| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

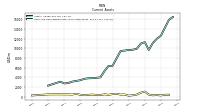

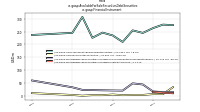

| Common Stock Value | 139.61 | 138.85 | 138.10 | 137.78 | 137.23 | 136.67 | 137.88 | 206.35 | 205.80 | 205.25 | 204.71 | 203.79 | 204.15 | 203.92 | 203.62 | 203.46 | 203.26 | 203.06 | 202.78 | 202.59 | 202.53 | 202.43 | 202.41 | 202.34 | 42.34 | 75.23 | |

| Weighted Average Number Of Diluted Shares Outstanding | 43.35 | 43.31 | 43.29 | NA | 43.26 | 43.34 | 43.36 | NA | 43.31 | 43.31 | 43.28 | NA | 43.17 | 43.14 | 43.14 | NA | 43.12 | 43.12 | 43.11 | NA | 43.09 | 43.08 | 43.07 | NA | 31.98 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 43.24 | 43.24 | 43.18 | NA | 43.11 | 43.21 | 43.19 | NA | 43.18 | 43.17 | 43.16 | NA | 43.12 | 43.12 | 43.10 | NA | 43.06 | 43.06 | 43.05 | NA | 43.04 | 43.04 | 43.04 | NA | 31.97 | NA | |

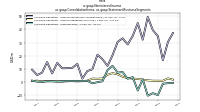

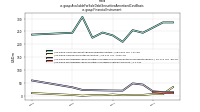

| Earnings Per Share Basic | 1.68 | 1.31 | 1.07 | 1.12 | 1.22 | 1.12 | 1.03 | 0.77 | 1.22 | 1.06 | 1.35 | 1.30 | 1.19 | 0.87 | 0.49 | 0.61 | 0.40 | 0.34 | 0.23 | 0.34 | 0.37 | 0.35 | 0.33 | 0.49 | 0.30 | 0.10 | |

| Earnings Per Share Diluted | 1.68 | 1.31 | 1.07 | 1.12 | 1.22 | 1.11 | 1.02 | 0.76 | 1.22 | 1.05 | 1.35 | 1.30 | 1.19 | 0.87 | 0.49 | 0.61 | 0.40 | 0.34 | 0.23 | 0.34 | 0.37 | 0.35 | 0.33 | 0.49 | 0.30 | 0.10 |

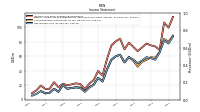

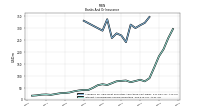

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

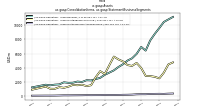

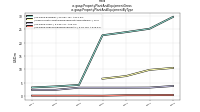

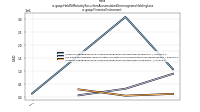

| Interest And Fee Income Loans And Leases | 266.56 | 228.73 | 189.45 | 164.68 | 129.10 | 85.99 | 72.20 | 77.11 | 72.92 | 68.28 | 75.52 | 74.52 | 71.86 | 63.98 | 53.56 | 56.83 | 52.78 | 42.37 | 34.45 | 34.00 | 32.06 | 28.79 | 24.61 | 23.10 | 22.02 | 17.69 | |

| Interest Expense | 179.24 | 152.45 | 110.60 | 86.03 | 48.73 | 17.24 | 10.29 | 9.84 | 8.43 | 8.03 | 7.59 | 8.67 | 10.94 | 16.97 | 22.06 | 26.18 | 27.14 | 20.84 | 15.54 | 15.65 | 14.10 | 11.92 | 8.93 | 7.96 | 7.62 | 5.51 | |

| Interest Income Expense Net | 117.44 | 105.62 | 100.69 | 95.41 | 85.39 | 72.03 | 65.72 | 72.74 | 68.88 | 64.41 | 71.96 | 69.24 | 65.32 | 51.23 | 38.35 | 37.62 | 32.62 | 27.92 | 24.13 | 24.18 | 23.48 | 22.21 | 20.11 | 18.95 | 18.39 | 15.18 | |

| Interest Paid Net | 177.40 | 137.14 | 101.38 | 76.45 | 38.73 | 14.96 | 10.23 | 10.85 | 8.43 | 7.65 | 6.97 | 11.17 | 13.10 | 21.06 | 23.78 | 27.37 | 21.65 | 18.13 | 14.74 | 17.58 | 13.60 | 10.35 | 7.75 | 7.50 | 7.35 | 4.48 | |

| Income Tax Expense Benefit | 25.06 | 3.27 | 18.36 | 17.72 | 18.91 | 18.10 | 16.70 | 17.58 | 20.10 | 17.98 | 22.17 | 20.60 | 19.61 | 14.23 | 8.38 | 9.43 | 6.50 | 5.33 | 3.54 | 5.70 | 5.58 | 5.19 | 4.68 | 1.33 | 6.45 | 5.73 | |

| Income Taxes Paid Net | 20.26 | 28.85 | 0.97 | 19.33 | 18.84 | 28.83 | -0.50 | 21.07 | 16.02 | 41.10 | 0.56 | 21.80 | 17.89 | 17.59 | 0.05 | 5.46 | 2.50 | 11.31 | 0.06 | 3.94 | 6.95 | NA | NA | 9.82 | 3.73 | 6.88 | |

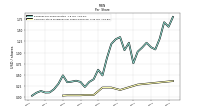

| Profit Loss | 81.50 | 65.30 | 54.95 | 57.16 | 58.49 | 53.94 | 50.14 | 55.20 | 58.50 | 51.42 | 61.98 | 59.79 | 55.00 | 41.16 | 24.58 | 30.06 | 20.26 | 16.44 | 10.57 | 15.42 | 16.74 | 15.65 | 15.06 | 20.33 | 10.47 | 8.75 | |

| Net Income Loss | 81.50 | 65.30 | 54.95 | 57.16 | 58.49 | 53.94 | 50.14 | 55.20 | 58.50 | 51.42 | 61.98 | 59.79 | 55.00 | 41.16 | 24.58 | 30.06 | 20.26 | 16.44 | 10.57 | 15.42 | 16.74 | 15.65 | 15.06 | 20.33 | 10.47 | 8.75 | |

| Comprehensive Income Net Of Tax | 83.79 | 66.00 | 57.75 | 58.32 | 54.87 | 52.17 | 45.29 | 53.48 | 58.77 | 51.16 | 61.86 | 59.75 | 54.70 | 40.94 | 25.05 | 29.83 | 20.31 | 16.93 | 11.03 | 16.41 | 16.91 | 15.75 | 14.74 | 19.79 | 10.55 | 8.17 | |

| Preferred Stock Dividends Income Statement Impact | 8.67 | 8.67 | 8.67 | 8.80 | 5.73 | 5.73 | 5.73 | 5.73 | 5.73 | 5.66 | 3.76 | 3.62 | 3.62 | 3.62 | 3.62 | 3.62 | 3.02 | 1.74 | 0.83 | 0.83 | 0.83 | 0.83 | 0.83 | 0.83 | 0.83 | 0.83 | |

| Net Income Loss Available To Common Stockholders Basic | 72.84 | 56.63 | 46.29 | 48.36 | 52.76 | 48.21 | 44.41 | 49.47 | 52.77 | 45.76 | 58.23 | 56.17 | 51.38 | 37.54 | 20.96 | 26.44 | 17.24 | 14.70 | 9.74 | 14.59 | 15.91 | 14.82 | 14.23 | 19.50 | 9.63 | 7.92 | |

| Interest Income Expense After Provision For Loan Loss | 113.42 | 83.01 | 93.83 | 89.00 | 83.16 | 65.82 | 63.27 | 70.16 | 67.80 | 64.72 | 70.30 | 65.12 | 62.34 | 49.49 | 35.35 | 35.63 | 31.43 | 27.82 | 23.48 | 22.57 | 22.86 | 21.21 | 18.70 | 17.55 | 17.80 | 14.94 | |

| Noninterest Expense | 42.93 | 44.32 | 34.77 | 37.11 | 34.95 | 32.96 | 31.03 | 37.65 | 29.47 | 28.18 | 30.08 | 27.46 | 26.38 | 20.28 | 22.29 | 18.84 | 15.52 | 15.92 | 13.04 | 16.18 | 12.45 | 12.00 | 10.27 | 10.80 | 8.94 | 7.38 | |

| Noninterest Income | 36.07 | 29.88 | 14.26 | 22.98 | 29.19 | 39.17 | 34.60 | 40.27 | 40.27 | 32.85 | 43.94 | 42.73 | 38.66 | 26.19 | 19.90 | 22.70 | 10.85 | 9.87 | 3.66 | 14.73 | 11.91 | 11.63 | 11.31 | 14.91 | 8.06 | 6.92 |

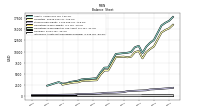

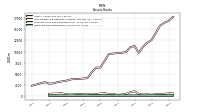

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

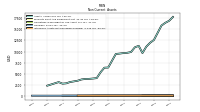

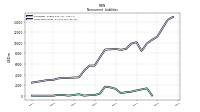

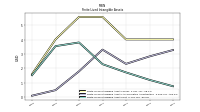

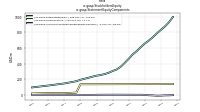

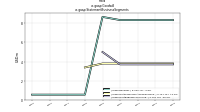

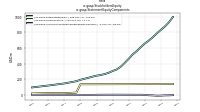

| Assets | 16495.24 | 15874.87 | 14240.97 | 12615.23 | 11978.72 | 11086.06 | 9650.59 | 11278.64 | 10952.03 | 9881.53 | 9705.26 | 9645.38 | 9530.48 | 9439.40 | 7908.40 | 6371.93 | 6337.19 | 5287.39 | 3976.72 | 3884.16 | 3806.95 | 3786.68 | 3675.85 | 3393.13 | 3237.49 | 2718.51 | |

| Liabilities | 14862.52 | 14314.57 | 12735.28 | 11155.49 | 10566.13 | 9857.52 | 8462.09 | 10123.23 | 9842.16 | 8822.47 | 8694.00 | 8834.75 | 8773.34 | 8731.20 | 7235.43 | 5718.20 | 5707.75 | 4772.38 | 3498.89 | 3462.93 | 3399.60 | 3393.76 | 3296.14 | 3025.66 | 2994.20 | 2512.22 | |

| Liabilities And Stockholders Equity | 16495.24 | 15874.87 | 14240.97 | 12615.23 | 11978.72 | 11086.06 | 9650.59 | 11278.64 | 10952.03 | 9881.53 | 9705.26 | 9645.38 | 9530.48 | 9439.40 | 7908.40 | 6371.93 | 6337.19 | 5287.39 | 3976.72 | 3884.16 | 3806.95 | 3786.68 | 3675.85 | 3393.13 | 3237.49 | 2718.51 | |

| Stockholders Equity | 1632.71 | 1560.30 | 1505.68 | 1459.74 | 1412.59 | 1228.54 | 1188.50 | 1155.41 | 1109.88 | 1059.06 | 1011.25 | 810.62 | 757.13 | 708.20 | 672.97 | 653.73 | 629.44 | 515.01 | 477.83 | 421.24 | 407.35 | 392.92 | 379.71 | 367.47 | 243.28 | 206.29 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | NA | 377.31 | 369.59 | 226.16 | 323.96 | 258.15 | 411.52 | 1032.61 | 802.58 | 402.05 | 269.44 | 179.73 | 429.20 | 403.19 | 568.08 | 506.71 | 364.98 | 460.89 | 313.45 | 336.52 | 410.76 | 352.40 | 287.73 | 359.52 | 566.81 | 445.70 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 407.24 | 377.31 | 369.59 | 226.16 | 323.96 | 258.15 | 411.52 | 1032.61 | 802.58 | 402.05 | 269.44 | 179.73 | NA | NA | NA | 506.71 | NA | NA | NA | 336.52 | NA | NA | NA | NA | NA | NA | |

| Available For Sale Securities Debt Securities | NA | NA | NA | NA | NA | 336.81 | 314.27 | 310.63 | 301.12 | 315.26 | 241.69 | 269.80 | 278.86 | 259.66 | 339.05 | 290.24 | NA | NA | NA | 331.07 | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

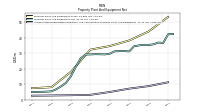

| Property Plant And Equipment Gross | NA | NA | NA | 44.17 | NA | NA | NA | 38.31 | NA | NA | NA | 34.67 | NA | NA | NA | 32.34 | NA | NA | NA | 17.95 | NA | NA | NA | 8.01 | NA | 7.37 | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 8.73 | NA | NA | NA | 7.09 | NA | NA | NA | 4.91 | NA | NA | NA | 3.07 | NA | NA | NA | 2.81 | NA | NA | NA | 2.65 | NA | 2.52 | |

| Property Plant And Equipment Net | 36.73 | 36.95 | 35.79 | 35.44 | 35.49 | 35.09 | 34.56 | 31.21 | 31.42 | 31.38 | 31.26 | 29.76 | 29.26 | 29.36 | 29.41 | 29.27 | 29.21 | 26.58 | 21.08 | 15.14 | 10.85 | 8.58 | 6.71 | 5.35 | 5.14 | 4.85 | |

| Goodwill | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.85 | 15.57 | 15.57 | 17.14 | 17.48 | 5.30 | 5.37 | 5.14 | 3.90 | 6.04 | 0.52 | |

| Intangible Assets Net Excluding Goodwill | 0.83 | 0.95 | 1.07 | 1.19 | 1.31 | 1.44 | 1.57 | 1.71 | 1.84 | 1.99 | 2.14 | 2.28 | 2.66 | 3.04 | 3.42 | 3.80 | 4.18 | 4.57 | 3.38 | 3.54 | 1.76 | 1.84 | 1.92 | 1.51 | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 1.19 | NA | NA | NA | 1.71 | NA | NA | NA | 2.28 | NA | NA | NA | 3.80 | NA | NA | NA | 3.54 | NA | NA | NA | 1.51 | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 2.06 | 3.43 | 0.34 | 0.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1010.75 | 1058.59 | 1106.58 | 1118.97 | 1005.49 | NA | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | NA | NA | NA | NA | NA | 347.59 | 322.73 | 312.59 | 300.79 | 315.29 | 241.38 | 269.32 | 278.34 | 258.76 | 337.85 | 289.66 | NA | NA | NA | 331.53 | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | NA | NA | 2.09 | 0.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 2.06 | 3.43 | 0.34 | 0.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 1012.80 | 1062.02 | 1104.84 | 1119.08 | 1005.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | NA | NA | NA | NA | 1005.49 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

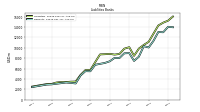

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

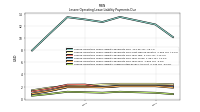

| Time Deposit Maturities Year One | 4903.83 | 5018.14 | 4004.94 | 2958.04 | NA | NA | NA | 1079.43 | NA | NA | NA | 240.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

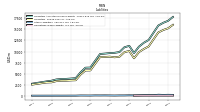

| Deposits | 13007.34 | 13059.86 | 11345.23 | 10071.34 | 10319.48 | 8299.74 | 7475.82 | 8982.61 | 8947.32 | 8039.58 | 8063.18 | 7408.07 | 7084.65 | 6908.63 | 6722.70 | 5478.07 | 5499.65 | 4655.99 | 3121.03 | 3231.09 | 3302.37 | 3176.35 | 3062.60 | 2943.56 | 2901.46 | 2428.62 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | NA | 97.28 | 1440.90 | NA | 1033.95 | 809.14 | 701.37 | 545.16 | 1348.26 | 1618.20 | 1761.11 | 444.57 | 181.44 | 159.67 | 62.23 | 338.03 | 195.45 | 67.28 | 189.51 | 199.38 | 56.61 | 56.62 | 57.01 |

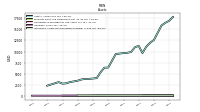

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

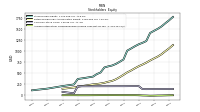

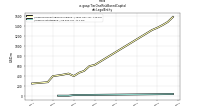

| Stockholders Equity | 1632.71 | 1560.30 | 1505.68 | 1459.74 | 1412.59 | 1228.54 | 1188.50 | 1155.41 | 1109.88 | 1059.06 | 1011.25 | 810.62 | 757.13 | 708.20 | 672.97 | 653.73 | 629.44 | 515.01 | 477.83 | 421.24 | 407.35 | 392.92 | 379.71 | 367.47 | 243.28 | 206.29 | |

| Common Stock Value | 139.61 | 138.85 | 138.10 | 137.78 | 137.23 | 136.67 | 137.88 | 206.35 | 205.80 | 205.25 | 204.71 | 203.79 | 204.15 | 203.92 | 203.62 | 203.46 | 203.26 | 203.06 | 202.78 | 202.59 | 202.53 | 202.43 | 202.41 | 202.34 | 42.34 | 75.23 | |

| Retained Earnings Accumulated Deficit | 998.25 | 928.88 | 875.70 | 832.87 | 787.53 | 737.79 | 694.78 | 657.15 | 610.27 | 560.08 | 516.96 | 461.74 | 407.98 | 358.89 | 323.65 | 304.98 | 280.55 | 265.32 | 252.64 | 244.91 | 232.04 | 217.86 | 204.76 | 192.01 | 173.94 | 145.27 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -4.75 | -7.04 | -7.73 | -10.52 | -11.69 | -8.07 | -6.30 | -1.45 | 0.26 | -0.00 | 0.25 | 0.37 | 0.41 | 0.71 | 0.93 | 0.46 | 0.69 | 0.64 | 0.15 | -0.31 | -1.30 | -1.47 | -1.57 | -1.01 | -0.47 | -0.63 |

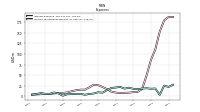

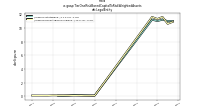

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

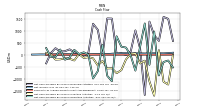

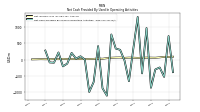

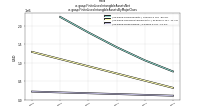

| Net Cash Provided By Used In Operating Activities | -527.75 | -241.49 | -301.53 | -858.14 | 959.14 | -420.86 | 1295.63 | 338.62 | -658.45 | -25.18 | 295.79 | 333.34 | 762.70 | -1099.32 | -871.62 | 408.00 | -681.64 | -986.11 | 2.74 | 98.81 | 27.21 | 201.33 | -123.76 | -207.56 | 215.24 | 273.63 | |

| Net Cash Provided By Used In Investing Activities | -14.50 | -1236.37 | -1120.18 | 187.09 | -1698.07 | -1104.73 | -247.15 | -360.38 | 51.79 | 29.03 | -194.71 | -637.87 | -763.88 | -562.13 | -568.35 | -258.80 | -445.63 | -149.70 | -103.55 | -131.73 | 29.88 | -238.02 | -169.20 | -145.80 | -193.03 | 74.26 | |

| Net Cash Provided By Used In Financing Activities | 572.18 | 1485.58 | 1565.13 | 573.25 | 804.74 | 1372.21 | -1669.57 | 251.79 | 1007.18 | 128.75 | -11.37 | 55.05 | 27.19 | 1496.55 | 1501.34 | -7.48 | 1031.36 | 1283.24 | 77.74 | -41.31 | 1.26 | 101.36 | 221.17 | 146.06 | 128.05 | -358.23 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -527.75 | -241.49 | -301.53 | -858.14 | 959.14 | -420.86 | 1295.63 | 338.62 | -658.45 | -25.18 | 295.79 | 333.34 | 762.70 | -1099.32 | -871.62 | 408.00 | -681.64 | -986.11 | 2.74 | 98.81 | 27.21 | 201.33 | -123.76 | -207.56 | 215.24 | 273.63 | |

| Net Income Loss | 81.50 | 65.30 | 54.95 | 57.16 | 58.49 | 53.94 | 50.14 | 55.20 | 58.50 | 51.42 | 61.98 | 59.79 | 55.00 | 41.16 | 24.58 | 30.06 | 20.26 | 16.44 | 10.57 | 15.42 | 16.74 | 15.65 | 15.06 | 20.33 | 10.47 | 8.75 | |

| Profit Loss | 81.50 | 65.30 | 54.95 | 57.16 | 58.49 | 53.94 | 50.14 | 55.20 | 58.50 | 51.42 | 61.98 | 59.79 | 55.00 | 41.16 | 24.58 | 30.06 | 20.26 | 16.44 | 10.57 | 15.42 | 16.74 | 15.65 | 15.06 | 20.33 | 10.47 | 8.75 | |

| Increase Decrease In Other Operating Capital Net | -0.02 | 1.55 | 1.59 | -4.75 | 3.23 | -1.36 | 0.99 | -5.56 | 0.07 | 0.50 | 0.41 | -0.27 | 0.28 | -0.85 | -1.38 | -1.48 | -1.54 | -1.92 | -0.80 | -2.94 | -0.37 | -0.37 | -0.31 | -0.77 | -0.67 | -0.14 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -14.50 | -1236.37 | -1120.18 | 187.09 | -1698.07 | -1104.73 | -247.15 | -360.38 | 51.79 | 29.03 | -194.71 | -637.87 | -763.88 | -562.13 | -568.35 | -258.80 | -445.63 | -149.70 | -103.55 | -131.73 | 29.88 | -238.02 | -169.20 | -145.80 | -193.03 | 74.26 | |

| Payments To Acquire Property Plant And Equipment | 0.52 | 1.90 | 1.04 | 0.58 | 1.06 | 1.17 | 3.94 | 0.36 | 0.59 | 0.68 | 2.00 | 2.19 | 0.39 | 0.44 | 0.59 | 1.71 | 2.62 | 5.44 | 4.21 | 3.75 | 2.40 | 1.99 | 1.05 | 0.03 | 0.54 | 0.03 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2016-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 572.18 | 1485.58 | 1565.13 | 573.25 | 804.74 | 1372.21 | -1669.57 | 251.79 | 1007.18 | 128.75 | -11.37 | 55.05 | 27.19 | 1496.55 | 1501.34 | -7.48 | 1031.36 | 1283.24 | 77.74 | -41.31 | 1.26 | 101.36 | 221.17 | 146.06 | 128.05 | -358.23 | |

| Payments Of Dividends | 12.13 | 12.13 | 12.13 | 11.81 | 8.75 | 8.75 | 8.76 | 8.32 | 8.32 | 8.39 | 6.21 | 5.92 | 5.92 | 5.92 | 5.92 | 5.63 | 8.78 | 0.00 | 2.84 | 2.55 | 2.55 | 2.55 | 2.55 | 2.27 | 1.91 | 1.89 | |

| Payments For Repurchase Of Common Stock | NA | NA | NA | 0.00 | 0.00 | 3.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |