| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

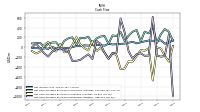

| Earnings Per Share Basic | 0.21 | 0.22 | 0.23 | 0.20 | 0.17 | 0.13 | 0.18 | 0.15 | 0.12 | 0.12 | 0.11 | 0.10 | 0.12 | 0.06 | 0.08 | 0.09 | 0.10 | 0.06 | 0.07 | 0.04 | 0.05 | 0.00 | -0.03 | -0.03 | -0.11 | -0.07 | 0.02 | -0.08 | |

| Earnings Per Share Diluted | 0.21 | 0.21 | 0.22 | 0.20 | 0.17 | 0.13 | 0.18 | 0.15 | 0.12 | 0.12 | 0.11 | 0.10 | 0.12 | 0.06 | 0.08 | 0.09 | 0.10 | 0.06 | 0.07 | 0.04 | 0.05 | 0.00 | -0.03 | -0.03 | -0.11 | -0.07 | 0.02 | -0.08 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 624.32 | 617.70 | 600.37 | 589.89 | 579.84 | 568.67 | 557.30 | 532.31 | 520.23 | 509.53 | 491.63 | 475.23 | 464.10 | 459.18 | 449.75 | 449.79 | 444.28 | 443.33 | 441.58 | 435.50 | 432.62 | 30.11 | 28.58 | 423.67 | 329.95 | 14.16 | 13.71 | 238.75 | |

| Revenues | 624.32 | 617.70 | 600.37 | 589.89 | 579.84 | 568.67 | 557.30 | 532.31 | 520.23 | 509.53 | 491.63 | 475.23 | 464.10 | 459.18 | 449.75 | 449.79 | 444.28 | 443.33 | 441.58 | 435.50 | 432.62 | 434.25 | 432.43 | 423.67 | 329.95 | 243.54 | 242.22 | 238.75 | |

| Costs And Expenses | 542.45 | 535.53 | 503.43 | 493.42 | 496.86 | 503.18 | 466.60 | 452.57 | 451.55 | 456.10 | 439.97 | 429.43 | 433.69 | 438.38 | 419.11 | 418.43 | 426.63 | 434.89 | 428.96 | 435.03 | 435.89 | 448.05 | 452.19 | 448.49 | NA | NA | NA | NA | |

| General And Administrative Expense | 22.39 | 22.71 | 19.79 | 17.45 | 16.92 | 20.12 | 19.34 | 17.64 | 19.67 | 19.37 | 19.83 | 16.95 | 16.68 | 17.97 | 14.43 | 14.23 | 15.38 | 16.41 | 15.96 | 26.54 | 25.34 | 21.15 | 24.64 | 27.64 | 63.59 | 27.46 | 18.43 | 58.27 | |

| Interest Expense | 90.05 | 86.74 | 78.62 | 78.05 | 78.41 | 76.45 | 74.84 | 74.39 | 79.12 | 79.37 | 80.76 | 83.41 | 95.38 | 87.71 | 86.07 | 84.76 | 88.42 | 89.07 | 95.71 | 93.98 | 96.51 | 97.56 | 97.23 | 92.30 | 74.24 | 56.80 | 57.36 | 68.57 | |

| Interest Paid Net | 78.22 | 66.15 | 78.61 | 67.68 | 79.19 | 66.43 | 63.88 | 66.23 | 64.22 | 72.20 | 70.92 | 78.17 | 76.36 | 83.56 | 75.83 | 77.33 | 73.00 | 84.32 | 81.45 | 83.32 | 76.97 | 84.09 | 87.12 | 87.80 | 62.25 | 53.49 | 56.92 | 53.65 | |

| Allocated Share Based Compensation Expense | 8.01 | 8.93 | 6.07 | 6.50 | 6.40 | 7.93 | 7.99 | 6.65 | 6.10 | 6.05 | 9.21 | 5.81 | 4.80 | 6.09 | 2.11 | 4.10 | 4.31 | 4.62 | 3.62 | 5.61 | 5.92 | 6.07 | 8.02 | 9.50 | 16.74 | 12.00 | 8.22 | 44.24 | |

| Income Tax Expense Benefit | 0.18 | 0.06 | 0.02 | NA | -0.09 | 0.07 | 0.08 | 0.08 | 0.09 | 0.08 | 0.14 | 0.24 | 0.15 | 0.29 | 0.30 | 0.13 | 0.31 | 0.58 | 0.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Taxes Paid Net | 0.16 | 0.06 | 0.05 | -0.02 | 0.04 | 0.39 | 0.71 | 0.40 | 0.20 | 0.11 | 0.17 | 0.33 | 0.00 | 0.32 | 0.60 | 0.36 | 0.46 | 0.62 | 0.83 | 0.87 | 0.50 | 0.20 | 0.70 | 0.67 | 0.54 | 0.00 | 1.99 | 0.00 | |

| Profit Loss | 129.94 | 132.22 | 138.28 | 120.58 | 100.86 | 79.43 | 111.50 | 93.00 | 74.87 | 69.50 | 60.69 | 57.72 | 71.13 | 32.87 | 43.18 | 50.28 | 52.55 | 33.98 | 39.41 | 21.17 | 25.71 | 1.04 | -14.19 | -17.58 | -46.45 | -22.51 | 5.53 | -42.39 | |

| Other Comprehensive Income Loss Net Of Tax | -56.20 | 6.76 | 46.80 | -31.74 | 6.11 | 112.53 | 60.49 | 207.29 | 91.88 | 35.49 | 17.07 | 117.70 | 52.34 | 33.39 | -24.77 | -332.87 | 66.33 | -76.00 | -156.49 | -98.73 | -167.75 | 33.51 | 12.23 | 60.17 | 40.18 | 3.60 | -8.70 | 13.27 | |

| Net Income Loss | 129.55 | 131.82 | 137.86 | 120.24 | 100.57 | 79.18 | 110.96 | 92.61 | 74.54 | 69.18 | 60.34 | 57.37 | 70.70 | 32.65 | 42.90 | 49.96 | 51.99 | 33.71 | 38.94 | 20.82 | 25.27 | 1.02 | -13.95 | -17.27 | -45.97 | -22.51 | 5.53 | -25.51 | |

| Comprehensive Income Net Of Tax | 73.52 | 138.56 | 184.52 | 88.58 | 106.67 | 191.28 | 171.21 | 299.02 | 166.03 | 104.43 | 77.16 | 174.35 | 122.72 | 65.84 | 18.16 | -280.85 | 117.82 | -41.65 | -115.77 | -76.29 | -139.58 | 33.95 | -1.91 | 41.84 | -6.25 | -18.91 | -3.17 | -29.12 | |

| Net Income Loss Available To Common Stockholders Basic | 129.37 | 131.64 | 137.70 | 120.07 | 100.43 | 79.03 | 110.81 | 92.39 | 74.48 | 69.11 | 60.24 | 57.27 | 70.59 | 32.54 | 42.78 | 49.85 | 51.90 | 33.62 | 38.83 | 20.72 | 25.08 | 0.82 | -14.15 | -17.49 | -46.24 | -22.75 | 5.42 | -25.51 | |

| Net Income Loss Available To Common Stockholders Diluted | 129.37 | 131.64 | 137.70 | 120.07 | 100.43 | 79.03 | 110.81 | 92.39 | 74.48 | 69.11 | 60.24 | 57.27 | 70.59 | 32.54 | 42.78 | 49.85 | 51.90 | 33.62 | 38.83 | 20.72 | 25.08 | 0.82 | -14.15 | -17.49 | -46.24 | -22.75 | 5.42 | -25.51 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 19220.97 | 19466.20 | 18542.26 | 18503.21 | 18536.71 | 18678.41 | 18506.98 | 18544.22 | 18537.85 | 18250.57 | 17484.61 | 17490.42 | 17506.22 | 17750.79 | 17746.32 | 17593.35 | 17392.91 | 17660.02 | 17714.15 | 17853.62 | 18063.43 | 18476.65 | 18665.36 | 18696.44 | 18683.64 | 9524.52 | 9519.33 | 9588.16 | |

| Liabilities | 9030.53 | 9196.65 | 8259.55 | 8250.70 | 8213.08 | 8332.07 | 8225.00 | 8319.09 | 8699.04 | 8727.32 | 8864.93 | 8858.06 | 8950.15 | 9419.41 | 9402.44 | 9635.22 | 9126.83 | 9483.51 | 9676.68 | 9632.25 | 9694.24 | 9912.00 | 10081.78 | 10059.55 | 10033.76 | 5922.51 | 5875.35 | 5930.12 | |

| Liabilities And Stockholders Equity | 19220.97 | 19466.20 | 18542.26 | 18503.21 | 18536.71 | 18678.41 | 18506.98 | 18544.22 | 18537.85 | 18250.57 | 17484.61 | 17490.42 | 17506.22 | 17750.79 | 17746.32 | 17593.35 | 17392.91 | 17660.02 | 17714.15 | 17853.62 | 18063.43 | 18476.65 | 18665.36 | 18696.44 | 18683.64 | 9524.52 | 9519.33 | 9588.16 | |

| Stockholders Equity | 10155.97 | 10235.80 | 10249.87 | 10219.47 | 10291.34 | 10315.13 | 10238.69 | 10182.86 | 9797.74 | 9482.98 | 8580.04 | 8580.11 | 8504.83 | 8280.87 | 8293.76 | 7908.24 | 8214.42 | 8097.26 | 7957.68 | 8139.92 | 8229.11 | 8421.13 | 8439.66 | 8491.94 | 8498.08 | 3602.01 | 3643.97 | 3658.04 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 700.62 | 762.64 | 414.29 | 325.28 | 262.87 | 300.31 | 272.71 | 467.46 | 610.17 | 569.66 | 126.17 | 187.31 | 213.42 | 559.57 | 571.72 | 297.06 | 92.26 | 81.53 | 77.05 | 130.90 | 144.94 | 130.04 | 166.87 | 134.89 | 179.88 | 134.44 | 158.93 | 192.45 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 897.48 | 979.89 | 619.53 | 528.30 | 453.93 | 515.90 | 479.60 | 683.15 | 818.86 | 821.15 | 368.14 | 410.82 | 411.77 | 808.91 | 795.61 | 515.79 | 286.25 | 326.41 | 319.45 | 351.42 | 359.99 | 383.64 | 409.92 | 390.75 | 416.56 | 288.22 | 297.20 | NA | |

| Land | 4881.89 | 4907.45 | 4774.30 | 4789.12 | 4800.11 | 4810.45 | 4802.14 | 4769.62 | 4737.94 | 4664.89 | 4578.22 | 4551.87 | 4539.80 | 4501.83 | 4487.94 | 4498.59 | 4499.35 | 4491.15 | 4522.98 | 4532.85 | 4561.44 | 4575.70 | 4635.18 | 4637.54 | 4646.92 | 2733.83 | 2716.93 | 2701.44 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Net | 31.47 | 24.46 | 24.98 | 24.78 | 24.48 | 20.44 | 17.56 | 16.79 | 16.59 | 13.14 | 9.30 | 9.15 | 9.99 | 8.81 | 9.14 | 9.36 | 9.82 | 10.51 | 10.88 | 9.65 | 11.79 | 12.25 | 17.98 | 15.41 | 16.59 | 6.52 | 6.00 | 5.61 | |

| Goodwill | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | 258.21 | NA | NA | NA | |

| Held To Maturity Securities | 86.47 | 86.62 | 86.82 | 86.91 | 86.98 | 115.03 | 115.18 | 157.06 | 157.17 | 197.25 | 229.20 | 244.60 | 245.24 | 309.12 | 310.38 | 311.54 | 316.99 | 326.83 | 331.09 | 358.25 | 366.60 | 392.86 | 483.38 | 424.35 | 378.55 | 230.62 | 230.50 | 209.39 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 8546.05 | 8547.24 | 7765.56 | 7768.05 | 7769.08 | 7753.03 | 7753.93 | 7855.61 | 7998.66 | 7813.14 | 8014.44 | 8022.68 | 8031.50 | 8330.05 | 8351.57 | 8638.81 | 8467.49 | 8655.89 | 8964.97 | 9080.92 | 9249.82 | 9454.92 | 9662.76 | 9668.85 | 9651.66 | NA | NA | NA | |

| Senior Notes | 3305.47 | 3304.08 | 2520.02 | 2519.10 | 2518.18 | 2517.27 | 2516.36 | 1922.72 | 1921.97 | 931.89 | 298.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 34.46 | 33.75 | 32.84 | 33.03 | 32.29 | 31.22 | 43.30 | 42.28 | 41.06 | 40.27 | 39.64 | 52.25 | 51.25 | 50.51 | 50.11 | 49.88 | 51.66 | 79.25 | 79.79 | 81.45 | 140.07 | 143.52 | 143.92 | 144.96 | 151.79 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 10155.97 | 10235.80 | 10249.87 | 10219.47 | 10291.34 | 10315.13 | 10238.69 | 10182.86 | 9797.74 | 9482.98 | 8580.04 | 8580.11 | 8504.83 | 8280.87 | 8293.76 | 7908.24 | 8214.42 | 8097.26 | 7957.68 | 8139.92 | 8229.11 | 8421.13 | 8439.66 | 8491.94 | 8498.08 | 3602.01 | 3643.97 | 3658.04 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 10190.43 | 10269.55 | 10282.71 | 10252.50 | 10323.63 | 10346.35 | 10281.99 | 10225.13 | 9838.80 | 9523.25 | 8619.68 | 8632.36 | 8556.07 | 8331.38 | 8343.87 | 7958.13 | 8266.08 | 8176.51 | 8037.47 | 8221.37 | 8369.19 | 8564.65 | 8583.58 | 8636.90 | 8649.88 | NA | NA | NA | |

| Additional Paid In Capital | 11156.74 | 11149.73 | 11141.83 | 11136.46 | 11138.46 | 11133.26 | 11113.15 | 11093.79 | 10873.54 | 10622.69 | 9725.48 | 9705.12 | 9707.26 | 9521.18 | 9515.62 | 9066.51 | 9010.19 | 8938.49 | 8686.93 | 8685.06 | 8629.46 | 8624.38 | 8619.30 | 8612.11 | 8602.60 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1070.59 | -1039.78 | -1011.06 | -989.43 | -951.22 | -916.14 | -860.27 | -836.49 | -794.87 | -767.23 | -737.44 | -700.73 | -661.16 | -646.95 | -595.32 | -556.30 | -524.59 | -505.89 | -469.13 | -439.74 | -392.59 | -360.34 | -303.80 | -232.30 | -157.59 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 63.70 | 119.73 | 112.98 | 66.33 | 97.98 | 91.89 | -20.29 | -80.53 | -286.94 | -378.43 | -413.68 | -429.96 | -546.94 | -598.97 | -632.15 | -607.40 | -276.60 | -340.72 | -265.37 | -110.66 | -12.96 | 151.89 | 118.95 | 106.92 | 47.88 | NA | NA | NA | |

| Minority Interest | 34.46 | 33.75 | 32.84 | 33.03 | 32.29 | 31.22 | 43.30 | 42.28 | 41.06 | 40.27 | 39.64 | 52.25 | 51.25 | 50.51 | 50.11 | 49.88 | 51.66 | 79.25 | 79.79 | 81.45 | 140.07 | 143.52 | 143.92 | 144.96 | 151.79 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 8.01 | 8.93 | 6.07 | 6.50 | 6.40 | 7.93 | 7.99 | 6.65 | 6.10 | 6.05 | 9.21 | 5.81 | 4.80 | 6.09 | 2.11 | 4.10 | 4.31 | 4.62 | 3.62 | 5.61 | 5.92 | 6.07 | 8.02 | 9.50 | 16.74 | 12.00 | 8.22 | 32.24 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.51 | 0.51 | 0.85 | 0.49 | 0.41 | 0.49 | 0.92 | 0.58 | 0.45 | 0.45 | 0.61 | 0.60 | 0.53 | 0.54 | 0.53 | 0.53 | 0.46 | 0.72 | 0.71 | 1.18 | 0.99 | 0.99 | 1.00 | 1.04 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

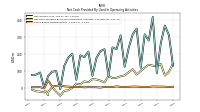

| Net Cash Provided By Used In Operating Activities | 87.54 | 420.80 | 280.95 | 317.79 | 119.64 | 351.89 | 317.02 | 235.03 | 125.35 | 312.21 | 229.51 | 240.59 | 71.04 | 229.74 | 218.21 | 177.72 | 71.28 | 215.51 | 182.16 | 193.18 | 48.16 | 202.75 | 180.25 | 130.08 | -7.48 | 100.04 | 96.36 | 70.86 | |

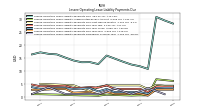

| Net Cash Provided By Used In Investing Activities | -3.96 | -677.61 | -22.14 | -69.84 | -58.32 | -175.41 | -291.46 | -289.23 | -431.25 | -445.44 | -160.32 | -122.56 | -230.78 | -104.87 | -8.76 | -80.74 | 128.80 | -65.76 | -15.84 | 55.03 | 204.03 | 48.34 | -87.38 | -102.00 | 64.71 | -85.93 | -37.03 | 111.53 | |

| Net Cash Provided By Used In Financing Activities | -166.00 | 617.17 | -167.57 | -173.58 | -123.29 | -140.18 | -229.12 | -81.52 | 303.61 | 586.23 | -111.87 | -118.98 | -237.40 | -111.57 | 70.37 | 132.57 | -240.25 | -142.79 | -198.29 | -256.78 | -275.84 | -277.37 | -73.70 | -53.90 | -11.80 | -38.61 | -92.85 | -188.06 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 87.54 | 420.80 | 280.95 | 317.79 | 119.64 | 351.89 | 317.02 | 235.03 | 125.35 | 312.21 | 229.51 | 240.59 | 71.04 | 229.74 | 218.21 | 177.72 | 71.28 | 215.51 | 182.16 | 193.18 | 48.16 | 202.75 | 180.25 | 130.08 | -7.48 | 100.04 | 96.36 | 70.86 | |

| Net Income Loss | 129.55 | 131.82 | 137.86 | 120.24 | 100.57 | 79.18 | 110.96 | 92.61 | 74.54 | 69.18 | 60.34 | 57.37 | 70.70 | 32.65 | 42.90 | 49.96 | 51.99 | 33.71 | 38.94 | 20.82 | 25.27 | 1.02 | -13.95 | -17.27 | -45.97 | -22.51 | 5.53 | -25.51 | |

| Profit Loss | 129.94 | 132.22 | 138.28 | 120.58 | 100.86 | 79.43 | 111.50 | 93.00 | 74.87 | 69.50 | 60.69 | 57.72 | 71.13 | 32.87 | 43.18 | 50.28 | 52.55 | 33.98 | 39.41 | 21.17 | 25.71 | 1.04 | -14.19 | -17.58 | -46.45 | -22.51 | 5.53 | -42.39 | |

| Share Based Compensation | 8.01 | 8.93 | 6.07 | 6.50 | 6.40 | 7.93 | 7.99 | 6.65 | 6.10 | 6.05 | 9.21 | 5.81 | 4.80 | 6.09 | 2.11 | 4.10 | 4.31 | 4.62 | 3.62 | 5.61 | 5.92 | 6.07 | 8.02 | 9.50 | 16.74 | 12.00 | 8.22 | 44.24 | |

| Amortization Of Financing Costs | 4.20 | 4.13 | 3.96 | 3.91 | 3.91 | 3.91 | 3.66 | 3.54 | 3.39 | 3.17 | 3.06 | 3.51 | 7.67 | 3.80 | 6.40 | 7.95 | 9.87 | 9.23 | 10.01 | 10.15 | 9.37 | 8.15 | 5.68 | 4.00 | 2.72 | 3.19 | 5.03 | 11.33 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -3.96 | -677.61 | -22.14 | -69.84 | -58.32 | -175.41 | -291.46 | -289.23 | -431.25 | -445.44 | -160.32 | -122.56 | -230.78 | -104.87 | -8.76 | -80.74 | 128.80 | -65.76 | -15.84 | 55.03 | 204.03 | 48.34 | -87.38 | -102.00 | 64.71 | -85.93 | -37.03 | 111.53 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -166.00 | 617.17 | -167.57 | -173.58 | -123.29 | -140.18 | -229.12 | -81.52 | 303.61 | 586.23 | -111.87 | -118.98 | -237.40 | -111.57 | 70.37 | 132.57 | -240.25 | -142.79 | -198.29 | -256.78 | -275.84 | -277.37 | -73.70 | -53.90 | -11.80 | -38.61 | -92.85 | -188.06 | |

| Payments Of Dividends | 159.29 | 159.29 | 159.26 | 160.29 | 134.66 | 134.57 | 134.98 | 134.82 | 101.70 | 98.28 | 96.60 | 97.23 | 84.50 | 84.19 | 81.68 | 81.77 | 69.92 | 70.47 | 68.33 | 67.97 | 57.52 | 57.56 | 57.56 | 57.43 | 25.09 | 25.09 | 18.82 | 0.00 | |

| Dividends | 160.35 | 160.54 | 159.49 | 158.45 | 135.65 | 135.04 | 134.74 | 134.24 | 102.18 | 98.97 | 97.05 | 96.93 | 84.91 | 84.29 | 81.92 | 81.67 | 70.69 | 70.47 | 68.33 | 67.97 | 57.52 | 57.56 | 57.56 | 57.43 | 25.18 | 25.14 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 624.32 | 617.70 | 600.37 | 589.89 | 579.84 | 568.67 | 557.30 | 532.31 | 520.23 | 509.53 | 491.63 | 475.23 | 464.10 | 459.18 | 449.75 | 449.79 | 444.28 | 443.33 | 441.58 | 435.50 | 432.62 | 434.25 | 432.43 | 423.67 | 329.95 | 243.54 | 242.22 | 238.75 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 624.32 | 617.70 | 600.37 | 589.89 | 579.84 | 568.67 | 557.30 | 532.31 | 520.23 | 509.53 | 491.63 | 475.23 | 464.10 | 459.18 | 449.75 | 449.79 | 444.28 | 443.33 | 441.58 | 435.50 | 432.62 | 30.11 | 28.58 | 423.67 | 329.95 | 14.16 | 13.71 | 238.75 |