| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.45 | 0.45 | 0.45 | 0.46 | 0.46 | 0.46 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.31 | 0.31 | 0.31 | 0.05 | 0.05 | |

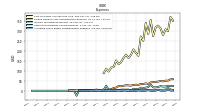

| Earnings Per Share Basic | 1.60 | 1.58 | 1.64 | 1.38 | 1.21 | 1.58 | 2.09 | 1.20 | 1.25 | 0.96 | 1.03 | 0.51 | 0.58 | 0.69 | 0.67 | 0.32 | 0.31 | 0.31 | 0.29 | 0.25 | 0.26 | 0.24 | 0.29 | 0.22 | -0.16 | 0.19 | 0.16 | 0.13 | 0.16 | 0.13 | 0.14 | 0.06 | 0.10 | 0.06 | 0.12 | 0.13 | 1.24 | 0.33 | 0.67 | |

| Earnings Per Share Diluted | 1.59 | 1.56 | 1.63 | 1.37 | 1.20 | 1.57 | 2.08 | 1.20 | 1.24 | 0.95 | 1.02 | 0.51 | 0.58 | 0.68 | 0.66 | 0.31 | 0.32 | 0.31 | 0.29 | 0.25 | 0.26 | 0.24 | 0.29 | 0.22 | -0.16 | 0.19 | 0.16 | 0.13 | 0.16 | 0.13 | 0.14 | 0.06 | 0.10 | 0.06 | 0.12 | 0.13 | 1.24 | 0.33 | 0.67 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

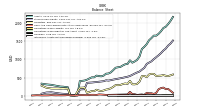

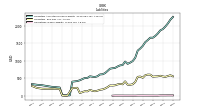

| Revenues | 450.38 | 418.98 | 456.29 | 452.06 | 431.09 | 407.94 | 525.14 | 393.62 | 452.25 | 342.34 | 373.81 | 234.48 | 254.10 | 275.82 | 232.83 | 213.27 | 230.12 | 209.40 | 183.51 | 168.63 | 185.12 | 149.99 | 155.01 | 128.26 | 137.42 | 113.71 | 104.95 | 99.34 | 119.76 | 91.67 | 98.94 | 69.96 | 85.51 | 75.20 | 71.99 | 58.45 | 67.57 | 49.68 | 65.84 | |

| Cost Of Goods And Services Sold | 308.75 | 279.96 | 313.35 | 327.45 | 318.63 | 274.62 | 356.25 | 285.26 | 341.49 | 251.00 | 272.83 | 175.49 | 190.25 | 207.94 | 178.94 | 164.30 | 181.41 | 164.68 | 143.22 | 133.26 | 152.46 | 119.33 | 116.24 | 96.53 | 110.84 | 88.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gross Profit | 141.63 | 139.01 | 142.94 | 124.61 | 112.45 | 133.32 | 168.90 | 108.36 | 110.76 | 91.34 | 100.98 | 58.99 | 63.85 | 67.89 | 53.90 | 48.97 | 48.71 | 44.73 | 40.28 | 35.37 | 36.99 | 30.66 | 34.62 | 27.13 | 28.83 | 25.41 | 22.93 | 21.29 | 29.20 | 22.26 | 23.56 | 15.69 | 18.38 | 15.81 | 17.28 | 16.21 | 15.30 | 15.02 | 16.48 | |

| Selling General And Administrative Expense | 50.92 | 46.88 | 49.23 | 45.95 | 44.63 | 43.25 | 41.80 | 34.27 | 37.09 | 33.71 | 33.98 | 29.49 | 30.42 | 29.18 | 25.67 | 26.87 | 27.55 | 25.08 | 22.49 | 23.53 | 16.07 | 13.98 | 7.28 | 5.83 | 4.45 | 4.30 | 4.17 | 4.28 | 3.97 | 4.33 | 4.43 | 4.03 | 3.96 | 3.38 | 3.38 | 2.94 | 0.69 | 4.64 | 2.49 | |

| Allocated Share Based Compensation Expense | 0.47 | 0.30 | 0.50 | 5.50 | 0.17 | 0.20 | 0.20 | 2.92 | 0.18 | 0.20 | 0.20 | 2.58 | 0.14 | 0.10 | 0.10 | 1.73 | NA | 0.20 | 0.20 | 1.64 | NA | 0.20 | 0.20 | 1.20 | 0.36 | 0.20 | 0.20 | 1.90 | 0.32 | 0.10 | 0.60 | 0.20 | 0.17 | 0.10 | 0.10 | 0.10 | NA | NA | NA | |

| Income Tax Expense Benefit | 21.48 | 20.98 | 23.15 | 19.03 | 16.79 | 16.96 | 30.28 | 18.44 | 15.51 | 13.90 | 15.69 | 7.50 | 7.66 | 9.97 | 1.35 | 6.04 | 5.03 | 5.83 | 5.33 | 3.83 | 3.79 | 4.73 | 5.24 | 3.37 | 25.40 | 5.36 | 4.38 | 3.89 | 6.04 | 3.66 | 4.23 | 1.45 | 2.94 | 1.86 | 2.17 | 2.21 | -24.85 | 0.00 | 0.00 | |

| Profit Loss | 80.36 | 77.11 | 81.06 | 68.14 | 61.16 | 80.63 | 108.00 | 64.20 | 67.08 | 51.26 | 58.28 | 27.76 | 30.29 | 35.95 | 34.84 | 16.72 | 17.55 | 19.14 | 16.12 | 11.49 | 16.93 | 15.37 | 19.00 | 13.24 | -4.38 | 11.93 | 9.43 | 8.23 | 13.10 | 8.16 | 9.42 | 4.49 | 7.07 | 5.29 | 7.00 | 6.19 | 65.36 | -0.68 | -2.81 | |

| Net Income Loss | 73.02 | 72.16 | 75.27 | 64.18 | 55.55 | 73.52 | 101.26 | 61.58 | 63.47 | 48.51 | 52.26 | 25.97 | 29.31 | 34.82 | 33.65 | 15.92 | 15.92 | 15.67 | 14.46 | 12.61 | 13.35 | 12.20 | 14.87 | 11.20 | -8.20 | 9.28 | 7.69 | 6.20 | 7.68 | 6.24 | 6.74 | 3.09 | 4.69 | 2.83 | 3.79 | 4.02 | 31.57 | -0.60 | -2.75 | |

| Net Income Loss Available To Common Stockholders Basic | 72.30 | 71.44 | 74.55 | NA | 54.83 | 72.80 | 100.54 | 60.86 | 63.40 | 48.51 | 52.26 | 25.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

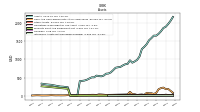

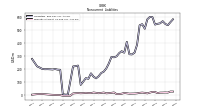

| Assets | 1902.83 | 1866.65 | 1776.57 | 1706.46 | 1655.67 | 1657.73 | 1588.27 | 1528.66 | 1421.87 | 1347.32 | 1287.14 | 1079.92 | 988.85 | 944.58 | 910.25 | 975.18 | 875.54 | 865.79 | 832.96 | 793.02 | 784.03 | 771.02 | 705.05 | 643.19 | 612.23 | 606.51 | 554.32 | 533.47 | 540.98 | 554.11 | 505.89 | 505.53 | 473.88 | 440.13 | 418.13 | 409.02 | 400.32 | 8.83 | 8.84 | |

| Liabilities | 548.68 | 569.76 | 553.35 | 549.56 | 543.62 | 601.27 | 602.78 | 584.12 | 511.31 | 546.69 | 537.93 | 387.45 | 325.89 | 312.06 | 313.82 | 409.89 | 325.53 | 337.09 | 321.81 | 297.07 | 289.86 | 292.98 | 242.84 | 204.12 | 179.19 | 168.26 | 142.87 | 126.94 | 139.50 | 165.41 | 123.23 | 128.21 | 102.02 | 76.09 | 225.73 | 221.41 | 218.73 | NA | 1.41 | |

| Liabilities And Stockholders Equity | 1902.83 | 1866.65 | 1776.57 | 1706.46 | 1655.67 | 1657.73 | 1588.27 | 1528.66 | 1421.87 | 1347.32 | 1287.14 | 1079.92 | 988.85 | 944.58 | 910.25 | 975.18 | 875.54 | 865.79 | 832.96 | 793.02 | 784.03 | 771.02 | 705.05 | 643.19 | 612.23 | 606.51 | 554.32 | 533.47 | 540.98 | 554.11 | 505.89 | 505.53 | 473.88 | 440.13 | 418.13 | 409.02 | 400.32 | 8.83 | 8.84 | |

| Stockholders Equity | 1300.70 | 1245.22 | 1174.08 | 1114.15 | 1061.91 | 1009.24 | 947.39 | 912.18 | 874.55 | 766.79 | 717.39 | 666.13 | 640.24 | 610.08 | 575.76 | 542.98 | 523.17 | 508.71 | 493.47 | 480.87 | 468.35 | 455.69 | 443.32 | 428.39 | 416.35 | 424.21 | 399.94 | 392.10 | 384.57 | 376.59 | 370.21 | 362.87 | 359.53 | 352.79 | 179.86 | 175.96 | 171.86 | 14.41 | 15.01 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash | 179.76 | NA | NA | NA | 76.59 | NA | NA | 66.08 | 78.70 | 21.56 | 33.52 | NA | 19.48 | 40.27 | 43.16 | 105.86 | 33.27 | 35.12 | 34.38 | 23.87 | 38.31 | 33.12 | 37.07 | 34.45 | 36.68 | 20.72 | 27.30 | NA | 35.16 | NA | NA | NA | 21.21 | NA | NA | NA | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 199.46 | 246.16 | 231.20 | 195.69 | 93.27 | 66.94 | 89.65 | 80.23 | 93.55 | 53.00 | 57.12 | 43.44 | 33.63 | 50.85 | 51.32 | 112.63 | 37.69 | 41.23 | 38.85 | 26.61 | 41.76 | 45.01 | 41.20 | 38.85 | 40.29 | 25.09 | 31.77 | 37.83 | 39.60 | NA | NA | NA | 23.77 | NA | NA | NA | 22.98 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 14.78 | NA | NA | NA | 11.63 | NA | NA | NA | 10.98 | NA | NA | NA | 11.13 | NA | NA | NA | 10.55 | NA | NA | NA | 9.36 | NA | NA | NA | 2.05 | NA | NA | NA | 1.81 | NA | NA | NA | 1.44 | NA | NA | NA | 2.25 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 7.73 | NA | NA | NA | 8.71 | NA | NA | NA | 8.16 | NA | NA | NA | 7.53 | NA | NA | NA | 6.24 | NA | NA | NA | 4.67 | NA | NA | NA | 1.25 | NA | NA | NA | 0.92 | NA | NA | NA | 0.64 | NA | NA | NA | 0.63 | 0.74 | 0.73 | |

| Property Plant And Equipment Net | 7.05 | 5.40 | 4.38 | 3.91 | 2.92 | 2.89 | 2.76 | 2.62 | 2.81 | 3.17 | 3.71 | 3.51 | 3.60 | 3.62 | 3.99 | 4.74 | 4.31 | 4.19 | 4.26 | 4.46 | 4.69 | 4.20 | 3.45 | 2.11 | 0.80 | 0.68 | 0.72 | 0.81 | 0.89 | 0.95 | 0.85 | 0.75 | 0.80 | 1.92 | 1.79 | 1.78 | 1.63 | 0.05 | 0.06 | |

| Goodwill | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 0.68 | 1.73 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 0.37 | 0.39 | 0.41 | 0.43 | 0.45 | 0.47 | 0.49 | 0.52 | 0.54 | 0.56 | 0.58 | 0.60 | 0.62 | 0.64 | 0.67 | 0.69 | 0.71 | 0.73 | 0.75 | 0.77 | 0.86 | 1.04 | 0.28 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 350.48 | NA | NA | NA | 371.93 | NA | NA | NA | 339.50 | NA | NA | NA | 220.50 | NA | NA | NA | NA | NA | NA | NA | NA | 198.97 | 166.40 | NA | 116.93 | NA | NA | NA | 85.95 | NA | NA | NA | 57.66 | NA | NA | NA | 176.21 | NA | NA | |

| Minority Interest | 17.31 | 16.43 | 16.15 | 12.45 | 20.91 | 21.56 | 16.10 | 10.18 | 14.15 | 16.43 | 14.30 | 10.63 | 9.17 | 8.82 | 8.19 | 10.90 | 13.23 | 7.78 | 5.17 | 4.79 | 17.28 | 14.51 | 12.21 | 10.68 | 16.69 | 14.03 | 11.51 | 14.43 | 16.91 | 12.11 | 12.45 | 14.45 | 12.32 | 11.25 | 12.54 | 11.65 | 9.74 | -7.66 | -7.58 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

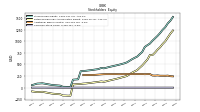

| Stockholders Equity | 1300.70 | 1245.22 | 1174.08 | 1114.15 | 1061.91 | 1009.24 | 947.39 | 912.18 | 874.55 | 766.79 | 717.39 | 666.13 | 640.24 | 610.08 | 575.76 | 542.98 | 523.17 | 508.71 | 493.47 | 480.87 | 468.35 | 455.69 | 443.32 | 428.39 | 416.35 | 424.21 | 399.94 | 392.10 | 384.57 | 376.59 | 370.21 | 362.87 | 359.53 | 352.79 | 179.86 | 175.96 | 171.86 | 14.41 | 15.01 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1318.01 | 1261.65 | 1190.22 | 1126.60 | 1082.82 | 1030.80 | 963.50 | 922.36 | 888.69 | 783.22 | 731.69 | 676.76 | 649.41 | 618.90 | 583.95 | 553.88 | 536.39 | 516.49 | 498.64 | 485.66 | 485.63 | 470.19 | 455.53 | 439.07 | 433.04 | 438.25 | 411.45 | 406.53 | 401.49 | 388.70 | 382.66 | 377.32 | 371.86 | 364.04 | 192.40 | 187.61 | 181.60 | 6.75 | 7.43 | |

| Common Stock Value | 0.45 | 0.45 | 0.45 | 0.46 | 0.46 | 0.46 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.51 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.49 | 0.31 | 0.31 | 0.31 | 0.05 | 0.05 | |

| Additional Paid In Capital | 255.61 | 256.76 | 256.96 | 263.55 | 259.41 | 261.57 | 293.34 | 292.15 | 289.64 | 293.05 | 292.16 | 293.16 | 293.24 | 292.39 | 292.89 | 294.69 | 290.80 | 291.11 | 289.74 | 291.27 | 291.30 | 291.01 | 290.84 | 290.77 | 289.94 | NA | NA | NA | 273.15 | NA | NA | NA | 271.87 | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 997.04 | 940.40 | 868.96 | 817.80 | 754.34 | 699.51 | 701.33 | 600.79 | 539.87 | 476.39 | 427.89 | 375.62 | 349.66 | 320.35 | 285.53 | 250.94 | 235.03 | 220.26 | 204.59 | 190.13 | 177.53 | 164.17 | 151.97 | 137.11 | 125.90 | 134.10 | 124.82 | 117.13 | 110.93 | 103.26 | 97.01 | 90.27 | 87.18 | 80.55 | 77.72 | 73.94 | 69.92 | -172.39 | -171.79 | |

| Minority Interest | 17.31 | 16.43 | 16.15 | 12.45 | 20.91 | 21.56 | 16.10 | 10.18 | 14.15 | 16.43 | 14.30 | 10.63 | 9.17 | 8.82 | 8.19 | 10.90 | 13.23 | 7.78 | 5.17 | 4.79 | 17.28 | 14.51 | 12.21 | 10.68 | 16.69 | 14.03 | 11.51 | 14.43 | 16.91 | 12.11 | 12.45 | 14.45 | 12.32 | 11.25 | 12.54 | 11.65 | 9.74 | -7.66 | -7.58 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.41 | 0.36 | 0.46 | 0.57 | 0.15 | 0.20 | 0.18 | 0.28 | 0.16 | 0.16 | 0.17 | 0.15 | 0.14 | 0.14 | 0.08 | 0.13 | 0.14 | 0.14 | 0.12 | 0.10 | 0.19 | 0.10 | 0.10 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | 0.07 | -0.03 | 0.24 | 0.16 | 0.03 | 0.11 | 0.08 | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 5.00 | 3.00 | 0.00 | 11.06 | 5.00 | 0.00 | 0.00 | 5.72 | 5.00 | 0.00 | 1.61 | NA | 0.00 | 0.00 | 2.28 | 2.97 | 0.00 | 0.00 | 0.26 | 10.73 | 0.00 | 0.32 | 2.38 | 8.04 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

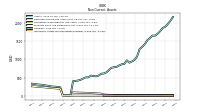

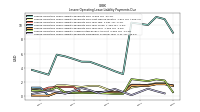

| Net Cash Provided By Used In Operating Activities | -19.36 | 22.53 | 55.46 | 154.71 | 59.34 | -18.08 | 63.41 | -13.99 | 22.12 | 4.22 | -110.69 | -8.02 | -29.00 | 25.09 | 37.84 | 1.16 | -0.82 | -0.45 | -11.56 | -9.23 | -1.15 | -26.02 | 8.07 | -20.37 | 4.80 | -27.28 | -12.88 | 16.55 | 21.40 | -20.62 | 9.47 | -17.30 | -26.09 | -9.78 | -1.32 | -10.39 | 8.42 | -0.97 | -2.06 | |

| Net Cash Provided By Used In Investing Activities | -3.35 | -2.17 | -4.73 | -3.10 | -1.53 | -2.75 | -1.75 | -0.45 | -0.24 | -0.32 | -0.74 | -0.74 | -1.24 | -10.38 | -0.62 | -1.05 | -6.03 | -0.69 | -0.57 | -0.57 | -1.44 | -2.10 | -26.68 | -0.60 | -0.17 | -0.27 | 0.00 | 0.00 | -0.12 | -0.18 | -0.16 | -0.01 | 0.69 | -0.32 | -0.32 | 2.41 | 11.76 | 0.00 | 0.00 | |

| Net Cash Provided By Used In Financing Activities | -24.00 | -5.41 | -15.21 | -49.19 | -31.48 | -1.89 | -52.24 | 1.12 | 18.68 | -8.01 | 125.11 | 18.57 | 13.03 | -15.18 | -98.54 | 74.84 | 3.31 | 3.52 | 24.37 | -5.34 | -0.66 | 31.94 | 20.96 | 19.53 | 10.57 | 20.87 | 6.82 | -18.32 | -5.88 | 16.44 | -9.66 | 20.56 | 30.90 | 9.33 | -0.26 | 3.78 | -9.80 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -19.36 | 22.53 | 55.46 | 154.71 | 59.34 | -18.08 | 63.41 | -13.99 | 22.12 | 4.22 | -110.69 | -8.02 | -29.00 | 25.09 | 37.84 | 1.16 | -0.82 | -0.45 | -11.56 | -9.23 | -1.15 | -26.02 | 8.07 | -20.37 | 4.80 | -27.28 | -12.88 | 16.55 | 21.40 | -20.62 | 9.47 | -17.30 | -26.09 | -9.78 | -1.32 | -10.39 | 8.42 | -0.97 | -2.06 | |

| Net Income Loss | 73.02 | 72.16 | 75.27 | 64.18 | 55.55 | 73.52 | 101.26 | 61.58 | 63.47 | 48.51 | 52.26 | 25.97 | 29.31 | 34.82 | 33.65 | 15.92 | 15.92 | 15.67 | 14.46 | 12.61 | 13.35 | 12.20 | 14.87 | 11.20 | -8.20 | 9.28 | 7.69 | 6.20 | 7.68 | 6.24 | 6.74 | 3.09 | 4.69 | 2.83 | 3.79 | 4.02 | 31.57 | -0.60 | -2.75 | |

| Profit Loss | 80.36 | 77.11 | 81.06 | 68.14 | 61.16 | 80.63 | 108.00 | 64.20 | 67.08 | 51.26 | 58.28 | 27.76 | 30.29 | 35.95 | 34.84 | 16.72 | 17.55 | 19.14 | 16.12 | 11.49 | 16.93 | 15.37 | 19.00 | 13.24 | -4.38 | 11.93 | 9.43 | 8.23 | 13.10 | 8.16 | 9.42 | 4.49 | 7.07 | 5.29 | 7.00 | 6.19 | 65.36 | -0.68 | -2.81 | |

| Depreciation Depletion And Amortization | 1.10 | 0.86 | 0.83 | 0.75 | 0.65 | 0.59 | 0.50 | 0.62 | 0.67 | 0.68 | 0.55 | 0.84 | 1.21 | 0.92 | 0.91 | 0.63 | 0.64 | 0.77 | 0.79 | 0.89 | 1.14 | 0.77 | 0.64 | 0.40 | 0.09 | 0.07 | 0.08 | 0.09 | 0.09 | 0.08 | 0.07 | 0.06 | -0.34 | 0.62 | 0.36 | 0.23 | 0.71 | 0.17 | 0.14 | |

| Increase Decrease In Accounts Receivable | 0.68 | 2.90 | -0.20 | 1.97 | -1.95 | 0.41 | -0.22 | 0.18 | -0.16 | 0.02 | -0.55 | 2.34 | -0.43 | -8.84 | 8.47 | 1.30 | -4.79 | 4.50 | 2.24 | -2.07 | 0.78 | -2.15 | 4.45 | -0.06 | -0.20 | -0.57 | -0.49 | 0.42 | 0.38 | -0.12 | -1.94 | 0.81 | 2.59 | -0.08 | -0.12 | 0.18 | 0.34 | 0.01 | -0.04 | |

| Increase Decrease In Inventories | 70.64 | 57.54 | 31.05 | -49.99 | -30.70 | 83.52 | 41.35 | 123.43 | 33.18 | 63.93 | 185.12 | 76.03 | 65.08 | 28.06 | -19.68 | 16.88 | 12.58 | 20.75 | 28.93 | 21.72 | 20.66 | 65.19 | 9.49 | 33.95 | 24.81 | 44.86 | 28.90 | -3.15 | -3.05 | 36.07 | 8.76 | 32.50 | 27.26 | 3.37 | 12.67 | 15.43 | 37.61 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -3.35 | -2.17 | -4.73 | -3.10 | -1.53 | -2.75 | -1.75 | -0.45 | -0.24 | -0.32 | -0.74 | -0.74 | -1.24 | -10.38 | -0.62 | -1.05 | -6.03 | -0.69 | -0.57 | -0.57 | -1.44 | -2.10 | -26.68 | -0.60 | -0.17 | -0.27 | 0.00 | 0.00 | -0.12 | -0.18 | -0.16 | -0.01 | 0.69 | -0.32 | -0.32 | 2.41 | 11.76 | 0.00 | 0.00 | |

| Payments To Acquire Property Plant And Equipment | 3.01 | 1.94 | 1.27 | 1.58 | 0.66 | 0.28 | 0.62 | 0.45 | 0.24 | 0.32 | 0.74 | 0.73 | 1.16 | 0.53 | 0.13 | 1.05 | 0.73 | 0.69 | 0.57 | 0.57 | 1.44 | 0.59 | 0.58 | 0.60 | 0.12 | 0.03 | 0.00 | 0.00 | 0.12 | 0.18 | 0.16 | 0.01 | -0.69 | 0.32 | 0.32 | 0.36 | 1.38 | 0.00 | 0.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -24.00 | -5.41 | -15.21 | -49.19 | -31.48 | -1.89 | -52.24 | 1.12 | 18.68 | -8.01 | 125.11 | 18.57 | 13.03 | -15.18 | -98.54 | 74.84 | 3.31 | 3.52 | 24.37 | -5.34 | -0.66 | 31.94 | 20.96 | 19.53 | 10.57 | 20.87 | 6.82 | -18.32 | -5.88 | 16.44 | -9.66 | 20.56 | 30.90 | 9.33 | -0.26 | 3.78 | -9.80 | 0.00 | 0.00 | |

| Payments Of Dividends | 0.72 | 0.72 | 0.72 | 0.72 | 0.72 | 0.72 | 0.72 | 0.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 17.79 | 0.00 | 12.64 | 15.35 | 0.00 | 9.15 | 66.51 | 25.80 | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 1.80 | 0.33 | 0.06 | 0.98 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 450.38 | 418.98 | 456.29 | 452.06 | 431.09 | 407.94 | 525.14 | 393.62 | 452.25 | 342.34 | 373.81 | 234.48 | 254.10 | 275.82 | 232.83 | 213.27 | 230.12 | 209.40 | 183.51 | 168.63 | 185.12 | 149.99 | 155.01 | 128.26 | 137.42 | 113.71 | 104.95 | 99.34 | 119.76 | 91.67 | 98.94 | 69.96 | 85.51 | 75.20 | 71.99 | 58.45 | 67.57 | 49.68 | 65.84 | |

| Homebuilders, Real Estate Other | 1.86 | 3.06 | 1.84 | 1.70 | 1.06 | 11.20 | 12.63 | 28.95 | 32.20 | 3.44 | 40.31 | 17.24 | 7.66 | 11.94 | 4.17 | 22.08 | 6.85 | 9.30 | 8.45 | 7.04 | 13.13 | 12.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Homebuyers, Residential Real Estate | 448.52 | 415.92 | 454.44 | 450.36 | 430.03 | 396.75 | 512.51 | 364.66 | 420.05 | 338.90 | 333.50 | 217.24 | 246.44 | 263.88 | 228.67 | 191.19 | 223.27 | 199.92 | 175.05 | 161.59 | 171.99 | 139.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Real Estate Other | 1.86 | 3.06 | 1.84 | 1.70 | 1.06 | 11.20 | 12.63 | 28.95 | 32.20 | 3.44 | 40.31 | 17.24 | 7.66 | 11.94 | 4.17 | 22.08 | 6.85 | 9.49 | 8.45 | 7.04 | 13.13 | 12.59 | 11.13 | 7.90 | 2.92 | 5.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Residential Real Estate | 448.52 | 415.92 | 454.44 | 450.36 | 430.03 | 396.75 | 512.51 | 364.66 | 420.05 | 338.90 | 333.50 | 217.24 | 246.44 | 263.88 | 228.67 | 191.19 | 223.27 | 199.92 | 175.05 | 161.59 | 177.25 | 137.40 | 146.18 | 121.26 | 137.34 | 108.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Real Estate Other, Transferred At Point In Time | 1.86 | 3.06 | 1.84 | 1.70 | 1.06 | 11.20 | 12.63 | 28.95 | 32.20 | 3.44 | 40.31 | 17.24 | 7.66 | 11.94 | 4.17 | 22.08 | 6.85 | 9.49 | 8.45 | 7.04 | 13.13 | 12.59 | 11.13 | 7.90 | NA | 5.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Residential Real Estate, Transferred At Point In Time | 448.39 | 415.83 | 454.14 | 449.43 | 428.58 | 394.73 | 510.54 | 363.06 | 419.13 | 338.07 | 332.28 | 216.13 | 245.55 | 262.32 | 226.78 | 189.25 | 223.27 | 197.28 | 172.49 | 159.23 | 169.53 | 137.40 | 143.88 | 120.37 | 133.47 | 108.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Residential Real Estate, Transferred Over Time | 0.13 | 0.10 | 0.31 | 0.93 | 1.44 | 2.02 | 1.98 | 1.60 | 0.92 | 0.82 | 1.22 | 1.10 | 0.89 | 1.57 | 1.88 | 1.94 | 0.00 | 2.64 | 2.56 | 2.35 | 2.46 | 2.06 | 2.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |