| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.43 | 0.41 | 0.41 | 0.41 | 0.41 | 0.40 | 0.40 | 0.40 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.39 | 0.39 | 0.39 | 0.38 | 0.38 | 0.36 | 0.36 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.31 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | NA | 0.26 | NA | NA | NA | |

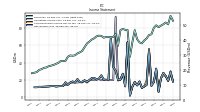

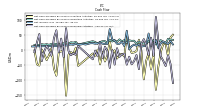

| Earnings Per Share Basic | 0.67 | 0.54 | 0.15 | 0.80 | 0.44 | 0.33 | 1.37 | 0.36 | 0.32 | 0.28 | 0.46 | 0.35 | 0.45 | 0.31 | 0.05 | 1.60 | 0.31 | 0.68 | 0.51 | 0.51 | 0.78 | 0.88 | 1.74 | 0.51 | 0.50 | 0.52 | 0.64 | 0.54 | 0.53 | 0.57 | 0.58 | 0.53 | 0.49 | 0.53 | 0.48 | 0.47 | 0.58 | 0.47 | 0.50 | 0.47 | 0.40 | 0.47 | 0.36 | 0.40 | 0.39 | 0.38 | 0.40 | 0.40 | 0.39 | 0.38 | 0.38 | 0.20 | 0.37 | 0.22 | 0.33 | 0.29 | |

| Earnings Per Share Diluted | 0.67 | 0.54 | 0.15 | 0.80 | 0.44 | 0.32 | 1.36 | 0.36 | 0.32 | 0.28 | 0.46 | 0.35 | 0.45 | 0.31 | 0.05 | 1.60 | 0.31 | 0.68 | 0.51 | 0.51 | 0.77 | 0.88 | 1.73 | 0.51 | 0.50 | 0.52 | 0.64 | 0.54 | 0.53 | 0.57 | 0.58 | 0.53 | 0.48 | 0.52 | 0.48 | 0.47 | 0.57 | 0.46 | 0.50 | 0.46 | 0.40 | 0.47 | 0.36 | 0.40 | 0.39 | 0.38 | 0.40 | 0.40 | 0.39 | 0.38 | 0.37 | 0.20 | 0.37 | 0.22 | 0.33 | 0.29 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

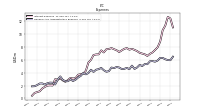

| Revenues | 50.20 | 49.30 | 48.25 | 49.50 | 47.84 | 43.50 | 43.02 | 40.79 | 39.44 | 37.47 | 38.13 | 40.28 | 46.27 | 38.17 | 28.48 | 46.41 | 46.46 | 47.12 | 46.27 | 35.86 | 43.59 | 41.78 | 41.47 | 41.81 | 41.73 | 41.25 | 42.47 | 42.62 | 42.14 | 40.84 | 40.00 | 38.60 | 37.39 | 34.94 | 32.39 | 31.48 | 30.75 | 29.54 | 29.23 | 29.44 | 28.59 | 25.82 | 25.68 | 25.66 | 24.51 | 23.79 | 23.09 | 22.64 | 22.30 | 21.43 | 21.18 | 20.25 | 19.82 | 18.36 | 17.93 | 17.59 | |

| Costs And Expenses | 38.65 | 31.92 | 42.32 | 31.69 | 30.04 | 30.10 | 27.00 | 26.76 | 26.96 | 29.44 | 25.64 | 25.95 | 28.66 | 26.29 | 26.10 | 26.77 | 26.23 | 26.84 | 26.36 | 16.51 | 21.49 | 21.94 | 21.61 | 22.08 | 21.28 | 21.25 | 22.72 | 21.55 | 21.77 | 20.50 | 19.90 | 19.02 | 20.30 | 15.97 | 15.21 | 14.04 | 13.57 | 12.42 | 12.09 | 12.43 | 13.94 | 11.40 | 11.79 | 12.69 | 11.73 | 11.29 | 9.95 | 9.69 | 9.66 | 8.98 | 8.84 | 7.98 | 7.79 | 6.82 | 6.25 | NA | |

| General And Administrative Expense | 5.94 | 5.96 | 6.09 | 6.29 | 6.30 | 5.89 | 5.71 | 5.81 | 5.77 | 5.32 | 5.34 | 5.03 | 5.22 | 4.81 | 4.58 | 5.10 | 4.54 | 4.75 | 4.60 | 4.57 | 4.80 | 4.88 | 4.72 | 4.80 | 4.24 | 4.14 | 4.39 | 4.74 | 4.55 | 4.46 | 4.12 | 4.46 | 3.95 | 3.74 | 3.95 | 3.50 | 3.27 | 2.91 | 2.70 | 2.95 | 2.67 | 2.68 | 2.87 | 3.42 | 2.91 | 2.17 | 2.43 | 2.45 | 2.36 | 2.15 | 2.33 | 2.31 | 2.07 | 1.90 | 1.87 | NA | |

| Operating Income Loss | 28.29 | 22.25 | 6.23 | 33.19 | 17.82 | 13.01 | 54.11 | 14.13 | 12.55 | 10.74 | 17.95 | 13.56 | 17.66 | 11.91 | 2.57 | 63.49 | 15.61 | 26.52 | 20.41 | 19.34 | 92.78 | 19.84 | 19.86 | 19.73 | 20.45 | 20.00 | 19.75 | 21.07 | 20.37 | 20.34 | 20.10 | 19.59 | 17.09 | 18.97 | 17.18 | 17.44 | 17.18 | 17.12 | 17.13 | 17.00 | 14.65 | 14.43 | 13.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Expense | 12.42 | 12.67 | 11.31 | 10.61 | 8.83 | 7.94 | 7.52 | 7.14 | 6.93 | 6.61 | 6.86 | 6.97 | 7.09 | 7.36 | 7.55 | 7.71 | 7.58 | 7.83 | 7.71 | 7.47 | 7.21 | 7.50 | 7.66 | 7.83 | 7.68 | 7.64 | 7.15 | 7.47 | 6.86 | 6.84 | 6.75 | 6.00 | 5.58 | 4.30 | 3.85 | 3.77 | 3.68 | 3.17 | 3.09 | 3.19 | 2.85 | 2.58 | 2.80 | 3.13 | 2.91 | 2.99 | 2.00 | 2.03 | 1.99 | 1.79 | 1.54 | 1.10 | 0.98 | 0.85 | 0.42 | NA | |

| Interest Paid Net | 12.14 | 12.35 | 11.26 | 11.42 | 6.42 | 8.47 | 6.38 | 7.53 | 6.02 | 7.27 | 5.86 | 7.58 | 5.91 | 8.39 | 6.21 | 8.94 | 6.34 | 8.87 | 6.36 | 7.20 | 6.25 | 8.88 | 6.33 | 8.67 | 6.19 | 7.76 | 6.54 | 7.57 | 5.49 | 6.96 | 5.24 | 6.81 | 3.85 | 5.08 | 2.37 | 4.77 | 2.62 | 4.48 | 2.23 | 4.38 | 1.53 | 3.83 | 1.92 | 4.12 | 1.89 | 1.64 | 2.06 | 1.85 | 1.50 | 1.49 | 1.01 | 1.03 | 0.77 | 0.22 | NA | NA | |

| Profit Loss | 28.67 | 22.63 | 6.60 | 33.56 | 18.20 | 13.39 | 54.49 | 14.51 | 12.93 | 11.11 | 18.33 | 13.85 | 17.66 | 12.34 | 1.95 | 63.72 | 12.63 | 27.28 | 20.53 | 20.43 | 30.84 | 34.94 | 68.94 | 20.36 | 19.83 | 20.62 | 25.38 | 21.51 | 20.67 | 22.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 14.65 | 17.29 | 12.90 | 12.98 | 12.78 | 12.50 | 13.11 | 12.93 | 12.60 | 12.42 | 12.26 | 12.15 | 12.29 | 11.56 | 11.63 | NA | |

| Net Income Loss | 28.23 | 22.20 | 6.17 | 33.13 | 17.94 | 13.29 | 54.38 | 14.41 | 12.84 | 11.02 | 18.24 | 13.76 | 17.57 | 12.22 | 1.87 | 63.63 | 12.54 | 27.19 | 20.45 | 20.35 | 30.77 | 34.92 | 68.94 | 20.36 | 19.83 | 20.62 | 25.38 | 21.51 | 20.67 | 22.41 | 22.18 | 19.86 | 17.95 | 19.65 | 17.93 | 17.55 | 21.00 | 17.12 | 18.27 | 17.00 | 14.65 | 17.29 | 12.90 | 12.98 | 12.77 | 12.49 | 13.10 | 12.92 | 12.56 | 12.38 | 12.21 | 12.11 | 12.24 | 11.51 | 11.58 | NA | |

| Comprehensive Income Net Of Tax | 25.74 | 22.23 | 7.38 | 31.77 | 17.21 | 16.60 | 55.92 | 19.38 | 12.39 | 11.11 | 18.33 | 13.85 | 17.66 | 12.34 | 1.95 | 63.72 | 12.63 | 27.28 | 20.53 | 20.43 | 30.84 | 34.94 | 68.94 | 20.36 | 19.83 | 20.62 | 25.38 | 21.51 | 20.66 | 22.41 | 22.18 | 19.83 | 17.95 | 19.64 | 17.92 | 17.54 | 20.99 | 17.11 | 18.26 | 17.00 | 14.64 | 17.28 | 12.89 | 12.97 | 12.76 | 12.49 | 13.09 | 12.91 | 12.54 | 12.36 | 12.20 | 12.09 | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 28.08 | 22.05 | 6.03 | 32.93 | 17.84 | 13.16 | 54.06 | 14.28 | 12.73 | 10.91 | 18.13 | 13.64 | 17.49 | 12.11 | 1.77 | 63.37 | 12.45 | 27.08 | 20.35 | 20.25 | 30.64 | 34.78 | 68.66 | 20.27 | 19.75 | 20.54 | 25.27 | 21.42 | 20.58 | 22.32 | 22.07 | 19.76 | 17.84 | 18.71 | 16.98 | 16.61 | 20.04 | 16.18 | 17.34 | 16.08 | 13.73 | 16.37 | 11.99 | 12.06 | 11.85 | 11.58 | 12.19 | 12.01 | 11.66 | 11.47 | 11.31 | 5.39 | 9.58 | 5.57 | 7.74 | 6.69 | |

| Net Income Loss Available To Common Stockholders Diluted | 28.08 | 22.05 | 6.03 | 32.93 | 17.84 | 13.16 | 54.06 | 14.28 | 12.73 | 10.91 | 18.13 | 13.64 | 17.49 | 12.11 | 1.77 | 63.37 | 12.45 | 27.08 | 20.35 | 20.35 | 30.77 | 34.92 | 68.94 | 20.27 | 19.83 | 20.62 | 25.38 | 21.51 | 20.67 | 22.41 | 22.18 | 19.76 | 17.84 | 19.53 | 17.80 | 17.43 | 20.86 | 17.00 | 18.16 | 16.90 | 11.28 | 17.19 | 11.99 | 12.06 | 11.85 | 11.58 | 12.19 | 12.01 | 11.66 | 11.47 | 11.31 | 5.39 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

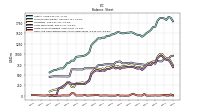

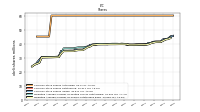

| Assets | 1855.10 | 1867.86 | 1858.24 | 1798.86 | 1656.10 | 1651.96 | 1578.23 | 1536.10 | 1504.83 | 1453.09 | 1416.47 | 1455.30 | 1459.49 | 1477.24 | 1510.17 | 1524.79 | 1514.21 | 1512.23 | 1499.48 | 1496.37 | 1513.62 | 1535.85 | 1499.63 | 1479.13 | 1465.57 | 1431.19 | 1440.56 | 1391.59 | 1394.90 | 1373.39 | 1380.12 | 1318.85 | 1275.42 | 1216.91 | 1043.05 | 995.42 | 965.82 | 952.57 | 945.19 | 942.24 | 931.41 | 841.24 | 845.06 | 792.66 | 789.59 | 709.83 | 654.85 | 658.60 | 647.10 | 619.02 | 614.42 | NA | 561.26 | NA | NA | NA | |

| Liabilities | 938.83 | 1007.48 | 998.63 | 934.24 | 805.80 | 826.80 | 767.73 | 793.50 | 759.70 | 700.16 | 654.09 | 690.53 | 683.68 | 698.42 | 722.87 | 718.73 | 728.78 | 718.34 | 711.87 | 708.21 | 680.65 | 712.56 | 693.93 | 722.27 | 706.92 | 674.56 | 683.39 | 638.45 | 654.85 | 632.75 | 649.38 | 646.16 | 616.22 | 555.71 | 383.53 | 336.04 | 305.70 | 320.89 | 312.91 | 310.47 | 298.97 | 205.22 | 209.84 | 325.85 | 326.48 | 244.94 | 189.39 | 193.23 | 178.39 | 149.77 | 144.32 | NA | 103.74 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1855.10 | 1867.86 | 1858.24 | 1798.86 | 1656.10 | 1651.96 | 1578.23 | 1536.10 | 1504.83 | 1453.09 | 1416.47 | 1455.30 | 1459.49 | 1477.24 | 1510.17 | 1524.79 | 1514.21 | 1512.23 | 1499.48 | 1496.37 | 1513.62 | 1535.85 | 1499.63 | 1479.13 | 1465.57 | 1431.19 | 1440.56 | 1391.59 | 1394.90 | 1373.39 | 1380.12 | 1318.85 | 1275.42 | 1216.91 | 1043.05 | 995.42 | 965.82 | 952.57 | 945.19 | 942.24 | 931.41 | 841.24 | 845.06 | 792.66 | 789.59 | 709.83 | 654.85 | 658.60 | 647.10 | 619.02 | 614.42 | NA | 561.26 | NA | NA | NA | |

| Stockholders Equity | 881.28 | 825.41 | 824.67 | 838.82 | 828.37 | 803.25 | 802.97 | 734.19 | 736.71 | 744.52 | 753.98 | 756.37 | 767.40 | 770.42 | 778.89 | 797.63 | 776.94 | 785.43 | 779.17 | 779.76 | 825.49 | 815.84 | 801.13 | 753.38 | 755.16 | 756.63 | 757.17 | 753.14 | 740.05 | 740.63 | 730.74 | 672.69 | 659.20 | 661.21 | 659.52 | 659.38 | 660.12 | 631.68 | 632.28 | 631.77 | 632.44 | 636.02 | 635.23 | 466.81 | 463.10 | 464.54 | 465.06 | 464.97 | 466.75 | 467.28 | 468.14 | NA | 455.56 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

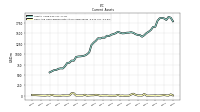

| Cash And Cash Equivalents At Carrying Value | 20.29 | 11.30 | 7.03 | 5.54 | 10.38 | 6.48 | 6.40 | 4.39 | 5.16 | 45.46 | 5.71 | 8.20 | 7.77 | 22.81 | 50.37 | 30.89 | 4.24 | 3.96 | 3.21 | 6.71 | 2.66 | 20.41 | 4.26 | 3.78 | 5.21 | 3.84 | 9.30 | 8.73 | 7.99 | 3.61 | 17.76 | 24.28 | 12.94 | 11.73 | 8.05 | 3.42 | 25.24 | 7.59 | 8.06 | 7.54 | 6.78 | 60.34 | 63.31 | 9.62 | 7.19 | 8.27 | 10.31 | 3.30 | 4.41 | 5.21 | 6.39 | 23.39 | 6.90 | 12.49 | 5.50 | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 20.29 | 11.30 | 7.03 | 5.54 | 10.38 | 6.48 | 6.40 | 4.39 | 5.16 | 45.46 | 5.71 | 8.20 | 7.77 | 22.81 | 50.37 | 30.89 | 4.24 | 6.07 | 5.32 | 8.82 | 4.76 | 22.57 | 6.71 | 3.78 | 5.21 | 3.84 | 9.30 | NA | 7.99 | NA | NA | NA | 12.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 121.72 | 123.92 | 124.90 | 123.34 | 124.67 | 124.67 | 125.79 | 120.20 | 123.24 | 123.24 | 123.24 | 126.33 | 127.77 | 127.77 | 127.77 | 127.77 | 126.70 | 129.40 | 126.03 | 125.90 | 125.36 | 125.53 | 125.88 | 121.50 | 124.04 | 121.90 | 122.85 | 115.79 | 116.10 | 114.63 | 113.75 | 108.87 | 106.84 | 98.49 | 85.18 | 83.86 | 80.02 | 79.66 | 79.21 | 80.99 | 80.99 | 76.75 | 75.09 | 75.41 | 75.41 | 63.12 | 60.36 | 58.46 | 57.09 | 50.41 | 48.23 | NA | 43.03 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Finite Lived Intangible Assets Net | 13.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 891.32 | 956.22 | 953.39 | 901.04 | 767.85 | 793.76 | 734.87 | 762.78 | 722.72 | 661.83 | 618.46 | 659.42 | 649.38 | 664.34 | 689.47 | 689.43 | 693.39 | 683.87 | 675.84 | 675.80 | 645.03 | 670.99 | 652.44 | 687.39 | 667.50 | 637.95 | 642.90 | 597.87 | 609.39 | 589.26 | 606.73 | 608.26 | 571.87 | 517.97 | 357.97 | NA | 281.63 | NA | NA | NA | 278.83 | NA | NA | NA | 303.94 | NA | NA | NA | 159.20 | 3.20 | 3.20 | NA | 3.73 | NA | NA | NA | |

| Minority Interest | 34.99 | 34.97 | 34.95 | 25.79 | 21.94 | 21.92 | 7.52 | 8.41 | 8.41 | 8.41 | 8.40 | 8.40 | 8.40 | 8.40 | 8.41 | 8.43 | 8.48 | 8.46 | 8.44 | 8.39 | 7.48 | 7.45 | 4.57 | 3.49 | 3.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.01 | 0.35 | 0.41 | 0.41 | 1.96 | 1.96 | 1.96 | NA | 1.96 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 881.28 | 825.41 | 824.67 | 838.82 | 828.37 | 803.25 | 802.97 | 734.19 | 736.71 | 744.52 | 753.98 | 756.37 | 767.40 | 770.42 | 778.89 | 797.63 | 776.94 | 785.43 | 779.17 | 779.76 | 825.49 | 815.84 | 801.13 | 753.38 | 755.16 | 756.63 | 757.17 | 753.14 | 740.05 | 740.63 | 730.74 | 672.69 | 659.20 | 661.21 | 659.52 | 659.38 | 660.12 | 631.68 | 632.28 | 631.77 | 632.44 | 636.02 | 635.23 | 466.81 | 463.10 | 464.54 | 465.06 | 464.97 | 466.75 | 467.28 | 468.14 | NA | 455.56 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 916.27 | 860.38 | 859.62 | 864.62 | 850.31 | 825.17 | 810.50 | 742.60 | 745.13 | 752.93 | 762.38 | 764.77 | 775.81 | 778.82 | 787.30 | 806.05 | 785.43 | 793.89 | 787.61 | 788.15 | 832.97 | 823.29 | 805.70 | 756.86 | 758.65 | 756.63 | 757.17 | 753.14 | 740.05 | NA | NA | NA | 659.20 | NA | NA | NA | 660.12 | NA | NA | NA | 632.44 | 636.02 | 635.23 | 466.81 | 463.11 | 464.89 | 465.46 | 465.38 | 468.71 | 469.24 | 470.11 | NA | 457.52 | NA | NA | NA | |

| Common Stock Value | 0.43 | 0.41 | 0.41 | 0.41 | 0.41 | 0.40 | 0.40 | 0.40 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.39 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.39 | 0.39 | 0.39 | 0.38 | 0.38 | 0.36 | 0.36 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.31 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | NA | 0.26 | NA | NA | NA | |

| Additional Paid In Capital | 991.66 | 937.55 | 935.43 | 933.37 | 931.12 | 899.92 | 893.15 | 857.56 | 856.89 | 854.92 | 852.96 | 851.15 | 852.78 | 851.00 | 849.33 | 847.57 | 867.35 | 865.72 | 863.99 | 862.38 | 862.71 | 861.23 | 858.83 | 857.43 | 856.99 | 855.75 | 854.34 | 853.13 | 839.00 | 837.89 | 829.23 | 772.68 | 758.68 | 720.22 | 719.22 | 718.05 | 717.40 | 691.25 | 690.37 | 689.55 | 688.65 | 688.34 | 687.84 | 516.01 | 510.24 | 509.43 | 507.75 | 506.70 | 507.34 | 506.85 | 506.51 | NA | 398.60 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | 6.11 | 8.60 | 8.57 | 7.36 | 8.72 | 9.45 | 6.14 | 4.70 | -0.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | 0.01 | 0.01 | 0.02 | 0.05 | 0.06 | 0.07 | 0.07 | 0.08 | 0.09 | 0.10 | 0.11 | 0.12 | 0.12 | 0.13 | 0.14 | 0.15 | 0.16 | 0.17 | 0.19 | 0.20 | 0.22 | 0.23 | NA | 0.26 | NA | NA | NA | |

| Minority Interest | 34.99 | 34.97 | 34.95 | 25.79 | 21.94 | 21.92 | 7.52 | 8.41 | 8.41 | 8.41 | 8.40 | 8.40 | 8.40 | 8.40 | 8.41 | 8.43 | 8.48 | 8.46 | 8.44 | 8.39 | 7.48 | 7.45 | 4.57 | 3.49 | 3.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.01 | 0.35 | 0.41 | 0.41 | 1.96 | 1.96 | 1.96 | NA | 1.96 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

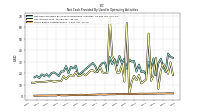

| Net Cash Provided By Used In Operating Activities | 25.47 | 32.40 | 28.50 | 18.04 | 32.81 | 24.33 | 29.88 | 18.57 | 21.60 | 20.94 | 27.39 | 21.26 | 30.47 | 29.98 | 31.79 | 23.85 | 32.38 | 28.42 | 34.88 | 26.79 | 32.10 | 27.97 | 33.88 | 21.59 | 29.17 | 28.80 | 26.29 | 21.05 | 26.06 | 28.81 | NA | NA | NA | NA | NA | 17.86 | 26.48 | 24.05 | 25.41 | 19.83 | 26.02 | 21.43 | 21.35 | 17.38 | 19.28 | 20.58 | 19.99 | 16.84 | 18.95 | 17.37 | 18.83 | 15.69 | 17.37 | 16.30 | NA | NA | |

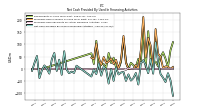

| Net Cash Provided By Used In Investing Activities | 19.34 | -6.85 | -55.17 | -132.23 | -9.44 | -64.69 | -10.34 | -35.47 | -97.54 | -1.99 | 33.84 | -4.09 | -8.05 | -9.87 | 10.19 | 51.66 | -21.88 | -13.04 | -15.66 | -28.42 | -1.24 | -11.76 | 28.72 | -19.34 | -38.20 | -6.82 | -47.88 | 0.89 | -19.40 | -11.92 | NA | NA | NA | NA | NA | -52.75 | 7.52 | -13.32 | -7.31 | -15.92 | -151.68 | -0.39 | -5.18 | -6.71 | -85.34 | -61.71 | 6.21 | -17.68 | -33.79 | -13.20 | 1.52 | -51.92 | -47.76 | -1.67 | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -35.83 | -21.27 | 28.16 | 109.35 | -19.47 | 40.44 | -17.52 | 16.14 | 35.64 | 20.80 | -63.71 | -16.74 | -37.46 | -47.67 | -22.50 | -48.87 | -12.32 | -14.63 | -22.73 | 5.69 | -48.67 | -0.34 | -59.68 | -3.69 | 10.40 | -27.43 | 22.16 | -21.20 | -2.29 | -31.03 | NA | NA | NA | NA | NA | 13.07 | -16.35 | -11.21 | -17.58 | -3.14 | 72.10 | -24.02 | 37.52 | -8.25 | 64.97 | 39.09 | -19.18 | -0.27 | 14.03 | -5.35 | -37.34 | 52.72 | 24.80 | -7.64 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 25.47 | 32.40 | 28.50 | 18.04 | 32.81 | 24.33 | 29.88 | 18.57 | 21.60 | 20.94 | 27.39 | 21.26 | 30.47 | 29.98 | 31.79 | 23.85 | 32.38 | 28.42 | 34.88 | 26.79 | 32.10 | 27.97 | 33.88 | 21.59 | 29.17 | 28.80 | 26.29 | 21.05 | 26.06 | 28.81 | NA | NA | NA | NA | NA | 17.86 | 26.48 | 24.05 | 25.41 | 19.83 | 26.02 | 21.43 | 21.35 | 17.38 | 19.28 | 20.58 | 19.99 | 16.84 | 18.95 | 17.37 | 18.83 | 15.69 | 17.37 | 16.30 | NA | NA | |

| Net Income Loss | 28.23 | 22.20 | 6.17 | 33.13 | 17.94 | 13.29 | 54.38 | 14.41 | 12.84 | 11.02 | 18.24 | 13.76 | 17.57 | 12.22 | 1.87 | 63.63 | 12.54 | 27.19 | 20.45 | 20.35 | 30.77 | 34.92 | 68.94 | 20.36 | 19.83 | 20.62 | 25.38 | 21.51 | 20.67 | 22.41 | 22.18 | 19.86 | 17.95 | 19.65 | 17.93 | 17.55 | 21.00 | 17.12 | 18.27 | 17.00 | 14.65 | 17.29 | 12.90 | 12.98 | 12.77 | 12.49 | 13.10 | 12.92 | 12.56 | 12.38 | 12.21 | 12.11 | 12.24 | 11.51 | 11.58 | NA | |

| Profit Loss | 28.67 | 22.63 | 6.60 | 33.56 | 18.20 | 13.39 | 54.49 | 14.51 | 12.93 | 11.11 | 18.33 | 13.85 | 17.66 | 12.34 | 1.95 | 63.72 | 12.63 | 27.28 | 20.53 | 20.43 | 30.84 | 34.94 | 68.94 | 20.36 | 19.83 | 20.62 | 25.38 | 21.51 | 20.67 | 22.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 14.65 | 17.29 | 12.90 | 12.98 | 12.78 | 12.50 | 13.11 | 12.93 | 12.60 | 12.42 | 12.26 | 12.15 | 12.29 | 11.56 | 11.63 | NA | |

| Depreciation Depletion And Amortization | 9.33 | 9.50 | 9.38 | 9.21 | 9.29 | 9.38 | 9.38 | 9.44 | 9.45 | 9.46 | 9.51 | 9.88 | 9.84 | 9.77 | 9.80 | 9.67 | 9.82 | 9.93 | 9.86 | 9.61 | 9.40 | 9.45 | 9.27 | 9.44 | 9.42 | 9.52 | 9.31 | 9.36 | 9.31 | 9.15 | 8.91 | 8.56 | 8.31 | 7.37 | 6.98 | 6.78 | NA | 6.33 | 6.30 | 6.30 | 6.24 | 6.20 | 6.13 | 6.14 | 5.69 | 5.92 | 5.37 | 5.17 | 5.14 | 4.97 | 4.99 | 4.52 | 4.16 | 4.07 | NA | NA | |

| Increase Decrease In Other Operating Capital Net | 3.93 | -7.13 | -1.06 | 8.51 | -2.43 | -0.93 | -3.30 | 4.55 | 2.18 | -3.82 | -4.12 | 2.79 | 1.52 | -2.57 | -0.90 | 3.98 | 0.75 | 1.06 | -4.69 | 4.63 | -2.54 | -2.46 | -2.14 | 4.11 | -0.17 | -1.32 | 3.96 | 7.55 | 1.49 | -1.29 | -2.07 | 5.61 | -4.59 | -3.04 | -1.79 | 4.03 | -1.18 | -0.97 | -0.31 | 2.83 | -1.91 | -2.18 | -0.50 | 1.06 | 0.06 | -0.95 | -1.34 | 1.68 | -1.05 | 0.24 | -1.31 | 0.94 | -0.98 | -0.20 | NA | NA | |

| Share Based Compensation | 2.13 | 2.12 | 2.14 | 2.09 | 2.01 | 2.01 | 2.01 | 1.93 | 1.98 | 1.98 | 1.96 | 1.85 | 1.78 | 1.69 | 1.76 | 1.78 | 1.63 | 1.63 | 1.62 | 1.69 | 1.49 | 1.49 | 1.52 | 1.38 | 1.28 | 1.28 | 1.43 | 1.26 | 1.13 | 1.13 | 1.03 | 0.99 | 0.91 | 1.01 | 1.10 | 0.98 | 0.93 | 0.88 | 0.78 | 0.67 | 0.54 | 0.54 | 0.52 | 0.98 | 0.46 | 0.45 | 0.46 | 0.45 | 0.37 | 0.37 | 0.36 | 0.36 | 0.30 | 0.26 | NA | NA | |

| Amortization Of Financing Costs | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.29 | 0.28 | 0.26 | 0.34 | 0.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.13 | 0.12 | 0.13 | 0.13 | 0.12 | 0.12 | 0.23 | 0.15 | 0.22 | 0.17 | 0.15 | 0.20 | 0.10 | 0.05 | 0.06 | NA | NA | NA | NA | 0.00 | 0.04 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.11 | 0.18 | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 19.34 | -6.85 | -55.17 | -132.23 | -9.44 | -64.69 | -10.34 | -35.47 | -97.54 | -1.99 | 33.84 | -4.09 | -8.05 | -9.87 | 10.19 | 51.66 | -21.88 | -13.04 | -15.66 | -28.42 | -1.24 | -11.76 | 28.72 | -19.34 | -38.20 | -6.82 | -47.88 | 0.89 | -19.40 | -11.92 | NA | NA | NA | NA | NA | -52.75 | 7.52 | -13.32 | -7.31 | -15.92 | -151.68 | -0.39 | -5.18 | -6.71 | -85.34 | -61.71 | 6.21 | -17.68 | -33.79 | -13.20 | 1.52 | -51.92 | -47.76 | -1.67 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -35.83 | -21.27 | 28.16 | 109.35 | -19.47 | 40.44 | -17.52 | 16.14 | 35.64 | 20.80 | -63.71 | -16.74 | -37.46 | -47.67 | -22.50 | -48.87 | -12.32 | -14.63 | -22.73 | 5.69 | -48.67 | -0.34 | -59.68 | -3.69 | 10.40 | -27.43 | 22.16 | -21.20 | -2.29 | -31.03 | NA | NA | NA | NA | NA | 13.07 | -16.35 | -11.21 | -17.58 | -3.14 | 72.10 | -24.02 | 37.52 | -8.25 | 64.97 | 39.09 | -19.18 | -0.27 | 14.03 | -5.35 | -37.34 | 52.72 | 24.80 | -7.64 | NA | NA | |

| Payments Of Dividends | 24.00 | 23.61 | 23.60 | 23.56 | 23.31 | 23.09 | 22.64 | 22.48 | 22.44 | 22.44 | 22.44 | 23.17 | 22.37 | 22.37 | 22.36 | 23.17 | 22.66 | 22.66 | 22.65 | 22.93 | 22.60 | 22.60 | 22.59 | 22.58 | 22.55 | 22.55 | 22.56 | 22.55 | 22.36 | 21.18 | 20.68 | 20.35 | 19.92 | 18.96 | 18.95 | 18.93 | 18.70 | 18.59 | 18.58 | 18.56 | 18.54 | 16.98 | 16.35 | 15.04 | 15.01 | 14.68 | 14.05 | 14.04 | 13.56 | 13.56 | 16.62 | 12.83 | 13.36 | 14.56 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 50.20 | 49.30 | 48.25 | 49.50 | 47.84 | 43.50 | 43.02 | 40.79 | 39.44 | 37.47 | 38.13 | 40.28 | 46.27 | 38.17 | 28.48 | 46.41 | 46.46 | 47.12 | 46.27 | 35.86 | 43.59 | 41.78 | 41.47 | 41.81 | 41.73 | 41.25 | 42.47 | 42.62 | 42.14 | 40.84 | 40.00 | 38.60 | 37.39 | 34.94 | 32.39 | 31.48 | 30.75 | 29.54 | 29.23 | 29.44 | 28.59 | 25.82 | 25.68 | 25.66 | 24.51 | 23.79 | 23.09 | 22.64 | 22.30 | 21.43 | 21.18 | 20.25 | 19.82 | 18.36 | 17.93 | 17.59 |