| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | |

| dei: Entity Common Stock Shares Outstanding | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic | -0.17 | -0.42 | -0.08 | -0.36 | -0.38 | -0.52 | -0.14 | -0.54 | -0.49 | -0.48 | -0.51 | -0.44 | -0.43 | -0.22 | -0.14 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.17 | -0.42 | -0.08 | -0.36 | -0.38 | -0.52 | -0.14 | -0.54 | -0.49 | -0.48 | -0.51 | -0.44 | -0.43 | -0.22 | -0.14 | NA | NA | NA | NA | NA | NA | NA | NA |

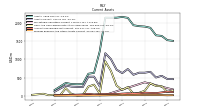

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

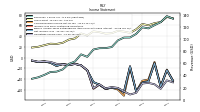

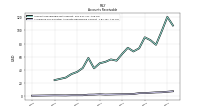

| Revenue From Contract With Customer Including Assessed Tax | 137.78 | 127.82 | 122.83 | 117.56 | 119.32 | 108.50 | 102.52 | 102.38 | 97.72 | 86.73 | 85.03 | 84.85 | 82.65 | 70.64 | 74.66 | 62.92 | 58.94 | 49.80 | 46.17 | 45.56 | 40.80 | 36.82 | 34.45 | |

| Cost Of Revenue | 62.00 | 61.73 | 58.62 | 57.31 | 56.74 | 55.83 | 56.47 | 53.91 | 47.94 | 41.24 | 40.32 | 37.49 | 33.75 | 29.29 | 29.70 | 27.27 | 25.53 | 22.29 | 20.78 | 19.72 | 17.71 | 16.71 | 15.70 | |

| Gross Profit | 75.77 | 66.09 | 64.21 | 60.25 | 62.58 | 52.68 | 46.05 | 48.47 | 49.77 | 45.49 | 44.71 | 47.36 | 48.90 | 41.35 | 44.97 | 35.66 | 33.41 | 27.50 | 25.39 | 25.84 | 23.09 | 20.11 | 18.75 | |

| Operating Expenses | 118.36 | 124.43 | 114.04 | 107.53 | 111.05 | 118.44 | 115.02 | 111.47 | 106.43 | 100.42 | 102.17 | 97.32 | 106.24 | 64.80 | 59.40 | 47.63 | 47.44 | 40.26 | 37.07 | 33.91 | 30.15 | 27.83 | 24.20 | |

| Research And Development Expense | 38.27 | 39.07 | 37.42 | 37.43 | 37.20 | 38.96 | 38.72 | 40.44 | 35.00 | 32.53 | 30.35 | 28.99 | 25.59 | 18.27 | 16.66 | 14.30 | 12.95 | 12.12 | 11.24 | 10.18 | 9.31 | 9.23 | 8.10 | |

| General And Administrative Expense | 31.43 | 30.00 | 28.82 | 25.83 | 29.23 | 32.48 | 29.54 | 29.55 | 29.28 | 28.61 | 35.49 | 33.46 | 45.88 | 23.96 | 18.07 | 14.17 | 12.90 | 10.58 | 8.92 | 8.70 | 7.35 | 6.26 | 4.13 | |

| Selling And Marketing Expense | 48.66 | 51.04 | 47.80 | 44.27 | 44.62 | 47.01 | 46.76 | 41.48 | 42.15 | 39.29 | 36.33 | 34.87 | 34.77 | 22.57 | 24.68 | 19.17 | 21.59 | 17.56 | 16.91 | 15.04 | 13.49 | 12.33 | 11.97 | |

| Operating Income Loss | -42.58 | -58.34 | -49.83 | -47.27 | -48.46 | -65.77 | -68.97 | -63.00 | -56.66 | -54.93 | -57.47 | -49.96 | -57.34 | -23.45 | -14.44 | -11.98 | -14.03 | -12.76 | -11.68 | -8.08 | -7.06 | -7.72 | -5.45 | |

| Interest Expense | 0.74 | 0.86 | 1.23 | 1.21 | 1.35 | 1.38 | 1.53 | 1.62 | 1.59 | 1.55 | 1.44 | 0.66 | 0.45 | 0.41 | 0.37 | 0.32 | 0.39 | 0.62 | 2.99 | 1.24 | 0.59 | 0.48 | 0.36 | |

| Interest Expense Debt | 0.50 | 0.60 | 0.90 | 0.80 | 0.70 | 0.80 | 0.90 | 1.00 | 1.10 | 1.00 | 1.00 | 0.20 | -0.20 | 0.40 | 0.40 | 0.30 | 0.40 | 0.60 | 3.00 | 1.20 | 0.70 | 0.50 | 0.40 | |

| Interest Paid Net | 0.29 | 0.36 | 0.43 | 0.50 | 0.69 | 0.67 | 0.71 | 0.59 | 0.56 | 0.62 | 0.40 | 0.35 | 0.83 | 0.41 | 0.19 | 0.15 | 0.49 | 0.50 | 2.99 | 1.45 | 0.52 | 0.38 | NA | |

| Gains Losses On Extinguishment Of Debt | 15.66 | 0.00 | 36.76 | NA | 0.00 | 0.00 | 54.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 35.45 | 35.71 | 36.99 | 28.15 | 31.42 | 39.38 | 34.98 | 40.02 | 39.59 | 36.64 | 33.43 | 30.84 | 29.68 | 12.14 | 16.28 | 6.33 | 4.59 | 3.84 | 2.24 | 1.47 | 1.28 | 0.96 | 0.99 | |

| Income Tax Expense Benefit | -0.47 | -0.00 | 0.11 | 0.14 | -0.22 | 0.12 | 0.16 | 0.04 | 0.03 | 0.03 | -0.15 | 0.17 | -12.61 | 0.34 | -0.02 | 0.82 | 0.31 | 0.05 | 0.08 | 0.06 | 0.04 | 0.05 | 0.04 | |

| Income Taxes Paid Net | -0.04 | -0.08 | 0.27 | 0.18 | 0.03 | 0.04 | 0.01 | 0.17 | 0.03 | 0.07 | 0.11 | 0.07 | 0.22 | 0.09 | 0.10 | 0.81 | 0.35 | 0.00 | 0.01 | 0.00 | -0.06 | 0.07 | NA | |

| Net Income Loss | -23.39 | -54.31 | -10.70 | -44.69 | -46.65 | -63.42 | -16.44 | -64.26 | -57.52 | -56.20 | -58.30 | -50.68 | -45.70 | -23.78 | -14.46 | -11.99 | -14.07 | -12.16 | -15.59 | -9.73 | -7.31 | -8.49 | -5.84 | |

| Comprehensive Income Net Of Tax | -22.46 | -53.09 | -8.26 | -40.99 | -43.26 | -63.56 | -19.48 | -71.13 | -59.73 | -56.36 | -58.42 | -50.83 | -45.82 | -24.04 | -14.76 | -11.50 | -13.86 | -12.20 | -15.59 | -9.67 | -7.31 | -8.52 | -5.87 |

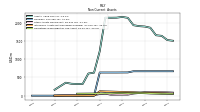

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

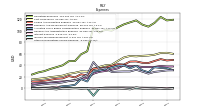

| Assets | 1525.19 | 1640.66 | 1657.42 | 1862.41 | 1896.11 | 1906.60 | 1932.80 | 2134.42 | 2159.02 | 2138.93 | 2136.87 | 2138.29 | 1219.95 | 631.52 | 607.86 | 323.85 | 320.97 | 327.32 | 356.38 | NA | 162.75 | NA | NA | |

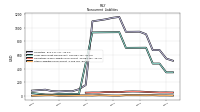

| Liabilities | 545.70 | 672.09 | 669.66 | 903.86 | 940.96 | 939.62 | 939.06 | 1157.70 | 1145.07 | 1123.36 | 1107.78 | 1093.26 | 158.09 | 96.40 | 65.70 | 67.80 | 63.32 | 67.91 | 89.05 | NA | 75.10 | NA | NA | |

| Liabilities And Stockholders Equity | 1525.19 | 1640.66 | 1657.42 | 1862.41 | 1896.11 | 1906.60 | 1932.80 | 2134.42 | 2159.02 | 2138.93 | 2136.87 | 2138.29 | 1219.95 | 631.52 | 607.86 | 323.85 | 320.97 | 327.32 | 356.38 | NA | 162.75 | NA | NA | |

| Stockholders Equity | 979.49 | 968.57 | 987.75 | 958.55 | 955.16 | 966.98 | 993.74 | 976.72 | 1013.95 | 1015.58 | 1029.09 | 1045.03 | 1061.87 | 535.12 | 542.16 | 256.05 | 257.65 | 259.42 | 267.32 | -133.60 | -131.93 | -126.61 | -119.51 |

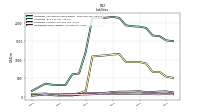

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 463.67 | 551.46 | 505.14 | 661.64 | 636.48 | 637.18 | 579.67 | 737.08 | 624.65 | 719.88 | 1008.10 | 1167.43 | 261.26 | 529.72 | 525.42 | 241.83 | 249.32 | 255.93 | 286.35 | NA | 117.27 | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 107.92 | 270.30 | 273.74 | 348.46 | 143.39 | 87.90 | 62.51 | 245.79 | 166.07 | 282.13 | 687.99 | 948.78 | 62.90 | 309.97 | 257.42 | 22.50 | 16.14 | 54.71 | 213.46 | 21.36 | 36.96 | 21.28 | 61.43 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 108.07 | 270.45 | 273.89 | 348.61 | 143.54 | 88.05 | 62.66 | 246.69 | 166.96 | 283.02 | 688.97 | 949.76 | 63.88 | 380.06 | 327.50 | 92.59 | 86.23 | 54.79 | 213.55 | 21.36 | 36.96 | 21.28 | 61.43 | |

| Marketable Securities Current | 214.80 | NA | NA | NA | 374.58 | NA | NA | NA | NA | NA | NA | 29.93 | 20.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 120.50 | 98.62 | 78.30 | 85.34 | 89.58 | 72.91 | 68.22 | 73.72 | 64.62 | 54.23 | 56.06 | 52.36 | 50.26 | 42.59 | 58.33 | 43.02 | 37.14 | 33.91 | 28.54 | NA | 24.73 | NA | NA | |

| Prepaid Expense And Other Assets Current | 20.45 | 24.48 | 29.50 | 29.72 | 28.93 | 31.32 | 29.04 | 23.62 | 32.16 | 22.23 | 22.22 | 18.41 | 16.73 | 14.77 | 12.97 | 12.14 | 10.99 | 14.22 | 12.19 | NA | 8.90 | NA | NA | |

| Available For Sale Securities Debt Securities | 286.37 | 190.34 | 201.65 | 315.63 | 539.69 | 631.11 | 704.86 | 788.41 | 890.71 | 790.78 | 414.97 | 177.72 | 151.73 | 92.30 | 126.61 | 94.08 | 114.97 | 153.10 | 32.16 | NA | 46.68 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

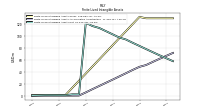

| Amortization Of Intangible Assets | 4.90 | 5.20 | 5.20 | 5.17 | 5.59 | 5.50 | 5.30 | 5.31 | 5.27 | 5.30 | 5.30 | 5.36 | 5.20 | 0.10 | 0.10 | 0.10 | 0.02 | 0.04 | 0.03 | 0.10 | 0.04 | 0.02 | 0.02 | |

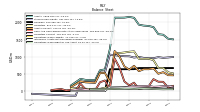

| Goodwill | 670.36 | 670.36 | 670.36 | 670.19 | 670.18 | 670.16 | 670.19 | 637.57 | 636.80 | 635.63 | 635.65 | 635.64 | 635.59 | 0.36 | 0.35 | 0.35 | 0.37 | 0.35 | 0.36 | NA | 0.36 | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 62.48 | 67.38 | 72.55 | 77.72 | 82.90 | 88.48 | 93.98 | 97.29 | 102.60 | 107.91 | 113.22 | 116.38 | 121.74 | 2.79 | 2.86 | 1.09 | 1.12 | 1.16 | 1.20 | NA | 0.61 | NA | NA | |

| Finite Lived Intangible Assets Net | 62.48 | 67.38 | 72.55 | 77.72 | 82.90 | 88.11 | 93.61 | 96.92 | 102.23 | 107.53 | 112.85 | 116.01 | 121.37 | 2.42 | 2.50 | 1.09 | 1.12 | 1.16 | 1.20 | NA | 0.61 | NA | NA | |

| Other Assets Noncurrent | 90.78 | 94.35 | 95.55 | 94.80 | 92.62 | 73.26 | 60.20 | 30.02 | 29.47 | 28.14 | 27.58 | 56.92 | 45.37 | 15.15 | 13.40 | 11.51 | 10.11 | 13.24 | 12.86 | NA | 2.16 | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 287.31 | 192.18 | 204.72 | 320.67 | 548.33 | 643.22 | 716.84 | 797.34 | 892.95 | 790.87 | 415.09 | 177.70 | 151.63 | 92.06 | 126.18 | 93.51 | 114.87 | 153.10 | 32.14 | NA | 46.70 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

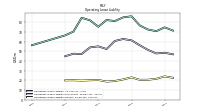

| Liabilities Current | 147.69 | 143.34 | 131.60 | 125.20 | 152.32 | 144.60 | 140.99 | 140.17 | 131.87 | 107.27 | 103.03 | 98.30 | 94.09 | 66.45 | 38.31 | 40.40 | 37.12 | 45.38 | 65.27 | NA | 31.75 | NA | NA | |

| Accounts Payable Current | 5.61 | 5.72 | 5.56 | 4.67 | 4.79 | 8.27 | 10.01 | 8.25 | 9.26 | 7.77 | 10.20 | 12.02 | 9.15 | 12.27 | 6.09 | 9.46 | 4.60 | 6.80 | 5.75 | NA | 2.33 | NA | NA | |

| Other Accrued Liabilities Current | 3.58 | 3.67 | 4.82 | 5.29 | 5.99 | 6.57 | 13.30 | 8.02 | 4.87 | 6.53 | 6.05 | 5.32 | 4.37 | 3.55 | 4.60 | 3.53 | 3.97 | 2.95 | 6.08 | NA | 5.46 | NA | NA | |

| Taxes Payable Current | 4.34 | NA | 5.10 | 6.51 | 8.70 | NA | NA | NA | 8.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accrued Liabilities Current | 61.82 | 56.59 | 47.00 | 42.31 | 61.16 | 54.19 | 49.94 | 49.90 | 36.11 | 36.06 | 28.61 | 36.32 | 34.33 | 38.56 | 22.63 | 20.22 | 19.88 | 23.46 | 25.10 | NA | 15.54 | NA | NA | |

| Other Liabilities Current | 40.54 | 40.23 | 36.23 | 32.94 | 34.39 | 33.42 | 33.70 | 36.57 | 45.11 | 24.76 | 29.73 | 19.04 | 19.68 | 9.55 | 4.40 | 5.43 | 8.17 | 1.61 | 1.59 | NA | 2.51 | NA | NA | |

| Contract With Customer Liability Current | 33.82 | 33.25 | 28.12 | 24.60 | 28.05 | 22.73 | 25.48 | 28.45 | 26.42 | 21.63 | 22.67 | 18.17 | 15.92 | 0.04 | 0.05 | 0.85 | 0.32 | NA | NA | NA | 1.62 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt Noncurrent | 343.51 | 472.82 | 472.37 | 705.38 | 704.71 | 704.04 | 703.38 | 934.12 | 933.21 | 932.30 | 931.38 | 930.29 | NA | 26.01 | 24.86 | 26.04 | 25.16 | 15.54 | 17.88 | NA | 39.44 | NA | NA | |

| Other Liabilities Noncurrent | 4.42 | 4.30 | 7.22 | 6.14 | 7.08 | 7.20 | 7.56 | 2.21 | 2.58 | 5.06 | 6.50 | 3.52 | 4.40 | 3.94 | 2.53 | 1.36 | 1.04 | 6.98 | 5.91 | NA | 0.65 | NA | NA | |

| Operating Lease Liability Noncurrent | 48.48 | 47.77 | 51.45 | 56.27 | 61.34 | 62.75 | 60.66 | 52.33 | 55.11 | 54.07 | 47.18 | 47.51 | 44.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

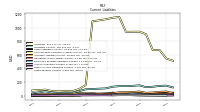

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

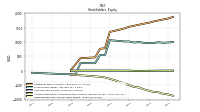

| Stockholders Equity | 979.49 | 968.57 | 987.75 | 958.55 | 955.16 | 966.98 | 993.74 | 976.72 | 1013.95 | 1015.58 | 1029.09 | 1045.03 | 1061.87 | 535.12 | 542.16 | 256.05 | 257.65 | 259.42 | 267.32 | -133.60 | -131.93 | -126.61 | -119.51 | |

| Common Stock Value | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | NA | NA | |

| Additional Paid In Capital | 1815.24 | 1781.87 | 1747.96 | 1710.50 | 1666.11 | 1634.67 | 1597.87 | 1561.37 | 1527.47 | 1469.37 | 1426.52 | 1384.05 | 1350.05 | 777.23 | 760.24 | 459.36 | 449.46 | 439.48 | 435.19 | NA | 16.40 | NA | NA | |

| Retained Earnings Accumulated Deficit | -834.75 | -811.37 | -757.05 | -746.35 | -701.66 | -655.01 | -591.59 | -575.15 | -510.89 | -453.37 | -397.17 | -338.88 | -288.19 | -242.24 | -218.46 | -204.00 | -192.01 | -177.94 | -165.77 | NA | -146.19 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1.01 | -1.93 | -3.15 | -5.59 | -9.29 | -12.68 | -12.54 | -9.50 | -2.63 | -0.42 | -0.26 | -0.14 | 0.01 | 0.12 | 0.39 | 0.69 | 0.20 | -0.02 | 0.01 | NA | -0.04 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 29.50 | 32.77 | 31.95 | 27.46 | 29.37 | 36.24 | 31.82 | 30.86 | 40.62 | 39.29 | 33.81 | 31.21 | 30.48 | 12.74 | 16.67 | 6.58 | 5.04 | 3.84 | 2.24 | 1.47 | 1.28 | 0.96 | 0.99 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

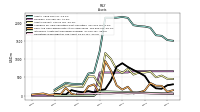

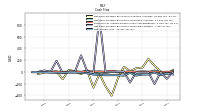

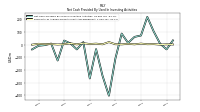

| Net Cash Provided By Used In Operating Activities | -7.38 | -8.39 | 24.99 | -8.86 | -12.13 | -27.63 | -16.68 | -13.19 | -7.91 | -2.69 | -17.01 | -10.87 | -31.15 | 27.20 | -8.78 | -7.19 | -3.06 | -12.60 | -5.57 | -10.08 | -0.79 | -3.62 | NA | |

| Net Cash Provided By Used In Investing Activities | -37.24 | 7.68 | 104.98 | 219.53 | 72.59 | 61.52 | 13.95 | 87.68 | -110.66 | -403.94 | -244.50 | -35.40 | -267.44 | 20.24 | -37.57 | 9.74 | 32.48 | -125.26 | 8.70 | -3.59 | -8.85 | -37.69 | NA | |

| Net Cash Provided By Used In Financing Activities | -117.83 | -2.68 | -205.16 | -5.71 | -5.01 | -8.39 | -181.20 | 5.45 | 2.60 | 0.93 | 0.75 | 932.26 | -17.58 | 5.19 | 281.36 | 3.77 | 1.93 | -20.91 | 189.05 | -1.92 | 25.31 | 1.15 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

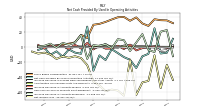

| Net Cash Provided By Used In Operating Activities | -7.38 | -8.39 | 24.99 | -8.86 | -12.13 | -27.63 | -16.68 | -13.19 | -7.91 | -2.69 | -17.01 | -10.87 | -31.15 | 27.20 | -8.78 | -7.19 | -3.06 | -12.60 | -5.57 | -10.08 | -0.79 | -3.62 | NA | |

| Net Income Loss | -23.39 | -54.31 | -10.70 | -44.69 | -46.65 | -63.42 | -16.44 | -64.26 | -57.52 | -56.20 | -58.30 | -50.68 | -45.70 | -23.78 | -14.46 | -11.99 | -14.07 | -12.16 | -15.59 | -9.73 | -7.31 | -8.49 | -5.84 | |

| Increase Decrease In Accounts Receivable | 22.59 | 20.54 | -6.48 | -3.70 | 17.29 | 5.95 | -5.10 | 9.22 | 10.55 | -1.59 | 3.93 | 1.69 | 2.60 | -15.54 | 16.18 | 6.03 | 3.25 | 5.64 | -0.70 | 4.59 | 1.79 | 1.07 | NA | |

| Increase Decrease In Accounts Payable | -0.88 | 0.31 | 1.12 | -0.17 | -1.27 | -4.30 | 3.34 | -2.49 | 1.80 | -1.81 | -1.96 | 2.12 | -2.99 | 5.68 | -1.75 | 3.11 | -2.19 | 1.31 | 1.58 | 1.69 | -1.89 | 2.91 | NA | |

| Share Based Compensation | 35.45 | 35.71 | 36.99 | 28.15 | 31.42 | 39.38 | 34.98 | 40.02 | 39.59 | 36.64 | 33.43 | 30.84 | 29.68 | 12.14 | 16.28 | 6.33 | 4.59 | 3.84 | 2.24 | 1.47 | 1.28 | 0.96 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -37.24 | 7.68 | 104.98 | 219.53 | 72.59 | 61.52 | 13.95 | 87.68 | -110.66 | -403.94 | -244.50 | -35.40 | -267.44 | 20.24 | -37.57 | 9.74 | 32.48 | -125.26 | 8.70 | -3.59 | -8.85 | -37.69 | NA | |

| Payments To Acquire Property Plant And Equipment | 2.69 | 0.33 | 4.46 | 3.49 | 8.53 | 2.63 | 6.43 | 2.39 | 3.55 | 20.25 | 2.93 | 8.08 | 5.13 | 11.89 | 2.33 | 10.22 | 4.21 | 1.17 | 5.20 | 4.03 | 6.86 | 0.01 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -117.83 | -2.68 | -205.16 | -5.71 | -5.01 | -8.39 | -181.20 | 5.45 | 2.60 | 0.93 | 0.75 | 932.26 | -17.58 | 5.19 | 281.36 | 3.77 | 1.93 | -20.91 | 189.05 | -1.92 | 25.31 | 1.15 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

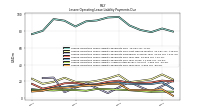

| Revenue From Contract With Customer Including Assessed Tax | 137.78 | 127.82 | 122.83 | 117.56 | 119.32 | 108.50 | 102.52 | 102.38 | 97.72 | 86.73 | 85.03 | 84.85 | 82.65 | 70.64 | 74.66 | 62.92 | 58.94 | 49.80 | 46.17 | 45.56 | 40.80 | 36.82 | 34.45 | |

| New Revenue Methodology | 137.78 | 127.82 | 122.83 | 117.56 | 119.32 | 108.50 | 102.52 | 102.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prior Revenue Methodology | 137.78 | 127.82 | 122.83 | 117.56 | 119.32 | 108.50 | 102.52 | 102.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Enterprise Customers, New Revenue Methodology | 127.09 | 117.33 | 112.66 | 107.37 | 109.53 | 98.50 | 92.61 | 92.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Enterprise Customers, Prior Revenue Methodology | 125.03 | 116.19 | 111.19 | 106.06 | 107.23 | 97.27 | 91.25 | 91.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Nonenterprise Customers, New Revenue Methodology | 10.68 | 10.49 | 10.17 | 10.19 | 9.79 | 10.01 | 9.91 | 9.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Nonenterprise Customers, Prior Revenue Methodology | 12.75 | 11.62 | 11.64 | 11.51 | 12.09 | 11.24 | 11.27 | 11.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| 20.24 | 18.93 | 17.27 | 16.43 | 19.12 | 14.37 | 12.87 | 11.72 | 11.53 | 9.80 | 9.08 | 9.15 | 9.90 | 10.31 | 14.06 | 9.85 | 6.06 | 4.61 | 4.46 | NA | NA | NA | NA | ||

| 10.89 | 10.49 | 10.87 | 10.52 | 10.34 | 9.54 | 9.24 | 9.35 | 9.21 | 8.55 | 8.23 | 9.64 | 9.22 | 8.00 | 7.99 | 7.77 | 7.71 | 7.11 | 6.44 | NA | NA | NA | NA | ||

| US | 101.76 | 93.42 | 89.87 | 85.36 | 84.31 | 80.17 | 76.05 | 75.61 | 80.54 | 62.29 | 59.67 | 62.73 | 60.34 | 49.14 | 46.05 | 41.01 | 41.43 | 35.47 | 32.52 | 33.42 | 30.36 | 28.21 | 26.90 |