| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Earnings Per Share Basic | 2.56 | 1.76 | -1.74 | 3.58 | 4.42 | 8.91 | 5.64 | 0.65 | 5.74 | 3.71 | -0.25 | -1.89 | -12.71 | -17.12 | -3.94 | 0.55 | -0.09 | 0.21 | 0.23 | -0.09 | 0.68 | 0.16 | 0.23 | 0.27 | 0.10 | 0.08 | 0.16 | 0.23 | |

| Earnings Per Share Diluted | 2.56 | 1.75 | -1.74 | 3.57 | 4.40 | 8.88 | 5.62 | 0.64 | 5.57 | 3.65 | -0.25 | -1.89 | -12.71 | -17.12 | -3.94 | 0.55 | -0.09 | 0.21 | 0.23 | -0.09 | 0.68 | 0.16 | 0.23 | 0.27 | 0.10 | 0.08 | 0.16 | 0.22 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Including Assessed Tax | 601.36 | 619.30 | 562.28 | 560.05 | 704.25 | 835.88 | 913.62 | 777.22 | 692.19 | 552.56 | 440.40 | 359.88 | 295.97 | 290.03 | 157.23 | 289.92 | 196.09 | 155.38 | 167.05 | 153.05 | 161.90 | 161.21 | 137.07 | 127.44 | 118.21 | 84.61 | 82.28 | 81.36 | |

| Operating Expenses | 419.84 | 398.37 | 785.04 | 375.86 | 380.44 | 395.28 | 416.80 | 357.92 | 327.77 | 241.45 | 234.33 | 206.50 | 808.14 | 919.73 | 1518.91 | 242.06 | 177.72 | 102.83 | 108.54 | 109.82 | 103.56 | 88.40 | 69.67 | 66.45 | 64.19 | 53.19 | 58.54 | 49.11 | |

| General And Administrative Expense | 28.44 | 29.34 | 29.77 | 27.80 | 15.34 | 14.02 | 10.91 | 17.12 | 13.12 | 9.50 | 11.06 | 16.80 | 10.61 | 8.22 | 10.02 | 8.32 | 13.63 | 9.39 | 10.56 | 11.75 | 8.51 | 9.72 | 8.29 | 8.77 | 8.17 | 7.26 | 6.43 | 5.21 | |

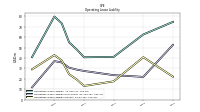

| Operating Income Loss | 181.52 | 220.93 | -222.76 | 184.19 | 323.81 | 440.60 | 496.82 | 419.30 | 364.42 | 311.11 | 206.07 | 153.38 | -513.33 | -629.71 | -1361.68 | 47.86 | 18.38 | 52.54 | 58.51 | 43.23 | 58.33 | 72.81 | 67.40 | 60.99 | 54.03 | 31.43 | 23.74 | 32.25 | |

| Interest Expense | 42.61 | 43.15 | 47.24 | 46.31 | 17.95 | 19.47 | 20.69 | 21.56 | 25.23 | 27.74 | 24.63 | 24.42 | 26.49 | 24.68 | 22.68 | 20.48 | 0.69 | 0.74 | 0.74 | 0.74 | 0.73 | 0.71 | 0.59 | 0.46 | 0.46 | 0.44 | 0.59 | 0.67 | |

| Interest Paid Net | 32.46 | 54.52 | 33.86 | 54.23 | -77.44 | 53.85 | 80.84 | 25.14 | 22.40 | 17.90 | 31.75 | 12.98 | 28.86 | 30.77 | 15.83 | 15.82 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 1.24 | NA | NA | -3.24 | 0.00 | -42.42 | NA | -43.46 | 2.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 16.59 | 0.51 | -156.21 | -50.70 | 4.79 | 3.52 | 3.01 | 0.48 | -0.84 | 2.42 | -0.48 | -0.92 | 6.75 | 0.00 | 51.25 | -64.05 | 5.86 | 17.90 | 16.69 | -5.15 | 5.65 | 1.49 | 0.48 | 0.49 | 0.25 | 0.24 | 0.32 | 0.47 | |

| Income Taxes Paid | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | |

| Net Income Loss | 168.97 | 119.48 | -107.90 | 220.64 | 272.47 | 549.60 | 348.01 | 39.74 | 285.35 | 171.90 | -11.70 | -80.41 | -505.07 | -680.38 | -1564.73 | 216.56 | -23.54 | 55.83 | 55.18 | -19.54 | 156.19 | 37.93 | 50.47 | 55.76 | 22.82 | 17.08 | 33.39 | 47.13 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 6711.48 | 6728.52 | 6565.56 | 6651.66 | 6146.08 | 6099.94 | 5948.33 | 5745.52 | 5547.50 | 4686.42 | 4546.40 | 4476.87 | 4362.87 | 4937.34 | 5810.13 | 7379.96 | 7194.84 | 4016.92 | 3915.50 | 4108.83 | 3979.17 | 3708.74 | 3507.33 | 2835.52 | 2693.30 | 2614.08 | 2581.66 | 2335.58 | |

| Liabilities | 2720.11 | 2867.47 | 3022.89 | 3001.91 | 3060.66 | 3290.94 | 3688.99 | 3830.93 | 3681.74 | 3753.39 | 3789.11 | 3708.84 | 3651.87 | 3733.24 | 3928.75 | 3937.06 | 3971.53 | 1548.27 | 1431.62 | 1680.39 | 1533.96 | 1420.43 | 1257.72 | 924.38 | 837.33 | 781.22 | 765.77 | 555.55 | |

| Liabilities And Stockholders Equity | 6711.48 | 6728.52 | 6565.56 | 6651.66 | 6146.08 | 6099.94 | 5948.33 | 5745.52 | 5547.50 | 4686.42 | 4546.40 | 4476.87 | 4362.87 | 4937.34 | 5810.13 | 7379.96 | 7194.84 | 4016.92 | 3915.50 | 4108.83 | 3979.17 | 3708.74 | 3507.33 | 2835.52 | 2693.30 | 2614.08 | 2581.66 | 2335.58 | |

| Stockholders Equity | 3991.36 | 3861.06 | 3542.67 | 3649.76 | 3085.42 | 2809.00 | 2259.34 | 1914.59 | 1865.77 | 933.03 | 757.29 | 768.02 | 711.00 | 1204.10 | 1881.38 | 3442.90 | 3223.31 | 2468.65 | 2483.87 | 2428.45 | 2445.21 | 2288.31 | 2249.61 | 1911.14 | 1855.97 | 1832.87 | 1815.90 | 1780.03 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 252.13 | 296.71 | 827.91 | 274.64 | 297.64 | 350.93 | 405.01 | 384.99 | 295.44 | 268.53 | 243.86 | 236.35 | 178.37 | 159.91 | 163.73 | 356.75 | 268.67 | 165.37 | 138.10 | 171.00 | 222.62 | 188.97 | 640.37 | 147.17 | 144.86 | 149.50 | 228.57 | 116.00 | |

| Cash And Cash Equivalents At Carrying Value | 3.33 | 3.46 | 3.65 | 3.37 | 3.40 | 4.35 | 6.10 | 4.15 | 9.88 | 3.70 | 3.80 | 24.35 | 20.24 | 10.50 | 7.50 | 14.80 | 13.34 | 11.31 | 16.05 | 10.48 | 16.05 | 12.13 | 509.15 | 18.47 | 28.00 | 61.61 | 139.15 | 35.27 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 3.33 | 3.46 | 3.65 | 3.37 | 3.40 | 4.35 | 6.10 | 4.15 | 9.88 | 3.70 | 3.80 | 24.35 | 20.24 | 10.50 | 7.50 | 14.80 | 13.34 | 11.31 | 16.05 | 10.48 | 16.05 | 12.13 | 509.15 | 18.47 | 28.00 | NA | NA | NA | |

| Accounts Receivable Net Current | 206.79 | 262.39 | 164.71 | 210.11 | 237.13 | 285.59 | 360.95 | 347.59 | 232.44 | 216.12 | 200.25 | 179.13 | 133.11 | 112.54 | 95.84 | 93.01 | 209.46 | 114.12 | 93.04 | 137.11 | 131.72 | 168.75 | 111.96 | 122.41 | 114.32 | 81.97 | 77.64 | 75.96 | |

| Other Assets Current | 30.15 | 29.66 | 37.98 | 35.41 | 35.78 | 46.24 | 37.96 | 33.25 | 30.75 | 30.11 | 24.88 | 32.88 | 24.10 | 27.05 | 28.83 | 24.28 | 19.81 | 14.91 | 15.84 | 12.03 | 9.74 | 3.80 | 7.69 | 2.08 | 2.14 | 2.58 | 2.54 | 1.67 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 14.23 | 13.85 | 13.51 | 14.77 | 14.38 | 14.02 | 30.87 | 30.44 | 30.24 | 29.80 | 29.45 | 28.95 | 28.65 | 33.45 | 35.44 | 32.89 | 31.95 | NA | NA | NA | 16.56 | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 6150.01 | 6102.80 | 5419.81 | 6227.10 | 5734.91 | 5637.44 | 5449.81 | 5273.95 | 5165.65 | 4278.03 | 4215.61 | 4149.11 | 4088.96 | 4674.67 | 5540.82 | 6845.20 | 6669.12 | NA | NA | NA | 3718.86 | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 101.60 | 66.91 | 77.27 | 58.38 | 68.56 | 71.99 | 52.21 | 41.05 | 40.16 | 89.99 | 33.44 | 37.79 | 17.73 | 15.47 | 11.22 | 14.13 | 10.72 | 4.09 | 6.06 | 6.27 | 6.28 | 5.55 | 5.32 | 5.52 | 5.40 | 0.83 | 0.66 | 0.68 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 646.96 | 749.79 | 680.79 | 697.69 | 702.81 | 794.00 | 1042.04 | 1073.30 | 872.49 | 828.38 | 813.80 | 672.05 | 497.11 | 417.40 | 477.69 | 583.77 | 652.25 | 301.01 | 291.93 | 323.94 | 314.92 | 333.13 | 245.34 | 238.53 | 205.77 | 178.09 | 161.87 | 155.41 | |

| Accounts Payable And Accrued Liabilities Current | 526.45 | 585.53 | 507.47 | 550.92 | 536.23 | 594.28 | 606.09 | 516.44 | 569.99 | 442.05 | 419.43 | 374.75 | 345.37 | 332.98 | 405.60 | 525.33 | 511.62 | 243.48 | 221.45 | 230.99 | 261.18 | 251.75 | 193.98 | 187.27 | 162.88 | 147.34 | 144.96 | 131.25 | |

| Accrued Liabilities Current | 526.45 | 585.53 | 507.47 | 550.92 | 536.23 | 594.28 | 606.09 | 516.44 | 569.99 | 442.05 | 419.43 | 374.75 | 345.37 | 332.98 | 405.60 | 525.33 | 511.62 | NA | NA | NA | 285.85 | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Current | 96.37 | 103.08 | 100.70 | 146.19 | 150.38 | 151.02 | 134.58 | 163.94 | 116.52 | 61.64 | 62.67 | 72.85 | 41.51 | 30.01 | 15.05 | 15.90 | 26.57 | 1.95 | 2.47 | 8.51 | 13.31 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Contract With Customer Liability Current | 226.80 | NA | NA | NA | 244.41 | NA | NA | NA | 294.14 | NA | NA | NA | 162.76 | NA | NA | NA | 145.82 | NA | NA | NA | 94.11 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

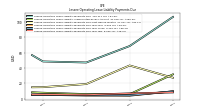

| Long Term Debt | 1918.65 | 1948.62 | 2268.12 | 2204.51 | 2241.30 | 2373.36 | 2516.34 | 2623.28 | 2694.11 | 2809.61 | 2865.15 | 2937.24 | 2969.26 | 3190.27 | 3350.73 | 3250.91 | 3186.11 | 1190.65 | 1095.26 | 1319.87 | 1189.47 | 1053.53 | 988.46 | 670.37 | 620.20 | 595.12 | 595.14 | 390.54 | |

| Deferred Finance Costs Noncurrent Net | 12.80 | 14.23 | 15.45 | 17.15 | 18.82 | 13.50 | 14.96 | 16.54 | 18.12 | 19.27 | 20.67 | 22.18 | 23.64 | 24.85 | 25.99 | 21.38 | 22.23 | 5.08 | 5.43 | 5.74 | 6.09 | 6.41 | 5.75 | 4.59 | 4.86 | 5.21 | 5.27 | 2.74 | |

| Other Liabilities Noncurrent | 81.97 | 82.95 | 35.80 | 38.09 | 49.24 | 54.40 | 51.94 | 44.75 | 49.26 | 41.45 | 44.40 | 42.22 | 12.66 | 11.41 | 12.16 | 11.84 | 14.53 | 0.00 | 0.10 | 0.99 | 0.10 | 6.17 | 0.67 | 0.47 | 0.41 | 0.41 | 0.41 | 0.28 | |

| Operating Lease Liability Noncurrent | 52.72 | NA | NA | NA | 21.88 | NA | NA | NA | 23.55 | NA | NA | NA | 27.58 | 28.91 | 30.73 | 35.75 | 37.09 | NA | NA | 11.75 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 3991.36 | 3861.06 | 3542.67 | 3649.76 | 3085.42 | 2809.00 | 2259.34 | 1914.59 | 1865.77 | 933.03 | 757.29 | 768.02 | 711.00 | 1204.10 | 1881.38 | 3442.90 | 3223.31 | 2468.65 | 2483.87 | 2428.45 | 2445.21 | 2288.31 | 2249.61 | 1911.14 | 1855.97 | 1832.87 | 1815.90 | 1780.03 | |

| Additional Paid In Capital Common Stock | 4186.52 | 4225.18 | 4026.34 | 4025.53 | 4022.19 | 4018.24 | 4018.18 | 4021.44 | 4012.36 | 3365.12 | 3361.28 | 3360.32 | 3222.96 | 3210.99 | 3204.31 | 3201.11 | 3198.08 | 2421.56 | 2483.95 | 2481.88 | 2477.28 | 2474.75 | 2472.16 | 2182.60 | 2181.36 | 2179.26 | 2177.55 | 2173.24 | |

| Retained Earnings Accumulated Deficit | -195.83 | -364.80 | -484.29 | -376.39 | -937.39 | -1209.86 | -1759.46 | -2107.47 | -2147.20 | -2432.55 | -2604.46 | -2592.76 | -2512.36 | -2007.28 | -1326.90 | 237.83 | 21.27 | 44.81 | -2.37 | -55.73 | -34.36 | -188.73 | -224.84 | -273.49 | -327.43 | -348.43 | -363.68 | -395.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 298.27 | 266.83 | 279.52 | 247.91 | 372.65 | 475.27 | 372.32 | 281.27 | 366.31 | 294.56 | 175.60 | 137.66 | 134.58 | 135.70 | 97.80 | 191.69 | 137.58 | 113.69 | 150.49 | 74.56 | 151.64 | 116.04 | 107.76 | 92.22 | 80.19 | 53.89 | 43.13 | 52.68 | |

| Net Cash Provided By Used In Investing Activities | -226.47 | 67.73 | -338.66 | -209.91 | -230.33 | -332.94 | -213.82 | -221.94 | -421.23 | -237.78 | -118.87 | -98.51 | -80.22 | 3.99 | -199.29 | -254.37 | -124.13 | -139.76 | 82.78 | -207.28 | -281.05 | -674.73 | -218.93 | -149.35 | -136.95 | -129.14 | -137.94 | -668.50 | |

| Net Cash Provided By Used In Financing Activities | -71.93 | -334.75 | 59.42 | -38.03 | -143.28 | -144.08 | -156.56 | -65.06 | 61.11 | -56.89 | -77.28 | -35.04 | -44.63 | -136.69 | 94.19 | 64.13 | -11.42 | 21.32 | -227.69 | 127.15 | 133.33 | 61.67 | 601.84 | 47.62 | 23.15 | -2.29 | 198.69 | -1.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 298.27 | 266.83 | 279.52 | 247.91 | 372.65 | 475.27 | 372.32 | 281.27 | 366.31 | 294.56 | 175.60 | 137.66 | 134.58 | 135.70 | 97.80 | 191.69 | 137.58 | 113.69 | 150.49 | 74.56 | 151.64 | 116.04 | 107.76 | 92.22 | 80.19 | 53.89 | 43.13 | 52.68 | |

| Net Income Loss | 168.97 | 119.48 | -107.90 | 220.64 | 272.47 | 549.60 | 348.01 | 39.74 | 285.35 | 171.90 | -11.70 | -80.41 | -505.07 | -680.38 | -1564.73 | 216.56 | -23.54 | 55.83 | 55.18 | -19.54 | 156.19 | 37.93 | 50.47 | 55.76 | 22.82 | 17.08 | 33.39 | 47.13 | |

| Depreciation Depletion And Amortization | 143.75 | 138.60 | 127.35 | 125.97 | 131.30 | 122.83 | 109.41 | 102.98 | 112.55 | 89.89 | 83.13 | 70.99 | 96.04 | 114.20 | 138.93 | 131.46 | 61.95 | 56.00 | 62.92 | 59.77 | 59.50 | 48.26 | 38.73 | 35.42 | 36.54 | 28.52 | 26.21 | 24.43 | |

| Increase Decrease In Accounts Receivable | -34.07 | 28.35 | -18.55 | -24.02 | -55.44 | -71.48 | 14.07 | 116.32 | 3.17 | 15.87 | 21.67 | 45.68 | 20.34 | 16.93 | 2.83 | -115.87 | 52.67 | 21.08 | -44.07 | 5.39 | -37.03 | 56.76 | -10.45 | 8.07 | 32.35 | 4.34 | 3.74 | 4.07 | |

| Deferred Income Tax Expense Benefit | 18.83 | -0.70 | -152.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 3.31 | 0.00 | 51.25 | 64.05 | 5.64 | 17.90 | 16.69 | -5.15 | 5.65 | 1.49 | 0.48 | 0.49 | 0.25 | 0.24 | 0.32 | 0.47 | |

| Share Based Compensation | 1.89 | 3.96 | 3.69 | 1.88 | 1.45 | 0.10 | -3.21 | 4.17 | 0.94 | -0.90 | 5.28 | 7.61 | 0.47 | 1.49 | 1.04 | 3.78 | 1.90 | 1.57 | 1.75 | 4.54 | 1.82 | 1.71 | 1.63 | 1.13 | 1.24 | 1.22 | 4.87 | 0.93 | |

| Amortization Of Financing Costs | 2.81 | 2.73 | 2.61 | 2.63 | 1.02 | 1.06 | 1.49 | 1.72 | 2.96 | 2.66 | 2.25 | 2.26 | 2.32 | 0.44 | 0.74 | 0.41 | 0.69 | 0.74 | 0.74 | 0.74 | 0.73 | 0.71 | 0.59 | 0.45 | 0.46 | 0.44 | 0.59 | 0.67 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -226.47 | 67.73 | -338.66 | -209.91 | -230.33 | -332.94 | -213.82 | -221.94 | -421.23 | -237.78 | -118.87 | -98.51 | -80.22 | 3.99 | -199.29 | -254.37 | -124.13 | -139.76 | 82.78 | -207.28 | -281.05 | -674.73 | -218.93 | -149.35 | -136.95 | -129.14 | -137.94 | -668.50 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -71.93 | -334.75 | 59.42 | -38.03 | -143.28 | -144.08 | -156.56 | -65.06 | 61.11 | -56.89 | -77.28 | -35.04 | -44.63 | -136.69 | 94.19 | 64.13 | -11.42 | 21.32 | -227.69 | 127.15 | 133.33 | 61.67 | 601.84 | 47.62 | 23.15 | -2.29 | 198.69 | -1.90 | |

| Payments For Repurchase Of Common Stock | 40.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Including Assessed Tax | 601.36 | 619.30 | 562.28 | 560.05 | 704.25 | 835.88 | 913.62 | 777.22 | 692.19 | 552.56 | 440.40 | 359.88 | 295.97 | 290.03 | 157.23 | 289.92 | 196.09 | 155.38 | 167.05 | 153.05 | 161.90 | 161.21 | 137.07 | 127.44 | 118.21 | 84.61 | 82.28 | 81.36 | |

| 43.92 | 46.49 | 40.63 | 43.37 | 49.78 | 67.55 | 75.53 | 67.62 | 69.78 | 58.10 | 36.62 | 29.36 | 25.67 | 23.02 | 14.48 | 18.12 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | ||

| 19.41 | 25.05 | 14.42 | 23.59 | 42.77 | 81.02 | 64.91 | 43.98 | 56.67 | 36.52 | 24.08 | 24.22 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| Oil And Gas Exploration And Production | 427.03 | 438.67 | 421.77 | 409.56 | 513.73 | 575.85 | 619.81 | 553.25 | 506.44 | 409.29 | 333.44 | 267.05 | 222.73 | 231.65 | 130.51 | 265.77 | 183.07 | 148.21 | 160.73 | 141.10 | 150.40 | 142.60 | 122.61 | 115.29 | 104.13 | 73.35 | 72.89 | NA | |

| Oil And Gas Purchased | 110.99 | 109.10 | 85.46 | 83.53 | 97.97 | 111.46 | 153.37 | 112.38 | 59.29 | 48.65 | 46.25 | 39.26 | 27.85 | 20.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |