| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | NA | 260.29 | 258.79 | 256.90 | NA | 255.19 | 167.59 | 98.22 | NA | 91.67 | 201.13 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 260.29 | 258.79 | 256.90 | NA | 255.19 | 167.59 | 98.22 | NA | 91.67 | 87.20 | |

| Earnings Per Share Basic | 0.00 | -0.02 | -0.09 | -0.10 | -0.13 | -0.11 | -0.20 | -0.15 | -0.11 | -0.21 | 0.02 | |

| Earnings Per Share Diluted | 0.00 | -0.02 | -0.09 | -0.10 | -0.13 | -0.11 | -0.20 | -0.15 | -0.11 | -0.21 | 0.01 |

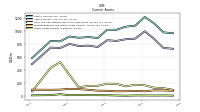

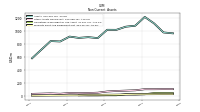

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

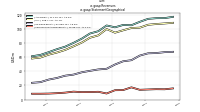

| Revenue From Contract With Customer Excluding Assessed Tax | 165.33 | 157.25 | 150.63 | 144.98 | 135.67 | 127.06 | 118.69 | 110.98 | 104.11 | 96.33 | 93.50 | |

| Revenues | 165.33 | 157.25 | 150.63 | 144.98 | 135.67 | 127.06 | 118.69 | 110.98 | 104.11 | 96.33 | 93.50 | |

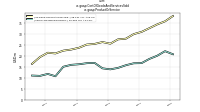

| Cost Of Goods And Services Sold | 39.33 | 40.52 | 42.16 | 41.72 | 39.80 | 38.70 | 37.34 | 31.71 | 33.10 | 30.22 | 27.29 | |

| Gross Profit | 126.01 | 116.73 | 108.47 | 103.26 | 95.86 | 88.36 | 81.35 | 79.27 | 71.01 | 66.11 | 66.20 | |

| Operating Expenses | 127.82 | 121.33 | 130.15 | 126.39 | 129.03 | 114.64 | 110.66 | 89.77 | 78.26 | 81.39 | 61.35 | |

| Research And Development Expense | 20.13 | 19.21 | 19.99 | 17.33 | 15.76 | 16.62 | 15.09 | 13.09 | 13.41 | 10.39 | 8.15 | |

| General And Administrative Expense | 24.40 | 22.59 | 23.21 | 22.11 | 21.39 | 21.83 | 25.32 | 16.21 | 16.11 | 25.77 | 10.93 | |

| Selling And Marketing Expense | 83.30 | 79.54 | 86.94 | 86.94 | 79.88 | 76.19 | 70.25 | 60.47 | 48.74 | 45.23 | 42.27 | |

| Operating Income Loss | -1.82 | -4.60 | -21.68 | -23.13 | -33.17 | -26.29 | -29.30 | -10.50 | -7.25 | -15.28 | 4.85 | |

| Allocated Share Based Compensation Expense | 15.60 | 11.21 | 16.20 | 12.51 | 12.18 | 12.42 | 16.63 | 8.91 | 12.36 | 23.31 | 5.84 | |

| Income Tax Expense Benefit | 1.30 | 2.35 | 2.17 | 2.46 | 0.78 | 1.82 | 2.51 | 1.80 | 0.89 | 1.10 | 0.38 | |

| Income Taxes Paid | 1.51 | 2.25 | 1.63 | 1.26 | 0.93 | 0.96 | 0.69 | 0.88 | 0.90 | 1.00 | NA | |

| Net Income Loss | -0.67 | -5.86 | -23.93 | -25.29 | -111.47 | -29.23 | -33.25 | -14.49 | -10.80 | -18.97 | 3.01 | |

| Comprehensive Income Net Of Tax | 2.39 | -8.14 | -25.09 | -28.47 | -113.08 | -29.23 | -33.65 | -14.89 | -10.14 | -18.55 | 3.58 | |

| Net Income Loss Available To Common Stockholders Basic | -0.67 | -5.86 | -23.93 | -25.29 | -34.30 | -29.23 | -33.25 | -14.49 | -11.40 | -18.97 | 1.38 | |

| Net Income Loss Available To Common Stockholders Diluted | NA | NA | NA | -25.29 | -34.30 | -29.23 | -33.25 | -14.49 | -11.40 | -18.97 | 3.01 |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

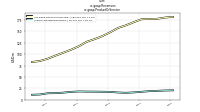

| Assets | 1024.99 | 897.00 | 911.28 | 900.17 | 920.05 | 844.71 | 851.48 | NA | 585.89 | NA | NA | |

| Liabilities | 475.66 | 379.57 | 403.27 | 393.81 | 404.20 | 326.30 | 317.49 | NA | 403.16 | NA | NA | |

| Liabilities And Stockholders Equity | 1024.99 | 897.00 | 911.28 | 900.17 | 920.05 | 844.71 | 851.48 | NA | 585.89 | NA | NA | |

| Stockholders Equity | 549.33 | 517.43 | 508.01 | 506.36 | 515.85 | 518.41 | 533.98 | 184.30 | 182.73 | 201.41 | -14.52 |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

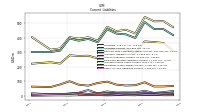

| Assets Current | 862.53 | 757.60 | 778.64 | 772.38 | 805.26 | 741.88 | 747.86 | NA | 492.79 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 188.39 | 156.03 | 154.21 | 131.82 | 321.43 | 522.39 | 433.99 | NA | 68.04 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 188.39 | 156.03 | 154.21 | 131.82 | 321.43 | 522.39 | 433.99 | 84.19 | 68.04 | 137.41 | 105.33 | |

| Other Assets Current | 10.05 | 10.78 | 11.55 | 12.73 | 10.91 | 26.07 | 11.59 | NA | 8.26 | NA | NA | |

| Prepaid Expense And Other Assets Current | 78.86 | 80.56 | 94.05 | 105.39 | 109.17 | 96.81 | 94.17 | NA | 95.82 | NA | NA | |

| Available For Sale Securities Debt Securities | 390.24 | 388.09 | 386.65 | 399.04 | 210.98 | 19.11 | 114.81 | NA | 212.65 | NA | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

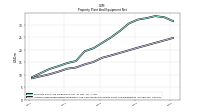

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 16.88 | 15.16 | 14.17 | 12.91 | 12.43 | 11.23 | 10.19 | NA | 8.60 | NA | NA | |

| Property Plant And Equipment Net | 22.89 | 20.68 | 19.46 | 15.50 | 14.71 | 13.44 | 12.32 | NA | 9.01 | NA | NA | |

| Goodwill | 50.03 | NA | NA | NA | 49.91 | 49.85 | 46.85 | NA | 46.82 | NA | NA | |

| Intangible Assets Net Including Goodwill | 50.35 | 50.49 | 50.58 | 50.70 | 50.71 | 50.78 | 47.29 | NA | 47.43 | NA | NA | |

| Other Assets Noncurrent | 73.50 | 54.72 | 49.51 | 46.83 | 49.38 | 38.61 | 44.01 | NA | 36.67 | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 390.93 | 390.04 | 388.15 | 400.37 | 211.18 | 19.11 | 114.80 | NA | 212.63 | NA | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

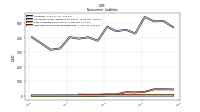

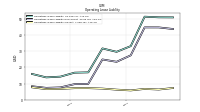

| Liabilities Current | 458.90 | 368.50 | 392.19 | 379.57 | 395.05 | 311.21 | 301.56 | NA | 301.56 | NA | NA | |

| Accounts Payable Current | 30.10 | 15.78 | 39.51 | 21.04 | 15.80 | 11.05 | 10.15 | NA | 16.95 | NA | NA | |

| Other Accrued Liabilities Current | 14.00 | 19.47 | 12.60 | 20.10 | 13.65 | 11.68 | 10.46 | NA | 6.36 | NA | NA | |

| Accrued Income Taxes Current | 3.14 | 5.00 | 4.20 | 4.06 | 2.56 | 3.35 | 2.69 | NA | 0.68 | NA | NA | |

| Accrued Liabilities Current | 97.52 | 88.37 | 69.94 | 76.24 | 100.22 | 78.23 | 60.28 | NA | 63.17 | NA | NA | |

| Contract With Customer Liability Current | 324.14 | 257.66 | 276.22 | 274.63 | 279.03 | 221.92 | 231.13 | NA | 221.44 | NA | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | 1.29 | 1.09 | 1.09 | 1.10 | 1.10 | 0.87 | 0.87 | NA | 0.87 | NA | NA | |

| Other Liabilities Noncurrent | 4.47 | 1.36 | 1.41 | 1.44 | 2.72 | 2.37 | 1.87 | NA | 2.01 | NA | NA | |

| Operating Lease Liability Noncurrent | 9.63 | 7.60 | 7.31 | 8.30 | NA | NA | NA | NA | NA | NA | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

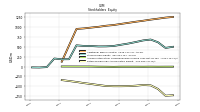

| Stockholders Equity | 549.33 | 517.43 | 508.01 | 506.36 | 515.85 | 518.41 | 533.98 | 184.30 | 182.73 | 201.41 | -14.52 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 549.33 | NA | NA | NA | 515.85 | NA | NA | NA | 193.85 | NA | NA | |

| Additional Paid In Capital | 1074.15 | 1045.40 | 1027.85 | 1001.10 | 982.12 | 960.70 | 947.04 | NA | 122.06 | NA | NA | |

| Retained Earnings Accumulated Deficit | -496.61 | -496.70 | -490.85 | -466.92 | -441.63 | -418.45 | -389.22 | NA | -341.28 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -4.38 | -7.44 | -5.17 | -4.00 | -0.82 | -0.01 | -0.01 | NA | 0.79 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 15.99 | 11.98 | 16.62 | 12.46 | 12.16 | 12.40 | 16.61 | 8.66 | 12.11 | 23.06 | 5.60 |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

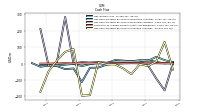

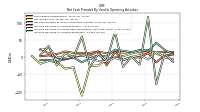

| Net Cash Provided By Used In Operating Activities | 22.07 | 1.61 | 5.88 | -2.91 | -14.99 | -1.07 | -6.46 | -10.40 | -8.46 | -7.67 | NA | |

| Net Cash Provided By Used In Investing Activities | -4.53 | -4.05 | 7.20 | -192.12 | -195.13 | 89.07 | 71.75 | 18.66 | -44.84 | -171.49 | NA | |

| Net Cash Provided By Used In Financing Activities | 12.76 | 5.57 | 10.12 | 6.52 | 9.27 | 1.21 | 284.65 | 8.01 | -16.25 | 211.41 | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

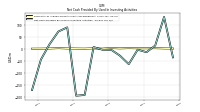

| Net Cash Provided By Used In Operating Activities | 22.07 | 1.61 | 5.88 | -2.91 | -14.99 | -1.07 | -6.46 | -10.40 | -8.46 | -7.67 | NA | |

| Net Income Loss | -0.67 | -5.86 | -23.93 | -25.29 | -111.47 | -29.23 | -33.25 | -14.49 | -10.80 | -18.97 | 3.01 | |

| Depreciation Depletion And Amortization | 3.32 | 3.23 | 3.00 | 2.50 | 2.42 | 2.19 | 1.86 | 1.59 | 1.44 | 1.37 | NA | |

| Increase Decrease In Accounts Receivable | 74.11 | -10.91 | 8.97 | -27.42 | 59.84 | -0.93 | 12.12 | -23.93 | 32.60 | 6.84 | NA | |

| Increase Decrease In Accounts Payable | 15.71 | -23.86 | 17.45 | 5.17 | 4.68 | 0.98 | -5.57 | -1.18 | 5.49 | 2.76 | NA | |

| Share Based Compensation | 15.60 | 11.21 | 16.20 | 12.51 | 12.18 | 12.42 | 16.63 | 8.91 | 11.17 | 23.31 | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -4.53 | -4.05 | 7.20 | -192.12 | -195.13 | 89.07 | 71.75 | 18.66 | -44.84 | -171.49 | NA | |

| Payments To Acquire Property Plant And Equipment | 3.17 | 0.57 | 1.71 | 0.64 | 0.95 | 1.33 | 2.70 | 1.16 | 0.62 | 0.49 | NA |

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 12.76 | 5.57 | 10.12 | 6.52 | 9.27 | 1.21 | 284.65 | 8.01 | -16.25 | 211.41 | NA |

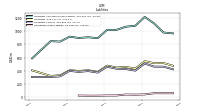

| 2023-01-31 | 2022-10-31 | 2022-07-31 | 2022-04-30 | 2022-01-31 | 2021-10-31 | 2021-07-31 | 2021-04-30 | 2021-01-31 | 2020-10-31 | 2020-07-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

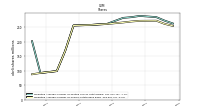

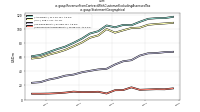

| Revenues | 165.33 | 157.25 | 150.63 | 144.98 | 135.67 | 127.06 | 118.69 | 110.98 | 104.11 | 96.33 | 93.50 | |

| Professional Services | 16.98 | 17.34 | 17.55 | 17.66 | 17.97 | 17.11 | 15.38 | 14.21 | 14.03 | 11.29 | 10.69 | |

| License And Service | 148.35 | 139.91 | 133.07 | 127.32 | 117.69 | 109.94 | 103.31 | 96.77 | 90.08 | 85.04 | 82.81 | |

| 102.33 | 104.93 | 96.82 | 93.54 | 86.35 | 80.33 | 74.93 | 71.31 | 67.17 | 63.24 | 61.37 | ||

| US | 94.75 | 99.84 | 90.92 | 87.60 | 80.80 | 75.40 | 70.30 | 66.60 | 63.70 | 59.60 | 58.20 | |

| Non U S And Non E M E A | 13.32 | 8.67 | 11.09 | 10.71 | 10.60 | 11.32 | 9.90 | 9.10 | 8.56 | 8.35 | 8.34 | |

| EMEA | 49.68 | 43.65 | 42.72 | 40.73 | 38.72 | 35.41 | 33.87 | 30.57 | 28.38 | 24.74 | 23.79 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 165.33 | 157.25 | 150.63 | 144.98 | 135.67 | 127.06 | 118.69 | 110.98 | 104.11 | 96.33 | 93.50 | |

| Professional Services | 16.98 | 17.34 | 17.55 | 17.66 | 17.97 | 17.11 | 15.38 | 14.21 | 14.03 | 11.29 | 10.69 | |

| License And Service | 148.35 | 139.91 | 133.07 | 127.32 | 117.69 | 109.94 | 103.31 | 96.77 | 90.08 | 85.04 | 82.81 | |

| 102.33 | 104.93 | 96.82 | 93.54 | 86.35 | 80.33 | 74.93 | 71.31 | 67.17 | 63.24 | 61.37 | ||

| US | 94.75 | 99.84 | 90.92 | 87.60 | 80.80 | 75.40 | 70.30 | 66.60 | 63.70 | 59.60 | 58.20 | |

| Non U S And Non E M E A | 13.32 | 8.67 | 11.09 | 10.71 | 10.60 | 11.32 | 9.90 | 9.10 | 8.56 | 8.35 | 8.34 | |

| EMEA | 49.68 | 43.65 | 42.72 | 40.73 | 38.72 | 35.41 | 33.87 | 30.57 | 28.38 | 24.74 | 23.79 |