| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.52 | 0.52 | 0.52 | 0.52 | 0.48 | 0.48 | 0.48 | 0.48 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | NA | 0.34 | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 59.11 | 59.15 | 58.92 | NA | 58.80 | 58.99 | 58.94 | NA | 59.52 | 59.97 | 60.10 | NA | 59.94 | 60.00 | 60.48 | NA | 50.97 | 51.29 | 50.15 | NA | 48.57 | 48.70 | 44.85 | NA | 33.11 | 33.14 | 33.09 | NA | 25.89 | 22.88 | 17.12 | NA | 16.95 | 16.59 | 16.64 | NA | 16.70 | 16.82 | 17.05 | NA | 17.21 | 17.14 | 17.32 | NA | 17.62 | 17.93 | 18.11 | NA | 18.28 | 18.23 | 18.21 | NA | 18.19 | 18.18 | |

| Weighted Average Number Of Shares Outstanding Basic | 59.10 | 59.15 | 58.77 | NA | 58.68 | 58.89 | 58.74 | NA | 59.31 | 59.70 | 59.84 | NA | 59.94 | 59.88 | 59.88 | NA | 50.49 | 50.69 | 49.53 | NA | 47.69 | 47.72 | 43.88 | NA | 32.18 | 32.12 | 31.90 | NA | 25.43 | 22.48 | 16.91 | NA | 16.73 | 16.40 | 16.48 | NA | 16.62 | 16.74 | 16.88 | NA | 17.05 | 17.11 | 17.29 | NA | 17.56 | 17.89 | 18.06 | NA | 18.23 | 18.18 | 18.16 | NA | 18.15 | 18.14 | |

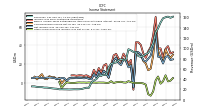

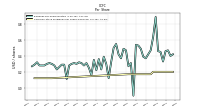

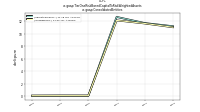

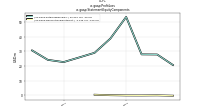

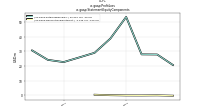

| Earnings Per Share Basic | 0.33 | 0.45 | 0.46 | 0.89 | 0.64 | 0.48 | 0.42 | 0.37 | 0.40 | 0.49 | 0.53 | 0.53 | -0.10 | 0.31 | 0.28 | 0.47 | 0.50 | 0.37 | 0.43 | 0.56 | 0.50 | 0.33 | 0.12 | 0.31 | 0.40 | 0.24 | 0.38 | 0.22 | 0.36 | 0.16 | 0.25 | 0.31 | 0.28 | 0.31 | 0.32 | 0.30 | 0.31 | 0.31 | 0.28 | 0.12 | 0.29 | 0.29 | 0.26 | 0.23 | 0.28 | 0.30 | 0.31 | 0.30 | 0.28 | 0.28 | 0.28 | 0.32 | 0.29 | 0.27 | |

| Earnings Per Share Diluted | 0.33 | 0.45 | 0.46 | 0.89 | 0.64 | 0.47 | 0.42 | 0.37 | 0.39 | 0.49 | 0.53 | 0.54 | -0.10 | 0.31 | 0.27 | 0.47 | 0.49 | 0.37 | 0.42 | 0.55 | 0.50 | 0.32 | 0.12 | 0.30 | 0.39 | 0.23 | 0.36 | 0.22 | 0.35 | 0.16 | 0.25 | 0.31 | 0.28 | 0.31 | 0.32 | 0.30 | 0.31 | 0.30 | 0.28 | 0.11 | 0.29 | 0.29 | 0.26 | 0.23 | 0.28 | 0.30 | 0.31 | 0.30 | 0.28 | 0.28 | 0.28 | 0.32 | 0.29 | 0.27 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

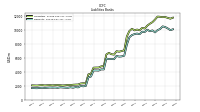

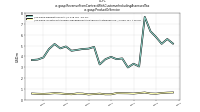

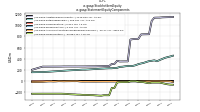

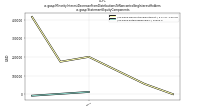

| Revenues | 158.41 | 150.10 | 139.03 | 130.28 | 110.50 | 99.42 | 90.98 | 88.46 | 85.42 | 83.34 | 84.87 | 92.56 | 92.96 | 95.88 | 98.21 | 77.08 | 76.89 | 78.41 | 76.42 | 72.36 | 71.38 | 70.08 | 62.84 | 47.91 | 48.03 | 46.88 | 46.01 | 39.90 | 37.31 | 33.14 | 23.07 | 23.15 | 21.97 | 20.58 | 20.17 | 20.07 | 20.14 | 19.90 | 19.75 | 19.96 | 19.98 | 20.16 | 20.05 | 21.19 | 21.51 | 22.05 | 22.86 | 23.42 | 23.44 | 24.24 | 24.29 | 24.76 | 25.73 | 25.81 | |

| Interest And Fee Income Loans And Leases | 133.93 | 129.10 | 121.72 | 117.05 | 100.14 | 90.73 | 82.47 | 81.39 | 78.89 | 77.05 | 77.91 | 85.00 | 85.93 | 88.35 | 89.94 | 70.30 | 69.72 | 70.92 | 69.00 | 65.32 | 64.50 | 63.13 | 56.60 | 42.91 | 43.33 | 42.61 | 41.74 | 36.80 | 34.61 | 30.52 | 21.04 | 21.14 | 19.98 | 18.55 | 18.03 | 17.84 | 17.94 | 17.53 | 17.25 | 17.37 | 17.40 | 17.43 | 17.66 | 18.53 | 18.72 | 19.12 | 19.80 | 20.45 | 20.36 | 21.02 | 21.16 | 21.66 | 22.31 | 22.23 | |

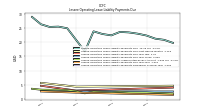

| Operating Expenses | 64.48 | 62.93 | 61.31 | 59.73 | 59.00 | 58.66 | 57.49 | 64.83 | 58.67 | 51.67 | 51.68 | 70.92 | 56.79 | 55.93 | 62.80 | 47.60 | 43.36 | 50.91 | 47.27 | 37.79 | 39.53 | 50.90 | 56.82 | 26.43 | 30.73 | 37.13 | 30.96 | 25.83 | 25.03 | 28.65 | 16.72 | 15.88 | 16.15 | 14.39 | 13.74 | 14.40 | 14.45 | 14.85 | 14.26 | 19.61 | 13.78 | 13.72 | 12.66 | 13.24 | 13.84 | 12.87 | 12.94 | 13.02 | 13.13 | 13.38 | 13.13 | 13.93 | 13.76 | 13.26 | |

| Interest Expense | 67.41 | 57.99 | 40.23 | 23.79 | 14.53 | 8.62 | 6.76 | 7.87 | 8.29 | 9.32 | 11.27 | 14.71 | 16.17 | 17.21 | 18.56 | 13.72 | 13.49 | 13.57 | 12.03 | 10.52 | 9.88 | 8.63 | 7.13 | 5.40 | 4.97 | 4.71 | 4.53 | 4.15 | 3.37 | 3.13 | 2.51 | 2.46 | 2.40 | 2.14 | 2.04 | 2.04 | 2.04 | 1.74 | 1.68 | 1.71 | 2.44 | 2.62 | 2.86 | 3.17 | 3.51 | 3.66 | 3.76 | 4.14 | 4.37 | 4.59 | 4.95 | 5.88 | 6.16 | 6.11 | |

| Interest Income Expense Net | 91.00 | 92.11 | 98.80 | 106.49 | 95.97 | 90.80 | 84.23 | 80.59 | 77.13 | 74.02 | 73.60 | 77.85 | 76.79 | 78.67 | 79.64 | 63.35 | 63.39 | 64.84 | 64.39 | 61.84 | 61.50 | 61.45 | 55.71 | 42.51 | 43.06 | 42.17 | 41.48 | 35.75 | 33.94 | 30.01 | 20.56 | 20.69 | 19.57 | 18.43 | 18.13 | 18.02 | 18.10 | 18.16 | 18.07 | 18.25 | 17.54 | 17.54 | 17.19 | 18.02 | 18.00 | 18.39 | 19.11 | 19.27 | 19.07 | 19.64 | 19.34 | 18.88 | 19.57 | 19.70 | |

| Interest Paid Net | 62.66 | 52.38 | 33.91 | 21.75 | 12.89 | 9.97 | 5.09 | 9.37 | 7.07 | 10.57 | 10.38 | 14.96 | 15.41 | 16.79 | 19.29 | 13.02 | 13.75 | 13.05 | 12.49 | 9.81 | 10.42 | 9.29 | 6.92 | 5.89 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | 6.46 | 9.00 | 8.65 | 17.35 | 12.30 | 8.94 | 7.97 | 4.08 | 7.35 | 10.05 | 10.68 | 10.42 | -2.61 | 5.88 | 4.04 | 3.18 | 6.30 | 4.46 | 4.84 | 4.27 | 5.28 | 3.02 | 1.00 | 10.19 | 5.70 | 3.17 | 3.80 | 2.98 | 4.79 | 1.93 | 2.45 | 2.78 | 2.58 | 2.78 | 2.74 | 2.49 | 2.79 | 2.77 | 2.56 | 0.78 | 2.66 | 2.77 | 2.40 | 2.12 | 2.68 | 3.00 | 3.13 | 3.01 | 2.75 | 2.85 | 2.86 | 1.70 | 3.19 | 2.88 | |

| Income Taxes Paid | 8.07 | 18.81 | 1.27 | 12.75 | 9.00 | 3.06 | 0.57 | 11.82 | 13.01 | 25.13 | 0.57 | 0.51 | 2.30 | 2.93 | 0.00 | 3.50 | 5.24 | 11.25 | 0.02 | 2.17 | 0.01 | 0.13 | 0.00 | 6.00 | 0.01 | 0.00 | 0.00 | 3.85 | 2.40 | 4.66 | 0.00 | 2.70 | 7.10 | 0.60 | 0.16 | 2.80 | 2.40 | 5.36 | 1.24 | 1.34 | 1.33 | 5.19 | 0.28 | 2.90 | 0.30 | 5.81 | 0.01 | 1.83 | 3.72 | 7.76 | 4.90 | 2.76 | 1.95 | NA | |

| Profit Loss | 20.53 | 27.88 | 27.90 | 53.31 | 38.80 | 29.48 | 25.76 | 22.66 | 24.17 | 30.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -0.62 | -1.59 | 0.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.55 | -0.55 | NA | NA | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | 1.54 | -1.03 | 6.67 | 2.51 | -9.40 | -13.92 | -12.35 | -2.09 | -0.76 | -0.29 | -0.31 | -0.32 | -0.18 | 0.62 | 1.72 | 0.15 | 0.29 | 1.04 | 0.77 | 0.49 | -0.29 | 1.65 | -0.10 | -0.18 | 0.16 | 0.18 | 0.23 | -0.00 | 0.19 | 0.12 | 0.32 | 0.09 | 0.26 | 0.20 | 0.32 | 0.08 | -0.29 | -0.33 | 0.04 | 0.39 | -2.17 | -5.67 | 0.78 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 20.67 | 27.80 | 27.88 | 53.27 | 38.61 | 28.96 | 25.76 | 22.66 | 24.17 | 30.55 | 32.70 | 33.06 | -4.93 | 18.64 | 16.53 | 23.45 | 24.97 | 18.98 | 21.17 | 26.73 | 24.07 | 15.70 | 5.43 | 9.96 | 12.82 | 7.68 | 12.02 | 6.05 | 9.13 | 3.66 | 4.21 | 5.23 | 4.70 | 5.13 | 5.26 | 4.93 | 5.17 | 5.12 | 4.71 | 1.94 | 4.97 | 4.99 | 4.44 | 4.04 | 4.96 | 5.37 | 5.65 | 5.46 | 5.07 | 5.10 | 5.11 | 5.78 | 5.24 | 4.95 | |

| Comprehensive Income Net Of Tax | 22.20 | 26.76 | 34.55 | 55.79 | 29.21 | 15.04 | 13.41 | 20.57 | 23.41 | 30.27 | 32.39 | 32.74 | -5.11 | 19.25 | 18.25 | 23.60 | 25.26 | 20.02 | 21.94 | 27.23 | 23.78 | 17.35 | 5.32 | 9.78 | 12.98 | 7.86 | 12.25 | 6.05 | 9.31 | 3.79 | 4.52 | 5.31 | 4.96 | 5.33 | 5.58 | 5.01 | 4.88 | 4.79 | 4.75 | 2.33 | 2.80 | -0.68 | 5.22 | 3.74 | 5.96 | 5.83 | 7.01 | 3.79 | 4.32 | 9.18 | 6.54 | 3.64 | 6.42 | NA | |

| Net Income Loss Available To Common Stockholders Basic | 19.66 | 26.79 | 26.88 | 52.27 | 37.61 | 27.96 | 24.75 | 21.65 | 23.16 | 29.55 | 31.69 | 32.06 | -6.02 | 18.64 | 16.53 | 23.45 | 24.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Diluted | 19.66 | 26.79 | 26.88 | 52.27 | 37.61 | 27.96 | 24.75 | 21.65 | 23.16 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 80.71 | 90.88 | 95.79 | 102.84 | 94.95 | 89.54 | 82.38 | 82.16 | 80.31 | 80.48 | 74.22 | 73.78 | 41.07 | 69.02 | 69.68 | 63.00 | 63.09 | 64.48 | 63.77 | 61.34 | 60.60 | 60.74 | 54.34 | 41.09 | 41.89 | 41.01 | 40.78 | 35.24 | 33.05 | 29.35 | 20.00 | 20.39 | 19.27 | 18.13 | 17.76 | 17.20 | 17.10 | 17.88 | 17.54 | 18.05 | 16.84 | 16.74 | 16.09 | 14.92 | 16.60 | 16.69 | 17.41 | 17.27 | 17.22 | 17.45 | 17.64 | 16.88 | 17.97 | 17.50 | |

| Noninterest Income | 10.76 | 8.93 | 2.07 | 27.55 | 15.15 | 7.54 | 8.85 | 9.41 | 9.88 | 11.80 | 20.84 | 40.62 | 8.18 | 11.43 | 13.70 | 11.23 | 11.54 | 9.88 | 9.51 | 8.75 | 8.29 | 8.88 | 8.91 | 6.75 | 7.36 | 6.97 | 6.00 | 6.26 | 5.90 | 4.88 | 3.38 | 4.12 | 4.15 | 4.17 | 3.99 | 4.57 | 5.30 | 4.85 | 4.00 | 4.28 | 4.57 | 4.74 | 3.41 | 4.49 | 4.88 | 4.54 | 4.31 | 4.21 | 3.73 | 3.90 | 3.46 | 4.53 | 4.22 | 3.60 |

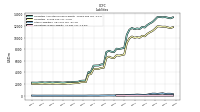

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

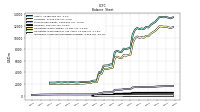

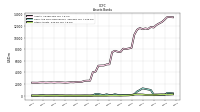

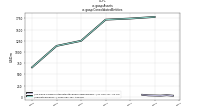

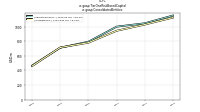

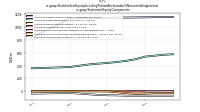

| Assets | 13498.18 | 13538.90 | 13555.17 | 13103.90 | 12683.45 | 12438.65 | 12164.94 | 11739.62 | 11829.69 | 11483.90 | 11577.47 | 11448.31 | 11651.30 | 11345.36 | 10489.07 | 8246.15 | 8135.17 | 8029.06 | 8092.95 | 7516.15 | 7562.59 | 7736.90 | 7494.90 | 5416.01 | 5383.91 | 5202.20 | 5196.34 | 5167.05 | 4151.02 | 4047.49 | 2588.45 | 2593.07 | 2557.90 | 2395.10 | 2384.14 | 2356.71 | 2308.70 | 2329.14 | 2281.71 | 2249.71 | 2286.29 | 2305.66 | 2303.71 | 2269.23 | 2304.43 | 2287.53 | 2261.21 | 2302.09 | 2281.79 | 2239.01 | NA | 2251.33 | NA | NA | |

| Liabilities | 11860.58 | 11912.62 | 11944.80 | 11518.43 | 11143.24 | 10917.22 | 10645.61 | 10223.06 | 10316.44 | 9975.11 | 10078.75 | 9964.18 | 10189.58 | 9868.93 | 9079.24 | 7093.03 | 6990.65 | 6891.76 | 6965.78 | 6476.80 | 6532.74 | 6724.34 | 6487.44 | 4814.06 | 4787.66 | 4614.90 | 4613.66 | 4595.01 | 3733.77 | 3638.24 | 2347.37 | 2354.62 | 2323.21 | 2173.57 | 2163.84 | 2138.45 | 2090.05 | 2113.30 | 2065.52 | 2035.36 | 2072.52 | 2089.39 | 2084.16 | 2049.44 | 2084.74 | 2068.70 | 2040.74 | 2085.24 | 2065.89 | 2025.64 | NA | 2050.08 | NA | NA | |

| Liabilities And Stockholders Equity | 13498.18 | 13538.90 | 13555.17 | 13103.90 | 12683.45 | 12438.65 | 12164.94 | 11739.62 | 11829.69 | 11483.90 | 11577.47 | 11448.31 | 11651.30 | 11345.36 | 10489.07 | 8246.15 | 8135.17 | 8029.06 | 8092.95 | 7516.15 | 7562.59 | 7736.90 | 7494.90 | 5416.01 | 5383.91 | 5202.20 | 5196.34 | 5167.05 | 4151.02 | 4047.49 | 2588.45 | 2593.07 | 2557.90 | 2395.10 | 2384.14 | 2356.71 | 2308.70 | 2329.14 | 2281.71 | 2249.71 | 2286.29 | 2305.66 | 2303.71 | 2269.23 | 2304.43 | 2287.53 | 2261.21 | 2302.09 | 2281.79 | 2239.01 | NA | 2251.33 | NA | NA | |

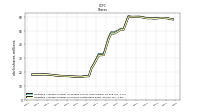

| Stockholders Equity | 1636.89 | 1625.43 | 1609.55 | 1584.66 | 1539.25 | 1520.49 | 1519.33 | 1516.55 | 1513.25 | 1508.79 | 1498.72 | 1484.13 | 1461.71 | 1476.43 | 1409.83 | 1153.12 | 1144.53 | 1137.30 | 1127.16 | 1039.36 | 1029.84 | 1012.57 | 1007.46 | 601.94 | 596.25 | 587.30 | 582.68 | 572.04 | 417.24 | 409.26 | 241.08 | 238.45 | 234.69 | 221.53 | 220.30 | 218.26 | 218.65 | 215.84 | 216.19 | 214.35 | 213.77 | 216.28 | 219.55 | 219.79 | 219.69 | 218.84 | 220.47 | 216.85 | 215.90 | 213.37 | 205.99 | 201.25 | 199.43 | 194.83 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 408.88 | 457.75 | 496.23 | 167.99 | 170.71 | 189.06 | 211.18 | 224.78 | 1007.67 | 1111.09 | 1189.75 | 1318.66 | 1038.41 | 779.31 | 307.21 | 133.23 | 155.68 | 154.92 | 155.54 | 122.33 | 149.09 | 254.47 | 119.36 | 109.61 | NA | NA | NA | 301.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goodwill | 506.15 | 506.15 | 506.15 | 506.15 | 506.15 | 506.15 | 500.32 | 500.32 | 500.32 | 500.32 | 500.32 | 500.32 | 500.85 | 501.47 | 500.09 | 374.63 | 374.54 | 374.59 | 375.10 | 338.44 | 338.10 | 338.97 | 337.52 | 150.50 | 148.13 | 148.43 | 147.81 | 145.06 | 66.54 | 67.10 | 2.08 | 1.82 | 1.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 10.49 | 11.48 | 12.47 | 13.50 | 14.66 | 15.83 | 17.00 | 18.21 | 19.56 | 20.91 | 22.27 | 23.67 | 25.19 | 26.73 | 28.28 | 15.61 | 16.61 | 17.61 | 18.63 | 16.97 | 17.95 | 18.95 | 19.95 | 8.88 | 9.38 | 9.89 | 10.40 | 10.92 | 3.72 | 3.90 | 0.31 | 0.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 145.25 | 116.28 | 101.50 | 115.77 | 126.47 | 85.30 | 54.52 | 9.77 | 6.83 | 5.46 | 8.76 | 3.23 | 4.44 | 6.24 | 11.16 | 3.91 | 4.95 | NA | NA | 20.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 1047.34 | 1109.76 | 1149.67 | 1110.04 | 905.43 | 987.53 | 1050.89 | 1152.74 | 1143.38 | 1169.12 | 1099.74 | 968.47 | 902.42 | 895.90 | 928.58 | 777.29 | 826.96 | 869.17 | 896.81 | 832.82 | 864.17 | 906.99 | NA | 761.66 | 746.50 | 724.25 | 695.56 | 598.12 | 478.73 | 520.97 | 378.61 | 397.76 | 400.85 | 420.41 | 449.95 | 474.21 | 493.06 | 485.12 | 498.38 | 495.08 | 517.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.42 | 0.54 | 2.55 | 1.24 | 0.51 | 0.92 | 1.79 | 18.97 | 20.49 | 23.24 | 21.29 | 29.38 | 29.25 | 28.02 | 19.05 | 8.22 | 8.19 | NA | NA | 1.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 145.25 | 116.28 | 101.50 | 115.77 | 126.47 | 85.30 | 54.52 | 9.77 | 6.83 | 5.46 | 8.76 | 3.23 | 4.44 | 6.24 | 11.16 | 3.91 | 4.95 | NA | NA | 20.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Fair Value | 1029.62 | 1045.25 | 964.23 | 1023.93 | 883.41 | 903.32 | 935.22 | 627.41 | 543.58 | 439.07 | 432.57 | 133.49 | 139.44 | 94.70 | 196.81 | 218.40 | 250.10 | NA | NA | 674.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 1189.34 | 1222.51 | 1245.42 | 1221.14 | 1027.71 | 1068.03 | 1099.51 | 1139.19 | 1125.38 | 1146.73 | NA | 937.25 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Twelve Months Or Longer Fair Value | 707.21 | 754.28 | 776.91 | 538.58 | 420.34 | 210.80 | 225.24 | 55.40 | 19.50 | 8.45 | 12.97 | 46.97 | 45.68 | 49.37 | 51.02 | 151.09 | 178.71 | NA | NA | 556.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Continuous Unrealized Loss Position Less Than Twelve Months Fair Value | 322.42 | 290.96 | 187.32 | 485.35 | 463.08 | 692.51 | 709.98 | 572.01 | 524.09 | 430.63 | 419.59 | 86.52 | 93.76 | 45.33 | 145.78 | 67.31 | 71.39 | NA | NA | 118.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

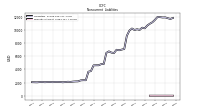

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | NA | NA | NA | 1042.73 | NA | NA | NA | 552.67 | NA | NA | NA | 973.43 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

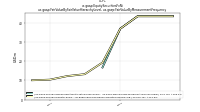

| Deposits | 10533.93 | 10158.34 | 9993.09 | 9675.21 | 9959.47 | 9831.48 | 10056.23 | 9732.82 | 9774.10 | 9415.29 | 9502.81 | 9427.62 | 9283.29 | 8967.75 | 7892.07 | 6328.78 | 6220.85 | 6187.49 | 6290.48 | 5814.57 | 5854.25 | 5819.41 | 5907.34 | 4342.80 | 4350.26 | 4176.91 | 4198.66 | 4187.75 | 3324.68 | 3206.26 | 1971.36 | 1916.68 | 1967.77 | 1761.67 | 1800.93 | 1720.13 | 1781.23 | 1705.51 | 1720.13 | 1746.76 | 1768.91 | 1703.75 | 1740.29 | 1719.67 | 1739.97 | 1708.38 | 1680.44 | 1706.08 | 1687.91 | 1639.23 | NA | 1663.97 | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | 195.40 | NA | NA | NA | 229.14 | NA | NA | NA | 235.47 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt And Capital Lease Obligations | 885.22 | 1362.04 | 1613.17 | 1475.67 | 805.40 | 788.90 | 387.18 | 347.91 | NA | NA | NA | 363.93 | NA | NA | NA | 687.80 | NA | NA | NA | 610.67 | NA | NA | NA | 424.88 | NA | NA | NA | 376.99 | NA | NA | NA | 422.76 | NA | NA | NA | 400.55 | NA | NA | NA | 270.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 0.71 | 0.85 | 0.82 | 0.80 | 0.96 | 0.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

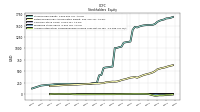

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

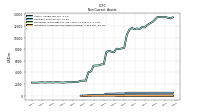

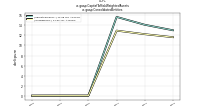

| Stockholders Equity | 1636.89 | 1625.43 | 1609.55 | 1584.66 | 1539.25 | 1520.49 | 1519.33 | 1516.55 | 1513.25 | 1508.79 | 1498.72 | 1484.13 | 1461.71 | 1476.43 | 1409.83 | 1153.12 | 1144.53 | 1137.30 | 1127.16 | 1039.36 | 1029.84 | 1012.57 | 1007.46 | 601.94 | 596.25 | 587.30 | 582.68 | 572.04 | 417.24 | 409.26 | 241.08 | 238.45 | 234.69 | 221.53 | 220.30 | 218.26 | 218.65 | 215.84 | 216.19 | 214.35 | 213.77 | 216.28 | 219.55 | 219.79 | 219.69 | 218.84 | 220.47 | 216.85 | 215.90 | 213.37 | 205.99 | 201.25 | 199.43 | 194.83 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 1637.60 | 1626.28 | 1610.37 | 1585.46 | 1540.22 | 1521.43 | 1519.33 | 1516.55 | 1513.25 | 1508.79 | 1498.72 | 1484.13 | NA | NA | NA | 1153.12 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Common Stock Value | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.52 | 0.52 | 0.52 | 0.52 | 0.48 | 0.48 | 0.48 | 0.48 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | 0.34 | NA | 0.34 | NA | NA | |

| Additional Paid In Capital Common Stock | 1160.87 | 1159.39 | 1158.01 | 1154.82 | 1153.07 | 1151.36 | 1149.50 | 1146.78 | 1145.45 | 1143.91 | 1142.29 | 1137.71 | 1137.15 | 1135.84 | 1078.44 | 840.69 | 839.58 | 838.61 | 836.55 | 757.96 | 756.95 | 752.22 | 745.48 | 354.38 | 353.82 | 353.30 | 352.32 | 364.43 | 308.98 | 308.46 | 271.00 | 269.76 | 269.33 | 267.25 | 266.82 | 265.26 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 577.71 | 569.87 | 554.94 | 540.51 | 499.97 | 474.11 | 456.25 | 442.31 | 430.72 | 417.66 | 398.28 | 378.27 | 356.40 | 372.55 | 364.27 | 358.67 | 343.63 | 327.30 | 316.98 | 305.06 | 286.46 | 273.75 | 268.99 | 271.02 | 266.05 | 258.47 | 256.05 | 238.19 | 236.47 | 230.90 | 231.02 | 229.14 | 226.12 | 223.64 | 220.68 | 217.71 | 214.95 | 211.82 | 208.73 | 206.20 | 206.29 | 203.38 | 200.47 | 198.11 | 196.18 | 193.38 | 190.17 | 186.67 | 183.41 | 180.53 | NA | 174.68 | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -28.81 | -30.35 | -29.32 | -35.98 | -38.50 | -29.09 | -15.17 | -2.82 | -0.73 | 0.03 | 0.31 | 0.62 | 0.94 | 1.12 | 0.51 | -1.21 | -1.35 | -1.64 | -2.68 | -3.45 | -3.94 | -3.65 | -5.31 | -5.35 | -5.04 | -5.20 | -5.38 | -5.61 | -5.61 | -5.80 | -5.92 | -6.24 | -6.33 | -6.59 | -6.79 | -7.11 | -7.19 | -6.90 | -6.58 | -6.62 | -7.01 | -4.84 | 0.83 | 0.05 | 0.35 | -0.65 | -1.10 | -2.47 | -0.79 | -0.04 | NA | -5.56 | NA | NA | |

| Treasury Stock Value | NA | NA | NA | NA | NA | NA | 63.85 | 61.71 | 56.28 | 46.59 | 35.65 | 25.65 | 25.65 | 25.65 | 25.65 | 36.90 | 28.89 | 18.23 | 14.64 | 10.84 | 0.00 | 0.00 | 0.00 | 15.97 | 16.37 | 16.98 | 17.95 | 22.55 | 120.10 | 121.73 | 252.38 | 251.50 | 251.65 | 259.92 | 257.49 | 254.61 | 251.00 | 250.55 | 247.05 | 245.27 | 245.28 | 241.71 | 240.88 | 237.50 | 235.80 | 233.16 | 227.56 | 226.30 | 224.18 | 224.18 | NA | 224.46 | NA | NA | |

| Minority Interest | 0.71 | 0.85 | 0.82 | 0.80 | 0.96 | 0.94 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 1.57 | 1.51 | 1.83 | 1.62 | 1.62 | 1.85 | 1.55 | 1.18 | 1.50 | 1.49 | 1.24 | 0.53 | 1.25 | 1.37 | 1.11 | 0.72 | 0.54 | 1.69 | 0.91 | 0.51 | 0.74 | 0.98 | 0.81 | 0.50 | 0.47 | 0.47 | 0.73 | 0.32 | 0.42 | 0.43 | 0.33 | 0.32 | 0.35 | 0.35 | 0.29 | 0.25 | 0.25 | 0.25 | 0.18 | 0.16 | 0.18 | 0.17 | 0.16 | 0.20 | 0.03 | 0.19 | 0.17 | 0.12 | 1.30 | -0.79 | 0.27 | 0.27 | 1.30 | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.00 | 0.06 | NA | 0.20 | 0.18 | 0.41 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

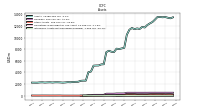

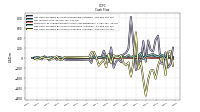

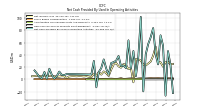

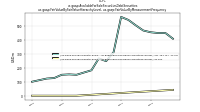

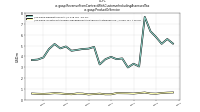

| Net Cash Provided By Used In Operating Activities | 54.82 | 71.89 | 24.37 | 40.45 | 83.70 | 68.65 | 57.64 | 40.92 | -19.75 | 101.93 | 36.87 | 5.12 | 46.28 | 17.56 | 63.70 | 18.27 | 22.52 | 21.40 | 38.07 | 30.32 | 28.02 | 26.51 | 7.70 | 17.43 | 32.50 | 18.25 | 11.95 | -13.12 | 29.99 | 8.04 | 7.89 | NA | NA | NA | NA | NA | NA | NA | NA | 8.68 | 6.70 | 7.46 | 12.62 | 5.39 | 1.06 | 7.21 | 17.23 | 0.83 | 11.95 | 1.16 | 3.60 | 9.37 | 14.39 | NA | |

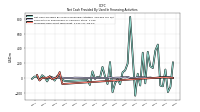

| Net Cash Provided By Used In Investing Activities | 8.73 | -7.97 | -146.65 | -411.83 | -235.38 | -249.12 | -424.69 | -751.37 | -424.72 | -78.59 | -223.16 | 514.30 | -82.30 | -369.02 | -85.15 | -143.80 | -98.80 | 61.84 | 8.63 | 10.59 | 59.54 | -105.79 | 84.22 | -181.59 | -34.63 | -85.62 | -153.38 | 16.34 | 126.40 | 117.73 | 11.23 | NA | NA | NA | NA | NA | NA | NA | NA | 22.84 | 16.51 | -41.00 | -29.77 | 37.31 | 6.59 | -26.41 | -10.24 | -3.64 | -6.77 | 24.58 | -17.59 | -26.96 | -5.02 | NA | |

| Net Cash Provided By Used In Financing Activities | -112.42 | -102.40 | 450.52 | 368.66 | 133.32 | 158.35 | 353.43 | -72.44 | 341.06 | -102.00 | 57.38 | -239.16 | 295.12 | 823.55 | 195.44 | 103.08 | 77.04 | -83.86 | -13.49 | -67.67 | -192.94 | 214.38 | -82.16 | 18.51 | 149.73 | -0.22 | 15.30 | -13.44 | 88.97 | -93.81 | -28.81 | NA | NA | NA | NA | NA | NA | NA | NA | -41.62 | -21.53 | 4.56 | 25.97 | -35.51 | 7.80 | 21.02 | -46.43 | 9.87 | 36.34 | -28.17 | 13.89 | 19.42 | -10.69 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 54.82 | 71.89 | 24.37 | 40.45 | 83.70 | 68.65 | 57.64 | 40.92 | -19.75 | 101.93 | 36.87 | 5.12 | 46.28 | 17.56 | 63.70 | 18.27 | 22.52 | 21.40 | 38.07 | 30.32 | 28.02 | 26.51 | 7.70 | 17.43 | 32.50 | 18.25 | 11.95 | -13.12 | 29.99 | 8.04 | 7.89 | NA | NA | NA | NA | NA | NA | NA | NA | 8.68 | 6.70 | 7.46 | 12.62 | 5.39 | 1.06 | 7.21 | 17.23 | 0.83 | 11.95 | 1.16 | 3.60 | 9.37 | 14.39 | NA | |

| Net Income Loss | 20.67 | 27.80 | 27.88 | 53.27 | 38.61 | 28.96 | 25.76 | 22.66 | 24.17 | 30.55 | 32.70 | 33.06 | -4.93 | 18.64 | 16.53 | 23.45 | 24.97 | 18.98 | 21.17 | 26.73 | 24.07 | 15.70 | 5.43 | 9.96 | 12.82 | 7.68 | 12.02 | 6.05 | 9.13 | 3.66 | 4.21 | 5.23 | 4.70 | 5.13 | 5.26 | 4.93 | 5.17 | 5.12 | 4.71 | 1.94 | 4.97 | 4.99 | 4.44 | 4.04 | 4.96 | 5.37 | 5.65 | 5.46 | 5.07 | 5.10 | 5.11 | 5.78 | 5.24 | 4.95 | |

| Profit Loss | 20.53 | 27.88 | 27.90 | 53.31 | 38.80 | 29.48 | 25.76 | 22.66 | 24.17 | 30.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Depreciation Depletion And Amortization | 3.08 | 2.99 | 3.09 | 3.16 | 2.90 | 2.87 | 2.76 | 3.21 | 2.08 | 2.00 | 2.06 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Expense Benefit | -0.06 | -0.02 | -0.02 | 1.84 | -0.02 | -0.02 | -0.03 | 3.04 | 0.67 | -0.04 | -0.06 | -4.71 | -0.06 | -0.08 | 0.24 | 15.72 | -0.04 | -0.07 | 0.45 | -4.57 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.57 | 1.51 | 1.83 | 1.62 | 1.62 | 1.85 | 1.55 | 1.18 | 1.50 | 1.49 | 1.24 | 0.53 | 1.25 | 1.37 | 1.11 | 0.72 | 0.54 | 1.69 | 0.91 | 0.51 | 0.74 | 0.98 | 0.81 | 0.50 | 0.47 | 0.47 | 0.73 | 0.32 | 0.42 | 0.43 | 0.33 | 0.32 | 0.35 | 0.35 | 0.29 | 0.25 | 0.25 | 0.25 | 0.18 | 0.16 | 0.18 | 0.17 | 0.16 | 0.20 | 0.03 | 0.19 | 0.17 | 0.12 | 0.26 | 0.26 | 0.27 | 0.27 | 0.27 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 8.73 | -7.97 | -146.65 | -411.83 | -235.38 | -249.12 | -424.69 | -751.37 | -424.72 | -78.59 | -223.16 | 514.30 | -82.30 | -369.02 | -85.15 | -143.80 | -98.80 | 61.84 | 8.63 | 10.59 | 59.54 | -105.79 | 84.22 | -181.59 | -34.63 | -85.62 | -153.38 | 16.34 | 126.40 | 117.73 | 11.23 | NA | NA | NA | NA | NA | NA | NA | NA | 22.84 | 16.51 | -41.00 | -29.77 | 37.31 | 6.59 | -26.41 | -10.24 | -3.64 | -6.77 | 24.58 | -17.59 | -26.96 | -5.02 | NA | |

| Payments To Acquire Property Plant And Equipment | 1.34 | 2.56 | 2.15 | 1.75 | 2.61 | 4.04 | 7.71 | 15.55 | 11.24 | 9.91 | 5.34 | 5.71 | 5.42 | 1.79 | 1.80 | 1.83 | 1.58 | 0.82 | 0.84 | 1.06 | 3.88 | 4.62 | 1.93 | 39.67 | 7.04 | 1.03 | 0.96 | 2.09 | 3.20 | 0.51 | 0.88 | 0.81 | 1.38 | 0.82 | 0.87 | 0.80 | 1.01 | 1.18 | 0.97 | 1.74 | 0.35 | 1.36 | 0.83 | 0.67 | 0.51 | 0.83 | 0.59 | 0.41 | 0.64 | 0.62 | 0.56 | 1.20 | 0.66 | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -112.42 | -102.40 | 450.52 | 368.66 | 133.32 | 158.35 | 353.43 | -72.44 | 341.06 | -102.00 | 57.38 | -239.16 | 295.12 | 823.55 | 195.44 | 103.08 | 77.04 | -83.86 | -13.49 | -67.67 | -192.94 | 214.38 | -82.16 | 18.51 | 149.73 | -0.22 | 15.30 | -13.44 | 88.97 | -93.81 | -28.81 | NA | NA | NA | NA | NA | NA | NA | NA | -41.62 | -21.53 | 4.56 | 25.97 | -35.51 | 7.80 | 21.02 | -46.43 | 9.87 | 36.34 | -28.17 | 13.89 | 19.42 | -10.69 | NA | |

| Payments Of Dividends Common Stock | 12.83 | 12.84 | 12.76 | 12.73 | 12.76 | 11.03 | 11.00 | 11.07 | 11.10 | 11.18 | 11.16 | 11.19 | 11.23 | 10.22 | 10.27 | 8.30 | 8.64 | 8.66 | 8.64 | 8.14 | 7.15 | 7.17 | 7.11 | 4.85 | 4.88 | 4.77 | 4.79 | 3.83 | 3.31 | 3.28 | 2.20 | 2.20 | 2.21 | 2.14 | 2.15 | 2.17 | 2.01 | 2.03 | 2.04 | 2.03 | 2.06 | 2.06 | 2.09 | 2.12 | 2.12 | 2.17 | 2.18 | 2.20 | 2.20 | 2.20 | 2.19 | 2.19 | 2.19 | NA | |

| Payments For Repurchase Of Common Stock | NA | NA | NA | 0.00 | 0.00 | 5.25 | 2.14 | 5.43 | 9.69 | 10.95 | 9.99 | 0.00 | 0.00 | 0.00 | 14.81 | 8.01 | 10.66 | 3.59 | 3.81 | 2.44 | 0.00 | 8.40 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | 0.00 | 2.00 | NA | NA | 3.62 | 0.54 | NA | NA | 0.00 | 3.60 | 0.87 | 3.64 | 1.70 | 2.88 | 5.75 | 1.56 | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | 2011-12-31 | 2011-09-30 | 2011-06-30 | 2011-03-31 | 2010-12-31 | 2010-09-30 | 2010-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 158.41 | 150.10 | 139.03 | 130.28 | 110.50 | 99.42 | 90.98 | 88.46 | 85.42 | 83.34 | 84.87 | 92.56 | 92.96 | 95.88 | 98.21 | 77.08 | 76.89 | 78.41 | 76.42 | 72.36 | 71.38 | 70.08 | 62.84 | 47.91 | 48.03 | 46.88 | 46.01 | 39.90 | 37.31 | 33.14 | 23.07 | 23.15 | 21.97 | 20.58 | 20.17 | 20.07 | 20.14 | 19.90 | 19.75 | 19.96 | 19.98 | 20.16 | 20.05 | 21.19 | 21.51 | 22.05 | 22.86 | 23.42 | 23.44 | 24.24 | 24.29 | 24.76 | 25.73 | 25.81 | |

| Deposit Account | 5.18 | 5.60 | 5.16 | 5.78 | 6.32 | 7.65 | 3.06 | 3.31 | 2.97 | 3.81 | 3.74 | 3.95 | 3.73 | 3.25 | 4.87 | 4.71 | 4.68 | 4.59 | 4.52 | 4.91 | 4.74 | 5.14 | 4.67 | 3.90 | 3.70 | 3.66 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Investment Advisory Management And Administrative Service | 0.66 | 0.65 | 0.61 | 0.55 | 0.57 | 0.66 | 0.61 | 0.56 | 0.58 | 0.59 | 0.60 | 0.49 | 0.49 | 0.56 | 0.52 | 0.48 | 0.56 | 0.57 | 0.50 | 0.52 | 0.57 | 0.59 | 0.55 | 0.53 | 0.54 | 0.56 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |