| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 586.95 | 586.95 | 586.95 | 586.95 | 586.95 | 586.95 | NA | 586.95 | NA | NA | NA | 586.95 | 586.95 | 468.57 | 468.57 | 468.57 | 468.57 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.73 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | NA | 110.06 | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 38.83 | 39.02 | 39.30 | NA | 39.34 | 39.47 | 39.73 | NA | NA | 39.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 30.40 | 30.34 | 30.26 | 30.31 | 30.34 | 30.23 | 30.15 | 30.15 | 30.11 | 16.43 | 16.41 | 16.40 | 16.39 | 16.38 | 16.37 | 16.36 | 16.36 | 16.34 | 16.34 | 16.33 | 16.31 | 16.32 | 16.30 | NA | 14.65 | 14.58 | |

| Weighted Average Number Of Shares Outstanding Basic | 38.69 | 38.97 | 39.10 | NA | 39.15 | 39.29 | 39.45 | NA | NA | 39.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 30.13 | 30.09 | 30.00 | 30.03 | 30.05 | 29.87 | 29.76 | 29.70 | 29.64 | 16.37 | 16.35 | 16.35 | 16.35 | 16.35 | 16.35 | 16.35 | 16.35 | 16.33 | 16.33 | 16.31 | 16.29 | 16.29 | 16.29 | NA | 14.65 | 14.57 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

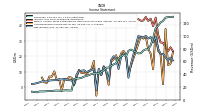

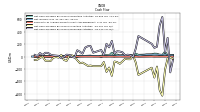

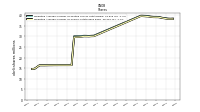

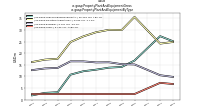

| Revenues | 123.69 | 121.33 | 116.10 | 112.47 | 96.98 | 85.36 | 78.94 | 79.04 | 77.03 | 73.05 | 72.62 | 78.68 | 76.71 | 68.01 | 70.39 | 67.88 | 65.21 | 57.22 | 55.35 | 53.08 | 50.48 | 50.21 | 46.34 | 43.69 | 41.08 | 41.50 | 41.18 | 40.04 | 38.53 | 37.23 | 36.19 | 34.18 | 33.37 | 33.13 | 32.34 | 14.40 | 14.34 | 14.64 | 14.54 | 13.98 | 14.10 | 14.26 | 14.12 | 13.50 | 13.39 | 13.26 | 12.92 | 12.88 | 12.87 | 11.52 | 12.04 | 12.49 | |

| Interest And Fee Income Loans And Leases | 115.41 | 111.05 | 106.90 | 104.95 | 90.73 | 81.28 | 76.03 | 76.89 | 75.09 | 71.10 | NA | 75.80 | 72.94 | 64.83 | 66.80 | 63.52 | 60.33 | 53.31 | 51.70 | 49.49 | 47.02 | 46.95 | 43.24 | 40.63 | 38.01 | 38.60 | 37.80 | 36.56 | 35.02 | 33.69 | 32.28 | 30.22 | 29.31 | 29.00 | 28.10 | 10.46 | 10.11 | 10.17 | 10.15 | 9.89 | 9.92 | 10.08 | 10.04 | 9.41 | 9.38 | 9.20 | 8.96 | 8.95 | 9.22 | 9.04 | 9.38 | 9.42 | |

| Marketing And Advertising Expense | 0.55 | 0.56 | 0.53 | 0.45 | 0.46 | 0.43 | 0.35 | 0.45 | 0.34 | 0.28 | NA | 0.43 | NA | NA | NA | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 61.33 | 57.48 | 49.01 | 34.46 | 18.82 | 9.77 | 8.58 | 8.58 | 8.78 | 10.04 | 11.46 | 17.89 | 21.43 | 20.58 | 21.98 | 22.35 | 20.26 | 17.06 | 15.39 | 14.14 | 12.33 | 10.40 | 9.32 | 8.59 | 7.94 | 8.09 | 8.15 | 7.64 | 7.21 | 6.77 | 6.46 | 5.50 | 5.08 | 4.55 | 4.80 | 2.73 | 2.73 | 2.78 | 2.82 | 2.75 | 2.73 | 2.84 | 2.94 | 2.95 | 3.05 | 3.10 | 3.07 | 3.08 | 2.92 | 3.14 | 3.65 | 3.83 | |

| Interest Expense Debt | 5.29 | 6.77 | 8.93 | 7.92 | 5.52 | 4.06 | 3.57 | 3.30 | 3.30 | 3.62 | NA | 4.29 | 4.22 | 4.30 | 4.63 | 5.75 | 4.91 | 4.66 | 4.71 | 4.97 | 4.64 | 3.45 | 3.21 | 3.10 | 2.83 | 2.96 | 3.00 | 3.21 | 3.27 | 3.00 | 2.80 | 2.20 | 2.05 | 1.63 | 2.07 | 1.43 | 1.41 | 1.46 | 1.49 | 1.47 | 1.45 | 1.48 | 1.61 | 1.64 | 1.64 | NA | 1.68 | 1.67 | 1.66 | NA | NA | NA | |

| Interest Income Expense Net | 62.36 | 63.84 | 67.08 | 78.01 | 78.16 | 75.59 | 70.36 | 70.46 | 68.25 | 63.01 | 61.16 | 60.79 | 55.28 | 47.43 | 48.41 | 45.53 | 44.95 | 40.16 | 39.96 | 38.95 | 38.15 | 39.81 | 37.02 | 35.10 | 33.14 | 33.41 | 33.02 | 32.39 | 31.32 | 30.46 | 29.73 | 28.68 | 28.29 | 28.58 | 27.55 | 11.67 | 11.61 | 11.87 | 11.72 | 11.23 | 11.37 | 11.42 | 11.18 | 10.55 | 10.35 | 10.16 | 9.85 | 9.79 | 9.95 | 8.38 | 8.38 | 8.66 | |

| Interest Paid Net | 59.54 | 57.98 | 46.59 | 33.30 | 16.43 | 9.32 | 8.79 | 9.12 | 9.43 | NA | NA | 16.56 | 24.63 | NA | 23.27 | 21.83 | 22.34 | NA | 15.14 | 14.13 | 10.93 | NA | 11.16 | 7.04 | 7.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 1.30 | 1.20 | 1.10 | 1.40 | 1.20 | 1.20 | 1.10 | 1.30 | 1.20 | 1.00 | NA | 0.50 | 0.50 | NA | 0.70 | 0.70 | 0.80 | NA | 0.60 | 0.30 | 0.60 | NA | 0.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -50.94 | 17.00 | 33.97 | 0.03 | 0.01 | 0.03 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 7.23 | 7.44 | 9.08 | 12.35 | 10.43 | 11.89 | 11.35 | 12.30 | 10.88 | 10.65 | 10.87 | 2.52 | 1.05 | 6.20 | 6.44 | 5.50 | 2.49 | 3.64 | 2.10 | 4.60 | 0.44 | 12.69 | 5.61 | 2.09 | 4.91 | -3.45 | 5.44 | 5.00 | 4.78 | 4.62 | 5.23 | 5.07 | 5.01 | 4.99 | 0.25 | 1.99 | 1.61 | 1.83 | 1.97 | 1.94 | 1.75 | 1.68 | 1.63 | 2.21 | 2.15 | 1.88 | 1.88 | 1.93 | 1.71 | -0.93 | 1.63 | 1.08 | |

| Income Taxes Paid Net | 8.72 | 17.40 | 1.26 | 17.81 | 10.59 | 20.53 | 0.30 | 9.62 | 15.51 | NA | NA | 4.62 | 7.48 | 5.30 | 5.38 | NA | NA | 6.58 | 1.01 | 0.27 | 1.22 | 11.54 | 1.60 | 3.01 | 0.06 | 4.75 | 3.51 | 4.45 | 10.23 | 0.83 | 4.50 | 7.04 | 5.50 | 0.34 | 2.10 | 2.05 | 0.50 | 2.53 | 0.56 | 1.63 | 0.00 | 0.77 | 1.62 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 21.41 | 21.39 | 24.93 | 32.56 | 28.91 | 32.36 | 31.38 | 33.04 | 32.10 | 32.22 | 33.00 | 14.83 | 6.03 | 20.78 | 21.70 | 19.28 | 11.63 | 18.67 | 19.90 | 17.53 | 4.25 | 10.58 | 13.08 | 7.68 | 11.88 | -2.02 | 11.86 | 10.86 | 10.39 | 9.57 | 10.84 | 10.52 | 10.38 | 8.02 | 1.77 | 4.38 | 4.40 | 4.98 | 5.09 | 4.92 | 4.92 | 4.47 | 4.45 | 4.35 | 4.23 | 3.62 | 3.70 | 3.58 | 3.02 | 2.57 | 2.14 | 2.01 | |

| Comprehensive Income Net Of Tax | 1.83 | 21.42 | 23.43 | 36.69 | 11.53 | 21.52 | 24.52 | 32.61 | 31.31 | 32.72 | NA | 13.68 | 8.64 | 20.76 | 23.45 | 21.68 | 15.14 | 20.57 | 17.86 | 16.39 | 1.42 | 9.39 | 13.46 | 7.76 | 11.44 | -5.59 | 16.90 | 11.37 | 10.17 | 8.27 | 9.26 | 9.03 | 11.16 | 6.43 | 1.14 | 6.05 | 6.47 | 4.67 | 5.08 | -2.47 | 5.03 | 4.36 | 10.12 | 6.75 | 6.79 | 2.74 | 3.06 | 6.12 | NA | NA | NA | NA | |

| Preferred Stock Dividends Income Statement Impact | 1.51 | 1.51 | 1.51 | 1.51 | 1.51 | 1.51 | 1.51 | 1.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 19.90 | 19.89 | 23.42 | 31.05 | 27.41 | 30.85 | 29.87 | 31.32 | 32.10 | 32.22 | 33.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 10.58 | 13.08 | 7.68 | 11.88 | -2.02 | 11.86 | 10.86 | 10.37 | 9.54 | 10.81 | 10.49 | 10.35 | 8.00 | 1.74 | 4.35 | 4.37 | 4.96 | 5.07 | 4.89 | 4.87 | 4.44 | 4.43 | 4.27 | 4.09 | 3.24 | 3.56 | 3.44 | 2.87 | 2.43 | 1.99 | 1.87 | |

| Net Income Loss Available To Common Stockholders Diluted | 19.84 | 19.83 | 23.38 | 30.98 | 27.34 | 30.78 | 29.79 | 31.26 | 32.02 | 32.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 60.86 | 60.84 | 66.08 | 74.71 | 68.16 | 72.59 | 68.91 | 69.65 | 67.14 | 64.66 | NA | 45.79 | 39.28 | 46.93 | 46.41 | 44.43 | 40.45 | 39.06 | 38.86 | 37.84 | 20.35 | 37.81 | 35.57 | 33.65 | 32.04 | 8.21 | 26.27 | 28.64 | 28.32 | 25.40 | 25.55 | 27.13 | 26.47 | 26.11 | 26.25 | 11.38 | 10.98 | 11.52 | 11.72 | 11.23 | 11.37 | 11.32 | 10.96 | 10.65 | 10.24 | 9.86 | 8.83 | 9.54 | 9.07 | 6.33 | 7.08 | 7.88 | |

| Noninterest Expense | 35.78 | 35.45 | 34.87 | 33.31 | 32.14 | 31.70 | 29.23 | 28.08 | 28.18 | 26.26 | NA | 33.06 | 35.06 | 22.20 | 20.38 | 21.59 | 28.06 | 18.27 | 18.29 | 17.11 | 17.06 | 16.57 | 18.64 | 25.30 | 18.25 | 15.25 | 14.55 | 14.35 | 14.35 | 13.58 | 13.30 | 14.97 | 12.63 | 15.16 | 25.40 | 6.74 | 7.50 | 6.46 | 6.21 | 6.08 | 6.54 | 6.19 | 7.51 | 5.69 | 5.81 | 6.22 | 5.53 | 5.76 | 5.93 | 6.00 | 5.44 | 6.27 | |

| Noninterest Income | 3.56 | 3.44 | 2.79 | 3.51 | 3.32 | 3.36 | 3.05 | 3.78 | 4.02 | 4.47 | NA | 4.62 | 2.85 | 2.25 | 2.11 | 1.94 | 1.74 | 1.51 | 1.43 | 1.39 | 1.41 | 2.02 | 1.76 | 1.42 | 3.00 | 1.57 | 5.58 | 1.57 | 1.20 | 2.36 | 3.82 | 3.44 | 1.55 | 2.08 | 1.17 | 1.72 | 2.52 | 1.76 | 1.54 | 1.71 | 1.84 | 1.02 | 2.63 | 1.60 | 1.96 | 1.87 | 2.28 | 1.73 | 1.60 | 1.30 | 2.13 | 1.48 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

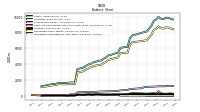

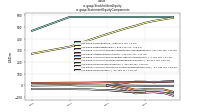

| Assets | 9678.89 | 9723.96 | 9960.47 | 9644.95 | 9478.25 | 8841.51 | NA | 8129.48 | NA | NA | NA | 7617.18 | 7279.33 | 6174.03 | 6161.27 | 6109.07 | 6048.98 | 5462.09 | 5368.64 | 5275.37 | 5158.37 | 5108.44 | 4844.76 | 4681.28 | 4460.82 | 4426.35 | 4327.80 | 4262.91 | 4091.00 | 4016.72 | 3838.25 | 3660.06 | 3505.89 | 3448.57 | 3356.26 | 1665.81 | 1676.16 | 1673.08 | 1644.42 | 1605.70 | 1609.80 | 1629.77 | 1612.08 | 1501.02 | 1476.60 | 1432.74 | 1376.52 | 1307.44 | NA | 1207.38 | NA | NA | |

| Liabilities | 8490.73 | 8524.57 | 8769.50 | 8466.20 | 8329.96 | 7698.36 | NA | 7005.27 | NA | NA | NA | 6749.44 | 6425.62 | 5442.84 | 5441.11 | 5409.84 | 5366.58 | 4848.16 | 4773.77 | 4696.81 | 4594.10 | 4543.01 | 4287.06 | 4135.11 | 3920.54 | 3895.32 | 3828.22 | 3778.50 | 3616.27 | 3539.38 | 3367.11 | 3196.07 | 3049.70 | 3002.35 | 2914.42 | 1487.53 | 1502.35 | 1504.50 | 1479.28 | 1444.41 | 1445.04 | 1469.07 | 1454.89 | 1353.04 | 1334.51 | 1296.82 | 1242.71 | 1177.33 | NA | 1086.43 | NA | NA | |

| Liabilities And Stockholders Equity | 9678.89 | 9723.96 | 9960.47 | 9644.95 | 9478.25 | 8841.51 | NA | 8129.48 | NA | NA | NA | 7617.18 | 7279.33 | 6174.03 | 6161.27 | 6109.07 | 6048.98 | 5462.09 | 5368.64 | 5275.37 | 5158.37 | 5108.44 | 4844.76 | 4681.28 | 4460.82 | 4426.35 | 4327.80 | 4262.91 | 4091.00 | 4016.72 | 3838.25 | 3660.06 | 3505.89 | 3448.57 | 3356.26 | 1665.81 | 1676.16 | 1673.08 | 1644.42 | 1605.70 | 1609.80 | 1629.77 | 1612.08 | 1501.02 | 1476.60 | 1432.74 | 1376.52 | 1307.44 | NA | 1207.38 | NA | NA | |

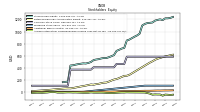

| Stockholders Equity | 1188.15 | 1199.40 | 1190.97 | 1178.75 | 1148.30 | 1143.15 | 1138.52 | 1124.21 | 1098.43 | 964.96 | 935.64 | 867.74 | 853.71 | 731.19 | 720.16 | 699.22 | 682.39 | 613.93 | 594.87 | 578.56 | 564.27 | 565.44 | 557.69 | 546.17 | 540.28 | 531.03 | 499.59 | 484.41 | 474.73 | 477.34 | 471.15 | 463.98 | 456.19 | 446.22 | 441.84 | 178.28 | NA | 168.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 253.30 | 319.92 | 562.42 | 268.31 | 333.84 | 299.32 | NA | 265.54 | NA | NA | NA | 349.36 | 282.81 | 201.48 | 194.01 | 185.65 | 172.55 | 172.37 | 155.85 | 176.17 | 142.79 | 149.58 | 141.26 | 146.51 | 161.87 | 200.40 | 233.79 | 175.11 | 118.26 | 200.90 | 158.52 | 125.48 | 88.54 | 126.85 | 138.01 | 92.62 | 106.28 | 82.69 | 33.56 | 61.96 | 116.75 | 106.14 | 102.11 | 85.67 | 78.21 | 111.10 | 113.08 | 109.47 | NA | 37.50 | NA | NA | |

| Equity Securities Fv Ni | 17.68 | 17.95 | 18.02 | 15.81 | 15.56 | 15.99 | NA | 13.79 | NA | NA | NA | 13.41 | 13.36 | 11.19 | NA | NA | NA | 11.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 581.87 | 612.82 | 629.00 | 634.88 | 623.63 | 675.94 | NA | 534.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 66.52 | NA | NA | NA | 69.22 | NA | NA | NA | NA | NA | 70.04 | NA | NA | NA | 61.75 | NA | NA | NA | 62.35 | NA | NA | NA | 60.38 | NA | NA | NA | 58.36 | NA | NA | NA | 54.46 | NA | NA | NA | 36.87 | NA | NA | NA | 35.96 | NA | NA | NA | 33.14 | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 38.72 | NA | NA | NA | 40.19 | NA | NA | NA | NA | NA | 50.80 | NA | NA | NA | 42.22 | NA | NA | NA | 40.15 | NA | NA | NA | 37.70 | NA | NA | NA | 35.29 | NA | NA | NA | 32.98 | NA | NA | NA | 23.18 | NA | NA | NA | 22.40 | NA | NA | NA | 20.82 | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.35 | 0.37 | 0.37 | 0.41 | 0.41 | 0.43 | 0.43 | 0.48 | 0.48 | 0.51 | NA | 0.65 | 0.65 | 0.34 | 0.34 | 0.36 | 0.36 | 0.14 | 0.14 | 0.17 | 0.17 | 0.17 | 0.17 | 0.19 | 0.19 | 0.19 | 0.19 | 0.22 | 0.22 | 0.22 | 0.22 | 0.24 | 0.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 28.43 | 29.09 | 29.60 | 27.80 | 28.52 | 28.39 | NA | 29.03 | NA | NA | NA | 31.10 | 32.86 | 19.24 | 19.75 | 19.78 | 20.15 | 19.06 | 21.00 | 20.39 | 21.04 | 21.66 | 21.92 | 21.63 | 22.26 | 22.07 | 22.11 | 22.48 | 22.65 | 22.33 | 21.52 | 21.25 | 20.36 | 20.65 | 20.90 | 14.01 | 13.83 | 13.68 | 13.47 | 13.46 | 13.54 | 13.56 | 13.56 | 12.22 | 12.27 | 12.33 | 12.39 | 12.58 | NA | 12.94 | NA | NA | |

| Goodwill | 208.37 | 208.37 | 208.37 | 208.37 | 208.37 | 208.37 | NA | 208.37 | NA | NA | NA | 208.37 | 208.38 | 162.57 | 162.57 | 162.57 | 156.24 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 145.91 | 16.82 | 16.82 | 16.83 | 16.83 | 16.84 | 16.85 | 16.86 | 16.87 | 16.80 | 16.89 | 16.90 | 16.91 | 16.93 | NA | 16.96 | NA | NA | |

| Equity Securities Fv Ni | 17.68 | 17.95 | 18.02 | 15.81 | 15.56 | 15.99 | NA | 13.79 | NA | NA | NA | 13.41 | 13.36 | 11.19 | NA | NA | NA | 11.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 704.84 | 703.51 | 709.39 | 721.80 | 718.73 | 731.13 | NA | 535.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 2.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 1571.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 7438.49 | 7538.30 | 7753.18 | 7356.62 | 7310.51 | 6617.60 | NA | 6332.95 | NA | NA | NA | 5826.86 | 5509.19 | 4767.54 | 4751.23 | 4641.14 | 4594.00 | 4092.09 | 3988.76 | 3905.41 | 3749.59 | 3795.13 | 3623.77 | 3430.37 | 3355.48 | 3344.27 | 3268.95 | 3200.99 | 2893.07 | 2790.97 | 2666.62 | 2569.23 | 2496.01 | 2475.61 | 2469.17 | 1274.62 | 1339.88 | 1342.01 | 1314.32 | 1280.89 | 1282.22 | 1306.92 | 1293.01 | 1174.65 | 1153.47 | 1121.41 | 1060.02 | 965.68 | NA | 860.33 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

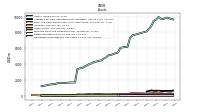

| Stockholders Equity | 1188.15 | 1199.40 | 1190.97 | 1178.75 | 1148.30 | 1143.15 | 1138.52 | 1124.21 | 1098.43 | 964.96 | 935.64 | 867.74 | 853.71 | 731.19 | 720.16 | 699.22 | 682.39 | 613.93 | 594.87 | 578.56 | 564.27 | 565.44 | 557.69 | 546.17 | 540.28 | 531.03 | 499.59 | 484.41 | 474.73 | 477.34 | 471.15 | 463.98 | 456.19 | 446.22 | 441.84 | 178.28 | NA | 168.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 586.95 | 586.95 | 586.95 | 586.95 | 586.95 | 586.95 | NA | 586.95 | NA | NA | NA | 586.95 | 586.95 | 468.57 | 468.57 | 468.57 | 468.57 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.55 | 412.73 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 374.29 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | 110.06 | NA | 110.06 | NA | NA | |

| Additional Paid In Capital | 32.03 | 30.74 | 31.35 | 30.13 | 28.76 | 27.54 | NA | 27.25 | NA | NA | NA | 22.07 | 21.75 | 21.34 | 20.45 | 19.78 | 16.51 | 15.54 | 14.62 | 13.76 | 13.43 | 13.60 | 12.84 | 12.38 | 11.80 | 11.41 | 10.41 | 9.86 | 9.32 | 8.53 | 8.31 | 8.12 | 7.08 | 6.01 | 5.82 | 5.38 | 5.00 | 4.99 | 4.95 | 4.92 | 4.82 | 4.80 | 4.75 | 4.74 | 4.72 | 4.71 | 4.97 | 4.96 | NA | 4.94 | NA | NA | |

| Retained Earnings Accumulated Deficit | 579.78 | 566.50 | 553.26 | 535.91 | 510.96 | 489.64 | NA | 440.17 | NA | NA | NA | 288.69 | 273.82 | 271.78 | 254.16 | 235.65 | 219.56 | 211.34 | 195.10 | 177.62 | 162.51 | 160.03 | 151.85 | 141.18 | 135.94 | 126.46 | 130.88 | 121.30 | 112.66 | 104.61 | 97.32 | 88.77 | 80.53 | 72.40 | 66.62 | 67.11 | 65.05 | 61.91 | 58.19 | 54.36 | 50.69 | 46.75 | 43.19 | 39.66 | 36.29 | 32.70 | 30.03 | 26.96 | NA | 21.63 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -53.41 | -33.84 | -33.86 | -32.36 | -36.49 | -19.10 | NA | -1.40 | NA | NA | NA | 0.31 | 1.46 | -1.15 | -1.13 | -2.88 | -5.28 | -8.79 | -10.68 | -8.65 | -7.51 | -4.02 | -2.83 | -3.21 | -3.29 | -2.85 | 0.72 | -4.32 | -4.83 | -4.61 | -3.31 | -1.73 | -0.24 | -1.01 | 0.58 | 1.20 | -0.47 | -2.54 | -2.23 | -2.22 | 5.17 | 5.06 | 5.17 | -0.49 | -2.89 | -5.45 | -4.57 | -3.92 | NA | -7.67 | NA | NA | |

| Treasury Stock Value | NA | NA | NA | 52.80 | 52.80 | 52.80 | NA | 39.67 | NA | NA | NA | 30.27 | 30.27 | 29.36 | 21.89 | 21.89 | 16.97 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 16.72 | 17.08 | 17.08 | 17.08 | 17.08 | 17.23 | 17.23 | 17.23 | 17.23 | 17.35 | 17.35 | 17.69 | 17.69 | NA | 17.70 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.28 | 1.22 | 1.14 | 1.37 | 1.22 | 1.15 | 1.15 | 1.33 | 1.25 | 0.98 | NA | 0.67 | 0.54 | 0.80 | 0.67 | 0.64 | 0.63 | 0.57 | 0.60 | 0.27 | 0.45 | 0.46 | 0.46 | 0.46 | 0.39 | 0.46 | 0.55 | 0.35 | 0.76 | -0.13 | 0.15 | 0.25 | 0.48 | -0.18 | 0.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

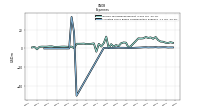

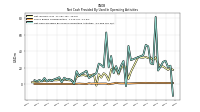

| Net Cash Provided By Used In Operating Activities | 26.92 | 21.26 | 16.37 | 81.83 | 23.98 | 25.12 | 45.84 | 47.63 | 35.19 | NA | NA | 29.11 | 46.46 | -2.67 | 28.09 | 22.27 | 13.00 | 21.73 | 13.04 | 34.07 | 20.23 | 62.82 | 20.27 | 23.23 | 24.82 | 13.09 | NA | NA | 7.33 | 16.10 | 13.93 | 12.46 | 9.82 | 15.62 | 0.01 | 4.27 | 6.13 | 5.38 | 7.62 | 1.98 | 8.17 | 6.70 | 5.75 | 3.50 | 5.12 | 3.00 | 7.24 | 3.05 | 4.79 | 3.32 | 4.48 | NA | |

| Net Cash Provided By Used In Investing Activities | -39.44 | -9.72 | -26.56 | -213.65 | -629.88 | -539.49 | -160.21 | -337.16 | -178.43 | NA | NA | -294.56 | -95.36 | 16.30 | -42.00 | -41.43 | -35.34 | -75.66 | -115.58 | -88.16 | -77.82 | -309.03 | -175.51 | -246.21 | -86.97 | -153.64 | NA | NA | -153.61 | -143.64 | -148.97 | -120.86 | -96.44 | -105.52 | -57.57 | -2.13 | 20.84 | 17.31 | -68.38 | -54.55 | 28.07 | -15.69 | -6.31 | -16.90 | -69.42 | -65.88 | -66.19 | -0.58 | -19.93 | -49.55 | -55.60 | NA | |

| Net Cash Provided By Used In Financing Activities | -54.11 | -254.03 | 304.28 | 66.29 | 640.43 | 502.14 | 160.38 | 141.88 | 207.02 | NA | NA | 332.00 | 130.23 | -6.16 | 22.27 | 32.26 | 22.53 | 70.45 | 82.23 | 87.47 | 50.79 | 254.53 | 150.00 | 207.62 | 23.63 | 107.16 | NA | NA | 63.64 | 169.92 | 168.08 | 145.34 | 48.31 | 78.74 | 102.96 | -15.80 | -3.38 | 26.44 | 32.36 | -2.22 | -25.62 | 13.02 | 17.00 | 20.86 | 31.40 | 60.90 | 62.57 | 26.87 | 57.77 | 8.24 | 28.95 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 26.92 | 21.26 | 16.37 | 81.83 | 23.98 | 25.12 | 45.84 | 47.63 | 35.19 | NA | NA | 29.11 | 46.46 | -2.67 | 28.09 | 22.27 | 13.00 | 21.73 | 13.04 | 34.07 | 20.23 | 62.82 | 20.27 | 23.23 | 24.82 | 13.09 | NA | NA | 7.33 | 16.10 | 13.93 | 12.46 | 9.82 | 15.62 | 0.01 | 4.27 | 6.13 | 5.38 | 7.62 | 1.98 | 8.17 | 6.70 | 5.75 | 3.50 | 5.12 | 3.00 | 7.24 | 3.05 | 4.79 | 3.32 | 4.48 | NA | |

| Net Income Loss | 21.41 | 21.39 | 24.93 | 32.56 | 28.91 | 32.36 | 31.38 | 33.04 | 32.10 | 32.22 | 33.00 | 14.83 | 6.03 | 20.78 | 21.70 | 19.28 | 11.63 | 18.67 | 19.90 | 17.53 | 4.25 | 10.58 | 13.08 | 7.68 | 11.88 | -2.02 | 11.86 | 10.86 | 10.39 | 9.57 | 10.84 | 10.52 | 10.38 | 8.02 | 1.77 | 4.38 | 4.40 | 4.98 | 5.09 | 4.92 | 4.92 | 4.47 | 4.45 | 4.35 | 4.23 | 3.62 | 3.70 | 3.58 | 3.02 | 2.57 | 2.14 | 2.01 | |

| Share Based Compensation | 1.28 | 1.22 | 1.14 | 1.37 | 1.22 | 1.15 | 1.15 | 1.33 | 1.25 | NA | NA | 0.67 | 0.54 | 0.80 | 0.67 | 0.64 | 0.83 | 1.39 | 0.60 | 0.27 | -0.37 | 0.46 | 0.46 | 0.46 | 0.39 | 0.46 | 0.55 | 0.35 | 0.76 | -0.13 | 0.15 | 0.25 | 0.48 | 0.17 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | |

| Amortization Of Financing Costs | 0.13 | 0.13 | 0.81 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.07 | NA | NA | 0.09 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | 0.09 | 0.04 | 0.04 | 0.04 | 0.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -39.44 | -9.72 | -26.56 | -213.65 | -629.88 | -539.49 | -160.21 | -337.16 | -178.43 | NA | NA | -294.56 | -95.36 | 16.30 | -42.00 | -41.43 | -35.34 | -75.66 | -115.58 | -88.16 | -77.82 | -309.03 | -175.51 | -246.21 | -86.97 | -153.64 | NA | NA | -153.61 | -143.64 | -148.97 | -120.86 | -96.44 | -105.52 | -57.57 | -2.13 | 20.84 | 17.31 | -68.38 | -54.55 | 28.07 | -15.69 | -6.31 | -16.90 | -69.42 | -65.88 | -66.19 | -0.58 | -19.93 | -49.55 | -55.60 | NA | |

| Payments To Acquire Property Plant And Equipment | 0.47 | 0.61 | 2.87 | 0.95 | 1.08 | 0.56 | 0.72 | 0.31 | 1.93 | NA | NA | -0.87 | 1.73 | 0.19 | 0.69 | 0.39 | 0.26 | 0.42 | 1.40 | 0.09 | 0.14 | 0.51 | 1.09 | 0.13 | 0.94 | 0.93 | 0.39 | 0.44 | 0.94 | 1.40 | 0.86 | 1.23 | 0.50 | -0.16 | 1.45 | 0.40 | 0.35 | 0.44 | 0.23 | 0.12 | 0.18 | 0.25 | 0.31 | 0.15 | 0.14 | 0.19 | 0.04 | 0.06 | 0.04 | 0.03 | 0.10 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -54.11 | -254.03 | 304.28 | 66.29 | 640.43 | 502.14 | 160.38 | 141.88 | 207.02 | NA | NA | 332.00 | 130.23 | -6.16 | 22.27 | 32.26 | 22.53 | 70.45 | 82.23 | 87.47 | 50.79 | 254.53 | 150.00 | 207.62 | 23.63 | 107.16 | NA | NA | 63.64 | 169.92 | 168.08 | 145.34 | 48.31 | 78.74 | 102.96 | -15.80 | -3.38 | 26.44 | 32.36 | -2.22 | -25.62 | 13.02 | 17.00 | 20.86 | 31.40 | 60.90 | 62.57 | 26.87 | 57.77 | 8.24 | 28.95 | NA | |

| Payments Of Dividends Common Stock | 6.62 | 6.65 | 6.07 | 6.09 | 6.09 | 6.10 | 5.15 | 5.15 | 4.38 | NA | NA | -0.03 | 3.58 | 3.12 | 3.19 | 3.19 | 2.66 | 2.42 | 2.42 | 2.42 | 2.41 | 2.40 | 2.40 | 2.40 | 2.40 | 2.26 | 2.27 | 2.22 | 2.31 | 2.25 | 2.25 | 2.25 | 2.25 | 2.26 | 2.23 | 1.23 | 1.23 | 1.23 | 1.05 | 1.08 | 0.90 | 0.90 | 0.90 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.44 | NA | |

| Payments For Repurchase Of Common Stock | 6.23 | 4.22 | 4.85 | 0.00 | 0.00 | 8.34 | 4.79 | 1.36 | 5.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 123.69 | 121.33 | 116.10 | 112.47 | 96.98 | 85.36 | 78.94 | 79.04 | 77.03 | 73.05 | 72.62 | 78.68 | 76.71 | 68.01 | 70.39 | 67.88 | 65.21 | 57.22 | 55.35 | 53.08 | 50.48 | 50.21 | 46.34 | 43.69 | 41.08 | 41.50 | 41.18 | 40.04 | 38.53 | 37.23 | 36.19 | 34.18 | 33.37 | 33.13 | 32.34 | 14.40 | 14.34 | 14.64 | 14.54 | 13.98 | 14.10 | 14.26 | 14.12 | 13.50 | 13.39 | 13.26 | 12.92 | 12.88 | 12.87 | 11.52 | 12.04 | 12.49 |