| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 46.95 | 46.87 | 40.62 | NA | 39.75 | 39.27 | 38.59 | NA | 29.53 | 13.17 | 12.92 | NA | 12.53 | 16.20 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | NA | 40.62 | NA | 39.75 | 39.27 | 38.59 | NA | 29.53 | 13.17 | 12.92 | NA | 12.53 | 12.44 | |

| Earnings Per Share Basic | 0.07 | 0.09 | -0.06 | -0.35 | -0.46 | -0.38 | -0.31 | -0.28 | -0.98 | -0.01 | -1.04 | -0.81 | -0.25 | NA | |

| Earnings Per Share Diluted | 0.06 | 0.08 | -0.06 | -0.35 | -0.46 | -0.38 | -0.31 | -0.28 | -0.98 | -0.01 | -1.04 | -0.81 | -0.25 | NA |

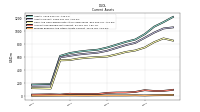

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

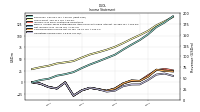

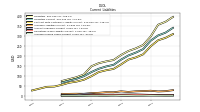

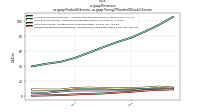

| Revenue From Contract With Customer Excluding Assessed Tax | 137.62 | 126.84 | 115.66 | 103.82 | 96.06 | 88.39 | 81.22 | 73.01 | 63.59 | 58.80 | 55.36 | 48.27 | 45.30 | 40.01 | |

| Revenues | 137.62 | 126.84 | 115.66 | 103.82 | 96.06 | 88.39 | 81.22 | 73.01 | 63.59 | 58.80 | 55.36 | 48.27 | 45.30 | 40.01 | |

| Interest Income Operating | 8.62 | 7.54 | 5.64 | 4.27 | 2.26 | 0.67 | 0.03 | NA | NA | NA | NA | NA | NA | NA | |

| Cost Of Revenue | 36.25 | 33.79 | 31.49 | 27.77 | 26.30 | 23.87 | 21.49 | 19.95 | 18.08 | 16.14 | 15.02 | 12.86 | 13.10 | 11.81 | |

| Gross Profit | 101.37 | 93.05 | 84.17 | 76.05 | 69.76 | 64.52 | 59.73 | 53.06 | 45.52 | 42.67 | 40.34 | 35.41 | 32.20 | 28.20 | |

| Operating Expenses | 106.04 | 97.92 | 92.69 | 94.21 | 89.92 | 79.55 | 71.58 | 70.48 | 74.22 | 43.14 | 53.76 | 45.98 | 35.27 | 28.12 | |

| Research And Development Expense | 50.30 | 47.95 | 45.84 | 44.47 | 41.98 | 34.22 | 29.78 | 30.02 | 29.34 | 21.94 | 22.53 | 15.44 | 15.89 | 12.11 | |

| General And Administrative Expense | 33.40 | 32.23 | 30.24 | 30.71 | 30.23 | 30.06 | 26.86 | 25.95 | 29.61 | 11.59 | 11.45 | 20.83 | 8.23 | 7.38 | |

| Selling And Marketing Expense | 22.34 | 17.73 | 16.60 | 19.03 | 17.72 | 15.28 | 14.94 | 14.51 | 15.27 | 9.62 | 19.77 | 9.71 | 11.14 | 8.62 | |

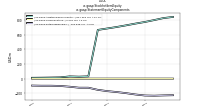

| Operating Income Loss | -4.67 | -4.87 | -8.52 | -18.15 | -20.16 | -15.03 | -11.85 | -17.41 | -28.70 | -0.48 | -13.41 | -10.57 | -3.07 | 0.08 | |

| Allocated Share Based Compensation Expense | 25.43 | 23.71 | 21.07 | 20.63 | 20.49 | 18.11 | 14.59 | 14.68 | 20.66 | 2.91 | 2.55 | 12.51 | 1.68 | 1.68 | |

| Income Tax Expense Benefit | 0.12 | -1.31 | -0.12 | 0.72 | 0.05 | 0.14 | 0.03 | 0.11 | 0.05 | 0.00 | 0.02 | 0.02 | 0.02 | 0.01 | |

| Income Taxes Paid Net | 0.26 | 1.91 | 0.03 | 0.01 | 0.00 | 0.60 | 0.00 | 0.04 | 0.04 | 0.06 | 0.00 | NA | NA | NA | |

| Net Income Loss | 2.81 | 3.73 | -2.58 | -13.93 | -18.45 | -15.04 | -12.15 | -17.52 | -28.97 | -0.18 | -13.47 | -10.41 | -3.18 | 0.04 | |

| Comprehensive Income Net Of Tax | 2.81 | 3.73 | -2.58 | -13.93 | -18.45 | -15.04 | -12.15 | -17.52 | -28.97 | -0.18 | -13.47 | -10.41 | -3.18 | 0.04 |

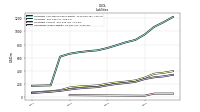

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

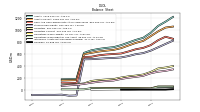

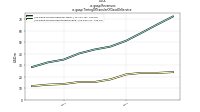

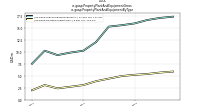

| Assets | 870.71 | 834.80 | 790.38 | 747.35 | 713.70 | 701.05 | 684.51 | 661.31 | 617.78 | 181.69 | NA | 175.74 | NA | NA | |

| Liabilities | 255.90 | 238.40 | 225.19 | 205.27 | 179.87 | 172.83 | 163.80 | 148.25 | 107.05 | 92.86 | NA | 73.82 | NA | NA | |

| Liabilities And Stockholders Equity | 870.71 | 834.80 | 790.38 | 747.35 | 713.70 | 701.05 | 684.51 | 661.31 | 617.78 | 181.69 | NA | 175.74 | NA | NA | |

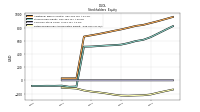

| Stockholders Equity | 614.82 | 596.40 | 565.19 | 542.08 | 533.83 | 528.22 | 520.71 | 513.06 | 510.73 | -93.78 | -97.78 | -80.69 | -83.70 | -82.88 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 819.11 | 784.94 | 741.23 | 697.18 | 668.33 | 655.15 | 640.63 | 619.27 | 596.34 | 162.57 | NA | 158.38 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 701.74 | 678.66 | 641.09 | 608.18 | 599.97 | 591.16 | 577.33 | 553.92 | 549.44 | 114.64 | NA | 120.49 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 701.74 | 678.66 | 641.09 | 608.18 | 599.97 | 591.16 | 577.33 | 553.92 | 549.44 | 114.64 | 117.46 | 120.49 | 82.30 | 81.13 | |

| Accounts Receivable Net Current | 61.71 | 53.41 | 52.51 | 46.73 | 30.20 | 28.21 | 28.57 | 33.16 | 20.74 | 25.13 | NA | 20.45 | NA | NA | |

| Prepaid Expense And Other Assets Current | 9.53 | 7.79 | 7.50 | 7.23 | 7.91 | 6.56 | 6.95 | 7.97 | 6.44 | 5.63 | NA | 3.85 | NA | NA |

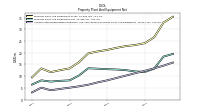

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 23.28 | 22.81 | 22.07 | 21.19 | 20.54 | 19.71 | 15.92 | 13.31 | 12.56 | 11.70 | 13.31 | 9.49 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 11.27 | 10.24 | 9.23 | 8.22 | 7.35 | 6.35 | 5.67 | 5.10 | 4.55 | 4.01 | 5.10 | 3.07 | NA | NA | |

| Property Plant And Equipment Net | 12.01 | 12.57 | 12.84 | 12.97 | 13.19 | 13.36 | 10.25 | 8.21 | 8.01 | 7.69 | 8.21 | 6.43 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 13.77 | 10.40 | 8.47 | 8.50 | NA | NA | NA | 4.57 | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 1.25 | 1.24 | 1.37 | 1.51 | 1.59 | 1.21 | 1.04 | 0.89 | 1.01 | 0.90 | NA | 0.56 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 234.93 | 217.11 | 202.81 | 181.77 | 155.63 | 147.33 | 135.78 | 119.13 | 98.64 | 85.05 | NA | 65.69 | NA | NA | |

| Accounts Payable Current | 2.71 | 2.31 | 0.99 | 1.18 | 3.36 | 1.50 | 2.02 | 7.82 | 8.71 | 4.27 | NA | 2.20 | NA | NA | |

| Other Accrued Liabilities Current | 7.54 | 6.74 | 6.35 | 6.97 | 5.77 | 6.39 | 5.53 | 4.12 | 3.39 | 3.37 | NA | 2.82 | NA | NA | |

| Accrued Income Taxes Current | 0.06 | 0.06 | 0.93 | 1.07 | 0.14 | 0.09 | 0.14 | 0.11 | 0.03 | 0.01 | NA | 0.07 | NA | NA | |

| Accrued Liabilities Current | 23.28 | 21.99 | 18.96 | 21.97 | 17.18 | 17.54 | 14.52 | 12.93 | 9.45 | 9.78 | NA | 8.63 | NA | NA | |

| Contract With Customer Liability Current | 208.89 | 192.75 | 181.94 | 157.55 | 134.94 | 128.19 | 119.10 | 98.27 | 80.46 | 71.00 | 65.26 | 54.79 | 46.00 | 44.63 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Lease Liability Noncurrent | 20.96 | 21.29 | 22.38 | 23.50 | 24.24 | 25.50 | 28.02 | 29.12 | 8.40 | 7.81 | NA | 8.13 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 614.82 | 596.40 | 565.19 | 542.08 | 533.83 | 528.22 | 520.71 | 513.06 | 510.73 | -93.78 | -97.78 | -80.69 | -83.70 | -82.88 | |

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | |

| Additional Paid In Capital | 841.35 | 825.75 | 798.25 | 772.56 | 750.38 | 726.33 | 703.78 | 683.97 | 664.12 | 30.65 | NA | 30.09 | NA | NA | |

| Retained Earnings Accumulated Deficit | -226.54 | -229.34 | -233.07 | -230.49 | -216.56 | -198.11 | -183.07 | -170.91 | -153.40 | -124.43 | NA | -110.78 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 25.43 | 23.71 | 21.07 | 20.63 | 20.49 | 18.11 | 14.59 | 14.68 | 20.66 | 2.91 | 2.55 | 12.51 | 1.68 | 1.68 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

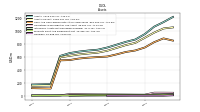

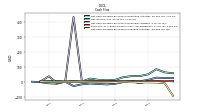

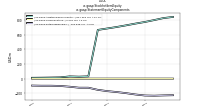

| Net Cash Provided By Used In Operating Activities | 37.65 | 37.17 | 29.60 | 11.61 | 8.76 | 12.66 | 20.63 | 0.43 | 4.51 | -0.90 | 5.12 | 3.68 | 0.85 | NA | |

| Net Cash Provided By Used In Investing Activities | -4.75 | -3.37 | -1.31 | -4.95 | -3.52 | -3.27 | -2.44 | -1.11 | -1.46 | -1.86 | -1.78 | -1.33 | -0.36 | NA | |

| Net Cash Provided By Used In Financing Activities | -9.82 | 3.78 | 4.62 | 1.55 | 3.56 | 4.44 | 5.23 | 5.16 | 431.76 | -0.07 | -6.38 | 35.85 | 0.68 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

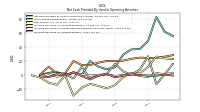

| Net Cash Provided By Used In Operating Activities | 37.65 | 37.17 | 29.60 | 11.61 | 8.76 | 12.66 | 20.63 | 0.43 | 4.51 | -0.90 | 5.12 | 3.68 | 0.85 | NA | |

| Net Income Loss | 2.81 | 3.73 | -2.58 | -13.93 | -18.45 | -15.04 | -12.15 | -17.52 | -28.97 | -0.18 | -13.47 | -10.41 | -3.18 | 0.04 | |

| Depreciation Depletion And Amortization | 1.66 | 1.63 | 1.76 | 1.44 | 1.48 | 1.17 | 0.77 | 0.76 | 0.73 | 0.64 | 0.60 | 0.61 | 0.63 | NA | |

| Increase Decrease In Accounts Receivable | 8.30 | 0.90 | 5.78 | 16.53 | 1.99 | -0.36 | -4.59 | 12.43 | -4.39 | 1.78 | 2.90 | 2.54 | 0.45 | NA | |

| Increase Decrease In Accounts Payable | 0.34 | 1.40 | -0.34 | -2.79 | 2.45 | -0.51 | -5.80 | -0.89 | 4.44 | 0.49 | 1.58 | -2.45 | -1.45 | NA | |

| Share Based Compensation | 25.43 | 23.71 | 21.07 | 20.63 | 20.49 | 18.11 | 14.59 | 14.68 | 20.66 | 2.91 | 2.55 | 12.51 | 1.68 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -4.75 | -3.37 | -1.31 | -4.95 | -3.52 | -3.27 | -2.44 | -1.11 | -1.46 | -1.86 | -1.78 | -1.33 | -0.36 | NA | |

| Payments To Acquire Property Plant And Equipment | 0.76 | 0.83 | 0.68 | 0.29 | 2.08 | 1.86 | 1.33 | 0.52 | 1.08 | 1.14 | 0.84 | 0.82 | 0.36 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -9.82 | 3.78 | 4.62 | 1.55 | 3.56 | 4.44 | 5.23 | 5.16 | 431.76 | -0.07 | -6.38 | 35.85 | 0.68 | NA |

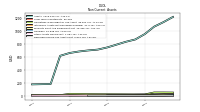

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

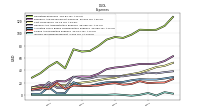

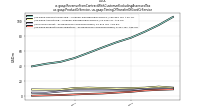

| Revenues | 137.62 | 126.84 | 115.66 | 103.82 | 96.06 | 88.39 | 81.22 | 73.01 | 63.59 | 58.80 | 55.36 | 48.27 | 45.30 | 40.01 | |

| English Test, Transferred Over Time | 10.61 | 9.81 | 9.97 | 8.41 | 8.19 | 8.04 | 8.08 | 8.10 | 6.70 | 4.83 | 5.04 | NA | NA | NA | |

| Advertising, Transferred Over Time | 11.68 | 13.06 | 11.63 | 11.15 | 10.62 | 11.22 | 11.75 | 11.14 | 9.03 | 9.06 | 9.28 | NA | NA | NA | |

| License And Service, Transferred Over Time | 105.89 | 95.16 | 86.19 | 78.13 | 72.17 | 65.19 | 58.01 | 51.11 | 46.03 | 43.50 | 40.05 | NA | NA | NA | |

| Product And Service Other, Transferred Over Time | 9.45 | 8.81 | 7.87 | 6.14 | 5.08 | 3.94 | 3.38 | 2.67 | 1.84 | 1.41 | 0.99 | NA | NA | NA | |

| Transferred At Point In Time | NA | NA | NA | NA | 23.89 | 23.19 | 23.21 | 21.90 | 17.57 | 15.30 | 15.30 | 13.53 | 12.99 | 11.74 | |

| Transferred Over Time | NA | NA | NA | NA | 72.17 | 65.19 | 58.01 | 51.11 | 46.03 | 43.50 | 40.05 | 34.74 | 32.32 | 28.27 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 137.62 | 126.84 | 115.66 | 103.82 | 96.06 | 88.39 | 81.22 | 73.01 | 63.59 | 58.80 | 55.36 | 48.27 | 45.30 | 40.01 | |

| English Test, Transferred Over Time | 10.61 | 9.81 | 9.97 | 8.41 | 8.19 | 8.04 | 8.08 | 8.10 | 6.70 | 4.83 | 5.04 | NA | NA | NA | |

| Advertising, Transferred Over Time | 11.68 | 13.06 | 11.63 | 11.15 | 10.62 | 11.22 | 11.75 | 11.14 | 9.03 | 9.06 | 9.28 | NA | NA | NA | |

| License And Service, Transferred Over Time | 105.89 | 95.16 | 86.19 | 78.13 | 72.17 | 65.19 | 58.01 | 51.11 | 46.03 | 43.50 | 40.05 | NA | NA | NA | |

| Product And Service Other, Transferred Over Time | 9.45 | 8.81 | 7.87 | 6.14 | 5.08 | 3.94 | 3.38 | 2.67 | 1.84 | 1.41 | 0.99 | NA | NA | NA | |

| Transferred At Point In Time | NA | NA | NA | NA | 23.89 | 23.19 | 23.21 | 21.90 | 17.57 | 15.30 | 15.30 | 13.53 | 12.99 | 11.74 | |

| Transferred Over Time | NA | NA | NA | NA | 72.17 | 65.19 | 58.01 | 51.11 | 46.03 | 43.50 | 40.05 | 34.74 | 32.32 | 28.27 | |

| Interest Income Operating | 8.62 | 7.54 | 5.64 | 4.27 | 2.26 | 0.67 | 0.03 | NA | NA | NA | NA | NA | NA | NA |