| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 102.67 | 96.25 | NA | NA | 104.93 | 102.50 | 106.98 | NA | 107.95 | 106.77 | 49.43 | NA | 42.22 | 41.42 | 39.95 | |

| Weighted Average Number Of Shares Outstanding Basic | 87.67 | 89.01 | 95.56 | NA | 96.56 | 102.50 | 106.98 | NA | 107.95 | 106.77 | 49.43 | NA | 42.22 | 41.42 | 39.95 | |

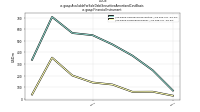

| Earnings Per Share Basic | 0.22 | 0.01 | -0.37 | -0.10 | 0.10 | -0.06 | -0.17 | -0.13 | -0.02 | -0.02 | -0.07 | -0.33 | -0.24 | -0.06 | -0.42 | |

| Earnings Per Share Diluted | 0.20 | 0.01 | -0.37 | -0.10 | 0.10 | -0.06 | -0.17 | -0.13 | -0.02 | -0.02 | -0.07 | -0.33 | -0.24 | -0.06 | -0.42 |

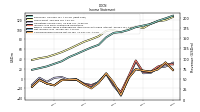

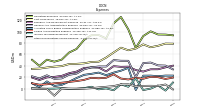

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

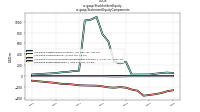

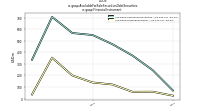

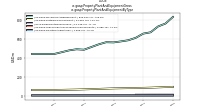

| Revenue From Contract With Customer Excluding Assessed Tax | 177.06 | 169.81 | 165.13 | 163.00 | 152.12 | 133.88 | 127.33 | 119.66 | 111.43 | 103.81 | 93.66 | 87.52 | 81.16 | 76.91 | 72.79 | |

| Revenues | 177.06 | 169.81 | 165.13 | 163.00 | 152.12 | 133.88 | 127.33 | 119.66 | 111.43 | 103.81 | 93.66 | 87.52 | 81.16 | 76.91 | 72.79 | |

| Cost Of Revenue | 70.33 | 67.35 | 71.88 | 63.39 | 54.54 | 47.25 | 46.76 | 44.40 | 43.51 | 43.15 | 39.54 | 38.58 | 37.06 | 35.20 | 34.68 | |

| Gross Profit | 106.73 | 102.46 | 93.25 | 99.61 | 97.58 | 86.64 | 80.57 | 75.26 | 67.92 | 60.66 | 54.12 | 48.94 | 44.10 | 41.71 | 38.11 | |

| Operating Expenses | 71.27 | 103.96 | 125.79 | 114.70 | 88.19 | 94.01 | 93.71 | 85.40 | 69.59 | 63.30 | 50.86 | 47.30 | 50.82 | 39.93 | 50.60 | |

| Research And Development Expense | 32.63 | 38.57 | 38.27 | 39.45 | 30.24 | 36.96 | 37.24 | 36.23 | 29.93 | 27.12 | 22.40 | 20.66 | 19.71 | 15.13 | 19.48 | |

| General And Administrative Expense | 20.06 | 48.86 | 48.94 | 50.08 | 38.85 | 38.84 | 37.42 | 33.83 | 26.35 | 24.36 | 18.04 | 17.28 | 23.41 | 17.84 | 21.66 | |

| Selling And Marketing Expense | 19.02 | 16.10 | 17.71 | 25.18 | 19.10 | 18.22 | 19.04 | 15.33 | 13.31 | 11.81 | 10.42 | 9.36 | 7.70 | 6.96 | 9.45 | |

| Operating Income Loss | 35.47 | -1.50 | -32.53 | -15.10 | 9.39 | -7.38 | -13.14 | -10.14 | -1.67 | -2.63 | 3.25 | 1.64 | -6.72 | 1.78 | -12.49 | |

| Interest Expense | 2.33 | 2.11 | 2.19 | 2.12 | 2.13 | 2.10 | 2.06 | 1.07 | 0.19 | 0.23 | 2.26 | 3.12 | 3.19 | 3.78 | 3.52 | |

| Interest Paid Net | 0.34 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.09 | 0.10 | 0.10 | 0.15 | 2.00 | 2.92 | 3.20 | 3.49 | 2.79 | |

| Gains Losses On Extinguishment Of Debt | NA | NA | NA | 0.00 | 0.00 | 0.00 | -0.41 | 0.00 | 0.00 | 0.00 | -3.44 | 0.00 | 0.00 | 0.00 | -0.26 | |

| Allocated Share Based Compensation Expense | -2.37 | 36.43 | 31.53 | 28.07 | 23.59 | 28.18 | 25.98 | 24.20 | 18.55 | 12.20 | 6.62 | 4.59 | 12.73 | 2.76 | 9.38 | |

| Income Tax Expense Benefit | 17.94 | 3.32 | 7.61 | -2.73 | 0.44 | -1.17 | 3.34 | 0.92 | -0.14 | -0.47 | 1.00 | 0.05 | -0.13 | 0.25 | 0.75 | |

| Income Taxes Paid Net | 0.54 | 1.10 | 0.39 | 2.90 | 0.56 | 0.10 | 1.00 | 0.38 | -0.09 | 0.17 | 0.46 | 0.08 | 0.08 | 0.06 | 0.39 | |

| Net Income Loss | 19.18 | 0.67 | -34.94 | -10.07 | 10.10 | -6.19 | -18.12 | -12.12 | -1.85 | -2.19 | -3.34 | -13.85 | -10.21 | -2.57 | -16.93 | |

| Comprehensive Income Net Of Tax | 19.10 | 0.40 | -33.57 | -7.81 | 10.76 | -8.86 | -20.05 | -12.15 | -1.93 | -2.23 | -3.35 | -13.84 | -10.18 | -2.57 | -16.76 | |

| Net Income Loss Available To Common Stockholders Basic | 19.18 | 0.67 | -34.94 | -10.07 | 10.10 | -6.19 | -18.12 | -12.12 | -1.85 | -2.19 | -3.34 | -13.85 | -10.21 | -2.57 | -16.93 | |

| Net Income Loss Available To Common Stockholders Diluted | 20.74 | 0.67 | NA | NA | 10.10 | -6.19 | -18.12 | -12.12 | -1.85 | -2.19 | -3.34 | -13.85 | -10.21 | -2.57 | -16.93 |

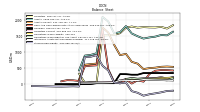

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

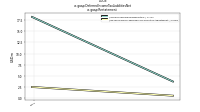

| Assets | 1425.14 | 1497.90 | 1584.40 | 1815.91 | 1623.69 | 1590.71 | 1956.83 | 2100.99 | 965.83 | 915.43 | 893.26 | 430.25 | NA | NA | NA | |

| Liabilities | 1783.91 | 1765.48 | 1802.05 | 1764.82 | 1593.47 | 1542.43 | 1529.00 | 1522.80 | 59.39 | 57.35 | 48.16 | 329.27 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1425.14 | 1497.90 | 1584.40 | 1815.91 | 1623.69 | 1590.71 | 1956.83 | 2100.99 | 965.83 | 915.43 | 893.26 | 430.25 | NA | NA | NA | |

| Stockholders Equity | -358.77 | -267.58 | -217.65 | 51.09 | 30.22 | 48.27 | 427.83 | 578.20 | 906.43 | 858.08 | 845.11 | -72.09 | -65.44 | -70.13 | -73.90 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

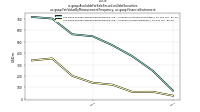

| Assets Current | 471.46 | 642.07 | 698.61 | 946.55 | 908.36 | 1231.13 | 1611.90 | 1770.06 | 642.78 | 629.12 | 607.28 | 147.95 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 79.36 | 120.05 | 20.87 | 140.77 | 24.11 | 72.18 | 464.84 | 1713.39 | 589.75 | 577.22 | 560.05 | 100.31 | 121.24 | 126.22 | 91.02 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 81.11 | 130.89 | 31.72 | 151.81 | 35.15 | 74.11 | 466.87 | 1715.42 | 591.98 | 579.44 | 562.28 | 102.54 | 123.65 | 128.64 | 93.44 | |

| Marketable Securities Current | 304.72 | 430.46 | 591.68 | 723.46 | 800.54 | 1093.98 | 1090.37 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 60.24 | 57.08 | 54.97 | 53.83 | 52.42 | 44.06 | 42.53 | 39.62 | 36.51 | 33.92 | 28.94 | 26.80 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 27.14 | 34.48 | 31.09 | 28.48 | 31.28 | 20.92 | 14.17 | 17.05 | 16.53 | 17.98 | 18.29 | 20.84 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 304.72 | 430.46 | 591.68 | 723.46 | 800.54 | 1093.98 | 1090.37 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 715.93 | 677.24 | 663.76 | 651.74 | 651.07 | 625.72 | 594.78 | 564.14 | 566.54 | 553.37 | 532.51 | 512.75 | NA | NA | 512.75 | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 363.14 | 340.50 | 321.92 | 317.33 | 321.68 | 301.81 | 282.98 | 265.23 | 279.30 | 267.14 | 249.94 | 237.61 | NA | NA | 237.61 | |

| Property Plant And Equipment Net | 284.81 | 270.71 | 277.96 | 273.17 | 270.99 | 268.42 | 259.38 | 249.64 | 241.08 | 243.05 | 242.72 | 238.96 | NA | NA | 238.96 | |

| Goodwill | 348.32 | 296.58 | 296.58 | 313.72 | 315.16 | 32.17 | 32.17 | 32.17 | 32.17 | 2.67 | 2.67 | 2.67 | NA | NA | NA | |

| Indefinite Lived Intangible Assets Excluding Goodwill | NA | NA | NA | 44.82 | NA | NA | NA | 39.91 | NA | NA | NA | 34.27 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 145.89 | 113.85 | 117.64 | 118.93 | 122.54 | 52.20 | 46.45 | 42.91 | 43.27 | 34.50 | 34.57 | 34.65 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 74.11 | NA | NA | NA | 3.01 | NA | NA | NA | 0.38 | NA | NA | NA | |

| Other Assets Noncurrent | 5.89 | 5.46 | 5.59 | 6.35 | 4.62 | 4.76 | 4.79 | 4.08 | 4.21 | 3.78 | 3.71 | 3.71 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 304.91 | 430.96 | 591.70 | 724.73 | 804.01 | 1098.37 | 1092.27 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

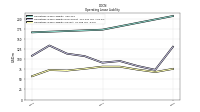

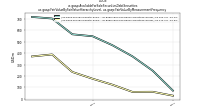

| Liabilities Current | 184.29 | 167.31 | 186.15 | 164.27 | 98.81 | 74.23 | 62.45 | 58.24 | 57.58 | 55.39 | 46.05 | 84.78 | NA | NA | NA | |

| Accounts Payable Current | 14.31 | 9.60 | 11.01 | 21.14 | 11.76 | 17.76 | 16.33 | 12.66 | 12.69 | 16.19 | 15.15 | 12.43 | NA | NA | NA | |

| Taxes Payable Current | NA | NA | NA | 39.35 | 39.82 | NA | NA | 6.75 | 6.58 | 9.32 | 8.46 | 7.76 | NA | NA | 7.76 | |

| Accrued Liabilities Current | 24.78 | 27.89 | 38.22 | 33.99 | 36.65 | 39.02 | 25.63 | 31.91 | 28.41 | 21.98 | 16.76 | 27.02 | NA | NA | NA | |

| Other Liabilities Current | 63.99 | 53.14 | 58.86 | 45.91 | 44.92 | 12.71 | 15.25 | 8.85 | 11.34 | 12.19 | 9.22 | 22.99 | NA | NA | 22.99 | |

| Contract With Customer Liability Current | 5.09 | 4.99 | 5.01 | 5.55 | 5.48 | 4.73 | 5.25 | 4.83 | 5.14 | 5.03 | 4.92 | 4.87 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt Noncurrent | 1475.91 | 1474.03 | 1472.15 | 1470.27 | 1468.39 | 1466.52 | 1464.53 | 1462.68 | NA | NA | NA | 242.22 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 6.64 | 5.28 | 3.77 | 18.21 | 22.11 | 0.42 | 0.42 | 0.42 | 0.21 | 0.20 | 0.21 | 0.21 | NA | NA | NA | |

| Other Liabilities Noncurrent | 9.84 | 5.50 | 6.51 | 3.83 | 4.16 | 1.27 | 1.60 | 1.46 | 1.61 | 1.75 | 1.90 | 2.06 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 107.23 | 113.37 | 133.47 | 108.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

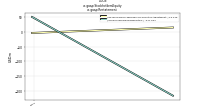

| Stockholders Equity | -358.77 | -267.58 | -217.65 | 51.09 | 30.22 | 48.27 | 427.83 | 578.20 | 906.43 | 858.08 | 845.11 | -72.09 | -65.44 | -70.13 | -73.90 | |

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | |

| Additional Paid In Capital | NA | NA | 28.78 | 263.96 | 235.28 | 268.69 | 639.39 | 769.71 | 1085.79 | 1035.51 | 1020.31 | 99.78 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -357.75 | -266.63 | -245.76 | -210.82 | -200.75 | -210.85 | -204.66 | -186.54 | -174.41 | -172.56 | -170.37 | -167.03 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1.02 | -0.95 | -0.68 | -2.05 | -4.31 | -4.97 | -2.30 | -0.37 | -0.35 | -0.27 | -0.23 | -0.24 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | -2.00 | 36.64 | 31.92 | 28.51 | 24.08 | 28.57 | 26.39 | 24.53 | 18.82 | 12.46 | 6.68 | 4.68 | 12.86 | 2.92 | 9.52 |

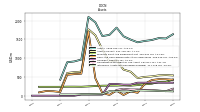

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

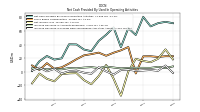

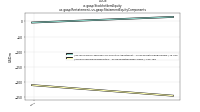

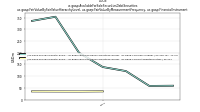

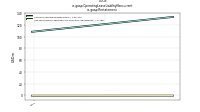

| Net Cash Provided By Used In Operating Activities | 54.05 | 64.16 | 36.22 | 65.14 | 54.36 | 45.37 | 30.28 | 32.74 | 40.18 | 40.41 | 19.79 | 17.97 | 23.25 | 15.57 | 1.32 | |

| Net Cash Provided By Used In Investing Activities | 4.56 | 135.75 | 107.96 | 51.58 | -40.56 | -38.23 | -1120.95 | -32.40 | -31.54 | -25.98 | -23.69 | -30.41 | -26.06 | -30.80 | -28.23 | |

| Net Cash Provided By Used In Financing Activities | -108.35 | -100.75 | -264.23 | 0.18 | -52.76 | -399.90 | -157.88 | 1123.11 | 3.89 | 2.74 | 463.64 | -8.68 | -2.18 | 50.42 | 84.46 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 54.05 | 64.16 | 36.22 | 65.14 | 54.36 | 45.37 | 30.28 | 32.74 | 40.18 | 40.41 | 19.79 | 17.97 | 23.25 | 15.57 | 1.32 | |

| Net Income Loss | 19.18 | 0.67 | -34.94 | -10.07 | 10.10 | -6.19 | -18.12 | -12.12 | -1.85 | -2.19 | -3.34 | -13.85 | -10.21 | -2.57 | -16.93 | |

| Depreciation Depletion And Amortization | 30.55 | 27.62 | 28.91 | 28.33 | 25.63 | 24.34 | 23.93 | 23.45 | 22.38 | 21.59 | 20.95 | 20.37 | 19.48 | 18.33 | 17.39 | |

| Increase Decrease In Other Operating Capital Net | -10.13 | 6.14 | -12.80 | 8.98 | -3.17 | 3.59 | -5.76 | 0.26 | -1.03 | -1.80 | 0.24 | 1.13 | 0.07 | 0.69 | 0.10 | |

| Increase Decrease In Accounts Receivable | 5.98 | 5.67 | 5.12 | 6.38 | 7.76 | 5.58 | 6.93 | 6.26 | 5.17 | 5.54 | 3.75 | 4.10 | 3.75 | 4.14 | 5.15 | |

| Share Based Compensation | -2.37 | 36.43 | 31.53 | 28.07 | 23.59 | 28.18 | 25.98 | 24.20 | 18.55 | 12.20 | 6.62 | 4.59 | 12.73 | 2.76 | 9.38 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

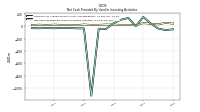

| Net Cash Provided By Used In Investing Activities | 4.56 | 135.75 | 107.96 | 51.58 | -40.56 | -38.23 | -1120.95 | -32.40 | -31.54 | -25.98 | -23.69 | -30.41 | -26.06 | -30.80 | -28.23 | |

| Payments To Acquire Property Plant And Equipment | 20.23 | 23.53 | 23.31 | 28.67 | 29.68 | 25.07 | 22.98 | 30.59 | 19.44 | 24.64 | 22.40 | 28.41 | 21.76 | 27.37 | 20.67 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -108.35 | -100.75 | -264.23 | 0.18 | -52.76 | -399.90 | -157.88 | 1123.11 | 3.89 | 2.74 | 463.64 | -8.68 | -2.18 | 50.42 | 84.46 | |

| Payments For Repurchase Of Common Stock | 106.03 | 103.02 | 265.90 | 0.00 | 50.00 | 400.00 | 150.00 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

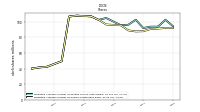

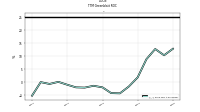

| Revenues | 177.06 | 169.81 | 165.13 | 163.00 | 152.12 | 133.88 | 127.33 | 119.66 | 111.43 | 103.81 | 93.66 | 87.52 | 81.16 | 76.91 | 72.79 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 177.06 | 169.81 | 165.13 | 163.00 | 152.12 | 133.88 | 127.33 | 119.66 | 111.43 | 103.81 | 93.66 | 87.52 | 81.16 | 76.91 | 72.79 |