| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 432.20 | 430.50 | 429.60 | NA | 429.40 | 429.10 | 428.80 | NA | 428.70 | 428.90 | 428.50 | NA | 415.70 | 314.50 | 314.50 | NA | 314.50 | 314.50 | NA | 37.20 | |

| Weighted Average Number Of Shares Outstanding Basic | 430.80 | 430.50 | 429.60 | NA | 429.20 | 429.10 | 428.80 | NA | 428.60 | 428.90 | 428.50 | NA | 415.70 | 314.50 | 314.50 | NA | 314.50 | 314.50 | NA | 37.20 | |

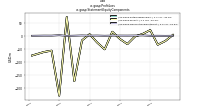

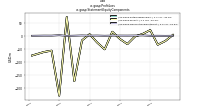

| Earnings Per Share Basic | 0.01 | -0.04 | -0.08 | 0.05 | 0.02 | -0.01 | -0.07 | -0.03 | 0.04 | -0.12 | -0.06 | 0.04 | -0.04 | -0.66 | 0.13 | -0.83 | -0.28 | -0.30 | NA | -2.04 | |

| Earnings Per Share Diluted | 0.01 | -0.04 | -0.08 | 0.05 | 0.02 | -0.01 | -0.07 | -0.03 | 0.04 | -0.12 | -0.06 | 0.04 | -0.04 | -0.66 | 0.13 | -0.83 | -0.28 | -0.30 | NA | -2.04 |

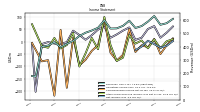

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

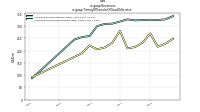

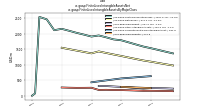

| Revenue From Contract With Customer Excluding Assessed Tax | 588.50 | 554.70 | 540.40 | 595.00 | 556.30 | 537.30 | 536.00 | 598.30 | 541.90 | 520.90 | 504.50 | 480.10 | 442.10 | 420.60 | 395.30 | 432.70 | 408.20 | 398.90 | 174.10 | 178.70 | |

| Revenues | 588.50 | 554.70 | 540.40 | 595.00 | 556.30 | 537.30 | 536.00 | 598.30 | 541.90 | 520.90 | 504.50 | 480.10 | 442.10 | 420.60 | 395.30 | 432.70 | 408.20 | 398.90 | 174.10 | 178.70 | |

| Cost Of Goods And Service Excluding Depreciation Depletion And Amortization | 206.50 | 205.00 | 195.90 | 188.10 | 175.00 | 181.60 | 176.70 | 176.70 | 159.40 | 167.30 | 160.90 | NA | NA | NA | NA | NA | NA | NA | NA | 56.70 | |

| Costs And Expenses | 536.40 | 538.20 | 532.50 | 536.70 | 510.80 | 507.60 | 519.60 | 537.40 | 492.40 | 494.00 | 496.20 | NA | NA | NA | NA | NA | NA | NA | NA | 190.30 | |

| Selling General And Administrative Expense | 181.60 | 183.60 | 187.00 | 196.70 | 184.10 | 176.60 | 188.20 | 199.10 | 171.50 | 164.30 | 179.80 | 156.60 | 131.90 | 143.40 | 125.10 | 158.90 | 152.70 | 126.00 | NA | 122.40 | |

| Operating Income Loss | 52.10 | 16.50 | 7.90 | 58.30 | 45.50 | 29.70 | 16.40 | 60.90 | 49.50 | 26.90 | 8.30 | 27.50 | 45.20 | -1.40 | -8.30 | -7.00 | -1.00 | -9.10 | -202.90 | -11.60 | |

| Interest Expense | 57.00 | 56.10 | 55.30 | 55.00 | 49.10 | 41.90 | 47.20 | 61.20 | 48.30 | 48.00 | 48.90 | 49.30 | 60.80 | 78.00 | 83.00 | 82.90 | 85.60 | 86.00 | NA | 5.50 | |

| Interest Income Expense Net | -55.30 | -55.00 | -53.90 | -53.90 | -48.60 | -41.60 | -46.90 | -61.00 | -48.10 | -47.80 | -48.80 | -49.20 | -60.60 | -77.80 | -82.70 | -82.60 | -85.10 | -85.40 | NA | -5.20 | |

| Interest Paid Net | 48.20 | 58.20 | 44.80 | 55.70 | 39.40 | 42.70 | 40.70 | 42.10 | 62.20 | 24.50 | 63.00 | 25.90 | 87.40 | 32.60 | 103.10 | 45.20 | 113.00 | NA | NA | 2.40 | |

| Interest Income Expense Nonoperating Net | 3.00 | 2.90 | 3.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | NA | NA | NA | 0.00 | 0.00 | 0.00 | -16.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 20.80 | 24.80 | 20.50 | NA | 17.90 | 15.30 | 10.70 | 9.60 | 9.00 | 7.10 | 7.60 | 6.50 | 9.70 | 25.10 | 3.80 | 3.80 | 3.60 | 3.70 | NA | 11.70 | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | -6.50 | -37.00 | -45.40 | 7.60 | 5.70 | -0.70 | -39.80 | -17.70 | 14.70 | -8.50 | -33.70 | 1.20 | -24.90 | -201.90 | -0.60 | -263.00 | -79.80 | -86.40 | NA | -102.80 | |

| Income Tax Expense Benefit | -11.20 | -17.50 | -11.80 | -15.20 | -4.20 | -0.10 | -9.30 | -7.00 | -2.80 | 43.00 | -9.80 | -1.40 | -9.30 | -27.50 | -74.20 | -34.10 | -24.00 | -23.10 | NA | -27.50 | |

| Income Taxes Paid Net | 12.10 | 49.90 | 13.50 | 28.00 | 27.50 | 53.80 | 30.50 | 15.10 | 6.80 | 48.20 | -57.40 | 31.00 | 70.50 | 10.60 | 8.80 | 7.60 | 7.40 | NA | NA | 3.40 | |

| Profit Loss | 5.30 | -18.80 | -32.80 | 23.50 | 10.40 | 0.00 | -29.80 | -10.00 | 18.20 | -50.80 | -23.30 | 8.30 | -14.90 | -173.80 | 73.90 | -228.10 | -55.30 | -60.50 | -209.60 | -74.80 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -3.70 | 18.40 | -10.70 | -2.40 | 12.50 | 7.30 | 23.60 | 7.10 | -0.10 | -1.00 | 1.80 | 0.60 | 0.60 | 0.40 | -1.00 | 0.50 | 0.00 | -1.20 | NA | -0.10 | |

| Other Comprehensive Income Loss Net Of Tax | -26.50 | 5.30 | -7.40 | 27.10 | -64.20 | -77.90 | -12.80 | 100.90 | -30.00 | 15.80 | -47.10 | -100.40 | 36.50 | -12.90 | -26.70 | 15.70 | -24.00 | -17.40 | NA | 71.20 | |

| Comprehensive Income Net Of Tax | -21.90 | -14.10 | -41.20 | 51.40 | -52.50 | -76.20 | -44.10 | 88.70 | -13.40 | -36.80 | -72.80 | -95.40 | 17.20 | -186.60 | 48.50 | -218.60 | -74.50 | -79.20 | NA | -4.60 | |

| Net Income Loss Available To Common Stockholders Basic | 4.40 | -19.40 | -33.70 | 22.80 | 8.00 | -1.80 | -31.30 | -11.60 | 16.60 | -51.70 | -25.00 | 7.00 | -17.00 | -207.10 | 41.50 | -263.30 | -88.80 | -94.00 | -227.90 | -75.60 | |

| Net Income Loss Available To Common Stockholders Diluted | 4.40 | -19.40 | -33.70 | 22.80 | 8.00 | -1.80 | -31.30 | -11.60 | 16.60 | -51.70 | -25.00 | 1.80 | -16.30 | -208.00 | NA | NA | NA | NA | NA | NA |

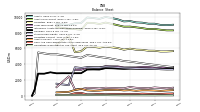

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

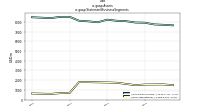

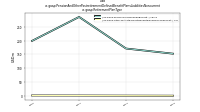

| Assets | 9135.20 | 9267.20 | 9303.30 | 9471.90 | 9429.70 | 9696.60 | 9857.20 | 9997.20 | 9747.30 | 9860.40 | 9924.90 | 9219.40 | 9185.40 | 8985.10 | NA | 9112.80 | NA | NA | NA | NA | |

| Liabilities | 5711.50 | 5817.60 | 5842.40 | 5963.50 | 5842.10 | 6050.90 | 6148.30 | 6251.90 | 6102.00 | 6211.80 | 6246.70 | 5641.70 | 5521.70 | 7596.10 | NA | 6503.30 | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 9135.20 | 9267.20 | 9303.30 | 9471.90 | 9429.70 | 9696.60 | 9857.20 | 9997.20 | 9747.30 | 9860.40 | 9924.90 | 9219.40 | 9185.40 | 8985.10 | NA | 9112.80 | NA | NA | NA | NA | |

| Stockholders Equity | 3412.30 | 3438.90 | 3450.80 | 3499.30 | 3525.30 | 3582.10 | 3643.50 | 3681.20 | 3583.20 | 3587.90 | 3617.60 | 3519.20 | 3607.90 | 1331.10 | NA | 1519.90 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 685.60 | 690.10 | 623.30 | 703.90 | 666.60 | 748.10 | 732.30 | 718.00 | 649.00 | 624.20 | 673.20 | 874.00 | 723.40 | 489.00 | NA | 417.90 | NA | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 230.10 | 260.60 | 204.10 | 208.40 | 203.90 | 209.60 | 215.80 | 177.10 | 234.40 | 177.60 | 173.40 | 354.50 | 311.30 | 99.80 | NA | 98.60 | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 230.10 | 260.60 | 204.10 | 208.40 | 209.50 | 215.50 | 215.80 | 177.10 | 234.40 | 177.60 | 173.40 | 354.50 | 311.30 | 99.80 | 158.10 | 98.60 | 100.60 | 199.50 | NA | 117.60 | |

| Accounts Receivable Net Current | 221.40 | 188.50 | 181.40 | 271.60 | 200.40 | 321.70 | 339.40 | 401.70 | 285.20 | 322.50 | 366.80 | 313.70 | 250.40 | 246.20 | NA | 269.30 | NA | NA | NA | NA | |

| Other Assets Current | 90.80 | 96.40 | 73.60 | 89.00 | 25.60 | 23.70 | 14.00 | 23.10 | 3.80 | 3.10 | 6.10 | 29.30 | 4.90 | 6.50 | NA | 4.60 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Noncurrent | 8449.60 | 8577.10 | 8680.00 | 8768.00 | 8763.10 | 8948.50 | 9124.90 | 9279.20 | 9098.30 | 9236.20 | 9251.70 | 8345.40 | 8462.00 | 8496.10 | NA | 8694.90 | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 41.80 | 38.70 | 42.30 | 38.40 | 34.50 | 31.00 | 30.30 | 27.50 | 27.60 | 25.00 | 22.20 | 14.00 | 14.40 | 12.00 | NA | 7.50 | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 103.70 | 103.90 | 106.70 | NA | 111.10 | 112.00 | 115.80 | NA | 122.60 | 122.90 | 122.40 | NA | 113.40 | 113.50 | 116.10 | NA | 108.80 | 121.00 | 70.70 | 3.20 | |

| Property Plant And Equipment Net | 95.90 | 98.50 | 101.80 | 96.90 | 93.30 | 94.80 | 95.60 | 96.80 | 97.90 | 97.20 | 27.90 | 26.40 | 30.60 | 28.10 | NA | 29.40 | NA | NA | NA | NA | |

| Long Term Investments | 19.30 | 19.50 | 21.00 | 24.90 | 26.20 | 26.50 | 27.60 | 27.20 | 27.70 | 27.30 | 26.40 | 27.00 | 28.00 | 26.80 | NA | 23.70 | NA | NA | NA | NA | |

| Goodwill | 3413.90 | 3422.40 | 3435.70 | 3431.30 | 3400.80 | 3437.10 | 3475.40 | 3493.30 | 3318.70 | 3331.10 | 3318.20 | 2856.20 | 2853.90 | 2848.00 | 2850.80 | 2840.10 | 2967.40 | 2792.60 | 2797.60 | 773.50 | |

| Indefinite Lived Intangible Assets Excluding Goodwill | 1280.00 | 1280.00 | 1280.00 | 1280.00 | 1280.00 | 1280.00 | 1280.00 | 1280.00 | 1275.80 | 1275.80 | 1275.80 | 1275.80 | 1275.80 | 1275.80 | 1275.80 | 1275.80 | NA | NA | NA | 158.40 | |

| Intangible Assets Net Excluding Goodwill | 3998.40 | 4113.30 | 4218.60 | 4320.10 | 4395.90 | 4541.70 | 4689.70 | 4824.50 | 4909.90 | 5047.30 | 5157.70 | 4812.00 | 4925.30 | 5022.30 | 5143.40 | 5251.40 | 5254.00 | 5361.30 | 5488.10 | 281.10 | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 3671.90 | NA | NA | NA | 4102.00 | NA | NA | NA | 3968.90 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 141.60 | 137.50 | 121.30 | 128.20 | 144.40 | 158.30 | 166.90 | 172.60 | 132.10 | 133.70 | 137.70 | 120.50 | 147.40 | 130.70 | NA | 134.60 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 937.10 | 974.60 | 999.40 | 1102.60 | 936.40 | 948.00 | 973.40 | 1004.90 | 919.60 | 972.90 | 996.30 | 825.30 | 785.70 | 2453.60 | NA | 1089.80 | NA | NA | NA | NA | |

| Debt Current | 32.70 | 32.70 | 32.70 | 32.70 | 32.70 | 32.70 | 32.70 | 28.10 | 28.10 | 28.10 | 28.10 | 25.30 | 25.30 | 325.30 | NA | 81.90 | NA | NA | NA | NA | |

| Long Term Debt Current | 32.70 | 32.70 | 32.70 | 32.70 | 32.70 | 32.70 | 32.70 | 28.10 | 28.10 | 28.10 | 28.10 | 25.30 | 25.30 | 325.30 | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 80.40 | 79.30 | 81.50 | 80.50 | 89.70 | 81.30 | 74.90 | 83.50 | 65.10 | 76.70 | 76.00 | 61.20 | 60.40 | 59.90 | NA | 55.00 | NA | NA | NA | NA | |

| Other Accrued Liabilities Current | 46.00 | 59.10 | 53.20 | 65.80 | 45.00 | 44.00 | 36.80 | 32.90 | 31.30 | 21.10 | 27.90 | 21.60 | 16.80 | 56.20 | NA | 25.80 | NA | NA | NA | NA | |

| Accrued Income Taxes Current | 18.20 | 8.00 | 15.60 | 13.20 | 11.80 | 5.90 | 6.20 | 16.40 | 18.60 | 17.40 | 22.60 | 6.90 | 11.20 | 23.20 | NA | 7.80 | NA | NA | NA | NA | |

| Contract With Customer Liability Current | 560.70 | 598.90 | 624.90 | 563.10 | 536.60 | 582.70 | 632.80 | 569.40 | 555.60 | 592.30 | 634.40 | 467.20 | 481.60 | 520.80 | NA | 467.50 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

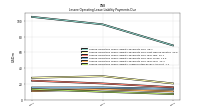

| Long Term Debt | 3638.60 | 3645.70 | 3585.70 | 3584.90 | 3584.80 | 3712.50 | 3721.40 | 3744.80 | 3571.60 | 3573.90 | 3576.10 | 3281.10 | 3282.80 | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 3605.90 | 3613.00 | 3553.00 | 3552.20 | 3552.10 | 3679.80 | 3688.70 | 3716.70 | 3543.50 | 3545.80 | 3548.00 | 3255.80 | 3257.50 | 3620.80 | NA | 3818.90 | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 911.90 | 958.20 | 999.40 | 1023.70 | 1090.70 | 1137.10 | 1180.10 | 1207.20 | 1183.60 | 1215.60 | 1202.40 | 1105.00 | 1136.80 | 1187.80 | NA | 1233.50 | NA | NA | NA | NA | |

| Pension And Other Postretirement Defined Benefit Plans Liabilities Noncurrent | 141.50 | 146.90 | 151.10 | 158.20 | 138.30 | 153.60 | 167.00 | 178.40 | 308.10 | 321.70 | 334.10 | 293.50 | 177.20 | 185.70 | NA | 206.60 | NA | NA | NA | NA | |

| Minority Interest | 11.40 | 10.70 | 10.10 | 9.10 | 62.30 | 63.60 | 65.40 | 64.10 | 62.10 | 60.70 | 60.60 | 58.50 | 55.80 | 57.90 | NA | 57.80 | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 115.10 | 124.90 | 139.50 | 126.80 | 124.60 | 132.40 | 139.10 | 144.70 | 129.10 | 136.70 | 147.00 | 143.20 | 147.70 | 131.10 | NA | 137.70 | NA | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 35.10 | 37.60 | 42.00 | 43.90 | 42.60 | 47.10 | 50.90 | 59.40 | 62.30 | 67.50 | 74.30 | 68.40 | 73.10 | 62.40 | NA | 71.20 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 3412.30 | 3438.90 | 3450.80 | 3499.30 | 3525.30 | 3582.10 | 3643.50 | 3681.20 | 3583.20 | 3587.90 | 3617.60 | 3519.20 | 3607.90 | 1331.10 | NA | 1519.90 | NA | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 3423.70 | 3449.60 | 3460.90 | 3508.40 | 3587.60 | 3645.70 | 3708.90 | 3745.30 | 3645.30 | 3648.60 | 3678.20 | 3577.70 | 3663.70 | 1389.00 | 1619.50 | 1577.70 | 1875.30 | 1812.00 | 1896.80 | -681.90 | |

| Additional Paid In Capital | 4433.90 | 4438.60 | 4436.40 | 4443.70 | 4517.30 | 4521.60 | 4506.80 | 4500.40 | 4491.00 | 4482.30 | 4475.20 | 4310.20 | 4303.50 | 2043.90 | NA | 2116.90 | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -812.80 | -817.20 | -797.80 | -764.10 | -786.90 | -794.90 | -793.10 | -761.80 | -754.00 | -770.60 | -718.90 | -685.00 | -692.00 | -675.00 | NA | -573.50 | NA | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -208.50 | -182.20 | -187.50 | -180.00 | -204.80 | -144.30 | -69.90 | -57.10 | -153.50 | -123.50 | -138.40 | -106.00 | -3.60 | -37.80 | NA | -23.50 | NA | NA | NA | NA | |

| Minority Interest | 11.40 | 10.70 | 10.10 | 9.10 | 62.30 | 63.60 | 65.40 | 64.10 | 62.10 | 60.70 | 60.60 | 58.50 | 55.80 | 57.90 | NA | 57.80 | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 17.20 | 24.10 | 14.50 | 22.00 | 17.50 | 14.80 | 6.40 | 9.30 | 8.70 | 7.10 | 5.90 | 6.70 | 11.40 | 23.50 | 3.70 | 4.90 | 3.60 | 3.70 | NA | 11.70 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | NA | NA | NA | 13.80 | 0.00 | 0.10 | 0.20 | 0.20 | 0.20 | 1.70 | 0.10 | 0.60 | 6.50 | 0.10 | 0.20 | 0.20 | 2.30 | 3.20 | NA | 0.10 |

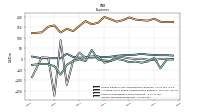

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

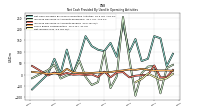

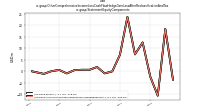

| Net Cash Provided By Used In Operating Activities | 69.10 | 58.90 | 155.70 | 97.30 | 223.30 | 77.70 | 138.80 | 102.50 | 108.70 | 124.30 | 168.20 | 77.20 | 4.00 | 109.30 | 5.10 | 69.10 | 2.60 | NA | NA | -65.40 | |

| Net Cash Provided By Used In Investing Activities | -39.10 | -41.60 | -39.60 | -44.60 | -62.50 | -54.00 | -49.40 | -288.00 | -41.70 | -111.10 | -637.90 | -25.40 | -43.90 | -31.00 | -34.00 | -26.80 | -149.80 | NA | NA | -5.30 | |

| Net Cash Provided By Used In Financing Activities | -51.30 | 34.20 | -122.20 | -62.90 | -153.50 | -13.70 | -51.00 | 126.00 | -7.30 | -8.70 | 290.10 | -6.70 | 244.00 | -151.90 | 103.90 | -53.00 | 64.00 | NA | NA | 96.90 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 69.10 | 58.90 | 155.70 | 97.30 | 223.30 | 77.70 | 138.80 | 102.50 | 108.70 | 124.30 | 168.20 | 77.20 | 4.00 | 109.30 | 5.10 | 69.10 | 2.60 | NA | NA | -65.40 | |

| Profit Loss | 5.30 | -18.80 | -32.80 | 23.50 | 10.40 | 0.00 | -29.80 | -10.00 | 18.20 | -50.80 | -23.30 | 8.30 | -14.90 | -173.80 | 73.90 | -228.10 | -55.30 | -60.50 | -209.60 | -74.80 | |

| Depreciation Depletion And Amortization | 146.70 | 145.00 | 145.40 | 145.70 | 145.10 | 147.00 | 149.40 | 157.20 | 156.70 | 152.30 | 149.70 | 135.90 | 134.10 | 132.50 | 134.40 | 141.80 | 123.30 | NA | NA | 11.10 | |

| Increase Decrease In Accounts Receivable | 34.70 | 6.20 | -92.70 | 70.60 | 252.50 | -8.60 | -59.50 | 102.60 | -33.10 | -45.90 | -9.90 | 60.70 | 3.50 | -4.50 | -17.40 | 43.10 | 19.90 | NA | NA | -16.30 | |

| Increase Decrease In Accounts Payable | -1.60 | -2.70 | -5.30 | -12.20 | 10.50 | 8.60 | -12.10 | 12.70 | -11.10 | 0.40 | -2.10 | 0.70 | -0.80 | 7.20 | -2.10 | 8.90 | -3.90 | NA | NA | 37.80 | |

| Share Based Compensation | 20.80 | 24.80 | 20.50 | 22.10 | 17.90 | 15.30 | 10.70 | 9.60 | 9.00 | 6.80 | 7.90 | 6.50 | 9.70 | 25.10 | 3.80 | 4.90 | 3.60 | NA | NA | 11.70 | |

| Amortization Of Financing Costs | 5.60 | 4.20 | 4.20 | 4.20 | 4.30 | 4.30 | 11.00 | 17.00 | 4.80 | 4.70 | 4.70 | NA | NA | NA | NA | NA | NA | NA | NA | 3.30 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -39.10 | -41.60 | -39.60 | -44.60 | -62.50 | -54.00 | -49.40 | -288.00 | -41.70 | -111.10 | -637.90 | -25.40 | -43.90 | -31.00 | -34.00 | -26.80 | -149.80 | NA | NA | -5.30 | |

| Payments To Acquire Property Plant And Equipment | 1.10 | 1.30 | 1.30 | 2.40 | 2.70 | 3.40 | 4.10 | 1.50 | 4.20 | 79.40 | 1.20 | -0.10 | 4.50 | 2.50 | 1.40 | 3.50 | 2.10 | 5.80 | NA | 0.20 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -51.30 | 34.20 | -122.20 | -62.90 | -153.50 | -13.70 | -51.00 | 126.00 | -7.30 | -8.70 | 290.10 | -6.70 | 244.00 | -151.90 | 103.90 | -53.00 | 64.00 | NA | NA | 96.90 | |

| Payments Of Dividends | 21.60 | 21.50 | 21.50 | 21.40 | NA | NA | NA | NA | NA | NA | NA | 0.00 | -0.00 | 32.10 | 32.00 | 32.00 | 32.10 | NA | NA | 0.00 |

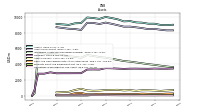

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2019-02-07 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 588.50 | 554.70 | 540.40 | 595.00 | 556.30 | 537.30 | 536.00 | 598.30 | 541.90 | 520.90 | 504.50 | 480.10 | 442.10 | 420.60 | 395.30 | 432.70 | 408.20 | 398.90 | 174.10 | 178.70 | |

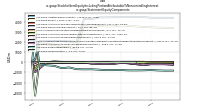

| Operating, Finance And Risk Management, International | 113.60 | 107.80 | 110.80 | 106.00 | 102.20 | 101.90 | 109.00 | 110.20 | 108.70 | 104.10 | 107.40 | 63.90 | 66.30 | 55.90 | 58.60 | 57.50 | 58.10 | 63.90 | NA | 43.40 | |

| Operating, Finance And Risk Management, North America | 234.90 | 210.60 | 201.20 | 231.10 | 224.10 | 209.50 | 202.20 | 230.50 | 214.00 | 199.70 | 190.50 | 217.90 | 206.60 | 193.60 | 192.80 | 217.10 | 208.40 | 200.80 | NA | 80.40 | |

| Operating, Sales And Marketing Solutions, International | 53.50 | 55.30 | 54.90 | 54.10 | 50.50 | 54.10 | 59.70 | 59.40 | 59.10 | 59.60 | 62.50 | 16.00 | 13.50 | 12.50 | 13.00 | 15.10 | 14.60 | 12.10 | NA | 13.00 | |

| Operating, Sales And Marketing Solutions, North America | 186.50 | 181.00 | 173.50 | 203.80 | 179.50 | 171.80 | 165.10 | 198.20 | 160.10 | 157.50 | 148.90 | 182.90 | 156.70 | 160.70 | 148.70 | 182.60 | 166.30 | 160.10 | NA | 67.80 | |

| Operating, International | 167.10 | 163.10 | 165.70 | 160.10 | 152.70 | 156.00 | 168.70 | 169.60 | 167.80 | 163.70 | 169.90 | 79.90 | 79.80 | 68.40 | 71.60 | 72.60 | 72.70 | 76.00 | NA | 56.40 | |

| Operating, North America | 421.40 | 391.60 | 374.70 | 434.90 | 403.60 | 381.30 | 367.30 | 428.70 | 374.10 | 357.20 | 339.40 | 400.80 | 363.30 | 354.30 | 341.50 | 399.70 | 374.70 | 360.90 | NA | 148.20 | |

| Black Knight Inc, Products Data And Professional Services, | 3.40 | 3.40 | NA | 1.30 | 0.00 | 3.30 | NA | 1.30 | 3.20 | 3.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Paysafe Limited, Data License And Risk Management Solution Services, | 5.80 | 1.90 | 1.70 | 2.10 | 5.90 | 1.50 | 0.90 | 0.60 | 3.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finance And Risk Management | 348.50 | 318.40 | 312.00 | 337.10 | 326.30 | 311.40 | 311.20 | 340.80 | 322.70 | 303.80 | 295.60 | 281.60 | 272.50 | 249.20 | 241.60 | 251.30 | 243.40 | 241.60 | NA | 104.60 | |

| Sales And Marketing Solutions | 240.00 | 236.30 | 228.40 | 257.90 | 230.00 | 225.90 | 224.80 | 257.50 | 219.20 | 217.10 | 208.90 | 198.50 | 169.60 | 171.40 | 154.10 | 181.40 | 164.80 | 157.30 | NA | 74.10 | |

| Transferred At Point In Time | 248.10 | 227.80 | 215.60 | 269.70 | 232.20 | 214.30 | 208.80 | 280.10 | 232.10 | 212.50 | 205.00 | 220.70 | 189.50 | 173.80 | NA | NA | NA | NA | NA | 91.40 | |

| Transferred Over Time | 340.40 | 326.90 | 324.80 | 325.30 | 324.10 | 323.00 | 327.20 | 318.20 | 309.80 | 308.40 | 299.50 | 259.20 | 254.90 | 244.90 | NA | NA | NA | NA | NA | 87.30 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 588.50 | 554.70 | 540.40 | 595.00 | 556.30 | 537.30 | 536.00 | 598.30 | 541.90 | 520.90 | 504.50 | 480.10 | 442.10 | 420.60 | 395.30 | 432.70 | 408.20 | 398.90 | 174.10 | 178.70 | |

| Operating, Finance And Risk Management, International | 113.60 | 107.80 | 110.80 | 106.00 | 102.20 | 101.90 | 109.00 | 110.20 | 108.70 | 104.10 | 107.40 | 63.90 | 66.30 | 55.90 | 58.60 | 57.50 | 58.10 | 63.90 | NA | 43.40 | |

| Operating, Finance And Risk Management, North America | 234.90 | 210.60 | 201.20 | 231.10 | 224.10 | 209.50 | 202.20 | 230.50 | 214.00 | 199.70 | 190.50 | 217.90 | 206.60 | 193.60 | 192.80 | 217.10 | 208.40 | 200.80 | NA | 80.40 | |

| Operating, Sales And Marketing Solutions, International | 53.50 | 55.30 | 54.90 | 54.10 | 50.50 | 54.10 | 59.70 | 59.40 | 59.10 | 59.60 | 62.50 | 16.00 | 13.50 | 12.50 | 13.00 | 15.10 | 14.60 | 12.10 | NA | 13.00 | |

| Operating, Sales And Marketing Solutions, North America | 186.50 | 181.00 | 173.50 | 203.80 | 179.50 | 171.80 | 165.10 | 198.20 | 160.10 | 157.50 | 148.90 | 182.90 | 156.70 | 160.70 | 148.70 | 182.60 | 166.30 | 160.10 | NA | 67.80 | |

| Operating, International | 167.10 | 163.10 | 165.70 | 160.10 | 152.70 | 156.00 | 168.70 | 169.60 | 167.80 | 163.70 | 169.90 | 79.90 | 79.80 | 68.40 | 71.60 | 72.60 | 72.70 | 76.00 | NA | 56.40 | |

| Operating, North America | 421.40 | 391.60 | 374.70 | 434.90 | 403.60 | 381.30 | 367.30 | 428.70 | 374.10 | 357.20 | 339.40 | 400.80 | 363.30 | 354.30 | 341.50 | 399.70 | 374.70 | 360.90 | NA | 148.20 | |

| Black Knight Inc, Products Data And Professional Services, | 3.40 | 3.40 | NA | 1.30 | 0.00 | 3.30 | NA | 1.30 | 3.20 | 3.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Paysafe Limited, Data License And Risk Management Solution Services, | 5.80 | 1.90 | 1.70 | 2.10 | 5.90 | 1.50 | 0.90 | 0.60 | 3.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finance And Risk Management | 348.50 | 318.40 | 312.00 | 337.10 | 326.30 | 311.40 | 311.20 | 340.80 | 322.70 | 303.80 | 295.60 | 281.60 | 272.50 | 249.20 | 241.60 | 251.30 | 243.40 | 241.60 | NA | 104.60 | |

| Sales And Marketing Solutions | 240.00 | 236.30 | 228.40 | 257.90 | 230.00 | 225.90 | 224.80 | 257.50 | 219.20 | 217.10 | 208.90 | 198.50 | 169.60 | 171.40 | 154.10 | 181.40 | 164.80 | 157.30 | NA | 74.10 | |

| Transferred At Point In Time | 248.10 | 227.80 | 215.60 | 269.70 | 232.20 | 214.30 | 208.80 | 280.10 | 232.10 | 212.50 | 205.00 | 220.70 | 189.50 | 173.80 | NA | NA | NA | NA | NA | 91.40 | |

| Transferred Over Time | 340.40 | 326.90 | 324.80 | 325.30 | 324.10 | 323.00 | 327.20 | 318.20 | 309.80 | 308.40 | 299.50 | 259.20 | 254.90 | 244.90 | NA | NA | NA | NA | NA | 87.30 |