| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 394.59 | 382.42 | 370.74 | NA | 359.75 | 352.05 | 348.68 | NA | 352.12 | 340.26 | 332.99 | NA | 130.60 | 129.65 | 128.67 | |

| Weighted Average Number Of Shares Outstanding Basic | 394.59 | 382.42 | 370.74 | NA | 359.75 | 352.05 | 348.68 | NA | 352.12 | 340.26 | 332.99 | NA | 130.60 | 129.65 | 128.67 | |

| Earnings Per Share Basic | -0.34 | -0.37 | -0.40 | -0.40 | -0.33 | -0.27 | -0.25 | -0.21 | -0.15 | -0.11 | -0.23 | -1.93 | -0.29 | -0.20 | NA | |

| Earnings Per Share Diluted | -0.34 | -0.37 | -0.40 | -0.40 | -0.33 | -0.27 | -0.25 | -0.21 | -0.15 | -0.11 | -0.23 | -1.93 | -0.29 | -0.20 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

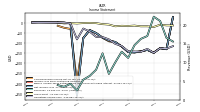

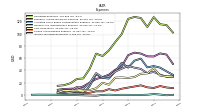

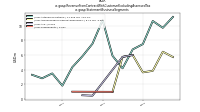

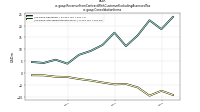

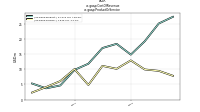

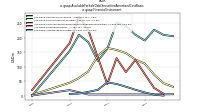

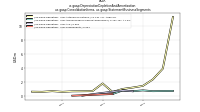

| Revenue From Contract With Customer Excluding Assessed Tax | 16.96 | 16.20 | 14.51 | 11.13 | 12.79 | 9.93 | 6.86 | 12.34 | 7.98 | 6.31 | 5.31 | 2.43 | 4.22 | 3.42 | 3.87 | |

| Revenues | 16.96 | 16.20 | 14.51 | 11.13 | 12.79 | 9.93 | 6.86 | 12.34 | 7.98 | 6.31 | 5.31 | 2.43 | 4.22 | 3.42 | 3.87 | |

| Cost Of Revenue | 35.12 | 34.53 | 29.13 | 27.73 | 28.51 | 28.09 | 16.65 | 19.84 | 10.76 | 7.85 | 7.64 | 6.74 | 6.92 | 7.44 | 3.84 | |

| Gross Profit | -18.16 | -18.34 | -14.62 | -16.60 | -15.73 | -18.16 | -9.80 | -7.49 | -2.78 | -1.54 | -2.33 | -4.31 | -2.70 | -4.02 | 0.03 | |

| Operating Expenses | 110.77 | 125.56 | 127.27 | 124.08 | 99.23 | 86.28 | 72.53 | 63.47 | 67.36 | 42.66 | 26.92 | 26.08 | 19.09 | 15.83 | 14.86 | |

| Research And Development Expense | 62.94 | 67.48 | 69.05 | 64.92 | 46.31 | 40.94 | 33.11 | 29.05 | 25.89 | 19.91 | 14.01 | 10.38 | 10.15 | 9.71 | 8.41 | |

| General And Administrative Expense | 35.44 | 42.42 | 44.49 | 47.18 | 42.81 | 38.15 | 30.02 | 28.57 | 35.60 | 19.24 | 10.27 | 13.16 | 6.61 | 4.89 | 4.61 | |

| Selling And Marketing Expense | 12.40 | 15.65 | 13.73 | 11.97 | 10.11 | 7.19 | 9.40 | 5.85 | 5.87 | 3.51 | 2.63 | 2.54 | 2.33 | 1.23 | 1.84 | |

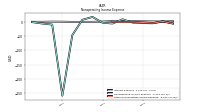

| Operating Income Loss | -128.93 | -143.89 | -141.90 | -140.68 | -114.95 | -104.44 | -82.33 | -70.96 | -70.14 | -44.20 | -29.24 | -82.32 | -4.10 | -0.21 | -0.25 | |

| Interest Expense | 2.78 | 1.27 | 1.67 | 2.01 | 2.66 | 3.15 | 3.28 | 1.17 | 0.37 | 0.29 | 0.20 | 0.79 | 1.08 | 0.49 | 0.53 | |

| Interest Expense Debt | NA | NA | 1.90 | NA | 2.00 | 1.90 | 1.90 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 0.00 | NA | NA | 3.91 | 0.00 | NA | NA | 0.16 | 0.02 | 0.02 | 0.02 | 0.78 | 0.69 | 1.00 | 0.33 | |

| Allocated Share Based Compensation Expense | 44.88 | 59.20 | 55.95 | 44.53 | 52.55 | 38.62 | 26.70 | 27.80 | 33.52 | 14.53 | 1.84 | 4.00 | 1.30 | 2.28 | 1.13 | |

| Income Tax Expense Benefit | 0.30 | 0.01 | NA | 0.11 | 0.17 | -0.01 | 0.40 | 0.00 | -1.26 | NA | NA | NA | -0.05 | -0.03 | 0.25 | |

| Net Income Loss | -134.34 | -141.76 | -146.77 | -144.82 | -117.55 | -95.24 | -88.33 | -73.89 | -51.34 | -36.83 | -75.92 | -358.92 | -4.03 | -0.12 | 0.77 | |

| Comprehensive Income Net Of Tax | -133.76 | -140.56 | -144.55 | -143.05 | -117.53 | -96.69 | -91.98 | -74.90 | -51.25 | -36.81 | -75.97 | -290.02 | -31.24 | -25.42 | -15.59 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

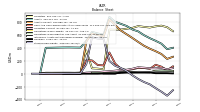

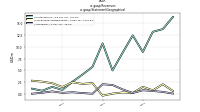

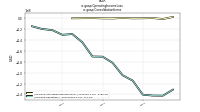

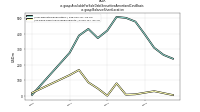

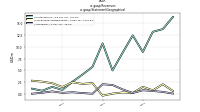

| Assets | 552.88 | 599.77 | 658.35 | 687.33 | 742.51 | 775.60 | 807.80 | 883.54 | 607.81 | 626.17 | 651.21 | 510.35 | 406.30 | 407.53 | 408.83 | |

| Liabilities | 718.54 | 728.92 | 740.63 | 713.73 | 699.55 | 687.04 | 683.92 | 685.55 | 68.71 | 79.15 | 84.05 | 361.61 | 17.10 | 14.30 | 15.48 | |

| Liabilities And Stockholders Equity | 552.88 | 599.77 | 658.35 | 687.33 | 742.51 | 775.60 | 807.80 | 883.54 | 607.81 | 626.17 | 651.21 | 510.35 | 406.30 | 407.53 | 408.83 | |

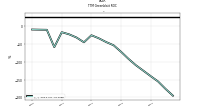

| Stockholders Equity | -165.66 | -129.15 | -82.28 | -26.41 | 42.96 | 88.56 | 123.88 | 197.99 | 539.10 | 547.02 | 567.16 | 148.74 | 5.00 | 6.10 | 6.22 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 389.42 | 435.25 | 494.35 | 554.59 | 613.47 | 671.05 | 758.38 | 845.39 | 578.38 | 601.59 | 626.84 | 500.81 | 0.58 | 1.12 | 1.13 | |

| Cash | 40.79 | 33.60 | 25.90 | 27.50 | 22.96 | 41.11 | 31.74 | 303.37 | 17.10 | 16.30 | 21.44 | 10.65 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 74.72 | 89.11 | 89.93 | 69.55 | 56.07 | 76.72 | 159.42 | 329.98 | 129.32 | 134.69 | 206.73 | 208.94 | 0.52 | 1.01 | 0.98 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 78.19 | 91.50 | 92.16 | 71.11 | 57.30 | 77.70 | 160.13 | 330.70 | 130.05 | 135.41 | 207.46 | 209.72 | 50.92 | 20.87 | 8.46 | |

| Accounts Receivable Net Current | 18.90 | 16.81 | 21.05 | 11.17 | 9.94 | 9.28 | 3.26 | 13.01 | 1.03 | 2.44 | 2.14 | 5.97 | NA | NA | NA | |

| Inventory Net | 16.70 | 20.32 | 14.92 | 8.79 | 9.15 | 9.35 | 10.01 | 10.34 | 7.87 | 4.32 | 3.28 | 3.61 | 2.92 | 4.96 | 6.17 | |

| Prepaid Expense And Other Assets Current | 29.39 | 29.95 | 33.86 | 44.20 | 40.10 | 46.18 | 37.55 | 29.20 | 23.88 | 13.66 | 10.37 | 4.80 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 243.00 | 262.17 | 336.47 | 389.67 | 480.39 | 501.93 | 582.00 | 418.88 | 417.99 | 515.81 | 552.90 | 410.03 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 98.89 | 94.67 | 90.47 | 40.41 | 30.68 | 27.85 | 23.96 | 17.79 | NA | NA | NA | 13.54 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 26.25 | 15.53 | 12.08 | 10.15 | 9.04 | 7.90 | 7.52 | 6.78 | NA | NA | NA | 5.85 | NA | NA | NA | |

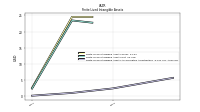

| Amortization Of Intangible Assets | 1.10 | 1.10 | 1.06 | 0.69 | 0.70 | 0.80 | 0.06 | 0.03 | 0.20 | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 72.65 | 79.14 | 78.39 | 30.26 | 21.65 | 19.95 | 16.44 | 11.01 | NA | NA | NA | 7.69 | NA | NA | NA | |

| Goodwill | 19.88 | 19.88 | 19.88 | 18.82 | 18.83 | 18.46 | 2.94 | 3.11 | 3.11 | 0.70 | 0.70 | 0.70 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 27.06 | 28.16 | 29.25 | 22.08 | 22.77 | 23.46 | 2.36 | 2.42 | 2.49 | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | NA | 22.77 | 23.46 | NA | 2.42 | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | 27.06 | 28.16 | 29.25 | 22.08 | 22.77 | 23.46 | 2.36 | 2.42 | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 24.21 | 16.30 | 15.49 | 40.34 | 42.98 | 25.23 | 13.67 | 12.46 | 2.54 | 2.64 | 2.47 | 1.15 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 243.24 | 262.98 | 338.47 | 393.90 | 486.38 | 507.93 | 586.55 | 419.78 | 417.89 | 515.80 | 552.90 | 410.00 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

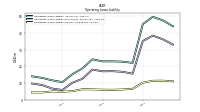

| Liabilities Current | 85.70 | 94.02 | 100.48 | 77.54 | 62.19 | 57.84 | 47.22 | 39.00 | 33.23 | 24.24 | 21.18 | 16.59 | 3.10 | 0.30 | 1.48 | |

| Accounts Payable Current | 20.73 | 21.91 | 29.92 | 18.63 | 24.22 | 20.12 | 17.29 | 14.42 | 9.68 | 7.00 | 7.84 | 6.04 | NA | NA | NA | |

| Other Accrued Liabilities Current | 20.88 | 21.85 | 24.59 | 22.36 | 6.04 | 7.27 | 6.43 | 6.73 | 6.15 | 4.96 | 3.65 | 4.00 | NA | NA | NA | |

| Accrued Liabilities Current | 58.49 | 66.04 | 64.66 | 52.96 | 31.83 | 31.50 | 24.85 | 19.84 | 18.55 | 12.90 | 8.92 | 10.45 | 2.94 | 0.09 | 0.08 | |

| Contract With Customer Liability Current | 3.02 | 4.14 | 4.56 | 1.99 | 3.46 | 3.70 | 0.90 | 0.90 | 0.60 | 0.60 | 0.70 | 2.30 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other Liabilities Noncurrent | 1.02 | 0.36 | 6.03 | 4.00 | 2.34 | 1.81 | 0.43 | 0.60 | 0.91 | 1.13 | 1.24 | 1.32 | NA | NA | NA | |

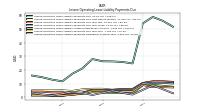

| Operating Lease Liability Noncurrent | 15.55 | 16.70 | 17.06 | 16.99 | 18.06 | 12.46 | 10.10 | 5.77 | 6.64 | 8.76 | 9.66 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

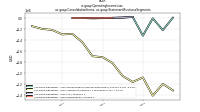

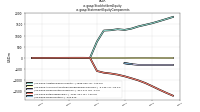

| Stockholders Equity | -165.66 | -129.15 | -82.28 | -26.41 | 42.96 | 88.56 | 123.88 | 197.99 | 539.10 | 547.02 | 567.16 | 148.74 | 5.00 | 6.10 | 6.22 | |

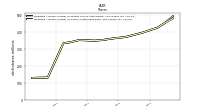

| Additional Paid In Capital | 1838.30 | 1741.05 | 1647.36 | 1558.68 | 1485.00 | 1413.06 | 1314.74 | 1257.21 | 1287.56 | 1244.23 | 1227.56 | 733.17 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -1691.29 | -1556.96 | -1415.20 | -1268.43 | -1123.61 | -1006.06 | -910.82 | -822.49 | -748.59 | -697.25 | -660.42 | -584.50 | 2.04 | 6.07 | 6.19 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -0.23 | -0.81 | -2.00 | -4.23 | -5.99 | -6.00 | -4.56 | -0.91 | 0.10 | 0.01 | -0.01 | 0.03 | NA | NA | NA | |

| Treasury Stock Value | NA | NA | NA | NA | NA | NA | 275.52 | 235.87 | NA | NA | NA | NA | NA | NA | NA | |

| Stock Issued During Period Value New Issues | 0.90 | 0.61 | 1.04 | 1.10 | 1.10 | 0.66 | 1.08 | -490.80 | 1.55 | 2.88 | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 44.02 | 48.57 | 48.80 | 40.11 | 43.21 | 35.54 | 23.66 | 24.82 | 30.41 | 13.91 | 1.84 | 1.01 | 1.31 | 2.29 | 1.14 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

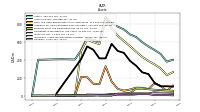

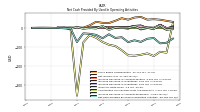

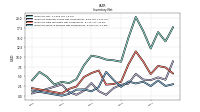

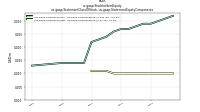

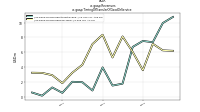

| Net Cash Provided By Used In Operating Activities | -56.54 | -73.31 | -64.67 | -74.67 | -48.36 | -52.36 | -32.84 | -54.16 | -36.07 | -30.17 | -28.01 | -74.09 | -1.16 | -1.27 | 0.88 | |

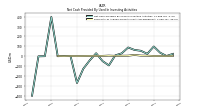

| Net Cash Provided By Used In Investing Activities | 23.14 | 53.77 | 62.60 | 87.07 | 27.92 | 7.40 | -94.39 | -50.61 | 28.87 | -44.09 | -128.35 | -272.50 | 0.67 | 1.30 | -1.26 | |

| Net Cash Provided By Used In Financing Activities | 20.10 | 18.88 | 23.13 | 1.41 | 0.05 | -37.47 | -43.34 | 305.43 | 1.84 | 2.22 | 154.10 | 346.05 | 155.84 | 30.69 | -2.73 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -56.54 | -73.31 | -64.67 | -74.67 | -48.36 | -52.36 | -32.84 | -54.16 | -36.07 | -30.17 | -28.01 | -74.09 | -1.16 | -1.27 | 0.88 | |

| Net Income Loss | -134.34 | -141.76 | -146.77 | -144.82 | -117.55 | -95.24 | -88.33 | -73.89 | -51.34 | -36.83 | -75.92 | -358.92 | -4.03 | -0.12 | 0.77 | |

| Depreciation Depletion And Amortization | 11.93 | 4.55 | 2.99 | 2.19 | 1.83 | 1.74 | 0.81 | 1.92 | 0.91 | 0.70 | 0.66 | 0.59 | 0.69 | 0.60 | 0.63 | |

| Increase Decrease In Accounts Receivable | 2.09 | -4.24 | 9.88 | 1.31 | 0.58 | 2.72 | -9.76 | 11.98 | -2.22 | 0.30 | -3.83 | 5.02 | -4.66 | 2.38 | 1.56 | |

| Increase Decrease In Inventories | 0.29 | 13.38 | 11.58 | 3.83 | 3.83 | 2.05 | 0.77 | 4.09 | 4.02 | 2.20 | 0.44 | 0.81 | -0.23 | 0.93 | 2.51 | |

| Increase Decrease In Accounts Payable | 0.26 | -7.43 | 11.19 | -3.08 | 0.99 | 1.41 | 5.98 | 0.51 | 2.48 | -0.91 | 1.77 | 0.16 | 2.37 | 0.12 | -0.03 | |

| Share Based Compensation | 44.88 | 59.20 | 55.95 | 44.53 | 52.55 | 38.62 | 26.70 | 27.80 | 33.52 | 14.53 | 1.84 | 4.00 | 1.30 | 2.29 | 1.13 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 23.14 | 53.77 | 62.60 | 87.07 | 27.92 | 7.40 | -94.39 | -50.61 | 28.87 | -44.09 | -128.35 | -272.50 | 0.67 | 1.30 | -1.26 | |

| Payments To Acquire Property Plant And Equipment | 4.30 | 5.15 | 11.68 | 4.34 | 3.79 | 2.49 | 5.00 | 2.28 | 1.45 | 1.82 | 0.89 | 0.24 | 1.25 | -0.19 | 0.90 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 20.10 | 18.88 | 23.13 | 1.41 | 0.05 | -37.47 | -43.34 | 305.43 | 1.84 | 2.22 | 154.10 | 346.05 | 155.84 | 30.69 | -2.73 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

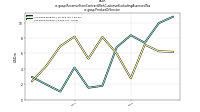

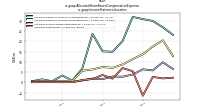

| Revenues | 16.96 | 16.20 | 14.51 | 11.13 | 12.79 | 9.93 | 6.86 | 12.34 | 7.98 | 6.31 | 5.31 | 2.43 | 4.22 | 3.42 | 3.87 | |

| Intersegment Elimination | NA | NA | -9.11 | -7.36 | -9.42 | -5.94 | -4.52 | -4.66 | -3.90 | -3.05 | -2.42 | -1.58 | -1.45 | -0.89 | -0.84 | |

| Operating | NA | NA | 23.61 | 18.48 | 22.20 | 15.87 | 11.37 | 17.01 | 11.87 | 9.36 | 7.73 | 4.01 | 5.67 | 4.31 | 4.71 | |

| Intersegment Elimination,ATS | NA | NA | NA | NA | -5.56 | -0.50 | NA | NA | -1.52 | -1.21 | NA | NA | NA | NA | NA | |

| Intersegment Elimination, Advanced Technologies And Services | NA | NA | -4.55 | NA | NA | NA | -2.16 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intersegment Elimination, Autonomy Solutions | NA | NA | -4.55 | -3.09 | -3.86 | -5.43 | -2.36 | -2.60 | -2.38 | -1.85 | -1.27 | -0.88 | -0.64 | NA | NA | |

| Intersegment Elimination, Components | NA | NA | NA | NA | NA | NA | -2.16 | NA | NA | NA | -1.14 | NA | NA | NA | NA | |

| Operating,ATS | NA | NA | NA | NA | 11.57 | 6.26 | NA | NA | 1.94 | 1.69 | NA | NA | NA | NA | NA | |

| Operating, Advanced Technologies And Services | NA | NA | 8.39 | NA | NA | NA | 3.11 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Autonomy Solutions | NA | NA | 15.23 | 10.59 | 10.64 | 9.61 | 8.26 | 13.39 | 9.93 | 7.67 | 5.61 | 2.68 | 4.12 | 2.81 | 3.30 | |

| Operating, Components | NA | NA | NA | NA | NA | NA | 3.11 | NA | NA | NA | 2.12 | NA | NA | NA | NA | |

| Product | 10.75 | 9.92 | 7.37 | 8.36 | 6.80 | 1.80 | 1.54 | 4.17 | 1.04 | 1.98 | 2.93 | NA | NA | NA | NA | |

| Service | 6.21 | 6.27 | 7.14 | 2.77 | 5.99 | 8.13 | 5.31 | 8.18 | 6.94 | 4.33 | 2.38 | NA | NA | NA | NA | |

| ATS | NA | NA | NA | NA | 6.01 | 5.75 | NA | NA | 0.43 | 0.49 | NA | NA | NA | NA | NA | |

| Advanced Technologies And Services | 5.73 | 6.46 | 3.84 | 3.63 | 6.01 | 5.75 | 0.96 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Autonomy Solutions | 11.23 | 9.74 | 10.67 | 7.50 | 6.78 | 4.18 | 5.90 | 10.79 | 7.55 | 5.82 | 4.34 | 1.80 | 3.48 | 2.81 | 3.30 | |

| Components | NA | NA | NA | NA | NA | NA | 0.96 | NA | NA | NA | 0.98 | NA | NA | NA | NA | |

| 0.04 | 0.39 | 0.59 | 0.74 | 0.17 | 0.93 | 1.86 | 2.03 | 0.00 | 0.15 | 0.32 | 0.19 | 0.51 | 0.20 | 0.01 | ||

| 16.37 | 13.78 | 13.20 | 8.91 | 12.44 | 8.72 | 4.97 | 10.73 | 5.71 | 4.06 | 2.54 | 0.81 | 1.47 | 0.64 | 1.08 | ||

| Europe And Middle East | 0.59 | 2.03 | 0.72 | 1.48 | 0.18 | 0.28 | 0.03 | -0.41 | 2.27 | 2.09 | 2.45 | 1.43 | 2.24 | 2.58 | 2.78 | |

| Transferred At Point In Time | 10.75 | 9.93 | 7.36 | 7.53 | 6.73 | 1.80 | 1.54 | 3.98 | 0.87 | 1.99 | 2.05 | 0.56 | 1.29 | 0.18 | 0.61 | |

| Transferred Over Time | 6.21 | 6.26 | 7.15 | 3.60 | 6.06 | 8.13 | 5.31 | 8.37 | 7.11 | 4.32 | 3.26 | 1.87 | 2.94 | 3.24 | 3.26 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 16.96 | 16.20 | 14.51 | 11.13 | 12.79 | 9.93 | 6.86 | 12.34 | 7.98 | 6.31 | 5.31 | 2.43 | 4.22 | 3.42 | 3.87 | |

| Intersegment Elimination | NA | NA | -9.11 | -7.36 | -9.42 | -5.94 | -4.52 | -4.66 | -3.90 | -3.05 | -2.42 | -1.58 | -1.45 | -0.89 | -0.84 | |

| Operating | NA | NA | 23.61 | 18.48 | 22.20 | 15.87 | 11.37 | 17.01 | 11.87 | 9.36 | 7.73 | 4.01 | 5.67 | 4.31 | 4.71 | |

| Intersegment Elimination,ATS | NA | NA | NA | NA | -5.56 | -0.50 | NA | NA | -1.52 | -1.21 | NA | NA | NA | NA | NA | |

| Intersegment Elimination, Advanced Technologies And Services | NA | NA | -4.55 | NA | NA | NA | -2.16 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intersegment Elimination, Autonomy Solutions | NA | NA | -4.55 | -3.09 | -3.86 | -5.43 | -2.36 | -2.60 | -2.38 | -1.85 | -1.27 | -0.88 | -0.64 | NA | NA | |

| Intersegment Elimination, Components | NA | NA | NA | NA | NA | NA | -2.16 | NA | NA | NA | -1.14 | NA | NA | NA | NA | |

| Operating,ATS | NA | NA | NA | NA | 11.57 | 6.26 | NA | NA | 1.94 | 1.69 | NA | NA | NA | NA | NA | |

| Operating, Advanced Technologies And Services | NA | NA | 8.39 | NA | NA | NA | 3.11 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Autonomy Solutions | NA | NA | 15.23 | 10.59 | 10.64 | 9.61 | 8.26 | 13.39 | 9.93 | 7.67 | 5.61 | 2.68 | 4.12 | 2.81 | 3.30 | |

| Operating, Components | NA | NA | NA | NA | NA | NA | 3.11 | NA | NA | NA | 2.12 | NA | NA | NA | NA | |

| Product | 10.75 | 9.92 | 7.37 | 8.36 | 6.80 | 1.80 | 1.54 | 4.17 | 1.04 | 1.98 | 2.93 | NA | NA | NA | NA | |

| Service | 6.21 | 6.27 | 7.14 | 2.77 | 5.99 | 8.13 | 5.31 | 8.18 | 6.94 | 4.33 | 2.38 | NA | NA | NA | NA | |

| ATS | NA | NA | NA | NA | 6.01 | 5.75 | NA | NA | 0.43 | 0.49 | NA | NA | NA | NA | NA | |

| Advanced Technologies And Services | 5.73 | 6.46 | 3.84 | 3.63 | 6.01 | 5.75 | 0.96 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Autonomy Solutions | 11.23 | 9.74 | 10.67 | 7.50 | 6.78 | 4.18 | 5.90 | 10.79 | 7.55 | 5.82 | 4.34 | 1.80 | 3.48 | 2.81 | 3.30 | |

| Components | NA | NA | NA | NA | NA | NA | 0.96 | NA | NA | NA | 0.98 | NA | NA | NA | NA | |

| 0.04 | 0.39 | 0.59 | 0.74 | 0.17 | 0.93 | 1.86 | 2.03 | 0.00 | 0.15 | 0.32 | 0.19 | 0.51 | 0.20 | 0.01 | ||

| 16.37 | 13.78 | 13.20 | 8.91 | 12.44 | 8.72 | 4.97 | 10.73 | 5.71 | 4.06 | 2.54 | 0.81 | 1.47 | 0.64 | 1.08 | ||

| Europe And Middle East | 0.59 | 2.03 | 0.72 | 1.48 | 0.18 | 0.28 | 0.03 | -0.41 | 2.27 | 2.09 | 2.45 | 1.43 | 2.24 | 2.58 | 2.78 | |

| Transferred At Point In Time | 10.75 | 9.93 | 7.36 | 7.53 | 6.73 | 1.80 | 1.54 | 3.98 | 0.87 | 1.99 | 2.05 | 0.56 | 1.29 | 0.18 | 0.61 | |

| Transferred Over Time | 6.21 | 6.26 | 7.15 | 3.60 | 6.06 | 8.13 | 5.31 | 8.37 | 7.11 | 4.32 | 3.26 | 1.87 | 2.94 | 3.24 | 3.26 |