| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

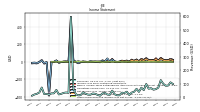

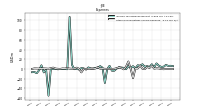

| Earnings Per Share Basic | 0.22 | 0.33 | 0.60 | 0.18 | 0.48 | 0.21 | 0.29 | 0.23 | 0.55 | 0.26 | 0.41 | 0.05 | 0.34 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.17 | 0.00 | -0.01 | -3.56 | -0.03 | -0.14 | 0.15 | -0.03 | -0.14 | -0.09 | -0.13 | |

| Earnings Per Share Diluted | 0.22 | 0.33 | 0.60 | 0.18 | 0.48 | 0.21 | 0.29 | 0.23 | 0.55 | 0.26 | 0.41 | 0.05 | 0.34 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.17 | 0.00 | -0.01 | -3.56 | -0.03 | -0.14 | 0.15 | -0.03 | -0.14 | -0.09 | -0.13 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 86.74 | 101.39 | 128.17 | 72.99 | 61.62 | 57.58 | 68.25 | 64.87 | 99.46 | 54.00 | 72.24 | 41.30 | 63.86 | 42.04 | 36.08 | 18.57 | 42.66 | 32.86 | 35.55 | 16.02 | 16.30 | 23.68 | 50.43 | 19.86 | 21.56 | 33.65 | 30.38 | 13.20 | 18.75 | 27.19 | 29.55 | 20.25 | 21.10 | 27.83 | 37.85 | 17.09 | 15.68 | 23.95 | 68.16 | 594.09 | 33.87 | 36.83 | 33.79 | 26.77 | 22.61 | 55.91 | 30.36 | 30.52 | 19.82 | 26.75 | 25.28 | 73.44 | 37.10 | 27.11 | 22.04 | 13.30 | |

| Costs And Expenses | 69.43 | 81.10 | 86.34 | 61.69 | 51.36 | 45.40 | 49.45 | 44.65 | 57.45 | 37.84 | 41.49 | 35.77 | 37.58 | 31.02 | 24.98 | 19.90 | 27.46 | 25.44 | 24.68 | 18.18 | 17.64 | 21.73 | 21.09 | 20.41 | 23.45 | 29.20 | 25.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Income Loss | 17.31 | 20.29 | 41.83 | 11.30 | 10.26 | 12.18 | 18.80 | 20.22 | 42.01 | 16.16 | 30.75 | 5.54 | 26.28 | 11.03 | 11.11 | -1.32 | 15.20 | 7.42 | 10.87 | -2.16 | -1.34 | 1.94 | 29.34 | -0.54 | -1.88 | 4.45 | 4.66 | -4.90 | -0.88 | 1.59 | 2.14 | -0.90 | -3.86 | -2.38 | 5.81 | -5.70 | -15.95 | -1.33 | 21.04 | 509.49 | -1.96 | 3.38 | 1.58 | -2.23 | -9.26 | 15.36 | -2.37 | -1.60 | -383.86 | -4.20 | -20.58 | 21.33 | -1.27 | -17.95 | -15.24 | -17.09 | |

| Interest Expense | 8.79 | 8.41 | 7.21 | 6.21 | 5.43 | 4.73 | 4.07 | 4.15 | 4.21 | 4.11 | 3.85 | 3.67 | 3.45 | 3.38 | 3.39 | 3.35 | 3.23 | 3.11 | 3.02 | 2.94 | 2.94 | 2.93 | 2.95 | 3.02 | 3.03 | 3.04 | 3.04 | 3.04 | 3.04 | 3.08 | 3.15 | 3.04 | 3.03 | 2.88 | 2.65 | 2.88 | 2.77 | 2.95 | 2.25 | 0.64 | 0.65 | 0.52 | 0.27 | 0.60 | 0.42 | 0.92 | 0.66 | 0.83 | 0.86 | 1.08 | 0.98 | 1.00 | 1.21 | 5.17 | 1.14 | 1.09 | |

| Interest Paid Net | 6.65 | 10.15 | 4.68 | 8.12 | 2.89 | 6.47 | 2.10 | 5.69 | 1.67 | 5.63 | 1.11 | 5.21 | 1.16 | 5.53 | 1.00 | 5.11 | 1.13 | 4.77 | 0.85 | 5.13 | 0.97 | 5.06 | 0.69 | 5.13 | 0.94 | 5.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | 0.00 | -0.13 | 0.00 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 4.30 | 6.76 | 11.50 | 3.44 | 9.75 | 4.16 | 5.95 | 4.54 | 9.80 | 6.43 | 7.70 | 1.05 | 5.82 | 2.44 | 5.91 | -0.49 | 2.35 | 3.00 | 3.43 | 0.66 | -3.55 | -3.48 | 6.55 | -0.25 | -28.71 | 2.64 | 5.91 | 2.28 | 1.98 | 0.95 | 0.98 | 3.24 | -1.23 | 1.24 | 1.86 | -1.07 | 0.30 | -0.39 | 8.69 | 106.91 | -0.57 | 0.16 | 0.00 | 0.00 | -0.59 | 0.36 | -0.02 | 0.65 | -54.79 | -1.47 | -6.95 | 7.55 | -2.55 | -8.57 | -6.14 | -6.59 | |

| Income Taxes Paid Net | 19.82 | 2.50 | NA | NA | 3.70 | 6.75 | NA | NA | 4.50 | 2.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 2.00 | 0.03 | 3.09 | 2.31 | 0.00 | 0.00 | 0.00 | 2.30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 16.71 | 17.80 | 35.51 | 0.47 | -0.04 | 0.02 | 0.03 | -0.02 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 12.03 | 18.70 | 33.84 | 9.48 | 27.62 | 12.06 | 17.09 | 13.45 | 31.99 | 14.78 | 24.02 | 2.96 | 19.81 | 7.78 | 19.22 | -1.33 | 8.63 | 5.83 | 10.23 | 1.98 | -0.43 | 5.34 | 26.07 | 0.62 | 38.29 | 6.14 | 10.61 | 4.19 | 2.63 | 2.70 | 1.58 | 8.55 | -2.74 | 2.76 | -0.27 | -1.72 | -11.16 | -0.16 | 14.61 | 402.99 | 0.56 | 4.19 | 2.70 | -2.48 | -8.64 | 15.33 | 0.17 | -0.88 | -328.62 | -2.44 | -13.34 | 14.09 | -2.72 | -13.13 | -8.63 | -11.42 | |

| Other Comprehensive Income Loss Net Of Tax | -1.09 | 0.15 | 0.58 | -0.63 | 0.41 | 1.39 | 0.40 | 2.00 | 0.49 | 0.34 | -0.01 | 0.26 | 0.04 | 0.02 | -0.64 | -0.56 | 0.15 | -0.42 | -0.00 | 0.61 | -0.37 | 0.31 | 0.22 | 0.63 | -0.27 | -0.25 | -4.16 | 0.71 | 1.21 | 1.98 | 0.06 | -0.05 | -0.82 | -0.51 | 1.20 | 0.77 | 6.51 | -0.72 | 0.66 | -0.26 | -0.14 | -0.44 | 1.62 | 0.10 | 1.09 | -0.08 | -0.22 | 0.44 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 13.19 | 19.41 | 34.73 | 10.39 | 28.13 | 12.35 | 17.04 | 13.41 | 31.94 | 15.20 | 24.22 | 3.20 | 19.79 | 7.75 | 19.20 | -1.53 | 8.69 | 5.72 | 10.37 | 2.00 | -0.07 | 5.48 | 26.20 | 0.76 | 38.50 | 5.94 | 10.76 | 4.37 | 2.71 | 2.71 | 1.81 | 8.66 | -2.54 | 2.77 | -0.22 | -1.74 | -11.10 | -0.05 | 14.61 | 403.00 | 0.56 | 4.20 | 2.70 | -2.47 | -8.63 | 15.34 | 0.18 | -0.87 | -328.61 | -2.43 | -13.34 | 14.10 | -2.71 | -13.12 | -8.62 | -11.41 | |

| Comprehensive Income Net Of Tax | 12.45 | 19.51 | 35.13 | 10.03 | 28.51 | 13.31 | 17.20 | 14.72 | 32.43 | 15.54 | 24.21 | 3.46 | 19.83 | 7.77 | 18.56 | -2.09 | 8.84 | 5.30 | 10.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 13.19 | 19.41 | 34.73 | 10.39 | 28.13 | 12.35 | 17.04 | 13.41 | 31.94 | 15.20 | 24.22 | 3.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 13.19 | 19.41 | 34.73 | 10.39 | 28.13 | 12.35 | 17.04 | 13.41 | 31.94 | 15.20 | 24.22 | 3.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

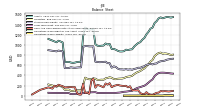

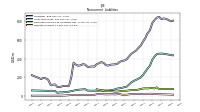

| Assets | 1523.53 | 1542.11 | 1522.10 | 1466.26 | 1430.84 | 1339.54 | 1319.83 | 1256.35 | 1208.15 | 1136.55 | 1102.01 | 1053.39 | 1037.32 | 1003.91 | 966.32 | 913.02 | 909.23 | 898.03 | 906.25 | 875.84 | 870.96 | 870.60 | 883.77 | 905.58 | 920.99 | 919.69 | 1020.35 | 1007.44 | 1027.94 | 986.43 | 984.44 | 978.99 | 984.81 | 1012.46 | 1319.46 | 1305.49 | 1303.13 | 1318.85 | 1340.87 | 1169.08 | 669.47 | 667.07 | 662.52 | 651.32 | 645.52 | 652.72 | 666.38 | 662.87 | 661.29 | 1048.66 | 1066.55 | 1082.25 | 1051.69 | NA | NA | NA | |

| Liabilities | 825.04 | 848.47 | 840.39 | 813.88 | 779.73 | 703.08 | 672.38 | 619.31 | 582.05 | 537.93 | 513.49 | 485.29 | 469.15 | 451.49 | 423.67 | 392.11 | 379.56 | 375.48 | 364.11 | 345.52 | 337.85 | 336.50 | 334.23 | 324.39 | 328.41 | 352.93 | 362.48 | 349.88 | 341.15 | 313.27 | 315.62 | 311.86 | 311.37 | 335.29 | 339.62 | 326.73 | 323.43 | 334.50 | 355.69 | 199.34 | 105.95 | 105.74 | 106.30 | 100.69 | 93.19 | 92.72 | 121.62 | 118.56 | 117.40 | 172.80 | 186.42 | 193.16 | 179.26 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1523.53 | 1542.11 | 1522.10 | 1466.26 | 1430.84 | 1339.54 | 1319.83 | 1256.35 | 1208.15 | 1136.55 | 1102.01 | 1053.39 | 1037.32 | 1003.91 | 966.32 | 913.02 | 909.23 | 898.03 | 906.25 | 875.84 | 870.96 | 870.60 | 883.77 | 905.58 | 920.99 | 919.69 | 1020.35 | 1007.44 | 1027.94 | 986.43 | 984.44 | 978.99 | 984.81 | 1012.46 | 1319.46 | 1305.49 | 1303.13 | 1318.85 | 1340.87 | 1169.08 | 669.47 | 667.07 | 662.52 | 651.32 | 645.52 | 652.72 | 666.38 | 662.87 | 661.29 | 1048.66 | 1066.55 | 1082.25 | 1051.69 | NA | NA | NA | |

| Stockholders Equity | 683.06 | 677.39 | 664.66 | 635.14 | 630.80 | 615.25 | 627.52 | 616.28 | 607.41 | 579.69 | 568.87 | 549.36 | 550.62 | 534.91 | 527.14 | 510.56 | 519.52 | 512.70 | 522.89 | 513.71 | 518.17 | 518.60 | 533.69 | 566.53 | 577.56 | 550.72 | 640.55 | 640.24 | 669.29 | 665.33 | 660.97 | 659.05 | 665.26 | 668.71 | 971.37 | 970.24 | 971.21 | 975.80 | 976.52 | 961.09 | 558.35 | 557.94 | 554.19 | 549.62 | 552.02 | 559.68 | 544.43 | 543.99 | 543.56 | 875.58 | 879.84 | 888.78 | 872.12 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 86.07 | 92.00 | 60.63 | 57.15 | 37.75 | 18.85 | 21.85 | 33.12 | 70.16 | 27.26 | 33.34 | 52.31 | 106.79 | 102.35 | 106.04 | 106.43 | 185.72 | 165.31 | 195.59 | 190.82 | 195.16 | 200.88 | 215.09 | 202.59 | 192.08 | 166.77 | 247.18 | 216.98 | 241.11 | 165.29 | 183.48 | 201.32 | 212.77 | 157.89 | 337.97 | 289.71 | 34.52 | 61.58 | 50.88 | 237.42 | 21.89 | 22.83 | 54.18 | 168.65 | 165.98 | 172.40 | 169.90 | 165.69 | 162.39 | 188.24 | 199.83 | 216.23 | 183.83 | 196.40 | 138.86 | 152.64 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 90.77 | 103.03 | 75.48 | 64.18 | 45.30 | 26.80 | 29.65 | 41.80 | 74.40 | 29.73 | 36.77 | 55.90 | 110.12 | 107.49 | 109.92 | 110.19 | 188.68 | 168.56 | 198.72 | 193.84 | 198.07 | 203.75 | 217.99 | 202.87 | 192.37 | 168.38 | 248.81 | 218.96 | 243.09 | NA | NA | NA | 217.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Inventory Net | 4.25 | 4.52 | 4.54 | 4.13 | 3.98 | 3.69 | 3.50 | 3.33 | 2.80 | 2.64 | 2.52 | 2.33 | 2.03 | NA | NA | NA | 1.38 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 145.52 | NA | NA | NA | 106.00 | NA | NA | NA | 93.88 | NA | NA | NA | 80.58 | NA | NA | NA | 80.98 | NA | NA | NA | 71.25 | NA | NA | NA | 71.98 | NA | NA | NA | 68.04 | NA | NA | NA | 66.92 | NA | NA | NA | 69.83 | NA | NA | NA | 73.09 | NA | NA | NA | 49.39 | 49.85 | 49.88 | 50.60 | 50.91 | NA | NA | NA | 48.97 | NA | NA | NA | |

| Construction In Progress Gross | 0.95 | NA | NA | NA | 0.78 | NA | NA | NA | 1.52 | NA | NA | NA | 0.70 | NA | NA | NA | 1.26 | NA | NA | NA | 1.05 | NA | NA | NA | 0.49 | NA | NA | NA | 0.35 | NA | NA | NA | 0.33 | NA | NA | NA | 0.65 | NA | NA | NA | 0.52 | NA | NA | NA | 0.37 | 0.40 | 0.39 | 0.43 | 0.55 | NA | NA | NA | 0.89 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 80.42 | 75.88 | 71.49 | 67.67 | 67.13 | 64.67 | 64.24 | 66.01 | 64.25 | 62.55 | 61.85 | 61.82 | 60.43 | 65.56 | 64.52 | 63.65 | 63.22 | 62.46 | 61.69 | 60.87 | 60.27 | 60.40 | 61.63 | 61.13 | 60.70 | 60.37 | 59.89 | 59.80 | 59.40 | 57.20 | 57.80 | 57.70 | 57.10 | 61.30 | 61.30 | 61.40 | 60.28 | 61.10 | 60.70 | 60.50 | 62.21 | 38.20 | 37.60 | NA | 37.61 | 37.17 | 36.69 | 36.53 | 36.51 | NA | NA | NA | 36.85 | NA | NA | NA | |

| Property Plant And Equipment Net | 66.05 | 69.13 | 68.95 | 42.41 | 39.64 | 36.98 | 35.45 | 35.97 | 31.14 | 32.29 | 27.12 | 27.46 | 20.85 | 18.75 | 19.50 | 19.40 | 19.02 | 18.75 | 18.95 | 12.75 | 12.03 | 12.34 | 11.67 | 11.70 | 11.78 | 9.28 | 9.54 | 9.07 | 8.99 | 9.17 | 9.41 | 9.73 | 10.14 | 10.27 | 10.09 | 10.51 | 10.20 | 10.48 | 10.95 | 10.91 | 11.41 | 11.65 | 11.88 | 12.12 | 12.15 | 13.08 | 13.58 | 14.51 | 14.95 | 15.29 | 16.10 | 17.15 | 13.01 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 453.64 | 453.12 | 446.64 | 420.69 | 385.86 | 321.08 | 291.47 | 256.76 | 223.03 | 196.10 | 183.09 | 169.73 | 158.91 | 143.38 | 120.52 | 98.34 | 92.53 | 85.58 | 80.24 | 77.79 | 69.37 | 62.33 | 59.17 | 55.45 | 55.63 | 55.74 | 55.50 | 55.52 | 55.04 | 54.23 | 54.21 | 54.65 | 55.19 | 69.73 | 68.28 | 66.49 | 63.80 | 60.68 | 54.25 | 49.41 | 44.22 | 37.83 | 38.21 | 35.75 | 36.06 | 30.38 | 51.70 | 52.78 | 53.46 | 52.43 | 53.15 | 53.94 | 54.65 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 71.83 | 70.58 | 90.12 | 78.26 | 82.71 | 81.56 | 77.88 | 79.75 | 77.26 | 72.58 | 65.46 | 61.27 | 60.91 | 60.12 | 57.86 | 53.52 | 52.81 | 52.08 | 48.21 | 44.52 | 44.31 | 47.45 | 49.09 | 48.52 | 48.98 | NA | NA | NA | 68.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 15.43 | 16.25 | 17.05 | 17.24 | 20.31 | 21.21 | 19.92 | 20.75 | 18.69 | 18.93 | 19.65 | 18.74 | 17.55 | 17.51 | 15.51 | 10.35 | 10.15 | 9.85 | 19.25 | 16.61 | 14.94 | 15.51 | 15.85 | 14.66 | 15.03 | 16.03 | 17.32 | 17.33 | 17.51 | 7.83 | 7.84 | 8.07 | 8.18 | 8.45 | 8.47 | 8.51 | 8.49 | 8.55 | 8.66 | 8.66 | 5.17 | 3.39 | 2.04 | 1.02 | 0.31 | 0.32 | 0.32 | 0.33 | 0.33 | 0.28 | 0.29 | 0.30 | 0.31 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

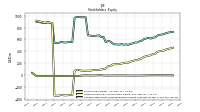

| Stockholders Equity | 683.06 | 677.39 | 664.66 | 635.14 | 630.80 | 615.25 | 627.52 | 616.28 | 607.41 | 579.69 | 568.87 | 549.36 | 550.62 | 534.91 | 527.14 | 510.56 | 519.52 | 512.70 | 522.89 | 513.71 | 518.17 | 518.60 | 533.69 | 566.53 | 577.56 | 550.72 | 640.55 | 640.24 | 669.29 | 665.33 | 660.97 | 659.05 | 665.26 | 668.71 | 971.37 | 970.24 | 971.21 | 975.80 | 976.52 | 961.09 | 558.35 | 557.94 | 554.19 | 549.62 | 552.02 | 559.68 | 544.43 | 543.99 | 543.56 | 875.58 | 879.84 | 888.78 | 872.12 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 698.49 | 693.64 | 681.71 | 652.38 | 651.11 | 636.47 | 647.44 | 637.03 | 626.10 | 598.62 | 588.51 | 568.10 | 568.17 | 552.42 | 542.65 | 520.91 | 529.67 | 522.55 | 542.14 | 530.32 | 533.11 | 534.10 | 549.54 | 581.20 | 592.58 | 566.75 | 657.87 | 657.56 | 686.80 | 673.16 | 668.82 | 667.13 | 673.45 | 677.16 | 979.84 | 978.76 | 979.70 | 984.35 | 985.18 | 969.75 | 563.52 | 561.33 | 556.23 | 550.63 | 552.33 | 560.00 | 544.76 | 544.31 | 543.89 | 875.86 | 880.12 | 889.09 | 872.44 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 410.37 | 404.19 | 391.79 | 362.90 | 358.34 | 336.05 | 329.59 | 318.45 | 310.93 | 283.70 | 273.21 | 253.70 | 255.22 | 239.55 | 231.80 | 212.60 | 214.22 | 205.54 | 199.82 | 189.45 | 187.45 | 187.52 | 182.03 | 155.84 | 154.32 | 115.82 | 109.88 | 99.11 | 94.75 | 92.04 | 89.33 | 87.52 | 78.85 | 81.39 | 78.62 | 78.84 | 80.58 | 91.68 | 91.73 | 77.12 | -325.87 | -326.43 | -330.63 | -333.33 | -330.86 | -322.23 | -337.57 | -337.75 | -336.87 | 876.83 | 879.26 | 892.60 | 878.50 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 1.84 | 2.58 | 2.48 | 2.07 | 2.43 | 2.05 | 1.08 | 0.92 | -0.39 | -0.88 | -1.22 | -1.21 | -1.47 | -1.51 | -1.53 | -0.89 | -0.34 | -0.49 | -0.07 | -0.07 | -0.67 | -0.30 | -0.61 | -0.83 | -1.46 | -1.19 | -0.94 | 3.22 | 2.51 | 1.29 | -0.69 | -0.74 | -0.69 | 0.14 | 0.65 | -0.55 | -1.32 | -7.83 | -7.12 | -7.78 | -7.52 | -7.38 | -6.94 | -8.55 | -8.65 | -9.74 | -9.66 | -9.44 | -9.88 | -7.79 | -5.85 | -10.38 | -10.55 | NA | NA | NA | |

| Minority Interest | 15.43 | 16.25 | 17.05 | 17.24 | 20.31 | 21.21 | 19.92 | 20.75 | 18.69 | 18.93 | 19.65 | 18.74 | 17.55 | 17.51 | 15.51 | 10.35 | 10.15 | 9.85 | 19.25 | 16.61 | 14.94 | 15.51 | 15.85 | 14.66 | 15.03 | 16.03 | 17.32 | 17.33 | 17.51 | 7.83 | 7.84 | 8.07 | 8.18 | 8.45 | 8.47 | 8.51 | 8.49 | 8.55 | 8.66 | 8.66 | 5.17 | 3.39 | 2.04 | 1.02 | 0.31 | 0.32 | 0.32 | 0.33 | 0.33 | 0.28 | 0.29 | 0.30 | 0.31 | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.00 | 0.15 | 0.00 | 2.09 | 0.18 | 0.43 | 1.11 | 0.71 | 0.29 | 0.30 | 0.33 | 0.32 | 0.23 | 0.39 | NA | NA | 0.40 | 0.00 | 0.20 | NA | 0.20 | 0.20 | NA | NA | 0.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -0.04 | -0.00 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

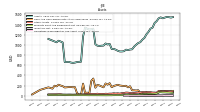

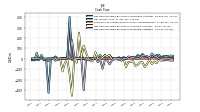

| Net Cash Provided By Used In Operating Activities | 11.56 | 39.36 | 33.76 | 19.17 | 17.96 | 1.25 | 9.19 | 19.81 | 46.66 | 17.94 | 37.37 | 9.83 | 14.78 | 10.04 | 9.39 | 3.12 | 15.66 | 2.43 | 13.52 | -1.23 | -4.54 | 8.45 | 35.58 | 1.94 | 5.96 | 3.83 | 38.83 | 7.14 | 2.30 | -1.28 | 7.42 | 4.43 | -13.17 | -2.45 | 36.97 | 1.07 | 8.14 | -17.71 | -11.53 | 352.14 | 2.63 | 4.70 | 6.69 | 2.32 | -6.68 | 21.94 | 4.15 | 3.63 | -24.96 | -11.60 | -10.72 | 37.45 | -13.14 | 58.90 | -14.94 | -14.50 | |

| Net Cash Provided By Used In Investing Activities | -17.68 | -11.32 | -42.95 | -27.19 | -50.65 | -8.97 | -48.81 | -81.34 | -35.06 | -32.99 | -59.45 | -68.59 | -23.67 | -29.21 | -31.35 | -80.26 | -0.18 | -14.43 | -11.99 | -2.69 | -7.16 | -4.75 | 33.57 | 22.41 | 31.81 | 12.58 | -2.56 | 2.62 | 63.88 | -16.92 | -24.91 | -1.02 | 58.38 | 125.87 | 9.21 | 251.95 | -37.83 | 21.99 | -355.96 | -146.88 | -11.76 | -37.40 | -121.90 | -0.33 | 0.45 | -0.07 | -0.01 | -0.18 | 3.78 | 0.07 | -5.70 | -0.29 | 0.15 | -0.81 | -0.15 | 0.30 | |

| Net Cash Provided By Used In Financing Activities | -6.15 | -0.48 | 20.49 | 26.90 | 51.19 | 4.88 | 27.46 | 28.93 | 33.07 | 8.01 | 2.95 | 4.55 | 11.52 | 16.73 | 21.69 | -1.34 | 4.64 | -18.17 | 3.35 | -0.31 | 5.94 | -17.93 | -54.03 | -13.84 | -12.46 | -96.81 | -6.08 | -33.89 | 9.64 | 0.00 | -0.35 | -14.86 | 9.68 | -303.50 | 2.08 | 2.17 | 2.62 | 6.41 | 180.96 | 10.27 | 8.19 | 1.35 | 0.74 | 0.68 | -0.19 | -19.36 | 0.07 | -0.15 | -4.67 | -0.06 | 0.03 | -4.76 | 0.42 | -0.54 | 1.32 | 3.03 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 11.56 | 39.36 | 33.76 | 19.17 | 17.96 | 1.25 | 9.19 | 19.81 | 46.66 | 17.94 | 37.37 | 9.83 | 14.78 | 10.04 | 9.39 | 3.12 | 15.66 | 2.43 | 13.52 | -1.23 | -4.54 | 8.45 | 35.58 | 1.94 | 5.96 | 3.83 | 38.83 | 7.14 | 2.30 | -1.28 | 7.42 | 4.43 | -13.17 | -2.45 | 36.97 | 1.07 | 8.14 | -17.71 | -11.53 | 352.14 | 2.63 | 4.70 | 6.69 | 2.32 | -6.68 | 21.94 | 4.15 | 3.63 | -24.96 | -11.60 | -10.72 | 37.45 | -13.14 | 58.90 | -14.94 | -14.50 | |

| Net Income Loss | 13.19 | 19.41 | 34.73 | 10.39 | 28.13 | 12.35 | 17.04 | 13.41 | 31.94 | 15.20 | 24.22 | 3.20 | 19.79 | 7.75 | 19.20 | -1.53 | 8.69 | 5.72 | 10.37 | 2.00 | -0.07 | 5.48 | 26.20 | 0.76 | 38.50 | 5.94 | 10.76 | 4.37 | 2.71 | 2.71 | 1.81 | 8.66 | -2.54 | 2.77 | -0.22 | -1.74 | -11.10 | -0.05 | 14.61 | 403.00 | 0.56 | 4.20 | 2.70 | -2.47 | -8.63 | 15.34 | 0.18 | -0.87 | -328.61 | -2.43 | -13.34 | 14.10 | -2.71 | -13.12 | -8.62 | -11.41 | |

| Profit Loss | 12.03 | 18.70 | 33.84 | 9.48 | 27.62 | 12.06 | 17.09 | 13.45 | 31.99 | 14.78 | 24.02 | 2.96 | 19.81 | 7.78 | 19.22 | -1.33 | 8.63 | 5.83 | 10.23 | 1.98 | -0.43 | 5.34 | 26.07 | 0.62 | 38.29 | 6.14 | 10.61 | 4.19 | 2.63 | 2.70 | 1.58 | 8.55 | -2.74 | 2.76 | -0.27 | -1.72 | -11.16 | -0.16 | 14.61 | 402.99 | 0.56 | 4.19 | 2.70 | -2.48 | -8.64 | 15.33 | 0.17 | -0.88 | -328.62 | -2.44 | -13.34 | 14.09 | -2.72 | -13.13 | -8.63 | -11.42 | |

| Depreciation Depletion And Amortization | 11.27 | 10.71 | 9.47 | 7.32 | 6.62 | 5.77 | 5.47 | 5.03 | 5.61 | 4.62 | 4.12 | 3.85 | 3.39 | 3.30 | 3.02 | 3.07 | 3.12 | 2.63 | 2.42 | 2.11 | 2.16 | 2.31 | 2.27 | 2.25 | 2.59 | 2.31 | 2.03 | 1.95 | 2.09 | 2.09 | 2.10 | 2.29 | 2.21 | 2.23 | 2.13 | 2.92 | 2.21 | 2.17 | 1.94 | 2.10 | 2.16 | 2.31 | 2.33 | 2.33 | 2.92 | 2.40 | 2.46 | 2.33 | 2.87 | 3.02 | 3.45 | 6.50 | 3.36 | 3.36 | 3.46 | 3.48 | |

| Share Based Compensation | 0.23 | 0.23 | 0.23 | 0.14 | 0.11 | 0.11 | 0.11 | 0.04 | NA | NA | NA | NA | 0.00 | 0.00 | 0.02 | 0.03 | 0.03 | 0.03 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.23 | 0.03 | 0.03 | 0.00 | 0.02 | 0.04 | 0.04 | 0.06 | 0.00 | 0.00 | 0.00 | NA | NA | 0.00 | 0.05 | NA | NA | 0.00 | 0.00 | 0.24 | 0.00 | -0.10 | -0.01 | 0.51 | 0.49 | -0.16 | 0.23 | -0.09 | 8.47 | 0.43 | 0.89 | 2.31 | 1.53 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

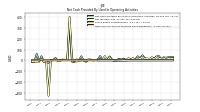

| Net Cash Provided By Used In Investing Activities | -17.68 | -11.32 | -42.95 | -27.19 | -50.65 | -8.97 | -48.81 | -81.34 | -35.06 | -32.99 | -59.45 | -68.59 | -23.67 | -29.21 | -31.35 | -80.26 | -0.18 | -14.43 | -11.99 | -2.69 | -7.16 | -4.75 | 33.57 | 22.41 | 31.81 | 12.58 | -2.56 | 2.62 | 63.88 | -16.92 | -24.91 | -1.02 | 58.38 | 125.87 | 9.21 | 251.95 | -37.83 | 21.99 | -355.96 | -146.88 | -11.76 | -37.40 | -121.90 | -0.33 | 0.45 | -0.07 | -0.01 | -0.18 | 3.78 | 0.07 | -5.70 | -0.29 | 0.15 | -0.81 | -0.15 | 0.30 | |

| Payments To Acquire Property Plant And Equipment | 1.73 | 1.86 | 0.93 | 1.66 | 3.96 | 0.60 | 1.35 | 1.44 | 1.17 | 1.47 | 0.86 | 0.80 | 1.46 | 0.99 | 1.77 | 1.48 | 1.15 | 0.80 | 6.23 | 1.18 | 0.92 | 0.44 | 0.66 | 0.59 | 0.48 | 1.25 | -3.58 | 4.85 | 0.49 | 0.43 | 1.64 | 0.35 | 1.02 | 0.74 | 0.65 | 0.90 | 0.61 | 0.36 | 0.41 | 1.10 | 0.45 | 1.26 | 1.36 | 0.53 | 0.21 | 0.07 | 0.01 | 0.19 | 0.84 | 0.03 | 1.27 | 0.29 | 0.17 | 0.83 | 0.17 | 0.12 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -6.15 | -0.48 | 20.49 | 26.90 | 51.19 | 4.88 | 27.46 | 28.93 | 33.07 | 8.01 | 2.95 | 4.55 | 11.52 | 16.73 | 21.69 | -1.34 | 4.64 | -18.17 | 3.35 | -0.31 | 5.94 | -17.93 | -54.03 | -13.84 | -12.46 | -96.81 | -6.08 | -33.89 | 9.64 | 0.00 | -0.35 | -14.86 | 9.68 | -303.50 | 2.08 | 2.17 | 2.62 | 6.41 | 180.96 | 10.27 | 8.19 | 1.35 | 0.74 | 0.68 | -0.19 | -19.36 | 0.07 | -0.15 | -4.67 | -0.06 | 0.03 | -4.76 | 0.42 | -0.54 | 1.32 | 3.03 | |

| Payments Of Dividends Common Stock | 7.00 | 7.00 | 5.80 | 5.83 | 5.83 | 5.90 | 5.90 | 5.89 | 4.71 | 4.70 | 4.70 | 4.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 86.74 | 101.39 | 128.17 | 72.99 | 61.62 | 57.58 | 68.25 | 64.87 | 99.46 | 54.00 | 72.24 | 41.30 | 63.86 | 42.04 | 36.08 | 18.57 | 42.66 | 32.86 | 35.55 | 16.02 | 16.30 | 23.68 | 50.43 | 19.86 | 21.56 | 33.65 | 30.38 | 13.20 | 18.75 | 27.19 | 29.55 | 20.25 | 21.10 | 27.83 | 37.85 | 17.09 | 15.68 | 23.95 | 68.16 | 594.09 | 33.87 | 36.83 | 33.79 | 26.77 | 22.61 | 55.91 | 30.36 | 30.52 | 19.82 | 26.75 | 25.28 | 73.44 | 37.10 | 27.11 | 22.04 | 13.30 | |

| Corporate And Reconciling Items | 1.00 | 1.50 | 0.85 | 1.10 | 0.89 | 0.86 | 0.55 | 0.52 | 0.80 | 0.34 | 0.38 | 0.48 | 0.27 | 0.21 | 1.23 | 0.09 | 0.06 | 0.34 | 0.44 | 0.12 | 0.01 | 0.30 | 2.25 | 0.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Commercial | 20.75 | 16.38 | 18.30 | 19.01 | 16.04 | 12.62 | 15.32 | 15.21 | 11.23 | 9.58 | 16.64 | 7.17 | 9.85 | 8.70 | 9.23 | 8.90 | 20.55 | 7.52 | 5.68 | 5.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Hospitality | 36.11 | 48.00 | 45.61 | 24.86 | 22.58 | 29.05 | 29.37 | 16.24 | 17.18 | 21.96 | 22.46 | 12.99 | 12.55 | 16.78 | 11.50 | 6.55 | 8.61 | 14.04 | 15.60 | 7.47 | 6.69 | 12.56 | 13.27 | 7.45 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Residential Real Estate | 28.87 | 35.51 | 63.41 | 28.03 | 22.11 | 15.05 | 23.01 | 32.90 | 70.25 | 22.11 | 32.76 | 20.66 | 41.20 | 16.35 | 14.13 | 3.04 | 13.44 | 10.96 | 13.82 | 3.36 | 5.12 | 1.96 | 28.75 | 7.03 | 6.36 | 9.41 | 4.71 | 1.27 | 3.58 | 3.12 | 5.80 | 6.99 | NA | 4.88 | 4.02 | 5.41 | NA | 3.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Latitude Margaritaville Watersound Jv | 74.48 | 92.13 | 80.84 | 76.43 | 56.80 | 50.78 | 24.61 | 7.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Pier Park Tps Llc | 0.71 | 1.37 | 1.74 | 0.90 | 0.88 | 1.66 | 1.79 | 1.12 | 1.00 | 2.25 | 2.28 | 0.94 | 0.80 | 1.00 | 0.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Sjbb Llc | 3.35 | 5.33 | 4.97 | 3.52 | 3.35 | 5.09 | 5.68 | 3.70 | 3.67 | 4.96 | 4.81 | 2.79 | 2.49 | 3.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Sjecc Llc Jv | 0.84 | 0.92 | 0.92 | 0.56 | 0.35 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Watersound Management Jv | 0.57 | 0.51 | 0.44 | 0.43 | 0.33 | 0.32 | 0.29 | 0.25 | 0.25 | 0.20 | 0.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Equity Method Investment Nonconsolidated Investee Or Group Of Investees | 79.95 | 100.27 | 88.91 | 81.83 | 62.58 | 59.70 | 33.91 | 13.37 | 24.53 | 7.51 | 7.17 | 3.73 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate And Reconciling Items, Real Estate | 0.94 | 1.35 | 0.78 | 1.06 | 0.85 | 0.82 | 0.52 | 0.48 | 0.79 | 0.34 | 0.36 | 0.48 | 0.27 | 0.21 | 1.23 | 0.09 | 0.06 | 0.34 | 0.44 | 0.12 | 0.01 | 0.30 | 2.25 | 0.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Hospitality, Commercial | 0.00 | -0.00 | 0.00 | NA | 0.01 | 0.19 | 0.23 | 0.09 | 0.12 | 0.35 | 0.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Hospitality, Hospitality | 35.47 | 47.37 | 45.09 | 24.50 | 22.34 | 28.84 | 29.32 | 16.23 | 17.16 | 21.94 | 22.45 | 12.99 | 12.55 | 16.77 | 11.49 | 6.55 | 8.62 | 14.00 | 15.56 | 7.43 | 6.68 | 12.13 | 12.85 | 7.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Real Estate, Commercial | 11.97 | 3.13 | 5.17 | 5.91 | 4.10 | 1.46 | 4.50 | 3.62 | 2.23 | 1.56 | 8.18 | 0.04 | 4.45 | 2.16 | 2.32 | 2.77 | 14.89 | 2.19 | 1.29 | 1.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Real Estate, Residential Real Estate | 28.81 | 35.47 | 63.40 | 28.02 | 22.08 | 15.04 | 23.00 | 32.67 | 69.99 | 21.60 | 32.53 | 20.54 | 41.08 | 16.10 | 14.00 | 2.95 | 12.90 | 10.96 | 13.82 | 3.36 | 5.12 | 1.96 | 28.72 | 6.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Commercial, Transferred At Point In Time | 7.93 | 4.12 | 6.52 | 7.61 | 5.37 | 2.82 | 6.05 | 6.57 | 3.42 | 2.62 | 10.35 | 1.63 | 5.27 | 3.75 | 4.38 | 4.62 | 16.21 | 3.52 | 2.05 | 1.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Hospitality, Transferred At Point In Time | 25.00 | 38.50 | 37.08 | 17.40 | 15.09 | 21.57 | 22.08 | 9.92 | 11.57 | 16.73 | 17.74 | 9.14 | 3.78 | 15.81 | 10.74 | 5.91 | 7.94 | 13.22 | 14.78 | 6.92 | 6.18 | 11.42 | 12.35 | 6.75 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Hospitality, Transferred Over Time | 10.47 | 8.87 | 8.02 | 7.10 | 7.25 | 7.27 | 7.25 | 6.31 | 5.59 | 5.21 | 4.71 | 3.85 | 8.77 | 0.97 | 0.75 | 0.64 | 0.68 | 0.78 | 0.78 | 0.51 | 0.50 | 0.71 | 0.50 | 0.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Residential Real Estate, Transferred At Point In Time | 28.81 | 35.47 | 63.40 | 28.02 | 22.08 | 15.04 | 23.00 | 32.77 | 70.11 | 21.96 | 32.70 | 20.62 | 41.12 | 16.34 | 14.07 | 3.02 | 13.40 | 10.96 | 13.82 | 3.36 | 5.12 | 1.96 | 28.75 | 7.03 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate And Reconciling Items, Transferred At Point In Time | 0.94 | 1.35 | 0.78 | 1.06 | 0.85 | 0.82 | 0.52 | 0.48 | 0.79 | 0.34 | 0.36 | 0.48 | 0.27 | 0.21 | 1.23 | 0.09 | 0.06 | 0.34 | 0.44 | 0.12 | 0.01 | 0.30 | 2.25 | 0.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Hospitality | 35.47 | 47.37 | 45.10 | 24.50 | 22.35 | 29.04 | 29.56 | 16.32 | 17.28 | 22.29 | 22.63 | 13.07 | 12.60 | 17.00 | 11.56 | 6.61 | 9.12 | 14.00 | 15.56 | 7.43 | 6.68 | 12.13 | 12.85 | 7.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Real Estate | 41.71 | 39.95 | 69.34 | 35.00 | 27.03 | 17.33 | 28.03 | 36.77 | 73.01 | 23.50 | 41.06 | 21.05 | 45.79 | 18.48 | 17.55 | 5.81 | 27.85 | 13.49 | 15.55 | 4.59 | 6.12 | 6.20 | 32.16 | 7.70 | 8.33 | 10.71 | 7.15 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred At Point In Time | 62.68 | 79.44 | 107.77 | 54.10 | 43.39 | 40.26 | 51.66 | 49.74 | 85.89 | 41.64 | 61.16 | 31.87 | 50.44 | 36.11 | 30.42 | 13.63 | 37.62 | 28.04 | 31.09 | 12.01 | 12.58 | 19.39 | 46.42 | 16.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Transferred Over Time | 10.47 | 8.87 | 8.02 | 7.10 | 7.25 | 7.27 | 7.25 | 6.31 | 5.59 | 5.21 | 4.71 | 3.85 | 8.77 | 0.97 | 0.75 | 0.64 | 0.68 | 0.78 | 0.78 | 0.51 | 0.50 | 0.71 | 0.50 | 0.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |