| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Weighted Average Number Of Diluted Shares Outstanding | 69.75 | 69.53 | 69.33 | NA | 66.88 | 61.82 | 61.70 | NA | 61.58 | 61.44 | 60.22 | NA | 54.00 | 11.89 | 11.54 | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 69.75 | 69.53 | 69.33 | NA | 66.88 | 61.82 | 61.70 | NA | 61.58 | 61.44 | 60.22 | NA | 54.00 | 11.89 | 11.54 | NA | NA | NA | |

| Earnings Per Share Basic | -0.88 | -0.97 | -0.95 | -0.90 | -1.37 | -1.10 | -1.21 | -1.14 | -1.08 | -0.90 | -0.81 | -0.22 | -0.57 | -1.77 | -3.16 | NA | NA | NA | |

| Earnings Per Share Diluted | -0.88 | -0.97 | -0.95 | -0.90 | -1.37 | -1.10 | -1.21 | -1.14 | -1.08 | -0.90 | -0.81 | -0.22 | -0.57 | -1.77 | -3.16 | NA | NA | NA |

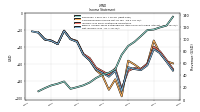

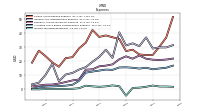

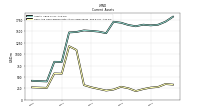

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

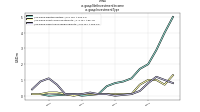

| Revenues | 114.50 | 104.60 | 95.20 | 88.40 | 74.00 | 50.00 | 44.30 | 41.00 | 35.70 | 28.20 | 23.50 | 20.50 | 17.80 | 29.90 | 26.20 | 23.50 | 19.00 | 13.80 | |

| Realized Investment Gains Losses | -0.70 | -0.10 | -0.10 | 0.00 | -0.40 | -0.40 | -0.10 | NA | -0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Premiums Earned Net | 86.60 | 76.50 | 68.20 | 63.20 | 50.60 | 31.20 | 27.40 | 25.40 | 21.50 | 16.30 | 13.80 | 12.30 | 10.50 | 29.20 | 25.30 | 22.20 | 17.80 | 13.30 | |

| Insurance Commissions And Fees | 4.20 | 5.00 | 4.80 | 3.80 | 3.90 | 2.10 | 2.00 | 1.70 | 1.30 | 1.10 | 0.50 | 0.10 | 0.10 | 0.10 | NA | 0.00 | 0.10 | 0.00 | |

| Net Investment Income | 7.00 | 5.60 | 5.00 | 3.70 | 2.60 | 1.20 | 0.90 | 0.90 | 0.60 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.90 | 1.30 | 1.10 | 0.50 | |

| Research And Development Expense | 21.80 | 24.10 | 21.80 | 23.50 | 21.40 | 17.80 | 16.90 | 16.40 | 14.30 | 14.00 | 7.10 | 6.40 | 5.30 | 4.20 | 3.50 | 3.40 | 2.80 | 2.10 | |

| General And Administrative Expense | 36.90 | 30.70 | 32.70 | 31.20 | 40.50 | 22.40 | 28.20 | 23.10 | 19.60 | 15.80 | 14.10 | 11.70 | 10.60 | 5.80 | 18.20 | 10.30 | 4.80 | 3.60 | |

| Selling And Marketing Expense | 24.40 | 24.80 | 28.20 | 27.20 | 35.80 | 37.00 | 38.30 | 37.20 | 42.20 | 33.10 | 29.10 | 22.90 | 22.20 | 16.10 | 19.20 | 23.60 | 27.50 | 19.00 | |

| Allocated Share Based Compensation Expense | 15.40 | 14.80 | 15.40 | 15.70 | 15.60 | 13.90 | 14.10 | 13.40 | 12.70 | 11.90 | 6.10 | 3.30 | 2.70 | 2.40 | 2.20 | 2.00 | 1.50 | 0.40 | |

| Income Tax Expense Benefit | 1.90 | 1.30 | 1.10 | -4.40 | 2.30 | 2.90 | 2.20 | 1.90 | 2.20 | 2.70 | 0.90 | 0.50 | 0.40 | 0.30 | 0.30 | 0.30 | 0.10 | 0.10 | |

| Income Taxes Paid | 0.30 | 0.10 | 0.20 | 0.00 | 0.70 | 1.60 | 1.10 | 1.10 | 1.00 | 0.50 | 0.60 | 0.50 | 0.30 | 0.30 | 0.50 | NA | NA | NA | |

| Net Income Loss | -61.50 | -67.20 | -65.80 | -63.70 | -91.40 | -67.90 | -74.80 | -70.30 | -66.40 | -55.60 | -49.00 | -33.90 | -30.90 | -21.00 | -36.50 | -32.70 | -31.10 | -23.10 | |

| Comprehensive Income Net Of Tax | -59.60 | -65.90 | -60.50 | -56.00 | -97.90 | -77.90 | -90.20 | -73.80 | -67.20 | -55.50 | -48.20 | -32.80 | -30.50 | -20.80 | -36.50 | -32.50 | -31.20 | -23.10 | |

| Net Income Loss Available To Common Stockholders Basic | -61.50 | -67.20 | -65.80 | -63.70 | -91.40 | -67.90 | -74.80 | -70.30 | -66.40 | -55.60 | -49.00 | -33.90 | -30.90 | -21.00 | -36.50 | -32.70 | -31.10 | -23.10 | |

| Net Income Loss Available To Common Stockholders Diluted | -61.50 | -67.20 | -65.80 | -63.70 | -91.40 | -67.90 | -74.80 | -70.30 | -66.40 | -55.60 | -49.00 | NA | NA | NA | NA | NA | NA | NA |

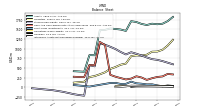

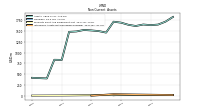

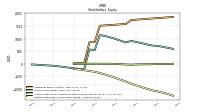

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 1647.60 | 1613.10 | 1641.20 | 1690.70 | 1712.90 | 1460.90 | 1495.40 | 1510.50 | 1521.70 | 1487.30 | 1477.50 | 828.70 | 831.50 | 399.90 | NA | 414.30 | NA | NA | |

| Liabilities | 920.70 | 842.10 | 819.40 | 823.90 | 806.10 | 611.80 | 582.70 | 522.30 | 473.70 | 385.70 | 333.80 | 287.70 | 262.50 | 141.30 | NA | 116.60 | NA | NA | |

| Liabilities And Stockholders Equity | 1647.60 | 1613.10 | 1641.20 | 1690.70 | 1712.90 | 1460.90 | 1495.40 | 1510.50 | 1521.70 | 1487.30 | 1477.50 | 828.70 | 831.50 | 399.90 | NA | 414.30 | NA | NA | |

| Stockholders Equity | 726.90 | 771.00 | 821.80 | 866.80 | 906.80 | 849.10 | 912.70 | 988.20 | 1048.00 | 1101.60 | 1143.70 | 541.00 | 569.00 | -221.60 | -204.60 | -182.50 | -152.20 | -122.70 |

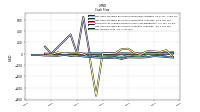

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 231.70 | 188.60 | 250.10 | 282.50 | 222.00 | 199.60 | 234.80 | 270.60 | 319.40 | 1092.40 | 1174.40 | 570.80 | 575.40 | 258.50 | NA | 270.00 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 238.10 | 193.80 | 254.80 | 286.50 | 225.00 | 199.60 | 235.00 | 270.60 | 319.60 | 1092.70 | 1174.70 | 571.40 | 575.70 | 258.80 | 274.20 | 270.30 | 303.20 | 226.90 | |

| Short Term Investments | 73.40 | 71.30 | 89.40 | 99.80 | 142.80 | 85.90 | 83.20 | 110.40 | 107.50 | NA | NA | NA | 15.00 | 29.90 | NA | 54.70 | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | 650.30 | 693.10 | 674.10 | 694.70 | 691.40 | 697.60 | 71.20 | 6.50 | 6.60 | 6.70 | 6.70 | NA | 5.90 | NA | NA |

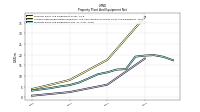

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 37.80 | NA | NA | NA | 17.60 | NA | NA | NA | 8.10 | NA | NA | NA | 3.80 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 18.20 | NA | NA | NA | 5.90 | NA | NA | NA | 2.40 | NA | NA | NA | 0.70 | NA | NA | |

| Property Plant And Equipment Net | 17.40 | 19.00 | 19.80 | 19.60 | 19.10 | 13.20 | 13.00 | 11.70 | 10.80 | 8.80 | 6.90 | 5.70 | 5.10 | 4.30 | NA | 3.10 | NA | NA | |

| Goodwill | 19.00 | 19.00 | 19.00 | 19.00 | 10.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 25.20 | 27.50 | 29.80 | 32.50 | 35.70 | NA | NA | 0.60 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 24.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | 673.50 | 722.20 | 698.40 | 714.50 | 696.80 | 698.60 | 71.30 | 6.40 | 6.40 | 6.50 | 6.50 | NA | 5.80 | NA | NA |

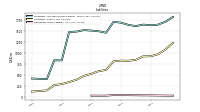

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 726.90 | 771.00 | 821.80 | 866.80 | 906.80 | 849.10 | 912.70 | 988.20 | 1048.00 | 1101.60 | 1143.70 | 541.00 | 569.00 | -221.60 | -204.60 | -182.50 | -152.20 | -122.70 | |

| Additional Paid In Capital | 1800.20 | 1784.70 | 1769.60 | 1754.10 | 1738.10 | 1582.50 | 1568.20 | 1553.50 | 1539.50 | 1525.90 | 1512.30 | 859.80 | 855.00 | 33.90 | NA | 15.70 | NA | NA | |

| Retained Earnings Accumulated Deficit | -1054.20 | -992.70 | -925.50 | -859.70 | -796.00 | -704.60 | -636.70 | -561.90 | -491.60 | -425.20 | -369.60 | -320.60 | -286.70 | -255.80 | NA | -198.30 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -19.10 | -21.00 | -22.30 | -27.60 | -35.30 | -28.80 | -18.80 | -3.40 | 0.10 | 0.90 | 1.00 | 1.80 | 0.70 | 0.30 | NA | 0.10 | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 15.40 | 14.80 | 15.40 | NA | 15.60 | 13.90 | 14.10 | NA | 12.70 | 11.90 | 6.10 | NA | 2.70 | 2.40 | 2.20 | NA | 1.50 | 0.40 |

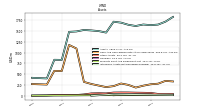

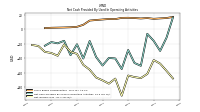

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

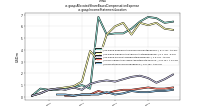

| Net Cash Provided By Used In Operating Activities | -6.30 | -50.30 | -46.40 | -28.60 | -54.70 | -40.20 | -39.50 | -49.90 | -38.20 | -16.20 | -40.30 | -20.70 | -35.70 | -15.90 | -19.40 | -17.70 | -22.70 | NA | |

| Net Cash Provided By Used In Investing Activities | 43.70 | -10.90 | 15.30 | 87.50 | 80.60 | 8.90 | 4.10 | 2.30 | -737.80 | -67.30 | -2.00 | 13.80 | 13.80 | -1.00 | 23.50 | -15.30 | -26.20 | NA | |

| Net Cash Provided By Used In Financing Activities | 7.90 | 0.20 | 0.10 | 0.30 | 2.30 | 0.40 | 0.60 | 0.60 | 0.90 | 1.70 | 646.40 | 1.50 | 338.20 | NA | NA | 0.20 | 125.20 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -6.30 | -50.30 | -46.40 | -28.60 | -54.70 | -40.20 | -39.50 | -49.90 | -38.20 | -16.20 | -40.30 | -20.70 | -35.70 | -15.90 | -19.40 | -17.70 | -22.70 | NA | |

| Net Income Loss | -61.50 | -67.20 | -65.80 | -63.70 | -91.40 | -67.90 | -74.80 | -70.30 | -66.40 | -55.60 | -49.00 | -33.90 | -30.90 | -21.00 | -36.50 | -32.70 | -31.10 | -23.10 | |

| Depreciation Depletion And Amortization | 5.00 | 5.10 | 5.10 | 5.40 | 3.70 | 1.60 | 1.50 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Increase Decrease In Accounts Payable | 2.00 | -1.20 | 0.80 | -0.40 | -0.60 | -1.30 | 1.60 | -2.00 | 1.70 | 0.30 | -0.40 | 0.40 | 0.20 | -0.10 | 0.20 | 0.00 | -0.60 | NA | |

| Share Based Compensation | 15.40 | 14.80 | 15.40 | 15.70 | 15.60 | 13.90 | 14.10 | 13.40 | 12.70 | 11.90 | 6.10 | 3.30 | 2.70 | 2.40 | 2.20 | 2.00 | 1.50 | NA |

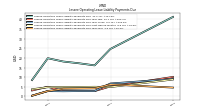

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 43.70 | -10.90 | 15.30 | 87.50 | 80.60 | 8.90 | 4.10 | 2.30 | -737.80 | -67.30 | -2.00 | 13.80 | 13.80 | -1.00 | 23.50 | -15.30 | -26.20 | NA | |

| Payments To Acquire Property Plant And Equipment | 2.20 | 1.90 | 2.70 | 2.60 | 2.90 | 1.80 | 2.80 | 2.00 | 2.70 | 2.70 | 2.00 | 1.30 | 1.20 | 1.20 | 0.70 | -0.30 | 1.60 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 7.90 | 0.20 | 0.10 | 0.30 | 2.30 | 0.40 | 0.60 | 0.60 | 0.90 | 1.70 | 646.40 | 1.50 | 338.20 | NA | NA | 0.20 | 125.20 | NA |

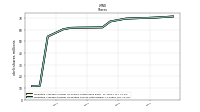

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 114.50 | 104.60 | 95.20 | 88.40 | 74.00 | 50.00 | 44.30 | 41.00 | 35.70 | 28.20 | 23.50 | 20.50 | 17.80 | 29.90 | 26.20 | 23.50 | 19.00 | 13.80 |