| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

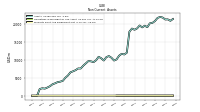

| Common Stock Value | 35.46 | 35.33 | 35.30 | 35.26 | 35.01 | 34.95 | 34.92 | 34.88 | 34.72 | 33.82 | 33.63 | 33.52 | 32.99 | 32.84 | 32.79 | 32.75 | 32.62 | 32.53 | 32.48 | 32.41 | 32.25 | 32.22 | 32.20 | 32.00 | 31.91 | 31.32 | 31.26 | 31.17 | 30.82 | 28.07 | 27.82 | 27.57 | 27.43 | 27.41 | 27.40 | 27.36 | 27.28 | 27.27 | 27.26 | 24.83 | 24.76 | 24.74 | 24.71 | 18.53 | 18.51 | 18.51 | 11.39 | 11.39 | 11.39 | 11.39 | 0.00 | 0.00 | |

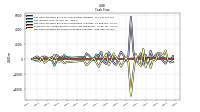

| Earnings Per Share Basic | 1.86 | 2.65 | 1.41 | 1.58 | 0.79 | 1.89 | 1.73 | 2.27 | 3.02 | 3.40 | 1.80 | 1.04 | 1.67 | 1.49 | 0.61 | -0.02 | 0.76 | 0.75 | 0.18 | 0.38 | 0.45 | 0.08 | 0.64 | 0.65 | 0.58 | 0.13 | 0.66 | 0.73 | 0.56 | 0.68 | 0.64 | 0.61 | 0.62 | 0.53 | 0.41 | 0.52 | 0.49 | 0.44 | 0.38 | 0.34 | 0.37 | 0.34 | 0.39 | 0.39 | 0.41 | 0.53 | 0.57 | 0.27 | 0.28 | 0.24 | 0.00 | -0.18 | |

| Earnings Per Share Diluted | 1.79 | 2.58 | 1.39 | 1.55 | 0.77 | 1.85 | 1.68 | 2.18 | 2.87 | 3.25 | 1.72 | 1.01 | 1.65 | 1.48 | 0.61 | -0.02 | 0.75 | 0.74 | 0.18 | 0.38 | 0.44 | 0.07 | 0.62 | 0.64 | 0.55 | 0.13 | 0.62 | 0.67 | 0.51 | 0.64 | 0.60 | 0.57 | 0.58 | 0.50 | 0.39 | 0.49 | 0.47 | 0.42 | 0.37 | 0.32 | 0.36 | 0.33 | 0.38 | 0.38 | 0.40 | 0.51 | 0.56 | 0.27 | 0.27 | 0.23 | 0.00 | -0.23 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Marketing And Advertising Expense | 0.85 | 0.65 | 0.55 | 1.05 | 1.11 | 0.76 | 0.35 | 0.32 | 0.34 | 0.30 | 0.31 | 0.56 | 0.00 | -0.00 | 0.58 | 1.64 | 0.90 | 0.98 | 1.36 | 0.81 | 0.92 | 0.82 | 0.32 | 0.39 | 0.36 | 0.40 | 0.15 | 0.18 | -0.60 | 0.59 | 0.33 | 0.26 | 0.37 | 0.33 | 0.43 | 0.35 | 0.22 | 0.26 | 0.43 | 0.41 | 0.30 | 0.45 | 0.41 | 0.12 | 0.37 | 0.27 | 0.30 | 0.28 | 0.35 | 0.21 | 0.20 | 0.44 | |

| Interest Expense | 173.41 | 176.57 | 164.89 | 165.05 | 134.51 | 76.88 | 31.48 | 18.78 | 20.34 | 22.96 | 24.12 | 28.38 | 30.15 | 32.21 | 33.24 | 44.02 | 46.40 | 50.98 | 47.27 | 41.77 | 41.78 | 46.04 | 40.32 | 31.93 | 29.32 | 30.27 | 25.24 | 20.67 | 19.48 | 19.63 | 18.16 | 15.77 | 14.24 | 13.80 | 13.12 | 12.39 | 12.18 | 11.08 | 8.16 | 7.08 | 6.80 | 6.55 | 5.56 | 5.39 | 5.58 | 5.41 | 5.55 | 5.23 | 5.42 | 5.70 | 5.79 | 4.57 | |

| Interest Income Expense Net | 172.51 | 199.77 | 165.27 | 149.90 | 135.14 | 159.03 | 164.85 | 164.70 | 193.69 | 219.89 | 138.76 | 132.73 | 122.95 | 107.44 | 91.98 | 81.32 | 77.59 | 75.73 | 64.68 | 59.30 | 61.52 | 64.00 | 67.32 | 65.03 | 68.30 | 68.02 | 68.62 | 62.42 | 64.13 | 64.58 | 63.16 | 57.63 | 53.47 | 49.93 | 46.56 | 46.33 | 44.99 | 40.21 | 36.93 | 29.51 | 27.69 | 27.00 | 25.99 | 22.52 | 21.66 | 22.55 | 14.15 | 13.47 | 14.02 | 9.71 | 0.00 | 7.20 | |

| Income Loss From Continuing Operations | 62.09 | 86.76 | 47.57 | 53.72 | 28.71 | 63.91 | 58.65 | 76.76 | 102.25 | 116.04 | 61.34 | 74.63 | 58.56 | 51.05 | 24.98 | 8.45 | NA | NA | NA | NA | NA | NA | NA | NA | 21.61 | 7.75 | 28.95 | 26.92 | 23.34 | 23.29 | 21.77 | 19.31 | 18.91 | 16.49 | 12.84 | 14.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 21.80 | 23.47 | 20.77 | 14.56 | 7.14 | 17.90 | 18.90 | 19.33 | 12.99 | 36.26 | 20.12 | 17.56 | 22.23 | 12.20 | 7.05 | 1.91 | 7.45 | 8.02 | 2.49 | 4.83 | 5.11 | 0.03 | 6.82 | 7.40 | 10.81 | 14.90 | 15.53 | 7.73 | 11.47 | 14.58 | 13.02 | 9.54 | 7.42 | 8.41 | 6.40 | 7.68 | 7.29 | 3.94 | 5.52 | 3.43 | 4.81 | 4.49 | 4.43 | 3.87 | 3.52 | 3.57 | 3.57 | 1.60 | 1.54 | 0.93 | 0.00 | 0.28 | |

| Net Income Loss | 62.09 | 86.76 | 47.57 | 53.72 | 28.71 | 63.91 | 58.65 | 76.76 | 100.67 | 116.04 | 61.34 | 36.59 | 56.24 | 50.52 | 22.72 | 3.10 | 27.53 | 27.07 | 9.30 | 15.44 | 17.86 | 6.03 | 23.66 | 24.14 | 21.61 | 7.75 | 23.72 | 25.75 | 19.83 | 21.19 | 19.43 | 17.70 | 17.79 | 15.29 | 11.56 | 13.95 | 13.18 | 11.66 | 10.23 | 8.14 | 9.01 | 8.27 | 8.23 | 7.19 | 7.57 | 6.64 | 6.50 | 3.11 | 3.22 | 2.35 | 0.00 | 0.44 | |

| Comprehensive Income Net Of Tax | 75.33 | 105.12 | 35.67 | 60.54 | 21.74 | 32.67 | -3.68 | 19.19 | 94.20 | 112.26 | 61.22 | 47.75 | 66.23 | 44.73 | 42.93 | -25.82 | 34.45 | 28.89 | 14.22 | 23.18 | 15.45 | 19.77 | 15.85 | -0.35 | 20.88 | 2.77 | 33.96 | 25.77 | 14.72 | 22.39 | 24.34 | 20.35 | 15.21 | 14.00 | 8.49 | 13.03 | 16.08 | 10.86 | 11.61 | 12.66 | 4.43 | 8.26 | 4.34 | 6.48 | 7.75 | 7.67 | 6.67 | 3.03 | 1.47 | 1.83 | 3.97 | -1.37 | |

| Preferred Stock Dividends Income Statement Impact | 3.87 | 3.80 | 3.57 | 3.46 | 3.09 | 2.55 | 2.13 | 1.86 | 2.02 | 2.98 | 3.30 | 3.39 | 3.41 | 3.43 | 3.58 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 2.55 | 2.06 | 1.29 | 1.01 | 0.98 | 0.51 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | 0.04 | 0.01 | 0.00 | 0.00 | |

| Net Income Loss Available To Common Stockholders Basic | 58.22 | 82.95 | 44.01 | 50.27 | 25.62 | 61.36 | 56.52 | 74.90 | 98.65 | 110.24 | 58.04 | 33.20 | 52.83 | 47.09 | 19.14 | -0.52 | 23.91 | 23.45 | 5.68 | 11.82 | 14.25 | 2.41 | 20.05 | 20.53 | 18.00 | 4.14 | 20.11 | 22.13 | 16.21 | 18.64 | 17.37 | 16.41 | 16.78 | 14.31 | 11.05 | 13.95 | 13.18 | 11.66 | 10.23 | 8.14 | 9.01 | 8.27 | 8.23 | 7.19 | 7.57 | 6.64 | 6.50 | 3.11 | 3.18 | 2.34 | 0.14 | 0.44 | |

| Net Income Loss Available To Common Stockholders Diluted | 58.22 | 82.95 | 44.01 | 50.27 | 25.62 | 61.36 | 56.52 | 74.90 | 98.65 | 110.24 | 58.04 | 33.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 158.98 | 181.92 | 141.64 | 130.30 | 106.92 | 167.03 | 141.00 | 148.70 | 179.80 | 206.73 | 135.47 | 135.65 | 125.86 | 94.48 | 71.04 | 49.53 | 67.90 | 71.31 | 59.33 | 54.54 | 60.14 | 61.08 | 68.11 | 62.91 | 67.47 | 65.67 | 68.08 | 59.37 | 64.66 | 64.50 | 62.37 | 55.65 | 47.30 | 47.84 | 37.22 | 43.37 | 42.53 | 35.18 | 34.04 | 25.14 | 31.93 | 26.25 | 21.37 | 21.43 | 20.05 | 12.44 | 11.41 | 11.67 | 11.17 | 8.81 | 0.00 | 6.35 | |

| Noninterest Expense | 93.77 | 89.47 | 89.30 | 80.13 | 78.42 | 76.20 | 76.20 | 73.81 | 81.55 | 80.01 | 70.82 | 61.93 | 71.16 | 65.56 | 63.51 | 66.46 | 58.74 | 59.59 | 59.58 | 53.98 | 57.05 | 57.10 | 53.75 | 52.28 | 54.79 | 61.04 | 30.57 | 30.15 | 30.51 | 56.22 | 38.18 | 33.91 | 31.51 | 30.31 | 25.66 | 27.46 | 27.86 | 24.68 | 25.20 | 21.17 | 22.30 | 18.35 | 16.89 | 16.48 | 13.44 | 11.99 | 13.97 | 10.69 | 10.71 | 9.13 | 0.00 | 7.41 | |

| Noninterest Income | 18.67 | 17.77 | 16.00 | 18.12 | 7.34 | -9.02 | 12.75 | 21.20 | 16.99 | 25.59 | 16.82 | 18.47 | 23.77 | 33.79 | 22.24 | 21.93 | 25.81 | 23.37 | 12.04 | 19.72 | 19.88 | 2.08 | 16.13 | 20.91 | 19.74 | 18.03 | 6.97 | 5.43 | 0.92 | 27.49 | 8.26 | 5.49 | 9.42 | 6.17 | 6.39 | 5.73 | 5.80 | 5.10 | 6.91 | 7.59 | 7.92 | 4.86 | 8.18 | 6.12 | 4.48 | 9.77 | 12.64 | 3.73 | 4.34 | 3.59 | 0.00 | 1.78 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

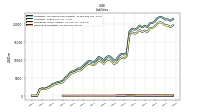

| Assets | 21316.26 | 21857.15 | 22028.56 | 21751.61 | 20896.11 | 20367.62 | 20252.00 | 19163.71 | 19575.03 | 19108.92 | 19635.11 | 18817.66 | 18439.25 | 18778.73 | 17903.12 | 12018.80 | 11520.72 | 11723.79 | 11182.43 | 10143.89 | 9833.42 | 10617.10 | 11092.85 | 10769.27 | 9839.56 | 10471.83 | 10883.55 | 9906.64 | 9382.74 | 9602.61 | 9684.62 | 9038.88 | 8401.31 | 7599.47 | 7617.64 | 7133.23 | 6825.37 | 6532.44 | 5635.73 | 5014.23 | 4153.17 | 3925.11 | 3793.26 | 3458.62 | 3201.23 | 2654.09 | 2283.03 | 1975.59 | 2077.53 | 1862.61 | 0.00 | 0.00 | |

| Liabilities | 19677.87 | 20295.54 | 20571.91 | 20330.59 | 19493.15 | 18980.69 | 18898.61 | 17786.30 | 18208.81 | 17824.62 | 18384.38 | 17628.94 | 17322.16 | 17727.24 | 16895.27 | 11054.16 | 10467.92 | 10704.64 | 10191.02 | 9165.52 | 8876.61 | 9662.29 | 10156.62 | 9850.18 | 8918.59 | 9561.19 | 9973.26 | 9026.82 | 8526.86 | 8812.79 | 9004.06 | 8439.63 | 7847.41 | 7061.49 | 7094.14 | 6675.27 | 6382.23 | 6106.64 | 5221.99 | 4613.29 | 3766.55 | 3536.23 | 3413.49 | 3181.71 | 2931.76 | 2392.59 | 2124.32 | 1824.28 | 1929.78 | 1712.95 | 0.00 | 0.00 | |

| Liabilities And Stockholders Equity | 21316.26 | 21857.15 | 22028.56 | 21751.61 | 20896.11 | 20367.62 | 20252.00 | 19163.71 | 19575.03 | 19108.92 | 19635.11 | 18817.66 | 18439.25 | 18778.73 | 17903.12 | 12018.80 | 11520.72 | 11723.79 | 11182.43 | 10143.89 | 9833.42 | 10617.10 | 11092.85 | 10769.27 | 9839.56 | 10471.83 | 10883.55 | 9906.64 | 9382.74 | 9602.61 | 9684.62 | 9038.88 | 8401.31 | 7599.47 | 7617.64 | 7133.23 | 6825.37 | 6532.44 | 5635.73 | 5014.23 | 4153.17 | 3925.11 | 3793.26 | 3458.62 | 3201.23 | 2654.09 | 2283.03 | 1975.59 | 2077.53 | 1862.61 | 0.00 | 0.00 | |

| Stockholders Equity | 1638.39 | 1561.61 | 1456.65 | 1421.02 | 1402.96 | 1386.93 | 1353.39 | 1377.41 | 1366.22 | 1284.30 | 1250.73 | 1188.72 | 1117.09 | 1051.49 | 1007.85 | 964.64 | 1052.80 | 1019.15 | 991.40 | 978.37 | 956.82 | 954.81 | 936.23 | 919.09 | 920.96 | 910.64 | 910.29 | 879.82 | 855.87 | 789.82 | 680.56 | 599.25 | 553.90 | 537.98 | 523.50 | 457.95 | 443.14 | 425.80 | 413.74 | 400.94 | 386.62 | 388.88 | 379.77 | 276.91 | 269.48 | 261.50 | 158.72 | 151.31 | 147.75 | 149.67 | 0.00 | 0.00 | |

| Tier One Risk Based Capital | 1798.94 | 1733.95 | 1648.18 | 1604.47 | 1608.63 | 1585.68 | 1520.84 | 1482.48 | 1429.06 | 1338.95 | 1299.87 | 1238.49 | 1172.31 | 1119.64 | 1071.29 | 1045.36 | 1039.28 | 1012.22 | 985.78 | 977.34 | 963.27 | 958.42 | 953.02 | 927.63 | 906.96 | 895.45 | 889.29 | 867.16 | 844.75 | 770.07 | 663.87 | 597.79 | 556.19 | 536.85 | 522.59 | 454.89 | 437.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 3846.35 | 3419.97 | 3155.22 | 2046.68 | 455.81 | 404.46 | 245.18 | 274.60 | 518.03 | 1052.05 | 430.50 | 515.36 | 693.35 | 331.42 | 1067.33 | 256.23 | 212.50 | 182.22 | 95.80 | 117.66 | 62.13 | 666.03 | 251.73 | 215.41 | 146.32 | 219.48 | 401.69 | 157.13 | 244.71 | 265.59 | 302.80 | 262.64 | 264.59 | 383.40 | 391.59 | 333.82 | 371.02 | 331.31 | 265.53 | 290.47 | 233.07 | 255.65 | 205.69 | 181.14 | 186.02 | 157.51 | 122.05 | 90.82 | 73.57 | 52.83 | 0.00 | 0.00 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 3846.35 | 3419.97 | 3155.22 | 2046.68 | 455.81 | 404.46 | 245.18 | 274.60 | 518.03 | 1052.05 | 430.50 | 515.36 | 693.35 | 331.42 | 1067.33 | 256.23 | 212.50 | 182.22 | 95.80 | 117.66 | 62.13 | 666.03 | 251.73 | 215.41 | 146.32 | NA | NA | NA | 264.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 28.78 | 26.48 | 26.70 | 26.71 | 26.48 | 24.86 | 24.77 | 25.82 | 25.57 | 5.00 | NA | 4.83 | 3.85 | 2.47 | 2.23 | 1.03 | 2.41 | 2.10 | NA | 1.72 | 1.72 | NA | NA | NA | 1.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

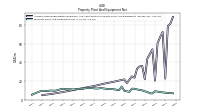

| Property Plant And Equipment Gross | 29.85 | NA | NA | NA | 29.38 | NA | NA | NA | 30.80 | NA | NA | NA | 34.99 | NA | NA | NA | 31.06 | NA | NA | NA | 30.29 | NA | NA | NA | 28.98 | NA | NA | NA | 26.71 | NA | NA | NA | 23.96 | NA | NA | NA | 21.05 | NA | NA | NA | 19.77 | NA | NA | NA | 15.92 | NA | NA | NA | 13.27 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 22.48 | 72.51 | 66.97 | 60.35 | 20.36 | 54.01 | 48.80 | 43.80 | 21.91 | 36.12 | 35.57 | 33.20 | 23.37 | 24.97 | 21.31 | 17.67 | 21.67 | NA | NA | NA | 19.23 | NA | NA | NA | 17.03 | NA | NA | NA | 14.45 | NA | NA | NA | 12.43 | NA | NA | NA | 10.24 | NA | NA | NA | 8.15 | NA | NA | NA | 6.25 | NA | NA | NA | 4.83 | NA | NA | NA | |

| Property Plant And Equipment Net | 7.37 | 7.79 | 8.03 | 8.58 | 9.03 | 6.61 | 6.75 | 8.23 | 8.89 | 9.94 | 10.39 | 10.94 | 11.63 | 11.74 | 8.38 | 8.89 | 9.39 | 14.07 | 10.10 | 10.54 | 11.06 | 11.30 | 11.22 | 11.56 | 11.96 | 12.37 | 12.03 | 11.83 | 12.26 | 12.43 | 12.46 | 12.44 | 11.53 | 11.57 | 11.45 | 11.06 | 10.81 | 11.15 | 11.07 | 11.23 | 11.62 | 11.05 | 10.17 | 9.55 | 9.67 | 9.71 | 9.32 | 9.38 | 9.42 | 8.83 | NA | 5.30 | |

| Intangible Assets Net Including Goodwill | 3.63 | 3.63 | 3.63 | 3.63 | 3.63 | 3.63 | 3.63 | 3.68 | 3.74 | 3.79 | 3.85 | 3.91 | 14.30 | 14.44 | 14.57 | 14.87 | 15.20 | 15.52 | 15.85 | 16.17 | 16.50 | 16.82 | 17.15 | 17.48 | 16.30 | 16.60 | 3.63 | 3.64 | 3.64 | 16.92 | 17.20 | NA | 3.70 | 3.65 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Securities Fv Ni | 28.78 | 26.48 | 26.70 | 26.71 | 26.48 | 24.86 | 24.77 | 25.82 | 25.57 | 5.00 | NA | 4.83 | 3.85 | 2.47 | 2.23 | 1.03 | 2.41 | 2.10 | NA | 1.72 | 1.72 | NA | NA | NA | 1.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 56.93 | 62.79 | 46.31 | 33.58 | 46.45 | 31.56 | 9.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1046.44 | 1115.58 | 1212.25 | 836.71 | 793.81 | 854.74 | 485.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 291.66 | 330.81 | 377.05 | NA | 0.00 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.20 | NA | NA | NA | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 56.93 | 62.79 | 46.31 | 33.58 | 46.45 | 31.56 | 9.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 1103.17 | 1178.37 | 1258.56 | 870.29 | 840.26 | 886.29 | 495.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

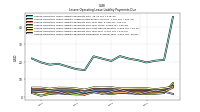

| Time Deposit Maturities Year One | 2474.93 | 2457.14 | 2367.79 | 2255.83 | 3389.30 | 1357.07 | 184.89 | NA | 380.49 | NA | NA | NA | 519.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 17920.24 | 18195.36 | 17950.43 | 17723.62 | 18156.95 | 17522.44 | 16944.72 | 16415.56 | 16777.92 | 16971.03 | 13873.94 | 12472.44 | 11309.93 | 10839.08 | 10965.88 | 8413.64 | 8648.94 | 8925.68 | 8185.78 | 7425.32 | 7142.24 | 8513.71 | 7295.95 | 7042.46 | 6800.14 | 7597.08 | 7021.92 | 6627.06 | 6846.98 | 7388.97 | 6751.26 | 6478.61 | 5909.50 | 5785.19 | 5477.16 | 4893.32 | 4532.54 | 4284.14 | 3690.89 | 3606.33 | 2959.92 | 3243.31 | 2775.71 | 2535.83 | 2440.82 | 2348.18 | 1929.86 | 1804.19 | 1583.19 | 1581.83 | NA | 1245.69 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

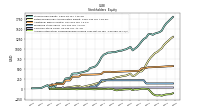

| Stockholders Equity | 1638.39 | 1561.61 | 1456.65 | 1421.02 | 1402.96 | 1386.93 | 1353.39 | 1377.41 | 1366.22 | 1284.30 | 1250.73 | 1188.72 | 1117.09 | 1051.49 | 1007.85 | 964.64 | 1052.80 | 1019.15 | 991.40 | 978.37 | 956.82 | 954.81 | 936.23 | 919.09 | 920.96 | 910.64 | 910.29 | 879.82 | 855.87 | 789.82 | 680.56 | 599.25 | 553.90 | 537.98 | 523.50 | 457.95 | 443.14 | 425.80 | 413.74 | 400.94 | 386.62 | 388.88 | 379.77 | 276.91 | 269.48 | 261.50 | 158.72 | 151.31 | 147.75 | 149.67 | 0.00 | 0.00 | |

| Common Stock Value | 35.46 | 35.33 | 35.30 | 35.26 | 35.01 | 34.95 | 34.92 | 34.88 | 34.72 | 33.82 | 33.63 | 33.52 | 32.99 | 32.84 | 32.79 | 32.75 | 32.62 | 32.53 | 32.48 | 32.41 | 32.25 | 32.22 | 32.20 | 32.00 | 31.91 | 31.32 | 31.26 | 31.17 | 30.82 | 28.07 | 27.82 | 27.57 | 27.43 | 27.41 | 27.40 | 27.36 | 27.28 | 27.27 | 27.26 | 24.83 | 24.76 | 24.74 | 24.71 | 18.53 | 18.51 | 18.51 | 11.39 | 11.39 | 11.39 | 11.39 | 0.00 | 0.00 | |

| Additional Paid In Capital | 564.54 | 559.35 | 555.74 | 552.25 | 551.72 | 549.07 | 545.67 | 542.40 | 542.39 | 525.89 | 519.29 | 515.32 | 455.59 | 452.96 | 450.67 | 446.84 | 444.22 | 441.50 | 439.07 | 436.71 | 434.31 | 431.20 | 428.80 | 424.10 | 422.10 | 429.63 | 428.49 | 428.45 | 427.01 | 374.73 | 367.84 | 364.65 | 362.61 | 360.90 | 359.45 | 357.52 | 355.82 | 354.56 | 353.37 | 308.82 | 307.23 | 306.18 | 305.36 | 213.02 | 212.09 | 211.87 | 123.87 | 123.13 | 122.60 | 122.41 | NA | 88.13 | |

| Retained Earnings Accumulated Deficit | 1159.58 | 1101.36 | 1018.41 | 974.40 | 924.13 | 898.51 | 837.15 | 780.63 | 705.73 | 607.09 | 496.84 | 438.80 | 438.58 | 385.75 | 338.67 | 319.53 | 381.52 | 357.61 | 334.16 | 328.48 | 316.65 | 302.40 | 299.99 | 279.94 | 258.08 | 240.08 | 235.94 | 215.83 | 193.70 | 176.93 | 158.29 | 140.92 | 124.51 | 107.73 | 93.42 | 82.37 | 68.42 | 55.24 | 43.58 | 79.14 | 71.01 | 62.00 | 53.73 | 45.50 | 38.31 | 30.75 | 24.11 | 17.61 | 14.50 | 11.31 | 0.00 | 0.00 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -136.57 | -149.81 | -168.18 | -156.28 | -163.10 | -156.13 | -124.88 | -62.55 | -4.98 | 1.49 | 5.27 | 5.39 | -5.76 | -15.75 | -9.96 | -30.18 | -1.25 | -8.17 | -9.99 | -14.92 | -22.66 | -20.25 | -34.00 | -26.19 | -0.36 | 0.38 | 5.36 | -4.87 | -4.89 | 0.77 | -0.43 | -5.33 | -7.98 | -5.41 | -4.11 | -1.05 | -0.12 | -3.02 | -2.22 | -3.60 | -8.12 | -3.54 | -3.53 | 0.35 | 1.06 | 0.88 | -0.16 | -0.33 | -0.24 | 1.51 | NA | -1.90 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 2.52 | 3.51 | 3.49 | 2.98 | 3.42 | 3.34 | 3.62 | 3.70 | 2.70 | 3.29 | 4.26 | 3.61 | 3.19 | 2.03 | 3.60 | 3.23 | 2.34 | 2.13 | 2.31 | 2.11 | 2.96 | 1.98 | 1.88 | 1.79 | 1.55 | 1.60 | 1.52 | 1.41 | 1.62 | 1.63 | 1.54 | 1.40 | 1.32 | 1.18 | 1.19 | 1.17 | 1.08 | 1.09 | 1.08 | 0.95 | 0.91 | 0.93 | 0.83 | 0.70 | 0.40 | 0.35 | 0.74 | 0.53 | 0.19 | 0.19 | 0.18 | 0.09 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

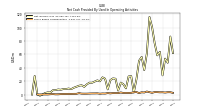

| Net Cash Provided By Used In Investing Activities | 1160.55 | 397.07 | 795.46 | 804.64 | -213.30 | 14.96 | -1188.74 | 88.67 | -1120.39 | 1388.94 | -943.16 | -526.65 | 661.57 | -1710.77 | -4942.26 | -433.52 | 221.10 | -452.21 | -1017.03 | -196.30 | 184.99 | 752.77 | -239.73 | -802.13 | 702.30 | 70.64 | -300.67 | -1037.40 | -454.12 | 155.77 | NA | NA | -845.31 | -245.56 | NA | NA | NA | NA | NA | NA | -413.13 | -576.25 | -259.69 | -338.95 | -255.99 | 558.58 | -157.55 | 117.09 | -246.80 | -513.68 | 334.20 | -49.85 | |

| Net Cash Provided By Used In Financing Activities | -615.80 | -268.42 | 223.61 | 768.70 | 560.49 | 35.33 | 1110.23 | -449.04 | 566.93 | -752.59 | 769.36 | 171.07 | -359.19 | 940.96 | 5678.64 | 512.38 | -234.41 | 507.08 | 986.02 | 257.84 | -788.00 | -508.69 | 299.80 | 919.33 | -651.76 | -422.78 | 961.29 | 497.80 | -166.84 | -155.78 | NA | NA | 782.88 | -45.26 | NA | NA | NA | NA | NA | NA | 256.52 | 74.88 | 335.59 | 246.03 | 532.48 | 366.11 | 297.71 | -103.93 | 212.84 | 352.58 | -159.18 | 350.65 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Income Loss | 62.09 | 86.76 | 47.57 | 53.72 | 28.71 | 63.91 | 58.65 | 76.76 | 100.67 | 116.04 | 61.34 | 36.59 | 56.24 | 50.52 | 22.72 | 3.10 | 27.53 | 27.07 | 9.30 | 15.44 | 17.86 | 6.03 | 23.66 | 24.14 | 21.61 | 7.75 | 23.72 | 25.75 | 19.83 | 21.19 | 19.43 | 17.70 | 17.79 | 15.29 | 11.56 | 13.95 | 13.18 | 11.66 | 10.23 | 8.14 | 9.01 | 8.27 | 8.23 | 7.19 | 7.57 | 6.64 | 6.50 | 3.11 | 3.22 | 2.35 | 0.00 | 0.44 | |

| Deferred Income Tax Expense Benefit | 0.18 | 19.23 | -15.89 | 18.66 | 7.34 | 18.37 | 4.01 | -22.81 | 10.70 | 3.56 | 9.69 | -6.20 | 8.22 | 1.92 | -5.82 | -22.29 | 5.82 | 9.38 | -2.56 | 1.88 | 3.06 | 2.07 | 1.49 | 2.68 | 14.53 | 2.87 | -2.30 | -0.28 | 2.27 | -2.82 | -2.60 | 0.57 | -2.51 | -4.10 | -1.94 | -1.54 | -6.30 | -2.10 | 0.00 | 2.21 | 2.21 | -0.01 | 0.00 | 0.00 | -2.62 | -1.30 | 0.00 | 0.19 | -2.73 | 0.00 | 0.00 | NA | |

| Share Based Compensation | 2.54 | 3.53 | 3.51 | 3.00 | 3.45 | 3.35 | 3.63 | 3.72 | 2.67 | 3.55 | 4.56 | 3.08 | 3.41 | 2.20 | 3.81 | 3.46 | 2.56 | 2.39 | 2.52 | 2.38 | 3.15 | 2.21 | 2.17 | 2.22 | 1.79 | 2.22 | 1.51 | 1.64 | 1.28 | 1.82 | 1.71 | 1.69 | 1.55 | 1.36 | 1.34 | 1.42 | 2.11 | 1.09 | 1.08 | 0.95 | 0.91 | 0.93 | 0.83 | 0.70 | 0.40 | 0.35 | 0.74 | 0.53 | 0.19 | 0.19 | 0.18 | 0.09 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 1160.55 | 397.07 | 795.46 | 804.64 | -213.30 | 14.96 | -1188.74 | 88.67 | -1120.39 | 1388.94 | -943.16 | -526.65 | 661.57 | -1710.77 | -4942.26 | -433.52 | 221.10 | -452.21 | -1017.03 | -196.30 | 184.99 | 752.77 | -239.73 | -802.13 | 702.30 | 70.64 | -300.67 | -1037.40 | -454.12 | 155.77 | NA | NA | -845.31 | -245.56 | NA | NA | NA | NA | NA | NA | -413.13 | -576.25 | -259.69 | -338.95 | -255.99 | 558.58 | -157.55 | 117.09 | -246.80 | -513.68 | 334.20 | -49.85 | |

| Payments To Acquire Property Plant And Equipment | 0.07 | 0.37 | 0.02 | 0.13 | 3.46 | 0.27 | 0.05 | 0.27 | 0.20 | 0.11 | 0.01 | 0.30 | 0.51 | 4.02 | 0.09 | 0.13 | -3.69 | 5.05 | 0.20 | 0.14 | 0.43 | 0.74 | 0.34 | 0.27 | 0.41 | 0.45 | 1.08 | 0.20 | 1.77 | 1.16 | 0.52 | 1.67 | 0.50 | 0.64 | 0.97 | 0.83 | 0.10 | 0.68 | 0.44 | 0.21 | 1.15 | 1.40 | 1.05 | 0.29 | 0.37 | 0.79 | 1.15 | 0.41 | 1.00 | 1.18 | -0.07 | 0.89 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2010-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

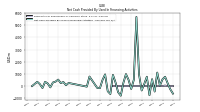

| Net Cash Provided By Used In Financing Activities | -615.80 | -268.42 | 223.61 | 768.70 | 560.49 | 35.33 | 1110.23 | -449.04 | 566.93 | -752.59 | 769.36 | 171.07 | -359.19 | 940.96 | 5678.64 | 512.38 | -234.41 | 507.08 | 986.02 | 257.84 | -788.00 | -508.69 | 299.80 | 919.33 | -651.76 | -422.78 | 961.29 | 497.80 | -166.84 | -155.78 | NA | NA | 782.88 | -45.26 | NA | NA | NA | NA | NA | NA | 256.52 | 74.88 | 335.59 | 246.03 | 532.48 | 366.11 | 297.71 | -103.93 | 212.84 | 352.58 | -159.18 | 350.65 | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.00 | 0.00 | 39.81 | 5.34 | 0.00 | 21.51 | 6.31 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.57 | 12.98 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |