| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.30 | 1.15 | 0.99 | 0.99 | 0.99 | 0.97 | 0.97 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.95 | 0.95 | 0.95 | 0.95 | 0.95 | 0.95 | 0.95 | 0.88 | 0.86 | 0.83 | 0.79 | 0.76 | 0.76 | 0.76 | 0.76 | 0.72 | 0.65 | 0.58 | 0.57 | 0.57 | 0.48 | 0.48 | 0.31 | 0.31 | 0.31 | 0.22 | 0.22 | NA | 0.00 | NA | NA | NA | |

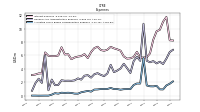

| Earnings Per Share Basic | 0.23 | 0.08 | -0.01 | 0.19 | 0.15 | 0.01 | 0.21 | -0.45 | 0.18 | 0.12 | 0.22 | 0.21 | 0.22 | 0.23 | 0.20 | 0.20 | 0.22 | -0.11 | 0.21 | 0.18 | 0.18 | 0.18 | 0.17 | 0.19 | 0.03 | 0.15 | 0.03 | 0.15 | 0.14 | 0.13 | 0.13 | 0.11 | 0.10 | 0.02 | 0.07 | 0.06 | 0.03 | 0.09 | -0.47 | -0.02 | -0.05 | -0.01 | 0.02 | 0.03 | |

| Earnings Per Share Diluted | 0.23 | 0.08 | -0.01 | 0.19 | 0.15 | 0.01 | 0.21 | -0.45 | 0.18 | 0.12 | 0.22 | 0.21 | 0.22 | 0.23 | 0.20 | 0.20 | 0.22 | -0.11 | 0.21 | 0.18 | 0.18 | 0.18 | 0.17 | 0.19 | 0.03 | 0.15 | 0.03 | 0.15 | 0.14 | 0.13 | 0.13 | 0.11 | 0.10 | 0.02 | 0.07 | 0.06 | 0.03 | 0.09 | -0.47 | -0.02 | -0.05 | -0.01 | 0.02 | 0.03 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

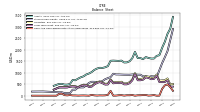

| Revenue From Contract With Customer Excluding Assessed Tax | 59.73 | 55.88 | 51.55 | 50.61 | 51.81 | 50.29 | 47.55 | 46.48 | 49.74 | 48.60 | 48.26 | 45.75 | 44.14 | 0.63 | 0.61 | 0.62 | 44.23 | 0.93 | 0.89 | 0.86 | 40.36 | 0.87 | 0.84 | 0.80 | 36.60 | 0.82 | 32.83 | 30.61 | 28.24 | 27.11 | 25.70 | 23.63 | 22.63 | 17.98 | 17.38 | 16.96 | 16.08 | 15.88 | 14.06 | 12.87 | 12.85 | 12.56 | 12.05 | 11.34 | |

| Revenues | 59.73 | 55.88 | 51.55 | 50.61 | 51.81 | 50.29 | 47.55 | 46.48 | 49.74 | 48.60 | 48.26 | 45.75 | 44.14 | 45.69 | 44.17 | 44.34 | 44.23 | 33.31 | 46.20 | 39.66 | 40.36 | 39.51 | 38.97 | 38.10 | 36.60 | 32.95 | 32.83 | 30.61 | 28.24 | 27.11 | 25.70 | 23.63 | 22.63 | 17.98 | 17.38 | 16.96 | 16.08 | 15.88 | 14.06 | 12.87 | 12.85 | 12.56 | 12.05 | 11.34 | |

| Costs And Expenses | 35.07 | 41.94 | 51.91 | 30.86 | 33.37 | 42.59 | 26.88 | 89.93 | 31.59 | 25.86 | 26.94 | 25.07 | 23.10 | 24.14 | 25.23 | 24.96 | 25.13 | 43.59 | 26.50 | 23.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| General And Administrative Expense | 6.51 | 5.52 | 4.72 | 5.06 | 4.81 | 5.16 | 4.98 | 5.21 | 10.74 | 5.20 | 5.80 | 5.14 | 3.38 | 4.11 | 4.76 | 4.05 | 3.74 | 3.50 | 4.61 | 3.31 | 2.92 | 3.09 | 3.36 | 3.19 | 2.69 | 3.06 | 2.98 | 2.39 | 2.57 | 2.28 | 2.21 | 2.23 | 2.21 | 2.29 | 1.59 | 1.56 | 2.40 | 0.80 | 6.01 | 1.90 | 2.53 | 1.84 | 0.73 | NA | |

| Interest Expense | 8.27 | 11.75 | 11.04 | 9.83 | 9.61 | 8.36 | 6.30 | 5.74 | 5.69 | 5.69 | 6.53 | 5.76 | 5.58 | 5.52 | 5.85 | 6.71 | 6.92 | 7.06 | 7.29 | 6.86 | 6.70 | 6.80 | 7.30 | 7.09 | 6.51 | 5.60 | 6.20 | 5.90 | 5.83 | 5.70 | 5.44 | 6.19 | 6.14 | 7.22 | 5.99 | 5.90 | 5.90 | 5.94 | 6.45 | 3.33 | 3.31 | 3.15 | 3.07 | NA | |

| Interest Paid Net | 11.49 | 7.54 | 14.33 | 6.67 | 11.01 | 3.91 | 9.63 | 1.35 | 9.57 | 2.60 | 9.34 | 1.32 | 9.02 | 1.08 | 9.30 | 2.29 | 10.36 | 2.69 | 10.72 | 2.24 | 10.17 | 2.36 | 10.74 | 2.67 | 10.27 | 8.76 | 9.07 | 1.51 | 9.06 | 1.38 | 8.69 | 2.10 | 9.35 | 1.54 | 9.26 | 1.54 | 9.24 | 1.59 | 3.08 | 3.33 | 3.31 | 3.17 | NA | NA | |

| Allocated Share Based Compensation Expense | 1.77 | 1.52 | 0.92 | 0.94 | 1.46 | 1.38 | 1.39 | 1.52 | 5.63 | 1.80 | 1.81 | 1.58 | 0.97 | 0.97 | 0.96 | 0.88 | 0.98 | 0.98 | 1.15 | 0.99 | 0.98 | 0.99 | 0.92 | 0.90 | 0.60 | 0.70 | 0.60 | 0.50 | 0.29 | 0.30 | 0.40 | 0.43 | 0.41 | 0.43 | 0.29 | 0.37 | 0.15 | 0.00 | 0.00 | NA | -0.01 | 0.00 | 0.00 | NA | |

| Profit Loss | 26.29 | 8.69 | -0.48 | 19.23 | 14.38 | 0.71 | 20.67 | -43.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 26.30 | 8.70 | -0.48 | 19.23 | 14.38 | 0.71 | 20.67 | -43.26 | 18.26 | 11.92 | 21.32 | 20.49 | 21.05 | 21.55 | 18.93 | 19.32 | 20.66 | -10.05 | 19.70 | 16.05 | 15.54 | 14.51 | 13.27 | 14.61 | 2.25 | 11.31 | 2.03 | 10.28 | 8.39 | 7.83 | 7.63 | 5.50 | 5.00 | 0.73 | 2.27 | 2.04 | 0.63 | 1.97 | -10.34 | -0.40 | -1.19 | -0.27 | 0.54 | 0.57 | |

| Net Income Loss Available To Common Stockholders Basic | 26.16 | 8.61 | -0.57 | 19.14 | 14.24 | 0.61 | 20.57 | -43.38 | 18.10 | 11.80 | 21.20 | 20.37 | 20.98 | 21.48 | 18.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 26.16 | 8.61 | -0.57 | 19.14 | 14.24 | 0.61 | 20.57 | -43.38 | 18.10 | 11.80 | 21.20 | 20.37 | 20.98 | 21.48 | 18.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

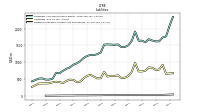

| Assets | 2084.84 | 1767.56 | 1736.95 | 1622.20 | 1620.78 | 1645.58 | 1685.77 | 1593.94 | 1640.85 | 1643.67 | 1912.42 | 1634.10 | 1503.56 | 1453.82 | 1450.01 | 1531.22 | 1518.86 | 1524.77 | 1531.56 | 1523.99 | 1291.76 | 1240.36 | 1211.84 | 1218.73 | 1184.99 | 1126.02 | 1030.06 | 967.44 | 925.36 | 845.09 | 803.48 | 743.51 | 673.17 | 684.97 | 511.18 | 482.79 | 482.57 | 517.94 | 513.35 | NA | 430.47 | NA | NA | NA | |

| Liabilities | 666.12 | 656.58 | 923.93 | 781.88 | 771.41 | 831.90 | 847.50 | 749.36 | 725.09 | 726.05 | 982.81 | 708.66 | 589.42 | 537.78 | 532.57 | 609.42 | 591.27 | 597.28 | 573.42 | 712.96 | 523.51 | 520.31 | 573.10 | 624.84 | 590.37 | 520.14 | 422.08 | 409.49 | 472.93 | 482.31 | 441.62 | 379.40 | 410.88 | 420.41 | 402.89 | 371.97 | 369.11 | 368.32 | 365.69 | NA | 267.78 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 2084.84 | 1767.56 | 1736.95 | 1622.20 | 1620.78 | 1645.58 | 1685.77 | 1593.94 | 1640.85 | 1643.67 | 1912.42 | 1634.10 | 1503.56 | 1453.82 | 1450.01 | 1531.22 | 1518.86 | 1524.77 | 1531.56 | 1523.99 | 1291.76 | 1240.36 | 1211.84 | 1218.73 | 1184.99 | 1126.02 | 1030.06 | 967.44 | 925.36 | 845.09 | 803.48 | 743.51 | 673.17 | 684.97 | 511.18 | 482.79 | 482.57 | 517.94 | 513.35 | NA | 430.47 | NA | NA | NA | |

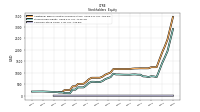

| Stockholders Equity | 1416.82 | 1109.92 | 813.02 | 840.32 | 849.37 | 813.68 | 838.27 | 844.58 | 915.76 | 917.62 | 929.61 | 925.44 | 914.14 | 916.04 | 917.45 | 921.79 | 927.59 | 927.49 | 958.14 | 811.03 | 768.25 | 720.05 | 638.74 | 593.89 | 594.62 | 605.88 | 607.98 | 557.95 | 452.43 | 362.77 | 361.85 | 364.11 | 262.29 | 264.56 | 108.29 | 110.82 | 113.46 | 149.62 | 147.66 | NA | 162.69 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 294.45 | 3.48 | 1.15 | 28.07 | 13.18 | 4.86 | 30.27 | 26.59 | 19.89 | 17.72 | 1.77 | 30.47 | 18.92 | 19.10 | 5.80 | 23.94 | 20.33 | 5.75 | 2.63 | 214.35 | 36.79 | 15.74 | 11.56 | 14.20 | 6.91 | 14.81 | 35.07 | 1.28 | 7.50 | 11.88 | 9.64 | 4.66 | 11.47 | 12.10 | 29.90 | 13.59 | 25.32 | 88.84 | 80.34 | 0.93 | 0.90 | 0.83 | 0.78 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 294.45 | 3.48 | 1.15 | 28.07 | 13.18 | 4.86 | 30.27 | 26.59 | 19.89 | 17.72 | 310.96 | 30.47 | 18.92 | 19.10 | 5.80 | 23.94 | 20.33 | 5.75 | 2.63 | 214.35 | 36.79 | 15.74 | 11.56 | 14.20 | 6.91 | NA | NA | NA | 7.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 279.28 | 270.81 | 266.01 | 235.01 | 238.74 | 236.30 | 236.68 | 236.99 | 251.79 | 251.35 | 244.74 | 243.46 | 205.36 | 209.28 | 208.23 | 208.23 | 204.15 | 198.03 | 197.51 | 176.80 | 166.95 | 163.66 | 153.58 | 153.58 | 151.88 | 128.81 | 119.44 | 114.39 | 110.65 | 107.24 | 101.26 | 95.25 | 91.31 | 80.88 | 79.80 | 76.74 | 75.07 | 74.13 | 74.13 | NA | 75.11 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Dividends Payable Current | 36.53 | 32.40 | 27.85 | 27.85 | 27.39 | 26.68 | 26.68 | 26.69 | 25.75 | 25.71 | 25.71 | 25.63 | 23.93 | 23.93 | 23.93 | 23.93 | 21.50 | 21.50 | 21.51 | 20.01 | 17.71 | 17.20 | 16.22 | 15.61 | 14.04 | 14.04 | 14.05 | 13.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 595.60 | 595.32 | 875.05 | 729.77 | 719.50 | 774.22 | 798.95 | 698.67 | 673.40 | 673.15 | 939.92 | 665.84 | 545.59 | 495.35 | 495.11 | 569.87 | 554.62 | 559.38 | 539.14 | 678.90 | 489.76 | 484.55 | 544.34 | 594.12 | 558.91 | 488.71 | 393.51 | 382.01 | 449.72 | 457.43 | 422.14 | 358.86 | 393.90 | 400.70 | 391.90 | 357.50 | 358.20 | 358.87 | 359.50 | NA | 259.31 | NA | NA | NA | |

| Unsecured Long Term Debt | 396.04 | 395.82 | 395.59 | 395.37 | 395.15 | 394.93 | 394.71 | 394.48 | 394.26 | 394.06 | 690.89 | 296.86 | 296.67 | 296.48 | 296.29 | 296.10 | 295.91 | 295.72 | 295.53 | 295.34 | 295.15 | 294.96 | 294.77 | 294.58 | 294.39 | 294.22 | 294.04 | 255.56 | 255.29 | 255.03 | 254.76 | 254.50 | 254.23 | 260.00 | 260.00 | 260.00 | 260.00 | 260.00 | 260.00 | NA | NA | NA | NA | NA | |

| Minority Interest | 1.90 | 1.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1416.82 | 1109.92 | 813.02 | 840.32 | 849.37 | 813.68 | 838.27 | 844.58 | 915.76 | 917.62 | 929.61 | 925.44 | 914.14 | 916.04 | 917.45 | 921.79 | 927.59 | 927.49 | 958.14 | 811.03 | 768.25 | 720.05 | 638.74 | 593.89 | 594.62 | 605.88 | 607.98 | 557.95 | 452.43 | 362.77 | 361.85 | 364.11 | 262.29 | 264.56 | 108.29 | 110.82 | 113.46 | 149.62 | 147.66 | NA | 162.69 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1418.72 | 1110.98 | 813.02 | 840.32 | 849.37 | 813.68 | 838.27 | 844.58 | 915.76 | NA | NA | NA | 914.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 1.30 | 1.15 | 0.99 | 0.99 | 0.99 | 0.97 | 0.97 | 0.96 | 0.96 | 0.96 | 0.96 | 0.96 | 0.95 | 0.95 | 0.95 | 0.95 | 0.95 | 0.95 | 0.95 | 0.88 | 0.86 | 0.83 | 0.79 | 0.76 | 0.76 | 0.76 | 0.76 | 0.72 | 0.65 | 0.58 | 0.57 | 0.57 | 0.48 | 0.48 | 0.31 | 0.31 | 0.31 | 0.22 | 0.22 | NA | 0.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1883.15 | 1566.16 | 1245.72 | 1244.79 | 1245.34 | 1196.66 | 1195.28 | 1195.59 | 1196.84 | 1191.20 | 1189.40 | 1180.84 | 1164.40 | 1163.42 | 1162.45 | 1161.80 | 1162.99 | 1162.05 | 1161.14 | 1012.29 | 965.58 | 915.24 | 831.29 | 783.51 | 783.24 | 782.71 | 782.07 | 720.06 | 611.48 | 519.20 | 516.24 | 516.28 | 410.22 | 409.79 | 246.70 | 246.41 | 246.04 | 146.98 | 146.98 | NA | NA | NA | NA | NA | |

| Minority Interest | 1.90 | 1.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

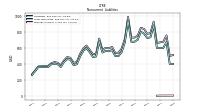

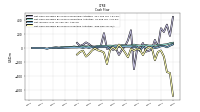

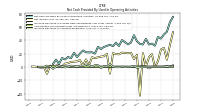

| Net Cash Provided By Used In Operating Activities | 42.67 | 45.11 | 31.87 | 35.12 | 33.74 | 42.37 | 33.72 | 34.58 | 38.51 | 47.81 | 36.61 | 33.95 | 37.35 | 40.44 | 31.42 | 36.52 | 31.14 | 33.42 | 31.66 | 30.07 | 26.97 | 30.27 | 20.06 | 22.06 | 21.87 | 22.03 | 24.73 | 20.17 | 14.92 | 21.40 | 13.12 | 14.99 | 11.22 | 13.45 | 4.53 | 11.05 | 4.55 | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -35.51 | -55.66 | -175.83 | -0.82 | 14.36 | -16.11 | -101.57 | -24.07 | -10.67 | -36.92 | -11.74 | -133.30 | -63.64 | -3.26 | 49.62 | -24.30 | 9.94 | -28.75 | -231.02 | -66.18 | -43.08 | -32.89 | -3.98 | -35.11 | -85.62 | -122.64 | -38.83 | -55.47 | -93.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 283.80 | 12.89 | 117.03 | -19.41 | -39.78 | -51.66 | 71.53 | -3.82 | -25.66 | -304.13 | 255.62 | 110.90 | 26.11 | -23.88 | -99.19 | -8.61 | -26.50 | -1.55 | -12.37 | 213.66 | 37.16 | 6.80 | -18.71 | 20.34 | 55.85 | 80.35 | 47.88 | 29.09 | 74.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 42.67 | 45.11 | 31.87 | 35.12 | 33.74 | 42.37 | 33.72 | 34.58 | 38.51 | 47.81 | 36.61 | 33.95 | 37.35 | 40.44 | 31.42 | 36.52 | 31.14 | 33.42 | 31.66 | 30.07 | 26.97 | 30.27 | 20.06 | 22.06 | 21.87 | 22.03 | 24.73 | 20.17 | 14.92 | 21.40 | 13.12 | 14.99 | 11.22 | 13.45 | 4.53 | 11.05 | 4.55 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 26.30 | 8.70 | -0.48 | 19.23 | 14.38 | 0.71 | 20.67 | -43.26 | 18.26 | 11.92 | 21.32 | 20.49 | 21.05 | 21.55 | 18.93 | 19.32 | 20.66 | -10.05 | 19.70 | 16.05 | 15.54 | 14.51 | 13.27 | 14.61 | 2.25 | 11.31 | 2.03 | 10.28 | 8.39 | 7.83 | 7.63 | 5.50 | 5.00 | 0.73 | 2.27 | 2.04 | 0.63 | 1.97 | -10.34 | -0.40 | -1.19 | -0.27 | 0.54 | 0.57 | |

| Profit Loss | 26.29 | 8.69 | -0.48 | 19.23 | 14.38 | 0.71 | 20.67 | -43.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 0.02 | 0.00 | -0.05 | 0.03 | 0.04 | -0.07 | -0.24 | -0.34 | -1.21 | 1.68 | -0.01 | 0.10 | -0.28 | 0.26 | -0.47 | -0.34 | 0.24 | 3.95 | 0.87 | 1.22 | -1.70 | 2.66 | 2.68 | 0.15 | 2.48 | 3.53 | 1.45 | 1.96 | 0.16 | 1.50 | 1.86 | -0.12 | -0.62 | 0.93 | 1.98 | 0.04 | -2.89 | 1.03 | 1.86 | -0.01 | 0.00 | -0.01 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -35.51 | -55.66 | -175.83 | -0.82 | 14.36 | -16.11 | -101.57 | -24.07 | -10.67 | -36.92 | -11.74 | -133.30 | -63.64 | -3.26 | 49.62 | -24.30 | 9.94 | -28.75 | -231.02 | -66.18 | -43.08 | -32.89 | -3.98 | -35.11 | -85.62 | -122.64 | -38.83 | -55.47 | -93.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 283.80 | 12.89 | 117.03 | -19.41 | -39.78 | -51.66 | 71.53 | -3.82 | -25.66 | -304.13 | 255.62 | 110.90 | 26.11 | -23.88 | -99.19 | -8.61 | -26.50 | -1.55 | -12.37 | 213.66 | 37.16 | 6.80 | -18.71 | 20.34 | 55.85 | 80.35 | 47.88 | 29.09 | 74.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 32.40 | 27.84 | 27.84 | 27.41 | 26.66 | 26.66 | 26.77 | 26.04 | 25.63 | 25.64 | 25.55 | 23.96 | 23.88 | 23.88 | 23.87 | 21.53 | 21.46 | 21.47 | 19.98 | 17.71 | 17.17 | 16.20 | 15.58 | 14.04 | 14.04 | 14.05 | 13.42 | 11.07 | 9.87 | 9.85 | 9.84 | 7.70 | 7.70 | 5.09 | 5.05 | 3.95 | 33.00 | 0.00 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 59.73 | 55.88 | 51.55 | 50.61 | 51.81 | 50.29 | 47.55 | 46.48 | 49.74 | 48.60 | 48.26 | 45.75 | 44.14 | 45.69 | 44.17 | 44.34 | 44.23 | 33.31 | 46.20 | 39.66 | 40.36 | 39.51 | 38.97 | 38.10 | 36.60 | 32.95 | 32.83 | 30.61 | 28.24 | 27.11 | 25.70 | 23.63 | 22.63 | 17.98 | 17.38 | 16.96 | 16.08 | 15.88 | 14.06 | 12.87 | 12.85 | 12.56 | 12.05 | 11.34 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 59.73 | 55.88 | 51.55 | 50.61 | 51.81 | 50.29 | 47.55 | 46.48 | 49.74 | 48.60 | 48.26 | 45.75 | 44.14 | 0.63 | 0.61 | 0.62 | 44.23 | 0.93 | 0.89 | 0.86 | 40.36 | 0.87 | 0.84 | 0.80 | 36.60 | 0.82 | 32.83 | 30.61 | 28.24 | 27.11 | 25.70 | 23.63 | 22.63 | 17.98 | 17.38 | 16.96 | 16.08 | 15.88 | 14.06 | 12.87 | 12.85 | 12.56 | 12.05 | 11.34 |