| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | NA | 125.17 | 125.27 | 125.48 | NA | 124.50 | 124.48 | 124.32 | NA | 118.79 | 106.81 | 106.33 | |

| Weighted Average Number Of Shares Outstanding Basic | NA | 124.28 | 124.59 | 124.31 | NA | 123.73 | 124.05 | 123.97 | NA | 117.48 | 106.81 | 106.33 | |

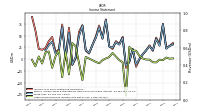

| Earnings Per Share Basic | 0.48 | 0.23 | 0.28 | 0.15 | 0.22 | 0.15 | 0.08 | NA | -0.10 | 0.15 | -0.04 | -0.15 | |

| Earnings Per Share Diluted | 0.47 | 0.23 | 0.28 | 0.15 | 0.21 | 0.15 | 0.08 | NA | -0.10 | 0.14 | -0.04 | -0.15 |

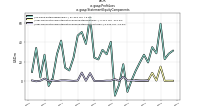

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

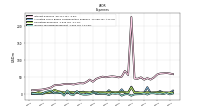

| Interest And Fee Income Loans And Leases | 2.78 | 2.70 | 2.35 | 7.19 | 2.77 | 2.69 | 2.45 | 3.28 | 12.65 | 3.05 | 3.50 | 1.52 | |

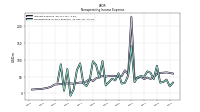

| Operating Expenses | 5.41 | 5.14 | 4.65 | 5.51 | 4.80 | 4.42 | 4.22 | 4.24 | 20.29 | 3.94 | 6.22 | 5.79 | |

| Costs And Expenses | 41.74 | 38.57 | 39.06 | 55.69 | 32.21 | 31.76 | 30.70 | 31.12 | 47.89 | 32.15 | 31.05 | 42.21 | |

| Interest Expense | 57.39 | 48.47 | 42.70 | 47.03 | 42.41 | 49.34 | 45.23 | 45.97 | 227.47 | 56.40 | 68.42 | 51.40 | |

| Interest Income Expense Net | 37.30 | 28.89 | 22.56 | 9.17 | 10.59 | -3.10 | -7.65 | -6.69 | 12.37 | -1.78 | -6.33 | 21.19 | |

| Interest Paid Net | NA | NA | NA | 36.15 | 41.71 | 45.16 | 31.89 | 54.36 | 38.22 | 66.50 | 48.80 | 49.42 | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | 0.69 | NA | NA | NA | NA | NA | 22.25 | 1.17 | 19.02 | 2.06 | |

| Allocated Share Based Compensation Expense | 3.80 | 3.74 | 3.64 | 20.41 | 3.43 | 3.07 | 5.37 | 5.28 | 21.77 | 4.22 | 2.71 | 14.03 | |

| Income Tax Expense Benefit | 1.01 | 2.61 | 2.59 | -1.31 | 2.24 | -0.21 | -0.32 | -0.78 | -4.71 | 0.01 | -0.55 | -4.54 | |

| Income Taxes Paid Net | NA | NA | NA | 0.01 | -0.61 | -2.15 | -0.63 | 0.86 | -0.85 | 3.08 | 0.16 | -0.19 | |

| Profit Loss | 74.25 | 28.68 | 43.21 | 19.15 | 27.07 | 18.93 | 10.46 | 0.43 | -11.58 | 21.38 | -5.19 | -14.06 | |

| Other Comprehensive Income Loss Net Of Tax | -2.20 | -0.96 | -7.10 | -6.64 | -1.03 | -0.87 | 1.40 | 6.85 | 17.98 | 18.74 | 26.12 | -78.01 | |

| Interest Income Expense After Provision For Loan Loss | 34.96 | 27.39 | 23.57 | 8.30 | 12.35 | -0.74 | -7.31 | -2.44 | 4.36 | 0.73 | -5.60 | -5.39 |

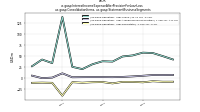

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

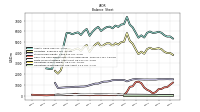

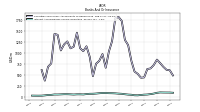

| Assets | 5951.17 | 5869.97 | 5843.01 | 5974.20 | 5851.25 | 5416.04 | 5616.81 | 5405.81 | 5881.23 | 6359.46 | 6609.55 | 7331.87 | |

| Liabilities | 4417.61 | 4366.35 | 4333.30 | 4465.04 | 4337.63 | 3906.49 | 4096.94 | 3874.97 | 4332.80 | 4837.67 | 5101.17 | 5831.05 | |

| Liabilities And Stockholders Equity | 5951.17 | 5869.97 | 5843.01 | 5974.20 | 5851.25 | 5416.04 | 5616.81 | 5405.81 | 5881.23 | 6359.46 | 6609.55 | 7331.87 | |

| Stockholders Equity | 1533.35 | 1501.96 | 1502.35 | 1502.69 | 1507.14 | 1502.94 | 1514.48 | 1525.61 | 1543.16 | 1516.50 | 1430.51 | 1333.19 |

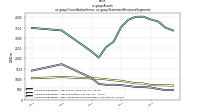

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

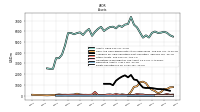

| Cash And Cash Equivalents At Carrying Value | 609.08 | 328.44 | 217.36 | 431.76 | 548.74 | 758.05 | 1169.84 | 1305.69 | 1254.43 | 875.84 | 826.06 | 358.35 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 659.60 | 357.18 | 282.93 | 495.22 | 621.55 | 843.53 | 1285.69 | 1452.06 | 1284.28 | 917.74 | 874.00 | 622.22 | |

| Equity Securities Fv Ni | 0.12 | 0.41 | 0.65 | 0.16 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 587.40 | 610.14 | 616.45 | 662.78 | 703.28 | 724.74 | 719.20 | 764.10 | 1058.32 | 1447.64 | 1506.73 | 1930.43 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

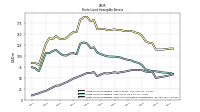

| Finite Lived Intangible Assets Net | 64.96 | 65.10 | 67.14 | 69.63 | 79.09 | 84.15 | 85.99 | 89.53 | 91.16 | 92.75 | 95.96 | 97.73 | |

| Equity Securities Fv Ni | 0.12 | 0.41 | 0.65 | 0.16 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 608.44 | 628.95 | 634.30 | 673.51 | 707.37 | 727.80 | 721.35 | 767.61 | 1068.65 | 1476.04 | 1553.88 | 2003.80 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

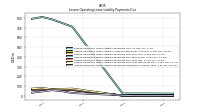

| Debt And Capital Lease Obligations | 3202.11 | 3196.62 | 3164.59 | 3303.81 | 3184.74 | NA | NA | NA | 4234.86 | NA | NA | NA |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1533.35 | 1501.96 | 1502.35 | 1502.69 | 1507.14 | 1502.94 | 1514.48 | 1525.61 | 1543.16 | 1516.50 | 1430.51 | 1333.19 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1533.56 | 1503.62 | 1509.71 | 1509.16 | 1513.62 | 1509.55 | 1519.87 | 1530.84 | 1548.42 | 1521.79 | 1508.38 | 1500.83 | |

| Additional Paid In Capital Common Stock | 1826.83 | 1823.04 | 1819.30 | 1815.66 | 1795.25 | 1791.95 | 1788.88 | 1785.35 | 1780.07 | 1726.34 | 1649.17 | 1546.14 | |

| Retained Earnings Accumulated Deficit | -177.00 | -207.43 | -206.92 | -214.08 | -207.80 | -209.82 | -203.71 | -188.76 | -163.72 | -126.97 | -120.08 | -94.17 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -21.01 | -18.81 | -17.86 | -10.75 | -4.11 | -3.08 | -2.21 | -3.61 | -10.46 | -28.45 | -45.08 | -65.92 | |

| Treasury Stock Value | NA | NA | NA | 88.26 | 76.32 | 76.23 | 68.59 | 67.50 | 62.86 | 54.54 | 53.62 | 52.98 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.80 | 3.74 | 3.64 | 20.41 | 3.43 | 3.07 | 3.52 | 5.28 | 21.77 | 4.22 | 2.71 | 14.03 | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 16.15 | 5.80 | 7.45 | 0.14 | 0.47 | 0.16 | 0.02 | 0.27 | 0.19 | 6.30 | 2.57 | 7.43 |

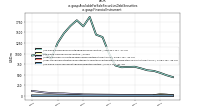

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 54.49 | 38.27 | 43.98 | -30.04 | 53.88 | 35.61 | 33.84 | -43.59 | 23.93 | 44.56 | 84.55 | -41.09 | |

| Net Cash Provided By Used In Investing Activities | 289.69 | 44.91 | -81.07 | -171.94 | -718.78 | -242.98 | -378.44 | 688.74 | 851.79 | 257.17 | 910.77 | -477.46 | |

| Net Cash Provided By Used In Financing Activities | -41.76 | -8.93 | -175.21 | 75.65 | 442.92 | -234.78 | 178.22 | -477.37 | -509.17 | -257.99 | -743.54 | 785.03 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 54.49 | 38.27 | 43.98 | -30.04 | 53.88 | 35.61 | 33.84 | -43.59 | 23.93 | 44.56 | 84.55 | -41.09 | |

| Profit Loss | 74.25 | 28.68 | 43.21 | 19.15 | 27.07 | 18.93 | 10.46 | 0.43 | -11.58 | 21.38 | -5.19 | -14.06 | |

| Depreciation Depletion And Amortization | 7.91 | 7.86 | 7.56 | 9.34 | 9.48 | 9.32 | 9.46 | 9.54 | 39.08 | 9.82 | 9.82 | 10.01 | |

| Deferred Income Tax Expense Benefit | -0.60 | -1.60 | 2.10 | -0.40 | 1.57 | -1.30 | -1.20 | 1.20 | -6.71 | -3.10 | -2.10 | 12.00 | |

| Share Based Compensation | 3.80 | 3.74 | 3.64 | 20.41 | 3.43 | 3.07 | 3.52 | 5.28 | 21.77 | 4.22 | 2.71 | 14.03 | |

| Amortization Of Financing Costs | 3.41 | 2.94 | 3.35 | 5.86 | 5.05 | 6.43 | 5.15 | 4.89 | 5.28 | 5.75 | 5.14 | 2.57 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 289.69 | 44.91 | -81.07 | -171.94 | -718.78 | -242.98 | -378.44 | 688.74 | 851.79 | 257.17 | 910.77 | -477.46 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -41.76 | -8.93 | -175.21 | 75.65 | 442.92 | -234.78 | 178.22 | -477.37 | -509.17 | -257.99 | -743.54 | 785.03 | |

| Dividends | 29.12 | 29.09 | 27.89 | 25.31 | 25.09 | 25.03 | 25.25 | 25.24 | 25.04 | 24.07 | 21.72 | 36.90 | |

| Payments For Repurchase Of Common Stock | 1.76 | 1.50 | 4.04 | 0.61 | 0.10 | 7.60 | 1.10 | 0.21 | 0.45 | 0.90 | 0.48 | 1.21 |

| 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A24 Second Avenue Holdings L L C | 4.33 | 4.86 | 4.92 | 5.07 | 4.93 | 4.88 | 4.54 | 4.51 | 4.35 | 4.34 | 4.29 | 4.48 |