| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.45 | 0.46 | 0.46 | 0.46 | 0.46 | 0.46 | 0.45 | 0.45 | 0.45 | 0.45 | 0.45 | 0.44 | 0.43 | 0.43 | 0.43 | 0.42 | 0.42 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.40 | 0.40 | 0.39 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.33 | 0.33 | 0.33 | 0.33 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | NA | NA | NA | |

| Earnings Per Share Basic | 0.74 | 0.68 | 0.92 | 0.79 | 0.05 | 0.78 | 0.47 | 0.18 | 0.14 | 0.67 | 0.85 | 0.78 | 0.83 | 0.95 | 0.99 | 1.37 | 0.95 | 0.98 | 0.92 | 0.83 | 0.88 | 0.97 | 0.91 | 0.93 | 0.91 | 0.95 | 0.93 | 1.11 | 1.03 | 0.84 | 1.16 | 0.85 | 1.44 | 0.89 | 0.83 | 0.79 | 0.80 | 0.76 | 0.77 | 0.71 | 0.93 | 1.53 | 0.71 | 0.56 | 1.48 | 0.52 | 0.61 | 0.66 | 0.65 | 0.68 | 0.90 | 0.69 | 0.61 | 0.62 | 0.69 | 0.58 | |

| Earnings Per Share Diluted | 0.74 | 0.68 | 0.92 | 0.79 | 0.05 | 0.78 | 0.47 | 0.18 | 0.13 | 0.67 | 0.85 | 0.78 | 0.83 | 0.95 | 0.99 | 1.37 | 0.95 | 0.97 | 0.92 | 0.83 | 0.87 | 0.97 | 0.91 | 0.92 | 0.90 | 0.94 | 0.93 | 1.10 | 1.03 | 0.83 | 1.16 | 0.85 | 1.44 | 0.89 | 0.83 | 0.79 | 0.80 | 0.76 | 0.76 | 0.71 | 0.93 | 1.53 | 0.71 | 0.56 | 1.47 | 0.52 | 0.61 | 0.66 | 0.65 | 0.68 | 0.90 | 0.69 | 0.61 | 0.62 | 0.69 | 0.58 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

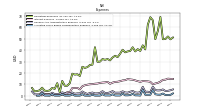

| Revenue From Contract With Customer Excluding Assessed Tax | 12.95 | 12.37 | 11.79 | 11.70 | 11.79 | 12.01 | 11.99 | 71.33 | 69.67 | 73.83 | 74.33 | 80.89 | 81.26 | 84.30 | 84.17 | 83.08 | 82.20 | 81.68 | 78.10 | 76.11 | 74.00 | 74.92 | 72.96 | 72.75 | 71.08 | 71.35 | 69.84 | 66.39 | 65.03 | 63.25 | 61.20 | 59.02 | 58.64 | 58.28 | 56.31 | 55.75 | 45.73 | 44.48 | 44.16 | 43.14 | 32.79 | 31.79 | 28.05 | 28.07 | 26.82 | 25.51 | 21.77 | 24.07 | 21.52 | 20.45 | 20.28 | 20.62 | 19.51 | 19.42 | 19.10 | 20.18 | |

| Revenues | 79.47 | 80.11 | 77.88 | 82.39 | 70.67 | 76.30 | 59.90 | 71.33 | 69.67 | 73.83 | 74.33 | 80.89 | 81.26 | 84.30 | 84.17 | 83.08 | 82.20 | 81.68 | 78.10 | 76.11 | 74.00 | 74.92 | 72.96 | 72.75 | 71.08 | 71.35 | 69.84 | 66.39 | 65.03 | 63.25 | 61.20 | 59.02 | 58.64 | 58.28 | 56.31 | 55.75 | 45.73 | 44.48 | 44.16 | 43.14 | 32.79 | 31.79 | 28.05 | 28.07 | 26.82 | 25.51 | 21.77 | 24.07 | 21.52 | 20.45 | 20.28 | 20.62 | 19.51 | 19.42 | 19.10 | 20.18 | |

| Interest And Fee Income Loans And Leases | 5.79 | 5.48 | 5.13 | 5.39 | 5.11 | 4.89 | 7.92 | 6.77 | 8.76 | 6.79 | 5.98 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating Expenses | 49.52 | 52.01 | 49.74 | 49.60 | 69.11 | 56.93 | 49.61 | 66.21 | 68.85 | 62.37 | 40.67 | 44.24 | 39.35 | 40.91 | 38.90 | 42.58 | 39.34 | 38.93 | 38.12 | 40.43 | 36.91 | 33.94 | 35.12 | 33.58 | 31.07 | 32.26 | 31.59 | 32.25 | 30.01 | 29.78 | 42.60 | 27.33 | 27.09 | 25.18 | 24.49 | 25.51 | 17.41 | 18.91 | 18.64 | 19.44 | 11.16 | 8.85 | 8.86 | 13.09 | 3.02 | 11.16 | 6.09 | 6.94 | 4.75 | 4.34 | 4.58 | 7.20 | 4.85 | 4.23 | 3.97 | 6.89 | |

| General And Administrative Expense | 4.92 | 4.43 | 4.31 | 5.65 | 4.88 | 4.74 | 5.05 | 8.10 | 3.20 | 3.65 | 3.59 | 7.99 | 3.18 | 2.79 | 3.03 | 4.31 | 3.61 | 2.80 | 2.97 | 4.01 | 2.82 | 2.79 | 2.77 | 4.17 | 3.07 | 2.51 | 2.52 | 4.11 | 2.56 | 2.17 | 2.12 | 2.93 | 2.47 | 1.69 | 2.51 | 3.85 | 2.16 | 2.16 | 1.85 | 2.94 | 2.08 | 1.76 | 2.33 | 3.09 | 1.78 | 1.64 | 1.59 | 2.79 | 1.20 | 1.21 | 1.29 | 3.77 | 1.30 | 1.26 | 1.33 | 3.81 | |

| Interest Expense | 14.85 | 15.09 | 14.19 | 14.03 | 12.45 | 11.41 | 10.86 | 10.20 | 12.28 | 12.71 | 12.84 | 12.97 | 12.29 | 12.89 | 13.56 | 14.14 | 14.37 | 14.66 | 13.75 | 13.52 | 12.85 | 12.37 | 12.22 | 11.61 | 10.59 | 12.24 | 11.83 | 11.66 | 11.36 | 10.82 | 10.67 | 10.26 | 10.16 | 9.77 | 9.29 | 8.41 | 5.65 | 7.00 | 6.83 | 6.89 | 3.22 | 3.29 | 1.60 | 1.12 | 1.32 | 0.85 | 0.75 | 0.50 | 1.22 | 1.78 | 1.59 | 0.48 | NA | NA | NA | NA | |

| Interest Income Expense Net | 66.63 | 67.15 | 64.98 | 69.97 | 58.59 | 64.70 | 48.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | 10.68 | 15.25 | 10.09 | 15.88 | 8.73 | 13.74 | 7.26 | 12.92 | 8.69 | 14.93 | 10.39 | 9.67 | 10.23 | 9.64 | 11.07 | 12.46 | 14.67 | 13.32 | 14.13 | 11.90 | 13.20 | 10.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gains Losses On Extinguishment Of Debt | 0.00 | 0.00 | -0.07 | NA | 0.00 | 0.00 | 0.00 | -0.15 | -1.46 | 0.00 | 0.00 | -0.45 | NA | NA | NA | NA | -0.82 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -0.74 | -1.62 | -0.49 | -0.10 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 0.86 | 0.87 | 0.77 | 2.10 | 1.04 | 1.06 | 1.43 | 5.08 | 0.99 | 0.99 | 0.99 | 5.45 | 0.29 | 0.46 | 0.47 | 1.84 | 0.69 | 0.48 | 0.48 | 2.00 | 0.36 | 0.34 | 0.37 | 1.43 | 0.34 | 0.41 | 0.34 | 1.52 | 0.25 | 0.25 | 0.25 | 0.98 | 0.20 | 0.23 | 0.23 | 1.46 | 0.22 | 0.22 | 0.22 | 1.35 | 0.25 | 0.25 | 0.25 | 1.58 | 0.24 | 0.24 | 0.25 | 1.43 | 0.17 | 0.27 | 0.27 | 2.37 | 0.16 | 0.17 | NA | NA | |

| Profit Loss | 31.72 | 29.03 | 39.45 | 34.18 | 1.56 | 34.23 | 21.47 | 8.25 | 6.50 | 30.85 | 39.23 | 35.38 | 37.16 | 42.66 | 44.42 | 61.06 | 42.04 | 42.76 | 39.98 | 35.68 | 37.08 | 40.98 | 37.84 | NA | 37.80 | 39.09 | 38.24 | 44.23 | 41.19 | 33.44 | 44.98 | 33.11 | 54.79 | 33.98 | 31.54 | 30.01 | 28.10 | 25.52 | 25.58 | 23.86 | 28.11 | 43.05 | 20.10 | 15.92 | 41.27 | 14.35 | 16.93 | 18.35 | 18.11 | 18.81 | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 32.05 | 29.35 | 39.78 | 34.48 | 1.86 | 34.47 | 21.67 | 8.40 | 6.48 | 30.81 | 39.18 | 35.33 | 37.14 | 42.59 | 44.37 | 61.02 | 42.04 | 42.76 | 39.98 | 35.68 | 37.08 | 40.98 | 37.84 | 38.43 | 37.80 | 39.09 | 38.24 | 44.23 | 41.19 | 33.03 | 44.59 | 32.73 | 54.40 | 33.60 | 31.18 | 29.68 | 27.53 | 25.25 | 25.29 | 23.53 | 27.77 | 42.74 | 19.92 | 15.74 | 41.10 | 14.35 | 16.93 | 18.35 | 18.11 | 18.81 | 25.12 | 19.09 | 16.95 | 17.33 | 19.19 | 15.94 | |

| Net Income Loss Available To Common Stockholders Basic | 32.03 | 29.33 | 39.76 | NA | 1.86 | 34.47 | 21.67 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.00 | NA | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

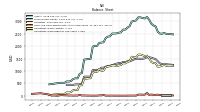

| Assets | 2488.48 | 2499.09 | 2498.49 | 2533.23 | 2507.42 | 2508.78 | 2587.29 | 2802.50 | 2838.88 | 2912.18 | 3077.45 | 3183.27 | 3120.49 | 3139.27 | 3166.97 | 3167.84 | 3042.24 | 3019.36 | 2997.38 | 2806.27 | 2750.57 | 2671.01 | 2673.24 | 2559.43 | 2545.82 | 2519.93 | 2511.04 | 2515.98 | 2403.63 | 2387.77 | 2335.45 | 2159.23 | 2146.35 | 2133.12 | 2012.82 | 2019.72 | 1982.96 | 1488.17 | 1483.13 | 1473.20 | 1455.82 | 917.11 | 887.23 | 700.14 | 705.98 | 675.27 | 598.40 | 572.90 | 579.56 | 522.30 | 521.96 | 522.14 | 509.34 | NA | NA | NA | |

| Liabilities | 1214.43 | 1218.27 | 1208.12 | 1244.63 | 1217.52 | 1182.14 | 1174.30 | 1313.71 | 1321.89 | 1362.97 | 1520.38 | 1620.56 | 1597.54 | 1635.27 | 1663.50 | 1660.84 | 1543.98 | 1556.37 | 1577.69 | 1390.28 | 1360.86 | 1307.61 | 1311.86 | 1239.55 | 1223.70 | 1192.27 | 1224.62 | 1228.69 | 1194.04 | 1180.78 | 1156.81 | 1019.54 | 1003.89 | 1088.46 | 966.31 | 973.27 | 933.03 | 707.15 | 702.75 | 690.02 | 678.66 | 426.70 | 418.25 | 231.76 | 237.93 | 224.86 | 153.13 | 127.29 | 136.08 | 74.81 | 74.54 | 74.62 | 66.84 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 2488.48 | 2499.09 | 2498.49 | 2533.23 | 2507.42 | 2508.78 | 2587.29 | 2802.50 | 2838.88 | 2912.18 | 3077.45 | 3183.27 | 3120.49 | 3139.27 | 3166.97 | 3167.84 | 3042.24 | 3019.36 | 2997.38 | 2806.27 | 2750.57 | 2671.01 | 2673.24 | 2559.43 | 2545.82 | 2519.93 | 2511.04 | 2515.98 | 2403.63 | 2387.77 | 2335.45 | 2159.23 | 2146.35 | 2133.12 | 2012.82 | 2019.72 | 1982.96 | 1488.17 | 1483.13 | 1473.20 | 1455.82 | 917.11 | 887.23 | 700.14 | 705.98 | 675.27 | 598.40 | 572.90 | 579.56 | 522.30 | 521.96 | 522.14 | 509.34 | NA | NA | NA | |

| Stockholders Equity | 1253.95 | 1260.11 | 1268.97 | 1267.49 | 1270.22 | 1306.37 | 1392.22 | 1479.29 | 1507.08 | 1539.06 | 1546.71 | 1552.18 | 1512.23 | 1493.05 | 1492.36 | 1495.56 | 1497.63 | 1462.37 | 1419.05 | 1415.98 | 1389.71 | 1363.40 | 1361.37 | 1319.88 | 1322.12 | NA | NA | NA | 1209.59 | 1206.99 | 1169.57 | 1130.57 | 1133.29 | 1034.90 | 1036.68 | 1036.54 | 1039.92 | 771.12 | 770.03 | 772.68 | 766.55 | 479.70 | 458.20 | 457.51 | 457.18 | 439.45 | NA | NA | 443.49 | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 22.35 | 16.58 | 17.41 | 13.88 | 19.29 | 28.81 | 43.44 | 36.12 | 37.41 | 48.39 | 32.54 | 113.38 | 43.34 | 42.20 | 46.85 | 46.05 | 5.21 | 5.88 | 5.63 | 5.18 | 4.66 | 2.64 | 3.04 | 3.23 | 3.06 | 3.93 | 3.47 | 5.68 | 4.83 | 4.20 | 3.88 | 28.81 | 13.29 | 14.20 | 3.29 | 4.19 | 3.29 | 3.56 | 7.16 | 6.25 | 11.31 | 7.45 | 36.47 | 6.05 | 9.17 | 4.41 | 9.80 | 6.93 | 15.89 | 15.48 | 21.90 | 21.10 | 2.66 | 2.45 | 11.74 | 4.36 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 24.62 | 18.50 | 19.27 | 15.53 | 21.52 | 31.71 | 46.06 | 39.93 | 39.48 | 50.20 | 34.73 | 116.23 | 46.34 | 51.11 | 65.42 | 79.82 | 15.67 | 16.28 | 16.54 | 15.55 | 9.91 | 7.96 | 8.45 | 8.61 | 8.07 | NA | NA | NA | 8.88 | NA | NA | NA | 17.91 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Land | 180.75 | 180.75 | 180.75 | 181.95 | 177.53 | 176.79 | 178.79 | 180.50 | 186.66 | 200.56 | 212.61 | 220.36 | 220.36 | 220.42 | 219.92 | 219.57 | 213.62 | 213.10 | 214.66 | 207.38 | 202.20 | 200.20 | 200.20 | 192.95 | 191.62 | 188.78 | 183.94 | 182.92 | 172.00 | 164.28 | 163.48 | 140.63 | 137.53 | 136.34 | 130.34 | 127.67 | 127.57 | 94.32 | 93.95 | 93.29 | 91.77 | 70.84 | 65.67 | 58.87 | 58.87 | 62.69 | 50.21 | 49.11 | 49.11 | 44.62 | 44.37 | 42.49 | 42.49 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

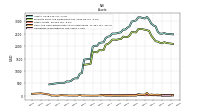

| Property Plant And Equipment Gross | 2780.36 | 2776.59 | 2773.80 | 2790.61 | 2729.90 | 2740.28 | 2780.30 | 2783.26 | 2894.55 | 3021.66 | 3241.70 | 3266.26 | 3265.07 | 3264.56 | 3247.14 | 3228.13 | 3074.85 | 3060.28 | 3058.72 | 2903.32 | 2818.36 | 2807.39 | 2803.95 | 2683.68 | 2665.90 | 2620.92 | 2612.80 | 2597.32 | 2472.85 | 2393.68 | 2348.02 | 2113.87 | 2095.87 | 2088.62 | 1984.08 | 1993.12 | 1988.85 | 1493.14 | NA | NA | 1422.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Construction In Progress Gross | 5.91 | 7.02 | 5.92 | 3.92 | 3.35 | 2.83 | 1.78 | 0.85 | 0.47 | 2.78 | 4.17 | 3.13 | 3.09 | 2.53 | 1.60 | 18.00 | 24.56 | 19.95 | 20.89 | 19.81 | 16.64 | 7.89 | 5.09 | 4.78 | 2.68 | 10.84 | 20.20 | 18.02 | 15.73 | 24.77 | 27.78 | 18.70 | 13.01 | 12.34 | 10.22 | 8.98 | 6.43 | 18.20 | 13.97 | 11.20 | 9.66 | 19.47 | 9.95 | 4.92 | 2.67 | 0.72 | 15.90 | 9.86 | 4.98 | NA | NA | NA | NA | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 673.28 | 656.15 | 638.63 | 625.74 | 611.69 | 599.42 | 593.04 | 582.17 | 576.67 | 593.22 | 622.94 | 618.30 | 597.64 | 576.61 | 555.76 | 534.90 | 514.45 | 494.83 | 487.59 | 468.56 | 451.48 | 433.48 | 415.33 | 397.54 | 380.20 | 363.04 | 345.99 | 329.17 | 313.08 | 297.19 | 281.96 | 272.78 | 259.06 | 245.41 | 233.20 | 225.30 | 212.30 | 202.60 | NA | NA | 174.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Property Plant And Equipment Net | 2107.08 | 2120.44 | 2135.17 | 2164.87 | 2118.21 | 2140.85 | 2187.27 | 2201.08 | 2317.88 | 2428.45 | 2618.76 | 2647.96 | 2667.43 | 2687.96 | 2691.38 | 2693.23 | 2560.39 | 2565.45 | 2571.13 | 2434.76 | 2366.88 | 2373.91 | 2388.62 | 2286.15 | 2285.70 | 2257.89 | 2266.81 | 2268.15 | 2159.77 | 2096.48 | 2066.06 | 1841.09 | 1836.81 | 1843.21 | 1750.88 | 1767.81 | 1776.55 | 1290.54 | NA | NA | 1247.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Line Of Credit | 245.00 | 205.00 | 196.00 | 215.00 | 42.00 | 10.00 | NA | 85.00 | NA | NA | 25.00 | 30.00 | 298.00 | 288.00 | 413.00 | 408.00 | 300.00 | 250.00 | 273.00 | 89.00 | 84.00 | 23.00 | 327.00 | 262.00 | 221.00 | 167.00 | 188.00 | 187.00 | 158.00 | 128.60 | 191.00 | 56.00 | 34.00 | 217.00 | 101.00 | 107.50 | 374.00 | 81.00 | NA | NA | 167.00 | NA | NA | NA | NA | NA | 120.00 | 95.30 | 97.30 | NA | NA | NA | 37.77 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minority Interest | 10.44 | 10.79 | 11.23 | 11.59 | 9.86 | 9.08 | 9.28 | 9.50 | 9.90 | 10.15 | 10.35 | 10.53 | 10.71 | 10.95 | 11.11 | 11.44 | 0.62 | 0.63 | 0.64 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 9.07 | 9.12 | 9.17 | 9.76 | 9.82 | 9.90 | 10.01 | 9.90 | 10.36 | 10.51 | 10.61 | 10.71 | 10.78 | 10.87 | 10.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

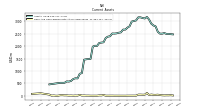

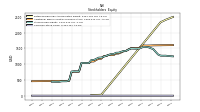

| Stockholders Equity | 1253.95 | 1260.11 | 1268.97 | 1267.49 | 1270.22 | 1306.37 | 1392.22 | 1479.29 | 1507.08 | 1539.06 | 1546.71 | 1552.18 | 1512.23 | 1493.05 | 1492.36 | 1495.56 | 1497.63 | 1462.37 | 1419.05 | 1415.98 | 1389.71 | 1363.40 | 1361.37 | 1319.88 | 1322.12 | NA | NA | NA | 1209.59 | 1206.99 | 1169.57 | 1130.57 | 1133.29 | 1034.90 | 1036.68 | 1036.54 | 1039.92 | 771.12 | 770.03 | 772.68 | 766.55 | 479.70 | 458.20 | 457.51 | 457.18 | 439.45 | NA | NA | 443.49 | NA | NA | NA | NA | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1264.39 | 1270.90 | 1280.20 | 1279.08 | 1280.08 | 1315.45 | 1401.50 | 1488.80 | 1516.98 | 1549.21 | 1557.06 | 1562.71 | 1522.94 | 1504.00 | 1503.47 | 1506.99 | 1498.25 | 1462.99 | 1419.69 | 1415.98 | 1389.71 | 1363.40 | 1361.37 | NA | 1322.12 | 1327.67 | 1286.43 | 1287.28 | 1209.59 | 1206.99 | 1178.64 | 1139.69 | 1142.46 | 1044.67 | 1046.51 | 1046.44 | 1049.93 | 781.02 | 780.38 | 783.18 | 777.16 | 490.41 | 468.99 | 468.38 | 468.05 | 450.41 | 445.27 | 445.61 | 443.49 | 447.48 | 447.42 | 447.52 | 442.50 | NA | NA | NA | |

| Common Stock Value | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.43 | 0.45 | 0.46 | 0.46 | 0.46 | 0.46 | 0.46 | 0.45 | 0.45 | 0.45 | 0.45 | 0.45 | 0.44 | 0.43 | 0.43 | 0.43 | 0.42 | 0.42 | 0.41 | 0.41 | 0.41 | 0.41 | 0.41 | 0.40 | 0.40 | 0.39 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.38 | 0.33 | 0.33 | 0.33 | 0.33 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | 0.28 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 1603.76 | 1602.89 | 1602.03 | 1601.26 | 1599.43 | 1598.38 | 1597.68 | 1596.26 | 1591.18 | 1590.19 | 1589.20 | 1594.34 | 1540.95 | 1510.80 | 1505.27 | 1505.00 | 1505.95 | 1467.29 | 1419.23 | 1406.82 | 1369.92 | 1336.78 | 1333.87 | 1288.86 | 1289.92 | 1295.71 | 1254.52 | 1254.78 | 1173.59 | 1173.59 | 1135.73 | 1085.90 | 1085.14 | 1035.55 | 1035.32 | 1035.16 | 1033.90 | 762.92 | 762.70 | 762.48 | 753.63 | 470.89 | 470.64 | 469.57 | 467.84 | 467.60 | 467.36 | 467.11 | 465.68 | 465.50 | 465.24 | 464.96 | 462.39 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 2466.84 | 2434.80 | 2405.45 | 2365.67 | 2331.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 29.87 | NA | NA | NA | 19.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 10.44 | 10.79 | 11.23 | 11.59 | 9.86 | 9.08 | 9.28 | 9.50 | 9.90 | 10.15 | 10.35 | 10.53 | 10.71 | 10.95 | 11.11 | 11.44 | 0.62 | 0.63 | 0.64 | NA | 0.00 | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 9.07 | 9.12 | 9.17 | 9.76 | 9.82 | 9.90 | 10.01 | 9.90 | 10.36 | 10.51 | 10.61 | 10.71 | 10.78 | 10.87 | 10.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

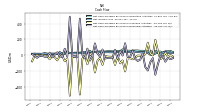

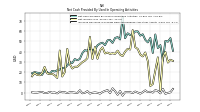

| Net Cash Provided By Used In Operating Activities | 53.20 | 49.70 | 50.50 | 31.05 | 46.36 | 43.53 | 56.77 | 38.68 | 53.36 | 48.99 | 51.60 | 56.91 | 55.62 | 59.72 | 59.73 | 57.08 | 56.15 | 57.90 | 53.08 | 73.84 | 51.87 | 54.17 | 53.32 | 48.51 | 51.37 | 51.01 | 46.27 | 48.67 | 47.90 | 46.12 | 41.90 | 41.30 | 43.63 | 40.80 | 41.43 | 38.56 | 32.93 | 31.59 | 32.74 | 28.88 | 29.78 | 26.49 | 24.08 | 23.85 | 22.53 | 21.86 | 20.62 | 21.25 | 18.20 | 19.92 | 21.38 | 17.36 | 19.18 | 19.46 | 20.01 | 18.89 | |

| Net Cash Provided By Used In Investing Activities | 2.34 | -19.95 | 33.50 | -27.52 | -49.20 | 54.92 | 194.28 | -2.06 | 21.92 | 158.13 | 14.36 | -9.13 | -6.29 | -3.29 | -29.11 | -51.02 | -37.62 | -36.87 | -202.99 | -65.04 | -100.82 | -8.58 | -121.31 | -19.59 | -19.01 | -16.93 | -7.47 | -120.44 | -29.67 | -69.64 | -216.23 | -14.30 | 22.42 | -113.28 | -2.40 | -43.06 | -493.84 | -9.84 | -14.61 | -22.02 | -508.69 | -39.20 | -75.79 | -2.15 | -7.93 | -64.18 | -23.64 | -4.06 | -49.91 | -8.68 | -2.90 | 6.02 | -11.75 | 2.60 | -6.66 | -76.22 | |

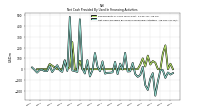

| Net Cash Provided By Used In Financing Activities | -49.42 | -30.54 | -80.25 | -9.52 | -7.36 | -112.80 | -244.92 | -36.18 | -85.99 | -191.65 | -147.47 | 22.11 | -54.10 | -70.73 | -45.02 | 58.08 | -19.14 | -21.28 | 150.90 | -3.16 | 51.21 | -46.00 | 67.81 | -28.75 | -33.02 | -33.63 | -41.02 | 72.62 | -17.60 | 23.84 | 149.40 | -11.48 | -66.96 | 83.39 | -39.93 | 5.40 | 460.64 | -25.35 | -17.22 | -11.92 | 482.77 | -16.31 | 82.13 | -24.82 | -9.84 | 36.92 | 5.89 | -26.14 | 32.12 | -17.67 | -17.67 | -4.94 | -7.22 | -31.35 | -5.97 | 15.98 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 53.20 | 49.70 | 50.50 | 31.05 | 46.36 | 43.53 | 56.77 | 38.68 | 53.36 | 48.99 | 51.60 | 56.91 | 55.62 | 59.72 | 59.73 | 57.08 | 56.15 | 57.90 | 53.08 | 73.84 | 51.87 | 54.17 | 53.32 | 48.51 | 51.37 | 51.01 | 46.27 | 48.67 | 47.90 | 46.12 | 41.90 | 41.30 | 43.63 | 40.80 | 41.43 | 38.56 | 32.93 | 31.59 | 32.74 | 28.88 | 29.78 | 26.49 | 24.08 | 23.85 | 22.53 | 21.86 | 20.62 | 21.25 | 18.20 | 19.92 | 21.38 | 17.36 | 19.18 | 19.46 | 20.01 | 18.89 | |

| Net Income Loss | 32.05 | 29.35 | 39.78 | 34.48 | 1.86 | 34.47 | 21.67 | 8.40 | 6.48 | 30.81 | 39.18 | 35.33 | 37.14 | 42.59 | 44.37 | 61.02 | 42.04 | 42.76 | 39.98 | 35.68 | 37.08 | 40.98 | 37.84 | 38.43 | 37.80 | 39.09 | 38.24 | 44.23 | 41.19 | 33.03 | 44.59 | 32.73 | 54.40 | 33.60 | 31.18 | 29.68 | 27.53 | 25.25 | 25.29 | 23.53 | 27.77 | 42.74 | 19.92 | 15.74 | 41.10 | 14.35 | 16.93 | 18.35 | 18.11 | 18.81 | 25.12 | 19.09 | 16.95 | 17.33 | 19.19 | 15.94 | |

| Profit Loss | 31.72 | 29.03 | 39.45 | 34.18 | 1.56 | 34.23 | 21.47 | 8.25 | 6.50 | 30.85 | 39.23 | 35.38 | 37.16 | 42.66 | 44.42 | 61.06 | 42.04 | 42.76 | 39.98 | 35.68 | 37.08 | 40.98 | 37.84 | NA | 37.80 | 39.09 | 38.24 | 44.23 | 41.19 | 33.44 | 44.98 | 33.11 | 54.79 | 33.98 | 31.54 | 30.01 | 28.10 | 25.52 | 25.58 | 23.86 | 28.11 | 43.05 | 20.10 | 15.92 | 41.27 | 14.35 | 16.93 | 18.35 | 18.11 | 18.81 | NA | NA | NA | NA | NA | NA | |

| Amortization Of Financing Costs | 1.29 | 1.31 | 1.03 | 1.05 | 1.07 | 1.06 | 1.07 | 1.09 | 1.07 | 1.03 | 1.06 | 1.19 | 1.62 | 1.43 | 1.18 | 1.17 | 1.45 | 1.11 | 1.29 | 1.26 | NA | NA | NA | NA | NA | NA | NA | NA | 0.95 | 0.87 | 0.87 | NA | 0.93 | 0.86 | 0.86 | 0.82 | 0.72 | 0.76 | 0.76 | 0.37 | 0.11 | 0.11 | 0.40 | 0.08 | 0.08 | 0.08 | 0.08 | NA | 0.47 | 0.03 | 0.04 | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 2.34 | -19.95 | 33.50 | -27.52 | -49.20 | 54.92 | 194.28 | -2.06 | 21.92 | 158.13 | 14.36 | -9.13 | -6.29 | -3.29 | -29.11 | -51.02 | -37.62 | -36.87 | -202.99 | -65.04 | -100.82 | -8.58 | -121.31 | -19.59 | -19.01 | -16.93 | -7.47 | -120.44 | -29.67 | -69.64 | -216.23 | -14.30 | 22.42 | -113.28 | -2.40 | -43.06 | -493.84 | -9.84 | -14.61 | -22.02 | -508.69 | -39.20 | -75.79 | -2.15 | -7.93 | -64.18 | -23.64 | -4.06 | -49.91 | -8.68 | -2.90 | 6.02 | -11.75 | 2.60 | -6.66 | -76.22 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -49.42 | -30.54 | -80.25 | -9.52 | -7.36 | -112.80 | -244.92 | -36.18 | -85.99 | -191.65 | -147.47 | 22.11 | -54.10 | -70.73 | -45.02 | 58.08 | -19.14 | -21.28 | 150.90 | -3.16 | 51.21 | -46.00 | 67.81 | -28.75 | -33.02 | -33.63 | -41.02 | 72.62 | -17.60 | 23.84 | 149.40 | -11.48 | -66.96 | 83.39 | -39.93 | 5.40 | 460.64 | -25.35 | -17.22 | -11.92 | 482.77 | -16.31 | 82.13 | -24.82 | -9.84 | 36.92 | 5.89 | -26.14 | 32.12 | -17.67 | -17.67 | -4.94 | -7.22 | -31.35 | -5.97 | 15.98 | |

| Payments Of Dividends | 39.07 | 39.07 | 39.05 | 39.05 | 39.05 | 40.19 | 41.27 | 41.27 | 41.27 | 41.27 | 50.55 | 49.82 | 49.31 | 49.23 | 49.23 | 46.82 | 46.15 | 45.52 | 45.36 | 42.70 | 42.23 | 42.17 | 41.53 | 39.46 | 39.45 | 38.94 | 38.79 | 35.86 | 35.86 | 35.24 | 34.56 | 32.64 | 31.93 | 31.93 | 31.93 | 28.86 | 25.45 | 25.45 | 25.45 | 24.29 | 20.49 | 20.49 | 19.37 | 24.79 | 18.65 | 18.07 | 18.06 | 24.14 | 17.06 | 17.04 | 17.04 | 16.75 | 16.75 | 15.91 | 15.90 | 17.96 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | 2010-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 79.47 | 80.11 | 77.88 | 82.39 | 70.67 | 76.30 | 59.90 | 71.33 | 69.67 | 73.83 | 74.33 | 80.89 | 81.26 | 84.30 | 84.17 | 83.08 | 82.20 | 81.68 | 78.10 | 76.11 | 74.00 | 74.92 | 72.96 | 72.75 | 71.08 | 71.35 | 69.84 | 66.39 | 65.03 | 63.25 | 61.20 | 59.02 | 58.64 | 58.28 | 56.31 | 55.75 | 45.73 | 44.48 | 44.16 | 43.14 | 32.79 | 31.79 | 28.05 | 28.07 | 26.82 | 25.51 | 21.77 | 24.07 | 21.52 | 20.45 | 20.28 | 20.62 | 19.51 | 19.42 | 19.10 | 20.18 | |

| Corporate Non | 0.07 | 0.15 | 0.05 | 0.08 | 0.09 | 0.07 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Real Estate Investment | 66.44 | 67.59 | 66.03 | 70.61 | 58.79 | 64.21 | 47.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Operating, Senior Housing Operating Portfolio | 12.95 | 12.37 | 11.79 | 11.70 | 11.79 | 12.01 | 11.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 12.95 | 12.37 | 11.79 | 11.70 | 11.79 | 12.01 | 11.99 | 71.33 | 69.67 | 73.83 | 74.33 | 80.89 | 81.26 | 84.30 | 84.17 | 83.08 | 82.20 | 81.68 | 78.10 | 76.11 | 74.00 | 74.92 | 72.96 | 72.75 | 71.08 | 71.35 | 69.84 | 66.39 | 65.03 | 63.25 | 61.20 | 59.02 | 58.64 | 58.28 | 56.31 | 55.75 | 45.73 | 44.48 | 44.16 | 43.14 | 32.79 | 31.79 | 28.05 | 28.07 | 26.82 | 25.51 | 21.77 | 24.07 | 21.52 | 20.45 | 20.28 | 20.62 | 19.51 | 19.42 | 19.10 | 20.18 | |

| Operating, Senior Housing Operating Portfolio | 12.95 | 12.37 | 11.79 | 11.70 | 11.79 | 12.01 | 11.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Nonperforming Financing Receivable | 0.40 | 0.50 | 0.40 | 0.40 | 0.00 | 0.50 | 0.30 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Montecito Medical Real Estate | 0.40 | 0.50 | 0.50 | 0.40 | 0.50 | 0.50 | 0.50 | 0.40 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |