| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 224.69 | 228.98 | 243.72 | NA | 246.26 | 246.18 | 246.15 | NA | 244.58 | 138.98 | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 171.00 | 167.31 | 171.60 | NA | 170.03 | 167.88 | 167.54 | NA | 158.99 | 138.98 | NA | NA | NA | NA | |

| Earnings Per Share Basic | 0.65 | 0.66 | 0.50 | 0.31 | 0.65 | 0.69 | 0.51 | 0.30 | 0.41 | -0.14 | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.65 | 0.66 | 0.50 | 0.31 | 0.65 | 0.67 | 0.50 | 0.29 | 0.39 | -0.14 | NA | NA | NA | NA |

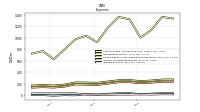

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

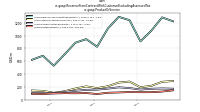

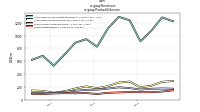

| Revenue From Contract With Customer Excluding Assessed Tax | 1827.00 | 1861.00 | 1574.00 | 1374.00 | 1818.00 | 1861.00 | 1598.00 | 1246.50 | 1404.80 | 1297.60 | 1055.00 | 831.50 | 1012.50 | 955.90 | |

| Revenues | 1827.00 | 1861.00 | 1574.00 | 1374.00 | 1818.00 | 1861.00 | 1598.00 | 1246.50 | 1404.80 | 1297.60 | 1055.00 | 831.50 | 1012.50 | 955.90 | |

| Cost Of Goods And Services Sold | 1333.00 | 1360.00 | 1135.00 | 1001.00 | 1318.00 | 1360.00 | 1177.00 | 919.10 | 1034.20 | 972.40 | 798.00 | 627.70 | 768.10 | 725.30 | |

| Gross Profit | 494.00 | 501.00 | 439.00 | 373.00 | 500.00 | 501.00 | 421.00 | 327.40 | 370.60 | 325.20 | 257.00 | 203.80 | 244.40 | 230.60 | |

| Operating Expenses | 277.00 | 275.00 | 258.00 | 249.00 | 266.00 | 264.00 | 241.00 | 218.80 | 223.10 | 225.40 | 188.00 | 171.70 | 179.70 | 171.10 | |

| Selling General And Administrative Expense | 240.00 | 238.00 | 223.00 | 213.00 | 231.00 | 230.00 | 206.00 | 183.40 | 187.90 | 191.80 | 154.00 | 137.40 | 144.80 | 136.80 | |

| Operating Income Loss | 217.00 | 226.00 | 181.00 | 124.00 | 234.00 | 237.00 | 180.00 | 108.60 | 147.50 | 99.80 | 69.00 | 32.10 | 64.70 | 59.50 | |

| Interest Expense | 20.00 | 22.00 | 17.00 | 20.00 | 16.00 | 17.00 | 13.00 | 12.70 | 13.00 | 36.80 | 36.00 | 35.20 | 35.60 | 35.00 | |

| Interest Paid Net | 30.00 | 31.00 | 28.00 | 27.00 | 20.00 | 15.00 | 12.00 | 12.00 | 12.00 | 52.00 | 50.00 | NA | NA | NA | |

| Income Tax Expense Benefit | 39.00 | 40.00 | 31.00 | 20.00 | 40.00 | 38.00 | 30.00 | 16.80 | 24.90 | 3.10 | 6.00 | -3.60 | 7.50 | 6.40 | |

| Income Taxes Paid | 21.00 | 34.00 | 27.00 | 40.00 | 45.00 | 34.00 | 28.00 | 26.00 | 14.00 | 8.00 | 7.00 | NA | NA | NA | |

| Profit Loss | 158.00 | 164.00 | 133.00 | 84.00 | 178.00 | 182.00 | 137.00 | 78.80 | 109.30 | -37.00 | 27.40 | 0.50 | 21.60 | 18.10 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -4.00 | 8.00 | -8.00 | -16.00 | 32.00 | -9.00 | 37.00 | 13.00 | 14.40 | 4.70 | 2.00 | 2.00 | 1.80 | 1.60 | |

| Net Income Loss | 112.00 | 110.00 | 86.00 | 54.00 | 111.00 | 115.00 | 86.00 | 47.70 | 64.40 | -20.00 | 27.00 | 0.50 | 21.60 | 18.10 | |

| Comprehensive Income Net Of Tax | 109.00 | 116.00 | 81.00 | 44.00 | 131.00 | 109.00 | 109.00 | 55.90 | 72.90 | 29.90 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 112.00 | 110.00 | 86.00 | 54.00 | 111.00 | 115.00 | 86.00 | 46.90 | 64.40 | -20.00 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 146.00 | 150.00 | 121.00 | 76.00 | 160.00 | 165.00 | 124.00 | 70.00 | 96.50 | -20.00 | NA | NA | NA | NA |

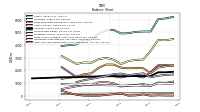

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

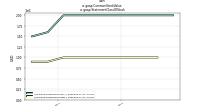

| Assets | 5067.00 | 5039.00 | 4929.00 | 4909.00 | 5190.00 | 5148.00 | 4894.00 | 4434.00 | 4380.80 | 4053.30 | NA | 3923.70 | NA | NA | |

| Liabilities | 2852.00 | 2826.00 | 2737.00 | 2499.00 | 2838.00 | 2983.00 | 2888.00 | 2603.00 | 2622.10 | 2505.30 | NA | 3123.00 | NA | NA | |

| Liabilities And Stockholders Equity | 5067.00 | 5039.00 | 4929.00 | 4909.00 | 5190.00 | 5148.00 | 4894.00 | 4434.00 | 4380.80 | 4053.30 | NA | 3923.70 | NA | NA | |

| Stockholders Equity | 1769.00 | 1695.00 | 1628.00 | 1747.00 | 1704.00 | 1550.00 | 1436.00 | 1325.00 | 1223.30 | 1071.90 | NA | NA | NA | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 2171.00 | 2182.00 | 2166.00 | 2211.00 | 2455.00 | 2461.00 | 2202.00 | 1767.00 | 1696.90 | 1508.30 | NA | 1337.10 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 101.00 | 20.00 | 1.00 | 177.00 | NA | NA | 1.00 | 1.00 | 4.90 | 66.60 | NA | 380.90 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 101.00 | 20.00 | 1.00 | 177.00 | NA | NA | 1.00 | 1.00 | 4.90 | 66.60 | 320.00 | 380.90 | 332.90 | 291.80 | |

| Accounts Receivable Net Current | 1132.00 | 1164.00 | 1031.00 | 851.00 | 1160.00 | 1178.00 | 1033.00 | 784.00 | 866.90 | 770.50 | NA | 494.90 | NA | NA | |

| Receivables Net Current | 1215.00 | 1231.00 | 1098.00 | 955.00 | 1273.00 | 1264.00 | 1113.00 | 884.00 | 946.10 | 832.90 | NA | 556.80 | NA | NA | |

| Inventory Net | 824.00 | 896.00 | 1030.00 | 1047.00 | 1148.00 | 1166.00 | 1063.00 | 856.00 | 721.20 | 593.20 | NA | 383.80 | NA | NA | |

| Prepaid Expense And Other Assets Current | 31.00 | 35.00 | 37.00 | 32.00 | 34.00 | 31.00 | 25.00 | 26.00 | 24.70 | 15.60 | NA | 15.60 | NA | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 212.00 | NA | NA | NA | 186.00 | 177.20 | 163.60 | NA | 158.00 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 107.00 | NA | NA | NA | 92.00 | 86.50 | 81.40 | NA | 71.80 | NA | NA | |

| Amortization Of Intangible Assets | 31.00 | 31.00 | 29.00 | 31.00 | 30.00 | 29.00 | 30.00 | 31.60 | 30.60 | 28.80 | 29.00 | 30.20 | 29.60 | 29.60 | |

| Property Plant And Equipment Net | 142.00 | 130.00 | 121.00 | 105.00 | 105.00 | 101.00 | 95.00 | 94.00 | 90.70 | 82.20 | NA | 86.20 | NA | NA | |

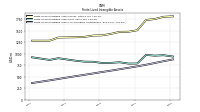

| Goodwill | 1552.00 | 1552.00 | 1536.00 | 1535.00 | 1537.00 | 1527.00 | 1517.00 | 1515.00 | 1515.40 | 1452.50 | NA | 1452.70 | NA | NA | |

| Finite Lived Intangible Assets Net | 782.00 | 811.00 | 798.00 | 795.00 | 822.00 | 824.00 | 844.00 | 871.00 | 899.30 | 861.70 | NA | 919.20 | NA | NA | |

| Other Assets Noncurrent | 85.00 | 89.00 | 81.00 | 88.00 | 108.00 | 69.00 | 79.00 | 35.00 | 19.80 | 4.40 | NA | NA | NA | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 921.00 | 842.00 | 798.00 | 726.00 | 987.00 | 1079.00 | 1066.00 | 839.00 | 842.60 | 744.80 | NA | 522.30 | NA | NA | |

| Long Term Debt Current | 15.00 | 15.00 | 15.00 | 15.00 | 15.00 | 15.00 | 15.00 | 15.00 | 15.00 | 15.00 | NA | 13.00 | NA | NA | |

| Accounts Payable Current | 646.00 | 601.00 | 581.00 | 479.00 | 701.00 | 826.00 | 859.00 | 608.00 | 613.30 | 564.90 | NA | 325.70 | NA | NA | |

| Accrued Income Taxes Current | NA | NA | NA | NA | 27.00 | 26.00 | 16.00 | 12.00 | NA | NA | NA | 3.00 | NA | NA | |

| Other Liabilities Current | 106.00 | 96.00 | 87.00 | 55.00 | 98.00 | 96.00 | 77.00 | 58.00 | 68.00 | 51.50 | NA | 70.10 | NA | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

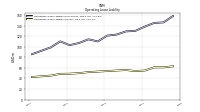

| Long Term Debt Noncurrent | 1436.00 | 1554.00 | 1571.00 | 1444.00 | 1537.00 | 1592.00 | 1510.00 | 1456.00 | 1459.00 | 1462.00 | NA | 2251.70 | NA | NA | |

| Deferred Income Tax Liabilities Net | 48.00 | 48.00 | 40.00 | 9.00 | 6.00 | 31.00 | 41.00 | 35.00 | 97.70 | 87.80 | NA | 232.10 | NA | NA | |

| Minority Interest | 446.00 | 518.00 | 564.00 | 663.00 | 648.00 | 615.00 | 570.00 | 506.00 | 535.40 | 476.10 | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 18.00 | 22.00 | 22.00 | 19.00 | 19.00 | 19.00 | 17.00 | 17.00 | 20.90 | 23.30 | NA | 31.00 | NA | NA | |

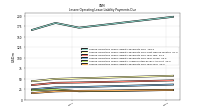

| Operating Lease Liability Noncurrent | 130.00 | 129.00 | 123.00 | 121.00 | 110.00 | 114.00 | 107.00 | 103.00 | 110.10 | 98.80 | NA | 85.90 | NA | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1769.00 | 1695.00 | 1628.00 | 1747.00 | 1704.00 | 1550.00 | 1436.00 | 1325.00 | 1223.30 | 1071.90 | NA | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2215.00 | 2213.00 | 2192.00 | 2410.00 | 2352.00 | 2165.00 | 2006.00 | 1831.00 | 1758.70 | 1548.00 | NA | NA | NA | NA | |

| Additional Paid In Capital | 1227.00 | 1196.00 | 1181.00 | 1241.00 | 1242.00 | 1216.00 | 1214.00 | 1214.00 | 1168.70 | 1090.30 | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 491.00 | 447.00 | 403.00 | 458.00 | 404.00 | 298.00 | 180.00 | 92.00 | 44.40 | -20.00 | NA | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 49.00 | 49.00 | 41.00 | 45.00 | 55.00 | 33.00 | 39.00 | 16.00 | 7.70 | -0.80 | NA | NA | NA | NA | |

| Minority Interest | 446.00 | 518.00 | 564.00 | 663.00 | 648.00 | 615.00 | 570.00 | 506.00 | 535.40 | 476.10 | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | NA | NA | NA | NA | 2.00 | 4.00 | 3.00 | NA | 2.70 | 4.50 | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 7.00 | 12.00 | 17.00 | NA | 21.00 | 17.00 | 3.00 | NA | 16.10 | NA | NA | NA | NA | NA |

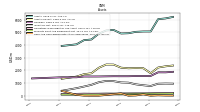

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

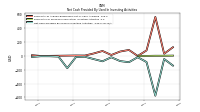

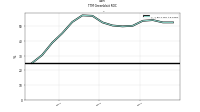

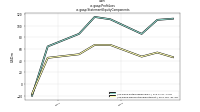

| Net Cash Provided By Used In Operating Activities | 373.00 | 282.00 | 120.00 | 307.00 | 154.00 | -23.00 | -37.00 | 35.20 | 32.90 | -55.10 | -44.00 | 59.80 | 61.00 | NA | |

| Net Cash Provided By Used In Investing Activities | -18.00 | -90.00 | -74.00 | -19.00 | -77.00 | -45.00 | -11.00 | -14.10 | -176.00 | -8.90 | -4.00 | -3.70 | -13.60 | NA | |

| Net Cash Provided By Used In Financing Activities | -274.00 | -173.00 | -222.00 | -111.00 | -77.00 | 67.00 | 48.00 | -25.10 | 81.40 | -189.30 | -13.00 | -8.10 | -6.30 | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 373.00 | 282.00 | 120.00 | 307.00 | 154.00 | -23.00 | -37.00 | 35.20 | 32.90 | -55.10 | -44.00 | 59.80 | 61.00 | NA | |

| Net Income Loss | 112.00 | 110.00 | 86.00 | 54.00 | 111.00 | 115.00 | 86.00 | 47.70 | 64.40 | -20.00 | 27.00 | 0.50 | 21.60 | 18.10 | |

| Profit Loss | 158.00 | 164.00 | 133.00 | 84.00 | 178.00 | 182.00 | 137.00 | 78.80 | 109.30 | -37.00 | 27.40 | 0.50 | 21.60 | 18.10 | |

| Depreciation Depletion And Amortization | 39.00 | 38.00 | 37.00 | 38.00 | 37.00 | 37.00 | 36.00 | 37.70 | 37.10 | 37.20 | 38.00 | 38.70 | 38.70 | NA | |

| Increase Decrease In Inventories | -71.00 | -150.00 | -35.00 | -106.00 | -43.00 | 91.00 | 207.00 | 135.30 | 95.30 | 84.40 | 125.00 | -7.00 | 12.80 | NA | |

| Increase Decrease In Accounts Payable | 44.00 | 15.00 | 98.00 | -224.00 | -133.00 | -34.00 | 251.00 | -4.90 | 40.20 | 32.70 | 206.00 | -81.10 | 29.50 | NA | |

| Share Based Compensation | 3.00 | 3.00 | 2.00 | 2.00 | 2.00 | 4.00 | 3.00 | 2.80 | 2.70 | 18.50 | 1.00 | 0.90 | 1.10 | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -18.00 | -90.00 | -74.00 | -19.00 | -77.00 | -45.00 | -11.00 | -14.10 | -176.00 | -8.90 | -4.00 | -3.70 | -13.60 | NA | |

| Payments To Acquire Productive Assets | 19.00 | 5.00 | 10.00 | 5.00 | 5.00 | 9.00 | 6.00 | 8.00 | 3.90 | 4.10 | 4.00 | 3.70 | 2.60 | NA |

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

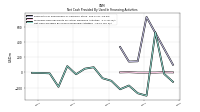

| Net Cash Provided By Used In Financing Activities | -274.00 | -173.00 | -222.00 | -111.00 | -77.00 | 67.00 | 48.00 | -25.10 | 81.40 | -189.30 | -13.00 | -8.10 | -6.30 | NA | |

| Payments For Repurchase Of Common Stock | 145.00 | 141.00 | 332.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

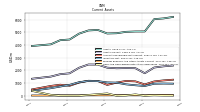

| 2023-10-29 | 2023-07-30 | 2023-04-30 | 2023-01-29 | 2022-10-30 | 2022-07-31 | 2022-05-01 | 2022-01-30 | 2021-10-31 | 2021-08-01 | 2021-05-02 | 2021-01-31 | 2020-11-01 | 2020-08-02 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

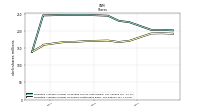

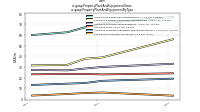

| Revenues | 1827.00 | 1861.00 | 1574.00 | 1374.00 | 1818.00 | 1861.00 | 1598.00 | 1246.50 | 1404.80 | 1297.60 | 1055.00 | 831.50 | 1012.50 | 955.90 | |

| Fire Protection Products | 170.00 | 174.00 | 169.00 | 157.00 | 180.00 | 192.00 | 172.00 | 156.00 | 152.40 | 137.90 | 119.00 | 100.20 | 104.60 | 101.00 | |

| Meter Products | 145.00 | 126.00 | 116.00 | 116.00 | 118.00 | 112.00 | 107.00 | 87.50 | 102.70 | 99.10 | 101.00 | 96.30 | 87.80 | 90.60 | |

| Pipes Valves And Fitting Products | 1222.00 | 1283.00 | 1074.00 | 909.00 | 1238.00 | 1291.00 | 1110.00 | 824.80 | 943.40 | 887.80 | 705.00 | 528.80 | 683.90 | 621.70 | |

| Storm Drainage Products | 290.00 | 278.00 | 215.00 | 192.00 | 282.00 | 266.00 | 209.00 | 178.20 | 206.30 | 172.80 | 130.00 | 106.20 | 136.20 | 142.60 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 1827.00 | 1861.00 | 1574.00 | 1374.00 | 1818.00 | 1861.00 | 1598.00 | 1246.50 | 1404.80 | 1297.60 | 1055.00 | 831.50 | 1012.50 | 955.90 | |

| Fire Protection Products | 170.00 | 174.00 | 169.00 | 157.00 | 180.00 | 192.00 | 172.00 | 156.00 | 152.40 | 137.90 | 119.00 | 100.20 | 104.60 | 101.00 | |

| Meter Products | 145.00 | 126.00 | 116.00 | 116.00 | 118.00 | 112.00 | 107.00 | 87.50 | 102.70 | 99.10 | 101.00 | 96.30 | 87.80 | 90.60 | |

| Pipes Valves And Fitting Products | 1222.00 | 1283.00 | 1074.00 | 909.00 | 1238.00 | 1291.00 | 1110.00 | 824.80 | 943.40 | 887.80 | 705.00 | 528.80 | 683.90 | 621.70 | |

| Storm Drainage Products | 290.00 | 278.00 | 215.00 | 192.00 | 282.00 | 266.00 | 209.00 | 178.20 | 206.30 | 172.80 | 130.00 | 106.20 | 136.20 | 142.60 |