| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.04 | 0.02 | NA | NA | NA | |

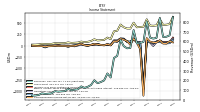

| Earnings Per Share Basic | 0.69 | 0.72 | 0.50 | 0.60 | 0.85 | -7.62 | 0.58 | 0.68 | 1.26 | 0.71 | 0.77 | 1.14 | 1.20 | 0.75 | 0.81 | 0.11 | 0.26 | 0.12 | 0.15 | 0.26 | 0.34 | 0.17 | 0.03 | 0.11 | 0.37 | 0.22 | 0.10 | 0.00 | -0.18 | -0.02 | -0.06 | 0.01 | NA | NA | NA | -0.84 | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.62 | 0.64 | 0.45 | 0.53 | 0.85 | -7.62 | 0.51 | 0.60 | 1.10 | 0.62 | 0.68 | 1.00 | 1.10 | 0.70 | 0.75 | 0.10 | 0.25 | 0.12 | 0.14 | 0.24 | 0.32 | 0.15 | 0.03 | 0.10 | 0.37 | 0.21 | 0.10 | 0.00 | -0.18 | -0.02 | -0.06 | 0.01 | NA | NA | NA | -0.84 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

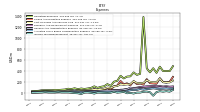

| Revenue From Contract With Customer Excluding Assessed Tax | 842.32 | 636.30 | 628.88 | 640.88 | 807.24 | 594.47 | 585.13 | 579.27 | 717.14 | 532.43 | 528.90 | 550.65 | 617.36 | 451.48 | 428.74 | 228.06 | 270.00 | 197.95 | 181.09 | 169.34 | 200.03 | 150.37 | 132.39 | 120.91 | 136.27 | 106.38 | 101.69 | 96.89 | 110.21 | 87.56 | 85.35 | 81.85 | 87.89 | 65.70 | 61.37 | 58.54 | 64.91 | 47.63 | 42.51 | 40.54 | |

| Revenues | 842.32 | 636.30 | 628.88 | 640.88 | 807.24 | 594.47 | 585.13 | 579.27 | 717.14 | 532.43 | 528.90 | 550.65 | 617.36 | 451.48 | 428.74 | 228.06 | 270.00 | 197.95 | 181.09 | 169.34 | 200.03 | 150.37 | 132.39 | 120.91 | 136.27 | 106.38 | 101.69 | 96.89 | 110.21 | 87.56 | 85.35 | 81.85 | 87.89 | 65.70 | 61.37 | 58.54 | 64.91 | 47.63 | 42.51 | 40.54 | |

| Cost Of Revenue | 255.76 | 188.83 | 188.64 | 195.45 | 225.78 | 174.40 | 171.42 | 173.00 | 208.97 | 153.66 | 148.97 | 142.92 | 150.78 | 120.17 | 111.38 | 82.42 | 90.82 | 68.95 | 58.60 | 52.66 | 57.11 | 46.95 | 45.41 | 41.30 | 44.22 | 36.38 | 35.72 | 34.66 | 37.01 | 29.31 | 29.10 | 27.91 | 30.20 | 24.16 | 21.91 | 20.71 | 22.78 | 18.11 | 17.34 | 15.39 | |

| Cost Of Goods And Services Sold | 255.76 | 188.83 | 188.64 | 195.45 | 225.78 | 174.40 | 171.42 | 173.00 | 208.97 | 153.66 | 148.97 | 142.92 | 150.78 | 120.17 | 111.38 | 82.42 | 90.82 | 68.95 | 58.60 | 52.66 | 57.11 | 46.95 | 45.41 | 41.30 | 44.22 | 36.38 | 35.72 | 34.66 | 37.01 | 29.31 | 29.10 | 27.91 | 30.20 | 24.16 | 21.91 | 20.71 | 22.78 | 18.11 | 17.34 | 15.39 | |

| Gross Profit | 586.57 | 447.48 | 440.24 | 445.42 | 581.47 | 420.07 | 413.71 | 406.27 | 508.17 | 378.77 | 379.93 | 407.73 | 466.57 | 331.31 | 317.36 | 145.64 | 179.17 | 129.00 | 122.49 | 116.68 | 142.92 | 103.42 | 86.98 | 79.62 | 92.05 | 70.00 | 65.97 | 62.23 | 73.20 | 58.25 | 56.25 | 53.94 | 57.70 | 41.53 | 39.46 | 37.83 | 42.13 | 29.52 | 25.16 | 25.14 | |

| Operating Expenses | 471.11 | 358.92 | 442.61 | 367.23 | 442.12 | 1374.85 | 341.15 | 321.96 | 365.92 | 295.03 | 290.83 | 257.09 | 305.24 | 213.14 | 198.22 | 120.27 | 154.14 | 114.77 | 104.64 | 85.04 | 113.43 | 84.68 | 74.22 | 65.82 | 73.76 | 62.57 | 77.69 | 64.33 | 69.75 | 55.58 | 51.58 | 47.15 | 49.28 | 43.20 | 43.25 | 42.68 | 41.96 | 32.57 | 28.96 | 24.72 | |

| Research And Development Expense | 117.49 | 113.93 | 121.99 | 115.92 | 112.79 | 108.04 | 102.09 | 89.48 | 82.56 | 73.52 | 61.75 | 53.71 | 51.16 | 45.91 | 45.23 | 37.78 | 35.70 | 32.47 | 28.77 | 24.95 | 28.54 | 24.42 | 23.57 | 20.72 | 17.79 | 16.96 | 21.75 | 18.12 | 16.12 | 14.90 | 11.84 | 12.23 | 11.21 | 11.41 | 10.07 | 10.01 | 9.72 | 10.08 | 8.79 | 8.04 | |

| General And Administrative Expense | 92.54 | 84.05 | 86.66 | 79.99 | 84.53 | 74.54 | 74.99 | 78.20 | 79.17 | 89.58 | 61.60 | 52.18 | 43.32 | 40.45 | 38.28 | 33.99 | 34.40 | 32.20 | 29.88 | 24.65 | 21.52 | 20.75 | 21.71 | 18.90 | 18.22 | 22.09 | 28.41 | 22.76 | 22.62 | 21.94 | 22.54 | 19.08 | 15.60 | 15.25 | 17.63 | 20.46 | 17.62 | 13.69 | 11.40 | 9.21 | |

| Selling And Marketing Expense | 261.08 | 160.94 | 165.87 | 171.31 | 244.81 | 147.24 | 164.07 | 154.28 | 204.20 | 131.93 | 167.47 | 151.20 | 210.76 | 126.78 | 114.71 | 48.51 | 84.03 | 50.10 | 45.99 | 35.44 | 63.36 | 39.52 | 28.94 | 26.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Income Loss | 115.46 | 88.56 | -2.37 | 78.20 | 139.34 | -954.78 | 72.56 | 84.31 | 142.25 | 83.74 | 89.11 | 150.64 | 161.34 | 118.17 | 119.14 | 25.36 | 25.04 | 14.23 | 17.85 | 31.64 | 29.49 | 18.74 | 12.76 | 13.80 | 18.29 | 7.42 | -11.72 | -2.10 | 3.45 | 2.67 | 4.67 | 6.78 | 8.42 | -1.67 | -3.79 | -4.84 | 0.18 | -3.05 | -3.79 | 0.42 | |

| Allocated Share Based Compensation Expense | 68.48 | 70.12 | 77.28 | 68.68 | 64.36 | 52.91 | 64.36 | 49.27 | 49.86 | 42.26 | 27.44 | 20.35 | 17.45 | 17.13 | 16.73 | 13.81 | 13.34 | 12.14 | 10.84 | 8.08 | 14.24 | 8.92 | 8.62 | 6.45 | 5.99 | 7.52 | 8.16 | 4.88 | 4.31 | 4.08 | 4.27 | 3.24 | 1.12 | 2.92 | 2.82 | 3.97 | 4.04 | 2.75 | 2.08 | 1.18 | |

| Income Tax Expense Benefit | 25.90 | 9.12 | -56.50 | 6.73 | 18.34 | 14.05 | 0.04 | -0.12 | -17.18 | -6.13 | -12.50 | 13.96 | 4.77 | -1.37 | 15.89 | -2.83 | -8.54 | -4.71 | -1.85 | -0.14 | -18.38 | -5.30 | 1.25 | 0.01 | -26.48 | -12.56 | -9.44 | -1.05 | 4.79 | 4.36 | 4.26 | 13.61 | 6.34 | 4.09 | 4.91 | 10.72 | 3.10 | 2.08 | -0.41 | 0.21 | |

| Income Taxes Paid | 13.08 | 0.30 | NA | NA | 16.61 | 0.21 | NA | NA | 28.05 | 58.04 | NA | NA | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 83.27 | 87.85 | 61.91 | 74.54 | 109.55 | -963.07 | 73.12 | 86.11 | 161.56 | 89.93 | 98.25 | 143.77 | 148.54 | 91.76 | 96.42 | 12.52 | 31.29 | 14.80 | 18.22 | 31.58 | 41.25 | 19.89 | 3.38 | 12.97 | 44.75 | 25.80 | 11.67 | -0.42 | -21.38 | -2.40 | -7.31 | 1.19 | -4.23 | -6.89 | -6.35 | -36.59 | -5.36 | -6.27 | -3.15 | -0.46 | |

| Comprehensive Income Net Of Tax | 119.55 | 70.72 | 73.14 | 90.91 | 168.19 | -1098.80 | -72.97 | 70.09 | 155.96 | 23.15 | 100.99 | 132.45 | 156.38 | 97.57 | 99.42 | 10.52 | 34.12 | 10.69 | 19.58 | 30.62 | 40.52 | 19.36 | 3.11 | 13.06 | 42.47 | 19.57 | -1.70 | -3.40 | -8.32 | -4.48 | -3.28 | -6.16 | 0.32 | -7.12 | -11.00 | -21.53 | -6.70 | -8.85 | -3.30 | -0.49 | |

| Net Income Loss Available To Common Stockholders Diluted | 84.85 | 89.43 | 63.51 | 76.13 | 109.55 | -963.07 | 74.71 | 87.70 | 163.15 | 91.52 | 99.19 | 144.55 | 153.07 | 96.25 | 100.39 | 12.52 | 31.29 | 14.80 | 18.22 | 31.58 | 41.25 | 19.89 | 3.38 | 12.97 | 44.75 | 25.80 | 12.50 | -0.42 | -21.38 | -2.40 | -7.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

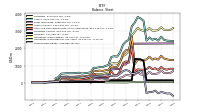

| Assets | 2685.40 | 2449.20 | 2568.75 | 2500.54 | 2634.96 | 2450.31 | 3607.10 | 3745.18 | 3831.81 | 3502.14 | 3290.42 | 2497.41 | 2404.49 | 2214.51 | 1762.03 | 1517.64 | 1542.35 | 1499.20 | 1021.77 | 981.17 | 901.85 | 907.37 | 865.31 | 870.16 | 605.58 | 574.06 | 554.32 | 530.74 | 581.19 | 569.20 | 550.96 | 549.18 | 553.06 | 538.62 | 529.13 | 331.36 | 249.13 | NA | NA | NA | |

| Liabilities | 3229.11 | 3071.72 | 3032.93 | 3040.73 | 3182.24 | 3056.55 | 3025.80 | 3068.31 | 3203.19 | 2968.52 | 2759.66 | 1813.64 | 1662.07 | 1547.84 | 1237.86 | 1110.80 | 1135.72 | 1109.94 | 579.47 | 561.15 | 500.95 | 512.75 | 495.22 | 485.68 | 208.69 | 225.85 | 246.04 | 235.69 | 236.44 | 224.75 | 217.94 | 219.65 | 222.56 | 215.83 | 203.37 | 196.25 | 101.83 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 2685.40 | 2449.20 | 2568.75 | 2500.54 | 2634.96 | 2450.31 | 3607.10 | 3745.18 | 3831.81 | 3502.14 | 3290.42 | 2497.41 | 2404.49 | 2214.51 | 1762.03 | 1517.64 | 1542.35 | 1499.20 | 1021.77 | 981.17 | 901.85 | 907.37 | 865.31 | 870.16 | 605.58 | 574.06 | 554.32 | 530.74 | 581.19 | 569.20 | 550.96 | 549.18 | 553.06 | 538.62 | 529.13 | 331.36 | 249.13 | NA | NA | NA | |

| Stockholders Equity | -543.72 | -622.53 | -464.18 | -540.19 | -547.27 | -606.24 | 581.29 | 676.87 | 628.62 | 533.62 | 530.75 | 683.77 | 742.42 | 666.67 | 524.17 | 406.85 | 406.63 | 389.26 | 442.30 | 420.01 | 400.90 | 394.62 | 370.09 | 384.49 | 396.89 | 348.21 | 308.28 | 295.05 | 344.76 | 344.46 | 333.02 | 329.53 | 330.50 | 322.79 | 325.76 | 54.90 | 67.09 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 1570.45 | 1343.86 | 1413.76 | 1344.95 | 1513.74 | 1352.11 | 1320.22 | 1295.14 | 1341.50 | 1077.33 | 2690.98 | 1893.62 | 1894.78 | 1697.83 | 1194.34 | 906.95 | 921.04 | 945.84 | 743.65 | 724.00 | 680.29 | 707.95 | 666.23 | 705.00 | 439.26 | 400.38 | 376.23 | 355.24 | 371.03 | 353.41 | 346.78 | 340.61 | 359.05 | 349.31 | 343.36 | 142.29 | 129.99 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 914.32 | 741.96 | 841.51 | 786.80 | 921.28 | 789.99 | 758.87 | 756.24 | 780.20 | 619.40 | 2053.88 | 1163.68 | 1244.10 | 1144.97 | 677.52 | 442.35 | 443.29 | 671.77 | 359.16 | 345.67 | 366.99 | 362.73 | 357.82 | 533.86 | 315.44 | 260.29 | 226.88 | 194.81 | 181.59 | 188.03 | 167.48 | 158.38 | 271.24 | 266.28 | 268.15 | 70.74 | 69.66 | 71.20 | 68.45 | 44.45 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 914.32 | 741.96 | 846.85 | 792.14 | 926.62 | 795.33 | 764.22 | 761.58 | 785.54 | 624.74 | 2059.22 | 1169.02 | 1249.44 | 1150.32 | 682.87 | 447.69 | 448.63 | 677.11 | 364.50 | 351.01 | 372.33 | 368.07 | 363.16 | 539.20 | 320.78 | 265.63 | 232.23 | 200.15 | 186.93 | NA | NA | NA | 276.58 | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 24.73 | 19.41 | 22.59 | 26.27 | 27.89 | 21.77 | 20.13 | 20.64 | 27.27 | 23.88 | 20.28 | 22.99 | 22.61 | 16.31 | 16.53 | 11.71 | 15.39 | 12.49 | 10.59 | 10.79 | 12.24 | 36.38 | 30.61 | 31.29 | 33.68 | 27.17 | 24.99 | 25.09 | 26.43 | 20.89 | 19.51 | 19.25 | 20.27 | 15.98 | 14.03 | 14.51 | 15.40 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 129.88 | 125.61 | 93.24 | 76.86 | 80.20 | 93.70 | 112.86 | 101.12 | 109.42 | 68.94 | 49.69 | 46.28 | 56.15 | 43.59 | 30.77 | 36.07 | 38.61 | 43.93 | 34.65 | 26.86 | 22.69 | 23.96 | 18.56 | 23.74 | 20.38 | 17.32 | 28.92 | 19.91 | 15.57 | 10.84 | 8.97 | 9.09 | 9.52 | 8.77 | 7.96 | 10.79 | 12.24 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

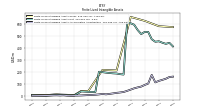

| Goodwill | 138.38 | 137.46 | 138.08 | 138.06 | 137.72 | 135.92 | 1269.15 | 1364.41 | 1371.06 | 1385.21 | 140.04 | 139.75 | 140.81 | 139.74 | 138.76 | 138.31 | 138.73 | 138.47 | 37.34 | 37.03 | 37.48 | 37.80 | 37.96 | 39.23 | 38.54 | 38.22 | 37.44 | 35.97 | 35.66 | 37.77 | 28.15 | 28.64 | 27.75 | 28.37 | 28.30 | 28.23 | 30.83 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 457.14 | 452.88 | 474.20 | 534.47 | 535.41 | 517.02 | 550.92 | 595.30 | 607.17 | 613.10 | 178.85 | 182.31 | 187.45 | 189.12 | 191.69 | 194.87 | 199.24 | 202.10 | 33.14 | 33.84 | 34.59 | 36.36 | 38.08 | NA | 4.10 | NA | NA | NA | 7.51 | 8.77 | NA | NA | 2.87 | NA | NA | NA | 5.41 | NA | NA | NA | |

| Other Assets Noncurrent | 45.19 | 46.21 | 49.79 | 43.67 | 42.36 | 42.81 | 47.48 | 49.04 | 50.77 | 28.08 | 20.48 | 23.06 | 24.40 | 25.83 | 24.25 | 28.34 | 29.54 | 27.03 | 25.13 | 26.30 | 0.51 | 0.67 | 0.68 | 0.71 | 0.72 | 0.88 | 0.94 | 0.96 | 0.98 | 1.04 | 0.93 | 1.72 | 1.63 | 1.75 | 2.11 | 2.12 | 2.02 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

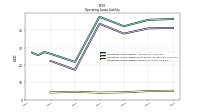

| Liabilities Current | 710.78 | 548.82 | 503.22 | 499.11 | 631.75 | 497.25 | 449.90 | 483.20 | 615.59 | 471.01 | 407.00 | 427.05 | 454.66 | 340.94 | 279.58 | 158.85 | 188.53 | 154.71 | 166.51 | 148.68 | 112.06 | 128.93 | 113.50 | 106.56 | 102.48 | 94.09 | 88.32 | 81.15 | 84.01 | 77.58 | 74.51 | 77.36 | 80.12 | 69.61 | 52.24 | 46.87 | 41.45 | NA | NA | NA | |

| Accounts Payable Current | 29.92 | 14.15 | 15.00 | 19.90 | 28.76 | 16.84 | 17.93 | 15.73 | 28.01 | 13.37 | 26.75 | 16.39 | 40.88 | 22.13 | 15.98 | 10.56 | 26.32 | 23.42 | 20.50 | 17.32 | 26.55 | 14.13 | 14.76 | 8.09 | 13.62 | 7.24 | 7.59 | 6.37 | 10.98 | 7.32 | 7.57 | 13.57 | 14.38 | 3.20 | 5.96 | 7.06 | 8.23 | NA | NA | NA | |

| Taxes Payable Current | 10.62 | 17.24 | 12.69 | 17.34 | 10.13 | 9.36 | 9.44 | 20.32 | 9.69 | NA | NA | NA | 5.37 | 72.80 | 64.32 | NA | 39.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 353.55 | 271.97 | 231.67 | 240.03 | 331.23 | 249.96 | 218.03 | 241.35 | 328.12 | 245.30 | 209.82 | 218.16 | 232.35 | 174.21 | 134.02 | 68.89 | 88.34 | 70.33 | 55.69 | 40.12 | 49.16 | 37.19 | 35.45 | 35.38 | 28.74 | 26.29 | 30.38 | 22.64 | 24.18 | 20.04 | 29.45 | 22.91 | 31.25 | 32.86 | 27.34 | 21.89 | 17.44 | NA | NA | NA | |

| Other Liabilities Current | 41.21 | 20.53 | 16.32 | 17.61 | 19.06 | 17.90 | 17.82 | 20.02 | 24.50 | 23.38 | 13.03 | 13.50 | 14.82 | 12.38 | 8.47 | 7.99 | 8.18 | 7.29 | 8.41 | 9.27 | 3.92 | 2.68 | 2.92 | 3.17 | 3.39 | 2.50 | 2.13 | 5.33 | 6.56 | 3.88 | 2.98 | 4.37 | 4.90 | 7.92 | NA | NA | 4.59 | NA | NA | NA | |

| Contract With Customer Liability Current | 14.63 | 14.98 | 14.41 | 14.51 | 14.01 | 12.22 | 11.87 | 12.50 | 12.34 | 12.52 | 12.31 | 12.26 | 11.26 | 10.51 | 9.18 | 8.25 | 7.62 | 7.43 | 8.01 | 7.79 | 7.48 | 7.18 | 6.44 | NA | 6.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

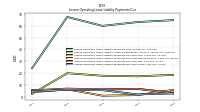

| Long Term Debt | 2283.82 | 2282.75 | 2281.68 | 2280.66 | 2279.64 | 2278.59 | 2277.52 | 2276.48 | 2275.42 | 2274.35 | 2273.33 | 1302.35 | 1062.30 | 1054.60 | 803.23 | 794.13 | 785.13 | 776.13 | 284.01 | 280.23 | 276.49 | 272.79 | 269.13 | 265.42 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 13.19 | 25.50 | 28.98 | 44.38 | 44.73 | 62.16 | 68.64 | 77.03 | 79.48 | 94.16 | 0.03 | 0.03 | 58.48 | 63.45 | 66.30 | 63.13 | 64.50 | 83.13 | 32.64 | 32.64 | 30.45 | NA | NA | NA | 23.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Liabilities Noncurrent | 121.70 | 113.55 | 116.42 | 112.43 | 120.41 | 112.24 | 122.46 | 122.74 | 122.42 | 90.30 | 38.33 | 41.17 | 41.64 | 41.70 | 39.49 | 43.23 | 43.96 | 40.40 | 38.90 | 40.01 | 19.86 | 17.38 | 17.46 | 18.13 | 18.26 | 25.97 | 25.83 | 25.31 | 24.70 | 23.75 | 22.76 | 22.27 | 21.65 | 21.70 | 21.66 | 21.57 | 1.91 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | 41.10 | NA | NA | NA | 38.09 | NA | NA | NA | 43.75 | NA | NA | NA | 17.20 | NA | NA | NA | 22.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

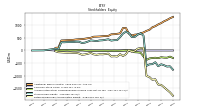

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | -543.72 | -622.53 | -464.18 | -540.19 | -547.27 | -606.24 | 581.29 | 676.87 | 628.62 | 533.62 | 530.75 | 683.77 | 742.42 | 666.67 | 524.17 | 406.85 | 406.63 | 389.26 | 442.30 | 420.01 | 400.90 | 394.62 | 370.09 | 384.49 | 396.89 | 348.21 | 308.28 | 295.05 | 344.76 | 344.46 | 333.02 | 329.53 | 330.50 | 322.79 | 325.76 | 54.90 | 67.09 | NA | NA | NA | |

| Common Stock Value | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.13 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.12 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.04 | 0.02 | NA | NA | NA | |

| Additional Paid In Capital | 1081.03 | 1028.34 | 957.74 | 913.67 | 815.09 | 773.89 | 712.05 | 672.49 | 631.76 | 624.37 | 590.23 | 664.24 | 883.17 | 886.29 | 675.21 | 657.31 | 642.63 | 637.18 | 573.61 | 570.91 | 562.03 | 551.29 | 546.12 | 542.55 | 499.44 | 482.94 | 462.58 | 447.65 | 442.51 | 433.89 | 417.98 | 411.21 | 406.02 | 398.64 | 394.48 | 112.69 | 103.36 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1357.39 | -1347.23 | -1135.41 | -1156.13 | -1048.27 | -1007.40 | 106.24 | 95.28 | 71.74 | -21.47 | -56.97 | 24.77 | -146.82 | -217.87 | -143.46 | -239.88 | -227.41 | -236.51 | -124.02 | -142.24 | -153.44 | -149.71 | -169.60 | -151.91 | -96.29 | -130.74 | -156.54 | -168.21 | -116.34 | -94.96 | -92.56 | -85.25 | -86.44 | -82.21 | -75.32 | -68.96 | -32.38 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -267.47 | -303.75 | -286.62 | -297.85 | -314.22 | -372.86 | -237.13 | -91.03 | -75.01 | -69.41 | -2.64 | -5.37 | 5.95 | -1.89 | -7.70 | -10.70 | -8.70 | -11.52 | -7.42 | -8.78 | -7.81 | -7.09 | -6.55 | -6.28 | -6.38 | -4.10 | 2.12 | 15.49 | 18.47 | 5.41 | 7.49 | 3.46 | 10.80 | 6.25 | 6.48 | 11.13 | -3.93 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 72.54 | 76.37 | 80.79 | 70.99 | 65.76 | 67.34 | 64.00 | 51.01 | 44.22 | 45.70 | 28.38 | 20.98 | 17.94 | 17.45 | 16.98 | 13.98 | 13.48 | 12.32 | 11.28 | 8.62 | 13.44 | 9.56 | 9.18 | 5.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

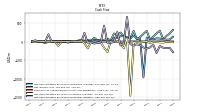

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

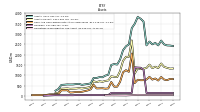

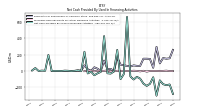

| Net Cash Provided By Used In Operating Activities | 295.11 | 218.51 | 136.27 | 55.63 | 291.75 | 206.56 | 125.75 | 59.54 | 290.46 | 90.93 | 121.70 | 148.47 | 243.67 | 185.19 | 220.43 | 29.66 | 78.58 | 47.05 | 49.84 | 31.46 | 101.79 | 30.62 | 40.09 | 26.42 | 35.10 | 16.87 | 12.14 | 3.31 | 18.52 | 9.21 | 17.25 | 1.79 | 10.20 | 5.38 | 4.74 | 8.89 | 0.10 | 5.07 | 0.73 | 6.18 | |

| Net Cash Provided By Used In Investing Activities | -19.32 | -11.27 | -6.62 | -36.10 | -0.09 | -3.46 | -16.32 | -10.15 | -23.11 | -1454.66 | 100.81 | -181.01 | -53.02 | 18.91 | 16.64 | 6.09 | -280.12 | -160.30 | -25.95 | -22.00 | -41.22 | -16.73 | -181.80 | -45.65 | 24.02 | 8.19 | 17.24 | 12.39 | -23.44 | 8.32 | -5.88 | -114.43 | -5.15 | -6.12 | -5.39 | -6.62 | -3.43 | -0.97 | -12.32 | -4.00 | |

| Net Cash Provided By Used In Financing Activities | -115.70 | -304.59 | -77.69 | -158.55 | -184.07 | -155.76 | -94.36 | -72.28 | -105.42 | -67.14 | 664.69 | -39.38 | -101.29 | 259.08 | -5.83 | -32.68 | -28.58 | 428.79 | -11.30 | -29.31 | -53.02 | -8.47 | -31.07 | 236.56 | -3.43 | 7.49 | 1.41 | -2.03 | 2.06 | 3.95 | -0.45 | 0.25 | 0.56 | -0.12 | 197.49 | 1.68 | 4.22 | -0.28 | 35.93 | 5.36 |

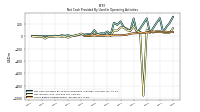

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 295.11 | 218.51 | 136.27 | 55.63 | 291.75 | 206.56 | 125.75 | 59.54 | 290.46 | 90.93 | 121.70 | 148.47 | 243.67 | 185.19 | 220.43 | 29.66 | 78.58 | 47.05 | 49.84 | 31.46 | 101.79 | 30.62 | 40.09 | 26.42 | 35.10 | 16.87 | 12.14 | 3.31 | 18.52 | 9.21 | 17.25 | 1.79 | 10.20 | 5.38 | 4.74 | 8.89 | 0.10 | 5.07 | 0.73 | 6.18 | |

| Net Income Loss | 83.27 | 87.85 | 61.91 | 74.54 | 109.55 | -963.07 | 73.12 | 86.11 | 161.56 | 89.93 | 98.25 | 143.77 | 148.54 | 91.76 | 96.42 | 12.52 | 31.29 | 14.80 | 18.22 | 31.58 | 41.25 | 19.89 | 3.38 | 12.97 | 44.75 | 25.80 | 11.67 | -0.42 | -21.38 | -2.40 | -7.31 | 1.19 | -4.23 | -6.89 | -6.35 | -36.59 | -5.36 | -6.27 | -3.15 | -0.46 | |

| Depreciation Depletion And Amortization | 23.03 | 22.17 | 22.95 | 23.17 | 22.79 | 24.13 | 25.03 | 24.75 | 24.99 | 23.21 | 12.98 | 13.08 | 13.10 | 15.75 | 14.17 | 15.16 | 15.27 | 12.81 | 9.81 | 10.14 | 7.63 | 6.44 | 6.36 | 6.32 | 6.58 | 7.02 | 6.66 | 6.94 | 6.91 | 5.79 | 5.10 | 4.73 | 4.51 | 4.97 | 4.73 | 4.34 | 4.73 | 4.46 | 4.13 | 3.90 | |

| Share Based Compensation | 68.48 | 70.12 | 77.28 | 68.68 | 64.36 | 52.91 | 64.36 | 49.27 | 49.86 | 42.26 | 27.44 | 20.35 | 17.45 | 17.13 | 16.73 | 13.81 | 13.34 | 12.14 | 10.84 | 8.08 | 14.24 | 8.92 | 8.62 | 6.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

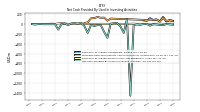

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -19.32 | -11.27 | -6.62 | -36.10 | -0.09 | -3.46 | -16.32 | -10.15 | -23.11 | -1454.66 | 100.81 | -181.01 | -53.02 | 18.91 | 16.64 | 6.09 | -280.12 | -160.30 | -25.95 | -22.00 | -41.22 | -16.73 | -181.80 | -45.65 | 24.02 | 8.19 | 17.24 | 12.39 | -23.44 | 8.32 | -5.88 | -114.43 | -5.15 | -6.12 | -5.39 | -6.62 | -3.43 | -0.97 | -12.32 | -4.00 | |

| Payments To Acquire Property Plant And Equipment | 5.20 | 3.89 | 1.60 | 2.25 | 1.89 | 2.72 | 2.42 | 3.21 | 5.51 | 3.82 | 1.39 | 0.53 | 1.06 | 0.18 | -0.36 | 0.57 | 1.64 | 2.14 | 3.06 | 0.68 | 0.58 | 0.14 | 0.11 | 0.19 | 0.08 | 0.28 | 0.89 | 2.70 | 1.83 | 7.88 | 15.41 | 10.87 | 1.59 | 4.98 | 2.69 | 1.85 | 0.42 | 0.09 | 0.22 | 0.57 | |

| Payments To Acquire Investments | 54.62 | 90.66 | NA | NA | 64.50 | 72.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -115.70 | -304.59 | -77.69 | -158.55 | -184.07 | -155.76 | -94.36 | -72.28 | -105.42 | -67.14 | 664.69 | -39.38 | -101.29 | 259.08 | -5.83 | -32.68 | -28.58 | 428.79 | -11.30 | -29.31 | -53.02 | -8.47 | -31.07 | 236.56 | -3.43 | 7.49 | 1.41 | -2.03 | 2.06 | 3.95 | -0.45 | 0.25 | 0.56 | -0.12 | 197.49 | 1.68 | 4.22 | -0.28 | 35.93 | 5.36 | |

| Payments For Repurchase Of Common Stock | 92.98 | 296.95 | 38.85 | 148.18 | 150.42 | 150.57 | 62.17 | 62.57 | 68.35 | 54.43 | NA | NA | 77.49 | 166.17 | 0.00 | 24.99 | 22.20 | 127.30 | 0.00 | 27.49 | 44.99 | 0.00 | 21.07 | 68.59 | 5.40 | 2.87 | 1.23 | 0.80 | 0.62 | 0.45 | 0.18 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 842.32 | 636.30 | 628.88 | 640.88 | 807.24 | 594.47 | 585.13 | 579.27 | 717.14 | 532.43 | 528.90 | 550.65 | 617.36 | 451.48 | 428.74 | 228.06 | 270.00 | 197.95 | 181.09 | 169.34 | 200.03 | 150.37 | 132.39 | 120.91 | 136.27 | 106.38 | 101.69 | 96.89 | 110.21 | 87.56 | 85.35 | 81.85 | 87.89 | 65.70 | 61.37 | 58.54 | 64.91 | 47.63 | 42.51 | 40.54 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 842.32 | 636.30 | 628.88 | 640.88 | 807.24 | 594.47 | 585.13 | 579.27 | 717.14 | 532.43 | 528.90 | 550.65 | 617.36 | 451.48 | 428.74 | 228.06 | 270.00 | 197.95 | 181.09 | 169.34 | 200.03 | 150.37 | 132.39 | 120.91 | 136.27 | 106.38 | 101.69 | 96.89 | 110.21 | 87.56 | 85.35 | 81.85 | 87.89 | 65.70 | 61.37 | 58.54 | 64.91 | 47.63 | 42.51 | 40.54 | |

| Services Revenue | 226.53 | 175.38 | 175.92 | 173.36 | 207.08 | 150.98 | 145.59 | 151.57 | 175.92 | 136.93 | 133.44 | 137.00 | 143.80 | 109.86 | 96.71 | 72.13 | 80.35 | 56.32 | 45.90 | 42.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |