| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

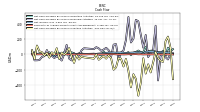

| Common Stock Value | 963.99 | 962.64 | 960.85 | 959.42 | 725.15 | 724.69 | 723.96 | 723.44 | 722.67 | 398.06 | 397.70 | 397.09 | 400.58 | 403.35 | 408.70 | 410.24 | 429.51 | 429.14 | 432.53 | 434.95 | 434.45 | 434.23 | 434.12 | 433.31 | 432.79 | 263.49 | 262.90 | 262.18 | 147.29 | 139.98 | 139.83 | 135.32 | 133.39 | 133.21 | 133.06 | 132.75 | 132.53 | 132.44 | 132.42 | 132.22 | 132.10 | 132.10 | 132.10 | 131.90 | 131.88 | 105.45 | 105.44 | 105.07 | 104.84 | 100.93 | 100.55 | 104.58 | 99.61 | 99.30 | 98.97 | |

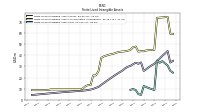

| Earnings Per Share Basic | 0.72 | 0.73 | 0.72 | 0.37 | 1.08 | 1.06 | 1.03 | 0.95 | 0.20 | 0.97 | 1.03 | 0.99 | 0.82 | 0.81 | 0.56 | 0.62 | 0.71 | 0.84 | 0.80 | 0.75 | 0.81 | 0.74 | 0.77 | 0.70 | 0.48 | 0.53 | 0.45 | 0.34 | 0.42 | 0.23 | 0.38 | 0.34 | 0.34 | 0.35 | 0.30 | 0.34 | 0.34 | 0.27 | 0.33 | 0.28 | 0.28 | 0.31 | 0.27 | 0.15 | -1.55 | 0.22 | 0.15 | -0.35 | 0.01 | -0.04 | 0.16 | 0.32 | -0.20 | 0.17 | 0.17 | |

| Earnings Per Share Diluted | 0.72 | 0.73 | 0.71 | 0.37 | 1.08 | 1.06 | 1.03 | 0.95 | 0.20 | 0.97 | 1.03 | 0.99 | 0.82 | 0.81 | 0.56 | 0.62 | 0.71 | 0.84 | 0.80 | 0.75 | 0.80 | 0.74 | 0.77 | 0.70 | 0.49 | 0.53 | 0.45 | 0.34 | 0.40 | 0.23 | 0.37 | 0.33 | 0.33 | 0.34 | 0.30 | 0.33 | 0.34 | 0.27 | 0.32 | 0.27 | 0.27 | 0.30 | 0.27 | 0.14 | -1.55 | 0.22 | 0.15 | -0.35 | 0.01 | -0.04 | 0.16 | 0.32 | -0.19 | 0.17 | 0.17 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Insurance Commissions And Fees | 1.58 | 1.21 | 1.41 | 1.31 | 1.71 | 1.39 | 1.15 | 0.94 | 1.09 | 1.20 | 2.47 | 2.19 | 2.33 | 2.36 | 2.09 | 2.07 | 2.06 | 2.20 | 2.20 | 2.03 | 2.25 | 2.42 | 2.12 | 1.94 | 2.00 | 1.43 | 1.04 | 0.84 | 0.95 | 0.97 | 0.94 | 0.94 | 0.66 | 0.69 | 0.67 | 0.56 | 0.75 | 0.69 | 0.71 | 0.59 | 0.56 | 0.59 | 0.58 | 0.40 | 0.51 | 0.51 | 0.43 | 0.38 | 0.36 | 0.38 | 0.41 | 0.35 | 0.39 | 0.33 | 0.34 | |

| Other Income | 2.22 | 1.35 | 3.25 | 3.32 | 1.34 | 1.59 | 1.49 | 2.26 | 0.89 | 2.06 | 2.09 | 2.00 | 0.65 | 2.58 | 1.54 | 1.18 | 0.57 | 1.84 | 1.56 | 1.70 | 0.60 | 1.57 | 1.19 | 1.53 | 0.14 | 0.99 | 1.14 | 0.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 44.09 | 39.15 | 34.18 | 24.69 | 8.74 | 2.96 | 2.18 | 2.23 | 2.37 | 2.00 | 2.38 | 2.77 | 3.32 | 3.96 | 5.02 | 7.27 | 8.31 | 8.60 | 8.61 | 8.37 | 7.35 | 6.37 | 5.50 | 4.55 | 4.22 | 3.37 | 2.91 | 2.17 | 2.00 | 1.90 | 1.84 | 1.87 | 1.75 | 1.74 | 1.66 | 1.75 | 1.90 | 2.03 | 2.15 | 2.14 | 2.31 | 2.60 | 2.90 | 3.17 | 3.76 | 4.22 | 4.50 | 4.84 | 5.26 | 5.74 | 6.05 | 6.51 | 6.85 | 7.74 | 8.18 | |

| Interest Income Expense Net | 82.48 | 84.70 | 86.98 | 92.49 | 84.37 | 85.33 | 78.27 | 76.88 | 73.84 | 58.55 | 58.76 | 55.24 | 56.01 | 54.73 | 52.62 | 54.76 | 54.66 | 53.78 | 54.41 | 53.36 | 53.85 | 51.84 | 51.23 | 50.51 | 48.86 | 41.64 | 39.92 | 34.30 | 31.29 | 30.35 | 31.54 | 30.20 | 30.05 | 30.39 | 29.61 | 29.70 | 30.92 | 31.34 | 33.81 | 35.53 | 35.28 | 33.73 | 35.60 | 31.92 | 35.69 | 34.47 | 32.95 | 32.09 | 31.92 | 33.49 | 34.48 | 32.31 | 33.57 | 31.07 | 31.54 | |

| Interest Paid Net | 43.32 | 37.69 | 35.36 | 19.33 | 6.89 | 2.78 | 2.22 | 2.42 | 2.76 | 2.10 | 2.41 | 2.93 | 3.72 | 4.17 | 5.59 | 7.33 | 8.33 | 8.69 | 8.70 | 8.01 | 7.29 | 6.11 | 5.16 | 4.48 | 4.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 1.20 | 1.20 | 1.10 | 1.10 | 1.10 | 0.70 | 0.60 | 0.55 | 0.54 | 0.54 | 0.83 | 0.40 | 0.53 | 0.61 | 0.90 | 0.51 | 0.52 | 0.55 | 0.80 | 0.40 | 0.37 | 0.37 | 0.60 | 0.23 | 0.23 | 0.20 | 0.48 | 0.18 | 0.19 | 0.15 | 0.26 | 0.12 | 0.16 | 0.15 | 0.28 | 0.13 | -247.73 | 0.02 | 0.20 | 0.02 | 0.00 | 0.00 | 0.22 | 0.00 | 0.03 | 0.02 | 0.26 | 0.00 | 0.26 | 0.16 | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 8.02 | 7.76 | 7.86 | 4.18 | 9.84 | 10.20 | 9.55 | 8.70 | 2.15 | 6.96 | 7.92 | 7.65 | 6.44 | 6.33 | 4.27 | 4.62 | 5.37 | 6.57 | 6.41 | 5.88 | 6.00 | 5.91 | 6.45 | 5.84 | 1.30 | 6.53 | 5.55 | 3.75 | 4.23 | 3.12 | 3.95 | 3.33 | 3.52 | 3.69 | 3.22 | 3.69 | 3.85 | 2.96 | 3.69 | 3.03 | 3.05 | 4.32 | 3.15 | 1.56 | -17.28 | 2.12 | 1.52 | -3.31 | 0.29 | 1.31 | 2.02 | 3.75 | -1.82 | 2.08 | 2.17 | |

| Income Taxes Paid Net | 7.88 | 8.94 | 12.87 | 0.05 | 10.63 | 13.37 | NA | NA | 6.90 | 9.28 | 6.74 | 9.59 | 8.30 | 20.19 | 1.09 | 0.02 | 4.23 | 6.91 | 13.09 | 0.10 | 3.83 | 7.14 | 10.37 | -0.18 | 4.26 | 6.71 | 10.06 | -1.50 | 1.28 | 11.44 | 3.37 | -4.30 | 2.68 | 2.05 | 2.88 | 6.21 | 2.09 | 2.59 | NA | NA | 0.97 | NA | NA | NA | 2.27 | 6.75 | 0.00 | 5.28 | 0.95 | 2.23 | 3.51 | 8.20 | 0.07 | 8.67 | NA | |

| Other Comprehensive Income Loss Net Of Tax | 92.72 | -62.61 | -24.11 | 27.94 | 16.06 | -108.68 | -84.40 | -139.99 | -27.19 | 2.94 | 3.46 | -18.54 | -3.13 | 0.13 | -3.91 | 16.13 | 1.49 | 1.75 | 9.15 | 4.70 | 0.01 | -0.78 | -1.46 | -5.59 | -0.63 | 0.15 | 1.29 | 0.89 | NA | 0.18 | 1.29 | 0.53 | NA | 0.35 | -0.61 | 0.13 | NA | -0.09 | -0.05 | 0.16 | NA | -1.91 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 29.67 | 29.89 | 29.40 | 15.16 | 38.43 | 37.95 | 36.59 | 33.97 | 10.52 | 27.64 | 29.29 | 28.19 | 23.65 | 23.30 | 16.35 | 18.18 | 20.88 | 25.02 | 23.86 | 22.29 | 23.89 | 21.99 | 22.73 | 20.67 | 14.18 | 13.09 | 11.15 | 7.55 | 8.36 | 4.68 | 7.64 | 6.84 | 6.80 | 7.00 | 6.24 | 6.99 | 7.09 | 5.58 | 6.65 | 5.68 | 5.68 | 6.33 | 5.59 | 3.10 | -25.94 | 4.42 | 3.29 | -5.18 | NA | NA | NA | NA | NA | NA | NA | |

| Comprehensive Income Net Of Tax | 122.40 | -32.72 | 5.29 | 43.10 | 54.49 | -70.73 | -47.81 | -106.02 | -16.67 | 30.59 | 32.74 | 9.66 | 20.52 | 23.43 | 12.45 | 34.31 | 22.37 | 26.77 | 33.01 | 26.98 | 23.91 | 21.21 | 21.23 | 15.13 | 13.55 | 13.24 | 12.44 | 8.44 | 4.80 | 4.86 | 8.93 | 7.36 | 3.96 | 7.35 | 5.63 | 7.12 | 4.58 | 5.49 | 6.60 | 5.84 | 10.97 | 4.43 | 4.46 | 2.91 | -18.28 | 4.75 | 3.46 | -4.83 | -3.84 | 2.80 | 4.51 | 6.57 | -4.51 | 4.04 | 4.73 | |

| Net Income Loss Available To Common Stockholders Basic | 29.53 | 29.65 | 29.20 | 15.05 | 38.23 | 37.70 | 36.41 | 33.77 | 10.51 | 27.52 | 29.12 | 28.02 | 23.53 | 23.23 | 16.26 | 18.10 | 20.76 | 24.90 | 23.75 | 22.29 | 23.89 | 21.99 | 22.73 | 20.67 | 14.18 | 13.09 | 11.15 | 7.55 | 8.36 | 4.62 | 7.58 | 6.78 | 6.76 | 6.87 | 6.03 | 6.77 | 6.88 | 5.36 | 6.43 | 5.46 | 5.46 | 6.12 | 5.37 | 2.85 | -26.47 | 3.73 | 2.46 | -5.94 | 0.19 | -0.73 | 2.69 | 5.33 | -3.27 | 2.82 | 2.92 | |

| Net Income Loss Available To Common Stockholders Diluted | 29.67 | 29.89 | 29.40 | 15.16 | 38.43 | 37.95 | 36.59 | 33.97 | 10.52 | 27.64 | 29.29 | 28.19 | 23.65 | 23.30 | 16.35 | 18.18 | 20.88 | 25.02 | 23.86 | 22.29 | 23.89 | 21.99 | 22.73 | 20.67 | 14.18 | 13.09 | 11.15 | 7.55 | 8.36 | 4.68 | 7.64 | 6.84 | 6.82 | 6.93 | 6.09 | 6.83 | 6.94 | 5.42 | 6.49 | 5.52 | 5.52 | 6.17 | 5.43 | 2.91 | -26.47 | 3.73 | 2.46 | -5.94 | 0.19 | -0.73 | 2.69 | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 79.53 | 84.70 | 84.62 | 79.98 | 79.37 | 79.93 | 78.27 | 74.88 | 60.40 | 58.90 | 56.82 | 55.24 | 51.98 | 48.61 | 33.33 | 49.17 | 51.48 | 54.88 | 54.72 | 52.86 | 53.15 | 51.76 | 51.94 | 54.17 | 48.86 | 41.64 | 39.92 | 33.57 | 31.29 | 30.35 | 31.82 | 29.94 | 30.10 | 31.80 | 28.76 | 29.87 | 29.45 | 29.86 | 30.15 | 31.96 | 26.38 | 28.75 | 30.01 | 20.77 | -8.89 | 27.40 | 26.48 | 10.54 | 22.04 | 24.34 | 23.55 | 20.97 | 3.02 | 22.68 | 23.53 | |

| Noninterest Expense | 56.39 | 62.22 | 61.59 | 74.17 | 45.66 | 48.70 | 49.40 | 51.47 | 62.79 | 40.82 | 40.98 | 40.06 | 41.88 | 40.44 | 38.90 | 40.08 | 38.56 | 38.92 | 40.44 | 39.27 | 37.67 | 39.24 | 38.87 | 43.60 | 43.62 | 34.38 | 35.08 | 32.07 | 28.18 | 27.72 | 26.15 | 24.77 | 25.50 | 24.61 | 24.30 | 23.71 | 22.99 | 25.93 | 24.78 | 23.55 | 23.93 | 23.70 | 25.76 | 23.22 | 25.80 | 23.66 | 23.45 | 24.38 | 24.19 | 23.96 | 22.91 | 25.04 | 22.01 | 20.71 | 21.96 | |

| Noninterest Income | 14.54 | 15.18 | 14.23 | 13.54 | 14.56 | 16.91 | 17.26 | 19.25 | 15.06 | 16.51 | 21.37 | 20.67 | 20.00 | 21.45 | 26.19 | 13.71 | 13.34 | 15.63 | 15.99 | 14.57 | 14.41 | 15.38 | 16.11 | 15.94 | 14.86 | 12.36 | 11.88 | 9.81 | 9.47 | 5.16 | 5.92 | 5.00 | 5.72 | 3.51 | 5.00 | 4.53 | 4.49 | 4.61 | 4.97 | 0.30 | 6.29 | 5.61 | 4.49 | 7.11 | -8.53 | 2.80 | 1.77 | 5.35 | 3.42 | 3.49 | 5.11 | 14.19 | 14.92 | 3.96 | 4.54 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

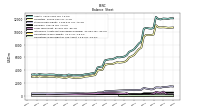

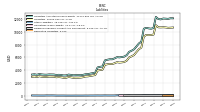

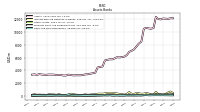

| Assets | 12114.94 | 11977.96 | 12033.00 | 12363.15 | 10625.05 | 10515.86 | 10566.22 | 10652.06 | 10508.90 | 8489.37 | 8200.58 | 7736.39 | 7289.75 | 7064.27 | 6888.60 | 6376.06 | 6143.64 | 6068.91 | 6012.04 | 6050.25 | 5864.12 | 5711.63 | 5717.60 | 5641.53 | 5547.04 | 4591.15 | 4528.62 | 4441.85 | 3614.86 | 3537.48 | 3466.55 | 3382.97 | 3362.07 | 3272.84 | 3211.52 | 3219.59 | 3218.38 | 3195.61 | 3266.50 | 3314.82 | 3185.07 | 3172.44 | 3247.41 | 3280.95 | 3244.91 | 3322.68 | 3328.76 | 3337.01 | 3290.47 | 3302.70 | 3333.75 | 3402.46 | 3278.93 | 3360.34 | 3318.34 | |

| Liabilities | 10742.56 | 10720.28 | 10735.36 | 11063.19 | 9593.45 | 9531.36 | 9503.87 | 9534.57 | 9278.33 | 7559.62 | 7296.07 | 6859.54 | 6396.33 | 6183.45 | 6020.70 | 5513.86 | 5291.24 | 5233.93 | 5196.87 | 5262.11 | 5099.89 | 4968.55 | 4992.88 | 4935.88 | 4854.06 | 4078.65 | 4027.97 | 3952.39 | 3246.76 | 3172.53 | 3104.93 | 3033.13 | 3019.88 | 2901.67 | 2846.13 | 2826.34 | 2830.68 | 2810.80 | 2885.41 | 2938.74 | 2813.15 | 2809.70 | 2887.30 | 2923.71 | 2888.79 | 2979.89 | 2988.68 | 2998.57 | 2945.32 | 2950.89 | 2981.45 | 3053.07 | 2934.33 | 3009.38 | 2969.60 | |

| Liabilities And Stockholders Equity | 12114.94 | 11977.96 | 12033.00 | 12363.15 | 10625.05 | 10515.86 | 10566.22 | 10652.06 | 10508.90 | 8489.37 | 8200.58 | 7736.39 | 7289.75 | 7064.27 | 6888.60 | 6376.06 | 6143.64 | 6068.91 | 6012.04 | 6050.25 | 5864.12 | 5711.63 | 5717.60 | 5641.53 | 5547.04 | 4591.15 | 4528.62 | 4441.85 | 3614.86 | 3537.48 | 3466.55 | 3382.97 | 3362.07 | 3272.84 | 3211.52 | 3219.59 | 3218.38 | 3195.61 | 3266.50 | 3314.82 | 3185.07 | 3172.44 | 3247.41 | 3280.95 | 3244.91 | 3322.68 | 3328.76 | 3337.01 | 3290.47 | 3302.70 | 3333.75 | 3402.46 | 3278.93 | 3360.34 | 3318.34 | |

| Stockholders Equity | 1372.38 | 1257.68 | 1297.64 | 1299.96 | 1031.60 | 984.50 | 1062.34 | 1117.49 | 1230.58 | 929.75 | 904.51 | 876.85 | 893.42 | 880.82 | 867.89 | 862.20 | 852.40 | 834.98 | 815.17 | 788.14 | 764.23 | 743.08 | 724.72 | 705.65 | 692.98 | 512.50 | 500.65 | 489.46 | 368.10 | 364.95 | 361.61 | 349.83 | 342.19 | 371.17 | 365.39 | 393.24 | 387.70 | 384.81 | 381.09 | 376.09 | 371.92 | 362.74 | 360.11 | 357.23 | 356.12 | 342.79 | 340.07 | 338.43 | 345.15 | 351.81 | 352.30 | 349.39 | 344.60 | 350.95 | 348.74 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 237.85 | 273.59 | 360.68 | 713.38 | 270.32 | 269.51 | 434.10 | 565.76 | 461.16 | 394.19 | 475.23 | 530.07 | 367.29 | 397.20 | 679.51 | 376.35 | 231.30 | 317.46 | 339.46 | 446.81 | 462.90 | 510.73 | 560.13 | NA | 489.49 | NA | NA | NA | 305.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

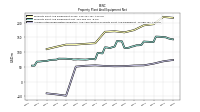

| Property Plant And Equipment Gross | 219.67 | NA | NA | NA | 195.04 | NA | NA | NA | 191.15 | NA | NA | NA | 174.97 | NA | NA | NA | 167.21 | NA | NA | NA | 170.96 | NA | NA | NA | 169.10 | NA | NA | NA | 130.41 | NA | NA | NA | 128.23 | NA | NA | NA | 125.79 | NA | NA | NA | 125.57 | NA | NA | NA | 118.12 | NA | NA | NA | 110.14 | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 68.71 | NA | NA | NA | 60.85 | NA | NA | NA | 55.05 | NA | NA | NA | 54.47 | NA | NA | NA | 52.35 | NA | NA | NA | 51.96 | NA | NA | NA | 52.87 | NA | NA | NA | 55.06 | NA | NA | NA | 53.67 | NA | NA | NA | 50.67 | NA | NA | NA | -48.13 | NA | NA | NA | -43.75 | NA | NA | NA | -40.16 | NA | NA | NA | NA | NA | NA | |

| Amortization Of Intangible Assets | 1.86 | 1.95 | 2.05 | 2.15 | 0.82 | 0.89 | 0.95 | 1.02 | 1.09 | 0.69 | 0.84 | 0.90 | 0.99 | 0.93 | 0.98 | 1.05 | 1.12 | 1.16 | 1.24 | 1.33 | 1.69 | 1.66 | 1.75 | 1.67 | 1.73 | 0.90 | 1.03 | 0.58 | 0.38 | 0.39 | 0.26 | 0.19 | 0.18 | 0.18 | 0.18 | 0.18 | 0.20 | 0.19 | 0.19 | 0.19 | 0.22 | 0.22 | 0.22 | 0.20 | 0.23 | 0.22 | 0.22 | 0.22 | 0.23 | 0.23 | 0.23 | 0.22 | 0.22 | 0.22 | 0.22 | |

| Property Plant And Equipment Net | 150.96 | 151.98 | 152.44 | 152.79 | 134.19 | 134.29 | 135.14 | 135.48 | 136.09 | 124.39 | 123.39 | 123.27 | 120.50 | 118.57 | 115.37 | 113.67 | 114.86 | 136.67 | 136.90 | 137.72 | 119.00 | 116.62 | 113.77 | 115.54 | 116.23 | 95.76 | 96.61 | 97.14 | 75.35 | 76.73 | 76.99 | 75.27 | 74.56 | 74.84 | 75.09 | 75.57 | 75.11 | 74.87 | 76.70 | 76.97 | 77.45 | 77.62 | 77.60 | 77.82 | 74.37 | 74.04 | 73.64 | 72.34 | 69.97 | 69.86 | 68.90 | 67.88 | 67.74 | 54.04 | 54.03 | |

| Goodwill | 478.75 | 478.75 | 478.75 | 478.75 | 364.26 | 364.26 | 364.26 | 364.26 | 364.26 | 231.91 | 231.91 | 239.27 | 239.27 | 240.97 | 234.37 | 234.37 | 234.37 | 234.37 | 234.37 | 234.37 | 234.37 | 232.46 | 232.46 | 231.68 | 233.07 | 144.67 | 139.12 | 142.87 | 75.04 | 75.39 | 73.54 | 67.53 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | 65.83 | |

| Intangible Assets Net Excluding Goodwill | 32.86 | 34.88 | 37.10 | 39.26 | 12.68 | 13.89 | 15.35 | 16.93 | 17.83 | 10.17 | 11.06 | 14.61 | 15.37 | 14.52 | 14.47 | 15.46 | 17.22 | 18.46 | 19.40 | 20.08 | 21.11 | 22.28 | 23.15 | 24.08 | 24.44 | 15.63 | 12.13 | 12.81 | 4.43 | 4.60 | 3.61 | 1.83 | 1.34 | 1.52 | 1.70 | 1.88 | 2.06 | 2.25 | 2.45 | 2.64 | 2.83 | 3.05 | 3.27 | 3.50 | 3.11 | 3.33 | 3.45 | 3.67 | 3.90 | 4.12 | 4.35 | 4.58 | 4.52 | 4.74 | 4.96 | |

| Finite Lived Intangible Assets Net | 32.86 | 34.88 | 33.32 | 35.37 | 8.67 | 9.50 | 10.38 | 11.34 | 12.36 | 4.28 | 4.97 | 8.68 | 9.58 | 8.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 84.09 | 125.14 | 95.95 | 90.94 | 109.18 | 125.59 | 93.76 | 53.80 | 5.67 | 1.57 | 2.20 | 4.85 | 0.17 | NA | 0.00 | 0.01 | 0.01 | 0.17 | 0.45 | NA | 1.86 | NA | NA | NA | 0.79 | NA | NA | NA | 1.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 449.62 | 410.32 | 441.88 | 448.90 | 432.53 | 418.60 | 452.66 | 492.31 | 511.70 | 369.95 | 292.77 | 195.42 | 170.73 | 112.11 | 96.32 | 62.38 | 68.33 | 74.47 | 79.04 | 90.28 | 99.91 | 103.36 | 107.07 | 111.20 | 119.00 | 124.88 | 129.70 | 134.19 | 130.19 | 139.51 | 146.10 | 151.68 | 157.15 | 162.86 | 167.76 | 174.76 | 182.41 | 57.60 | 57.61 | 57.19 | 56.70 | 56.82 | 58.38 | 60.76 | 61.50 | 61.88 | 61.68 | 61.23 | 62.75 | 61.51 | 59.86 | 58.53 | 53.31 | 54.30 | 47.79 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.04 | NA | 0.01 | 0.05 | 0.01 | NA | 0.01 | 0.02 | 3.54 | 3.63 | 3.25 | 1.43 | 3.35 | 1.91 | 1.39 | 1.09 | 0.41 | 0.37 | 0.44 | NA | 0.53 | NA | NA | NA | 1.28 | NA | NA | NA | 1.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 84.09 | 125.14 | 95.95 | 90.94 | 109.18 | 125.59 | 93.76 | 53.80 | 5.67 | 1.57 | 2.20 | 4.85 | 0.17 | NA | 0.00 | 0.01 | 0.01 | 0.17 | 0.45 | NA | 1.86 | NA | NA | NA | 0.79 | NA | NA | NA | 1.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 533.68 | 535.46 | 537.82 | 539.79 | 541.70 | 544.19 | 546.41 | 546.09 | 513.83 | NA | NA | NA | 167.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling After Ten Years Fair Value | 325.59 | NA | NA | NA | 366.71 | NA | NA | 457.37 | 473.48 | 336.71 | 256.88 | 159.86 | 131.19 | 66.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Six Through Ten Fair Value | 110.78 | NA | NA | NA | 50.73 | NA | NA | 15.99 | 16.11 | 8.53 | 8.82 | 5.39 | 3.54 | 5.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Two Through Five Fair Value | 1.80 | NA | NA | NA | 0.87 | NA | NA | NA | NA | 0.55 | 0.55 | 0.56 | 3.01 | 4.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

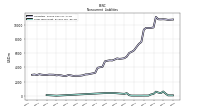

| Time Deposit Maturities Year One | 901.21 | NA | NA | NA | 882.74 | NA | NA | NA | 735.62 | NA | NA | NA | 681.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

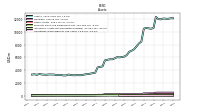

| Deposits | 10031.60 | 10235.40 | 10168.57 | 10372.60 | 9227.53 | 9229.27 | 9359.75 | 9385.15 | 9124.63 | 7432.77 | 7171.36 | 6733.49 | 6273.60 | 6060.23 | 5831.14 | 5044.99 | 4931.35 | 4875.38 | 4843.05 | 4797.24 | 4659.34 | 4528.37 | 4553.62 | 4495.71 | 4406.95 | 3651.24 | 3644.33 | 3629.17 | 2947.35 | 2910.84 | 2872.02 | 2826.82 | 2811.28 | 2707.75 | 2653.13 | 2693.61 | 2695.91 | 2679.01 | 2754.58 | 2786.72 | 2751.02 | 2740.86 | 2818.35 | 2857.57 | 2821.36 | 2834.46 | 2838.30 | 2831.06 | 2755.04 | 2729.40 | 2747.42 | 2844.44 | 2652.51 | 2751.48 | 2794.89 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 630.16 | 401.84 | 481.66 | 606.48 | 287.51 | 226.48 | 67.44 | 67.42 | 67.39 | 60.76 | 61.25 | 61.34 | 61.83 | 61.82 | 112.20 | 402.19 | 300.67 | NA | NA | NA | 409.55 | NA | NA | NA | 410.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 46.39 | NA | NA | NA | 133.89 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

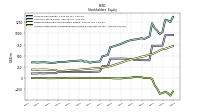

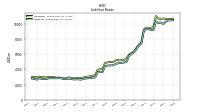

| Stockholders Equity | 1372.38 | 1257.68 | 1297.64 | 1299.96 | 1031.60 | 984.50 | 1062.34 | 1117.49 | 1230.58 | 929.75 | 904.51 | 876.85 | 893.42 | 880.82 | 867.89 | 862.20 | 852.40 | 834.98 | 815.17 | 788.14 | 764.23 | 743.08 | 724.72 | 705.65 | 692.98 | 512.50 | 500.65 | 489.46 | 368.10 | 364.95 | 361.61 | 349.83 | 342.19 | 371.17 | 365.39 | 393.24 | 387.70 | 384.81 | 381.09 | 376.09 | 371.92 | 362.74 | 360.11 | 357.23 | 356.12 | 342.79 | 340.07 | 338.43 | 345.15 | 351.81 | 352.30 | 349.39 | 344.60 | 350.95 | 348.74 | |

| Common Stock Value | 963.99 | 962.64 | 960.85 | 959.42 | 725.15 | 724.69 | 723.96 | 723.44 | 722.67 | 398.06 | 397.70 | 397.09 | 400.58 | 403.35 | 408.70 | 410.24 | 429.51 | 429.14 | 432.53 | 434.95 | 434.45 | 434.23 | 434.12 | 433.31 | 432.79 | 263.49 | 262.90 | 262.18 | 147.29 | 139.98 | 139.83 | 135.32 | 133.39 | 133.21 | 133.06 | 132.75 | 132.53 | 132.44 | 132.42 | 132.22 | 132.10 | 132.10 | 132.10 | 131.90 | 131.88 | 105.45 | 105.44 | 105.07 | 104.84 | 100.93 | 100.55 | 104.58 | 99.61 | 99.30 | 98.97 | |

| Retained Earnings Accumulated Deficit | 716.42 | 695.79 | 674.93 | 654.57 | 648.42 | 617.84 | 587.74 | 559.00 | 532.87 | 529.47 | 507.53 | 483.94 | 478.49 | 459.99 | 441.85 | 430.71 | 417.76 | 402.21 | 380.75 | 360.45 | 341.74 | 320.82 | 301.80 | 282.04 | 264.33 | 251.79 | 240.68 | 231.50 | 225.92 | 219.23 | 216.22 | 210.25 | 205.06 | 199.89 | 194.60 | 190.15 | 184.96 | 179.66 | 175.87 | 171.02 | 167.14 | 163.25 | 158.71 | 154.91 | 153.63 | 181.67 | 179.30 | 178.19 | 185.49 | 186.65 | 188.74 | 187.40 | 183.41 | 188.03 | 186.55 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -308.03 | -400.75 | -338.14 | -314.03 | -341.98 | -358.04 | -249.35 | -164.96 | -24.97 | 2.22 | -0.72 | -4.18 | 14.35 | 17.48 | 17.35 | 21.25 | 5.12 | 3.63 | 1.89 | -7.26 | -11.96 | -11.97 | -11.20 | -9.69 | -4.15 | -2.78 | -2.93 | -4.22 | -5.11 | -1.55 | -1.73 | -3.02 | -3.55 | -0.71 | -1.06 | -0.45 | -0.58 | 1.93 | 2.02 | 2.06 | 1.90 | -3.39 | -1.49 | -0.36 | -0.18 | -7.84 | -8.16 | -8.33 | -8.68 | -3.86 | -4.11 | -4.89 | -5.08 | -2.82 | -3.02 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

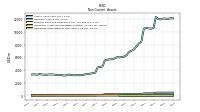

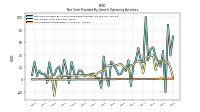

| Net Cash Provided By Used In Operating Activities | 45.63 | 20.61 | 28.54 | 36.62 | 51.45 | 48.69 | 30.37 | 100.14 | 27.73 | 30.08 | 50.37 | 30.73 | 23.03 | -10.45 | 30.82 | 13.67 | 17.82 | 8.77 | 7.65 | 17.01 | 22.72 | 28.68 | -10.41 | 5.42 | 36.70 | -13.44 | 2.91 | 0.66 | 9.61 | NA | NA | NA | 5.76 | 14.13 | 14.35 | 3.10 | 10.89 | 28.45 | -5.71 | 14.19 | 31.35 | 2.88 | 20.63 | 17.02 | 6.95 | 8.13 | 27.63 | -1.03 | 9.54 | 8.17 | 13.84 | 5.50 | 28.62 | 7.12 | NA | |

| Net Cash Provided By Used In Investing Activities | -96.33 | -84.83 | -42.59 | 32.38 | -101.84 | -234.05 | -128.44 | -249.03 | -49.23 | -366.12 | -537.04 | -318.05 | -257.86 | -427.85 | -216.14 | -58.43 | -156.26 | -55.10 | -45.87 | -167.47 | -198.45 | -49.17 | -11.42 | -54.25 | -20.84 | -42.31 | -68.99 | 3.61 | -54.59 | NA | NA | NA | -37.61 | -26.65 | -66.12 | -7.61 | -109.49 | -21.85 | 82.84 | 22.71 | -1.57 | 23.92 | -58.35 | 81.04 | -2.18 | 28.27 | -41.56 | 21.20 | -14.80 | 29.68 | 40.57 | 115.80 | -59.69 | 55.22 | NA | |

| Net Cash Provided By Used In Financing Activities | 14.96 | -22.87 | -338.65 | 374.07 | 51.20 | 20.77 | -33.59 | 253.48 | 88.48 | 255.01 | 431.83 | 450.10 | 204.92 | 155.99 | 488.48 | 189.81 | 52.28 | 24.33 | -69.13 | 134.37 | 127.89 | -28.93 | 55.23 | 86.08 | 64.79 | 47.03 | 78.48 | 94.89 | 69.65 | NA | NA | NA | 80.33 | 52.91 | -14.32 | -4.09 | 15.17 | -77.36 | -53.93 | 123.92 | 8.37 | -79.28 | -41.02 | -23.22 | -46.46 | -15.38 | -17.23 | 57.01 | -22.06 | -32.62 | -73.18 | -76.28 | -76.61 | 43.76 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 45.63 | 20.61 | 28.54 | 36.62 | 51.45 | 48.69 | 30.37 | 100.14 | 27.73 | 30.08 | 50.37 | 30.73 | 23.03 | -10.45 | 30.82 | 13.67 | 17.82 | 8.77 | 7.65 | 17.01 | 22.72 | 28.68 | -10.41 | 5.42 | 36.70 | -13.44 | 2.91 | 0.66 | 9.61 | NA | NA | NA | 5.76 | 14.13 | 14.35 | 3.10 | 10.89 | 28.45 | -5.71 | 14.19 | 31.35 | 2.88 | 20.63 | 17.02 | 6.95 | 8.13 | 27.63 | -1.03 | 9.54 | 8.17 | 13.84 | 5.50 | 28.62 | 7.12 | NA | |

| Net Income Loss | 29.67 | 29.89 | 29.40 | 15.16 | 38.43 | 37.95 | 36.59 | 33.97 | 10.52 | 27.64 | 29.29 | 28.19 | 23.65 | 23.30 | 16.35 | 18.18 | 20.88 | 25.02 | 23.86 | 22.29 | 23.89 | 21.99 | 22.73 | 20.67 | 14.18 | 13.09 | 11.15 | 7.55 | 8.36 | 4.68 | 7.64 | 6.84 | 6.80 | 7.00 | 6.24 | 6.99 | 7.09 | 5.58 | 6.65 | 5.68 | 5.68 | 6.33 | 5.59 | 3.10 | -25.94 | 4.42 | 3.29 | -5.18 | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.15 | 1.73 | 1.13 | 1.12 | 0.70 | 0.74 | 1.00 | 0.55 | 0.50 | 0.54 | 0.83 | 0.40 | 0.53 | 0.60 | 0.90 | 0.51 | 0.52 | 0.55 | 0.80 | 0.40 | 0.37 | 0.37 | 0.60 | 0.23 | 0.23 | 0.18 | 0.51 | 0.18 | 0.19 | 0.15 | 0.26 | 0.12 | 0.16 | 0.15 | 0.28 | 0.13 | 0.02 | 0.02 | 0.20 | 0.02 | 0.00 | 0.00 | 0.20 | 0.02 | 0.03 | 0.02 | 0.24 | 0.02 | 0.26 | 0.16 | 0.35 | 0.13 | 0.10 | 0.10 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

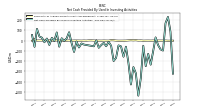

| Net Cash Provided By Used In Investing Activities | -96.33 | -84.83 | -42.59 | 32.38 | -101.84 | -234.05 | -128.44 | -249.03 | -49.23 | -366.12 | -537.04 | -318.05 | -257.86 | -427.85 | -216.14 | -58.43 | -156.26 | -55.10 | -45.87 | -167.47 | -198.45 | -49.17 | -11.42 | -54.25 | -20.84 | -42.31 | -68.99 | 3.61 | -54.59 | NA | NA | NA | -37.61 | -26.65 | -66.12 | -7.61 | -109.49 | -21.85 | 82.84 | 22.71 | -1.57 | 23.92 | -58.35 | 81.04 | -2.18 | 28.27 | -41.56 | 21.20 | -14.80 | 29.68 | 40.57 | 115.80 | -59.69 | 55.22 | NA | |

| Payments To Acquire Property Plant And Equipment | 1.22 | 1.35 | 1.51 | 0.35 | 1.54 | 1.05 | 1.49 | 1.22 | 0.56 | 2.53 | 1.78 | 4.53 | 3.38 | 4.55 | 3.11 | 1.32 | 0.82 | 0.75 | 0.52 | 1.45 | 4.07 | 4.70 | 0.73 | 1.22 | 1.62 | 0.91 | 1.26 | 0.87 | 1.81 | 3.18 | 2.77 | 0.93 | 1.65 | 0.87 | 1.36 | 1.60 | 1.47 | 0.44 | 2.06 | 0.78 | 1.00 | 1.20 | 0.94 | 3.15 | 1.46 | 1.55 | 2.44 | 3.50 | 1.20 | 2.08 | 2.11 | 1.21 | 14.73 | 1.00 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

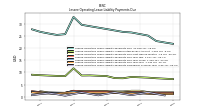

| Net Cash Provided By Used In Financing Activities | 14.96 | -22.87 | -338.65 | 374.07 | 51.20 | 20.77 | -33.59 | 253.48 | 88.48 | 255.01 | 431.83 | 450.10 | 204.92 | 155.99 | 488.48 | 189.81 | 52.28 | 24.33 | -69.13 | 134.37 | 127.89 | -28.93 | 55.23 | 86.08 | 64.79 | 47.03 | 78.48 | 94.89 | 69.65 | NA | NA | NA | 80.33 | 52.91 | -14.32 | -4.09 | 15.17 | -77.36 | -53.93 | 123.92 | 8.37 | -79.28 | -41.02 | -23.22 | -46.46 | -15.38 | -17.23 | 57.01 | -22.06 | -32.62 | -73.18 | -76.28 | -76.61 | 43.76 | NA | |

| Payments Of Dividends Common Stock | 9.04 | 9.04 | 9.02 | 7.85 | 7.85 | 7.84 | 7.84 | 7.12 | 5.70 | 5.69 | 5.69 | 5.14 | 5.14 | 5.24 | 5.24 | 5.33 | 3.55 | 3.57 | 3.57 | 2.97 | 2.97 | 2.97 | 2.97 | 2.37 | 1.98 | 1.98 | 1.97 | 1.67 | 1.64 | 1.60 | 1.58 | 1.58 | 1.58 | 1.58 | 1.58 | 1.58 | 1.58 | 1.58 | 1.58 | 1.57 | 1.57 | 1.57 | 1.57 | 1.57 | 1.36 | 1.36 | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 | 1.34 | 1.34 | 1.34 | NA |