| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | NA | NA | 0.00 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 54.39 | 54.26 | 54.03 | NA | 50.87 | 44.90 | 44.69 | NA | 44.37 | 43.80 | NA | NA | 16.94 | 1.63 | NA | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 54.39 | 54.26 | 54.03 | NA | 50.87 | 44.90 | 44.69 | NA | 44.37 | 43.80 | NA | NA | 16.94 | 1.24 | NA | NA | NA | NA | NA | |

| Earnings Per Share Basic | -0.68 | -0.45 | -0.75 | -0.86 | -0.90 | -1.01 | -0.95 | -0.85 | -0.65 | -0.60 | NA | NA | -1.09 | 0.00 | NA | NA | NA | NA | NA | |

| Earnings Per Share Diluted | -0.68 | -0.45 | -0.75 | -0.86 | -0.90 | -1.01 | -0.95 | -0.85 | -0.65 | -0.60 | NA | NA | -1.09 | 0.00 | NA | NA | NA | NA | NA |

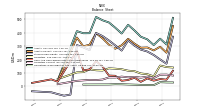

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

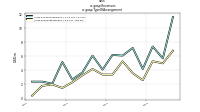

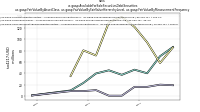

| Revenues | 18.47 | 30.68 | 12.69 | 6.78 | 10.79 | 11.43 | 9.62 | 7.40 | 10.25 | 7.09 | 5.01 | 6.69 | 4.08 | 4.18 | 2.86 | 1.86 | 10.58 | 9.44 | 9.23 | |

| Operating Expenses | 58.48 | 57.44 | 55.64 | 55.47 | 57.51 | 57.15 | 52.37 | 45.35 | 39.25 | 33.51 | 29.53 | 26.70 | 23.28 | 17.41 | 15.42 | 15.43 | 13.19 | NA | NA | |

| Research And Development Expense | 47.86 | 45.76 | 45.82 | 46.11 | 47.76 | 47.49 | 43.14 | 36.53 | 30.91 | 25.99 | 23.00 | 20.45 | 18.94 | 14.14 | 12.97 | 12.82 | 11.01 | NA | NA | |

| General And Administrative Expense | 10.62 | 11.68 | 9.82 | 9.37 | 9.75 | 9.65 | 9.23 | 8.82 | 8.34 | 7.51 | 6.53 | 6.25 | 4.34 | 3.27 | 2.45 | 2.60 | 2.18 | NA | NA | |

| Operating Income Loss | -40.01 | -26.77 | -42.95 | -48.69 | -46.72 | -45.72 | -42.74 | -37.95 | -29.00 | -26.41 | -24.52 | -20.01 | -19.19 | -13.23 | -12.55 | -13.56 | -2.61 | NA | NA | |

| Profit Loss | NA | NA | NA | NA | -45.71 | -45.40 | -42.53 | -37.70 | -28.84 | -26.38 | -24.27 | -19.91 | -18.52 | 7.58 | -12.39 | -13.52 | NA | NA | NA | |

| Net Income Loss | -36.98 | -24.28 | -40.73 | -46.72 | -45.71 | -45.40 | -42.53 | -37.70 | -28.84 | -26.38 | -24.27 | -19.91 | -18.52 | 7.58 | -12.39 | -13.52 | -2.43 | -3.07 | -2.69 | |

| Comprehensive Income Net Of Tax | -36.31 | -22.93 | -39.66 | -47.29 | -46.37 | -46.42 | -43.99 | -38.25 | -28.92 | -26.40 | -24.31 | -19.96 | -18.52 | 7.66 | -12.33 | -13.52 | -2.43 | NA | NA |

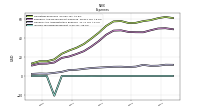

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

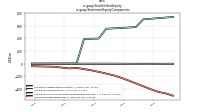

| Assets | 308.19 | 350.62 | 370.15 | 416.76 | 459.34 | 394.31 | 437.72 | 476.77 | 493.07 | 517.98 | 396.66 | 396.34 | 411.87 | NA | NA | 44.05 | NA | NA | NA | |

| Liabilities | 74.38 | 90.70 | 96.10 | 113.06 | 116.79 | 127.57 | 131.80 | 134.47 | 117.86 | 119.80 | 126.53 | 106.07 | 104.25 | NA | NA | 53.57 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 308.19 | 350.62 | 370.15 | 416.76 | 459.34 | 394.31 | 437.72 | 476.77 | 493.07 | 517.98 | 396.66 | 396.34 | 411.87 | NA | NA | 44.05 | NA | NA | NA | |

| Stockholders Equity | 233.82 | 259.92 | 274.05 | 303.70 | 342.55 | 266.74 | 305.92 | 342.30 | 375.22 | 398.18 | 270.13 | 290.27 | 307.62 | -61.53 | -69.80 | -57.71 | -44.44 | -42.20 | -39.36 |

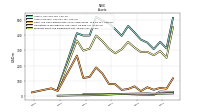

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 267.95 | 290.01 | 288.33 | 318.45 | 354.87 | 306.79 | 280.48 | 311.12 | 358.44 | 396.28 | 310.77 | 298.43 | 364.09 | NA | NA | 39.35 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 42.30 | 58.96 | 33.57 | 64.47 | 47.56 | 41.53 | 78.78 | 80.51 | 147.44 | 188.21 | 126.38 | 119.36 | 265.53 | NA | NA | 34.82 | 51.85 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | NA | NA | NA | NA | 47.56 | 41.53 | 78.78 | 80.51 | 147.44 | 188.21 | 126.38 | 119.53 | 265.70 | 159.33 | 56.41 | 34.99 | 52.02 | NA | NA | |

| Short Term Investments | NA | NA | NA | 244.67 | NA | 255.75 | 183.20 | 215.21 | 196.46 | 197.81 | 176.69 | 161.79 | 88.72 | NA | NA | 2.90 | NA | NA | NA | |

| Marketable Securities Current | 216.55 | 222.22 | 243.57 | 244.67 | 296.92 | NA | NA | 215.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 2.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 7.10 | 8.84 | 11.18 | 9.31 | 10.39 | 9.51 | 10.30 | 9.19 | 9.34 | 4.58 | 3.71 | 5.94 | 5.99 | NA | NA | 1.63 | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 41.63 | 41.64 | 39.04 | 36.83 | 34.65 | 32.20 | 29.23 | 26.22 | 23.69 | 22.82 | 20.79 | 19.86 | 19.07 | NA | NA | 14.87 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 25.05 | 23.14 | 21.32 | 19.67 | 18.15 | 16.69 | 15.71 | 14.88 | 14.12 | 14.47 | 13.83 | 13.18 | 12.54 | NA | NA | 11.00 | NA | NA | NA | |

| Property Plant And Equipment Net | 16.58 | 18.50 | 17.72 | 17.16 | 16.50 | 15.51 | 13.52 | 11.34 | 9.57 | 8.35 | 6.96 | 6.67 | 6.53 | NA | NA | 3.87 | NA | NA | NA | |

| Long Term Investments | NA | NA | NA | 63.88 | NA | 51.54 | 123.69 | 137.19 | 121.48 | 110.44 | 77.19 | 90.89 | 40.90 | NA | NA | 0.51 | NA | NA | NA | |

| Other Assets Noncurrent | 3.85 | 3.81 | 3.84 | 4.02 | 4.09 | 4.16 | 3.26 | 2.83 | 3.29 | 2.75 | 1.57 | 0.18 | 0.18 | NA | NA | 0.15 | NA | NA | NA |

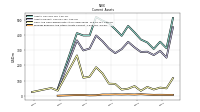

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 61.49 | 72.26 | 64.88 | 70.66 | 67.50 | 72.67 | 66.05 | 66.26 | 50.68 | 46.84 | 47.97 | 44.54 | 41.01 | NA | NA | 16.14 | NA | NA | NA | |

| Accounts Payable Current | 2.19 | 4.53 | 5.63 | 5.06 | 6.05 | 6.14 | 6.01 | 6.65 | 3.86 | 5.41 | 4.39 | 3.41 | 3.61 | NA | NA | 1.60 | NA | NA | NA | |

| Taxes Payable Current | 0.03 | 0.02 | 0.09 | 0.09 | 0.04 | 0.03 | 0.05 | 0.07 | 0.04 | NA | 0.33 | 0.07 | 0.03 | NA | NA | 0.03 | NA | NA | NA | |

| Other Liabilities Current | 0.83 | 1.24 | 1.02 | 1.50 | 1.65 | 2.24 | 0.55 | 0.66 | 0.63 | 0.60 | 0.70 | 0.70 | 0.96 | NA | NA | 0.31 | NA | NA | NA | |

| Contract With Customer Liability Current | 32.04 | 44.06 | 38.30 | 37.63 | 36.34 | 41.32 | 43.19 | 41.21 | 35.25 | 33.76 | 32.75 | 32.80 | 30.30 | NA | NA | 9.61 | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Lease Liability Noncurrent | 2.64 | 3.76 | 5.11 | 6.43 | 7.75 | 9.04 | 10.33 | 9.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

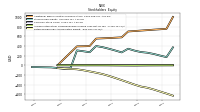

| Stockholders Equity | 233.82 | 259.92 | 274.05 | 303.70 | 342.55 | 266.74 | 305.92 | 342.30 | 375.22 | 398.18 | 270.13 | 290.27 | 307.62 | -61.53 | -69.80 | -57.71 | -44.44 | -42.20 | -39.36 | |

| Common Stock Value | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 | NA | NA | 0.00 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 738.24 | 728.04 | 719.24 | 709.22 | 700.77 | 578.61 | 571.36 | 563.76 | 558.42 | 552.46 | 398.02 | 393.84 | 391.23 | NA | NA | 2.74 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -503.24 | -466.26 | -441.99 | -401.25 | -354.54 | -308.83 | -263.43 | -220.89 | -183.19 | -154.35 | -127.97 | -103.70 | -83.78 | NA | NA | -60.46 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -1.23 | -1.90 | -3.25 | -4.32 | -3.74 | -3.08 | -2.07 | -0.61 | -0.06 | 0.03 | 0.05 | 0.09 | 0.14 | NA | NA | -0.00 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | NA | NA | NA | NA | 19.33 | NA | NA | NA | NA | 150.16 | NA | NA | 218.14 | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 8.47 | 8.75 | 8.51 | NA | 6.99 | 6.78 | 6.07 | NA | 4.31 | 3.94 | 2.70 | NA | 1.11 | 0.47 | 0.18 | NA | 0.14 | 0.10 | 0.10 |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

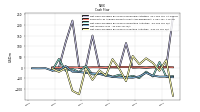

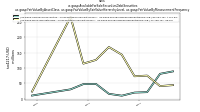

| Net Cash Provided By Used In Operating Activities | -41.13 | -18.47 | -48.45 | -37.95 | -46.31 | -32.91 | -42.63 | -30.91 | -29.97 | -31.54 | 8.05 | -20.48 | -6.14 | -14.43 | 40.97 | -12.75 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 22.77 | 43.83 | 16.07 | 55.01 | -63.08 | -4.76 | 40.03 | -36.52 | -12.23 | -57.11 | -2.39 | -124.56 | -108.08 | -2.34 | -19.42 | -4.37 | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | 1.70 | 0.03 | 1.48 | -0.14 | 115.41 | 0.43 | 1.49 | 0.50 | 1.55 | 150.47 | 1.36 | -1.13 | 220.42 | 119.68 | 0.05 | 0.08 | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

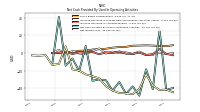

| Net Cash Provided By Used In Operating Activities | -41.13 | -18.47 | -48.45 | -37.95 | -46.31 | -32.91 | -42.63 | -30.91 | -29.97 | -31.54 | 8.05 | -20.48 | -6.14 | -14.43 | 40.97 | -12.75 | NA | NA | NA | |

| Net Income Loss | -36.98 | -24.28 | -40.73 | -46.72 | -45.71 | -45.40 | -42.53 | -37.70 | -28.84 | -26.38 | -24.27 | -19.91 | -18.52 | 7.58 | -12.39 | -13.52 | -2.43 | -3.07 | -2.69 | |

| Profit Loss | NA | NA | NA | NA | -45.71 | -45.40 | -42.53 | -37.70 | -28.84 | -26.38 | -24.27 | -19.91 | -18.52 | 7.58 | -12.39 | -13.52 | NA | NA | NA | |

| Increase Decrease In Accounts Payable | -1.20 | -2.24 | 0.40 | -0.90 | -0.76 | 1.85 | -0.10 | 0.86 | -1.39 | 1.22 | 0.90 | 0.63 | -1.14 | 1.45 | 0.30 | 0.04 | NA | NA | NA | |

| Share Based Compensation | 8.45 | 8.72 | 8.48 | 8.30 | 6.99 | 6.78 | 6.07 | 4.84 | 4.31 | 3.94 | 2.70 | 2.54 | 1.11 | 0.47 | 0.18 | 0.17 | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

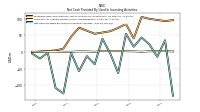

| Net Cash Provided By Used In Investing Activities | 22.77 | 43.83 | 16.07 | 55.01 | -63.08 | -4.76 | 40.03 | -36.52 | -12.23 | -57.11 | -2.39 | -124.56 | -108.08 | -2.34 | -19.42 | -4.37 | NA | NA | NA | |

| Payments To Acquire Property Plant And Equipment | 2.46 | 1.08 | 2.28 | 2.56 | 3.42 | 2.79 | 3.47 | 0.86 | 1.86 | 2.09 | 0.84 | 0.91 | 1.67 | 1.61 | 0.36 | 0.95 | NA | NA | NA | |

| Payments To Acquire Investments | NA | NA | NA | NA | NA | 64.79 | 15.24 | 90.68 | 74.58 | 135.50 | 47.74 | 134.16 | 111.43 | 10.58 | 19.06 | 3.41 | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 1.70 | 0.03 | 1.48 | -0.14 | 115.41 | 0.43 | 1.49 | 0.50 | 1.55 | 150.47 | 1.36 | -1.13 | 220.42 | 119.68 | 0.05 | 0.08 | NA | NA | NA |

| 2023-08-31 | 2023-05-31 | 2023-02-28 | 2022-11-30 | 2022-08-31 | 2022-05-31 | 2022-02-28 | 2021-11-30 | 2021-08-31 | 2021-05-31 | 2021-02-28 | 2020-11-30 | 2020-08-31 | 2020-05-31 | 2020-02-29 | 2019-11-30 | 2019-08-31 | 2019-05-31 | 2019-02-28 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 18.47 | 30.68 | 12.69 | 6.78 | 10.79 | 11.43 | 9.62 | 7.40 | 10.25 | 7.09 | 5.01 | 6.69 | 4.08 | 4.18 | 2.86 | 1.86 | 10.58 | 9.44 | 9.23 | |

| Collaboration Revenue | 18.47 | 10.68 | NA | NA | 10.79 | 11.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| License Revenue | 0.00 | 20.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| License Revenue, Gilead Agreement | 0.00 | 20.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Gilead Agreement | 11.60 | 5.70 | 7.40 | 4.20 | 7.20 | 6.10 | 6.20 | 4.10 | 6.10 | 3.70 | 2.70 | 5.20 | 2.10 | 2.40 | 2.40 | NA | NA | NA | NA | |

| Sanofi Agreement | 6.80 | 5.00 | 5.30 | 2.60 | 3.60 | 5.30 | 3.40 | 3.40 | 4.20 | 3.30 | 2.30 | 1.50 | 2.00 | 1.80 | 0.40 | NA | NA | NA | NA | |

| Sanofi Agreement | NA | NA | NA | NA | 3.60 | 5.30 | 3.40 | 3.40 | 4.20 | 3.30 | 2.30 | 1.50 | 2.00 | 1.80 | 0.40 | NA | NA | NA | NA |