| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 82.53 | 82.49 | 82.44 | 82.42 | 82.42 | 82.38 | 82.36 | 82.30 | 82.30 | 82.25 | 76.41 | 76.31 | 76.30 | 76.34 | 76.34 | 76.26 | 76.26 | 76.22 | 76.22 | 76.15 | 76.14 | 75.31 | 75.27 | 75.22 | 74.75 | 74.70 | 74.65 | 74.61 | 74.58 | NA | 75.54 | 75.73 | 75.64 | 75.44 | 0.32 | NA | NA | 0.32 | NA | NA | NA | NA | 0.32 | NA | NA | NA | |

| Earnings Per Share Basic | 0.31 | -0.14 | 0.02 | 0.14 | 0.03 | -2.01 | 0.31 | 0.06 | -0.12 | -0.82 | -1.13 | -0.61 | -5.76 | -0.30 | -1.81 | 0.78 | -2.96 | 0.66 | -0.60 | -0.31 | -4.35 | -0.15 | 0.31 | 0.27 | -2.32 | 0.58 | 0.99 | 0.23 | -0.62 | NA | -0.03 | 0.18 | -0.83 | -0.41 | -0.96 | 0.02 | 0.48 | 0.40 | NA | 0.16 | 0.65 | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | 0.30 | -0.14 | 0.02 | 0.14 | 0.03 | -2.01 | 0.30 | 0.06 | -0.10 | -0.82 | -1.13 | -0.61 | -5.78 | -0.30 | -1.81 | 0.77 | -2.96 | 0.66 | -0.60 | -0.31 | -4.34 | -0.15 | 0.31 | 0.27 | -2.32 | 0.57 | 0.98 | 0.23 | -0.61 | -0.96 | -0.03 | 0.18 | -0.83 | -0.41 | -0.96 | 0.02 | 0.47 | 0.40 | 0.62 | 0.16 | 0.64 | 0.50 | 0.68 | 0.51 | 0.50 | 0.31 |

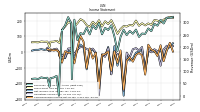

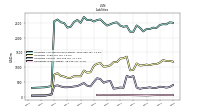

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 310.13 | 286.11 | 293.88 | 263.42 | 274.87 | 252.60 | 254.15 | 240.18 | 270.06 | 253.22 | 264.48 | 247.60 | 269.56 | 240.08 | 182.21 | 242.40 | 287.59 | 268.61 | 277.17 | 250.80 | 296.98 | 272.08 | 287.50 | 250.40 | 278.36 | 251.25 | 255.84 | 226.82 | 310.64 | 67.52 | 295.27 | 321.05 | 286.97 | 267.18 | 67.52 | 0.00 | 81.01 | 74.07 | 72.06 | 36.22 | 73.42 | 72.00 | 74.85 | 68.19 | 70.10 | 68.87 | |

| Revenues | 310.13 | 286.11 | 293.88 | 263.42 | 274.87 | 252.60 | 254.15 | 240.18 | 270.06 | 253.22 | 264.48 | 247.60 | 269.56 | 240.08 | 182.21 | 242.40 | 287.59 | 268.61 | 277.17 | 250.80 | 296.98 | 272.08 | 287.50 | 250.40 | 278.36 | 251.25 | 255.84 | 226.82 | 310.64 | 67.52 | 295.27 | 321.05 | 286.97 | 267.18 | 67.52 | 0.00 | 81.01 | 74.07 | 72.06 | 36.22 | 73.42 | 72.00 | 74.85 | 68.19 | 70.10 | 68.87 | |

| Cost Of Goods And Services Sold | 119.97 | 84.31 | 88.69 | 89.33 | 91.36 | 81.69 | 69.80 | 71.73 | 72.54 | 83.11 | 90.80 | 79.22 | 95.91 | 86.47 | 56.76 | 68.92 | 78.19 | 86.13 | 74.94 | 84.25 | 90.92 | 94.30 | 91.99 | 84.60 | 34.82 | 108.23 | 108.89 | 101.46 | 111.31 | NA | 106.45 | 130.65 | 123.57 | 130.21 | 9.54 | NA | 9.43 | 7.59 | NA | 3.66 | 6.77 | NA | NA | NA | NA | NA | |

| Gross Profit | 190.17 | 201.80 | 205.20 | 174.08 | 183.52 | 170.92 | 184.35 | 168.44 | 201.64 | 170.11 | 173.68 | 163.41 | 166.90 | 147.63 | 116.48 | 165.31 | 204.64 | 179.41 | 197.11 | 163.60 | 204.07 | 174.35 | 193.96 | 162.09 | 172.07 | 199.79 | 210.78 | 184.43 | 164.04 | 57.98 | 188.81 | 190.39 | 163.40 | 136.96 | 57.98 | NA | 71.58 | 66.48 | 65.53 | 32.56 | 66.65 | 65.59 | 67.42 | 61.73 | 63.17 | 62.33 | |

| Research And Development Expense | 46.17 | 46.54 | 51.12 | 49.99 | 44.93 | 35.73 | 34.23 | 40.92 | 44.10 | 42.13 | 52.56 | 44.62 | 44.48 | 47.37 | 25.15 | 35.90 | 25.87 | 45.90 | 34.54 | 43.58 | 37.64 | 42.42 | 34.22 | 31.75 | 5.61 | 31.39 | 43.01 | 29.65 | 28.38 | NA | 32.17 | 30.21 | 31.69 | 26.62 | 15.25 | 0.00 | 9.80 | 10.69 | NA | 6.75 | 10.82 | NA | NA | NA | NA | NA | |

| Selling General And Administrative Expense | 133.33 | 134.79 | 125.87 | 124.13 | 119.61 | 114.63 | 116.48 | 118.53 | 124.43 | 109.04 | 122.75 | 112.62 | 110.35 | 99.20 | 98.05 | 120.18 | 130.61 | 123.02 | 127.21 | 125.70 | 122.23 | 115.14 | 123.44 | 104.16 | 26.62 | 121.18 | 120.37 | 112.40 | 125.92 | NA | 107.55 | 120.18 | 115.58 | 98.17 | 41.19 | 0.00 | 33.71 | 29.69 | NA | 20.44 | 29.57 | NA | NA | NA | NA | NA | |

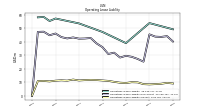

| Operating Income Loss | -87.99 | 4.46 | 17.38 | -2.34 | 13.96 | -131.97 | 31.76 | 9.51 | 24.75 | 17.87 | -34.86 | -4.42 | -249.02 | -7.51 | -15.24 | 0.61 | -143.98 | 25.76 | -29.88 | -20.78 | -276.45 | -5.76 | 21.61 | 12.53 | 18.33 | 32.06 | 31.08 | 18.61 | -14.88 | NA | 22.98 | 21.95 | -36.10 | -20.49 | -26.35 | 0.00 | 21.26 | 16.72 | NA | 5.37 | 26.26 | NA | NA | NA | NA | NA | |

| Interest Expense | 15.62 | 14.99 | 14.81 | 13.44 | 13.36 | 12.66 | 14.39 | 7.84 | 6.34 | 11.36 | 16.52 | 15.94 | 15.60 | 14.67 | 5.71 | 4.85 | 4.60 | 4.77 | 4.05 | 1.66 | 2.08 | 2.63 | 3.01 | 2.11 | 2.48 | 1.42 | 1.58 | 2.31 | 3.95 | NA | 3.50 | 1.98 | 1.19 | NA | 0.12 | NA | 0.02 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | -94.30 | -1.98 | 5.28 | 9.77 | 6.39 | -106.11 | 19.00 | 5.57 | -6.42 | -40.11 | -51.14 | -26.80 | -297.60 | -18.71 | -21.66 | -6.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -110.65 | 5.31 | 4.10 | 2.37 | 4.70 | 1.29 | 2.52 | 2.54 | 2.10 | 2.10 | 4.14 | 2.86 | -18.32 | -3.99 | 66.28 | -44.71 | -6.72 | -10.65 | -6.16 | -6.61 | -69.83 | -2.66 | -1.03 | 3.89 | 39.07 | 1.91 | 3.31 | 5.66 | -9.76 | NA | 9.73 | 8.42 | -1.26 | -18.32 | -1.46 | 0.00 | 6.80 | 6.35 | NA | 1.07 | 9.02 | NA | NA | NA | NA | NA | |

| Net Income Loss | 16.34 | -7.32 | 1.16 | 7.37 | 1.66 | -107.34 | 16.44 | 2.99 | -5.13 | -42.24 | -55.32 | -29.70 | -281.05 | -14.77 | -87.99 | 37.58 | -143.23 | 32.12 | -29.21 | -14.85 | -210.56 | -7.18 | 15.07 | 13.27 | -111.69 | 27.83 | 47.50 | 11.27 | -29.80 | -25.09 | -1.57 | 8.96 | -40.38 | -16.94 | -25.09 | 0.00 | 12.42 | 10.51 | 16.54 | 4.28 | 17.27 | 13.52 | 18.43 | 13.90 | 13.89 | 8.67 | |

| Comprehensive Income Net Of Tax | 43.26 | -26.54 | 6.61 | 14.46 | 46.65 | -145.58 | -22.29 | -5.96 | -18.92 | -62.13 | -34.18 | -55.57 | -241.63 | 9.93 | -70.56 | 4.45 | -121.01 | 3.68 | -13.68 | -19.09 | -234.79 | -4.79 | -42.48 | 22.87 | -104.84 | 65.43 | 103.33 | 24.79 | -72.94 | NA | -2.00 | -6.84 | 4.74 | -68.50 | -24.52 | 0.00 | 12.58 | 10.04 | NA | NA | 16.16 | NA | NA | NA | NA | NA |

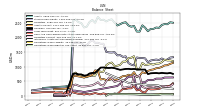

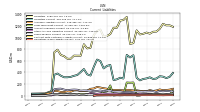

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 2429.56 | 2329.42 | 2341.55 | 2294.89 | 2294.77 | 2212.88 | 2336.24 | 2416.88 | 2200.95 | 2203.41 | 2396.52 | 2369.17 | 2411.35 | 2521.75 | 2502.66 | 2454.44 | 2411.80 | 2509.94 | 2621.66 | 2599.54 | 2549.70 | 2610.68 | 2597.14 | 2704.88 | 2503.89 | 2603.13 | 2533.68 | 2370.65 | 2342.63 | NA | 2496.96 | 2524.86 | 2617.71 | 2558.74 | 357.65 | NA | NA | 315.94 | NA | NA | NA | NA | 294.19 | NA | NA | NA | |

| Liabilities | 1151.93 | 1103.94 | 1100.95 | 1067.55 | 1087.15 | 1065.91 | 1054.24 | 1125.03 | 906.31 | 890.91 | 1356.05 | 1303.41 | 1292.52 | 1170.96 | 1169.48 | 1061.73 | 1028.08 | 1014.66 | 1138.33 | 1112.74 | 1045.96 | 825.69 | 814.10 | 885.89 | 688.58 | 688.70 | 690.16 | 635.72 | 635.72 | NA | 680.07 | 701.03 | 792.48 | 747.28 | 79.26 | NA | NA | 39.37 | NA | NA | NA | NA | 35.09 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 2429.56 | 2329.42 | 2341.55 | 2294.89 | 2294.77 | 2212.88 | 2336.24 | 2416.88 | 2200.95 | 2203.41 | 2396.52 | 2369.17 | 2411.35 | 2521.75 | 2502.66 | 2454.44 | 2411.80 | 2509.94 | 2621.66 | 2599.54 | 2549.70 | 2610.68 | 2597.14 | 2704.88 | 2503.89 | 2603.13 | 2533.68 | 2370.65 | 2342.63 | NA | 2496.96 | 2524.86 | 2617.71 | 2558.74 | 357.65 | NA | NA | 315.94 | NA | NA | NA | NA | 294.19 | NA | NA | NA | |

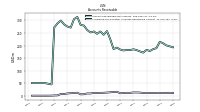

| Stockholders Equity | 1277.63 | 1225.47 | 1240.61 | 1227.34 | 1207.62 | 1146.96 | 1282.00 | 1291.85 | 1294.64 | 1312.50 | 1040.47 | 1065.76 | 1118.83 | 1350.79 | 1333.19 | 1392.71 | 1383.72 | 1495.28 | 1483.33 | 1486.81 | 1503.74 | 1784.99 | 1783.03 | 1818.98 | 1815.31 | 1914.43 | 1843.52 | 1734.93 | 1706.91 | NA | 1816.89 | 1823.83 | 1825.23 | 1811.46 | 278.39 | NA | NA | 276.57 | NA | NA | 269.89 | NA | 259.10 | NA | NA | NA |

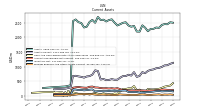

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 988.16 | 953.87 | 941.84 | 903.02 | 886.14 | 851.22 | 771.93 | 809.62 | 679.18 | 646.36 | 809.10 | 690.63 | 719.43 | 673.14 | 672.44 | 616.92 | 549.44 | 546.85 | 568.44 | 540.60 | 533.30 | 573.24 | 554.69 | 848.07 | 869.86 | 722.05 | 671.38 | 660.68 | 620.07 | NA | 647.33 | 662.34 | 683.67 | 673.41 | 282.41 | NA | NA | 240.72 | NA | NA | NA | NA | 220.43 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 266.50 | 233.94 | 222.94 | 214.34 | 214.17 | 231.11 | 109.02 | 128.74 | 207.99 | 181.85 | 329.39 | 252.54 | 252.83 | 227.81 | 232.55 | NA | 61.14 | 75.31 | 44.51 | 50.78 | 47.20 | 79.95 | 47.38 | 64.96 | 93.61 | 65.16 | 42.69 | 62.72 | 39.79 | NA | 63.63 | 63.89 | 87.47 | 112.61 | 189.78 | 0.00 | 162.36 | 124.19 | 116.21 | NA | 116.84 | NA | 103.30 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 577.87 | 532.72 | 534.36 | 522.96 | 515.62 | 506.28 | 406.77 | 442.38 | 207.99 | 181.85 | 329.39 | 252.54 | 252.83 | 227.81 | 232.55 | 125.82 | 61.14 | 75.31 | 44.51 | 50.78 | 47.20 | 79.95 | 47.38 | 64.96 | 93.61 | NA | NA | NA | 39.79 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 215.07 | 189.87 | 185.88 | 178.32 | 183.11 | 172.09 | 176.95 | 182.11 | 185.35 | 182.01 | 182.18 | 180.71 | 184.36 | 191.89 | 186.14 | 225.35 | 257.77 | 243.18 | 256.12 | 247.06 | 256.13 | 252.30 | 261.92 | 279.83 | 282.14 | 314.04 | 305.36 | 271.53 | 275.73 | NA | 284.35 | 299.63 | 288.54 | 272.35 | 45.57 | NA | NA | 50.57 | NA | NA | NA | NA | 50.67 | NA | NA | NA | |

| Inventory Net | 147.89 | 161.54 | 156.45 | 142.45 | 129.38 | 122.04 | 119.42 | 114.84 | 105.84 | 123.73 | 127.17 | 124.52 | 126.67 | 178.09 | 177.25 | 170.26 | 164.15 | 167.76 | 168.67 | 161.27 | 153.53 | 153.06 | 157.83 | 154.33 | 144.47 | 214.59 | 204.68 | 192.39 | 183.49 | NA | 197.65 | 192.73 | 210.76 | 212.45 | 25.94 | NA | NA | 23.96 | NA | NA | NA | NA | 17.63 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 27.18 | 44.23 | 38.85 | 34.95 | 24.99 | 23.59 | 35.36 | 41.03 | 35.74 | 26.81 | 28.82 | 28.75 | 24.79 | 32.03 | 34.84 | 42.40 | 28.60 | 22.50 | 24.87 | 34.27 | 29.57 | 37.67 | 35.62 | 31.10 | 39.04 | 55.18 | 49.21 | 56.05 | 60.45 | NA | 51.85 | 51.80 | 38.56 | 26.58 | NA | NA | NA | 4.81 | NA | NA | NA | NA | 3.69 | NA | NA | NA |

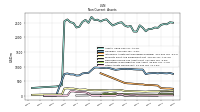

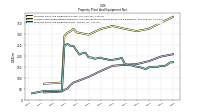

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 350.22 | NA | NA | NA | 322.31 | NA | NA | NA | 311.85 | NA | NA | NA | 322.43 | NA | NA | NA | 335.34 | NA | NA | NA | 321.44 | NA | NA | NA | 295.57 | NA | NA | NA | 306.42 | NA | 322.78 | 310.92 | 304.36 | 288.88 | 78.21 | NA | NA | 75.71 | NA | NA | NA | NA | 72.49 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 196.04 | NA | NA | NA | 175.12 | NA | NA | NA | 161.78 | NA | NA | NA | 158.62 | NA | NA | NA | 153.99 | NA | NA | NA | 130.03 | NA | NA | NA | 103.21 | NA | NA | NA | 82.58 | NA | 77.66 | 65.91 | 50.61 | 44.30 | 37.63 | NA | NA | 35.43 | NA | NA | NA | NA | 32.95 | NA | NA | NA | |

| Property Plant And Equipment Net | 154.18 | 149.30 | 149.57 | 149.06 | 147.19 | 139.16 | 143.31 | 147.96 | 150.07 | 152.73 | 157.41 | 157.89 | 163.81 | 190.51 | 185.67 | 183.53 | 181.35 | 179.51 | 185.10 | 185.95 | 191.40 | 188.46 | 186.16 | 191.70 | 192.36 | 213.77 | 211.16 | 205.12 | 223.84 | NA | 245.12 | 245.01 | 253.75 | 244.59 | 40.57 | NA | NA | 40.29 | NA | NA | NA | NA | 39.53 | NA | NA | NA | |

| Investments In Affiliates Subsidiaries Associates And Joint Ventures | 22.84 | NA | NA | NA | 16.27 | NA | NA | NA | 16.60 | NA | NA | NA | 31.09 | NA | NA | NA | 27.26 | NA | NA | NA | 24.82 | 24.11 | 21.13 | 22.08 | 34.49 | 46.38 | 41.01 | 58.73 | 61.09 | NA | 67.44 | 72.22 | 77.68 | 77.49 | NA | NA | NA | 17.13 | NA | NA | NA | NA | 15.94 | NA | NA | NA | |

| Goodwill | 782.94 | 767.05 | 779.21 | 774.45 | 768.79 | 742.37 | 898.07 | 896.60 | 899.52 | 905.15 | 918.27 | 909.99 | 922.32 | 918.48 | 902.20 | 888.57 | 915.79 | 945.54 | 961.72 | 952.12 | 956.82 | 969.28 | 965.70 | 875.56 | 784.24 | 781.07 | 763.52 | 698.28 | 691.71 | NA | 731.14 | 731.17 | 764.54 | 745.36 | NA | NA | NA | 0.00 | NA | NA | NA | NA | 0.00 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 261.18 | 347.67 | 357.42 | 364.06 | 368.56 | 365.03 | 389.38 | 390.45 | 399.68 | 408.95 | 419.18 | 423.85 | 437.64 | NA | NA | NA | 607.55 | NA | NA | NA | 770.44 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 149.17 | NA | NA | NA | 256.55 | NA | NA | NA | 287.68 | NA | NA | NA | 325.63 | 583.82 | 583.49 | 586.99 | 491.75 | 699.49 | 721.03 | 758.53 | 411.65 | 784.26 | 798.43 | 691.99 | 446.40 | 717.65 | 713.18 | 605.78 | 609.20 | NA | 650.37 | 659.28 | 674.74 | 658.94 | 10.40 | NA | NA | 10.17 | NA | NA | NA | NA | 11.65 | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | 894.95 | NA | NA | NA | 880.79 | NA | NA | NA | 1011.53 | NA | NA | NA | 1034.32 | NA | NA | NA | 1031.59 | NA | NA | NA | 1315.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Assets Noncurrent | 12.06 | 12.12 | 13.48 | 13.95 | 16.23 | 16.54 | 17.14 | 17.92 | 13.10 | 25.41 | 25.50 | 12.40 | 11.25 | 49.94 | 54.35 | 6.69 | 7.36 | 5.75 | 5.82 | 5.64 | 4.78 | 5.52 | 5.49 | 6.56 | 75.98 | 117.86 | 121.44 | 132.66 | 130.70 | NA | 149.56 | 146.55 | 5.52 | 5.45 | 2.08 | NA | NA | 1.56 | NA | NA | NA | NA | 0.86 | NA | NA | NA |

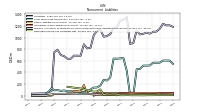

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 334.98 | 295.40 | 288.16 | 316.13 | 297.40 | 288.02 | 263.89 | 307.91 | 696.97 | 658.47 | 702.25 | 295.36 | 309.05 | 281.76 | 268.36 | 529.72 | 512.55 | 469.19 | 595.91 | 622.31 | 496.75 | 347.07 | 368.02 | 459.48 | 406.02 | 356.36 | 342.45 | 323.83 | 316.81 | NA | 316.89 | 343.91 | 381.55 | 359.12 | 71.01 | NA | NA | 31.45 | NA | NA | NA | NA | 29.90 | NA | NA | NA | |

| Debt Current | 18.11 | 19.03 | 19.07 | 22.30 | 23.43 | 21.70 | 6.24 | 4.75 | 229.67 | 227.77 | 232.01 | 11.79 | 13.34 | 13.95 | 7.45 | 223.31 | 77.40 | 68.78 | 37.73 | 39.44 | 28.79 | 48.98 | 110.59 | 119.71 | 84.03 | 52.07 | 55.78 | 45.46 | 47.65 | NA | 53.62 | 68.87 | 75.54 | 82.51 | NA | NA | NA | 0.00 | NA | NA | NA | NA | 0.00 | NA | NA | NA | |

| Long Term Debt Current | 17.48 | 18.42 | 18.44 | 21.56 | 20.89 | 18.75 | 3.21 | 1.73 | 226.95 | 223.61 | 226.98 | 7.70 | 8.38 | 9.69 | 3.64 | 176.14 | 73.18 | 65.68 | 29.81 | 22.88 | 23.30 | 23.58 | 21.64 | 25.07 | 25.84 | 24.12 | 23.35 | 21.59 | 21.30 | NA | 22.03 | 21.35 | 21.95 | 21.24 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Payable Current | 80.84 | 62.78 | 78.21 | 75.73 | 74.31 | 69.62 | 74.35 | 73.92 | 68.00 | 60.25 | 61.33 | 62.45 | 73.67 | 71.60 | 69.06 | 91.22 | 85.89 | 75.52 | 88.52 | 80.20 | 76.73 | 88.88 | 86.91 | 89.92 | 85.92 | 102.65 | 105.11 | 101.95 | 92.95 | NA | 104.55 | 121.15 | 118.86 | 109.59 | 15.61 | NA | NA | 7.25 | NA | NA | NA | NA | 7.57 | NA | NA | NA | |

| Other Accrued Liabilities Current | 24.45 | 22.17 | 18.33 | 27.96 | 26.23 | 25.71 | 34.00 | 30.52 | 28.64 | 27.74 | 27.42 | 31.43 | 25.41 | 34.07 | 34.37 | 35.47 | 32.19 | 35.85 | 40.36 | 31.85 | 39.02 | 45.47 | 19.57 | 16.39 | 14.26 | 20.50 | 18.58 | 19.34 | 19.13 | NA | 18.27 | 15.38 | 25.67 | 21.18 | 5.28 | NA | NA | 3.26 | NA | NA | NA | NA | 3.54 | NA | NA | NA | |

| Taxes Payable Current | 23.34 | 22.30 | 19.84 | 22.28 | 16.50 | 12.40 | 14.89 | 22.59 | 15.14 | 20.51 | 18.43 | 18.54 | 16.46 | 10.12 | 8.37 | 7.88 | 12.72 | 10.13 | 11.57 | 9.83 | 22.53 | 18.88 | 23.09 | 12.12 | 12.83 | 28.95 | 22.65 | 26.68 | 22.34 | NA | 16.66 | 20.12 | 26.95 | 26.70 | NA | NA | NA | 2.10 | NA | NA | NA | NA | 0.60 | NA | NA | NA | |

| Accrued Liabilities Current | 107.30 | 89.68 | 82.04 | 96.35 | 75.59 | 79.01 | 83.95 | 92.03 | 88.94 | 97.50 | 100.23 | 92.03 | 95.41 | 98.31 | 97.24 | 93.54 | 120.10 | 128.46 | 140.73 | 150.54 | 124.28 | 118.73 | 86.15 | 81.75 | 78.94 | 92.21 | 90.05 | 68.42 | 75.57 | NA | 62.05 | 63.23 | 80.53 | 80.51 | 55.41 | NA | NA | 24.20 | NA | NA | NA | NA | 4.77 | NA | NA | NA | |

| Contract With Customer Liability Current | 10.72 | 10.97 | 11.04 | 11.72 | 10.23 | 10.05 | 9.10 | 8.72 | 8.42 | 8.19 | 7.84 | 9.23 | 6.93 | 7.72 | 9.43 | 7.31 | 6.73 | 5.63 | NA | NA | 3.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 586.00 | 586.58 | 586.39 | 541.76 | 539.00 | 537.00 | 463.00 | 457.54 | 236.80 | 234.41 | 658.02 | 654.07 | 650.70 | NA | NA | NA | 333.51 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 122.86 | NA | 144.56 | 152.14 | 171.60 | 174.30 | NA | NA | NA | 0.00 | NA | NA | NA | NA | 0.00 | NA | NA | NA | |

| Long Term Debt Noncurrent | 568.54 | 568.16 | 567.95 | 520.20 | 518.07 | 518.25 | 459.79 | 455.81 | 9.85 | 10.80 | 431.03 | 646.37 | 642.30 | 637.11 | 639.19 | 315.56 | 260.33 | 272.89 | 174.38 | 141.85 | 139.54 | 108.09 | 50.41 | 63.65 | 61.96 | 71.85 | 69.74 | 76.07 | 75.22 | NA | 90.94 | 83.27 | 96.06 | 91.79 | NA | NA | NA | 0.00 | NA | NA | NA | NA | 0.00 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 11.57 | 9.93 | 8.92 | 8.63 | 8.52 | 6.53 | 7.66 | 7.88 | 7.73 | 8.31 | 10.46 | 8.15 | 8.91 | 28.36 | 30.11 | 25.99 | 32.22 | 16.13 | 108.77 | 73.14 | 68.19 | NA | NA | NA | 123.34 | NA | NA | NA | 152.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Pension And Other Postretirement Defined Benefit Plans Liabilities Noncurrent | 17.25 | 15.89 | 16.72 | 16.13 | 16.80 | 17.51 | 17.92 | 18.78 | 19.11 | 18.17 | 18.40 | 19.01 | 20.63 | 23.11 | 22.40 | 21.19 | 22.80 | 25.84 | 26.99 | 22.55 | 25.26 | 30.32 | 29.33 | 29.09 | 28.18 | 33.96 | 33.10 | 31.10 | 31.67 | NA | 32.01 | 31.89 | 32.53 | 31.14 | NA | NA | NA | 1.31 | NA | NA | NA | NA | 0.48 | NA | NA | NA | |

| Other Liabilities Noncurrent | 47.73 | 46.26 | 45.63 | 46.27 | 45.85 | 42.38 | 47.19 | 49.77 | 49.91 | 52.40 | 46.95 | 46.32 | 49.74 | 6.79 | 12.68 | 14.62 | 15.38 | 13.92 | 15.10 | 16.58 | 22.64 | 25.46 | 33.49 | 183.98 | 69.08 | 74.40 | 75.67 | 37.76 | 39.49 | NA | 27.17 | 29.61 | 31.81 | 29.74 | 1.37 | NA | NA | 0.83 | NA | NA | NA | NA | 4.71 | NA | NA | NA | |

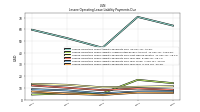

| Operating Lease Liability Noncurrent | 45.39 | 25.19 | 27.23 | 28.78 | 29.55 | 28.24 | 31.86 | 30.88 | 35.92 | 38.69 | 42.72 | 42.33 | 42.22 | 43.12 | 42.39 | 43.37 | 46.03 | 44.72 | 47.38 | 47.23 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1277.63 | 1225.47 | 1240.61 | 1227.34 | 1207.62 | 1146.96 | 1282.00 | 1291.85 | 1294.64 | 1312.50 | 1040.47 | 1065.76 | 1118.83 | 1350.79 | 1333.19 | 1392.71 | 1383.72 | 1495.28 | 1483.33 | 1486.81 | 1503.74 | 1784.99 | 1783.03 | 1818.98 | 1815.31 | 1914.43 | 1843.52 | 1734.93 | 1706.91 | NA | 1816.89 | 1823.83 | 1825.23 | 1811.46 | 278.39 | NA | NA | 276.57 | NA | NA | 269.89 | NA | 259.10 | NA | NA | NA | |

| Common Stock Value | 82.53 | 82.49 | 82.44 | 82.42 | 82.42 | 82.38 | 82.36 | 82.30 | 82.30 | 82.25 | 76.41 | 76.31 | 76.30 | 76.34 | 76.34 | 76.26 | 76.26 | 76.22 | 76.22 | 76.15 | 76.14 | 75.31 | 75.27 | 75.22 | 74.75 | 74.70 | 74.65 | 74.61 | 74.58 | NA | 75.54 | 75.73 | 75.64 | 75.44 | 0.32 | NA | NA | 0.32 | NA | NA | NA | NA | 0.32 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 2189.52 | 2180.66 | 2169.35 | 2162.93 | 2157.72 | 2143.76 | 2133.26 | 2121.10 | 2117.96 | 2107.39 | 1779.11 | 1770.41 | 1768.16 | 1758.47 | 1750.80 | 1739.87 | 1734.87 | 1725.48 | 1717.22 | 1707.12 | 1705.11 | 1750.89 | 1744.26 | 1738.04 | 1735.05 | 1731.57 | 1726.23 | 1721.24 | 1719.89 | NA | 1751.47 | 1756.21 | 1750.86 | 1742.03 | 466.46 | NA | NA | 445.36 | NA | NA | NA | NA | 426.87 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -966.48 | -982.82 | -975.50 | -976.66 | -984.03 | -985.69 | -878.35 | -894.79 | -897.78 | -879.65 | -837.42 | -782.10 | -752.40 | -472.58 | -457.80 | -369.81 | -406.75 | -263.52 | -295.64 | -266.43 | -251.58 | -40.93 | -33.76 | -48.82 | -39.66 | 72.02 | 44.19 | -3.30 | -14.57 | NA | 15.22 | 16.79 | 7.84 | 48.21 | 65.15 | NA | NA | 77.83 | NA | NA | NA | NA | 19.98 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -27.88 | -54.80 | -35.58 | -41.03 | -48.12 | -93.10 | -54.87 | -16.13 | -7.18 | 3.18 | 23.07 | 1.94 | 27.81 | -10.38 | -35.09 | -52.52 | -19.39 | -41.61 | NA | NA | -24.48 | NA | NA | NA | 45.31 | NA | NA | NA | -68.49 | NA | NA | NA | -9.11 | -54.23 | NA | NA | NA | -3.40 | -2.92 | NA | NA | NA | NA | NA | NA | NA | |

| Treasury Stock Value | 0.06 | 0.06 | 0.10 | 0.32 | 0.38 | 0.38 | 0.40 | 0.62 | 0.65 | 0.67 | 0.70 | 0.80 | 1.03 | 1.05 | 1.06 | 1.09 | 1.26 | 1.28 | 1.29 | 1.32 | 1.46 | 0.03 | 0.11 | 0.38 | 0.13 | 2.33 | 2.43 | 2.65 | 4.50 | NA | NA | NA | NA | 0.00 | 250.88 | NA | NA | 243.53 | NA | NA | NA | NA | 188.52 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

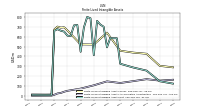

| Net Cash Provided By Used In Operating Activities | 53.96 | 18.14 | -17.94 | 20.76 | 18.70 | 35.64 | -10.24 | 25.82 | 33.48 | 23.95 | 25.63 | 19.48 | 36.98 | 8.66 | -19.02 | -106.05 | 2.87 | -76.59 | -19.39 | 1.97 | 20.89 | 51.06 | 28.14 | 20.39 | 17.67 | 42.10 | -1.65 | 33.21 | 40.80 | NA | 36.76 | 2.98 | 9.60 | NA | 30.72 | NA | 18.74 | 16.17 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -12.14 | -10.05 | -6.66 | -11.48 | -10.95 | -5.83 | -16.15 | -5.48 | -3.63 | -6.18 | 56.57 | -9.86 | -8.51 | -10.67 | -11.58 | -11.09 | -10.77 | -8.06 | -16.81 | -5.64 | -13.15 | -14.22 | -9.84 | -83.35 | -11.06 | -20.90 | -16.16 | -4.74 | -8.48 | NA | -13.72 | -7.10 | -8.95 | NA | -2.39 | NA | 18.35 | -1.20 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -5.02 | -4.28 | 36.01 | -5.24 | -1.66 | 73.23 | -6.32 | 214.88 | -3.30 | -164.10 | -5.76 | -8.33 | -5.17 | -3.77 | 136.60 | 183.09 | -7.16 | 116.68 | 29.47 | 7.59 | -39.44 | -3.84 | -31.12 | 32.05 | 21.29 | 0.20 | -4.17 | -6.03 | -54.72 | NA | -23.41 | -19.11 | -27.07 | NA | -1.04 | NA | 1.04 | -6.95 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 53.96 | 18.14 | -17.94 | 20.76 | 18.70 | 35.64 | -10.24 | 25.82 | 33.48 | 23.95 | 25.63 | 19.48 | 36.98 | 8.66 | -19.02 | -106.05 | 2.87 | -76.59 | -19.39 | 1.97 | 20.89 | 51.06 | 28.14 | 20.39 | 17.67 | 42.10 | -1.65 | 33.21 | 40.80 | NA | 36.76 | 2.98 | 9.60 | NA | 30.72 | NA | 18.74 | 16.17 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 16.34 | -7.32 | 1.16 | 7.37 | 1.66 | -107.34 | 16.44 | 2.99 | -5.13 | -42.24 | -55.32 | -29.70 | -281.05 | -14.77 | -87.99 | 37.58 | -143.23 | 32.12 | -29.21 | -14.85 | -210.56 | -7.18 | 15.07 | 13.27 | -111.69 | 27.83 | 47.50 | 11.27 | -29.80 | -25.09 | -1.57 | 8.96 | -40.38 | -16.94 | -25.09 | 0.00 | 12.42 | 10.51 | 16.54 | 4.28 | 17.27 | 13.52 | 18.43 | 13.90 | 13.89 | 8.67 | |

| Increase Decrease In Accounts Receivable | 20.62 | 7.53 | 8.27 | -7.56 | 3.15 | 0.79 | 2.37 | -1.49 | 7.89 | 3.19 | 1.29 | 3.37 | 6.61 | 0.85 | -41.92 | -24.34 | 10.75 | -5.71 | 7.34 | -7.06 | 9.32 | -8.71 | -12.69 | -9.11 | 29.83 | 3.19 | 22.48 | -6.57 | 5.41 | NA | -16.13 | 18.73 | 8.44 | 21.04 | -9.73 | NA | 4.54 | 3.75 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Inventories | -4.55 | 7.58 | 14.10 | 11.34 | 3.11 | 6.11 | 6.82 | 9.64 | 0.17 | -3.44 | -4.12 | 2.90 | -13.54 | -4.07 | 3.70 | 12.51 | -7.57 | 3.90 | 5.99 | 8.29 | 3.02 | -3.66 | 4.98 | 6.30 | -18.19 | 4.08 | 2.49 | 4.44 | -6.10 | NA | 4.13 | -13.94 | -10.80 | -38.08 | 1.05 | NA | 0.71 | 3.09 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 8.28 | 11.78 | 5.71 | 10.58 | 12.32 | 10.73 | 11.51 | 10.26 | 9.99 | 11.12 | 9.92 | 9.54 | 8.24 | 7.81 | 9.99 | 9.04 | 8.43 | 8.53 | 8.72 | 6.87 | 5.54 | 7.17 | 7.54 | 6.68 | 4.80 | 5.70 | 4.72 | 3.84 | 3.99 | NA | 4.77 | 4.69 | 6.12 | 12.24 | 15.68 | NA | 3.11 | 2.49 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Amortization Of Financing Costs | 4.81 | 4.71 | 4.52 | 5.02 | 4.94 | 4.67 | 7.31 | 4.41 | 3.57 | 4.10 | 4.58 | 4.41 | 4.24 | 4.25 | 0.68 | 0.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -12.14 | -10.05 | -6.66 | -11.48 | -10.95 | -5.83 | -16.15 | -5.48 | -3.63 | -6.18 | 56.57 | -9.86 | -8.51 | -10.67 | -11.58 | -11.09 | -10.77 | -8.06 | -16.81 | -5.64 | -13.15 | -14.22 | -9.84 | -83.35 | -11.06 | -20.90 | -16.16 | -4.74 | -8.48 | NA | -13.72 | -7.10 | -8.95 | NA | -2.39 | NA | 18.35 | -1.20 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 12.92 | 8.72 | 5.66 | 7.68 | 9.13 | 6.04 | 6.13 | 5.21 | 7.58 | 3.27 | 6.40 | 8.22 | 6.58 | 10.49 | 9.36 | 8.60 | 7.89 | 6.00 | 5.05 | 5.74 | 12.90 | 11.87 | 7.38 | 5.85 | 10.10 | 9.08 | 7.36 | 7.57 | 9.71 | NA | 10.95 | 7.69 | 8.14 | 12.98 | 1.39 | NA | 1.68 | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -5.02 | -4.28 | 36.01 | -5.24 | -1.66 | 73.23 | -6.32 | 214.88 | -3.30 | -164.10 | -5.76 | -8.33 | -5.17 | -3.77 | 136.60 | 183.09 | -7.16 | 116.68 | 29.47 | 7.59 | -39.44 | -3.84 | -31.12 | 32.05 | 21.29 | 0.20 | -4.17 | -6.03 | -54.72 | NA | -23.41 | -19.11 | -27.07 | NA | -1.04 | NA | 1.04 | -6.95 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-10-18 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-10-18 | 2015-09-30 | 2015-07-24 | 2015-04-24 | 2015-01-23 | 2014-12-26 | 2014-10-24 | 2014-07-25 | 2014-04-25 | 2014-01-24 | 2013-10-25 | 2013-07-26 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 310.13 | 286.11 | 293.88 | 263.42 | 274.87 | 252.60 | 254.15 | 240.18 | 270.06 | 253.22 | 264.48 | 247.60 | 269.56 | 240.08 | 182.21 | 242.40 | 287.59 | 268.61 | 277.17 | 250.80 | 296.98 | 272.08 | 287.50 | 250.40 | 278.36 | 251.25 | 255.84 | 226.82 | 310.64 | 67.52 | 295.27 | 321.05 | 286.97 | 267.18 | 67.52 | 0.00 | 81.01 | 74.07 | 72.06 | 36.22 | 73.42 | 72.00 | 74.85 | 68.19 | 70.10 | 68.87 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 310.13 | 286.11 | 293.88 | 263.42 | 274.87 | 252.60 | 254.15 | 240.18 | 270.06 | 253.22 | 264.48 | 247.60 | 269.56 | 240.08 | 182.21 | 242.40 | 287.59 | 268.61 | 277.17 | 250.80 | 296.98 | 272.08 | 287.50 | 250.40 | 278.36 | 251.25 | 255.84 | 226.82 | 310.64 | 67.52 | 295.27 | 321.05 | 286.97 | 267.18 | 67.52 | 0.00 | 81.01 | 74.07 | 72.06 | 36.22 | 73.42 | 72.00 | 74.85 | 68.19 | 70.10 | 68.87 | |

| Corporate Non | 1.62 | 1.45 | 0.68 | 0.78 | 1.65 | 1.18 | 1.18 | 1.19 | 37.75 | 1.29 | 0.97 | 0.74 | 0.79 | 0.80 | 0.46 | 0.67 | 1.02 | 0.64 | 0.66 | NA | NA | NA | NA | NA | 0.67 | 0.41 | 0.24 | 0.46 | 0.42 | NA | 0.48 | 0.40 | 0.44 | NA | 0.00 | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Advanced Circulatory Support | 10.11 | 10.95 | 9.42 | 9.84 | 9.63 | 8.64 | 9.35 | 11.68 | 13.79 | 15.40 | 13.28 | 12.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Cardiopulmonary | 161.47 | 144.83 | 150.60 | 132.07 | 136.46 | 120.96 | 125.82 | 117.08 | 133.15 | 123.23 | 117.88 | 108.72 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Neuromodulation | 136.93 | 128.88 | 133.18 | 120.72 | 127.14 | 121.83 | 117.80 | 110.23 | 121.55 | 113.29 | 117.64 | 103.70 | 109.17 | 98.41 | 57.21 | 89.66 | 113.09 | 112.54 | 104.27 | 94.65 | 113.55 | 104.94 | 110.65 | 93.84 | 99.79 | 91.02 | 97.02 | 87.16 | 90.50 | NA | 89.50 | 90.04 | 81.36 | NA | 67.52 | NA | 81.01 | 74.07 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating,, Advanced Circulatory Support | 0.23 | 0.28 | 0.17 | 0.08 | 0.23 | 0.11 | 0.50 | 0.60 | 0.36 | 0.35 | 0.18 | 0.23 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating,, Cardiopulmonary | 45.96 | 35.19 | 39.17 | 36.28 | 33.08 | 28.75 | 33.16 | 32.07 | 35.95 | 32.85 | 35.13 | 30.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating,, Neuromodulation | 16.37 | 12.66 | 15.12 | 13.28 | 12.99 | 11.13 | 13.71 | 12.46 | 12.64 | 12.52 | 14.60 | 11.68 | 11.54 | 10.47 | 6.42 | 10.58 | 12.18 | 10.43 | 13.00 | 10.66 | 10.71 | 9.50 | 11.94 | 10.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating,US, Advanced Circulatory Support | 9.83 | 10.56 | 9.20 | 9.66 | 9.34 | 8.43 | 8.79 | 10.96 | 13.37 | 14.93 | 12.96 | 12.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating,US, Cardiopulmonary | 56.93 | 48.55 | 46.71 | 36.11 | 45.05 | 38.48 | 37.87 | 38.10 | 40.78 | 40.14 | 37.39 | 35.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating,US, Neuromodulation | 106.46 | 102.47 | 104.06 | 94.49 | 99.40 | 96.50 | 91.43 | 87.21 | 95.67 | 88.72 | 91.78 | 82.30 | 85.16 | 79.85 | 44.22 | 73.28 | 89.46 | 88.43 | 80.55 | 76.89 | 94.40 | 87.19 | 89.39 | 77.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Locations Excluding The United States And Europe, Advanced Circulatory Support | 0.05 | 0.11 | 0.06 | 0.10 | 0.06 | 0.09 | 0.06 | 0.12 | 0.06 | 0.12 | 0.13 | 0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Locations Excluding The United States And Europe, Cardiopulmonary | 58.58 | 61.09 | 64.72 | 59.67 | 58.32 | 53.73 | 54.80 | 46.91 | 56.41 | 50.24 | 45.35 | 42.33 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Locations Excluding The United States And Europe, Neuromodulation | 14.09 | 13.74 | 13.99 | 12.95 | 14.74 | 14.20 | 12.65 | 10.56 | 13.24 | 12.05 | 11.25 | 9.72 | 12.46 | 8.08 | 6.58 | 5.80 | 11.44 | 13.69 | 10.72 | 7.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| 62.56 | 48.13 | 54.46 | 49.64 | 46.31 | 40.00 | 47.37 | 45.13 | 48.95 | 45.72 | 56.04 | 50.82 | 54.76 | 48.53 | 35.36 | 54.72 | 57.92 | 50.23 | 58.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | ||

| US | 173.22 | 161.58 | 159.97 | 140.27 | 153.79 | 143.41 | 138.09 | 136.27 | 149.83 | 143.79 | 144.34 | 133.34 | 138.00 | 128.86 | 78.19 | 123.58 | 145.08 | 138.43 | 134.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Locations Excluding The United States And Europe | 74.35 | 76.40 | 79.45 | 73.51 | 74.78 | 69.20 | 68.69 | 58.78 | 71.29 | 63.70 | 64.10 | 63.45 | 76.79 | 62.69 | 68.66 | 64.10 | 84.59 | 79.95 | 84.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |