| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Common Stock Value | 42.66 | 42.65 | 42.56 | 42.44 | 42.44 | 42.37 | |

| Weighted Average Number Of Diluted Shares Outstanding | 42.81 | 42.76 | 42.74 | 42.64 | 42.57 | 42.54 | |

| Weighted Average Number Of Shares Outstanding Basic | 42.76 | 42.70 | 42.62 | 42.58 | 42.48 | 42.36 | |

| Earnings Per Share Basic | 1.08 | 1.11 | 1.19 | 1.28 | 1.17 | 0.97 | |

| Earnings Per Share Diluted | 1.08 | 1.11 | 1.19 | 1.28 | 1.17 | 0.97 | |

| Tier One Risk Based Capital To Risk Weighted Assets | NA | NA | NA | NA | NA | NA | |

| Capital To Risk Weighted Assets | NA | NA | NA | NA | NA | NA |

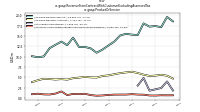

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

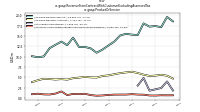

| Interest And Fee Income Loans And Leases | 182.39 | 168.90 | 153.84 | 122.91 | 108.72 | 102.37 | |

| Interest Expense | 99.68 | 88.37 | 64.77 | 19.93 | 10.43 | 6.58 | |

| Interest Income Expense Net | 145.76 | 147.13 | 152.21 | 155.88 | 142.46 | 134.68 | |

| Interest Paid Net | 83.42 | 71.38 | 51.30 | 19.36 | 10.42 | 6.68 | |

| Income Tax Expense Benefit | 13.48 | 15.38 | 15.32 | 14.12 | 15.40 | 12.12 | |

| Income Taxes Paid | 6.94 | 39.04 | 1.26 | 15.96 | 17.43 | 0.03 | |

| Other Comprehensive Income Loss Net Of Tax | -67.60 | -8.32 | 53.09 | -163.72 | -200.00 | -281.17 | |

| Net Income Loss | 48.09 | 49.42 | 52.78 | 56.56 | 51.87 | 43.09 | |

| Comprehensive Income Net Of Tax | -19.51 | 41.09 | 105.86 | -107.15 | -148.12 | -238.08 | |

| Preferred Stock Dividends Income Statement Impact | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | 2.01 | |

| Net Income Loss Available To Common Stockholders Basic | 46.08 | 47.40 | 50.76 | 54.55 | 49.86 | 41.08 | |

| Interest Income Expense After Provision For Loan Loss | 144.24 | 141.75 | 149.14 | 150.38 | 139.22 | 131.43 | |

| Noninterest Expense | 111.05 | 109.45 | 111.04 | 108.88 | 106.48 | 110.80 | |

| Noninterest Income | 28.38 | 32.49 | 30.00 | 29.18 | 34.54 | 34.57 |

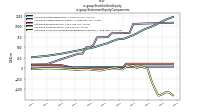

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

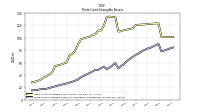

| Assets | 20129.79 | 20224.72 | 20182.54 | 19682.95 | 19658.40 | 19230.88 | |

| Liabilities | 18304.26 | 18365.73 | 18353.14 | 18026.99 | 17884.33 | 17299.02 | |

| Liabilities And Stockholders Equity | 20129.79 | 20224.72 | 20182.54 | 19682.95 | 19658.40 | 19230.88 | |

| Stockholders Equity | 1825.53 | 1858.99 | 1829.40 | 1655.96 | 1774.07 | 1931.86 | |

| Tier One Risk Based Capital | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 348.00 | 400.19 | 362.11 | 399.86 | 384.79 | 604.90 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 348.00 | 400.19 | 362.11 | 399.86 | 384.79 | 604.90 | |

| Equity Securities Fv Ni | NA | 20.69 | 20.60 | 20.26 | 20.44 | 20.53 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | NA | NA | NA | |

| Deposits | 17100.99 | 17663.54 | 17681.35 | 17267.12 | 17225.55 | 16666.68 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

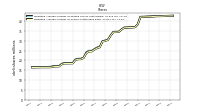

| Stockholders Equity | 1825.53 | 1858.99 | 1829.40 | 1655.96 | 1774.07 | 1931.86 | |

| Common Stock Value | 42.66 | 42.65 | 42.56 | 42.44 | 42.44 | 42.37 | |

| Additional Paid In Capital Common Stock | 1088.27 | 1087.36 | 1084.11 | 1079.28 | 1076.77 | 1073.05 | |

| Retained Earnings Accumulated Deficit | 1226.74 | 1193.52 | 1158.95 | 1074.17 | 1031.08 | 992.65 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -642.84 | -575.24 | -566.92 | -650.64 | -486.92 | -286.92 |

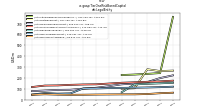

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

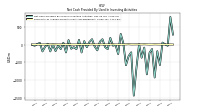

| Net Cash Provided By Used In Operating Activities | 212.35 | 110.29 | 74.43 | 124.65 | 104.71 | 83.78 | |

| Net Cash Provided By Used In Investing Activities | -34.85 | 7.16 | 54.58 | -185.72 | -925.78 | -126.45 | |

| Net Cash Provided By Used In Financing Activities | -229.69 | -79.37 | -129.98 | 76.13 | 600.96 | 211.97 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 212.35 | 110.29 | 74.43 | 124.65 | 104.71 | 83.78 | |

| Net Income Loss | 48.09 | 49.42 | 52.78 | 56.56 | 51.87 | 43.09 | |

| Depreciation Depletion And Amortization | 4.95 | 5.04 | 5.48 | 5.79 | 6.13 | 6.83 | |

| Increase Decrease In Other Operating Capital Net | -119.64 | -30.85 | 9.82 | -32.81 | -20.68 | -12.65 | |

| Share Based Compensation | 0.85 | 2.17 | 4.72 | 2.32 | 2.39 | 2.70 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -34.85 | 7.16 | 54.58 | -185.72 | -925.78 | -126.45 | |

| Payments To Acquire Property Plant And Equipment | 2.66 | 2.79 | 0.25 | 4.09 | 5.64 | 2.54 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -229.69 | -79.37 | -129.98 | 76.13 | 600.96 | 211.97 | |

| Payments Of Dividends | 14.81 | 14.78 | 14.75 | 13.47 | 13.45 | 13.43 |

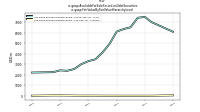

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | ||

|---|---|---|---|---|---|---|---|

| Capital Markets Fees | 1.84 | 4.04 | 2.45 | 1.81 | 4.87 | 3.04 | |

| Financial Service Brokerage And Insurance Commissions | 0.69 | 0.68 | 0.70 | 0.65 | 0.84 | 0.87 | |

| Fiduciary And Trust | 4.73 | 5.42 | 5.66 | 5.37 | 5.68 | 6.08 | |

| Financial Service | 18.55 | 19.63 | 17.14 | 17.28 | 18.07 | 15.25 |