| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

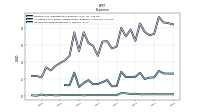

| Common Stock Value | 1.65 | 1.56 | 1.55 | 1.49 | 1.42 | 1.42 | 1.33 | 1.31 | 1.25 | 1.21 | 1.18 | 1.09 | 1.06 | 1.05 | 0.93 | 0.92 | 0.84 | 0.80 | 0.58 | 0.57 | 0.43 | 0.43 | 0.40 | NA | 0.00 | NA | NA | NA | |

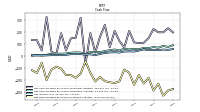

| Earnings Per Share Basic | 0.31 | 0.29 | 0.35 | 0.30 | 0.25 | 0.26 | 0.27 | 0.21 | 0.24 | 0.23 | 0.20 | 0.14 | 0.05 | 0.13 | 0.11 | 0.15 | 0.19 | 0.18 | 0.14 | 0.13 | 0.13 | 0.12 | 0.01 | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.30 | 0.29 | 0.35 | 0.29 | 0.25 | 0.26 | 0.27 | 0.21 | 0.25 | 0.23 | 0.20 | 0.14 | 0.05 | 0.13 | 0.11 | 0.15 | 0.18 | 0.18 | 0.14 | 0.13 | 0.13 | 0.12 | 0.01 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

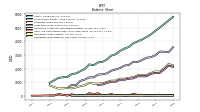

| Revenues | 97.73 | 91.66 | 86.52 | 83.69 | 74.28 | 70.66 | 71.45 | 70.12 | 65.02 | 59.60 | 57.07 | 48.55 | 41.11 | 42.91 | 38.50 | 41.49 | 39.20 | 36.29 | 32.76 | 31.11 | 28.65 | 25.74 | 21.69 | 20.17 | 17.47 | 13.58 | 13.32 | 10.09 | |

| Other Income | 0.22 | 0.12 | 0.16 | 1.07 | 0.17 | 0.42 | 0.41 | 0.19 | 1.05 | 0.10 | 0.04 | 0.01 | 0.02 | 0.06 | 0.00 | 0.01 | 0.02 | 0.39 | 0.24 | 0.01 | 0.55 | 0.03 | 0.06 | 0.00 | 0.14 | 0.09 | 0.56 | NA | |

| Costs And Expenses | 37.98 | 34.85 | 34.28 | 33.90 | 40.99 | 31.07 | 36.29 | 33.38 | 26.52 | 24.32 | 25.06 | 29.25 | 7.60 | 31.58 | 29.23 | 28.59 | 26.36 | 26.32 | 21.75 | 23.08 | 20.85 | 20.12 | 20.52 | 20.30 | 17.23 | 15.05 | 12.70 | NA | |

| General And Administrative Expense | 7.33 | 7.17 | 7.58 | 8.58 | 6.51 | 7.87 | 7.03 | 8.06 | 5.83 | 5.60 | 6.47 | 6.43 | 4.74 | 5.92 | 6.25 | 7.54 | 5.29 | 7.53 | 4.74 | 4.19 | 3.89 | 3.53 | 2.99 | 3.36 | 2.16 | 2.34 | 2.33 | NA | |

| Operating Income Loss | 64.60 | 58.67 | 64.78 | 54.70 | 45.85 | 45.92 | 45.25 | 38.40 | 38.99 | 36.62 | 35.72 | 23.09 | 35.36 | 12.33 | 10.37 | 14.77 | 15.54 | 14.06 | 14.48 | 8.70 | 8.14 | 7.08 | 3.56 | 1.10 | 3.25 | 0.50 | NA | NA | |

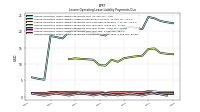

| Interest Expense | 15.76 | 12.63 | 12.07 | 12.13 | 12.13 | 9.89 | 9.19 | 9.16 | 9.17 | 8.96 | 7.81 | 7.68 | 7.76 | 7.65 | 7.40 | 6.83 | 6.96 | 7.21 | 5.78 | 7.09 | 6.72 | 6.56 | 8.63 | 8.28 | 7.38 | 6.32 | 5.16 | NA | |

| Interest Paid Net | 11.54 | 20.52 | 5.69 | 11.83 | 17.31 | 10.75 | 4.35 | 4.43 | 4.87 | 4.63 | 8.32 | 6.35 | 7.15 | 7.15 | 7.53 | 5.25 | 6.72 | 8.50 | 7.97 | 6.30 | 5.81 | 5.83 | 8.56 | 7.70 | 6.67 | 5.91 | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | -0.12 | NA | NA | 0.00 | 0.00 | 0.00 | -2.14 | 0.00 | 0.00 | -4.46 | NA | 0.00 | 0.00 | 0.00 | -0.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 2.17 | 2.14 | 1.97 | 2.72 | 2.23 | 2.23 | 2.19 | 2.83 | 1.13 | 1.10 | 1.86 | 1.59 | 1.39 | 1.35 | 1.84 | 1.51 | 1.02 | 2.74 | 1.23 | 1.24 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 0.16 | 0.16 | 0.16 | 0.15 | 0.23 | 0.19 | 0.28 | 0.30 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.07 | 0.03 | 0.09 | 0.07 | 0.08 | 0.07 | 0.05 | 0.03 | 0.09 | 0.03 | 0.13 | -0.01 | 0.04 | NA | |

| Income Taxes Paid Net | 0.12 | 0.14 | 0.72 | 0.50 | 0.16 | 0.00 | 0.95 | 0.10 | 0.22 | 0.00 | 0.18 | 0.24 | 0.16 | 0.34 | 0.00 | 0.05 | 0.00 | 0.06 | NA | NA | 0.01 | NA | NA | NA | 0.00 | NA | NA | NA | |

| Profit Loss | 49.27 | 46.09 | 53.00 | 43.06 | 35.52 | 36.59 | 35.81 | 26.82 | 29.79 | 27.65 | 23.40 | 15.38 | 5.71 | 12.34 | 10.44 | 14.04 | 14.63 | 14.11 | 10.57 | 8.72 | 8.30 | 7.71 | 0.32 | 1.11 | 3.14 | 0.52 | 2.05 | 0.58 | |

| Other Comprehensive Income Loss Net Of Tax | -45.57 | 6.66 | 16.86 | -14.83 | -5.22 | 22.84 | 10.18 | 28.96 | 8.81 | 2.78 | -7.11 | 18.02 | 4.62 | 3.01 | -4.97 | -38.10 | 3.07 | -2.10 | -3.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 49.09 | 45.91 | 52.80 | 42.90 | 35.35 | 36.43 | 35.65 | 26.70 | 29.64 | 27.51 | 23.28 | 15.29 | 5.67 | 12.26 | 10.38 | 13.96 | 14.52 | 13.24 | 7.95 | 6.13 | 5.78 | 5.32 | 3.40 | 1.11 | 3.15 | 0.52 | NA | NA | |

| Comprehensive Income Net Of Tax | 3.69 | 52.55 | 69.61 | 28.16 | 29.20 | 59.16 | 45.88 | 55.48 | 38.41 | 30.27 | 16.15 | 33.41 | 10.26 | 15.25 | 5.44 | -23.91 | 17.57 | 11.16 | 5.04 | 6.13 | 5.78 | 5.32 | 3.40 | 1.11 | 3.15 | 0.52 | 2.05 | NA | |

| Net Income Loss Available To Common Stockholders Basic | 48.99 | 45.81 | 52.70 | 42.80 | 35.26 | 36.34 | 35.56 | 26.61 | 29.58 | 27.45 | 23.22 | 15.18 | 5.57 | 12.17 | 10.30 | 13.83 | 14.40 | 13.13 | 7.84 | 5.97 | 5.64 | 5.17 | 3.40 | NA | NA | NA | 2.05 | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 49.17 | 45.99 | 52.90 | 42.95 | 35.43 | 36.50 | 35.72 | 26.73 | 29.73 | 27.59 | 23.33 | 15.26 | 5.60 | 12.24 | 10.37 | 13.91 | 14.51 | 14.00 | 10.46 | 8.57 | 8.15 | 7.55 | 0.32 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

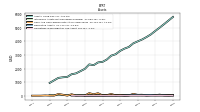

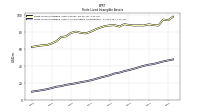

| Assets | 4768.26 | 4512.18 | 4312.82 | 4136.35 | 4000.03 | 3853.55 | 3587.48 | 3465.88 | 3298.80 | 3053.69 | 2948.67 | 2662.72 | 2488.80 | 2451.74 | 2247.24 | 2305.45 | 1975.45 | 1805.48 | 1643.30 | 1580.53 | 1380.90 | 1354.96 | 1312.41 | NA | 942.22 | NA | NA | NA | |

| Liabilities | 1781.26 | 1674.39 | 1505.56 | 1505.72 | 1503.26 | 1349.84 | 1319.50 | 1241.97 | 1254.99 | 1109.30 | 1106.10 | 1008.43 | 906.85 | 890.01 | 888.86 | 949.67 | 773.33 | 704.45 | 612.79 | 541.04 | 569.86 | 540.07 | 527.97 | NA | 760.82 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 4768.26 | 4512.18 | 4312.82 | 4136.35 | 4000.03 | 3853.55 | 3587.48 | 3465.88 | 3298.80 | 3053.69 | 2948.67 | 2662.72 | 2488.80 | 2451.74 | 2247.24 | 2305.45 | 1975.45 | 1805.48 | 1643.30 | 1580.53 | 1380.90 | 1354.96 | 1312.41 | NA | 942.22 | NA | NA | NA | |

| Stockholders Equity | 2978.58 | 2829.22 | 2798.73 | 2622.20 | 2488.26 | 2496.14 | 2260.53 | 2216.52 | 2036.57 | 1937.20 | 1835.39 | 1647.06 | 1574.76 | 1554.47 | 1351.09 | 1348.39 | 1194.45 | 1093.36 | 785.59 | 792.04 | 562.18 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 39.81 | 36.11 | 14.11 | 70.96 | 62.34 | 136.30 | 17.99 | 14.26 | 59.76 | 27.51 | 126.47 | 42.84 | 26.60 | 183.76 | 100.84 | 192.62 | 8.30 | 23.45 | 7.82 | 109.11 | 4.24 | 73.27 | 131.39 | 1.84 | 7.25 | 20.05 | 3.79 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 48.96 | 42.02 | 14.11 | 70.96 | 71.50 | 144.23 | 26.21 | 14.26 | 59.76 | 27.51 | 129.68 | 44.82 | 32.99 | 189.37 | 109.50 | 214.07 | 21.32 | 26.22 | 17.94 | 114.02 | 16.24 | 74.08 | 140.03 | 11.17 | 19.43 | 26.39 | 10.51 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Construction In Progress Gross | 96.52 | 69.11 | 59.57 | 42.78 | 34.54 | 29.97 | 22.15 | 9.32 | 8.86 | 2.80 | 4.33 | 4.03 | 3.91 | 7.24 | 10.96 | 11.56 | 12.13 | 10.23 | 7.08 | 2.46 | 1.32 | 3.93 | 11.26 | NA | 4.08 | NA | NA | NA | |

| Amortization Of Intangible Assets | 1.57 | 1.61 | 1.60 | 1.63 | 2.39 | 1.74 | 1.74 | 1.71 | 1.72 | 1.81 | 2.38 | 1.64 | 1.85 | 1.69 | 1.85 | 1.68 | 1.65 | 1.74 | 1.55 | 1.33 | 1.21 | 2.12 | 1.91 | 1.23 | 1.76 | 1.25 | 1.20 | NA | |

| Intangible Assets Net Excluding Goodwill | 47.86 | 47.78 | 49.57 | 51.22 | 53.23 | 55.59 | 54.59 | 57.12 | 59.01 | 59.74 | 59.26 | 58.74 | 57.45 | 56.91 | 58.57 | 61.24 | 60.50 | 57.47 | 58.11 | 53.86 | 52.78 | 52.28 | 53.13 | NA | 53.02 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1680.00 | 1605.00 | 1430.00 | 1430.00 | 1430.00 | 1280.00 | 1248.00 | 1177.00 | 1174.00 | 1030.00 | 1030.00 | 940.19 | 821.19 | 804.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Senior Notes | 395.85 | 395.71 | 395.57 | 395.43 | 395.29 | 395.14 | 395.00 | 394.86 | 394.72 | 394.63 | 394.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 8.42 | 8.57 | 8.53 | 8.43 | 8.51 | 7.56 | 7.45 | 7.39 | 7.24 | 7.19 | 7.18 | 7.23 | 7.19 | 7.26 | 7.30 | 7.39 | 7.66 | 7.67 | 244.92 | 247.45 | 248.86 | 250.34 | 252.23 | NA | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

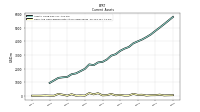

| Stockholders Equity | 2978.58 | 2829.22 | 2798.73 | 2622.20 | 2488.26 | 2496.14 | 2260.53 | 2216.52 | 2036.57 | 1937.20 | 1835.39 | 1647.06 | 1574.76 | 1554.47 | 1351.09 | 1348.39 | 1194.45 | 1093.36 | 785.59 | 792.04 | 562.18 | NA | NA | NA | NA | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2987.00 | 2837.79 | 2807.26 | 2630.63 | 2496.77 | 2503.70 | 2267.97 | 2223.91 | 2043.80 | 1944.39 | 1842.57 | 1654.28 | 1581.95 | 1561.73 | 1358.38 | 1355.78 | 1202.11 | 1101.03 | 1030.52 | 1039.49 | 811.04 | 814.89 | 784.44 | 232.75 | 181.40 | NA | NA | NA | |

| Common Stock Value | 1.65 | 1.56 | 1.55 | 1.49 | 1.42 | 1.42 | 1.33 | 1.31 | 1.25 | 1.21 | 1.18 | 1.09 | 1.06 | 1.05 | 0.93 | 0.92 | 0.84 | 0.80 | 0.58 | 0.57 | 0.43 | 0.43 | 0.40 | NA | 0.00 | NA | NA | NA | |

| Additional Paid In Capital | 3078.46 | 2885.82 | 2863.86 | 2712.80 | 2563.30 | 2561.12 | 2346.04 | 2311.92 | 2151.09 | 2057.67 | 1955.45 | 1753.85 | 1688.54 | 1652.96 | 1440.83 | 1422.17 | 1223.04 | 1120.30 | 806.38 | 805.14 | 569.41 | 568.37 | 531.59 | NA | 0.00 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -105.55 | -107.59 | -109.47 | -118.07 | -117.19 | -113.28 | -110.97 | -110.71 | -100.98 | -98.13 | -94.91 | -88.64 | -77.67 | -57.77 | -45.91 | -34.88 | -27.48 | -22.73 | -18.45 | -13.67 | -7.66 | -4.25 | 0.22 | NA | 0.00 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 4.02 | 49.42 | 42.78 | 25.98 | 40.72 | 46.87 | 24.13 | 13.99 | -14.79 | -23.56 | -26.33 | -19.25 | -37.18 | -41.77 | -44.76 | -39.82 | -1.95 | -5.00 | -2.91 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 8.42 | 8.57 | 8.53 | 8.43 | 8.51 | 7.56 | 7.45 | 7.39 | 7.24 | 7.19 | 7.18 | 7.23 | 7.19 | 7.26 | 7.30 | 7.39 | 7.66 | 7.67 | 244.92 | 247.45 | 248.86 | 250.34 | 252.23 | NA | 0.00 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

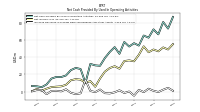

| Net Cash Provided By Used In Operating Activities | 72.59 | 62.90 | 65.40 | 53.69 | 56.45 | 52.59 | 57.88 | 44.11 | 51.88 | 46.23 | 39.15 | 30.14 | 30.62 | 32.31 | 10.11 | 26.35 | 27.66 | 25.07 | 18.86 | 16.98 | 17.14 | 15.21 | 8.35 | 5.22 | 6.18 | 6.59 | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -286.91 | -181.39 | -229.63 | -159.20 | -240.05 | -140.18 | -114.28 | -211.56 | -225.39 | -219.06 | -209.89 | -175.34 | -212.78 | -140.36 | -44.18 | -148.18 | -182.43 | -160.24 | -159.43 | -105.75 | -90.12 | -114.59 | -200.75 | -56.40 | -142.29 | -120.17 | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 221.26 | 146.41 | 107.38 | 104.97 | 110.88 | 205.60 | 68.36 | 121.95 | 205.76 | 70.66 | 255.60 | 157.03 | 25.78 | 187.91 | -70.49 | 314.59 | 149.87 | 143.44 | 44.49 | 186.55 | 15.15 | 33.44 | 321.25 | 42.92 | 129.16 | 129.46 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 72.59 | 62.90 | 65.40 | 53.69 | 56.45 | 52.59 | 57.88 | 44.11 | 51.88 | 46.23 | 39.15 | 30.14 | 30.62 | 32.31 | 10.11 | 26.35 | 27.66 | 25.07 | 18.86 | 16.98 | 17.14 | 15.21 | 8.35 | 5.22 | 6.18 | 6.59 | NA | NA | |

| Net Income Loss | 49.09 | 45.91 | 52.80 | 42.90 | 35.35 | 36.43 | 35.65 | 26.70 | 29.64 | 27.51 | 23.28 | 15.29 | 5.67 | 12.26 | 10.38 | 13.96 | 14.52 | 13.24 | 7.95 | 6.13 | 5.78 | 5.32 | 3.40 | 1.11 | 3.15 | 0.52 | NA | NA | |

| Profit Loss | 49.27 | 46.09 | 53.00 | 43.06 | 35.52 | 36.59 | 35.81 | 26.82 | 29.79 | 27.65 | 23.40 | 15.38 | 5.71 | 12.34 | 10.44 | 14.04 | 14.63 | 14.11 | 10.57 | 8.72 | 8.30 | 7.71 | 0.32 | 1.11 | 3.14 | 0.52 | 2.05 | 0.58 | |

| Depreciation Depletion And Amortization | 25.79 | 24.53 | 23.07 | 22.13 | 21.65 | 20.18 | 20.26 | 18.55 | 17.19 | 15.49 | 14.75 | 13.74 | 16.66 | 12.19 | 11.58 | 11.30 | 10.70 | 9.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -286.91 | -181.39 | -229.63 | -159.20 | -240.05 | -140.18 | -114.28 | -211.56 | -225.39 | -219.06 | -209.89 | -175.34 | -212.78 | -140.36 | -44.18 | -148.18 | -182.43 | -160.24 | -159.43 | -105.75 | -90.12 | -114.59 | -200.75 | -56.40 | -142.29 | -120.17 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 221.26 | 146.41 | 107.38 | 104.97 | 110.88 | 205.60 | 68.36 | 121.95 | 205.76 | 70.66 | 255.60 | 157.03 | 25.78 | 187.91 | -70.49 | 314.59 | 149.87 | 143.44 | 44.49 | 186.55 | 15.15 | 33.44 | 321.25 | 42.92 | 129.16 | 129.46 | NA | NA | |

| Payments Of Dividends | 43.95 | 43.70 | 41.18 | 39.40 | 38.68 | 36.07 | 34.33 | 32.61 | 30.54 | 29.70 | 26.40 | 25.70 | 24.24 | 21.54 | 21.30 | 19.39 | 17.65 | 16.92 | 16.14 | 13.19 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 97.73 | 91.66 | 86.52 | 83.69 | 74.28 | 70.66 | 71.45 | 70.12 | 65.02 | 59.60 | 57.07 | 48.55 | 41.11 | 42.91 | 38.50 | 41.49 | 39.20 | 36.29 | 32.76 | 31.11 | 28.65 | 25.74 | 21.69 | 20.17 | 17.47 | 13.58 | 13.32 | 10.09 |