| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

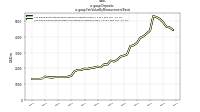

| Common Stock Value | 29.57 | 29.57 | 29.57 | 29.49 | 29.48 | 29.48 | 29.49 | 26.55 | 26.55 | 26.55 | 26.55 | 26.54 | 26.67 | 26.66 | 24.99 | 24.99 | 24.97 | 22.97 | 22.97 | 22.97 | 22.93 | 22.93 | 22.93 | 15.29 | |

| Weighted Average Number Of Diluted Shares Outstanding | 29.57 | 29.57 | 29.51 | NA | 29.48 | 29.48 | 29.40 | NA | 26.55 | 26.55 | 26.51 | 26.66 | NA | 26.64 | 24.99 | 24.97 | NA | 22.97 | 22.97 | 22.94 | NA | 22.93 | 22.93 | 22.91 | |

| Weighted Average Number Of Shares Outstanding Basic | 29.57 | 29.57 | 29.51 | NA | 29.48 | 29.48 | 29.40 | NA | 26.55 | 26.55 | 26.51 | 26.66 | NA | 26.64 | 24.99 | 24.97 | NA | 22.97 | 22.97 | 22.94 | NA | 22.93 | 22.93 | 22.91 | |

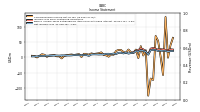

| Earnings Per Share Basic | 0.73 | 0.75 | 0.71 | 0.83 | 0.83 | 0.81 | 0.31 | 0.73 | 0.81 | 0.90 | 0.74 | 0.47 | 0.59 | 0.49 | 0.61 | 0.60 | 0.44 | 0.55 | 0.48 | 0.51 | 0.51 | 0.42 | 0.43 | 0.42 | |

| Earnings Per Share Diluted | 0.73 | 0.75 | 0.71 | 0.83 | 0.83 | 0.81 | 0.31 | 0.73 | 0.81 | 0.90 | 0.74 | 0.47 | 0.59 | 0.49 | 0.61 | 0.60 | 0.44 | 0.55 | 0.48 | 0.51 | 0.51 | 0.42 | 0.43 | 0.42 |

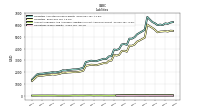

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

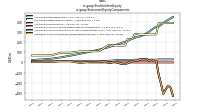

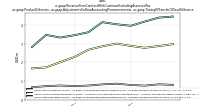

| Interest And Fee Income Loans And Leases | 55.20 | 52.20 | 49.06 | 47.11 | 43.13 | 39.99 | 38.94 | 34.06 | 35.48 | 34.50 | 35.10 | 37.86 | 41.40 | 40.92 | 35.05 | 35.12 | 33.68 | 28.15 | 26.31 | 23.95 | 23.70 | 23.18 | 22.60 | 22.26 | |

| Insurance Commissions And Fees | 2.06 | 2.13 | 3.13 | 2.05 | 2.00 | 2.25 | 3.72 | 1.95 | 2.01 | 2.02 | 3.29 | 3.23 | 1.92 | 1.88 | 1.93 | 3.21 | 1.88 | 1.83 | 1.70 | 2.93 | 1.87 | 1.73 | 1.74 | 2.64 | |

| Gain Loss On Investments | 0.00 | 0.04 | 0.00 | 0.09 | 0.02 | 0.08 | 0.37 | 0.75 | 0.22 | 0.30 | 0.97 | 0.59 | 0.26 | 0.31 | 0.52 | 0.15 | 0.27 | 0.09 | 0.07 | 0.27 | 0.02 | 0.57 | 0.00 | 0.00 | |

| Marketing And Advertising Expense | 1.28 | 1.26 | 1.17 | 1.04 | 1.22 | 1.03 | 1.14 | 1.81 | 0.90 | 0.70 | 0.78 | 1.07 | 1.37 | 1.05 | 0.94 | 0.87 | 1.08 | 0.85 | 0.86 | 0.70 | 0.82 | 1.31 | 0.63 | 0.78 | |

| Interest Expense | 18.08 | 15.26 | 11.48 | 8.48 | 4.83 | 2.67 | 2.37 | 2.25 | 2.29 | 2.41 | 2.59 | 7.32 | 7.92 | 8.33 | 7.39 | 7.60 | 6.61 | 4.93 | 4.06 | 3.54 | 3.16 | 3.07 | 2.59 | 2.31 | |

| Interest Income Expense Net | 47.56 | 48.26 | 49.01 | 52.38 | 51.70 | 49.60 | 46.91 | 40.73 | 41.29 | 39.88 | 38.93 | 36.26 | 39.41 | 38.58 | 33.64 | 33.59 | 32.98 | 28.55 | 27.47 | 25.61 | 25.45 | 24.92 | 24.81 | 24.73 | |

| Interest Paid Net | 16.09 | 14.20 | 10.15 | 8.30 | 4.31 | 3.17 | 1.66 | 2.77 | 1.91 | 2.96 | 2.39 | 7.70 | 8.31 | 7.56 | 7.42 | 7.47 | 5.81 | 4.79 | 4.00 | 3.64 | 3.03 | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 0.21 | 0.18 | 0.18 | 0.15 | 0.16 | 0.17 | 0.17 | 0.18 | 0.18 | 0.28 | 0.08 | 0.24 | 0.13 | 0.17 | 0.15 | 0.17 | 0.21 | 0.17 | 0.17 | 0.17 | 0.16 | 0.15 | 0.18 | 0.16 | |

| Income Tax Expense Benefit | 4.59 | 4.75 | 4.45 | 5.52 | 6.13 | 5.03 | 0.67 | 3.16 | 4.91 | 5.92 | 4.65 | 2.39 | 3.45 | 2.81 | 3.01 | 2.75 | 1.92 | 2.80 | 2.33 | 2.48 | 0.78 | 3.51 | 3.42 | 3.82 | |

| Income Taxes Paid Net | 5.13 | NA | NA | NA | 0.30 | 8.96 | -0.65 | NA | 4.12 | 9.73 | -0.25 | -0.04 | NA | 2.51 | 4.53 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 21.45 | 22.12 | 20.81 | 24.41 | 24.60 | 23.75 | 9.07 | 19.27 | 21.49 | 23.82 | 19.56 | 12.47 | 15.82 | 13.06 | 15.27 | 15.07 | 10.98 | 12.64 | 11.10 | 11.81 | 11.62 | 9.66 | 9.84 | 9.56 | |

| Comprehensive Income Net Of Tax | -57.31 | 3.76 | 53.75 | 70.03 | -73.37 | -68.95 | -124.82 | 23.49 | 6.33 | 36.70 | -2.27 | 25.73 | 15.07 | 17.71 | 24.16 | 24.48 | 21.14 | 8.72 | 9.60 | 2.60 | 6.62 | 8.35 | 16.41 | 13.55 | |

| Interest Income Expense After Provision For Loan Loss | 46.66 | 47.71 | 47.91 | 51.88 | 51.35 | 49.30 | 41.71 | 38.73 | 43.29 | 44.88 | 40.43 | 31.11 | 37.81 | 35.78 | 33.39 | 32.92 | 32.98 | 28.05 | 26.25 | 25.26 | 24.80 | 24.67 | 24.46 | 24.23 | |

| Noninterest Expense | 35.42 | 35.73 | 37.62 | 35.61 | 34.72 | 35.70 | 48.16 | 31.27 | 32.44 | 29.04 | 31.26 | 30.33 | 29.82 | 31.96 | 25.62 | 26.76 | 29.81 | 21.58 | 21.71 | 20.45 | 20.00 | 19.77 | 19.00 | 19.04 | |

| Noninterest Income | 14.80 | 14.90 | 14.97 | 13.67 | 14.10 | 15.18 | 16.19 | 14.97 | 15.56 | 13.90 | 15.04 | 14.08 | 11.28 | 12.06 | 10.51 | 11.66 | 9.73 | 8.96 | 8.88 | 9.49 | 7.59 | 8.28 | 7.80 | 8.19 |

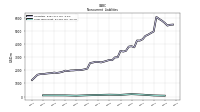

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

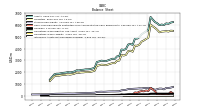

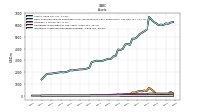

| Assets | 6005.67 | 6053.27 | 5996.92 | 6155.99 | 6259.90 | 6471.70 | 6697.63 | 5608.54 | 5475.75 | 5348.57 | 5219.83 | 4323.85 | 4397.67 | 4355.88 | 3970.74 | 3895.52 | 3929.09 | 3363.77 | 3344.54 | 3125.02 | 3144.36 | 3072.89 | 3004.80 | 2933.14 | |

| Liabilities | 5467.27 | 5450.70 | 5391.59 | 5597.60 | 5765.20 | 5897.27 | 6048.59 | 4940.08 | 4825.61 | 4699.57 | 4602.62 | 3740.31 | 3823.85 | 3792.95 | 3471.33 | 3416.34 | 3470.45 | 2987.65 | 2974.00 | 2761.01 | 2779.79 | 2712.26 | 2649.85 | 2591.93 | |

| Liabilities And Stockholders Equity | 6005.67 | 6053.27 | 5996.92 | 6155.99 | 6259.90 | 6471.70 | 6697.63 | 5608.54 | 5475.75 | 5348.57 | 5219.83 | 4323.85 | 4397.67 | 4355.88 | 3970.74 | 3895.52 | 3929.09 | 3363.77 | 3344.54 | 3125.02 | 3144.36 | 3072.89 | 3004.80 | 2933.14 | |

| Stockholders Equity | 538.39 | 602.57 | 605.33 | 558.39 | 494.70 | 574.43 | 649.04 | 668.46 | 650.14 | 649.00 | 617.21 | 583.54 | 573.82 | 562.93 | 499.41 | 479.19 | 458.64 | 376.12 | 370.54 | 364.00 | 364.57 | 360.62 | 354.95 | 341.22 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 132.42 | 140.67 | 80.30 | 119.08 | 373.05 | 526.04 | 670.59 | 396.89 | 448.74 | 370.08 | 393.24 | 90.14 | 103.88 | 89.13 | 90.01 | 59.53 | 96.55 | NA | NA | NA | 70.36 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 180.36 | 180.36 | 180.36 | 180.36 | 180.48 | 180.31 | 178.62 | 121.76 | 121.76 | 121.96 | 121.96 | 121.31 | 121.31 | 120.83 | 103.80 | 103.80 | 103.68 | 60.91 | 60.91 | 54.06 | 54.06 | 54.06 | 54.06 | 54.06 | |

| Intangible Assets Net Excluding Goodwill | 7.02 | 7.77 | 8.57 | 9.43 | 10.34 | 11.30 | 12.33 | 5.84 | 6.51 | 7.35 | 8.13 | 11.66 | 12.66 | 12.98 | 9.51 | 9.12 | 9.96 | 4.63 | 5.07 | 1.90 | 2.10 | 2.32 | 2.55 | 2.79 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 317.45 | NA | NA | NA | 268.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deposits | 5135.87 | 5179.70 | 5154.90 | 5350.05 | 5574.34 | 5713.61 | 5829.61 | 4744.32 | NA | NA | NA | NA | 3430.02 | NA | NA | NA | 3072.63 | NA | NA | NA | 2484.05 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | 64.46 | NA | NA | NA | 83.86 | NA | NA | NA | NA | 181.95 | NA | NA | NA | 126.64 | NA | NA | NA | 141.72 | NA | NA | NA | |

| Debt And Capital Lease Obligations | NA | NA | NA | 210.24 | NA | NA | NA | 152.18 | NA | NA | NA | NA | 349.69 | NA | NA | NA | 376.41 | NA | NA | NA | 275.22 | NA | 263.47 | 241.36 |

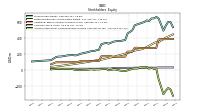

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

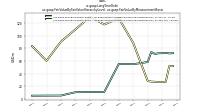

| Stockholders Equity | 538.39 | 602.57 | 605.33 | 558.39 | 494.70 | 574.43 | 649.04 | 668.46 | 650.14 | 649.00 | 617.21 | 583.54 | 573.82 | 562.93 | 499.41 | 479.19 | 458.64 | 376.12 | 370.54 | 364.00 | 364.57 | 360.62 | 354.95 | 341.22 | |

| Common Stock Value | 29.57 | 29.57 | 29.57 | 29.49 | 29.48 | 29.48 | 29.49 | 26.55 | 26.55 | 26.55 | 26.55 | 26.54 | 26.67 | 26.66 | 24.99 | 24.99 | 24.97 | 22.97 | 22.97 | 22.97 | 22.93 | 22.93 | 22.93 | 15.29 | |

| Additional Paid In Capital Common Stock | 388.95 | 388.46 | 387.63 | 387.17 | 386.76 | 386.37 | 385.27 | 276.06 | 275.68 | 275.31 | 274.67 | 274.86 | 278.95 | 278.61 | 229.94 | 229.63 | 229.35 | 166.23 | 165.92 | 165.53 | 165.29 | 164.99 | 164.68 | 172.01 | |

| Retained Earnings Accumulated Deficit | 447.48 | 433.38 | 418.62 | 405.17 | 387.51 | 369.67 | 352.68 | 350.36 | 336.65 | 320.72 | 302.45 | 253.78 | 253.09 | 241.80 | 233.27 | 222.25 | 211.42 | 204.19 | 194.99 | 187.34 | 178.97 | 169.86 | 163.18 | 156.32 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -327.61 | -248.85 | -230.49 | -263.44 | -309.06 | -211.09 | -118.40 | 15.48 | 11.26 | 26.43 | 13.55 | 28.36 | 15.11 | 15.86 | 11.21 | 2.32 | -7.10 | -17.26 | -13.34 | -11.84 | -2.62 | 2.85 | 4.16 | -2.41 |

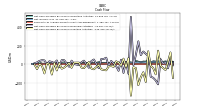

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

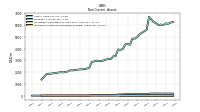

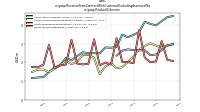

| Net Cash Provided By Used In Operating Activities | 24.42 | 21.77 | 31.47 | 27.54 | 32.17 | 4.05 | 46.27 | 26.91 | 28.51 | 18.73 | 26.69 | 23.94 | 19.44 | 32.91 | -2.46 | 15.34 | 19.87 | 13.84 | 14.88 | 13.74 | 11.06 | 15.32 | 5.85 | 22.64 | |

| Net Cash Provided By Used In Investing Activities | -40.14 | -15.25 | 145.03 | -108.27 | -40.32 | -14.68 | 139.09 | -190.31 | -85.93 | -139.31 | -224.75 | 65.00 | -31.91 | 59.66 | -15.11 | 18.03 | 31.21 | -27.78 | -19.43 | -22.79 | -65.08 | -61.59 | -55.26 | -7.36 | |

| Net Cash Provided By Used In Financing Activities | 7.47 | 53.85 | -215.28 | -173.24 | -144.85 | -133.92 | 88.34 | 111.54 | 136.08 | 97.42 | 245.56 | -102.68 | 27.22 | -93.44 | 48.06 | -70.40 | -20.11 | 8.24 | 35.62 | -21.09 | 69.82 | 56.79 | 56.01 | -42.66 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 24.42 | 21.77 | 31.47 | 27.54 | 32.17 | 4.05 | 46.27 | 26.91 | 28.51 | 18.73 | 26.69 | 23.94 | 19.44 | 32.91 | -2.46 | 15.34 | 19.87 | 13.84 | 14.88 | 13.74 | 11.06 | 15.32 | 5.85 | 22.64 | |

| Net Income Loss | 21.45 | 22.12 | 20.81 | 24.41 | 24.60 | 23.75 | 9.07 | 19.27 | 21.49 | 23.82 | 19.56 | 12.47 | 15.82 | 13.06 | 15.27 | 15.07 | 10.98 | 12.64 | 11.10 | 11.81 | 11.62 | 9.66 | 9.84 | 9.56 | |

| Share Based Compensation | 0.50 | 0.83 | 0.54 | 0.41 | 0.40 | 1.09 | 0.42 | 0.38 | 0.37 | 0.64 | 0.33 | 0.27 | 0.36 | 0.31 | 0.31 | 0.31 | 0.52 | 0.27 | 0.28 | 0.28 | 0.30 | 0.30 | 0.34 | 0.29 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -40.14 | -15.25 | 145.03 | -108.27 | -40.32 | -14.68 | 139.09 | -190.31 | -85.93 | -139.31 | -224.75 | 65.00 | -31.91 | 59.66 | -15.11 | 18.03 | 31.21 | -27.78 | -19.43 | -22.79 | -65.08 | -61.59 | -55.26 | -7.36 | |

| Payments To Acquire Property Plant And Equipment | 1.03 | 2.55 | 1.92 | 1.56 | 1.08 | 1.15 | 4.06 | 1.89 | 1.00 | 0.96 | 0.83 | 1.17 | 3.75 | 2.45 | 1.54 | 1.63 | 2.49 | 3.83 | 4.07 | 4.79 | 3.91 | 3.98 | 0.87 | 2.43 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 7.47 | 53.85 | -215.28 | -173.24 | -144.85 | -133.92 | 88.34 | 111.54 | 136.08 | 97.42 | 245.56 | -102.68 | 27.22 | -93.44 | 48.06 | -70.40 | -20.11 | 8.24 | 35.62 | -21.09 | 69.82 | 56.79 | 56.01 | -42.66 | |

| Payments Of Dividends | 7.36 | 7.36 | 7.35 | 6.76 | 6.76 | 6.75 | 6.75 | 5.55 | 5.56 | 5.55 | 5.55 | 5.07 | 4.53 | 4.53 | 4.25 | 4.25 | 3.74 | 3.44 | 3.44 | 3.44 | 2.98 | 2.98 | 2.98 | 2.90 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accounting Standards Update201409 | 13.27 | 13.16 | 13.52 | 12.12 | 12.30 | 12.75 | 13.43 | 11.09 | 10.81 | 10.58 | 10.82 | 10.50 | 9.27 | 9.29 | 8.68 | 9.18 | 9.36 | 7.55 | 7.17 | 8.03 | 7.58 | 6.21 | 6.12 | 6.73 | |

| Insurance Revenue | 2.06 | 2.13 | 3.13 | 2.05 | 2.00 | 2.25 | 3.72 | 1.95 | 2.01 | 2.02 | 3.29 | 3.23 | 1.92 | 1.88 | 1.93 | 3.21 | 1.88 | 1.83 | 1.70 | 2.93 | 1.87 | 1.73 | 1.74 | NA | |

| Interchange Fee Income | 4.47 | 4.41 | 4.20 | 3.97 | 4.05 | 4.17 | 3.63 | 3.46 | 3.34 | 3.48 | 2.83 | 2.48 | 2.48 | 2.54 | 2.33 | 2.10 | 2.23 | 1.85 | 1.71 | 1.48 | 1.20 | 1.19 | 1.16 | NA | |

| Service Chargeon Deposit Accounts | 2.98 | 2.88 | 2.79 | 2.89 | 3.01 | 2.87 | 2.68 | 2.29 | 2.02 | 1.74 | 1.68 | 2.24 | 2.40 | 2.40 | 2.02 | 1.90 | 2.07 | 1.86 | 1.64 | 1.47 | 1.61 | 1.61 | 1.48 | NA | |

| Wealth Management Fees | 2.96 | 2.91 | 2.64 | 2.42 | 2.38 | 2.64 | 2.64 | 2.65 | 2.69 | 2.62 | 2.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Wealth Management Fees, Accounting Standards Update201409 | 2.96 | 2.91 | 2.64 | 2.42 | 2.38 | 2.64 | 2.64 | 2.65 | 2.69 | 2.62 | 2.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Insurance Revenue, Accounting Standards Update201409, Transferred Over Time | 2.06 | 2.13 | 3.13 | 2.05 | 2.00 | 2.25 | 3.72 | 1.95 | 2.01 | 2.02 | 3.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interchange Fee Income, Accounting Standards Update201409, Transferred At Point In Time | 4.47 | 4.41 | 4.20 | 3.97 | 4.05 | 4.17 | 3.63 | 3.46 | 3.34 | 3.48 | 2.83 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Operating Income, Accounting Standards Update201409, Transferred At Point In Time | 0.80 | 0.82 | 0.75 | 0.79 | 0.86 | 0.82 | 0.76 | 0.73 | 0.76 | 0.73 | 0.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Service Chargeon Deposit Accounts, Accounting Standards Update201409, Transferred At Point In Time | 2.98 | 2.88 | 2.79 | 2.89 | 3.01 | 2.87 | 2.68 | 2.29 | 2.02 | 1.74 | 1.68 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |