 | -0.04 | 0.09 | 0.05 | -0.08 | -0.08 | -0.12 | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.08 | -0.08 | 0.04 | 0.05 | 0.02 | 0.01 | 0.05 | 0.04 | -0.16 | -0.08 | -0.04 | 0.09 | 0.05 | -0.08 | -0.08 | -0.12 | NA | NA | NA | NA | NA | NA | NA |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

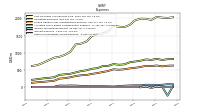

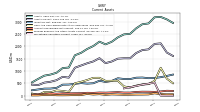

| Revenue From Contract With Customer Excluding Assessed Tax | 2846.66 | 2738.61 | 2777.77 | 2784.68 | 2707.48 | 2532.12 | 2431.01 | 2428.33 | 2388.40 | 2212.16 | 2155.04 | 2135.18 | 2043.01 | 1782.00 | 1699.86 | 1621.39 | 1354.53 | 1229.80 | 1153.55 | 1108.87 | 875.63 | 805.59 | 763.46 | |

| Cost Of Goods And Services Sold | 2044.14 | 1957.85 | 1991.00 | 1993.22 | 1947.37 | 1811.94 | 1748.21 | 1760.51 | 1782.89 | 1627.32 | 1561.58 | 1545.40 | 1488.83 | 1327.44 | 1266.50 | 1242.68 | 1028.37 | 938.02 | 881.31 | 854.98 | 703.59 | 639.71 | 613.47 | |

| Gross Profit | 802.53 | 780.76 | 786.77 | 791.46 | 760.11 | 720.18 | 682.80 | 667.82 | 605.51 | 584.84 | 593.45 | 589.78 | 554.18 | 454.56 | 433.36 | 378.71 | 326.15 | 291.78 | 272.24 | 253.89 | 172.04 | 165.88 | 149.99 | |

| Operating Expenses | 822.13 | 790.92 | 804.69 | 767.40 | 744.39 | 720.61 | 661.14 | 649.00 | 668.70 | 616.77 | 609.64 | 550.65 | 532.58 | 486.87 | 465.63 | 426.19 | 386.75 | 370.56 | 355.31 | 284.16 | 250.54 | 229.01 | 209.81 | |

| Selling General And Administrative Expense | 628.10 | 611.72 | 619.20 | 583.67 | 560.97 | 543.53 | 516.98 | 504.28 | 516.53 | 466.43 | 437.67 | 406.22 | 382.48 | 352.25 | 343.18 | 320.06 | 284.94 | 258.49 | 244.56 | 181.90 | 150.38 | 139.75 | 123.15 | |

| Marketing And Advertising Expense | 194.04 | 179.20 | 185.49 | 183.73 | 183.43 | 177.08 | 144.16 | 144.72 | 152.16 | 150.34 | 171.97 | 144.44 | 150.10 | 134.62 | 122.45 | 106.14 | 101.81 | 112.07 | 110.75 | 102.26 | 100.16 | 89.26 | 86.66 | |

| Operating Income Loss | -19.60 | -10.16 | -17.92 | 24.06 | 15.72 | -0.43 | 21.66 | 18.82 | -63.19 | -31.93 | -16.19 | 39.12 | 21.60 | -32.31 | -32.27 | -47.49 | -60.60 | -78.78 | -83.08 | -30.27 | -78.50 | -63.13 | -59.83 | |

| Interest Expense | 0.95 | 0.88 | 0.90 | 0.86 | 0.67 | 0.65 | 0.66 | 0.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | 0.00 | |

| Interest Income Expense Nonoperating Net | 31.38 | 10.17 | 8.93 | 8.02 | 6.20 | 2.75 | 0.69 | -0.34 | -0.42 | -0.31 | -0.50 | -0.40 | -0.55 | -0.54 | -0.55 | -0.38 | -0.34 | -0.22 | 0.20 | 0.72 | -0.12 | 0.02 | 0.01 | |

| Allocated Share Based Compensation Expense | 60.21 | 64.35 | 66.00 | 48.55 | 48.42 | 45.53 | 38.38 | 25.79 | 14.08 | 18.80 | 21.78 | 23.11 | 21.08 | 24.81 | 33.15 | 42.23 | 44.56 | 39.35 | 43.78 | 7.20 | 3.23 | 4.04 | 3.30 | |

| Income Tax Expense Benefit | 4.64 | 1.70 | 1.30 | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Net Income Loss | 34.26 | -35.81 | 18.95 | 22.18 | 6.10 | 2.31 | 22.34 | 18.47 | -63.61 | -32.24 | -16.69 | 38.72 | 21.05 | -32.85 | -32.82 | -47.87 | -60.94 | -79.00 | -82.88 | -29.55 | -78.62 | -63.11 | -59.81 |

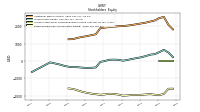

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

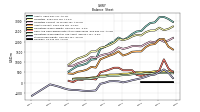

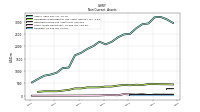

| Assets | 3186.85 | 2936.48 | 2904.01 | 2738.34 | 2515.08 | 2491.16 | 2368.51 | 2190.04 | 2086.28 | 2195.48 | 2018.36 | 1898.53 | 1740.91 | 1643.24 | 1144.84 | 1123.37 | 932.32 | 858.69 | 813.93 | 682.31 | NA | NA | NA | |

| Liabilities | 2676.61 | 2543.32 | 2539.39 | 2455.98 | 2301.12 | 2327.21 | 2251.12 | 2131.43 | 2071.55 | 2129.46 | 1943.31 | 1829.50 | 1742.91 | 1699.66 | 1522.45 | 1519.90 | 1336.30 | 1248.14 | 1175.67 | 1040.25 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 3186.85 | 2936.48 | 2904.01 | 2738.34 | 2515.08 | 2491.16 | 2368.51 | 2190.04 | 2086.28 | 2195.48 | 2018.36 | 1898.53 | 1740.91 | 1643.24 | 1144.84 | 1123.37 | 932.32 | 858.69 | 813.93 | 682.31 | NA | NA | NA | |

| Stockholders Equity | 510.24 | 393.17 | 364.63 | 282.37 | 213.96 | 163.96 | 117.39 | 58.61 | 14.74 | 66.02 | 75.05 | 69.02 | -2.00 | -56.42 | -377.61 | -396.54 | -403.97 | -389.46 | -361.73 | -357.94 | -273.73 | -198.66 | -139.92 |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

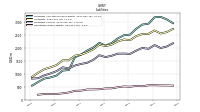

| Assets Current | 2104.35 | 1882.93 | 1854.39 | 1733.61 | 1520.32 | 1520.56 | 1505.43 | 1389.38 | 1323.53 | 1524.12 | 1392.53 | 1317.21 | 1226.78 | 1136.54 | 733.31 | 767.80 | 629.79 | 566.21 | 531.02 | 430.12 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 602.23 | 469.41 | 457.10 | 408.69 | 330.44 | 378.23 | 606.80 | 604.76 | 603.08 | 726.92 | 725.00 | 637.52 | 563.35 | 505.83 | 153.84 | 192.53 | 212.09 | 135.87 | 150.84 | 29.30 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 602.23 | 469.41 | 457.10 | 408.69 | 330.44 | 378.23 | 606.80 | 604.76 | 603.08 | 726.92 | 725.00 | 637.52 | 563.35 | 505.83 | 153.84 | 192.53 | 212.09 | 135.87 | 150.84 | 29.30 | 1.17 | 28.41 | 20.33 | |

| Marketable Securities Current | 531.78 | 487.77 | 448.32 | 394.49 | 346.94 | 296.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 154.04 | 160.98 | 162.68 | 151.72 | 126.35 | 126.96 | 143.81 | 133.23 | 123.51 | 128.71 | 113.43 | 117.56 | 100.70 | 97.92 | 93.78 | 98.09 | 80.48 | 94.09 | 59.99 | 58.98 | NA | NA | NA | |

| Inventory Net | 719.27 | 712.05 | 738.20 | 731.38 | 675.52 | 679.15 | 707.92 | 598.20 | 560.43 | 606.59 | 505.98 | 490.89 | 513.30 | 482.65 | 453.04 | 448.76 | 317.81 | 289.94 | 288.15 | 254.14 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 97.02 | 52.71 | 48.08 | 47.34 | 41.07 | 39.43 | 46.90 | 53.19 | 36.51 | 61.90 | 48.13 | 71.23 | 27.56 | 29.46 | 20.30 | 17.15 | 18.79 | 34.56 | 29.94 | 13.05 | NA | NA | NA |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Finite Lived Intangible Assets Net | 3.96 | NA | NA | NA | 7.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 47.15 | 25.88 | 63.62 | 42.95 | 53.15 | 65.63 | 20.30 | 24.80 | 22.89 | 11.73 | 10.08 | 8.70 | 6.90 | 6.74 | 4.70 | 4.00 | 4.75 | 3.73 | 3.45 | 1.50 | NA | NA | NA |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

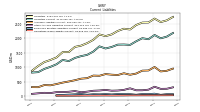

| Liabilities Current | 2110.88 | 1964.69 | 1999.39 | 1893.47 | 1769.35 | 1782.04 | 1778.31 | 1697.63 | 1644.88 | 1718.69 | 1538.95 | 1424.99 | 1380.86 | 1318.74 | 1209.14 | 1249.80 | 1100.54 | 1011.43 | 938.89 | 828.65 | NA | NA | NA | |

| Other Accrued Liabilities Current | 324.47 | 223.05 | 202.33 | 201.93 | 269.21 | 215.83 | 193.47 | 187.46 | 215.17 | 194.47 | 185.60 | 154.41 | 133.50 | 175.60 | 151.11 | 140.83 | 138.06 | 105.48 | 114.57 | 97.43 | NA | NA | NA | |

| Accrued Liabilities Current | 1005.94 | 886.26 | 880.07 | 779.62 | 738.47 | 790.09 | 728.92 | 740.64 | 761.56 | 703.00 | 709.93 | 620.46 | 602.50 | 549.30 | 506.54 | 466.94 | 417.49 | 373.74 | 381.98 | 309.05 | NA | NA | NA |

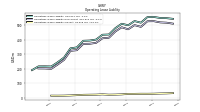

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Liabilities Noncurrent | 37.94 | 51.63 | 51.23 | 61.93 | 60.01 | 59.39 | 16.11 | 19.97 | 16.50 | 32.15 | 31.96 | 33.05 | 33.82 | 56.98 | 51.48 | 40.54 | 35.32 | 34.09 | 33.85 | 33.97 | NA | NA | NA | |

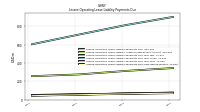

| Operating Lease Liability Noncurrent | 527.79 | 526.99 | 488.77 | 500.58 | 471.76 | 485.77 | 456.70 | 413.83 | 410.17 | 378.62 | 372.40 | 371.46 | 328.23 | 323.95 | 261.84 | 229.56 | 200.44 | 202.62 | 202.92 | NA | NA | NA | NA |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 510.24 | 393.17 | 364.63 | 282.37 | 213.96 | 163.96 | 117.39 | 58.61 | 14.74 | 66.02 | 75.05 | 69.02 | -2.00 | -56.42 | -377.61 | -396.54 | -403.97 | -389.46 | -361.73 | -357.94 | -273.73 | -198.66 | -139.92 | |

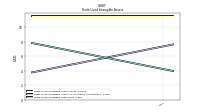

| Additional Paid In Capital | 2481.98 | 2345.08 | 2280.75 | 2217.46 | 2171.25 | 2127.37 | 2083.12 | 2046.71 | 2021.31 | 2009.01 | 1985.80 | 1963.11 | 1930.80 | 1897.46 | 1543.48 | 1491.79 | 1436.48 | 1390.09 | 1338.81 | 1263.71 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1975.65 | -1956.23 | -1920.42 | -1939.36 | -1961.54 | -1967.65 | -1969.96 | -1992.30 | -2010.78 | -1947.17 | -1914.92 | -1898.24 | -1936.96 | -1958.01 | -1925.16 | -1892.34 | -1844.47 | -1783.53 | -1704.53 | -1621.66 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 60.21 | 64.35 | 66.00 | 48.55 | 48.42 | 45.53 | 38.38 | 25.79 | 14.08 | 18.80 | 21.78 | 23.11 | 21.08 | 24.81 | 33.15 | 42.23 | 44.56 | 39.35 | 43.78 | 7.23 | 3.23 | 4.04 | 3.27 |

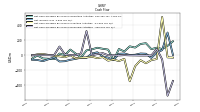

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

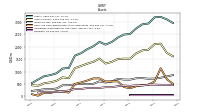

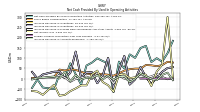

| Net Cash Provided By Used In Operating Activities | 98.86 | 80.21 | 158.76 | 148.39 | 100.55 | 117.42 | 49.17 | 82.43 | -65.97 | 74.25 | 85.08 | 98.37 | 77.47 | 63.43 | -28.89 | 20.75 | 74.33 | 1.58 | 21.81 | -51.14 | -43.17 | -3.93 | -45.27 | |

| Net Cash Provided By Used In Investing Activities | -49.91 | -65.11 | -106.31 | -66.04 | -145.62 | -344.25 | -48.19 | -77.42 | -57.56 | -72.00 | -24.83 | -38.88 | -19.67 | -30.38 | -33.18 | -40.46 | -0.00 | -26.71 | -14.98 | -8.16 | 15.61 | 11.69 | -3.49 | |

| Net Cash Provided By Used In Financing Activities | 82.53 | -2.80 | -4.03 | -4.11 | -2.72 | -1.74 | 1.06 | -3.33 | -0.32 | -0.33 | 27.22 | 14.70 | -0.28 | 318.94 | 23.38 | 0.17 | 1.89 | 10.16 | 114.72 | 0.27 | 0.32 | 0.33 | 0.33 |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 98.86 | 80.21 | 158.76 | 148.39 | 100.55 | 117.42 | 49.17 | 82.43 | -65.97 | 74.25 | 85.08 | 98.37 | 77.47 | 63.43 | -28.89 | 20.75 | 74.33 | 1.58 | 21.81 | -51.14 | -43.17 | -3.93 | -45.27 | |

| Net Income Loss | 34.26 | -35.81 | 18.95 | 22.18 | 6.10 | 2.31 | 22.34 | 18.47 | -63.61 | -32.24 | -16.69 | 38.72 | 21.05 | -32.85 | -32.82 | -47.87 | -60.94 | -79.00 | -82.88 | -29.55 | -78.62 | -63.11 | -59.81 | |

| Depreciation Depletion And Amortization | 27.50 | 25.52 | 27.80 | 28.88 | 22.61 | 23.02 | 20.34 | 17.34 | 16.87 | 14.02 | 12.69 | 11.43 | 11.07 | 9.26 | 8.08 | 7.25 | 7.93 | 8.14 | 7.63 | 6.95 | 6.31 | 5.36 | 4.72 | |

| Increase Decrease In Accounts Receivable | -7.56 | -1.70 | 10.96 | 25.37 | -0.72 | -16.84 | 10.57 | 9.72 | -5.20 | 15.28 | -4.13 | 16.87 | 2.78 | 4.14 | -4.32 | 17.61 | -13.61 | 34.09 | 1.01 | 10.25 | 4.81 | 3.22 | -4.25 | |

| Increase Decrease In Inventories | 4.73 | -26.15 | 6.83 | 55.86 | -3.63 | -28.77 | 109.72 | 37.77 | -46.16 | 100.62 | 15.09 | -22.42 | 30.66 | 29.61 | 4.28 | 130.95 | 27.87 | 1.78 | 34.02 | 33.28 | 19.95 | -0.04 | 32.54 | |

| Share Based Compensation | 60.21 | 64.35 | 66.00 | 48.55 | 48.42 | 45.53 | 38.38 | 25.79 | 14.08 | 18.80 | 21.78 | 23.11 | 21.08 | 24.81 | 33.15 | 42.23 | 44.56 | 39.35 | 43.78 | 7.23 | 3.23 | 4.04 | 3.27 |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -49.91 | -65.11 | -106.31 | -66.04 | -145.62 | -344.25 | -48.19 | -77.42 | -57.56 | -72.00 | -24.83 | -38.88 | -19.67 | -30.38 | -33.18 | -40.46 | -0.00 | -26.71 | -14.98 | -8.16 | 15.61 | 11.69 | -3.49 | |

| Payments To Acquire Productive Assets | 32.38 | 31.68 | 57.64 | 21.57 | 58.47 | 47.63 | 48.19 | 76.02 | 47.47 | 72.00 | 24.83 | 38.88 | 30.48 | 30.54 | 27.14 | 42.58 | 10.10 | 14.38 | 11.94 | 12.22 | 8.13 | 14.74 | 13.46 |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 82.53 | -2.80 | -4.03 | -4.11 | -2.72 | -1.74 | 1.06 | -3.33 | -0.32 | -0.33 | 27.22 | 14.70 | -0.28 | 318.94 | 23.38 | 0.17 | 1.89 | 10.16 | 114.72 | 0.27 | 0.32 | 0.33 | 0.33 |

| 2024-01-28 | 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | 2020-05-03 | 2020-02-02 | 2019-11-03 | 2019-08-04 | 2019-05-05 | 2018-10-28 | 2018-07-29 | 2018-04-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 2846.66 | 2738.61 | 2777.77 | 2784.68 | 2707.48 | 2532.12 | 2431.01 | 2428.33 | 2388.40 | 2212.16 | 2155.04 | 2135.18 | 2043.01 | 1782.00 | 1699.86 | 1621.39 | 1354.53 | 1229.80 | 1153.55 | 1108.87 | 875.63 | 805.59 | 763.46 |