| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 22.37 | 22.37 | 22.37 | 22.37 | 22.37 | NA | 22.37 | 22.37 | 22.37 | 22.37 | 22.36 | 22.36 | 22.30 | 22.30 | 22.30 | 22.30 | 22.21 | 22.21 | 22.20 | 22.20 | 22.18 | 22.18 | 22.17 | 22.09 | |

| Common Stock Par Or Stated Value Per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

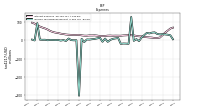

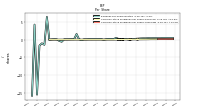

| Earnings Per Share Basic | 0.47 | 0.47 | 0.39 | 0.39 | 0.40 | 0.40 | 0.38 | 0.42 | 0.35 | 0.36 | 0.33 | 0.28 | 0.23 | 0.13 | 0.09 | 0.01 | 0.16 | 0.21 | 0.19 | 0.20 | 0.46 | 0.16 | 0.14 | 0.15 | |

| Earnings Per Share Diluted | 0.46 | 0.46 | 0.39 | 0.39 | 0.40 | 0.40 | 0.38 | 0.41 | 0.35 | 0.36 | 0.33 | 0.28 | 0.23 | 0.13 | 0.09 | 0.01 | 0.17 | 0.21 | 0.19 | 0.20 | 0.47 | 0.16 | 0.14 | 0.15 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

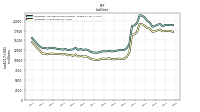

| Revenue From Contract With Customer Excluding Assessed Tax | 230.29 | 230.02 | 236.09 | 233.40 | 235.17 | 237.60 | 227.13 | 218.48 | 214.52 | 214.69 | 214.67 | 207.22 | 207.97 | 178.63 | 156.10 | 168.85 | 164.33 | 165.83 | 164.77 | 162.72 | 158.23 | 151.04 | 150.94 | 147.48 | |

| Revenues | 456.67 | 230.02 | 236.09 | 233.40 | 302.49 | 237.60 | 227.13 | 218.48 | 279.30 | 214.69 | 214.67 | 207.22 | 300.63 | 178.63 | 156.10 | 168.85 | 273.15 | 165.83 | 164.77 | 162.72 | 257.81 | 151.04 | 150.94 | 147.48 | |

| Interest And Fee Income Loans And Leases | 233.93 | 227.93 | 218.07 | 210.64 | 203.11 | 191.74 | 179.26 | 173.79 | 177.39 | 178.96 | 182.83 | 179.97 | 183.94 | 156.19 | 143.79 | 147.13 | 149.75 | 154.23 | 151.39 | 147.62 | 143.73 | 139.21 | 137.54 | 133.18 | |

| Marketing And Advertising Expense | 6.72 | 4.76 | 4.17 | 3.98 | 5.59 | 5.14 | 4.04 | 3.46 | 5.79 | 3.37 | 3.23 | 2.97 | 3.16 | 3.05 | 2.31 | 3.62 | 4.06 | 4.00 | 3.94 | 3.71 | 4.36 | 3.86 | 4.02 | 2.58 | |

| Interest Expense | 68.80 | 63.68 | 52.39 | 41.51 | 27.88 | 14.77 | 12.44 | 12.23 | 14.30 | 15.43 | 16.68 | 18.38 | 20.93 | 21.71 | 23.41 | 26.61 | 27.69 | 27.87 | 26.96 | 26.29 | 24.73 | 24.97 | 25.16 | 24.73 | |

| Interest Income Expense Net | 196.68 | 199.73 | 199.81 | 200.88 | 205.57 | 207.91 | 196.19 | 185.62 | 184.14 | 184.74 | 184.78 | 176.26 | 177.77 | 148.70 | 135.21 | 138.65 | 139.93 | 144.43 | 142.55 | 140.18 | 137.70 | 132.52 | 130.47 | 124.69 | |

| Interest Paid Net | 64.04 | 59.26 | 46.73 | 37.80 | 24.78 | 15.06 | 12.85 | 13.30 | 15.01 | 16.72 | 18.00 | 18.93 | 23.01 | 21.54 | 24.38 | 25.93 | 27.22 | 27.70 | 26.72 | 25.37 | 23.52 | 25.57 | 24.75 | 24.35 | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | 1.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.09 | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.30 | |

| Income Tax Expense Benefit | 5.38 | 26.97 | 30.28 | 31.93 | 33.36 | 32.03 | 34.10 | 43.02 | 41.62 | 37.06 | 40.09 | 28.02 | 15.35 | -4.40 | 6.05 | -2.97 | 126.89 | -19.27 | -18.01 | -17.62 | -19.28 | 12.33 | 10.16 | 7.76 | |

| Income Taxes Paid Net | 21.25 | 6.04 | 71.29 | 10.93 | 28.86 | 7.65 | 12.70 | 2.60 | 2.03 | 4.48 | 4.48 | 4.48 | 3.51 | 2.60 | 9.53 | 1.07 | 3.26 | 3.41 | 3.41 | 3.41 | 1.89 | 1.76 | 3.53 | 0.00 | |

| Other Comprehensive Income Loss Net Of Tax | 212.19 | -78.98 | -54.84 | 87.23 | 57.91 | -270.94 | -175.92 | -331.83 | -50.28 | -18.74 | 28.50 | -98.93 | 10.13 | -7.94 | 4.15 | 42.35 | 1.64 | 7.56 | 17.47 | 20.51 | 22.47 | -10.78 | -7.45 | -24.05 | |

| Net Income Loss | 79.49 | 82.02 | 70.66 | 70.70 | 73.17 | 74.60 | 74.69 | 82.60 | 73.64 | 75.68 | 70.56 | 61.15 | 50.14 | 28.61 | 21.26 | 2.27 | 36.45 | 46.33 | 41.29 | 43.31 | 101.11 | 36.32 | 31.03 | 33.15 | |

| Comprehensive Income Net Of Tax | 291.68 | 3.05 | 15.82 | 157.93 | 131.09 | -196.33 | -101.23 | -249.23 | 23.36 | 56.94 | 99.05 | -37.78 | 60.27 | 20.67 | 25.41 | 44.62 | 38.09 | 53.89 | 58.75 | 63.82 | 123.57 | 25.54 | 23.59 | 9.10 | |

| Net Income Loss Available To Common Stockholders Basic | 79.49 | 82.02 | 70.66 | 70.70 | 73.17 | 74.60 | 74.69 | 82.60 | 71.96 | 75.01 | 69.89 | 60.48 | 49.47 | 27.94 | 20.59 | 1.60 | 35.78 | 45.66 | 40.62 | 42.65 | 100.44 | 35.65 | 30.36 | 32.48 | |

| Interest Income Expense After Provision For Loan Loss | 177.87 | 195.33 | 177.59 | 185.38 | 189.86 | 192.13 | 186.18 | 199.43 | 196.35 | 196.82 | 210.94 | 191.52 | 170.08 | 101.78 | 96.20 | 61.28 | 131.46 | 137.03 | 130.01 | 128.36 | 130.05 | 121.00 | 110.94 | 104.15 | |

| Noninterest Expense | 126.61 | 116.64 | 112.92 | 115.27 | 112.93 | 115.19 | 108.33 | 106.66 | 111.47 | 114.04 | 130.17 | 133.30 | 134.76 | 107.51 | 89.79 | 92.18 | 102.31 | 92.83 | 92.94 | 89.97 | 90.69 | 90.86 | 90.22 | 86.03 | |

| Noninterest Income | 33.61 | 30.30 | 36.27 | 32.52 | 29.60 | 29.69 | 30.94 | 32.86 | 30.38 | 29.95 | 29.88 | 30.96 | 30.20 | 29.93 | 20.89 | 30.20 | 24.41 | 21.40 | 22.22 | 22.54 | 20.53 | 18.52 | 20.47 | 22.78 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

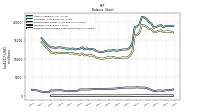

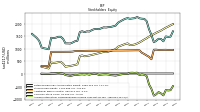

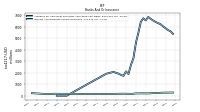

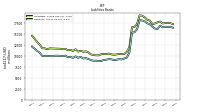

| Assets | 18909.55 | 18594.61 | 19152.46 | 18977.11 | 18634.48 | 18442.03 | 19531.63 | 19929.04 | 20785.28 | 21256.15 | 21369.96 | 19413.73 | 18793.07 | 18659.77 | 14096.41 | 13047.98 | 12611.27 | 12530.71 | 12537.20 | 12376.78 | 12243.56 | 12209.70 | 12384.86 | 12200.39 | |

| Liabilities | 17411.94 | 17291.54 | 17754.46 | 17571.52 | 17308.94 | 17176.70 | 17973.72 | 18147.94 | 18683.51 | 19058.19 | 19165.01 | 17193.31 | 16517.89 | 16434.49 | 11881.57 | 10848.23 | 10383.19 | 10330.12 | 10384.22 | 10276.32 | 10198.86 | 10282.28 | 10483.18 | 10323.28 | |

| Liabilities And Stockholders Equity | 18909.55 | 18594.61 | 19152.46 | 18977.11 | 18634.48 | 18442.03 | 19531.63 | 19929.04 | 20785.28 | 21256.15 | 21369.96 | 19413.73 | 18793.07 | 18659.77 | 14096.41 | 13047.98 | 12611.27 | 12530.71 | 12537.20 | 12376.78 | 12243.56 | 12209.70 | 12384.86 | 12200.39 | |

| Stockholders Equity | 1497.61 | 1303.07 | 1398.00 | 1405.59 | 1325.54 | 1265.33 | 1557.92 | 1781.10 | 2101.77 | 2197.97 | 2204.95 | 2220.43 | 2275.18 | 2225.28 | 2214.83 | 2199.75 | 2228.07 | 2200.59 | 2152.98 | 2100.46 | 2044.70 | 1927.41 | 1901.68 | 1877.10 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

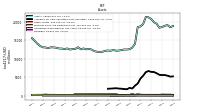

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 663.16 | 584.91 | 1047.53 | 823.60 | 480.50 | 554.99 | 1263.52 | 1696.25 | 2543.06 | 2658.17 | 2788.77 | NA | 1493.83 | NA | NA | NA | 644.10 | NA | NA | NA | NA | NA | NA | NA | |

| Land | 29.96 | NA | NA | NA | 24.48 | NA | NA | NA | 23.87 | NA | NA | NA | 23.87 | NA | NA | NA | 22.94 | NA | NA | NA | 24.64 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 5229.98 | 5175.80 | 5433.37 | 5589.26 | 5599.52 | 5668.69 | 6081.12 | 6424.66 | 6453.76 | 6689.48 | 6402.26 | 5406.79 | 4647.02 | 3294.65 | 2723.17 | 1932.18 | 2123.53 | 1736.56 | 1803.69 | 1905.23 | 1942.57 | 2011.22 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

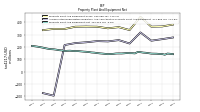

| Property Plant And Equipment Gross | 383.06 | NA | NA | NA | 367.76 | NA | NA | NA | 366.11 | NA | NA | NA | 445.34 | NA | NA | NA | 338.63 | NA | NA | NA | 362.06 | NA | NA | NA | |

| Furniture And Fixtures Gross | 161.89 | NA | NA | NA | 155.57 | NA | NA | NA | 148.17 | NA | NA | NA | 224.62 | NA | NA | NA | 146.84 | NA | NA | NA | 176.12 | NA | NA | NA | |

| Leasehold Improvements Gross | 77.70 | NA | NA | NA | 76.39 | NA | NA | NA | 79.42 | NA | NA | NA | 82.03 | NA | NA | NA | 56.53 | NA | NA | NA | 54.73 | NA | NA | NA | |

| Construction In Progress Gross | 6.85 | NA | NA | NA | 14.92 | NA | NA | NA | 8.09 | NA | NA | NA | 7.65 | NA | NA | NA | 17.13 | NA | NA | NA | 17.47 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 277.85 | NA | NA | NA | 264.23 | NA | NA | NA | 251.66 | NA | NA | NA | 318.66 | NA | NA | NA | 228.71 | NA | NA | NA | 256.36 | NA | NA | NA | |

| Amortization Of Intangible Assets | 1.85 | 1.90 | 2.00 | 2.04 | 2.13 | 2.20 | 2.20 | 2.29 | 2.75 | 2.80 | 2.80 | 2.95 | 3.00 | 1.49 | 0.71 | 0.71 | 0.77 | 0.77 | 0.75 | 0.80 | 0.86 | 0.86 | 0.86 | 1.01 | |

| Property Plant And Equipment Net | 142.02 | 144.61 | 146.64 | 137.58 | 142.94 | 143.43 | 145.40 | 145.85 | 146.42 | 149.89 | 152.97 | 154.68 | 158.21 | 159.77 | 148.05 | 149.86 | 149.99 | 151.19 | 148.81 | 147.41 | 147.81 | 147.15 | 144.51 | 143.12 | |

| Goodwill | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.61 | 38.63 | 34.40 | 28.10 | 28.10 | 28.10 | 28.10 | 28.10 | 28.10 | 28.10 | 28.10 | 28.10 | 28.10 | |

| Finite Lived Intangible Assets Net | 13.38 | 15.23 | 17.09 | 19.07 | 21.12 | 23.25 | 25.42 | 27.65 | 29.93 | 32.69 | 35.51 | 38.39 | 40.89 | 43.89 | NA | NA | 7.57 | 8.34 | 3.90 | NA | 4.30 | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 12.86 | 21.14 | 17.94 | 13.80 | 14.49 | 19.48 | 8.43 | NA | 13.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 13.10 | NA | NA | |

| Held To Maturity Securities Fair Value | 346.13 | 342.85 | 410.18 | 419.75 | 427.12 | 429.53 | 453.24 | 168.81 | 167.15 | 170.44 | 187.65 | 178.31 | 173.81 | 166.97 | 108.65 | 111.16 | 110.37 | 115.44 | 123.11 | 123.91 | 125.66 | 131.70 | 135.43 | 134.86 | |

| Held To Maturity Securities | 354.18 | 359.17 | 424.73 | 431.39 | 437.54 | 445.86 | 458.23 | NA | 178.13 | NA | NA | NA | NA | NA | NA | NA | 138.68 | 138.68 | 144.67 | 144.67 | 144.81 | 144.80 | 150.49 | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 5863.29 | 6021.07 | 6199.63 | 6300.70 | 6398.20 | 6527.68 | 6669.19 | 6836.84 | 6534.50 | 6716.33 | 6410.38 | 5443.42 | 4584.85 | 3242.95 | 2663.78 | 1875.68 | 2109.01 | 1723.69 | 1798.37 | 1917.38 | 1975.23 | 2066.36 | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 4.81 | 4.82 | 3.39 | 2.16 | 4.07 | 3.15 | 3.45 | NA | 2.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 12.86 | 21.14 | 17.94 | 13.80 | 14.49 | 19.48 | 8.43 | NA | 13.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 13.10 | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 269.92 | 266.96 | 352.19 | 363.48 | 358.90 | 389.99 | 340.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 269.92 | 266.96 | 195.42 | 108.27 | 98.80 | 121.44 | 127.32 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 16555.99 | 16435.24 | 16819.69 | 16051.97 | 16143.47 | 16569.58 | 17140.13 | 17335.40 | 17784.89 | 17984.66 | 18069.99 | 16010.44 | 15317.38 | 15202.90 | 10696.69 | 9562.31 | 9348.43 | 9132.90 | 9182.18 | 9070.83 | 8994.71 | 9148.24 | 9218.08 | 9066.47 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

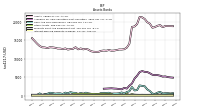

| Stockholders Equity | 1497.61 | 1303.07 | 1398.00 | 1405.59 | 1325.54 | 1265.33 | 1557.92 | 1781.10 | 2101.77 | 2197.97 | 2204.95 | 2220.43 | 2275.18 | 2225.28 | 2214.83 | 2199.75 | 2228.07 | 2200.59 | 2152.98 | 2100.46 | 2044.70 | 1927.41 | 1901.68 | 1877.10 | |

| Common Stock Value | 22.37 | 22.37 | 22.37 | 22.37 | 22.37 | NA | 22.37 | 22.37 | 22.37 | 22.37 | 22.36 | 22.36 | 22.30 | 22.30 | 22.30 | 22.30 | 22.21 | 22.21 | 22.20 | 22.20 | 22.18 | 22.18 | 22.17 | 22.09 | |

| Additional Paid In Capital | 965.71 | 963.79 | 962.23 | 959.91 | 970.72 | 969.37 | 589.17 | 687.07 | 738.29 | 799.13 | 847.41 | 945.48 | 946.48 | 945.21 | 943.82 | 942.52 | 941.65 | 940.70 | 939.77 | 938.80 | 939.67 | 938.78 | 937.92 | 936.34 | |

| Retained Earnings Accumulated Deficit | 1846.11 | 1790.65 | 1733.50 | 1688.18 | 1644.21 | 1593.28 | 1541.33 | 1489.99 | 1427.30 | 1375.80 | 1315.35 | 1260.46 | 1215.32 | 1176.82 | 1159.83 | 1150.20 | 1221.82 | 1196.93 | 1157.81 | 1123.72 | 1087.62 | 993.70 | 958.04 | 927.68 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -639.17 | -851.36 | -772.39 | -717.55 | -804.78 | -862.69 | -591.76 | -415.83 | -84.00 | -33.72 | -14.98 | -43.47 | 55.45 | 45.33 | 53.27 | 49.12 | 6.76 | 5.12 | -2.44 | -19.91 | -40.41 | -62.89 | -52.11 | -44.66 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

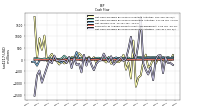

| Net Cash Provided By Used In Operating Activities | 79.24 | 117.27 | 51.04 | 115.42 | 105.73 | 115.14 | 104.77 | 114.83 | 96.17 | 79.03 | 111.85 | 112.68 | 127.10 | 48.23 | 30.87 | 91.53 | 58.60 | 78.54 | 74.16 | 82.98 | 74.50 | 55.55 | 62.90 | 95.38 | |

| Net Cash Provided By Used In Investing Activities | -95.98 | -7.50 | -25.50 | 50.53 | -173.28 | 49.51 | -224.70 | -332.99 | 219.62 | -47.59 | -666.92 | -768.09 | -1150.74 | 817.22 | -799.72 | -105.62 | -424.06 | 213.74 | -27.77 | -104.87 | -83.31 | -82.51 | -169.19 | 111.75 | |

| Net Cash Provided By Used In Financing Activities | 94.99 | -572.39 | 198.40 | 177.15 | -6.94 | -873.18 | -312.80 | -628.65 | -430.90 | -162.04 | 1825.67 | 679.75 | 47.97 | 302.57 | 982.62 | 457.70 | 33.62 | -56.63 | 104.33 | 25.26 | -61.76 | -204.67 | 150.87 | -79.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 79.24 | 117.27 | 51.04 | 115.42 | 105.73 | 115.14 | 104.77 | 114.83 | 96.17 | 79.03 | 111.85 | 112.68 | 127.10 | 48.23 | 30.87 | 91.53 | 58.60 | 78.54 | 74.16 | 82.98 | 74.50 | 55.55 | 62.90 | 95.38 | |

| Net Income Loss | 79.49 | 82.02 | 70.66 | 70.70 | 73.17 | 74.60 | 74.69 | 82.60 | 73.64 | 75.68 | 70.56 | 61.15 | 50.14 | 28.61 | 21.26 | 2.27 | 36.45 | 46.33 | 41.29 | 43.31 | 101.11 | 36.32 | 31.03 | 33.15 | |

| Deferred Income Tax Expense Benefit | 0.57 | 3.12 | 0.85 | 1.56 | 11.83 | 0.90 | 9.78 | 31.71 | 32.35 | 30.42 | 32.51 | 23.04 | 18.09 | -12.46 | 1.65 | -11.65 | 9.00 | 16.48 | 15.62 | 13.90 | 2.49 | 11.07 | 6.01 | 5.47 | |

| Share Based Compensation | 1.90 | 1.90 | 1.92 | 2.08 | 1.41 | 1.41 | 1.40 | 1.18 | 1.36 | 1.35 | 1.34 | 1.42 | 1.26 | 1.41 | 1.30 | 1.14 | 0.95 | 0.99 | 0.99 | 1.02 | 0.90 | 0.94 | 1.78 | 2.21 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -95.98 | -7.50 | -25.50 | 50.53 | -173.28 | 49.51 | -224.70 | -332.99 | 219.62 | -47.59 | -666.92 | -768.09 | -1150.74 | 817.22 | -799.72 | -105.62 | -424.06 | 213.74 | -27.77 | -104.87 | -83.31 | -82.51 | -169.19 | 111.75 | |

| Payments To Acquire Property Plant And Equipment | 2.66 | 3.73 | 14.52 | 1.69 | 5.02 | 3.60 | 5.08 | 6.76 | 2.57 | 2.66 | 4.80 | 3.32 | 4.75 | 4.31 | 2.63 | 4.38 | 5.33 | 6.83 | 6.26 | 4.05 | 4.40 | 5.81 | 5.16 | 5.14 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 94.99 | -572.39 | 198.40 | 177.15 | -6.94 | -873.18 | -312.80 | -628.65 | -430.90 | -162.04 | 1825.67 | 679.75 | 47.97 | 302.57 | 982.62 | 457.70 | 33.62 | -56.63 | 104.33 | 25.26 | -61.76 | -204.67 | 150.87 | -79.70 | |

| Payments Of Dividends Common Stock | 23.84 | 24.67 | 26.03 | 25.13 | 22.06 | 22.45 | 23.59 | 19.73 | 20.29 | 14.42 | 15.13 | 15.18 | 10.86 | 10.84 | 10.88 | 10.84 | 10.84 | 6.47 | 6.50 | 6.54 | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 76.32 | 73.70 | 0.00 | 53.22 | 50.51 | 74.54 | 100.00 | 52.71 | 64.42 | 50.30 | 99.43 | 2.38 | 0.00 | 0.01 | 0.00 | 0.20 | 0.00 | 0.05 | 0.02 | 1.88 | 0.01 | 0.08 | 0.12 | 2.62 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 456.67 | 230.02 | 236.09 | 233.40 | 302.49 | 237.60 | 227.13 | 218.48 | 279.30 | 214.69 | 214.67 | 207.22 | 300.63 | 178.63 | 156.10 | 168.85 | 273.15 | 165.83 | 164.77 | 162.72 | 257.81 | 151.04 | 150.94 | 147.48 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 230.29 | 230.02 | 236.09 | 233.40 | 235.17 | 237.60 | 227.13 | 218.48 | 214.52 | 214.69 | 214.67 | 207.22 | 207.97 | 178.63 | 156.10 | 168.85 | 164.33 | 165.83 | 164.77 | 162.72 | 158.23 | 151.04 | 150.94 | 147.48 | |

| Commercial And Corporate | 18.06 | 17.68 | 21.08 | 19.11 | 20.08 | 27.14 | 35.83 | 44.97 | 49.18 | 50.25 | 55.64 | 52.88 | 53.89 | 38.64 | 30.07 | 25.59 | 26.66 | 28.03 | 24.84 | 23.45 | 21.97 | 19.03 | 22.65 | 20.18 | |

| Consumer Retail Banking | 168.84 | 167.24 | 162.82 | 159.78 | 151.36 | 137.53 | 122.18 | 110.01 | 101.39 | 92.89 | 81.48 | 75.73 | 69.40 | 66.64 | 64.13 | 71.47 | 71.11 | 74.87 | 74.74 | 75.54 | 64.11 | 72.16 | 66.39 | 62.98 | |

| Mortgage Banking | 19.53 | 21.30 | 24.42 | 24.86 | 25.27 | 28.07 | 30.50 | 31.03 | 31.64 | 32.46 | 32.47 | 32.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Treasury And Investments | -6.21 | -4.06 | -1.11 | -0.50 | 5.95 | 14.86 | 11.41 | 7.30 | 5.98 | 12.82 | 19.12 | 21.64 | 32.26 | 24.03 | 17.09 | 28.20 | 20.88 | 17.71 | 17.93 | 16.87 | 25.29 | 11.43 | 12.51 | 14.90 | |

| United States Operations | 22.90 | 20.60 | 20.84 | 21.78 | 24.49 | 22.27 | 19.37 | 17.23 | 18.24 | 18.22 | 17.47 | 16.00 | 16.18 | 13.98 | 13.88 | 14.62 | 16.08 | 15.62 | 16.91 | 16.74 | 16.06 | 15.70 | 15.51 | 14.80 | |

| Virgin Islands Operations | 7.17 | 7.27 | 8.03 | 8.37 | 8.03 | 7.74 | 7.84 | 7.95 | 8.10 | 8.06 | 8.49 | 8.62 | 8.16 | 7.92 | 9.03 | 8.27 | 8.28 | 8.21 | 8.79 | 8.77 | 8.53 | 8.58 | 9.11 | 9.33 |