| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.60 | 1.60 | 1.60 | 1.61 | 1.61 | 1.61 | 1.61 | 1.62 | 1.64 | 1.66 | 1.69 | 1.69 | 1.69 | 1.69 | 1.69 | 1.48 | 1.48 | 1.48 | 1.48 | 1.48 | 1.47 | 1.47 | 1.47 | 1.47 | 1.48 | 1.48 | 1.40 | 1.40 | 1.40 | 1.40 | 1.40 | 1.40 | 1.39 | 1.39 | 1.39 | 1.39 | 1.39 | 1.30 | 1.30 | 1.30 | 1.30 | NA | NA | NA | |

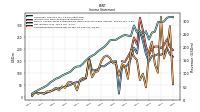

| Earnings Per Share Basic | 1.66 | 1.68 | 1.62 | 1.60 | 1.38 | 1.67 | 2.17 | 2.53 | 1.65 | 1.85 | 1.43 | 1.21 | 1.10 | 1.11 | 0.15 | 1.53 | 1.50 | 1.48 | 1.39 | 1.31 | 1.32 | 1.19 | 1.15 | 1.14 | 1.69 | 0.83 | 0.79 | 0.73 | 0.69 | 0.66 | 0.57 | 0.53 | 0.49 | 0.45 | 0.41 | 0.39 | 0.34 | 0.30 | 0.23 | 0.18 | 0.23 | NA | NA | NA | |

| Earnings Per Share Diluted | 1.64 | 1.66 | 1.61 | 1.59 | 1.37 | 1.66 | 2.16 | 2.52 | 1.64 | 1.84 | 1.42 | 1.21 | 1.10 | 1.11 | 0.15 | 1.52 | 1.49 | 1.47 | 1.39 | 1.30 | 1.31 | 1.18 | 1.14 | 1.13 | 1.65 | 0.82 | 0.77 | 0.72 | 0.68 | 0.65 | 0.57 | 0.52 | 0.48 | 0.44 | 0.41 | 0.38 | 0.33 | 0.29 | 0.23 | 0.18 | 0.22 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 297.28 | 296.11 | 260.13 | 256.25 | 230.04 | 261.77 | 244.41 | 264.61 | 256.92 | 283.54 | 243.26 | 244.80 | 247.20 | 243.04 | 236.08 | 228.84 | 228.76 | 226.39 | 211.89 | 200.53 | 193.12 | 185.00 | 173.77 | 167.46 | 161.11 | 150.20 | 137.61 | 127.59 | 126.37 | 121.25 | 108.17 | 102.47 | 97.48 | 91.74 | 84.07 | 80.01 | 72.74 | 64.62 | 54.28 | 47.82 | 42.35 | 36.45 | 29.56 | 23.03 | |

| Realized Investment Gains Losses | -4.89 | -0.23 | -1.59 | -0.49 | -5.52 | 0.17 | -0.47 | -7.35 | -0.19 | 0.22 | -0.25 | 0.64 | 0.56 | 0.27 | -1.27 | 3.13 | 0.83 | 1.15 | 0.58 | 0.66 | 0.16 | 0.52 | 0.44 | 0.20 | 0.25 | 0.56 | 0.54 | 0.66 | 0.45 | 0.43 | 0.58 | 0.47 | 0.79 | 0.55 | 0.57 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Premiums Earned Net | 245.61 | 246.81 | 213.23 | 211.26 | 207.25 | 207.93 | 212.01 | 215.33 | 217.32 | 218.72 | 217.44 | 219.07 | 222.34 | 222.26 | 211.47 | 206.50 | 207.67 | 203.47 | 188.49 | 177.79 | 173.30 | 166.68 | 156.96 | 152.56 | 147.98 | 137.94 | 126.56 | 117.65 | 116.79 | 110.80 | 100.71 | 94.40 | 89.38 | 83.69 | 78.36 | 75.04 | 67.81 | 60.32 | 50.34 | 44.75 | 40.34 | 34.28 | 27.48 | 21.26 | |

| Net Investment Income | 50.58 | 47.07 | 45.25 | 43.24 | 37.80 | 32.59 | 29.34 | 24.68 | 23.66 | 21.57 | 21.74 | 21.79 | 20.95 | 18.64 | 19.87 | 20.63 | 21.98 | 21.10 | 20.58 | 19.88 | 18.60 | 16.65 | 15.13 | 13.71 | 11.77 | 10.63 | 9.40 | 8.44 | 8.22 | 6.78 | 6.70 | 6.18 | 5.56 | 5.32 | 4.72 | 4.28 | 3.90 | 3.40 | 3.08 | 1.90 | 1.23 | 1.14 | 1.01 | 0.73 | |

| Other Income | 6.39 | 5.61 | 8.09 | 4.94 | -1.89 | 11.45 | 1.58 | 7.25 | 1.13 | 2.28 | 4.33 | 3.30 | 3.35 | 1.87 | 6.01 | -1.42 | -1.72 | 0.66 | 2.24 | 2.19 | 1.07 | 1.15 | 1.24 | 0.99 | 1.12 | 1.07 | 1.10 | 0.85 | 0.91 | 3.24 | 0.17 | 1.41 | 1.75 | 2.17 | 0.42 | 0.04 | 0.72 | 0.74 | 0.79 | 0.77 | 0.76 | 1.03 | 0.99 | 1.03 | |

| Interest Expense | 7.95 | 7.85 | 7.39 | 6.94 | 6.04 | 4.45 | 2.89 | 2.23 | 2.10 | 2.06 | 2.07 | 2.05 | 2.15 | 2.23 | 2.57 | 2.13 | 2.22 | 2.58 | 2.68 | 2.67 | 2.61 | 2.50 | 2.62 | 2.45 | 1.82 | 1.46 | 1.19 | 0.72 | 0.37 | 0.06 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 7.34 | 7.71 | 7.12 | 6.40 | 5.55 | 3.75 | 2.40 | 1.89 | 1.63 | 1.75 | 1.81 | 1.76 | 1.70 | 2.28 | 2.64 | 1.64 | 2.15 | 2.54 | 2.65 | 2.53 | 2.40 | 2.35 | 2.38 | 2.32 | 1.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 4.51 | 4.48 | 4.35 | 5.11 | 4.67 | 4.70 | 4.20 | 4.81 | 4.77 | 5.51 | 5.38 | 5.18 | 4.55 | 4.57 | 4.57 | 4.78 | 4.10 | 4.17 | 4.22 | 4.10 | 3.80 | 3.84 | 3.83 | 3.60 | 4.71 | 4.69 | 4.67 | 4.62 | 4.98 | 3.95 | 4.17 | 3.78 | 3.67 | 3.36 | 3.33 | 3.26 | 3.11 | 3.26 | 3.37 | 2.78 | 1.96 | 0.52 | 0.56 | 0.56 | |

| Income Tax Expense Benefit | 27.59 | 31.48 | 37.07 | 30.47 | 25.63 | 32.87 | 44.05 | 54.28 | 36.03 | 41.33 | 30.63 | 32.54 | 22.55 | 23.89 | 3.44 | 27.18 | 27.43 | 27.59 | 26.33 | 22.00 | 23.54 | 24.14 | 21.15 | 10.51 | -57.28 | 29.01 | 26.84 | 20.25 | 24.62 | 23.73 | 21.53 | 19.40 | 19.17 | 18.81 | 17.41 | 15.68 | 15.17 | 13.69 | 10.11 | 8.45 | 0.34 | 2.28 | -10.15 | 0.14 | |

| Income Taxes Paid | 86.37 | 18.67 | NA | NA | 24.78 | 23.53 | NA | NA | 20.80 | 15.00 | NA | NA | 11.21 | 17.50 | 10.00 | 0.00 | 8.50 | 12.00 | 21.00 | 0.01 | 10.68 | 8.20 | 10.40 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 175.37 | 177.96 | 172.23 | 170.83 | 147.37 | 178.05 | 231.77 | 274.17 | 180.99 | 205.35 | 159.79 | 135.65 | 123.60 | 124.54 | 15.38 | 149.52 | 146.96 | 144.63 | 136.41 | 127.72 | 128.53 | 116.01 | 111.75 | 111.07 | 162.64 | 78.39 | 72.12 | 66.60 | 62.69 | 59.71 | 52.26 | 47.95 | 44.48 | 40.82 | 37.19 | 34.84 | 28.87 | 25.07 | 19.55 | 15.01 | 19.02 | 15.62 | 23.58 | 7.20 | |

| Comprehensive Income Net Of Tax | 331.25 | 101.71 | 136.13 | 229.58 | 188.15 | 41.04 | 97.50 | 71.16 | 153.18 | 168.44 | 196.16 | 76.44 | 129.44 | 136.57 | 89.67 | 139.45 | 140.42 | 162.00 | 172.39 | 166.09 | 146.98 | 107.81 | 104.51 | 82.32 | 155.41 | 80.37 | 80.59 | 71.45 | 28.48 | 57.70 | 62.96 | 61.31 | 39.33 | 45.08 | 28.42 | 39.73 | 30.99 | 23.66 | 24.47 | 15.48 | 18.58 | 16.25 | 19.78 | 6.94 | |

| Net Income Loss Available To Common Stockholders Basic | 175.37 | 177.96 | 172.23 | 170.83 | 147.37 | 178.05 | 231.77 | 274.17 | 180.99 | 205.35 | 159.79 | 135.65 | 123.60 | 124.54 | 15.38 | 149.52 | 146.96 | 144.63 | 136.41 | 127.72 | 128.53 | 116.01 | 111.75 | 111.07 | 162.64 | 78.39 | 72.12 | 66.60 | 62.69 | 59.71 | 52.26 | 47.95 | 44.48 | 40.82 | 37.19 | 34.84 | 28.87 | 25.07 | 19.55 | 15.01 | 12.04 | 15.62 | 23.58 | 7.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

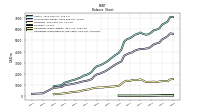

| Assets | 6426.67 | 6094.20 | 5983.31 | 5927.51 | 5723.80 | 5556.90 | 5521.10 | 5586.15 | 5722.17 | 5589.52 | 5521.79 | 5331.85 | 5202.72 | 5107.09 | 4899.95 | 4186.93 | 3873.43 | 3722.05 | 3539.90 | 3353.24 | 3149.97 | 2993.42 | 2849.43 | 2741.22 | 2674.37 | 2485.59 | 2152.89 | 1987.70 | 1883.00 | 1817.73 | 1658.21 | 1565.73 | 1469.10 | 1411.93 | 1327.49 | 1250.09 | 1181.46 | 991.60 | 925.37 | 905.05 | 853.97 | NA | NA | NA | |

| Liabilities | 1324.12 | 1286.19 | 1249.96 | 1278.57 | 1261.49 | 1262.70 | 1249.11 | 1371.08 | 1486.06 | 1421.53 | 1436.96 | 1410.91 | 1340.09 | 1360.54 | 1276.62 | 1079.86 | 888.58 | 866.88 | 835.61 | 825.44 | 784.25 | 778.28 | 745.86 | 745.93 | 733.93 | 705.02 | 655.00 | 574.95 | 539.23 | 507.51 | 409.60 | 384.24 | 349.86 | 335.70 | 299.71 | 254.07 | 225.72 | 196.71 | 157.41 | 164.92 | 131.83 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 6426.67 | 6094.20 | 5983.31 | 5927.51 | 5723.80 | 5556.90 | 5521.10 | 5586.15 | 5722.17 | 5589.52 | 5521.79 | 5331.85 | 5202.72 | 5107.09 | 4899.95 | 4186.93 | 3873.43 | 3722.05 | 3539.90 | 3353.24 | 3149.97 | 2993.42 | 2849.43 | 2741.22 | 2674.37 | 2485.59 | 2152.89 | 1987.70 | 1883.00 | 1817.73 | 1658.21 | 1565.73 | 1469.10 | 1411.93 | 1327.49 | 1250.09 | 1181.46 | 991.60 | 925.37 | 905.05 | 853.97 | NA | NA | NA | |

| Stockholders Equity | 5102.55 | 4808.01 | 4733.35 | 4648.94 | 4462.31 | 4294.21 | 4271.99 | 4215.07 | 4236.11 | 4167.98 | 4084.83 | 3920.94 | 3862.63 | 3746.54 | 3623.33 | 3107.07 | 2984.84 | 2855.17 | 2704.29 | 2527.80 | 2365.72 | 2215.14 | 2103.57 | 1995.29 | 1940.44 | 1780.57 | 1497.90 | 1412.75 | 1343.77 | 1310.21 | 1248.61 | 1181.49 | 1119.24 | 1076.24 | 1027.77 | 996.02 | 955.74 | 794.89 | 767.96 | 740.13 | 722.14 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

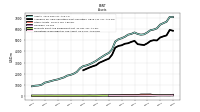

| Cash | 141.79 | 96.78 | 68.10 | 68.63 | 81.24 | 79.47 | 77.85 | 203.84 | 81.49 | 65.83 | 142.14 | 81.02 | 102.83 | 118.69 | 72.79 | 31.05 | 71.35 | 49.58 | 25.25 | 40.49 | 64.95 | 29.80 | 24.66 | 32.96 | 43.52 | 57.74 | 27.67 | 19.71 | 27.53 | 16.34 | 16.17 | 28.21 | 24.61 | 18.72 | 25.59 | 21.90 | 24.41 | 17.57 | 14.18 | 8.84 | 477.65 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 141.79 | 96.78 | 68.10 | 68.63 | 81.24 | 79.47 | 77.85 | 203.84 | 81.49 | 65.83 | 142.14 | 81.02 | 102.83 | 118.69 | 72.79 | 31.05 | 71.35 | 49.58 | 25.25 | 40.49 | 64.95 | 29.80 | 24.66 | 32.96 | 43.52 | NA | NA | NA | 27.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 5263.74 | 4997.69 | 5022.09 | 4950.04 | 4741.62 | 4584.84 | 4620.34 | 4662.90 | 4962.89 | 4870.02 | 4746.33 | 4701.48 | 4565.37 | 4502.35 | 4352.10 | 3705.53 | 3350.75 | 3234.61 | 3100.21 | 2976.09 | 2760.07 | 2665.75 | 2556.01 | NA | 2305.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 80.23 | NA | NA | NA | 73.81 | NA | NA | NA | 69.85 | NA | NA | NA | 67.35 | NA | NA | NA | 64.91 | NA | NA | NA | 61.50 | NA | NA | NA | 57.45 | NA | NA | NA | 54.66 | NA | NA | NA | 51.50 | NA | NA | NA | 45.10 | NA | NA | NA | 41.21 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 71.17 | 70.01 | 68.79 | 68.05 | 67.35 | 66.56 | 65.82 | 65.09 | 64.34 | 63.55 | 62.69 | 61.83 | 60.97 | 60.16 | 59.37 | 58.52 | 57.64 | 56.64 | 55.70 | 54.77 | 53.87 | 53.01 | 52.20 | 51.36 | 50.47 | 49.50 | 48.51 | 47.54 | 46.54 | 45.57 | 44.52 | 43.48 | 42.48 | 41.65 | 40.84 | 39.99 | 39.26 | 38.63 | 38.01 | 37.34 | 36.80 | NA | NA | NA | |

| Property Plant And Equipment Net | 41.30 | 40.71 | 31.32 | 18.51 | 19.57 | 19.78 | 20.57 | 20.31 | 11.92 | 12.48 | 12.99 | 14.26 | 15.10 | 14.60 | 15.46 | 16.32 | 17.31 | 16.79 | 17.32 | 17.94 | 7.63 | 7.39 | 7.29 | 6.59 | 6.98 | 7.83 | 7.96 | 8.21 | 8.12 | 8.29 | 9.03 | 9.23 | 9.02 | 8.13 | 8.63 | 8.07 | 5.84 | 5.20 | 4.87 | 4.37 | 4.41 | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | 72.83 | 64.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 5586.73 | 5502.93 | 5438.29 | 5325.09 | 5184.86 | 5075.98 | 4952.47 | 4836.53 | 4897.61 | 4772.40 | 4625.59 | 4616.90 | 4404.69 | 4346.55 | 4209.81 | 3656.35 | 3282.59 | 3158.53 | 3044.44 | 2963.19 | 2793.35 | 2719.76 | 2600.47 | NA | 2306.91 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deferred Income Tax Liabilities Net | 362.75 | 329.72 | 328.34 | 383.12 | 356.81 | 340.63 | 348.37 | 359.92 | 373.65 | 356.83 | 343.10 | 318.62 | 305.11 | 281.51 | 272.75 | 259.69 | 249.62 | 236.64 | 216.66 | 196.04 | 172.64 | NA | NA | NA | 127.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

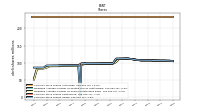

| Stockholders Equity | 5102.55 | 4808.01 | 4733.35 | 4648.94 | 4462.31 | 4294.21 | 4271.99 | 4215.07 | 4236.11 | 4167.98 | 4084.83 | 3920.94 | 3862.63 | 3746.54 | 3623.33 | 3107.07 | 2984.84 | 2855.17 | 2704.29 | 2527.80 | 2365.72 | 2215.14 | 2103.57 | 1995.29 | 1940.44 | 1780.57 | 1497.90 | 1412.75 | 1343.77 | 1310.21 | 1248.61 | 1181.49 | 1119.24 | 1076.24 | 1027.77 | 996.02 | 955.74 | 794.89 | 767.96 | 740.13 | 722.14 | NA | NA | NA | |

| Common Stock Value | 1.60 | 1.60 | 1.60 | 1.61 | 1.61 | 1.61 | 1.61 | 1.62 | 1.64 | 1.66 | 1.69 | 1.69 | 1.69 | 1.69 | 1.69 | 1.48 | 1.48 | 1.48 | 1.48 | 1.48 | 1.47 | 1.47 | 1.47 | 1.47 | 1.48 | 1.48 | 1.40 | 1.40 | 1.40 | 1.40 | 1.40 | 1.40 | 1.39 | 1.39 | 1.39 | 1.39 | 1.39 | 1.30 | 1.30 | 1.30 | 1.30 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1299.87 | 1309.72 | 1309.83 | 1334.61 | 1350.38 | 1345.60 | 1340.65 | 1358.58 | 1428.95 | 1493.01 | 1558.14 | 1571.13 | 1571.16 | 1566.45 | 1561.74 | 1117.29 | 1118.65 | 1114.59 | 1110.89 | 1106.80 | 1110.80 | 1107.21 | 1103.45 | 1099.68 | 1127.14 | 1122.68 | 920.45 | 915.89 | 918.30 | 913.22 | 909.31 | 905.16 | 904.22 | 900.55 | 897.17 | 893.84 | 893.28 | 763.52 | 760.25 | 756.89 | 754.39 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 4081.58 | 3933.07 | 3782.05 | 3636.76 | 3493.11 | 3370.57 | 3216.30 | 3007.16 | 2754.81 | 2594.80 | 2409.57 | 2269.04 | 2151.51 | 2045.98 | 1939.51 | 1942.20 | 1808.53 | 1676.38 | 1546.56 | 1410.16 | 1282.44 | 1153.91 | 1037.90 | 926.14 | 815.08 | 653.37 | 574.98 | 502.86 | 436.33 | 373.65 | 313.94 | 261.68 | 213.73 | 169.25 | 128.43 | 91.24 | 56.40 | 27.53 | 2.46 | -17.09 | -32.10 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -280.50 | -436.38 | -360.13 | -324.04 | -382.79 | -423.58 | -286.57 | -152.30 | 50.71 | 78.51 | 115.43 | 79.07 | 138.27 | 132.43 | 120.40 | 46.11 | 56.19 | 62.73 | 45.36 | 9.37 | -28.99 | -47.45 | -39.25 | -32.00 | -3.25 | 3.04 | 1.06 | -7.41 | -12.26 | 21.95 | 23.96 | 13.26 | -0.10 | 5.05 | 0.79 | 9.56 | 4.67 | 2.54 | 3.95 | -0.97 | -1.45 | -1.01 | -1.64 | 2.16 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

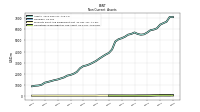

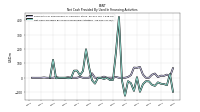

| Net Cash Provided By Used In Operating Activities | 215.45 | 195.05 | 167.71 | 184.79 | 172.36 | 172.56 | 63.27 | 180.63 | 191.09 | 178.37 | 152.02 | 187.77 | 179.43 | 202.72 | 182.65 | 163.13 | 165.27 | 159.09 | 126.80 | 138.68 | 139.37 | 143.30 | 120.79 | 221.87 | 116.55 | 107.62 | 66.52 | 77.89 | 74.65 | 76.76 | 54.58 | 67.49 | 64.95 | 69.34 | 42.67 | 47.18 | 52.14 | 56.32 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -129.23 | -134.84 | -112.17 | -149.34 | -145.86 | -147.41 | -144.49 | 38.89 | -179.75 | -163.90 | -53.26 | -186.26 | -71.10 | -138.42 | -563.47 | -381.43 | -128.66 | -119.48 | -141.90 | -155.04 | -103.94 | -138.09 | -88.50 | -216.36 | -205.04 | -275.64 | -105.88 | -103.58 | -113.55 | -126.22 | -64.50 | -61.05 | -59.07 | -76.23 | -38.98 | -46.44 | -170.08 | -52.94 | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -41.22 | -31.54 | -56.08 | -48.05 | -24.73 | -23.53 | -44.77 | -97.17 | 4.33 | -90.79 | -37.65 | -23.32 | -124.19 | -18.39 | 422.55 | 178.00 | -14.84 | -15.29 | -0.14 | -8.10 | -0.27 | -0.07 | -40.58 | -16.07 | 74.28 | 198.09 | 47.32 | 17.87 | 50.09 | 49.62 | -2.11 | -2.84 | -0.00 | 0.02 | -0.00 | -3.25 | 124.78 | 0.01 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 215.45 | 195.05 | 167.71 | 184.79 | 172.36 | 172.56 | 63.27 | 180.63 | 191.09 | 178.37 | 152.02 | 187.77 | 179.43 | 202.72 | 182.65 | 163.13 | 165.27 | 159.09 | 126.80 | 138.68 | 139.37 | 143.30 | 120.79 | 221.87 | 116.55 | 107.62 | 66.52 | 77.89 | 74.65 | 76.76 | 54.58 | 67.49 | 64.95 | 69.34 | 42.67 | 47.18 | 52.14 | 56.32 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 175.37 | 177.96 | 172.23 | 170.83 | 147.37 | 178.05 | 231.77 | 274.17 | 180.99 | 205.35 | 159.79 | 135.65 | 123.60 | 124.54 | 15.38 | 149.52 | 146.96 | 144.63 | 136.41 | 127.72 | 128.53 | 116.01 | 111.75 | 111.07 | 162.64 | 78.39 | 72.12 | 66.60 | 62.69 | 59.71 | 52.26 | 47.95 | 44.48 | 40.82 | 37.19 | 34.84 | 28.87 | 25.07 | 19.55 | 15.01 | 19.02 | 15.62 | 23.58 | 7.20 | |

| Depreciation Depletion And Amortization | 1.34 | 1.74 | 0.74 | 0.70 | 0.79 | 0.74 | 0.73 | 0.76 | 0.80 | 0.85 | 0.86 | 0.86 | 0.81 | 0.79 | 0.86 | 0.88 | 1.00 | 0.94 | 0.93 | 0.90 | 0.86 | 0.81 | 0.84 | 0.90 | 0.97 | 0.98 | 0.97 | 1.00 | 0.98 | 1.05 | 1.04 | 1.00 | 0.83 | 0.81 | 0.85 | 0.73 | 0.63 | 0.62 | 0.67 | 0.55 | 0.62 | 0.53 | 0.52 | 0.58 | |

| Increase Decrease In Accounts Receivable | -4.59 | 1.36 | 2.71 | 2.60 | -0.60 | 7.38 | 5.44 | -1.01 | -1.56 | 1.69 | 0.40 | -3.87 | 4.13 | 5.95 | -0.43 | -0.81 | 1.23 | 1.03 | 0.19 | 1.32 | 1.28 | 2.67 | 0.94 | 2.24 | 0.50 | 3.52 | 2.25 | 1.89 | 1.34 | 1.14 | 1.92 | 0.56 | 0.01 | 1.66 | 0.01 | 1.15 | 0.64 | 1.42 | 1.40 | 0.34 | 0.99 | -1.48 | 4.55 | 1.05 | |

| Deferred Income Tax Expense Benefit | 6.34 | 13.27 | -49.73 | 16.88 | 9.06 | 14.25 | 12.69 | 22.16 | 21.35 | 22.34 | 16.62 | 23.71 | 21.24 | 4.90 | -4.53 | 17.05 | 14.16 | 16.34 | 13.53 | 15.45 | 15.02 | 8.89 | 16.90 | 9.88 | -68.46 | 16.08 | 14.91 | 18.04 | 14.75 | 14.55 | 13.02 | 15.24 | 12.08 | 11.12 | 14.68 | 14.28 | 14.20 | 13.10 | 10.21 | 7.11 | -0.19 | 1.93 | -10.15 | 0.14 | |

| Share Based Compensation | 4.51 | 4.48 | 4.35 | 5.11 | 4.67 | 4.70 | 4.20 | 4.81 | 4.77 | 5.51 | 5.38 | 5.18 | 4.55 | 4.57 | 4.57 | 4.78 | 4.10 | 4.17 | 4.22 | 4.10 | 3.80 | 3.84 | 3.83 | 3.60 | 4.71 | 4.69 | 4.67 | 4.62 | 4.98 | 3.95 | 4.17 | 3.78 | 3.67 | 3.36 | 3.33 | 3.26 | 3.11 | 3.26 | 3.37 | 2.78 | 1.96 | 0.52 | 0.56 | 0.56 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

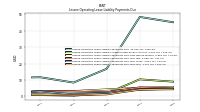

| Net Cash Provided By Used In Investing Activities | -129.23 | -134.84 | -112.17 | -149.34 | -145.86 | -147.41 | -144.49 | 38.89 | -179.75 | -163.90 | -53.26 | -186.26 | -71.10 | -138.42 | -563.47 | -381.43 | -128.66 | -119.48 | -141.90 | -155.04 | -103.94 | -138.09 | -88.50 | -216.36 | -205.04 | -275.64 | -105.88 | -103.58 | -113.55 | -126.22 | -64.50 | -61.05 | -59.07 | -76.23 | -38.98 | -46.44 | -170.08 | -52.94 | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 2.16 | 1.05 | 0.41 | 0.39 | 1.47 | 0.86 | 0.93 | 0.72 | 0.80 | 0.93 | 0.19 | 0.57 | 1.09 | 0.42 | 0.47 | 0.47 | 1.11 | 0.53 | 0.76 | 1.01 | 1.11 | 0.90 | 1.54 | 0.51 | 0.12 | 0.85 | 0.72 | 1.09 | 0.80 | 0.31 | 0.84 | 1.21 | 1.73 | 0.30 | 1.41 | 1.53 | 1.27 | 0.95 | 1.16 | 0.51 | 0.66 | 0.94 | 0.68 | 0.39 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -41.22 | -31.54 | -56.08 | -48.05 | -24.73 | -23.53 | -44.77 | -97.17 | 4.33 | -90.79 | -37.65 | -23.32 | -124.19 | -18.39 | 422.55 | 178.00 | -14.84 | -15.29 | -0.14 | -8.10 | -0.27 | -0.07 | -40.58 | -16.07 | 74.28 | 198.09 | 47.32 | 17.87 | 50.09 | 49.62 | -2.11 | -2.84 | -0.00 | 0.02 | -0.00 | -3.25 | 124.78 | 0.01 | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 26.42 | 26.50 | 26.53 | 26.77 | 24.58 | 23.51 | 22.44 | 21.59 | 20.78 | 19.93 | 19.07 | 17.94 | 17.91 | 17.91 | 17.91 | 15.69 | 14.68 | 14.67 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 14.80 | 5.04 | 29.55 | 21.28 | 0.14 | 0.02 | 22.33 | 75.42 | 69.04 | 70.86 | 18.58 | 5.38 | 0.00 | 0.00 | 0.05 | 6.31 | 0.16 | 0.62 | 0.12 | 8.10 | 0.21 | 0.08 | 0.06 | 31.07 | 0.25 | 0.09 | 0.11 | 7.13 | 0.06 | 0.09 | 0.03 | 3.84 | 0.03 | 0.06 | 0.06 | 5.02 | 0.08 | 0.04 | 0.06 | 2.33 | 0.08 | 0.03 | 0.00 | 0.19 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 297.28 | 296.11 | 260.13 | 256.25 | 230.04 | 261.77 | 244.41 | 264.61 | 256.92 | 283.54 | 243.26 | 244.80 | 247.20 | 243.04 | 236.08 | 228.84 | 228.76 | 226.39 | 211.89 | 200.53 | 193.12 | 185.00 | 173.77 | 167.46 | 161.11 | 150.20 | 137.61 | 127.59 | 126.37 | 121.25 | 108.17 | 102.47 | 97.48 | 91.74 | 84.07 | 80.01 | 72.74 | 64.62 | 54.28 | 47.82 | 42.35 | 36.45 | 29.56 | 23.03 |