| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

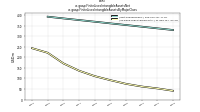

| Weighted Average Number Of Diluted Shares Outstanding | 266.07 | 264.20 | 265.20 | NA | 267.12 | 270.08 | 273.76 | NA | 277.72 | 278.44 | 277.88 | NA | 280.94 | 283.38 | 292.64 | NA | 298.15 | 298.13 | 298.05 | NA | 297.48 | 297.24 | 296.83 | NA | 297.87 | 298.40 | 297.96 | NA | 280.61 | 266.17 | 266.64 | NA | 265.87 | 265.87 | 265.81 | NA | 263.04 | 95.61 | 244.43 | 244.42 | NA | NA | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 161.85 | 160.03 | 161.34 | NA | 162.16 | 167.12 | 169.73 | NA | 172.49 | 171.62 | 171.74 | NA | 173.05 | 175.43 | 181.74 | NA | 178.35 | 176.80 | 175.85 | NA | 167.66 | 165.26 | 162.67 | NA | 158.10 | 157.92 | 156.49 | NA | 136.83 | 122.50 | 120.78 | NA | 115.90 | 112.85 | 109.40 | NA | 97.73 | 95.57 | 95.47 | 95.46 | NA | NA | NA | NA | NA | NA | NA | |

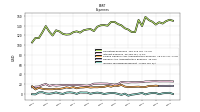

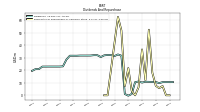

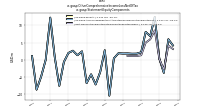

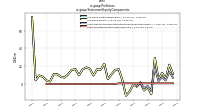

| Earnings Per Share Basic | 0.07 | 0.14 | 0.04 | 0.08 | 0.03 | 0.18 | -0.07 | -0.02 | -0.04 | 0.01 | -0.02 | -0.01 | -0.05 | -0.07 | 0.02 | 0.10 | 0.09 | 0.06 | 0.03 | 0.13 | 0.10 | 0.10 | 0.06 | 0.11 | 0.12 | 0.10 | 0.06 | 0.11 | 0.12 | 0.09 | 0.06 | 0.07 | 0.10 | 0.10 | 0.03 | 0.04 | 0.09 | 0.10 | 0.05 | 0.79 | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.07 | 0.14 | 0.04 | 0.08 | 0.03 | 0.18 | -0.07 | -0.02 | -0.04 | 0.01 | -0.02 | -0.01 | -0.05 | -0.07 | 0.02 | 0.10 | 0.09 | 0.06 | 0.03 | 0.13 | 0.10 | 0.10 | 0.06 | 0.10 | 0.12 | 0.10 | 0.06 | 0.11 | 0.12 | 0.09 | 0.06 | 0.07 | 0.10 | 0.10 | 0.03 | 0.04 | 0.09 | 0.10 | 0.05 | 0.79 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

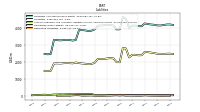

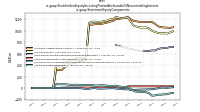

| Revenues | 191.53 | 190.54 | 164.62 | 181.27 | 183.71 | 198.02 | 164.03 | 160.33 | 165.05 | 153.41 | 145.30 | 151.40 | 146.57 | 141.03 | 170.22 | 194.93 | 192.87 | 176.24 | 167.29 | 199.31 | 186.40 | 178.53 | 168.50 | 183.07 | 187.32 | 177.12 | 164.95 | 179.26 | 175.85 | 165.81 | 157.07 | 165.20 | 175.78 | 164.77 | 151.88 | 170.41 | 169.44 | 155.17 | 140.31 | 149.39 | 62.28 | 59.57 | 62.42 | 83.63 | 59.41 | 57.40 | 59.84 | |

| Operating Expenses | 149.27 | 144.35 | 147.13 | 142.32 | 148.19 | 151.52 | 157.99 | 139.24 | 151.84 | 126.92 | 126.95 | 131.97 | 134.65 | 140.70 | 143.25 | 147.82 | 147.59 | 140.00 | 141.22 | 140.82 | 137.86 | 128.86 | 133.11 | 132.11 | 130.54 | 125.69 | 128.29 | 126.61 | 122.26 | 121.62 | 122.96 | 127.97 | 130.44 | 119.73 | 128.12 | 139.13 | 126.03 | 114.52 | 114.74 | 105.43 | NA | NA | NA | NA | NA | NA | NA | |

| Operating Costs And Expenses | 42.82 | 39.52 | 42.04 | 39.06 | 42.80 | 37.43 | 38.64 | 34.56 | 33.36 | 28.79 | 30.28 | 31.09 | 33.84 | 29.75 | 41.47 | 43.90 | 47.89 | 40.23 | 42.95 | 41.00 | 42.77 | 39.42 | 44.19 | 41.52 | 41.27 | 38.53 | 42.21 | 38.77 | 38.59 | 37.39 | 39.10 | 38.92 | 41.66 | 37.94 | 42.45 | 41.75 | 38.29 | 35.60 | 36.31 | 34.45 | NA | NA | NA | NA | NA | NA | NA | |

| Selling General And Administrative Expense | 16.01 | 16.07 | 15.71 | 16.48 | 15.72 | 15.88 | 13.69 | 13.58 | 14.43 | 14.09 | 13.85 | 13.63 | 14.52 | 18.15 | 15.95 | 16.62 | 14.42 | 16.00 | 14.03 | 13.67 | 13.15 | 13.22 | 12.63 | 13.75 | 12.90 | 12.58 | 11.09 | 13.46 | 11.80 | 12.91 | 10.92 | 9.68 | 10.18 | 9.11 | 9.10 | 9.25 | 10.07 | 12.19 | 8.68 | 15.25 | NA | NA | NA | NA | NA | NA | NA | |

| Operating Income Loss | 42.26 | 46.19 | 17.49 | 38.95 | 35.53 | 46.50 | 6.05 | 21.10 | 13.20 | 26.48 | 18.35 | 19.43 | 11.93 | 0.33 | 26.97 | 47.11 | 45.28 | 36.24 | 26.08 | 58.49 | 48.54 | 49.66 | 35.39 | 50.96 | 56.78 | 51.43 | 36.67 | 52.65 | 53.59 | 44.19 | 34.11 | 37.23 | 45.34 | 45.04 | 23.76 | 31.28 | 43.41 | 40.65 | 25.57 | 22.16 | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 25.38 | 25.41 | 25.30 | 25.63 | 25.52 | 25.04 | 25.01 | 23.84 | 23.58 | 23.42 | 23.55 | 23.00 | 23.36 | 23.93 | 19.62 | 18.53 | 19.43 | 20.60 | 20.69 | 20.85 | 20.66 | 20.52 | 17.59 | 16.36 | 16.89 | 17.48 | 17.74 | 17.84 | 17.94 | 17.42 | 17.95 | 17.19 | 16.68 | 17.57 | 16.05 | 19.82 | 17.67 | 14.63 | 14.34 | 13.15 | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 23.62 | 23.11 | 23.01 | 23.34 | 27.47 | 20.54 | 19.66 | 19.40 | 19.57 | 19.40 | 19.24 | 18.25 | 19.43 | 20.66 | 17.08 | 17.16 | 20.81 | 17.59 | 20.77 | 17.56 | 20.64 | 18.97 | 16.99 | 12.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 1.41 | 0.73 | -1.22 | 1.32 | 1.46 | 0.36 | -1.60 | 1.54 | 0.02 | -1.19 | -2.11 | -4.18 | 0.04 | -2.45 | -0.38 | 1.21 | 1.34 | 0.61 | -0.73 | 1.31 | 2.13 | 1.46 | -0.26 | 2.34 | 2.25 | 2.56 | -0.47 | 1.81 | 2.75 | 2.13 | -0.54 | 0.67 | 2.58 | 0.88 | -0.18 | 0.50 | 3.00 | 2.63 | -1.48 | -1.12 | NA | NA | NA | NA | NA | NA | NA | |

| Income Taxes Paid | 0.17 | 0.12 | 0.28 | 0.01 | -0.08 | 0.17 | 0.09 | 0.17 | 0.17 | 0.29 | 0.01 | 0.09 | 0.29 | 0.01 | 0.90 | 0.18 | 0.15 | 0.37 | 1.07 | 1.16 | 0.99 | 2.04 | 0.66 | 0.78 | 1.99 | 2.51 | 0.51 | 2.74 | 1.44 | 1.40 | 0.66 | 1.21 | 0.55 | 1.27 | 1.43 | 1.02 | 1.07 | 1.55 | 0.05 | 0.33 | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 19.93 | 36.95 | 11.69 | 21.62 | 10.12 | 48.70 | -17.22 | -4.07 | -10.18 | 4.41 | -3.19 | 0.71 | -12.27 | -19.62 | 8.29 | 28.72 | 26.78 | 18.93 | 9.86 | 39.78 | 29.23 | 30.18 | 18.06 | 32.26 | 35.49 | 31.36 | 19.14 | 33.01 | 32.90 | 24.64 | 16.70 | 19.37 | 26.09 | 26.59 | 7.89 | 10.96 | 22.73 | 25.28 | 11.23 | 148.92 | 2.28 | 3.07 | 1.93 | 22.04 | 9.02 | 6.77 | 10.81 | |

| Other Comprehensive Income Loss Net Of Tax | 7.25 | 10.05 | -6.67 | 0.44 | 20.98 | 12.80 | 13.06 | 3.45 | 2.82 | 2.80 | 2.93 | 2.90 | 2.94 | 0.61 | -16.90 | 4.77 | -5.94 | -12.18 | -7.24 | -12.27 | 4.31 | 2.30 | 4.78 | 3.74 | -1.28 | -14.37 | 1.39 | 26.25 | 0.93 | -10.86 | -19.37 | 2.46 | -4.38 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | |

| Comprehensive Income Net Of Tax | 15.70 | 27.81 | 2.68 | 12.86 | 18.02 | 36.46 | -3.19 | -1.03 | -5.22 | 3.81 | -0.81 | 1.58 | -6.33 | -12.42 | -6.00 | 19.56 | 12.29 | 3.86 | 1.41 | 16.00 | 18.77 | 17.95 | 12.39 | 19.24 | 18.11 | 8.96 | 10.72 | 29.23 | 15.92 | 6.12 | -1.30 | 8.63 | 9.55 | 11.12 | 3.14 | 3.90 | 8.56 | NA | NA | 75.25 | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 11.56 | 21.85 | 6.52 | 12.60 | 5.56 | 29.58 | -11.29 | -3.19 | -6.98 | 2.08 | -2.62 | -0.21 | -8.20 | -12.79 | 4.50 | 16.80 | 15.88 | 11.09 | 5.68 | 22.84 | 16.34 | 16.65 | 9.77 | 17.27 | 18.81 | 16.58 | 9.98 | 16.97 | 15.97 | 11.09 | 7.43 | 8.25 | 11.22 | 11.12 | 3.14 | 4.14 | 8.32 | 9.83 | 4.37 | 75.25 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

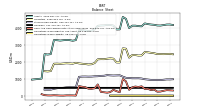

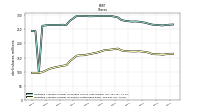

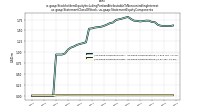

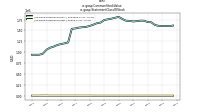

| Assets | 4216.55 | 4184.77 | 4157.36 | 4163.59 | 4201.14 | 4217.23 | 4243.33 | 4282.45 | 4112.16 | 4123.47 | 4151.52 | 4150.69 | 4010.71 | 4550.40 | 4664.56 | 3931.83 | 3925.32 | 4155.57 | 4192.44 | 4195.78 | 4166.83 | 4162.90 | 4141.81 | 3931.35 | 3848.93 | 3831.20 | 3866.18 | 3890.95 | 3882.57 | 3301.65 | 3263.37 | 3300.65 | 3308.77 | 3293.96 | 3272.99 | 3296.49 | 3302.02 | 2476.62 | 2450.42 | 2476.06 | NA | NA | NA | 975.67 | NA | NA | NA | |

| Liabilities | 2483.23 | 2473.16 | 2480.30 | 2480.50 | 2527.31 | 2551.14 | 2581.30 | 2598.11 | 2398.48 | 2390.26 | 2420.33 | 2419.39 | 2266.90 | 2794.36 | 2814.68 | 1983.92 | 1984.97 | 2207.54 | 2225.24 | 2204.67 | 2177.38 | 2179.76 | 2168.47 | 1953.61 | 1878.71 | 1867.25 | 1891.25 | 1908.09 | 1929.73 | 1964.88 | 1914.40 | 1927.96 | 1936.16 | 1921.42 | 1905.28 | 1915.40 | 1908.91 | 1476.78 | 1455.88 | 1472.88 | NA | NA | NA | NA | NA | NA | NA | |

| Liabilities And Stockholders Equity | 4216.55 | 4184.77 | 4157.36 | 4163.59 | 4201.14 | 4217.23 | 4243.33 | 4282.45 | 4112.16 | 4123.47 | 4151.52 | 4150.69 | 4010.71 | 4550.40 | 4664.56 | 3931.83 | 3925.32 | 4155.57 | 4192.44 | 4195.78 | 4166.83 | 4162.90 | 4141.81 | 3931.35 | 3848.93 | 3831.20 | 3866.18 | 3890.95 | 3882.57 | 3301.65 | 3263.37 | 3300.65 | 3308.77 | 3293.96 | 3272.99 | 3296.49 | 3302.02 | 2476.62 | 2450.42 | 2476.06 | NA | NA | NA | NA | NA | NA | NA | |

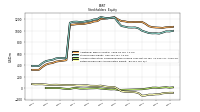

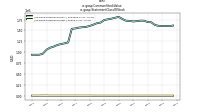

| Stockholders Equity | 987.08 | 965.95 | 948.25 | 954.38 | 952.38 | 957.80 | 978.42 | 998.13 | 1038.98 | 1055.66 | 1053.49 | 1055.25 | 1069.27 | 1080.22 | 1148.58 | 1228.52 | 1222.02 | 1215.65 | 1224.69 | 1238.48 | 1201.55 | 1194.53 | 1173.53 | 1168.28 | 1153.63 | 1150.14 | 1156.27 | 1154.14 | 1137.56 | 521.60 | 520.07 | 524.73 | 516.57 | 492.68 | 482.04 | 468.64 | 432.76 | 383.41 | 381.52 | 385.16 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

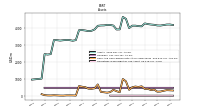

| Cash And Cash Equivalents At Carrying Value | 354.00 | 315.36 | 272.65 | 264.43 | 387.25 | 359.42 | 429.72 | 423.69 | 582.19 | 540.60 | 567.10 | 526.71 | 373.09 | 872.97 | 1008.98 | 233.95 | 293.71 | 375.33 | 242.91 | 204.98 | 229.75 | 251.80 | 690.47 | 464.34 | 432.11 | 440.96 | 532.44 | 554.37 | 594.30 | 35.45 | 44.44 | 46.69 | 46.39 | 34.22 | 36.46 | 45.73 | 52.92 | 41.79 | 44.70 | 60.74 | NA | NA | NA | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 420.95 | 395.81 | 380.83 | 314.68 | 439.81 | 412.76 | 482.67 | 474.64 | 620.97 | 578.57 | 607.40 | 567.94 | 427.95 | 931.85 | 1045.86 | 271.60 | 330.32 | 413.38 | 304.68 | 270.81 | 284.10 | 310.52 | 752.17 | 530.20 | 496.12 | 508.97 | 594.91 | 615.88 | NA | NA | NA | 112.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 366.36 | 361.50 | 361.50 | 365.54 | 334.60 | 334.60 | 336.28 | 336.28 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.20 | 201.17 | 187.57 | 187.57 | 187.57 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.50 | 491.48 | 491.48 | 491.48 | 491.50 | 491.48 | 491.50 | 491.48 | 491.48 | 491.50 | 491.50 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | 491.48 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

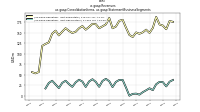

| Stockholders Equity | 987.08 | 965.95 | 948.25 | 954.38 | 952.38 | 957.80 | 978.42 | 998.13 | 1038.98 | 1055.66 | 1053.49 | 1055.25 | 1069.27 | 1080.22 | 1148.58 | 1228.52 | 1222.02 | 1215.65 | 1224.69 | 1238.48 | 1201.55 | 1194.53 | 1173.53 | 1168.28 | 1153.63 | 1150.14 | 1156.27 | 1154.14 | 1137.56 | 521.60 | 520.07 | 524.73 | 516.57 | 492.68 | 482.04 | 468.64 | 432.76 | 383.41 | 381.52 | 385.16 | NA | NA | NA | NA | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1733.32 | 1711.61 | 1677.07 | 1683.09 | 1673.83 | 1666.09 | 1662.03 | 1684.33 | 1713.68 | 1733.21 | 1731.19 | 1731.31 | 1743.82 | 1756.04 | 1849.88 | 1947.91 | 1940.35 | 1948.03 | 1967.20 | 1991.11 | 1989.45 | 1983.14 | 1973.34 | 1977.74 | 1970.23 | 1963.95 | 1974.93 | 1982.86 | 1952.84 | 1336.77 | 1348.97 | 1372.69 | 1372.61 | 1372.55 | 1367.71 | 1381.10 | 1393.10 | 999.84 | 994.54 | 1003.18 | NA | NA | NA | -10.86 | NA | NA | NA | |

| Additional Paid In Capital | 1058.54 | 1047.46 | 1051.93 | 1055.18 | 1060.32 | 1076.85 | 1119.20 | 1150.88 | 1148.93 | 1151.98 | 1147.59 | 1147.53 | 1161.87 | 1166.45 | 1195.88 | 1232.43 | 1226.27 | 1213.17 | 1207.39 | 1204.08 | 1165.08 | 1159.16 | 1138.60 | 1128.46 | 1116.03 | 1113.89 | 1112.36 | 1104.46 | 1100.71 | 484.58 | 476.11 | 469.15 | 460.16 | 435.63 | 426.48 | 406.85 | 366.21 | 316.86 | 316.68 | 316.56 | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -86.52 | -92.39 | -108.62 | -109.47 | -116.23 | -114.86 | -129.75 | -133.61 | -88.65 | -73.26 | -69.27 | -65.67 | -64.29 | -56.09 | -16.97 | 15.76 | 18.06 | 21.08 | 28.67 | 41.51 | 37.00 | 38.39 | 39.32 | 46.76 | 46.44 | 44.35 | 44.41 | 50.90 | 50.26 | 50.52 | 52.37 | 55.26 | 57.13 | 55.90 | 54.45 | 60.71 | 65.57 | 65.60 | 63.88 | 67.64 | NA | NA | NA | NA | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 13.44 | 9.28 | 3.34 | 7.05 | 6.67 | -5.83 | -12.73 | -20.85 | -23.03 | -24.79 | -26.54 | -28.32 | -30.04 | -31.87 | -32.11 | -21.50 | -24.11 | -20.39 | -13.13 | -8.85 | -2.23 | -4.70 | -6.04 | -8.55 | -10.43 | -9.70 | -2.07 | -2.79 | -14.96 | -14.74 | -9.63 | -0.88 | -1.90 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 3.80 | 3.80 | 3.00 | 3.90 | 3.90 | 3.90 | 3.80 | 3.20 | 3.90 | 3.40 | 0.00 | -1.30 | 0.00 | 12.40 | 12.60 | 11.20 | 13.00 | 13.30 | 13.20 | 12.00 | 14.10 | 14.30 | 14.40 | 14.60 | 14.80 | 14.90 | 14.90 | 15.10 | 15.10 | 15.40 | 12.60 | 12.60 | 12.80 | 13.10 | 13.30 | 13.70 | 14.40 | 12.80 | 12.80 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

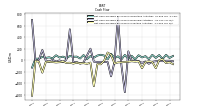

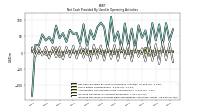

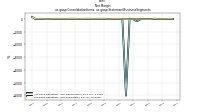

| Net Cash Provided By Used In Operating Activities | 90.14 | 19.54 | 86.36 | 37.19 | 90.31 | 15.98 | 67.69 | 45.46 | 83.30 | 10.33 | 73.40 | 18.74 | 89.13 | 9.65 | 64.77 | 34.22 | 109.09 | 11.38 | 77.90 | 91.62 | 77.72 | 41.13 | 68.56 | 17.54 | 86.49 | 27.40 | 60.03 | 56.52 | 70.02 | 32.51 | 59.54 | 43.58 | 82.52 | 29.70 | 47.38 | 36.92 | 55.50 | 22.22 | 23.91 | -131.93 | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -52.12 | 15.38 | -2.63 | -141.78 | -32.47 | -21.67 | -34.98 | -141.98 | -22.32 | -27.63 | -20.81 | -29.76 | -33.64 | -39.10 | -40.61 | -60.59 | 90.98 | 130.51 | -11.16 | -73.40 | -71.06 | -454.46 | -44.11 | -65.41 | -53.97 | -58.11 | -47.12 | -61.55 | -46.26 | -49.92 | -24.10 | -37.32 | -41.88 | -35.08 | -28.04 | -34.44 | -219.31 | -30.27 | -15.04 | -620.31 | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -12.87 | -19.94 | -17.58 | -20.55 | -30.78 | -64.22 | -24.69 | -49.81 | -18.59 | -11.52 | -13.13 | 151.01 | -559.38 | -84.56 | 750.10 | -32.35 | -283.13 | -33.19 | -32.88 | -31.51 | -33.08 | -28.32 | 197.53 | 80.11 | -41.37 | -60.78 | -34.84 | -34.90 | 535.09 | 8.43 | -37.68 | -5.97 | -28.48 | 3.14 | -28.61 | -9.67 | 174.94 | 5.13 | -24.91 | 696.02 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 90.14 | 19.54 | 86.36 | 37.19 | 90.31 | 15.98 | 67.69 | 45.46 | 83.30 | 10.33 | 73.40 | 18.74 | 89.13 | 9.65 | 64.77 | 34.22 | 109.09 | 11.38 | 77.90 | 91.62 | 77.72 | 41.13 | 68.56 | 17.54 | 86.49 | 27.40 | 60.03 | 56.52 | 70.02 | 32.51 | 59.54 | 43.58 | 82.52 | 29.70 | 47.38 | 36.92 | 55.50 | 22.22 | 23.91 | -131.93 | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 19.93 | 36.95 | 11.69 | 21.62 | 10.12 | 48.70 | -17.22 | -4.07 | -10.18 | 4.41 | -3.19 | 0.71 | -12.27 | -19.62 | 8.29 | 28.72 | 26.78 | 18.93 | 9.86 | 39.78 | 29.23 | 30.18 | 18.06 | 32.26 | 35.49 | 31.36 | 19.14 | 33.01 | 32.90 | 24.64 | 16.70 | 19.37 | 26.09 | 26.59 | 7.89 | 10.96 | 22.73 | 25.28 | 11.23 | 148.92 | 2.28 | 3.07 | 1.93 | 22.04 | 9.02 | 6.77 | 10.81 | |

| Depreciation Depletion And Amortization | 46.62 | 46.28 | 47.41 | 44.50 | 46.98 | 58.30 | 67.11 | 46.47 | 65.79 | 45.09 | 44.46 | 47.40 | 44.73 | 52.78 | 46.09 | 46.41 | 44.26 | 44.82 | 46.10 | 46.68 | 42.48 | 39.47 | 39.88 | 40.84 | 38.49 | 40.53 | 40.85 | 39.83 | 37.61 | 38.55 | 39.23 | 45.26 | 45.17 | 39.63 | 41.42 | 48.80 | 37.88 | 28.64 | 30.11 | 27.38 | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 4.75 | 8.97 | -0.26 | -6.40 | -13.12 | 25.68 | -0.85 | -3.02 | 2.43 | 2.49 | -4.79 | -4.31 | -3.95 | 7.25 | -2.87 | -3.87 | -1.98 | 9.21 | -7.38 | -1.90 | 9.78 | -3.61 | -2.99 | -6.33 | 10.67 | 3.42 | -1.96 | 2.97 | 5.05 | -0.31 | -3.95 | -13.62 | 15.97 | 3.67 | -10.99 | -5.61 | 1.41 | -3.46 | 4.53 | 7.59 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 4.99 | 5.37 | 4.37 | 5.41 | 5.37 | 5.76 | 4.46 | 4.84 | 5.38 | 5.30 | 4.73 | 5.32 | 5.50 | 8.78 | 5.89 | 5.46 | 3.65 | 6.33 | 5.42 | 4.72 | 4.85 | 4.66 | 4.55 | 3.29 | 3.84 | 3.81 | 3.15 | 2.48 | 2.61 | 2.55 | 2.10 | 1.22 | 1.33 | 1.23 | 1.69 | 0.81 | 0.94 | 0.94 | 1.02 | 2.99 | NA | NA | NA | NA | NA | NA | NA | |

| Amortization Of Financing Costs | 1.10 | 1.10 | 1.10 | 1.10 | 1.20 | 1.30 | 1.40 | 1.10 | 1.10 | 1.10 | 1.20 | 1.10 | 1.00 | 1.00 | 0.90 | 0.90 | 0.90 | 1.00 | 1.00 | 1.00 | 1.10 | 1.00 | 1.00 | 1.10 | 1.00 | 1.30 | 1.30 | 1.30 | 1.30 | 1.10 | 1.30 | 1.10 | 1.10 | 1.50 | 2.40 | 2.50 | 2.70 | 1.40 | 1.10 | 0.15 | 2.00 | 1.90 | 1.60 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -52.12 | 15.38 | -2.63 | -141.78 | -32.47 | -21.67 | -34.98 | -141.98 | -22.32 | -27.63 | -20.81 | -29.76 | -33.64 | -39.10 | -40.61 | -60.59 | 90.98 | 130.51 | -11.16 | -73.40 | -71.06 | -454.46 | -44.11 | -65.41 | -53.97 | -58.11 | -47.12 | -61.55 | -46.26 | -49.92 | -24.10 | -37.32 | -41.88 | -35.08 | -28.04 | -34.44 | -219.31 | -30.27 | -15.04 | -620.31 | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Productive Assets | 56.23 | 32.91 | 34.59 | 14.85 | 18.71 | 13.12 | 39.17 | 333.71 | 21.35 | 19.98 | 23.34 | 23.81 | 31.35 | 21.09 | 27.81 | 74.36 | 61.28 | 61.97 | 58.32 | 66.14 | 67.12 | 76.89 | 46.35 | 65.05 | 53.73 | 61.32 | 48.06 | 57.58 | 52.83 | 63.81 | 23.46 | 47.44 | 40.10 | 31.82 | 37.39 | 37.73 | 422.27 | 37.73 | 17.24 | 56.43 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

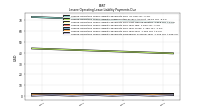

| Net Cash Provided By Used In Financing Activities | -12.87 | -19.94 | -17.58 | -20.55 | -30.78 | -64.22 | -24.69 | -49.81 | -18.59 | -11.52 | -13.13 | 151.01 | -559.38 | -84.56 | 750.10 | -32.35 | -283.13 | -33.19 | -32.88 | -31.51 | -33.08 | -28.32 | 197.53 | 80.11 | -41.37 | -60.78 | -34.84 | -34.90 | 535.09 | 8.43 | -37.68 | -5.97 | -28.48 | 3.14 | -28.61 | -9.67 | 174.94 | 5.13 | -24.91 | 696.02 | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 5.70 | 5.60 | 5.67 | 5.67 | 5.70 | 5.80 | 5.95 | 5.99 | 6.10 | 6.10 | 0.00 | 0.00 | 0.00 | 18.20 | 18.99 | 19.09 | 18.90 | 18.70 | 18.50 | 18.40 | 17.70 | 17.60 | 17.20 | 17.00 | 16.70 | 16.60 | 16.50 | 16.30 | 16.20 | 13.00 | 10.30 | 10.20 | 10.00 | 9.70 | 9.40 | 9.00 | 8.30 | 8.10 | 8.10 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Dividends | 10.53 | 10.51 | 9.74 | 10.58 | 10.63 | 10.76 | 10.82 | 10.18 | 11.03 | 10.51 | 1.05 | -0.32 | 1.05 | 31.67 | 32.65 | 31.39 | 32.18 | 32.25 | 31.94 | 30.58 | 32.08 | 32.09 | 31.79 | 31.78 | 31.78 | 31.78 | 31.63 | 31.64 | 31.64 | 28.53 | 23.14 | 22.98 | 22.97 | 22.98 | 22.97 | 22.95 | 22.95 | 20.92 | 20.90 | 19.52 | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 7.41 | 5.69 | 7.63 | 18.11 | 52.44 | 12.00 | 36.66 | 6.51 | 0.00 | 3.53 | 21.76 | 7.34 | 51.94 | 62.67 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

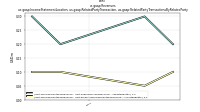

| Revenues | 191.53 | 190.54 | 164.62 | 181.27 | 183.71 | 198.02 | 164.03 | 160.33 | 165.05 | 153.41 | 145.30 | 151.40 | 146.57 | 141.03 | 170.22 | 194.93 | 192.87 | 176.24 | 167.29 | 199.31 | 186.40 | 178.53 | 168.50 | 183.07 | 187.32 | 177.12 | 164.95 | 179.26 | 175.85 | 165.81 | 157.07 | 165.20 | 175.78 | 164.77 | 151.88 | 170.41 | 169.44 | 155.17 | 140.31 | 149.39 | 62.28 | 59.57 | 62.42 | 83.63 | 59.41 | 57.40 | 59.84 | |

| Intersegment Elimination | -22.11 | -20.94 | -15.91 | -18.20 | -19.07 | -17.11 | -10.62 | -7.14 | -5.31 | -6.03 | -4.93 | -4.47 | 2.23 | -4.05 | -11.54 | -23.71 | -23.24 | -21.49 | -14.02 | -20.60 | -23.80 | -21.99 | -13.56 | -20.29 | -23.30 | -20.68 | -13.38 | -20.47 | -22.98 | -18.49 | -13.72 | -16.85 | -20.83 | -20.31 | -13.98 | -20.73 | -21.47 | -17.20 | -16.23 | -21.67 | -1.94 | -2.05 | -2.79 | NA | NA | NA | NA | |

| Operating, Observatory | 37.56 | 33.43 | 22.15 | 32.32 | 33.05 | 27.37 | 13.24 | 17.72 | 12.93 | 8.36 | 2.60 | 5.01 | 4.42 | 0.09 | 19.54 | 37.73 | 37.58 | 32.90 | 20.57 | 34.54 | 40.24 | 35.20 | 21.25 | 32.91 | 39.31 | 33.97 | 20.94 | 33.71 | 38.10 | 31.84 | 21.18 | 27.65 | 35.70 | 30.60 | 18.22 | NA | 35.68 | 30.39 | 17.30 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Real Estate | 176.08 | 178.05 | 158.38 | 167.16 | 169.73 | 187.76 | 161.41 | 149.76 | 157.42 | 151.08 | 147.63 | 150.86 | 139.92 | 145.00 | 162.22 | 180.92 | 178.54 | 164.84 | 160.75 | 185.37 | 169.97 | 165.32 | 160.81 | 170.46 | 171.31 | 163.83 | 157.39 | 166.03 | 160.73 | 152.46 | 149.61 | 154.41 | 160.91 | 152.71 | 143.72 | 155.07 | 147.93 | 127.14 | 123.30 | 118.70 | 56.39 | 53.32 | 56.19 | NA | NA | NA | NA | |

| Management Fees Revenue, Property Management Fee Revenue, | 0.10 | 0.05 | NA | NA | 0.10 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Management Fees Revenue, Supervisory Fee Revenue, | 0.20 | 0.30 | NA | NA | 0.20 | 0.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |