| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

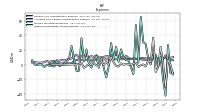

| Earnings Per Share Basic | -1.79 | -0.66 | 0.28 | -0.30 | 0.16 | 0.12 | -0.07 | 0.25 | 0.28 | 0.48 | 1.55 | -0.04 | 1.23 | -0.18 | -0.30 | -0.07 | 1.13 | 0.15 | 0.36 | -0.04 | 0.21 | 0.09 | 0.77 | -0.02 | 0.69 | -0.08 | 0.08 | 0.00 | |

| Earnings Per Share Diluted | -1.79 | -0.66 | 0.28 | -0.30 | 0.16 | 0.12 | -0.07 | 0.24 | 0.28 | 0.47 | 1.53 | -0.04 | 1.21 | -0.18 | -0.30 | -0.07 | 1.12 | 0.15 | 0.36 | -0.04 | 0.21 | 0.09 | 0.77 | -0.02 | 0.69 | -0.08 | 0.08 | 0.00 |

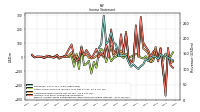

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

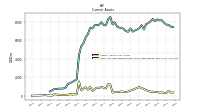

| Revenue From Contract With Customer Excluding Assessed Tax | 142.60 | 141.30 | 146.50 | 132.20 | 139.60 | 139.60 | 136.10 | 124.70 | 131.40 | 114.40 | 108.40 | 99.40 | 106.50 | 114.20 | 106.90 | 123.30 | 142.30 | 143.00 | 143.70 | 140.70 | 178.70 | 185.80 | 218.30 | 190.70 | 181.30 | 272.50 | 180.40 | 167.60 | |

| Revenues | 142.60 | 141.30 | 146.50 | 132.20 | 139.60 | 139.60 | 136.10 | 124.70 | 131.40 | 114.40 | 108.40 | 99.40 | 106.50 | 114.20 | 106.90 | 123.30 | 142.30 | 143.00 | 143.70 | 140.70 | 178.70 | 185.80 | 218.30 | 190.70 | 181.30 | 272.50 | 180.40 | 167.60 | |

| Costs And Expenses | 130.20 | 120.50 | 133.10 | 124.50 | 129.50 | 129.70 | 128.50 | 139.10 | 169.80 | 124.50 | 134.50 | 120.80 | 149.00 | 116.30 | 115.80 | 129.80 | 155.00 | 147.90 | 143.80 | 153.10 | 187.80 | 177.20 | 212.50 | 188.90 | 206.00 | 231.20 | 178.30 | 155.50 | |

| General And Administrative Expense | 10.20 | 8.40 | 8.70 | 8.40 | 10.70 | 9.20 | 9.40 | 7.90 | 8.60 | 8.90 | 9.00 | 6.80 | 8.50 | 8.60 | 8.00 | 9.50 | 12.20 | 8.40 | 10.90 | 10.90 | 14.20 | 11.70 | 13.50 | 11.40 | 11.50 | 10.80 | 10.00 | 10.00 | |

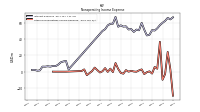

| Interest Expense | 66.70 | 64.20 | 66.00 | 62.30 | 60.00 | 57.10 | 53.20 | 50.50 | 51.00 | 45.30 | 44.50 | 51.60 | 59.90 | 50.80 | 51.70 | 48.80 | 52.30 | 51.80 | 55.70 | 55.30 | 56.90 | 55.20 | 67.20 | 58.90 | 58.80 | 56.80 | 52.10 | 50.00 | |

| Interest Paid Net | 74.70 | 65.30 | 33.70 | 78.30 | 49.90 | 68.10 | 27.80 | 68.60 | 42.70 | 53.40 | 51.40 | 36.20 | 83.20 | 23.20 | 80.40 | 22.90 | 102.70 | -0.70 | 82.90 | 26.20 | 85.70 | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | -1.70 | 0.10 | 29.90 | -1.30 | -1.10 | NA | -7.10 | 0.00 | -23.80 | -14.80 | -8.00 | 0.00 | -1.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 12.80 | 7.30 | 7.30 | 7.10 | 7.30 | 7.30 | 7.30 | 7.10 | 6.80 | 6.90 | 7.30 | 7.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -42.00 | -19.70 | 10.30 | -3.90 | 13.70 | 13.90 | 0.40 | 8.20 | 28.00 | 30.60 | 64.90 | 2.70 | 53.90 | -12.80 | -3.20 | 5.70 | 6.30 | 10.20 | 20.90 | 4.00 | 24.30 | 6.90 | 29.40 | -2.60 | -17.20 | -3.70 | 8.80 | -4.10 | |

| Income Taxes Paid | 5.10 | 5.30 | NA | NA | 4.70 | 7.80 | NA | NA | 1.30 | 10.90 | NA | NA | 2.10 | 8.40 | 0.10 | 2.00 | 7.80 | 8.90 | 0.50 | 3.40 | -0.40 | 4.00 | -0.90 | 3.90 | 0.50 | 6.60 | 0.50 | 8.50 | |

| Profit Loss | -235.90 | -64.10 | 47.30 | -28.70 | 39.20 | 23.60 | -0.90 | 40.00 | 44.30 | 72.50 | 221.20 | -1.60 | 172.50 | -19.70 | -39.10 | -5.90 | 158.90 | 19.40 | 141.20 | 1.60 | 32.90 | 12.90 | 167.30 | -1.00 | 105.40 | 9.80 | 21.80 | 0.90 | |

| Other Comprehensive Income Loss Net Of Tax | 23.10 | -27.50 | 18.10 | 12.90 | 41.80 | -31.00 | -37.60 | -16.80 | 4.50 | -11.50 | -5.90 | 16.30 | 21.30 | 10.60 | 1.40 | -9.20 | 21.20 | -8.30 | 7.70 | 14.60 | 0.10 | -7.60 | -31.50 | 27.90 | -38.10 | 39.20 | 58.20 | 29.90 | |

| Comprehensive Income Net Of Tax | -214.00 | -108.70 | 65.40 | -20.80 | 71.30 | -5.10 | -37.10 | 24.00 | 46.00 | 59.50 | 213.90 | 15.20 | 194.40 | -11.00 | -36.50 | -13.30 | 180.10 | 13.40 | 46.20 | 11.60 | 32.60 | 5.40 | 77.10 | 20.40 | 81.90 | -3.90 | 19.00 | 5.90 | |

| Preferred Stock Dividends Income Statement Impact | 10.90 | 10.80 | 8.40 | 7.90 | 7.90 | 7.90 | 7.80 | 5.30 | 4.30 | 4.30 | 4.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | -247.80 | -92.20 | 39.00 | -40.80 | 22.60 | 16.40 | -9.00 | 34.80 | 37.50 | 65.90 | 215.40 | -5.60 | 170.00 | -25.10 | -42.10 | -9.90 | 157.90 | 20.70 | 50.80 | -5.30 | 30.70 | 12.10 | 109.60 | -2.40 | 99.20 | -8.90 | 9.40 | 0.80 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

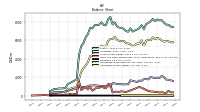

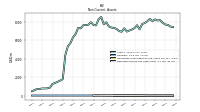

| Assets | 7712.10 | 7910.30 | 8193.90 | 8150.00 | 8271.80 | 8084.50 | 8320.10 | 8067.80 | 7876.50 | 7774.60 | 7187.90 | 7648.50 | 7329.00 | 7176.60 | 7069.50 | 6948.00 | 7304.50 | 6935.80 | 6996.20 | 7239.60 | 7357.10 | 7381.40 | 7505.40 | 7962.80 | 7724.80 | 8536.60 | 8284.30 | 7626.00 | |

| Liabilities | 5913.70 | 5858.00 | 5993.30 | 6178.60 | 6261.40 | 6141.30 | 6329.70 | 6004.60 | 6072.60 | 5941.70 | 5360.10 | 6002.20 | 5656.30 | 5660.00 | 5480.40 | 5293.00 | 5585.30 | 5660.10 | 5705.90 | 5937.40 | 5925.90 | 5939.60 | 6055.70 | 6396.10 | 6147.30 | 6142.30 | 5932.60 | 5288.80 | |

| Liabilities And Stockholders Equity | 7712.10 | 7910.30 | 8193.90 | 8150.00 | 8271.80 | 8084.50 | 8320.10 | 8067.80 | 7876.50 | 7774.60 | 7187.90 | 7648.50 | 7329.00 | 7176.60 | 7069.50 | 6948.00 | 7304.50 | 6935.80 | 6996.20 | 7239.60 | 7357.10 | 7381.40 | 7505.40 | 7962.80 | 7724.80 | 8536.60 | 8284.30 | 7626.00 | |

| Stockholders Equity | 1755.10 | 2008.60 | 2154.40 | 1924.90 | 1964.00 | 1926.40 | 1966.20 | 2037.50 | 1777.60 | 1799.80 | 1797.20 | 1617.80 | 1644.50 | 1488.90 | 1547.80 | 1612.50 | 1678.70 | 1235.10 | 1246.20 | 1230.50 | 1246.70 | 1253.00 | 1270.30 | 1345.40 | 1365.60 | 1013.40 | 1027.50 | 1025.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 313.70 | 330.90 | 387.00 | 349.30 | 439.30 | 420.30 | 460.60 | 462.10 | 524.80 | NA | NA | NA | 965.10 | NA | NA | 665.60 | 573.90 | NA | 404.00 | 442.90 | 488.00 | 419.40 | 447.10 | 433.00 | 351.30 | 1232.70 | 1264.80 | 808.30 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 313.70 | 330.90 | 387.00 | 349.30 | 439.30 | 420.30 | 460.60 | 462.10 | 524.80 | 840.80 | 686.50 | 1438.60 | 965.10 | 727.20 | 734.70 | 665.60 | 573.90 | 385.80 | 404.00 | 442.90 | 488.00 | 419.40 | 447.10 | 433.00 | 351.30 | NA | NA | NA | |

| Land | 1328.30 | 1309.00 | 1309.50 | 1304.70 | 1319.20 | 1259.60 | 1308.10 | 1286.50 | 1277.60 | 1236.30 | 1218.00 | 1200.30 | 1225.10 | 1310.90 | 1289.50 | 1261.20 | 1330.60 | 1309.80 | 1326.20 | 1343.10 | 1371.30 | 1393.60 | 1450.10 | 1569.80 | 1509.40 | 1487.20 | 1429.30 | 1386.70 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 30.80 | NA | NA | NA | 29.40 | NA | NA | NA | 27.40 | NA | NA | NA | 27.20 | NA | NA | NA | 21.90 | NA | NA | NA | 37.90 | NA | NA | NA | NA | NA | NA | NA | |

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 2069.10 | 2232.70 | 2320.90 | 2267.40 | 2238.10 | 2130.30 | 2183.40 | 2166.90 | 1947.60 | 1737.90 | 1577.50 | 1311.00 | 1289.30 | 1277.00 | 1276.10 | 1256.40 | 1334.60 | 1110.20 | 1073.80 | 907.30 | 859.90 | 789.70 | 613.70 | 544.10 | 486.40 | 507.80 | 499.00 | 567.60 | |

| Goodwill | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 | 23.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | 43.30 | 43.70 | 46.20 | 46.50 | 46.40 | 16.80 | 24.20 | 25.70 | 26.30 | 33.10 | 30.60 | 28.50 | 28.20 | 27.70 | 41.30 | 42.50 | 40.50 | 40.60 | 44.10 | 71.70 | 184.50 | 188.80 | 179.40 | 221.30 | 211.90 | 1380.90 | 1324.20 | 1312.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

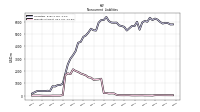

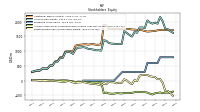

| Stockholders Equity | 1755.10 | 2008.60 | 2154.40 | 1924.90 | 1964.00 | 1926.40 | 1966.20 | 2037.50 | 1777.60 | 1799.80 | 1797.20 | 1617.80 | 1644.50 | 1488.90 | 1547.80 | 1612.50 | 1678.70 | 1235.10 | 1246.20 | 1230.50 | 1246.70 | 1253.00 | 1270.30 | 1345.40 | 1365.60 | 1013.40 | 1027.50 | 1025.00 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1798.40 | 2052.30 | 2200.60 | 1971.40 | 2010.40 | 1943.20 | 1990.40 | 2063.20 | 1803.90 | 1832.90 | 1827.80 | 1646.30 | 1672.70 | 1516.60 | 1589.10 | 1655.00 | 1719.20 | 1275.70 | 1290.30 | 1302.20 | 1431.20 | 1441.80 | 1449.70 | 1566.70 | 1577.50 | 2394.30 | 2351.70 | 2337.20 | |

| Additional Paid In Capital | 1718.60 | 1717.70 | 1710.50 | 1702.50 | 1679.50 | 1672.30 | 1665.30 | 1658.40 | 1679.60 | 1702.00 | 1719.50 | 1718.60 | 1725.20 | 1729.90 | 1746.30 | 1738.70 | 1754.50 | 1751.80 | 1747.30 | 1747.20 | 1744.60 | 1753.10 | 1747.70 | 1871.20 | 1883.30 | 1225.20 | 1215.90 | 1213.00 | |

| Retained Earnings Accumulated Deficit | -349.00 | -72.30 | 53.40 | 47.90 | 122.10 | 132.50 | 149.20 | 191.60 | 192.40 | 196.30 | 165.40 | -18.90 | 17.70 | -122.50 | -70.20 | 3.40 | 46.20 | -80.10 | -71.80 | -92.10 | -56.40 | -56.70 | -40.70 | -121.50 | -90.60 | -160.40 | -132.00 | -121.90 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -404.40 | -427.30 | -400.00 | -418.00 | -430.10 | -470.90 | -441.50 | -405.60 | -389.60 | -393.70 | -382.90 | -377.10 | -393.60 | -413.70 | -423.50 | -424.80 | -417.20 | -436.60 | -429.30 | -424.60 | -441.50 | -443.40 | -436.70 | -404.30 | -427.10 | -51.40 | -56.40 | -66.10 | |

| Minority Interest | 43.30 | 43.70 | 46.20 | 46.50 | 46.40 | 16.80 | 24.20 | 25.70 | 26.30 | 33.10 | 30.60 | 28.50 | 28.20 | 27.70 | 41.30 | 42.50 | 40.50 | 40.60 | 44.10 | 71.70 | 184.50 | 188.80 | 179.40 | 221.30 | 211.90 | 1380.90 | 1324.20 | 1312.20 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 1.90 | 19.70 | 1.10 | 5.00 | 0.20 | 9.30 | 0.90 | 0.40 | 12.80 | 3.40 | 2.40 | 0.10 | 0.70 | 16.40 | 1.60 | 0.20 | 4.10 | 1.70 | 135.50 | 122.70 | 11.10 | 1.00 | 102.70 | 1.20 | 12.70 | 17.10 | 60.30 | 15.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

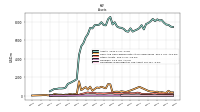

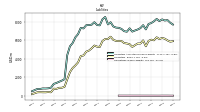

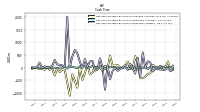

| Net Cash Provided By Used In Operating Activities | 51.60 | -0.40 | 64.70 | -67.00 | 37.60 | 16.80 | 37.40 | -58.90 | 54.40 | -18.40 | 10.30 | -76.60 | -7.20 | 60.40 | -29.20 | -36.60 | 20.00 | -7.60 | -6.80 | -25.10 | 1.30 | 32.10 | 10.90 | 48.80 | -56.60 | 61.40 | 57.00 | 11.20 | |

| Net Cash Provided By Used In Investing Activities | 8.90 | 39.20 | -96.70 | 36.90 | -2.80 | 116.60 | -229.10 | -246.30 | -357.70 | -419.30 | -413.90 | 152.90 | 456.60 | -48.00 | -57.80 | 240.00 | 76.30 | -6.60 | 11.80 | 100.80 | 80.50 | 84.10 | 483.10 | -54.60 | 72.50 | -141.80 | 8.30 | -9.20 | |

| Net Cash Provided By Used In Financing Activities | -76.80 | -93.10 | 66.10 | -61.00 | -43.10 | -152.80 | 208.70 | 251.40 | -12.80 | 603.00 | -350.80 | 392.60 | -236.60 | -31.70 | 155.00 | -93.30 | 93.40 | 1.80 | -58.10 | -122.90 | -8.00 | -137.00 | -462.90 | 79.10 | -873.90 | 28.30 | 368.50 | -88.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

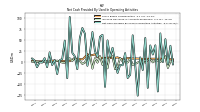

| Net Cash Provided By Used In Operating Activities | 51.60 | -0.40 | 64.70 | -67.00 | 37.60 | 16.80 | 37.40 | -58.90 | 54.40 | -18.40 | 10.30 | -76.60 | -7.20 | 60.40 | -29.20 | -36.60 | 20.00 | -7.60 | -6.80 | -25.10 | 1.30 | 32.10 | 10.90 | 48.80 | -56.60 | 61.40 | 57.00 | 11.20 | |

| Profit Loss | -235.90 | -64.10 | 47.30 | -28.70 | 39.20 | 23.60 | -0.90 | 40.00 | 44.30 | 72.50 | 221.20 | -1.60 | 172.50 | -19.70 | -39.10 | -5.90 | 158.90 | 19.40 | 141.20 | 1.60 | 32.90 | 12.90 | 167.30 | -1.00 | 105.40 | 9.80 | 21.80 | 0.90 | |

| Depreciation Depletion And Amortization | 39.50 | 38.80 | 40.10 | 39.40 | 40.20 | 46.10 | 43.30 | 43.30 | 41.00 | 39.20 | 41.70 | 44.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 12.00 | 9.30 | -0.50 | 3.00 | 3.40 | -1.10 | 6.80 | 4.30 | -1.40 | 1.50 | 1.90 | -1.50 | -4.60 | -6.80 | 8.10 | -1.20 | -1.10 | 0.90 | 9.10 | -9.90 | -16.40 | 11.80 | 17.30 | -14.60 | 9.00 | -6.70 | 13.20 | -1.60 | |

| Deferred Income Tax Expense Benefit | -44.90 | -20.70 | 5.90 | -6.20 | 6.70 | 12.30 | -6.40 | 5.70 | 30.10 | 20.30 | 63.60 | -1.80 | 48.10 | -15.90 | -4.90 | -0.10 | -0.10 | 7.30 | 19.60 | -0.10 | 18.80 | 4.40 | 20.60 | -4.50 | -18.70 | -5.40 | 5.40 | -5.80 | |

| Share Based Compensation | 12.80 | 7.30 | 7.30 | 7.10 | 7.30 | 7.30 | 7.30 | 7.10 | 6.80 | 6.90 | 7.30 | 7.70 | 7.80 | 7.60 | 8.30 | 8.60 | 6.30 | 6.30 | 7.20 | 10.40 | 9.20 | 9.30 | 8.80 | 9.90 | 9.00 | 9.30 | 9.40 | 10.50 | |

| Amortization Of Financing Costs | 2.40 | 2.40 | 2.30 | 2.10 | 2.50 | 2.40 | 2.10 | 2.10 | 2.70 | 1.20 | 5.90 | 6.40 | -5.10 | 1.80 | 1.90 | 2.20 | 2.10 | 2.40 | 2.20 | 2.60 | 2.80 | 2.10 | 5.50 | 3.10 | 6.00 | 2.20 | 2.10 | 2.00 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 8.90 | 39.20 | -96.70 | 36.90 | -2.80 | 116.60 | -229.10 | -246.30 | -357.70 | -419.30 | -413.90 | 152.90 | 456.60 | -48.00 | -57.80 | 240.00 | 76.30 | -6.60 | 11.80 | 100.80 | 80.50 | 84.10 | 483.10 | -54.60 | 72.50 | -141.80 | 8.30 | -9.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

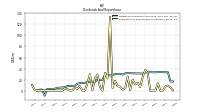

| Net Cash Provided By Used In Financing Activities | -76.80 | -93.10 | 66.10 | -61.00 | -43.10 | -152.80 | 208.70 | 251.40 | -12.80 | 603.00 | -350.80 | 392.60 | -236.60 | -31.70 | 155.00 | -93.30 | 93.40 | 1.80 | -58.10 | -122.90 | -8.00 | -137.00 | -462.90 | 79.10 | -873.90 | 28.30 | 368.50 | -88.20 | |

| Payments Of Dividends Common Stock | 33.50 | 33.40 | 33.50 | 35.60 | 32.80 | 32.90 | 32.80 | 36.10 | 29.50 | 29.90 | 31.50 | 32.60 | 33.40 | 30.50 | 30.60 | 31.60 | 26.70 | 28.40 | 29.50 | 30.30 | 27.00 | 26.70 | 28.20 | 29.30 | 2.10 | 19.20 | 19.40 | 18.50 | |

| Payments For Repurchase Of Common Stock | 7.50 | 0.00 | 0.00 | 13.40 | 0.00 | 0.10 | -0.20 | 31.30 | 37.50 | 24.90 | 6.50 | 14.30 | 11.10 | 20.00 | 0.70 | 25.60 | 3.90 | 1.80 | 7.10 | 7.90 | 17.80 | 4.50 | 133.60 | 22.00 | 32.10 | 0.00 | 6.40 | 29.20 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 142.60 | 141.30 | 146.50 | 132.20 | 139.60 | 139.60 | 136.10 | 124.70 | 131.40 | 114.40 | 108.40 | 99.40 | 106.50 | 114.20 | 106.90 | 123.30 | 142.30 | 143.00 | 143.70 | 140.70 | 178.70 | 185.80 | 218.30 | 190.70 | 181.30 | 272.50 | 180.40 | 167.60 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 142.60 | 141.30 | 146.50 | 132.20 | 139.60 | 139.60 | 136.10 | 124.70 | 131.40 | 114.40 | 108.40 | 99.40 | 106.50 | 114.20 | 106.90 | 123.30 | 142.30 | 143.00 | 143.70 | 140.70 | 178.70 | 185.80 | 218.30 | 190.70 | 181.30 | 272.50 | 180.40 | 167.60 | |

| , | 61.10 | 58.40 | 63.70 | 56.40 | 58.70 | 56.90 | 55.70 | 53.80 | 51.30 | 50.80 | 54.80 | 51.90 | 52.20 | 55.70 | 54.80 | 55.90 | 56.20 | 52.10 | 51.40 | 50.50 | 49.80 | 51.00 | 57.40 | 52.10 | 48.00 | 47.60 | 43.40 | NA | |

| , | 81.50 | 82.80 | 82.80 | 75.70 | 80.80 | 82.70 | 80.30 | 70.90 | 80.10 | 63.50 | 53.50 | 47.40 | 54.30 | 58.50 | 52.10 | 67.40 | 85.30 | 90.90 | 92.30 | 90.20 | 128.90 | 134.80 | 160.90 | 138.00 | 133.30 | 224.90 | 137.00 | NA | |

| , | 0.00 | 0.10 | 0.00 | 0.10 | 0.10 | 0.00 | 0.10 | NA | 0.00 | 0.10 | 0.10 | 0.10 | NA | NA | 0.00 | 0.00 | 0.80 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | |

| Corporate Non | 0.60 | 0.70 | 0.60 | 0.30 | 0.40 | 0.50 | 0.40 | 0.40 | 0.40 | 0.40 | 0.60 | 0.70 | 0.60 | 3.40 | 2.70 | 3.90 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | NA | |

| Corporate Non, Other Revenue | 0.60 | 0.70 | 0.60 | NA | 0.40 | 0.50 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

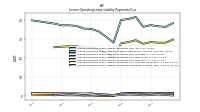

| Operating, Investment Management Fees, Co Investments Portfolio | 16.30 | 15.50 | 19.10 | 11.00 | 11.30 | 11.20 | 11.00 | 11.30 | 9.90 | 9.20 | 8.80 | 7.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Real Estate, Co Investments Portfolio | 11.60 | 6.10 | 4.70 | 3.70 | 3.70 | 3.00 | 2.70 | 2.30 | 2.40 | 2.40 | 2.20 | 1.60 | 1.60 | 1.30 | 0.20 | NA | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Co Investments Portfolio | 27.90 | 21.60 | 23.80 | 14.70 | 15.00 | 14.20 | 13.70 | 13.60 | 12.30 | 11.70 | 10.90 | 9.00 | 7.30 | 5.50 | 5.20 | 4.50 | 9.80 | 5.30 | 4.70 | 5.10 | NA | NA | NA | NA | NA | NA | NA | NA | |

| 14.40 | 16.60 | 15.50 | 10.60 | 13.70 | 14.00 | 12.70 | 6.50 | 7.90 | 6.20 | 2.20 | 0.80 | 3.50 | 3.10 | 0.10 | 7.20 | 17.60 | 25.10 | 22.80 | 15.00 | 38.10 | 43.50 | 37.80 | 36.30 | 31.70 | 37.30 | 29.00 | NA | ||

| Investment Management Fees | 16.30 | 15.50 | 19.10 | 11.00 | 11.30 | 11.20 | 11.00 | 11.30 | 9.90 | 9.20 | 8.80 | 7.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Revenue | 0.60 | 0.70 | 0.60 | NA | 0.40 | 0.50 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rental Services | 99.70 | 102.40 | 106.60 | 106.60 | 110.50 | 110.90 | 109.30 | 104.20 | 110.80 | 96.10 | 94.70 | 88.90 | 95.10 | 102.20 | 98.90 | 107.70 | 111.30 | 108.30 | 112.00 | 115.80 | 122.00 | 123.40 | 134.90 | 134.30 | 131.10 | 125.50 | 123.80 | NA | |

| Real Estate | 11.60 | 6.10 | 4.70 | 3.70 | 3.70 | 3.00 | 2.70 | 2.30 | 2.40 | 2.40 | 2.20 | 1.60 | 1.60 | 1.30 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.10 | 8.10 | 6.50 | 32.80 | 9.40 | 8.10 | 89.80 | 12.80 | NA | |

| Related Party | 24.10 | 15.10 | 12.40 | NA | 11.70 | 11.20 | 11.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |