| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

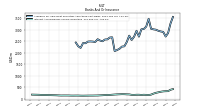

| Common Stock Value | 564.40 | 564.28 | 564.14 | 561.85 | 561.51 | 561.27 | 561.18 | 560.04 | 559.77 | 559.62 | 559.49 | 558.12 | 557.92 | 557.72 | 557.57 | 556.24 | 556.11 | 555.89 | 555.69 | 554.49 | 554.38 | 554.21 | 553.96 | 552.68 | 552.23 | 552.15 | |

| Earnings Per Share Basic | 0.38 | 0.42 | 0.46 | 0.39 | 0.48 | 0.41 | 0.42 | 0.38 | 0.36 | 0.45 | 0.38 | 0.43 | 0.30 | 0.38 | 0.24 | 0.16 | 0.30 | 0.38 | 0.36 | 0.33 | 0.33 | 0.37 | 0.20 | 0.28 | 0.19 | 0.28 | |

| Earnings Per Share Diluted | 0.37 | 0.42 | 0.46 | 0.39 | 0.47 | 0.40 | 0.42 | 0.38 | 0.36 | 0.45 | 0.38 | 0.43 | 0.30 | 0.38 | 0.24 | 0.16 | 0.29 | 0.37 | 0.35 | 0.33 | 0.33 | 0.37 | 0.20 | 0.28 | 0.20 | 0.28 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

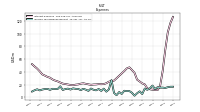

| Revenue From Contract With Customer Including Assessed Tax | 60.13 | 55.96 | 60.59 | 51.73 | 54.32 | 59.22 | 58.38 | 55.24 | 63.88 | 62.58 | 51.85 | 61.92 | 55.57 | 63.25 | 52.92 | 54.60 | 55.28 | 55.32 | 54.14 | 46.69 | 49.52 | 51.02 | 49.09 | 45.86 | 55.02 | 47.38 | |

| Gain Loss On Investments | -0.75 | 0.00 | -0.00 | 0.02 | -0.00 | -0.05 | 0.01 | 0.02 | 0.01 | 0.00 | 0.04 | 33.48 | 0.00 | 0.00 | 3.00 | 0.05 | 0.00 | 4.49 | 0.18 | 0.07 | 0.00 | 0.01 | 0.00 | 0.02 | 1.93 | 4.60 | |

| Interest Expense | 126.13 | 116.53 | 102.06 | 74.23 | 41.94 | 18.11 | 11.47 | 11.69 | 12.11 | 12.81 | 14.27 | 20.49 | 22.05 | 25.04 | 27.94 | 38.63 | 42.89 | 47.15 | 45.49 | 41.38 | 37.66 | 33.92 | 30.10 | 26.37 | 25.57 | 24.70 | |

| Interest Income Expense Net | 212.00 | 213.84 | 212.85 | 215.59 | 225.91 | 215.58 | 178.83 | 161.31 | 165.61 | 171.27 | 162.40 | 164.45 | 161.59 | 154.12 | 152.75 | 160.75 | 159.27 | 161.26 | 164.54 | 163.31 | 162.94 | 160.13 | 156.07 | 151.32 | 149.41 | 146.81 | |

| Interest Paid Net | 117.89 | 113.78 | 89.85 | 72.53 | 37.49 | 18.38 | 10.17 | 13.98 | 10.31 | 14.93 | 12.57 | 25.23 | 20.81 | 27.49 | 27.26 | 36.58 | 43.68 | 46.75 | 47.49 | 40.70 | 38.29 | 31.06 | 31.49 | 26.00 | 26.82 | NA | |

| Income Tax Expense Benefit | 16.76 | 16.75 | 16.07 | 14.87 | 15.42 | 15.36 | 16.00 | 13.25 | 18.59 | 14.27 | 11.99 | 13.90 | 5.36 | 9.53 | 6.54 | 2.76 | 7.26 | 10.03 | 9.89 | 10.48 | 5.50 | 8.49 | 3.50 | 7.08 | 27.19 | 12.65 | |

| Income Taxes Paid | 1.90 | 8.23 | 7.88 | 7.31 | 10.25 | 6.72 | 7.77 | 7.93 | 19.54 | 0.20 | 7.65 | 0.48 | 4.07 | 1.07 | 9.98 | 1.07 | 1.23 | 3.03 | 3.45 | 1.49 | 5.37 | 2.38 | 5.64 | 0.15 | -1.34 | 0.86 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 15.18 | 10.07 | 1.42 | 0.32 | 4.83 | -19.99 | -8.92 | -32.88 | -4.29 | -0.89 | 2.07 | -1.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 160.48 | -93.47 | -28.29 | 34.48 | 57.47 | -138.74 | -145.35 | -186.27 | 1.80 | -21.59 | 21.36 | -39.25 | 8.14 | 5.51 | 33.13 | 18.45 | -6.22 | 18.24 | 25.48 | 21.43 | 25.58 | -11.38 | -6.09 | -27.10 | -8.77 | 0.67 | |

| Net Income Loss | 64.26 | 72.10 | 79.61 | 68.31 | 81.83 | 70.87 | 69.99 | 64.29 | 61.89 | 75.58 | 64.96 | 73.06 | 50.83 | 61.61 | 39.56 | 26.05 | 47.79 | 62.11 | 59.78 | 56.66 | 58.08 | 65.63 | 35.20 | 49.48 | 34.00 | 48.91 | |

| Comprehensive Income Net Of Tax | 224.74 | -21.37 | 51.31 | 102.80 | 139.30 | -67.87 | -75.37 | -121.98 | 63.68 | 54.00 | 86.33 | 33.81 | 58.96 | 67.12 | 72.69 | 44.49 | 41.57 | 80.35 | 85.25 | 78.09 | 83.66 | 54.25 | 29.11 | 22.38 | 25.23 | 49.58 | |

| Net Income Loss Available To Common Stockholders Basic | 61.70 | 69.53 | 77.05 | 65.75 | 79.27 | 68.31 | 67.43 | 61.73 | 59.32 | 73.02 | 62.40 | 70.47 | 48.69 | 61.61 | 39.56 | 26.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 202.20 | 203.91 | 203.10 | 191.04 | 211.40 | 196.62 | 177.33 | 168.26 | 170.61 | 171.87 | 165.90 | 169.95 | 155.35 | 147.04 | 133.18 | 116.72 | 138.74 | 159.09 | 159.52 | 158.22 | 154.74 | 158.51 | 122.95 | 147.35 | 142.68 | 141.73 | |

| Noninterest Expense | 180.55 | 171.02 | 168.02 | 159.62 | 168.46 | 169.56 | 149.73 | 145.98 | 154.02 | 144.60 | 140.83 | 178.38 | 154.74 | 139.15 | 143.01 | 142.55 | 138.97 | 146.77 | 144.17 | 137.82 | 140.69 | 135.41 | 133.34 | 136.66 | 138.45 | 132.16 | |

| Noninterest Income | 59.38 | 55.96 | 60.59 | 51.75 | 54.32 | 59.16 | 58.39 | 55.26 | 63.88 | 62.58 | 51.89 | 95.40 | 55.57 | 63.25 | 55.92 | 54.64 | 55.28 | 59.81 | 54.31 | 46.75 | 49.52 | 51.03 | 49.09 | 45.88 | 56.96 | 51.97 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

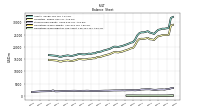

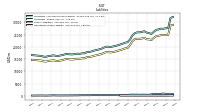

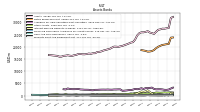

| Assets | 27571.92 | 27375.18 | 27403.16 | 27112.18 | 26931.70 | 26146.04 | 25252.69 | 25598.31 | 25796.40 | 26390.83 | 26079.77 | 25892.99 | 25906.73 | 25543.28 | 24617.86 | 22929.86 | 21886.04 | 21703.62 | 21308.67 | 20974.65 | 20682.15 | 20364.81 | 20172.54 | 19948.94 | 20036.90 | 20062.86 | |

| Liabilities | 24811.78 | 24808.48 | 24761.01 | 24493.18 | 24351.94 | 23674.88 | 22781.59 | 23028.78 | 23083.72 | 23691.01 | 23386.82 | 23263.33 | 23289.90 | 23153.02 | 22277.36 | 20644.11 | 19543.86 | 19379.60 | 18999.87 | 18673.63 | 18434.58 | 18081.80 | 17926.75 | 17713.45 | 17807.05 | 17837.07 | |

| Liabilities And Stockholders Equity | 27571.92 | 27375.18 | 27403.16 | 27112.18 | 26931.70 | 26146.04 | 25252.69 | 25598.31 | 25796.40 | 26390.83 | 26079.77 | 25892.99 | 25906.73 | 25543.28 | 24617.86 | 22929.86 | 21886.04 | 21703.62 | 21308.67 | 20974.65 | 20682.15 | 20364.81 | 20172.54 | 19948.94 | 20036.90 | 20062.86 | |

| Stockholders Equity | 2760.14 | 2566.69 | 2642.15 | 2619.00 | 2579.76 | 2471.16 | 2471.09 | 2569.53 | 2712.68 | 2699.82 | 2692.96 | 2629.66 | 2616.83 | 2390.26 | 2340.50 | 2285.75 | 2342.18 | 2324.02 | 2308.80 | 2301.02 | 2247.57 | 2283.01 | 2245.78 | 2235.49 | 2229.86 | 2225.79 | |

| Tier One Risk Based Capital | 2541.82 | NA | NA | NA | 2447.02 | NA | NA | NA | 2195.65 | NA | NA | NA | 2067.64 | NA | NA | NA | 1796.99 | NA | NA | NA | 1764.85 | NA | NA | NA | 1737.06 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

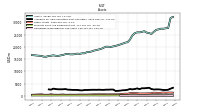

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 549.71 | 420.46 | 504.70 | 566.75 | 681.92 | 528.72 | 449.67 | 1157.96 | 1638.61 | 2471.01 | 1904.06 | 1661.88 | 1847.83 | 1534.89 | 1058.60 | 856.36 | 517.79 | 598.61 | 498.81 | 441.39 | 445.69 | 213.26 | 244.93 | 311.06 | 246.73 | 195.78 | |

| Available For Sale Securities Debt Securities | 2398.35 | 2418.87 | 2572.72 | 2642.39 | 2646.77 | 2597.38 | 2778.84 | 3324.33 | 3187.39 | 3084.34 | 3097.38 | 2758.60 | 3062.14 | 2793.48 | 2644.30 | 2790.83 | 2497.54 | 2315.54 | 2285.79 | 2159.81 | 2080.29 | 2008.82 | 2593.28 | 2592.82 | 2547.04 | 2548.46 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

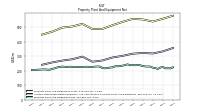

| Property Plant And Equipment Gross | 579.04 | NA | NA | NA | 558.21 | NA | NA | NA | 538.86 | NA | NA | NA | 553.25 | NA | NA | NA | 557.10 | NA | NA | NA | 536.55 | NA | NA | NA | 513.68 | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 356.16 | NA | NA | NA | 333.07 | NA | NA | NA | 318.51 | NA | NA | NA | 321.77 | NA | NA | NA | 317.06 | NA | NA | NA | 302.02 | NA | NA | NA | 290.88 | NA | |

| Amortization Of Intangible Assets | 0.60 | 0.60 | 1.07 | 0.67 | 0.69 | 0.69 | 0.18 | 0.18 | 0.15 | 0.15 | 0.18 | 0.12 | 0.13 | 0.13 | 0.13 | 0.13 | 0.14 | 1.07 | 0.11 | 0.11 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | |

| Property Plant And Equipment Net | 222.88 | 215.63 | 216.32 | 216.06 | 225.14 | 221.50 | 211.64 | 218.26 | 220.36 | 228.18 | 228.35 | 229.03 | 231.48 | 236.94 | 239.60 | 236.91 | 240.05 | 237.34 | 243.30 | 239.00 | 234.53 | 231.24 | 230.19 | 230.31 | 222.80 | 221.55 | |

| Goodwill | 553.35 | 553.35 | 553.35 | 553.89 | 550.54 | 550.52 | 537.70 | 537.88 | 534.30 | 536.70 | 536.85 | 536.54 | 536.66 | 534.91 | 535.04 | 535.17 | 535.30 | 534.18 | 535.25 | 535.36 | 531.56 | 531.56 | 531.56 | 531.56 | 531.56 | 531.56 | |

| Intangible Assets Net Including Goodwill | 560.69 | 561.28 | 561.88 | 563.50 | 560.82 | 561.50 | NA | NA | 538.05 | NA | NA | NA | 536.66 | NA | NA | NA | 535.30 | NA | NA | NA | 531.56 | NA | NA | NA | 531.56 | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 195.72 | 259.89 | 207.92 | 182.69 | 196.21 | 197.60 | 123.95 | 77.04 | 25.54 | 20.07 | 12.82 | 25.97 | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.09 | 3.75 | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1072.21 | 1019.84 | 1086.69 | 1125.03 | 1125.05 | 1141.71 | 1215.33 | 888.99 | 965.87 | 910.16 | 826.93 | 843.74 | 296.86 | 324.94 | 354.11 | 372.27 | 383.70 | 403.96 | 589.73 | 603.61 | 611.42 | 622.85 | NA | NA | NA | NA | |

| Held To Maturity Securities | 1267.92 | 1279.73 | 1294.61 | 1307.71 | 1321.26 | 1339.31 | 1338.96 | 964.34 | 980.38 | 916.42 | 824.28 | 853.41 | 278.28 | 304.24 | 330.51 | 350.61 | 369.84 | 390.07 | 567.56 | 588.44 | 606.68 | 626.60 | NA | NA | 0.00 | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 2698.26 | 2898.57 | 2916.61 | 2945.91 | 2992.51 | 3008.32 | 3034.09 | 3465.37 | 3129.53 | 3024.00 | 3009.06 | 2693.92 | 2947.50 | 2691.88 | 2548.26 | 2735.99 | 2465.03 | 2274.91 | 2263.82 | 2168.89 | 2115.26 | 2071.73 | 2664.16 | 2655.31 | 2574.94 | 2569.64 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 195.72 | 259.89 | 207.92 | 182.69 | 196.21 | 197.60 | 123.95 | 77.04 | 25.54 | 20.07 | 12.82 | 25.97 | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.09 | 3.75 | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 1072.21 | 1019.84 | 1086.69 | 1125.03 | 1125.05 | 1141.71 | 1091.22 | 712.30 | 762.92 | 646.42 | 580.34 | 573.08 | NA | NA | NA | NA | NA | NA | NA | NA | 20.60 | 608.80 | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 1072.21 | 1019.84 | 627.47 | 629.16 | 620.13 | 494.52 | 454.65 | 505.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 2180.32 | NA | NA | NA | 966.24 | NA | NA | NA | 1315.79 | NA | NA | NA | 1417.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 21537.62 | 21421.59 | 21206.54 | 21316.58 | 20649.54 | 21376.55 | 21143.87 | 21541.17 | 21573.50 | 22074.04 | 21724.31 | 21633.84 | 20839.21 | 20730.05 | 19884.21 | 17365.03 | 17393.91 | 17342.72 | 16388.90 | 16377.98 | 16376.16 | 16249.01 | 15599.80 | 15477.10 | 15797.53 | 16141.78 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

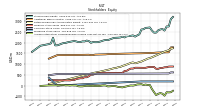

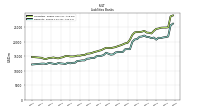

| Stockholders Equity | 2760.14 | 2566.69 | 2642.15 | 2619.00 | 2579.76 | 2471.16 | 2471.09 | 2569.53 | 2712.68 | 2699.82 | 2692.96 | 2629.66 | 2616.83 | 2390.26 | 2340.50 | 2285.75 | 2342.18 | 2324.02 | 2308.80 | 2301.02 | 2247.57 | 2283.01 | 2245.78 | 2235.49 | 2229.86 | 2225.79 | |

| Common Stock Value | 564.40 | 564.28 | 564.14 | 561.85 | 561.51 | 561.27 | 561.18 | 560.04 | 559.77 | 559.62 | 559.49 | 558.12 | 557.92 | 557.72 | 557.57 | 556.24 | 556.11 | 555.89 | 555.69 | 554.49 | 554.38 | 554.21 | 553.96 | 552.68 | 552.23 | 552.15 | |

| Additional Paid In Capital | 1552.86 | 1549.28 | 1545.71 | 1544.76 | 1541.84 | 1536.58 | 1527.76 | 1524.11 | 1519.87 | 1516.62 | 1513.64 | 1511.10 | 1508.12 | 1505.73 | 1503.75 | 1502.19 | 1499.68 | 1496.66 | 1493.63 | 1491.87 | 1489.70 | 1487.13 | 1484.18 | 1481.55 | 1478.39 | 1476.15 | |

| Retained Earnings Accumulated Deficit | 1619.30 | 1585.45 | 1542.16 | 1491.70 | 1450.76 | 1406.54 | 1363.34 | 1320.08 | 1282.38 | 1258.50 | 1208.09 | 1168.49 | 1120.78 | 1099.68 | 1059.16 | 1040.65 | 1079.39 | 1059.52 | 1018.74 | 980.71 | 946.03 | 915.69 | 871.19 | 857.15 | 821.62 | 812.15 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -312.28 | -472.76 | -379.29 | -350.99 | -385.48 | -442.95 | -304.21 | -158.85 | 27.41 | 25.61 | 47.20 | 25.84 | 65.09 | 56.95 | 51.44 | 18.31 | -0.14 | 6.08 | -12.16 | -37.63 | -59.06 | -84.64 | -73.26 | -67.17 | -32.97 | -24.20 | |

| Treasury Stock Value | 857.02 | 852.44 | 823.45 | 821.20 | 781.75 | 783.17 | 869.86 | 868.72 | 869.63 | 853.41 | 828.34 | 826.77 | 827.96 | 829.83 | 831.42 | 831.64 | 792.87 | 794.13 | 747.10 | 688.41 | 683.48 | 589.37 | 590.29 | 588.72 | 589.41 | 590.46 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.17 | 3.19 | 2.57 | 1.67 | 3.83 | 3.79 | 3.74 | 2.63 | 2.21 | 2.19 | 2.10 | 1.90 | 2.13 | 1.88 | 1.91 | 1.62 | 1.96 | 2.11 | 1.79 | 1.56 | 1.96 | 1.89 | 2.67 | 1.51 | 1.87 | 1.57 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

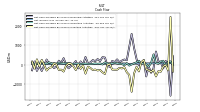

| Net Cash Provided By Used In Operating Activities | -57.40 | 203.48 | 170.95 | 45.96 | 79.05 | 534.91 | 92.09 | -107.78 | 20.10 | 88.59 | 30.17 | 203.41 | 124.99 | 64.83 | 11.54 | -46.88 | 84.18 | -35.31 | 40.58 | 38.27 | 64.13 | 97.86 | 63.01 | 71.83 | 64.38 | 119.48 | |

| Net Cash Provided By Used In Investing Activities | -10.72 | -94.33 | -366.15 | -338.01 | -610.66 | -258.94 | -380.53 | -288.92 | -239.70 | 243.01 | 133.68 | -350.95 | -107.14 | -454.88 | -1410.87 | -526.59 | -396.38 | -134.44 | -195.74 | -166.79 | -261.95 | -261.57 | -253.91 | 36.72 | -7.37 | -485.82 | |

| Net Cash Provided By Used In Financing Activities | 197.38 | -193.39 | 133.15 | 176.88 | 684.82 | -196.92 | -419.86 | -83.94 | -612.79 | 235.35 | 78.33 | -38.41 | 295.09 | 866.34 | 1601.57 | 912.03 | 231.38 | 269.56 | 212.58 | 124.22 | 274.88 | 132.04 | 197.25 | -116.68 | -48.53 | 371.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -57.40 | 203.48 | 170.95 | 45.96 | 79.05 | 534.91 | 92.09 | -107.78 | 20.10 | 88.59 | 30.17 | 203.41 | 124.99 | 64.83 | 11.54 | -46.88 | 84.18 | -35.31 | 40.58 | 38.27 | 64.13 | 97.86 | 63.01 | 71.83 | 64.38 | 119.48 | |

| Net Income Loss | 64.26 | 72.10 | 79.61 | 68.31 | 81.83 | 70.87 | 69.99 | 64.29 | 61.89 | 75.58 | 64.96 | 73.06 | 50.83 | 61.61 | 39.56 | 26.05 | 47.79 | 62.11 | 59.78 | 56.66 | 58.08 | 65.63 | 35.20 | 49.48 | 34.00 | 48.91 | |

| Amortization Of Financing Costs | 0.21 | 0.18 | 0.18 | 0.18 | 0.17 | 0.17 | 0.17 | 0.21 | 0.24 | 0.23 | 0.23 | 1.15 | 0.29 | 0.29 | 0.29 | 0.25 | 0.21 | 0.21 | 0.21 | 0.21 | 0.21 | 0.21 | 0.20 | 0.19 | 0.23 | 0.24 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -10.72 | -94.33 | -366.15 | -338.01 | -610.66 | -258.94 | -380.53 | -288.92 | -239.70 | 243.01 | 133.68 | -350.95 | -107.14 | -454.88 | -1410.87 | -526.59 | -396.38 | -134.44 | -195.74 | -166.79 | -261.95 | -261.57 | -253.91 | 36.72 | -7.37 | -485.82 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 197.38 | -193.39 | 133.15 | 176.88 | 684.82 | -196.92 | -419.86 | -83.94 | -612.79 | 235.35 | 78.33 | -38.41 | 295.09 | 866.34 | 1601.57 | 912.03 | 231.38 | 269.56 | 212.58 | 124.22 | 274.88 | 132.04 | 197.25 | -116.68 | -48.53 | 371.20 | |

| Payments Of Dividends | 30.41 | 30.25 | 27.37 | 27.70 | 37.60 | 26.72 | 26.66 | 25.03 | 38.07 | 25.38 | 25.31 | 23.27 | 27.57 | 21.05 | 20.98 | 21.35 | 27.89 | 21.76 | 22.09 | 20.59 | 28.11 | 21.16 | 21.05 | 19.33 | 24.51 | 19.24 | |

| Payments For Repurchase Of Common Stock | 6.12 | 30.49 | 0.00 | 40.45 | NA | NA | NA | NA | 17.78 | NA | NA | NA | 0.00 | 0.00 | 0.00 | 39.75 | 0.00 | 48.07 | 57.51 | 5.88 | 95.31 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

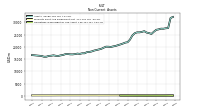

| Revenue From Contract With Customer Including Assessed Tax | 60.13 | 55.96 | 60.59 | 51.73 | 54.32 | 59.22 | 58.38 | 55.24 | 63.88 | 62.58 | 51.85 | 61.92 | 55.57 | 63.25 | 52.92 | 54.60 | 55.28 | 55.32 | 54.14 | 46.69 | 49.52 | 51.02 | 49.09 | 45.86 | 55.02 | 47.38 | |

| Deposit Account | 12.09 | 12.17 | 11.72 | 11.22 | 12.07 | 13.28 | 12.47 | 11.67 | 12.13 | 11.80 | 10.86 | 10.75 | 10.80 | 10.42 | 9.14 | 11.24 | 12.43 | 13.33 | 12.37 | 11.38 | 12.40 | 12.26 | 11.93 | 11.41 | 12.67 | 13.02 | |

| Fiduciary And Trust | 19.39 | 19.41 | 18.68 | 18.06 | 17.53 | 17.61 | 18.27 | 19.43 | 18.29 | 18.53 | 17.63 | 17.35 | 15.65 | 14.94 | 13.41 | 15.05 | 14.42 | 13.87 | 14.15 | 13.24 | 13.41 | 13.07 | 12.80 | 12.87 | 13.15 | 12.16 | |

| Financial Service Other | 20.78 | 19.72 | 23.14 | 17.51 | 18.60 | 20.81 | 20.36 | 16.01 | 18.48 | 16.74 | 17.13 | 16.34 | 16.81 | 18.31 | 16.75 | 18.42 | 19.63 | 18.28 | 18.44 | 14.76 | 13.26 | 15.43 | 16.43 | 13.96 | 13.83 | 12.25 | |

| Mortgage Banking | 2.29 | 3.19 | 2.94 | 1.97 | 2.14 | 3.72 | 3.77 | 4.58 | 7.24 | 9.54 | 2.84 | 13.96 | 9.31 | 16.80 | 9.96 | 6.23 | 5.08 | 6.66 | 6.59 | 4.77 | 4.77 | 4.90 | 5.16 | 4.19 | 4.39 | 4.80 | |

| Service Other | 5.59 | 1.46 | 4.11 | 2.97 | 3.97 | 3.80 | 3.51 | 3.55 | 7.74 | 5.97 | 3.39 | 3.52 | 3.00 | 2.77 | 3.66 | 3.65 | 3.73 | 3.18 | 2.58 | 2.54 | 5.68 | 5.37 | 2.76 | 3.43 | 10.99 | 5.14 |