| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | NA | 51.21 | 51.39 | 51.48 | NA | 51.55 | 51.99 | 52.05 | NA | 52.06 | 52.01 | 51.80 | NA | 51.60 | 51.60 | 51.60 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 51.06 | 51.18 | 51.15 | NA | 51.19 | 51.56 | 51.63 | NA | 51.43 | 51.27 | 51.16 | NA | 51.60 | 51.60 | 51.60 | |

| Earnings Per Share Basic | 1.02 | 1.50 | 1.51 | 1.69 | 2.02 | 2.05 | 2.16 | 2.11 | 2.37 | 2.10 | 1.59 | 1.72 | 1.25 | 0.88 | 0.05 | 1.01 | |

| Earnings Per Share Diluted | 1.03 | 1.49 | 1.51 | 1.68 | 2.00 | 2.04 | 2.14 | 2.09 | 2.35 | 2.08 | 1.57 | 1.69 | 1.25 | 0.88 | 0.05 | 1.01 |

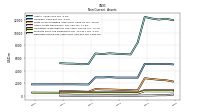

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

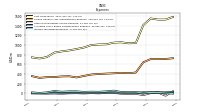

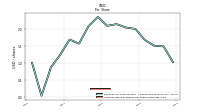

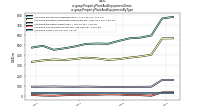

| Revenue From Contract With Customer Excluding Assessed Tax | 2230.76 | 1632.83 | 1614.71 | 1636.40 | 1640.72 | 1579.60 | 1568.10 | 1536.05 | 1466.61 | 1397.25 | 1369.88 | 1353.28 | 1300.86 | 1163.69 | 1066.36 | 1188.62 | |

| Revenues | 2230.76 | 1632.83 | 1614.71 | 1636.40 | 1640.72 | 1579.60 | 1568.10 | 1536.05 | 1466.61 | 1397.25 | 1369.88 | 1353.28 | 1300.86 | 1163.69 | 1066.36 | 1188.62 | |

| Cost Of Revenue | 1407.90 | 1039.14 | 1034.48 | 1055.24 | 1047.35 | 1012.75 | 1009.18 | 997.92 | 947.24 | 915.91 | 887.15 | 867.23 | 842.23 | 751.16 | 721.19 | 743.43 | |

| Gross Profit | 822.86 | 593.69 | 580.23 | 581.16 | 593.37 | 566.85 | 558.92 | 538.13 | 519.37 | 481.34 | 482.73 | 486.05 | 458.63 | 412.53 | 345.17 | 445.19 | |

| Selling General And Administrative Expense | 642.41 | 431.43 | 417.66 | 425.11 | 415.38 | 409.30 | 402.00 | 390.39 | 361.46 | 329.96 | 354.50 | 351.16 | 338.43 | 335.77 | 321.59 | 356.98 | |

| Operating Income Loss | 180.45 | 162.27 | 162.57 | 156.05 | 177.99 | 157.54 | 156.91 | 147.75 | 157.91 | 151.38 | 128.22 | 134.89 | 120.21 | 76.76 | 23.58 | 88.21 | |

| Interest And Debt Expense | 70.51 | 49.29 | 47.21 | 33.99 | 28.06 | 20.27 | 12.97 | 8.77 | 3.73 | 4.87 | 6.75 | 7.70 | 8.80 | 9.00 | 12.93 | 17.59 | |

| Allocated Share Based Compensation Expense | 23.81 | 10.74 | 11.19 | 16.75 | 9.84 | 9.86 | 12.65 | 15.17 | 10.90 | 9.46 | 9.28 | 7.12 | 3.88 | 3.93 | 3.84 | 4.26 | |

| Income Tax Expense Benefit | 7.62 | 29.17 | 27.12 | 30.47 | 57.62 | 42.23 | 33.45 | 36.05 | 30.81 | 42.62 | 42.12 | 34.57 | 49.95 | 21.77 | 9.82 | 21.54 | |

| Profit Loss | 69.49 | 77.64 | 78.85 | 87.87 | 104.94 | 107.12 | 113.03 | 110.54 | 124.11 | 109.75 | 82.90 | 88.81 | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 9.44 | 3.72 | -2.22 | 13.46 | 15.28 | -20.55 | -9.81 | -3.43 | -9.40 | -15.31 | 10.31 | -16.24 | -0.79 | 20.14 | -0.90 | -6.74 | |

| Other Comprehensive Income Loss Net Of Tax | 110.43 | 0.85 | -17.41 | 30.15 | -30.46 | -133.46 | -64.81 | -16.50 | -30.66 | -71.41 | 45.67 | -10.31 | NA | NA | NA | NA | |

| Net Income Loss | 69.49 | 77.64 | 78.85 | 87.87 | 104.94 | 106.69 | 113.14 | 110.27 | 124.11 | 109.75 | 82.90 | 88.81 | 64.63 | 45.40 | 2.47 | 52.32 | |

| Comprehensive Income Net Of Tax | 179.92 | 78.48 | 61.44 | 118.02 | 74.49 | -26.77 | 48.33 | 93.77 | 93.44 | 38.34 | 128.58 | 78.50 | 71.38 | 131.04 | -24.68 | 33.34 | |

| Net Income Loss Available To Common Stockholders Basic | 67.68 | 76.35 | 77.49 | 86.31 | 103.16 | 105.11 | 111.43 | 108.72 | 122.31 | 108.08 | 81.63 | 87.75 | 64.63 | 45.40 | 2.47 | 52.32 | |

| Net Income Loss Available To Common Stockholders Diluted | 67.69 | 76.35 | 77.49 | 86.32 | 103.18 | 105.12 | 111.44 | 108.73 | 122.33 | 108.11 | 81.65 | 87.76 | 64.63 | 45.40 | 2.47 | 52.32 |

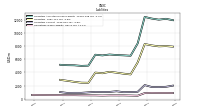

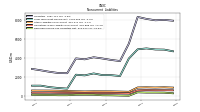

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

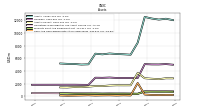

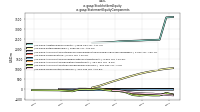

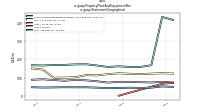

| Assets | 12491.83 | 8449.54 | 6560.01 | 6623.07 | 6669.77 | 6749.87 | 6612.65 | 6716.79 | 5046.37 | 5009.44 | 5102.24 | 5120.85 | 5177.56 | NA | NA | NA | |

| Liabilities | 8348.53 | 5546.02 | 3705.74 | 3822.57 | 3973.86 | 4103.25 | 3886.55 | 3982.52 | 2426.11 | 2443.68 | 2572.47 | 2731.57 | 2875.47 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 12491.83 | 8449.54 | 6560.01 | 6623.07 | 6669.77 | 6749.87 | 6612.65 | 6716.79 | 5046.37 | 5009.44 | 5102.24 | 5120.85 | 5177.56 | NA | NA | NA | |

| Stockholders Equity | 4143.29 | 2903.52 | 2854.26 | 2800.50 | 2695.90 | 2646.63 | 2723.95 | 2732.00 | 2620.26 | 2565.76 | 2529.77 | 2389.28 | 2302.09 | 1627.97 | 1492.54 | 1509.12 |

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 2858.65 | 3701.97 | 1752.06 | 1748.14 | 1754.33 | 1717.40 | 1628.98 | 1630.84 | 1543.07 | 1460.83 | 1476.87 | 1407.30 | 1423.38 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 295.34 | 2112.79 | 152.90 | 178.39 | 145.38 | 176.08 | 163.36 | 142.16 | 182.04 | 154.19 | 131.25 | 117.58 | 152.66 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 516.49 | 2124.03 | 162.35 | 190.03 | 157.46 | 178.50 | 164.10 | 143.16 | 183.01 | 155.59 | 132.48 | 119.20 | 156.35 | 97.09 | 98.22 | 86.84 | |

| Accounts Receivable Net Current | 1888.89 | 1379.44 | 1394.01 | 1381.61 | 1390.47 | 1355.07 | 1311.71 | 1324.74 | 1207.95 | 1131.42 | 1089.39 | 1129.01 | 1081.48 | NA | NA | NA | |

| Other Assets Current | 674.42 | 209.74 | 205.15 | 188.14 | 218.48 | 186.26 | 153.90 | 163.94 | 153.07 | 175.22 | 173.23 | 160.72 | 189.24 | NA | NA | NA |

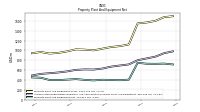

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 1549.98 | 1122.27 | 1088.22 | 1069.59 | 1035.90 | 1001.68 | 1015.95 | 1021.55 | 981.30 | 950.25 | 936.52 | 968.39 | 942.50 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 801.29 | 715.97 | 693.76 | 670.45 | 632.08 | 611.34 | 614.24 | 604.68 | 574.15 | 552.41 | 537.10 | 523.11 | 490.85 | NA | NA | NA | |

| Property Plant And Equipment Net | 748.69 | 406.30 | 394.46 | 399.13 | 403.83 | 390.34 | 401.72 | 416.87 | 407.14 | 397.84 | 399.42 | 445.29 | 451.65 | NA | NA | NA | |

| Goodwill | 5078.67 | 2897.05 | 2903.59 | 2905.08 | 2904.40 | 2971.82 | 2925.68 | 2942.44 | 1813.50 | 1822.64 | 1837.90 | 1837.92 | 1836.05 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 2804.97 | 873.09 | 910.78 | 948.90 | 985.57 | 1025.78 | 1037.99 | 1085.94 | 655.53 | 695.28 | 736.88 | 769.15 | 798.96 | NA | NA | NA | |

| Other Assets Noncurrent | 928.52 | 523.03 | 554.21 | 576.88 | 573.09 | 584.85 | 565.18 | 587.22 | 578.72 | 589.84 | 609.59 | 611.71 | 620.10 | NA | NA | NA |

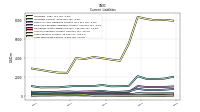

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

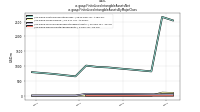

| Liabilities Current | 2074.04 | 1045.57 | 1007.48 | 993.97 | 1132.12 | 1028.21 | 1023.02 | 1036.28 | 968.21 | 888.79 | 889.61 | 877.58 | 1008.66 | NA | NA | NA | |

| Long Term Debt Current | 2.31 | NA | NA | NA | NA | 6.25 | 105.00 | 78.75 | NA | NA | NA | NA | 33.75 | NA | NA | NA | |

| Accounts Payable Current | 243.56 | 137.52 | 148.68 | 141.67 | 161.19 | 114.13 | 110.93 | 118.97 | 129.36 | 78.62 | 109.51 | 101.22 | 140.57 | NA | NA | NA | |

| Other Accrued Liabilities Current | 1016.41 | 398.31 | 399.54 | 392.72 | 395.30 | 397.23 | 346.20 | 376.88 | 351.64 | 342.91 | 356.67 | 373.18 | 371.07 | NA | NA | NA | |

| Taxes Payable Current | 80.58 | 39.38 | 41.05 | 70.79 | 68.66 | 45.47 | 23.37 | 46.70 | 33.78 | 48.94 | 29.14 | 37.91 | 20.73 | NA | NA | NA |

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 4939.71 | 3973.47 | 2130.96 | 2220.21 | 2224.29 | 2401.10 | 2197.88 | 2266.65 | 802.02 | 865.84 | 959.16 | 1113.22 | 1111.36 | NA | NA | NA | |

| Long Term Debt Noncurrent | 4939.71 | 3973.47 | 2130.96 | 2220.21 | 2224.29 | 2401.10 | 2197.88 | 2266.65 | 802.02 | 865.84 | 959.16 | 1113.22 | 1111.36 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 414.25 | 58.82 | 77.18 | 99.63 | 105.46 | 158.70 | 164.07 | 160.11 | 109.47 | 109.31 | 128.08 | 142.46 | 153.56 | NA | NA | NA | |

| Other Liabilities Noncurrent | 920.54 | 468.16 | 490.12 | 508.77 | 512.00 | 515.24 | 501.58 | 519.49 | 546.41 | 579.75 | 595.62 | 598.31 | 601.89 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 623.29 | 290.09 | 315.20 | 336.01 | 340.67 | 346.64 | 326.12 | 343.98 | 354.47 | 363.12 | 378.36 | 372.15 | 373.64 | NA | NA | NA |

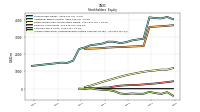

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 4143.29 | 2903.52 | 2854.26 | 2800.50 | 2695.90 | 2646.63 | 2723.95 | 2732.00 | 2620.26 | 2565.76 | 2529.77 | 2389.28 | 2302.09 | 1627.97 | 1492.54 | 1509.12 | |

| Common Stock Value | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | NA | NA | NA | NA | |

| Additional Paid In Capital | 3582.52 | 2471.94 | 2459.23 | 2447.42 | 2428.31 | 2415.87 | 2404.28 | 2389.40 | 2355.77 | 2338.11 | 2327.03 | 2315.00 | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 1024.46 | 975.59 | 912.20 | 847.67 | 774.11 | 683.47 | 589.74 | 489.66 | 392.50 | 281.47 | 171.72 | 88.81 | NA | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -191.73 | -302.16 | -303.01 | -285.60 | -315.75 | -285.29 | -151.83 | -87.03 | -70.53 | -39.86 | 31.55 | -14.12 | -3.81 | NA | NA | NA | |

| Treasury Stock Value | 271.97 | 241.85 | 214.17 | 209.00 | 190.78 | 167.42 | 118.25 | 60.04 | 57.49 | 13.96 | 0.53 | 0.41 | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 25.69 | 12.71 | 11.82 | 19.11 | 12.45 | 11.50 | 14.88 | 17.91 | 17.66 | 11.08 | 12.03 | 9.10 | 3.75 | 3.83 | 3.80 | 4.19 |

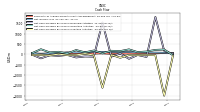

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

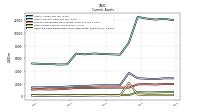

| Net Cash Provided By Used In Operating Activities | 229.26 | 211.42 | 133.44 | 103.89 | 235.68 | 152.56 | 167.47 | 45.02 | 182.05 | 93.01 | 203.23 | 35.88 | 119.04 | 91.38 | 242.31 | 54.89 | |

| Net Cash Provided By Used In Investing Activities | -1993.52 | -43.94 | -32.18 | -39.60 | -35.56 | -166.31 | -26.59 | -1610.82 | -36.21 | 31.33 | -31.82 | -41.95 | 7.72 | -50.55 | -31.71 | -34.67 | |

| Net Cash Provided By Used In Financing Activities | 166.42 | 1798.28 | -127.49 | -34.53 | -218.45 | 40.58 | -111.95 | 1527.35 | -113.78 | -105.51 | -151.97 | -30.62 | -75.05 | -47.24 | -195.70 | -17.24 |

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 229.26 | 211.42 | 133.44 | 103.89 | 235.68 | 152.56 | 167.47 | 45.02 | 182.05 | 93.01 | 203.23 | 35.88 | 119.04 | 91.38 | 242.31 | 54.89 | |

| Net Income Loss | 69.49 | 77.64 | 78.85 | 87.87 | 104.94 | 106.69 | 113.14 | 110.27 | 124.11 | 109.75 | 82.90 | 88.81 | 64.63 | 45.40 | 2.47 | 52.32 | |

| Profit Loss | 69.49 | 77.64 | 78.85 | 87.87 | 104.94 | 107.12 | 113.03 | 110.54 | 124.11 | 109.75 | 82.90 | 88.81 | NA | NA | NA | NA | |

| Increase Decrease In Other Operating Capital Net | -47.12 | -62.14 | 17.83 | 65.53 | -60.92 | 25.13 | 53.09 | 109.22 | -24.96 | -13.50 | 10.19 | 27.26 | -45.80 | -14.82 | -84.68 | 24.43 | |

| Increase Decrease In Accounts Receivable | 40.76 | -10.42 | 15.67 | -0.11 | 29.58 | 6.51 | -13.15 | 30.19 | 80.52 | 47.69 | -37.20 | 48.10 | 112.50 | 52.99 | -86.14 | 44.75 | |

| Increase Decrease In Accounts Payable | 31.41 | -18.20 | 5.80 | -9.67 | 38.09 | -5.69 | -10.61 | -7.17 | 37.74 | -27.26 | 12.73 | -27.77 | 29.14 | 6.15 | -3.37 | 4.63 | |

| Deferred Income Tax Expense Benefit | -78.03 | -13.97 | -22.32 | -7.39 | -26.45 | -5.34 | 11.61 | -10.65 | -4.46 | -16.51 | 3.51 | -8.28 | 5.87 | -14.51 | -4.17 | -7.04 | |

| Share Based Compensation | 23.73 | 10.65 | 11.13 | 16.60 | 9.74 | 9.81 | 12.56 | 15.03 | 10.83 | 9.65 | 8.88 | 6.81 | 3.75 | 3.83 | 3.80 | 4.19 |

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -1993.52 | -43.94 | -32.18 | -39.60 | -35.56 | -166.31 | -26.59 | -1610.82 | -36.21 | 31.33 | -31.82 | -41.95 | 7.72 | -50.55 | -31.71 | -34.67 | |

| Payments To Acquire Property Plant And Equipment | 64.81 | 43.94 | 32.18 | 39.60 | 42.74 | 26.11 | 25.77 | 45.39 | 36.21 | 42.11 | 28.81 | 41.95 | 65.08 | 37.01 | 25.35 | 43.89 |

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 166.42 | 1798.28 | -127.49 | -34.53 | -218.45 | 40.58 | -111.95 | 1527.35 | -113.78 | -105.51 | -151.97 | -30.62 | -75.05 | -47.24 | -195.70 | -17.24 | |

| Payments Of Dividends | 20.62 | 14.25 | 14.32 | 14.31 | 14.30 | 12.96 | 13.06 | 13.11 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 20.62 | 14.25 | 14.32 | 14.31 | 14.30 | 12.96 | 13.06 | 13.11 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 22.02 | 27.00 | 4.94 | 10.00 | 13.98 | 48.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-11-30 | 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

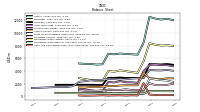

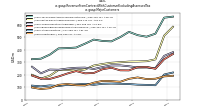

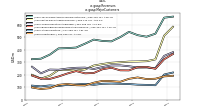

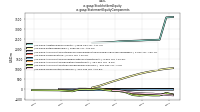

| Revenues | 2230.76 | 1632.83 | 1614.71 | 1636.40 | 1640.72 | 1579.60 | 1568.10 | 1536.05 | 1466.61 | 1397.25 | 1369.88 | 1353.28 | 1300.86 | 1163.69 | 1066.36 | 1188.62 | |

| PK | NA | NA | NA | NA | NA | NA | 123.96 | 83.20 | NA | NA | NA | NA | NA | NA | NA | NA | |

| P K Service Source International Inc | NA | NA | NA | NA | 163.26 | 142.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Banking Financial Services And Insurance | 323.46 | 246.77 | 261.96 | 259.65 | 234.14 | 234.84 | 255.58 | 243.25 | 213.40 | 210.73 | 228.82 | 209.08 | 185.52 | 165.96 | 168.28 | 192.70 | |

| Communications And Media | 350.42 | 252.50 | 257.79 | 256.99 | 267.40 | 274.42 | 273.82 | 260.64 | 245.17 | 256.46 | 254.86 | 248.79 | 239.27 | 240.72 | 210.68 | 263.56 | |

| Healthcare | 186.31 | 167.43 | 164.71 | 177.82 | 166.70 | 143.09 | 148.25 | 150.14 | 135.46 | 113.75 | 115.42 | 125.22 | 118.56 | 91.84 | 84.97 | 97.33 | |

| Other Industries | 201.02 | 115.46 | 118.08 | 119.83 | 124.81 | 127.06 | 128.67 | 126.91 | 118.64 | 126.55 | 121.54 | 118.36 | 109.06 | 113.69 | 106.05 | 112.20 | |

| Retail Travel And Ecommerce | 512.82 | 322.39 | 307.95 | 305.50 | 304.55 | 299.60 | 295.02 | 284.92 | 272.92 | 241.66 | 231.97 | 239.00 | 237.91 | 191.12 | 168.38 | 198.91 | |

| Technology And Consumer Electronics | 656.74 | 528.28 | 504.20 | 516.61 | 543.12 | 500.60 | 466.75 | 470.20 | 481.00 | 448.10 | 417.28 | 412.82 | 410.54 | 360.37 | 328.00 | 323.91 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 2230.76 | 1632.83 | 1614.71 | 1636.40 | 1640.72 | 1579.60 | 1568.10 | 1536.05 | 1466.61 | 1397.25 | 1369.88 | 1353.28 | 1300.86 | 1163.69 | 1066.36 | 1188.62 | |

| PK | NA | NA | NA | NA | NA | NA | 123.96 | 83.20 | NA | NA | NA | NA | NA | NA | NA | NA | |

| P K Service Source International Inc | NA | NA | NA | NA | 163.26 | 142.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Banking Financial Services And Insurance | 323.46 | 246.77 | 261.96 | 259.65 | 234.14 | 234.84 | 255.58 | 243.25 | 213.40 | 210.73 | 228.82 | 209.08 | 185.52 | 165.96 | 168.28 | 192.70 | |

| Communications And Media | 350.42 | 252.50 | 257.79 | 256.99 | 267.40 | 274.42 | 273.82 | 260.64 | 245.17 | 256.46 | 254.86 | 248.79 | 239.27 | 240.72 | 210.68 | 263.56 | |

| Healthcare | 186.31 | 167.43 | 164.71 | 177.82 | 166.70 | 143.09 | 148.25 | 150.14 | 135.46 | 113.75 | 115.42 | 125.22 | 118.56 | 91.84 | 84.97 | 97.33 | |

| Other Industries | 201.02 | 115.46 | 118.08 | 119.83 | 124.81 | 127.06 | 128.67 | 126.91 | 118.64 | 126.55 | 121.54 | 118.36 | 109.06 | 113.69 | 106.05 | 112.20 | |

| Retail Travel And Ecommerce | 512.82 | 322.39 | 307.95 | 305.50 | 304.55 | 299.60 | 295.02 | 284.92 | 272.92 | 241.66 | 231.97 | 239.00 | 237.91 | 191.12 | 168.38 | 198.91 | |

| Technology And Consumer Electronics | 656.74 | 528.28 | 504.20 | 516.61 | 543.12 | 500.60 | 466.75 | 470.20 | 481.00 | 448.10 | 417.28 | 412.82 | 410.54 | 360.37 | 328.00 | 323.91 |