| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 96.44 | 96.43 | 96.42 | 96.39 | 96.37 | 96.36 | 96.34 | 96.33 | 96.31 | 96.23 | 96.23 | 96.23 | 96.22 | 96.19 | 96.15 | 96.14 | 96.10 | 96.08 | 96.07 | 96.04 | 96.02 | 96.00 | 96.00 | 95.97 | |

| Weighted Average Number Of Diluted Shares Outstanding | 62.20 | 62.21 | 62.28 | 62.37 | 63.09 | 63.50 | 63.50 | 63.52 | 63.42 | 63.39 | 63.40 | 65.23 | NA | 65.64 | 65.87 | 65.83 | NA | 66.42 | 66.93 | 66.86 | NA | 66.75 | 66.72 | 66.75 | |

| Weighted Average Number Of Shares Outstanding Basic | 62.65 | 62.07 | 62.14 | 62.23 | 62.95 | 63.35 | 63.37 | 63.36 | 63.31 | 63.27 | 63.30 | 65.07 | NA | 65.45 | 65.65 | 65.62 | NA | 66.14 | 66.11 | 66.09 | NA | 66.06 | 66.05 | 65.99 | |

| Earnings Per Share Basic | 1.66 | 1.62 | 1.64 | 1.34 | 0.92 | 0.84 | 0.86 | 1.45 | 0.80 | 0.68 | 0.66 | 0.54 | 0.79 | 0.79 | 0.76 | 0.79 | 0.89 | 0.77 | 0.80 | 0.81 | 0.68 | 0.60 | 0.61 | 0.48 | |

| Earnings Per Share Diluted | 1.66 | 1.62 | 1.63 | 1.34 | 0.92 | 0.84 | 0.86 | 1.45 | 0.80 | 0.67 | 0.65 | 0.53 | 0.79 | 0.78 | 0.76 | 0.79 | 0.88 | 0.77 | 0.79 | 0.80 | 0.68 | 0.59 | 0.61 | 0.48 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Capital To Risk Weighted Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

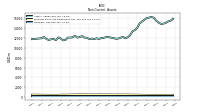

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 158.53 | 152.90 | 142.27 | 104.82 | 87.63 | 81.49 | 88.28 | 91.82 | 92.11 | 90.61 | 97.76 | 99.23 | 100.55 | 104.69 | 105.56 | 102.81 | 99.43 | 95.83 | 92.08 | 87.83 | 84.25 | 83.39 | 79.47 | 75.40 | |

| Interest Expense | 36.85 | 31.67 | 22.96 | 9.87 | 6.68 | 6.39 | 6.68 | 6.67 | 6.87 | 8.17 | 9.80 | 13.77 | 14.00 | 14.90 | 15.08 | 14.65 | 14.24 | 13.50 | 12.79 | 12.13 | 10.89 | 9.99 | 8.80 | 9.25 | |

| Interest Income Expense Net | 167.33 | 166.46 | 165.19 | 135.22 | 102.90 | 90.05 | 94.51 | 91.31 | 91.01 | 91.81 | 103.85 | 102.84 | 103.36 | 109.22 | 111.78 | 109.41 | 106.73 | 104.87 | 102.27 | 99.27 | 97.14 | 96.95 | 94.38 | 87.73 | |

| Interest Paid Net | 31.95 | 26.15 | 19.73 | 8.90 | 6.40 | 6.30 | 7.14 | 6.01 | 7.98 | 10.32 | 10.20 | 13.35 | 13.47 | 14.66 | 14.62 | 13.98 | 13.57 | 25.46 | -0.46 | 12.05 | 29.26 | -0.51 | -0.17 | 10.41 | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | 131.04 | 127.81 | 128.93 | 106.12 | 73.65 | 67.96 | 69.19 | 118.12 | 63.87 | 53.11 | 52.55 | 44.16 | 65.30 | 65.57 | 63.92 | 65.17 | 73.17 | 65.03 | 66.70 | 67.68 | 59.68 | 60.02 | 53.82 | 48.12 | |

| Income Tax Expense Benefit | 27.77 | 27.32 | 27.29 | 22.77 | 15.68 | 14.47 | 14.59 | 26.09 | 13.10 | 10.37 | 11.04 | 9.32 | 13.56 | 14.13 | 13.90 | 13.26 | 14.64 | 13.94 | 13.82 | 14.26 | 14.45 | 20.39 | 13.25 | 16.12 | |

| Income Taxes Paid Net | 21.47 | NA | NA | -1.66 | NA | NA | 31.26 | NA | NA | 34.46 | 0.16 | 0.21 | 5.50 | 10.73 | NA | NA | 0.85 | 11.77 | NA | NA | 12.54 | 19.50 | NA | NA | |

| Profit Loss | 103.26 | 100.48 | 101.64 | 83.36 | 57.97 | 53.49 | 54.60 | 92.03 | 50.77 | 42.74 | 41.51 | 34.84 | 51.73 | 51.44 | 50.02 | 51.91 | 58.53 | 51.09 | 52.89 | 53.42 | 45.23 | 39.63 | 40.57 | 32.00 | |

| Net Income Loss | 103.26 | 100.48 | 101.64 | 83.36 | 57.97 | 53.49 | 54.60 | 92.03 | 50.77 | 42.74 | 41.51 | 34.84 | 51.73 | 51.44 | 50.02 | 51.91 | 58.53 | 51.09 | 52.89 | 53.42 | 45.23 | 39.63 | 40.57 | 32.00 | |

| Comprehensive Income Net Of Tax | 40.36 | 38.66 | 151.65 | -94.68 | -13.63 | -119.66 | 47.03 | 92.50 | 47.76 | 33.84 | 18.48 | 96.84 | 49.52 | 60.26 | 75.17 | 77.14 | 99.09 | 35.43 | 41.70 | 13.47 | 23.38 | 40.00 | 47.59 | 44.77 | |

| Interest Income Expense After Provision For Loan Loss | 156.85 | 157.64 | 156.60 | 126.69 | 99.17 | 88.56 | 91.71 | 90.16 | 89.82 | 83.04 | 92.86 | 86.01 | 99.88 | 103.94 | 109.12 | 101.99 | 103.83 | 100.59 | 105.00 | 97.61 | 95.02 | 90.36 | 93.57 | 86.03 | |

| Noninterest Expense | 71.20 | 67.53 | 68.03 | 75.17 | 68.76 | 64.12 | 69.73 | 69.95 | 62.19 | 70.05 | 73.91 | 76.98 | 76.17 | 81.07 | 79.61 | 72.95 | 71.92 | 78.07 | 80.60 | 68.91 | 72.70 | 71.71 | 73.71 | 75.63 | |

| Noninterest Income | 45.38 | 37.70 | 40.36 | 54.60 | 43.24 | 43.51 | 47.21 | 97.91 | 36.24 | 40.12 | 33.60 | 35.13 | 41.58 | 42.70 | 34.42 | 36.13 | 41.26 | 42.50 | 42.30 | 38.98 | 37.36 | 41.37 | 33.96 | 37.72 |

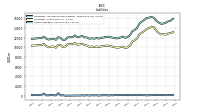

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 14907.94 | 14854.84 | 15134.95 | 16094.95 | 16271.18 | 16136.69 | 15677.50 | 15311.00 | 14921.53 | 13591.77 | 13324.52 | 12506.41 | 12112.89 | 11966.03 | 12227.02 | 12027.70 | 11871.95 | 11845.50 | 11989.00 | 12070.61 | 12184.70 | 12173.65 | 12035.22 | 11965.86 | |

| Liabilities | 12714.33 | 12662.84 | 12978.54 | 14140.67 | 14173.95 | 13989.01 | 13383.12 | 13025.33 | 12728.93 | 11450.72 | 11182.66 | 10363.90 | 9994.84 | 9898.11 | 10166.70 | 10043.00 | 9932.37 | 9986.66 | 10109.26 | 10239.35 | 10345.72 | 10358.47 | 10238.53 | 10217.30 | |

| Liabilities And Stockholders Equity | 14907.94 | 14854.84 | 15134.95 | 16094.95 | 16271.18 | 16136.69 | 15677.50 | 15311.00 | 14921.53 | 13591.77 | 13324.52 | 12506.41 | 12112.89 | 11966.03 | 12227.02 | 12027.70 | 11871.95 | 11845.50 | 11989.00 | 12070.61 | 12184.70 | 12173.65 | 12035.22 | 11965.86 | |

| Stockholders Equity | 2193.61 | 2191.99 | 2156.41 | 1954.27 | 2097.23 | 2147.68 | 2294.37 | 2285.67 | 2192.61 | 2141.05 | 2141.86 | 2142.51 | 2118.05 | 2067.92 | 2060.32 | 1984.70 | 1939.58 | 1858.85 | 1879.73 | 1831.26 | 1838.98 | 1815.18 | 1796.69 | 1748.56 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 698.61 | 1025.47 | 1195.05 | 3243.83 | 3416.72 | 3448.20 | 2287.32 | 2326.88 | 1967.77 | 1249.40 | 1198.21 | 354.71 | 256.82 | 286.52 | 321.12 | 349.16 | 316.80 | 285.66 | 265.12 | 254.62 | 265.36 | 290.57 | 316.92 | 297.81 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 698.61 | 1025.47 | 1195.05 | 3243.83 | 3416.72 | 3448.20 | 2287.32 | 2326.88 | 1967.77 | 1249.40 | 1198.21 | 354.71 | 256.82 | 286.52 | 321.12 | 349.16 | 316.80 | 285.66 | 265.12 | 254.62 | 265.36 | 290.57 | NA | NA | |

| Short Term Investments | 4700.50 | 4678.55 | 4868.61 | 4224.14 | 4303.34 | 4151.21 | 4563.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | 4859.82 | 4215.39 | 4294.36 | 4142.00 | 4554.31 | 4171.88 | 4057.36 | 3298.84 | 3097.73 | 3594.51 | 3378.92 | 3192.87 | 3467.91 | 3410.09 | 3411.35 | 3509.90 | 3720.57 | 3868.17 | 4124.19 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Net | 434.26 | 430.60 | 430.44 | 431.95 | 435.18 | 438.15 | 459.29 | 463.52 | 471.82 | 486.60 | 492.00 | 494.70 | 506.60 | 507.94 | 505.70 | 504.58 | 506.90 | 510.49 | 511.34 | 511.70 | 514.45 | 516.79 | 522.00 | 524.65 | |

| Held To Maturity Securities Fair Value | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 | 2.40 | 2.40 | 2.40 | 2.40 | 2.40 | 1.20 | 2.40 | 2.40 | 2.40 | 2.40 | 2.40 | 2.40 | 2.40 | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | 5397.13 | 4796.53 | 4648.03 | 4404.30 | 4540.75 | 4148.67 | 4034.75 | 3257.60 | 3045.14 | 3512.61 | 3376.07 | 3187.25 | 3473.48 | 3447.72 | 3481.16 | 3631.42 | 3822.19 | 3955.53 | 4196.26 | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Next Rolling Twelve Months Fair Value | 2.08 | 2.08 | 1.07 | 1.20 | 1.32 | 2.33 | 2.20 | 2.08 | 1.07 | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Rolling Year Two Through Five Fair Value | 1.32 | 1.32 | 2.33 | 2.20 | 2.08 | 1.07 | 1.20 | 1.32 | 2.33 | 2.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 11916.61 | 11935.31 | 12280.78 | 12880.51 | 12943.25 | 12795.34 | 12243.97 | 11876.77 | 11480.98 | 10306.73 | 10035.72 | 9009.89 | 8826.03 | 8812.06 | 8828.66 | 8895.93 | 8696.55 | 8645.60 | 8669.63 | 8854.91 | 8544.89 | 8613.54 | 8705.93 | 8864.32 |

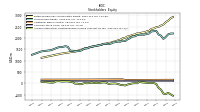

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2193.61 | 2191.99 | 2156.41 | 1954.27 | 2097.23 | 2147.68 | 2294.37 | 2285.67 | 2192.61 | 2141.05 | 2141.86 | 2142.51 | 2118.05 | 2067.92 | 2060.32 | 1984.70 | 1939.58 | 1858.85 | 1879.73 | 1831.26 | 1838.98 | 1815.18 | 1796.69 | 1748.56 | |

| Common Stock Value | 96.44 | 96.43 | 96.42 | 96.39 | 96.37 | 96.36 | 96.34 | 96.33 | 96.31 | 96.23 | 96.23 | 96.23 | 96.22 | 96.19 | 96.15 | 96.14 | 96.10 | 96.08 | 96.07 | 96.04 | 96.02 | 96.00 | 96.00 | 95.97 | |

| Additional Paid In Capital | 154.95 | 154.52 | 154.24 | 153.19 | 152.74 | 152.41 | 151.85 | 151.51 | 150.97 | 149.03 | 148.74 | 148.51 | 148.07 | 147.46 | 146.61 | 146.11 | 145.28 | 144.66 | 173.06 | 172.42 | 171.82 | 171.36 | 171.06 | 170.52 | |

| Retained Earnings Accumulated Deficit | 2922.71 | 2858.54 | 2758.06 | 2590.16 | 2544.15 | 2486.18 | 2414.18 | 2397.61 | 2305.58 | 2241.40 | 2233.45 | 2191.95 | 2200.57 | 2148.84 | 2133.24 | 2083.22 | 2064.13 | 2005.61 | 1982.46 | 1923.41 | 1891.81 | 1846.57 | 1828.74 | 1788.17 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -545.21 | -482.31 | -420.49 | -454.77 | -276.74 | -205.14 | 10.72 | 18.29 | 17.81 | 32.42 | 41.32 | 64.35 | 2.35 | 4.56 | -4.25 | -29.41 | -54.63 | -95.18 | -79.54 | -68.35 | -28.40 | -6.54 | -6.91 | -13.93 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 0.08 | 0.08 | 0.10 | 0.12 | 0.11 | 0.12 | 0.12 | 0.11 | 0.16 | 0.18 | 0.18 | 0.22 | 0.24 | 0.24 | 0.24 | 0.27 | 0.28 | 0.28 | 0.28 | 0.18 | NA | NA | NA | NA |

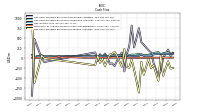

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 113.72 | 85.25 | 142.69 | 121.12 | 88.28 | 79.10 | 58.45 | 70.49 | 95.50 | 78.33 | 79.89 | 56.62 | 100.38 | 85.77 | 57.72 | 67.70 | 51.12 | 76.51 | 49.04 | 53.18 | 22.30 | 70.51 | 39.62 | 64.39 | |

| Net Cash Provided By Used In Investing Activities | -445.46 | 61.30 | -568.30 | -176.60 | -253.99 | -26.71 | -420.59 | -98.77 | -861.92 | -286.84 | -36.37 | -245.33 | -225.74 | 216.95 | -220.14 | -89.13 | 48.53 | 147.72 | 99.08 | 84.11 | -60.78 | -203.17 | -14.79 | -125.08 | |

| Net Cash Provided By Used In Financing Activities | 4.88 | -316.12 | -467.07 | -117.41 | 134.22 | 186.57 | 322.58 | 387.38 | 736.95 | 259.70 | 799.98 | 286.60 | 95.66 | -337.32 | 134.37 | 53.80 | -68.51 | -203.69 | -137.62 | -148.02 | 13.26 | 106.31 | -5.72 | 89.29 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 113.72 | 85.25 | 142.69 | 121.12 | 88.28 | 79.10 | 58.45 | 70.49 | 95.50 | 78.33 | 79.89 | 56.62 | 100.38 | 85.77 | 57.72 | 67.70 | 51.12 | 76.51 | 49.04 | 53.18 | 22.30 | 70.51 | 39.62 | 64.39 | |

| Net Income Loss | 103.26 | 100.48 | 101.64 | 83.36 | 57.97 | 53.49 | 54.60 | 92.03 | 50.77 | 42.74 | 41.51 | 34.84 | 51.73 | 51.44 | 50.02 | 51.91 | 58.53 | 51.09 | 52.89 | 53.42 | 45.23 | 39.63 | 40.57 | 32.00 | |

| Profit Loss | 103.26 | 100.48 | 101.64 | 83.36 | 57.97 | 53.49 | 54.60 | 92.03 | 50.77 | 42.74 | 41.51 | 34.84 | 51.73 | 51.44 | 50.02 | 51.91 | 58.53 | 51.09 | 52.89 | 53.42 | 45.23 | 39.63 | 40.57 | 32.00 | |

| Deferred Income Tax Expense Benefit | 7.94 | -1.35 | -1.84 | -1.25 | -0.67 | 0.08 | 0.03 | -0.76 | -0.06 | -2.58 | -0.74 | -14.12 | 2.98 | -0.43 | 2.20 | -1.44 | 3.77 | 1.01 | 0.09 | 0.27 | 4.60 | -0.24 | -0.02 | 0.23 | |

| Share Based Compensation | 0.08 | 0.08 | 0.10 | 0.12 | 0.11 | 0.12 | 0.12 | 0.11 | 0.16 | 0.18 | 0.18 | 0.22 | 0.24 | 0.24 | 0.24 | 0.27 | 0.28 | 0.28 | 0.28 | 0.18 | 0.20 | 0.21 | 0.22 | 0.27 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -445.46 | 61.30 | -568.30 | -176.60 | -253.99 | -26.71 | -420.59 | -98.77 | -861.92 | -286.84 | -36.37 | -245.33 | -225.74 | 216.95 | -220.14 | -89.13 | 48.53 | 147.72 | 99.08 | 84.11 | -60.78 | -203.17 | -14.79 | -125.08 | |

| Payments To Acquire Property Plant And Equipment | 9.19 | 5.59 | 4.29 | 4.23 | 6.08 | 2.49 | 1.81 | 2.65 | 1.61 | 1.65 | 1.82 | 2.77 | 5.78 | 9.40 | 8.28 | 6.13 | 5.14 | 5.98 | 6.75 | 3.52 | 4.01 | 2.69 | 3.65 | 3.96 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 4.88 | -316.12 | -467.07 | -117.41 | 134.22 | 186.57 | 322.58 | 387.38 | 736.95 | 259.70 | 799.98 | 286.60 | 95.66 | -337.32 | 134.37 | 53.80 | -68.51 | -203.69 | -137.62 | -148.02 | 13.26 | 106.31 | -5.72 | 89.29 | |

| Payments Of Dividends Common Stock | 39.10 | 0.00 | 39.15 | 37.35 | 0.00 | 38.03 | 38.03 | 0.00 | 34.81 | 0.00 | NA | NA | 35.85 | -0.00 | NA | NA | 27.78 | 0.00 | NA | NA | 21.80 | 0.00 | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.08 | 3.37 | 1.04 | 11.39 | 37.17 | 3.38 | 0.66 | 0.00 | 0.05 | 0.14 | 19.37 | 29.37 | 0.03 | 17.69 | 0.07 | 0.05 | 18.98 | 0.00 | NA | NA | 0.06 | 0.01 | 0.02 | 0.10 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Service Charges Commissions And Fees Banking | 14.31 | 14.39 | 14.05 | 15.99 | 12.94 | 12.52 | 15.75 | 13.23 | 12.18 | 14.47 | 11.23 | 11.17 | 13.65 | 14.71 | 11.76 | 10.88 | 11.31 | 13.10 | 11.15 | 11.12 | 10.46 | 13.10 | 11.03 | 10.38 | |

| Other Service Charges Commissions And Fees Nonbanking | 2.30 | 2.58 | 1.95 | 2.62 | 2.04 | 1.76 | 2.05 | 2.35 | 1.44 | 1.80 | 2.03 | 1.75 | 2.07 | 2.02 | 2.24 | 1.51 | 2.53 | 1.89 | 2.03 | 1.36 | 2.29 | 1.85 | 1.86 | 1.33 | |

| Service Charges On Deposit Accounts | 19.31 | 18.07 | 17.55 | 19.04 | 18.25 | 17.26 | 17.29 | 15.77 | 14.90 | 15.04 | 12.88 | 17.64 | 18.91 | 18.72 | 17.61 | 17.26 | 18.77 | 18.39 | 17.55 | 17.71 | 18.37 | 18.71 | 17.88 | 17.91 | |

| Other Service Charges Commissions And Fees Banking | 14.31 | 14.39 | 14.05 | 15.99 | 12.94 | 12.52 | 15.75 | 13.23 | 12.18 | 14.47 | 11.23 | 11.17 | 13.65 | 14.71 | 11.76 | 10.88 | 11.31 | 13.10 | 11.15 | 11.12 | 10.46 | 13.10 | 11.03 | 10.38 | |

| Other Service Charges Commissions And Fees Nonbanking | 2.30 | 2.58 | 1.95 | 2.62 | 2.04 | 1.76 | 2.05 | 2.35 | 1.44 | 1.80 | 2.03 | 1.75 | 2.07 | 2.02 | 2.24 | 1.51 | 2.53 | 1.89 | 2.03 | 1.36 | 2.29 | 1.85 | 1.86 | 1.33 | |

| Service Charges On Deposit Accounts | 19.31 | 18.07 | 17.55 | 19.04 | 18.25 | 17.26 | 17.29 | 15.77 | 14.90 | 15.04 | 12.88 | 17.64 | 18.91 | 18.72 | 17.61 | 17.26 | 18.77 | 18.39 | 17.55 | 17.71 | 18.37 | 18.71 | 17.88 | 17.91 |