| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.08 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

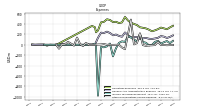

| Earnings Per Share Basic | 0.76 | 4.14 | 2.10 | 0.54 | 0.13 | 1.59 | 2.08 | 8.91 | 2.35 | 3.42 | 5.05 | 6.22 | 2.08 | 2.26 | 0.78 | -1.84 | 5.03 | 0.91 | -0.96 | -2.05 | -1.50 | 133.61 | -7.80 | -0.12 | -0.36 | -0.84 | 0.72 | -1.56 | 0.24 | 2.88 | -1.20 | 0.48 | 1.32 | 0.12 | -0.48 | -4.68 | 0.12 | -0.60 | -0.12 | 1.08 | -0.72 | 0.48 | 0.00 | -0.12 | -0.24 | |

| Earnings Per Share Diluted | 0.72 | 4.06 | 2.07 | 0.52 | 0.13 | 1.55 | 2.03 | 8.59 | 2.30 | 3.29 | 4.85 | 5.92 | 2.00 | 2.18 | 0.77 | -1.84 | 4.95 | 0.90 | -0.96 | -2.05 | -1.50 | 131.93 | -7.80 | -0.12 | -0.36 | -0.84 | 0.72 | -1.56 | 0.24 | 2.76 | -1.20 | 0.36 | 1.20 | 0.12 | -0.48 | -4.68 | 0.00 | -0.60 | -0.12 | 0.84 | -0.72 | 0.48 | 0.00 | -0.12 | -0.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

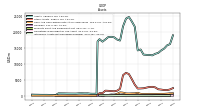

| Revenues | 404.00 | 574.00 | 486.00 | 330.00 | 303.00 | 510.00 | 599.00 | 1052.00 | 625.00 | 860.00 | 574.00 | 1267.00 | 953.00 | 872.00 | 630.00 | 278.00 | 740.00 | 618.00 | 399.00 | 250.00 | 252.00 | 342.00 | 164.00 | 3.08 | 2.19 | 1.96 | 2.29 | 2.03 | 1.61 | 1.22 | 1.28 | 1.39 | 1.50 | 1.29 | 1.49 | 1.47 | 1.75 | 1.84 | 1.72 | 2.15 | 2.83 | 3.32 | 3.72 | -0.97 | 4.10 | |

| Operating Expenses | 332.00 | 301.00 | 278.00 | 261.00 | 292.00 | 316.00 | 328.00 | 338.00 | 381.00 | 402.00 | 425.00 | 469.00 | 537.00 | 431.00 | 419.00 | 444.00 | 438.00 | 478.00 | 492.00 | 443.00 | 432.00 | 275.00 | 242.00 | 339.00 | 364.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -3.75 | NA | 3.02 | -15.17 | 6.21 | NA | 4.60 | 1.51 | 7.92 | |

| General And Administrative Expense | 168.00 | 135.00 | 122.00 | 113.00 | 117.00 | 133.00 | 125.00 | 110.00 | 150.00 | 151.00 | 148.00 | 184.00 | 238.00 | 156.00 | 171.00 | 198.00 | 184.00 | 228.00 | 254.00 | 228.00 | 234.00 | 136.00 | NA | 5.21 | 7.71 | 8.54 | 2.12 | 1.79 | 2.01 | 2.17 | 1.36 | 1.49 | 2.03 | 2.46 | 13.20 | 2.31 | 2.97 | 1.78 | 1.29 | 2.02 | 1.45 | 1.30 | 1.33 | 1.61 | 1.42 | |

| Interest Expense | 159.00 | 146.00 | 122.00 | 110.00 | 103.00 | 104.00 | 111.00 | 106.00 | 115.00 | 118.00 | 119.00 | 159.00 | 168.00 | 165.00 | 177.00 | 192.00 | 207.00 | 196.00 | 187.00 | 189.00 | 171.00 | 122.00 | NA | 164.00 | NA | 0.00 | 0.58 | 0.60 | 0.61 | 0.62 | 0.64 | 0.67 | 0.69 | 0.86 | 0.94 | 0.95 | 0.95 | 14.23 | 1.05 | 3.50 | 3.45 | 3.36 | 3.57 | 3.77 | 4.21 | |

| Income Tax Expense Benefit | 23.00 | 77.00 | 56.00 | -2.00 | -11.00 | 40.00 | 54.00 | 208.00 | 61.00 | 104.00 | 140.00 | 167.00 | 56.00 | 67.00 | 37.00 | -68.00 | -221.00 | 24.00 | -29.00 | -47.00 | -42.00 | -979.00 | -19.00 | 21.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | |

| Profit Loss | 46.00 | 275.00 | 142.00 | 37.00 | 1.00 | 113.00 | 151.00 | 658.00 | 155.00 | 299.00 | 439.00 | 561.00 | 191.00 | 214.00 | 73.00 | -171.00 | 461.00 | 83.00 | -88.00 | -186.00 | -136.00 | 1020.00 | -64.00 | 58.00 | 160.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 46.00 | 275.00 | 142.00 | 37.00 | 1.00 | 113.00 | 151.00 | 658.00 | 156.00 | 270.00 | 435.00 | 556.00 | 189.00 | 207.00 | 72.00 | -168.00 | 459.00 | 83.00 | -87.00 | -186.00 | -136.00 | 1011.00 | -64.00 | -2.00 | -5.78 | -13.54 | 33.91 | -25.82 | 13.29 | 135.89 | -21.14 | 17.91 | 51.05 | 5.57 | -8.42 | -77.98 | 1.25 | -9.57 | -1.30 | 17.32 | -12.84 | 7.52 | -0.88 | -2.48 | -3.82 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

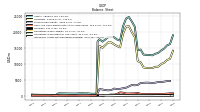

| Assets | 14196.00 | 13427.00 | 13144.00 | 12657.00 | 12776.00 | 12815.00 | 12895.00 | 14490.00 | 14204.00 | 21661.00 | 23308.00 | 24713.00 | 24165.00 | 21755.00 | 17300.00 | 17613.00 | 18305.00 | 18478.00 | 18405.00 | 17646.00 | 16973.00 | 17728.00 | 17026.00 | 610.56 | 608.92 | 614.12 | 732.74 | 717.03 | 747.63 | 736.19 | 661.98 | 668.35 | 674.12 | 685.06 | 710.22 | 717.64 | 732.63 | 156.14 | 168.81 | 250.45 | 274.23 | 267.64 | 273.96 | 297.32 | 310.50 | |

| Liabilities | 9914.00 | 9123.00 | 9065.00 | 8671.00 | 8719.00 | 8710.00 | 8858.00 | 10513.00 | 10837.00 | 18401.00 | 19958.00 | 21809.00 | 21661.00 | 19414.00 | 15155.00 | 15547.00 | 16074.00 | 16711.00 | 16727.00 | 15885.00 | 15028.00 | 15650.00 | NA | 20.86 | 17.30 | 16.82 | 14.60 | 32.90 | 37.85 | 39.84 | 101.69 | 87.09 | 110.91 | 173.07 | 203.97 | 203.15 | 140.55 | 67.91 | 71.21 | 151.67 | 193.01 | 202.51 | 216.45 | 239.13 | 249.88 | |

| Liabilities And Stockholders Equity | 14196.00 | 13427.00 | 13144.00 | 12657.00 | 12776.00 | 12815.00 | 12895.00 | 14490.00 | 14204.00 | 21661.00 | 23308.00 | 24713.00 | 24165.00 | 21755.00 | 17300.00 | 17613.00 | 18305.00 | 18478.00 | 18405.00 | 17646.00 | 16973.00 | 17728.00 | NA | 610.56 | 608.92 | 614.12 | 732.74 | 717.03 | 747.63 | 736.19 | 661.98 | 668.35 | 674.12 | 685.06 | 710.22 | 717.64 | 732.63 | 156.14 | 168.81 | 250.45 | 274.23 | 267.64 | 273.96 | 297.32 | 310.50 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

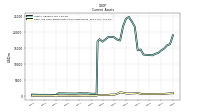

| Cash And Cash Equivalents At Carrying Value | 571.00 | 553.00 | 517.00 | 534.00 | 527.00 | 530.00 | 514.00 | 579.00 | 895.00 | 731.00 | 716.00 | 674.00 | 695.00 | 946.00 | 1041.00 | 579.00 | 329.00 | 371.00 | 245.00 | 181.00 | 242.00 | 198.00 | 166.00 | 29.06 | 27.89 | 26.71 | 25.54 | 36.05 | 21.73 | 2.49 | 3.03 | 3.52 | 1.19 | 9.92 | 15.35 | 19.35 | 2.77 | 78.01 | 6.34 | 1.82 | 4.46 | 11.99 | 8.35 | 8.70 | 9.53 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 740.00 | NA | NA | NA | 702.00 | NA | NA | NA | 1041.00 | NA | NA | 935.00 | 913.00 | 1175.00 | 1301.00 | 845.00 | 612.00 | 642.00 | 549.00 | 520.00 | 561.00 | 530.00 | 1623.00 | 604.84 | 604.09 | 605.64 | NA | 611.51 | 595.67 | 575.84 | NA | NA | NA | 581.36 | NA | NA | NA | 80.46 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

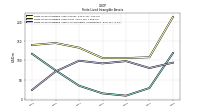

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 141.00 | 136.00 | 141.00 | 122.00 | 122.00 | 116.00 | 112.00 | 107.00 | 122.00 | 115.00 | 108.00 | 107.00 | 96.00 | 84.00 | 75.00 | 65.00 | 55.00 | 45.00 | 35.00 | 27.00 | 16.00 | 9.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 141.00 | 141.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 120.00 | 109.00 | 23.00 | 3.00 | 10.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 28.00 | NA | NA | NA | 8.00 | NA | NA | NA | 14.00 | NA | NA | NA | 34.00 | NA | NA | NA | 74.00 | NA | NA | NA | 117.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 4282.00 | NA | NA | NA | 4057.00 | 4105.00 | 4037.00 | 3977.00 | 3367.00 | 3260.00 | 3350.00 | 2904.00 | 2504.00 | 2341.00 | 2145.00 | 2066.00 | 2231.00 | 1767.00 | 1678.00 | 1761.00 | 1945.00 | 2078.00 | 1056.00 | 1941.00 | 1882.00 | 1722.00 | NA | NA | NA | 1683.00 | NA | NA | NA | NA | NA | NA | NA | NA | 97.60 | 98.78 | 81.22 | 65.13 | NA | NA | NA | |

| Common Stock Value | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.08 | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Additional Paid In Capital Common Stock | 1087.00 | 1081.00 | 1074.00 | 1066.00 | 1104.00 | 1099.00 | 1094.00 | 1085.00 | 1116.00 | 1108.00 | 1120.00 | 1113.00 | 1126.00 | 1120.00 | 1114.00 | 1108.00 | 1109.00 | 1106.00 | 1100.00 | 1095.00 | 1093.00 | 1093.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 4302.00 | 4256.00 | 3981.00 | 3839.00 | 3802.00 | 3801.00 | 3688.00 | 3537.00 | 2879.00 | 2724.00 | 2434.00 | 1995.00 | 1434.00 | 1243.00 | 1034.00 | 961.00 | 1122.00 | 659.00 | 575.00 | 662.00 | 848.00 | 984.00 | NA | 72.84 | 87.77 | 93.55 | 107.09 | 73.18 | 99.01 | 85.72 | -50.17 | -29.02 | -46.93 | -97.98 | -103.55 | -95.13 | -17.15 | -18.40 | -8.83 | -7.53 | -24.85 | -12.02 | -19.53 | -18.65 | -16.17 | |

| Treasury Stock Value | 1108.00 | 1034.00 | 977.00 | 920.00 | 850.00 | 796.00 | 747.00 | 647.00 | 630.00 | 574.00 | 206.00 | 206.00 | 58.00 | 24.00 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 7.00 | 8.00 | 8.00 | 5.00 | 5.00 | 7.00 | 9.00 | 8.00 | 8.00 | 7.00 | 8.00 | 6.00 | 6.00 | 6.00 | 6.00 | 4.00 | 4.00 | 5.00 | 5.00 | 4.00 | 0.00 | 2.00 | NA | 4.00 | 0.10 | 0.10 | 0.10 | 0.17 | 0.14 | 0.17 | 0.17 | 0.14 | 0.16 | 0.17 | 0.18 | 0.40 | 0.38 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

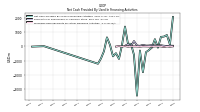

| Net Cash Provided By Used In Operating Activities | 124.00 | 623.00 | -11.00 | 160.00 | 623.00 | 562.00 | 1656.00 | 926.00 | 3402.00 | -656.00 | -38.00 | -76.00 | -1547.00 | -188.00 | 1356.00 | 710.00 | 730.00 | 24.00 | -337.00 | 285.00 | 1075.00 | 176.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -18.63 | NA | NA | NA | 18.59 | |

| Net Cash Provided By Used In Investing Activities | -748.00 | -512.00 | -469.00 | -107.00 | -335.00 | -102.00 | 79.00 | -964.00 | 181.00 | 1258.00 | -165.00 | -82.00 | -96.00 | -24.00 | -18.00 | 4.00 | -59.00 | -37.00 | -260.00 | 18.00 | -200.00 | -50.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.89 | NA | NA | NA | -5.24 | |

| Net Cash Provided By Used In Financing Activities | 660.00 | -94.00 | 500.00 | -88.00 | -264.00 | -411.00 | -1815.00 | -294.00 | -3456.00 | -594.00 | 174.00 | 180.00 | 1381.00 | 86.00 | -882.00 | -481.00 | -701.00 | 106.00 | 626.00 | -344.00 | -844.00 | -1219.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 9.22 | NA | NA | NA | -20.57 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 124.00 | 623.00 | -11.00 | 160.00 | 623.00 | 562.00 | 1656.00 | 926.00 | 3402.00 | -656.00 | -38.00 | -76.00 | -1547.00 | -188.00 | 1356.00 | 710.00 | 730.00 | 24.00 | -337.00 | 285.00 | 1075.00 | 176.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -18.63 | NA | NA | NA | 18.59 | |

| Profit Loss | 46.00 | 275.00 | 142.00 | 37.00 | 1.00 | 113.00 | 151.00 | 658.00 | 155.00 | 299.00 | 439.00 | 561.00 | 191.00 | 214.00 | 73.00 | -171.00 | 461.00 | 83.00 | -88.00 | -186.00 | -136.00 | 1020.00 | -64.00 | 58.00 | 160.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Depreciation Depletion And Amortization | 10.00 | 10.00 | 9.00 | 9.00 | 8.00 | 9.00 | 9.00 | 11.00 | 12.00 | 14.00 | 16.00 | 16.00 | 18.00 | 19.00 | 18.00 | 19.00 | 24.00 | 22.00 | 24.00 | 21.00 | 24.00 | 15.00 | NA | 14.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 263.00 | -94.00 | -121.00 | -76.00 | 202.00 | -44.00 | -142.00 | -169.00 | 339.00 | 89.00 | 43.00 | -91.00 | 205.00 | 85.00 | -13.00 | -300.00 | 37.00 | -16.00 | -129.00 | -120.00 | 33.00 | -76.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | 27.00 | 62.00 | 50.00 | -4.00 | 9.00 | 39.00 | 44.00 | 197.00 | 24.00 | 107.00 | 108.00 | 112.00 | 4.00 | 48.00 | 19.00 | -68.00 | -313.00 | 23.00 | -29.00 | -47.00 | -90.00 | -931.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -748.00 | -512.00 | -469.00 | -107.00 | -335.00 | -102.00 | 79.00 | -964.00 | 181.00 | 1258.00 | -165.00 | -82.00 | -96.00 | -24.00 | -18.00 | 4.00 | -59.00 | -37.00 | -260.00 | 18.00 | -200.00 | -50.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.89 | NA | NA | NA | -5.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 660.00 | -94.00 | 500.00 | -88.00 | -264.00 | -411.00 | -1815.00 | -294.00 | -3456.00 | -594.00 | 174.00 | 180.00 | 1381.00 | 86.00 | -882.00 | -481.00 | -701.00 | 106.00 | 626.00 | -344.00 | -844.00 | -1219.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 9.22 | NA | NA | NA | -20.57 | |

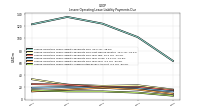

| Payments For Repurchase Of Common Stock | 72.00 | 58.00 | 57.00 | 89.00 | 54.00 | 50.00 | 100.00 | 35.00 | 56.00 | 368.00 | 0.00 | 148.00 | 34.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-07-31 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 404.00 | 574.00 | 486.00 | 330.00 | 303.00 | 510.00 | 599.00 | 1052.00 | 625.00 | 860.00 | 574.00 | 1267.00 | 953.00 | 872.00 | 630.00 | 278.00 | 740.00 | 618.00 | 399.00 | 250.00 | 252.00 | 342.00 | 164.00 | 3.08 | 2.19 | 1.96 | 2.29 | 2.03 | 1.61 | 1.22 | 1.28 | 1.39 | 1.50 | 1.29 | 1.49 | 1.47 | 1.75 | 1.84 | 1.72 | 2.15 | 2.83 | 3.32 | 3.72 | -0.97 | 4.10 | |

| Corporate Non | 21.00 | 22.00 | 21.00 | 19.00 | 20.00 | 22.00 | 22.00 | 12.00 | 16.00 | 35.00 | 39.00 | 96.00 | 113.00 | 108.00 | -1.00 | 2.00 | 2.00 | 11.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Originations | 67.00 | 88.00 | 97.00 | 80.00 | 68.00 | 156.00 | 182.00 | 324.00 | 360.00 | 474.00 | 430.00 | 595.00 | NA | NA | NA | 317.00 | 299.00 | 334.00 | 264.00 | 146.00 | 95.00 | 86.00 | NA | 133.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Servicing | 316.00 | 464.00 | 368.00 | 231.00 | 215.00 | 332.00 | 395.00 | 716.00 | 249.00 | 351.00 | 105.00 | 568.00 | NA | NA | NA | -146.00 | 334.00 | 163.00 | 27.00 | 8.00 | 53.00 | 183.00 | NA | 248.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |