| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.32 | 85.32 | 85.32 | 85.32 | 85.32 | 85.32 | 85.32 | 85.03 | NA | NA | NA | 84.25 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 59.25 | 59.51 | 60.62 | NA | 61.22 | 61.01 | 61.02 | NA | 60.84 | 60.74 | 60.81 | NA | 61.26 | 61.26 | 61.39 | NA | 61.45 | 61.12 | 61.11 | NA | NA | NA | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 58.57 | 59.01 | 60.29 | NA | 60.94 | 60.81 | 60.88 | NA | 60.74 | 60.65 | 60.65 | NA | 60.49 | 60.49 | 60.28 | NA | 60.21 | 59.98 | 59.52 | NA | NA | NA | NA | |

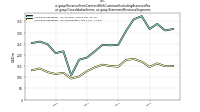

| Earnings Per Share Basic | 0.45 | 0.51 | 0.70 | 0.20 | 0.52 | 0.49 | 0.53 | 0.02 | 0.35 | 1.47 | 0.39 | 0.15 | 0.15 | -0.30 | 0.30 | 0.32 | 0.40 | 0.41 | 0.32 | 0.27 | 0.43 | 0.89 | 0.45 | |

| Earnings Per Share Diluted | 0.44 | 0.51 | 0.70 | 0.20 | 0.52 | 0.49 | 0.53 | 0.01 | 0.35 | 1.47 | 0.39 | 0.15 | 0.15 | -0.29 | 0.29 | 0.31 | 0.39 | 0.40 | 0.32 | 0.25 | 0.43 | 0.87 | 0.44 |

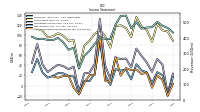

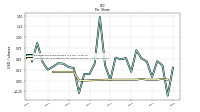

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 466.20 | 458.80 | 500.70 | 462.10 | 543.10 | 541.20 | 484.50 | 392.68 | 393.07 | 400.98 | 360.08 | 315.69 | 282.04 | 202.65 | 336.01 | 322.43 | 370.19 | 399.02 | 384.71 | 385.96 | 393.95 | 391.59 | 406.70 | |

| Revenues | 466.20 | 458.80 | 500.70 | 462.10 | 543.10 | 541.20 | 484.50 | 392.68 | 393.07 | 400.98 | 360.08 | 315.69 | 282.04 | 202.65 | 336.01 | 322.43 | 370.19 | 399.02 | 384.71 | 385.96 | 393.95 | 391.59 | 406.70 | |

| Cost Of Goods And Services Sold | 356.00 | 341.70 | 364.30 | 365.40 | 428.70 | 421.40 | 366.60 | 317.40 | 294.35 | 290.90 | 257.56 | 226.66 | 202.85 | 168.70 | 245.81 | 233.44 | 271.48 | 294.98 | 286.75 | NA | NA | NA | NA | |

| Gross Profit | 110.20 | 117.10 | 136.40 | 96.70 | 114.40 | 119.80 | 117.90 | 75.28 | 98.72 | 110.08 | 102.52 | 89.03 | 79.18 | 33.94 | 90.19 | 88.99 | 98.71 | 104.04 | 97.97 | 95.64 | 109.16 | 112.77 | 112.40 | |

| Research And Development Expense | 6.20 | 5.90 | 6.20 | 5.80 | 4.50 | 5.90 | 5.50 | 5.62 | 5.68 | 5.94 | 4.76 | 3.44 | 7.35 | 4.45 | 4.96 | 5.04 | 4.79 | 4.91 | 5.13 | NA | NA | NA | NA | |

| Selling General And Administrative Expense | 55.60 | 55.00 | 57.70 | 53.90 | 56.00 | 59.70 | 57.50 | 50.11 | 52.87 | 55.06 | 52.35 | 49.92 | 43.16 | 38.55 | 44.52 | 49.56 | 49.64 | 52.12 | 55.58 | NA | NA | NA | NA | |

| Operating Income Loss | 45.70 | 58.90 | 73.50 | 36.00 | 53.60 | 52.90 | 54.60 | 12.90 | 40.27 | 132.48 | 42.85 | 25.57 | 24.15 | -12.88 | 37.54 | 32.60 | 38.39 | 41.47 | 34.70 | 26.67 | 41.84 | 82.46 | 45.33 | |

| Interest Expense | 12.90 | 13.50 | 15.20 | 10.80 | 10.20 | 10.50 | 8.40 | 7.63 | 11.46 | 8.95 | 9.96 | 10.01 | 10.77 | 8.28 | 9.61 | 7.06 | 6.50 | 7.57 | 6.44 | NA | NA | NA | NA | |

| Income Loss From Continuing Operations Before Income Taxes Minority Interest And Income Loss From Equity Method Investments | 35.00 | 47.70 | 60.50 | 25.20 | 43.40 | 42.40 | 46.20 | 4.11 | 27.62 | 122.30 | 31.67 | 12.97 | 11.11 | -23.81 | 25.53 | 25.53 | 31.89 | 33.90 | 28.26 | 21.38 | 35.65 | 73.68 | 36.95 | |

| Income Tax Expense Benefit | 8.90 | 17.80 | 18.30 | 13.20 | 11.70 | 12.80 | 13.80 | 3.18 | 6.75 | 33.49 | 8.27 | 4.13 | 2.25 | -5.88 | 7.63 | 6.70 | 7.77 | 9.31 | 9.44 | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | 0.90 | -0.40 | -1.80 | NA | 10.60 | 8.50 | 13.00 | NA | -1.80 | 0.60 | 1.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 26.20 | 30.10 | 42.30 | 12.20 | 31.80 | 29.70 | 32.50 | 1.09 | 21.01 | 89.06 | 23.54 | 8.91 | 9.00 | -17.78 | 18.03 | 18.96 | 24.25 | 24.75 | 18.95 | 15.66 | 25.82 | 53.08 | 26.75 | |

| Comprehensive Income Net Of Tax | 25.70 | 23.00 | 31.80 | 30.40 | 34.90 | 19.50 | 57.40 | 6.53 | 9.52 | 98.05 | 20.81 | 20.65 | 5.17 | -17.20 | -4.81 | 19.50 | 18.95 | 15.49 | 18.25 | NA | NA | NA | NA |

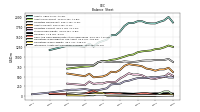

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

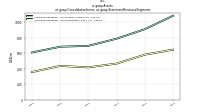

| Assets | 1833.70 | 1843.20 | 1888.80 | 1888.70 | 1843.40 | 1847.50 | 1768.60 | 1631.00 | 1538.93 | 1538.46 | 1425.81 | 1389.79 | 1347.83 | 1253.26 | 1323.85 | 1257.39 | NA | NA | NA | 1273.02 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 1833.70 | 1843.20 | 1888.80 | 1888.70 | 1843.40 | 1847.50 | 1768.60 | 1631.00 | 1538.93 | 1538.46 | 1425.81 | 1389.79 | 1347.83 | 1253.26 | 1323.85 | 1257.39 | NA | NA | NA | 1273.02 | NA | NA | NA | |

| Stockholders Equity | 482.90 | 464.20 | 461.00 | 459.40 | 430.70 | 395.20 | 377.40 | 319.70 | 312.75 | 302.11 | 202.85 | 181.01 | 157.17 | 150.82 | 166.81 | 186.01 | 176.26 | 167.32 | 168.79 | 158.90 | NA | NA | NA |

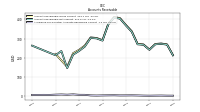

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

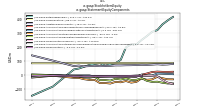

| Assets Current | 680.70 | 699.50 | 757.30 | 778.50 | 790.70 | 811.60 | 769.30 | 665.00 | 606.90 | 620.52 | 537.56 | 500.46 | 490.61 | 479.91 | 569.69 | 507.72 | NA | NA | NA | 575.32 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 59.10 | 77.30 | 76.80 | 60.80 | 43.10 | 40.90 | 41.30 | 65.70 | 62.33 | 74.05 | 62.63 | 64.87 | 97.54 | 143.37 | 107.54 | 63.73 | 55.95 | 53.16 | 60.92 | 57.02 | NA | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 60.60 | 79.90 | 79.40 | 63.40 | 46.60 | 44.50 | 44.00 | 68.50 | 65.16 | 76.95 | 65.50 | 67.86 | 100.39 | 146.11 | 110.22 | 68.23 | 60.31 | 57.70 | 65.42 | 61.60 | NA | NA | NA | |

| Accounts Receivable Net Current | 267.30 | 269.60 | 335.20 | 367.80 | 403.70 | 409.40 | 373.60 | 288.90 | 300.70 | 303.16 | 257.70 | 234.80 | 215.41 | 145.31 | 234.53 | 212.56 | NA | NA | NA | 262.82 | NA | NA | NA | |

| Inventory Net | 276.90 | 268.60 | 271.00 | 277.90 | 266.70 | 285.30 | 256.90 | 229.80 | 192.90 | 186.16 | 157.50 | 141.46 | 125.31 | 135.31 | 168.48 | 164.80 | NA | NA | NA | 183.63 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 68.50 | 68.80 | 61.30 | 66.80 | 70.30 | 68.90 | 88.70 | 68.50 | 38.06 | 41.86 | 45.33 | 44.45 | 39.09 | 34.78 | 32.07 | 37.36 | NA | NA | NA | 34.94 | NA | NA | NA |

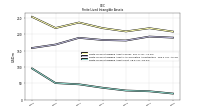

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Noncurrent | 1153.00 | 1143.70 | 1131.50 | 1110.20 | 1052.70 | 1035.90 | 999.30 | 966.00 | 932.03 | 917.94 | 888.25 | 889.34 | 857.23 | 773.35 | 754.16 | 749.68 | NA | NA | NA | 697.70 | NA | NA | NA | |

| Goodwill | 72.90 | 74.80 | 74.90 | 73.40 | 67.10 | 71.50 | 76.40 | 78.00 | 79.72 | 81.81 | 80.72 | 84.48 | 80.60 | 77.09 | 75.43 | 77.34 | NA | NA | NA | 55.55 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 25.30 | 25.80 | 27.30 | 27.80 | 26.90 | 30.20 | 34.00 | 36.30 | 38.79 | 41.67 | 42.97 | 46.77 | 47.06 | 47.08 | 48.12 | 50.60 | NA | NA | NA | 95.25 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | NA | NA | NA | 27.80 | NA | NA | NA | 36.30 | NA | NA | NA | 46.77 | NA | NA | NA | 50.60 | NA | NA | NA | 95.25 | NA | NA | NA | |

| Other Assets Noncurrent | 56.30 | 51.20 | 51.70 | 58.80 | 71.10 | 46.50 | 3.20 | 3.50 | 2.54 | 2.61 | 2.44 | 2.96 | 2.97 | 3.09 | 3.43 | 3.70 | NA | NA | NA | 2.93 | NA | NA | NA |

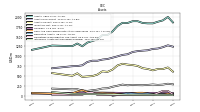

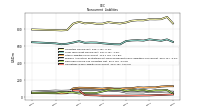

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Liabilities Current | 449.30 | 476.10 | 530.80 | 552.80 | 547.90 | 581.60 | 510.80 | 448.70 | 364.24 | 364.76 | 356.67 | 324.75 | 328.43 | 315.11 | 373.66 | 285.21 | NA | NA | NA | 320.34 | NA | NA | NA | |

| Debt Current | 149.10 | 189.00 | 230.20 | 258.30 | 261.00 | 263.10 | 202.30 | 151.70 | 70.60 | 70.11 | 107.84 | 82.62 | 123.48 | 136.97 | 144.85 | 36.41 | NA | NA | NA | 41.02 | NA | NA | NA | |

| Long Term Debt Current | 149.10 | 189.00 | 230.20 | 258.30 | 261.00 | 263.10 | 202.30 | 151.70 | 70.60 | 70.11 | 107.84 | 82.62 | 123.48 | 136.97 | 144.85 | 36.41 | NA | NA | NA | 41.02 | NA | NA | NA | |

| Accounts Payable Current | 170.90 | 170.30 | 184.40 | 184.10 | 178.10 | 218.30 | 208.00 | 195.10 | 150.15 | 151.70 | 141.53 | 131.25 | 105.59 | 90.13 | 145.34 | 156.30 | NA | NA | NA | 163.59 | NA | NA | NA | |

| Other Accrued Liabilities Current | NA | NA | NA | 7.00 | NA | NA | NA | 6.50 | NA | NA | NA | 12.54 | NA | NA | NA | 12.14 | NA | NA | NA | 15.37 | NA | NA | NA | |

| Taxes Payable Current | 36.60 | 34.50 | 36.80 | 31.30 | 22.60 | 18.00 | 19.40 | 16.90 | 51.56 | 57.11 | 28.23 | 23.91 | 19.64 | 15.34 | 14.93 | 14.15 | NA | NA | NA | 28.09 | NA | NA | NA | |

| Accrued Liabilities Current | 44.30 | 35.80 | 32.70 | 44.70 | 43.60 | 41.20 | 36.50 | 50.90 | 49.66 | 43.13 | 39.42 | 49.18 | 39.62 | 36.12 | 31.94 | 44.93 | NA | NA | NA | 56.30 | NA | NA | NA | |

| Other Liabilities Current | 48.40 | 46.50 | 46.70 | 34.40 | 42.60 | 41.00 | 44.60 | 34.10 | 41.21 | 41.63 | 38.70 | 36.68 | 39.15 | 35.64 | 35.71 | 32.51 | NA | NA | NA | 30.49 | NA | NA | NA |

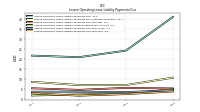

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

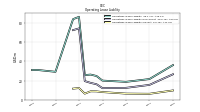

| Liabilities Noncurrent | 901.50 | 902.90 | 897.00 | 876.50 | 864.80 | 870.70 | 880.40 | 862.60 | 861.95 | 871.59 | 866.29 | 884.04 | 862.23 | 787.33 | 783.37 | 786.17 | NA | NA | NA | 793.79 | NA | NA | NA | |

| Long Term Debt Noncurrent | 662.80 | 666.90 | 664.60 | 657.00 | 618.20 | 619.60 | 625.00 | 631.20 | 639.27 | 640.34 | 637.13 | 655.83 | 640.03 | 625.80 | 619.88 | 630.26 | NA | NA | NA | 643.75 | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 80.40 | 73.70 | 80.20 | 70.00 | 86.90 | 86.80 | 78.80 | 61.80 | 44.89 | 46.07 | 44.62 | 38.77 | 49.69 | 48.77 | 54.06 | 43.31 | NA | NA | NA | 45.50 | NA | NA | NA | |

| Pension And Other Postretirement Defined Benefit Plans Liabilities Noncurrent | 50.90 | 51.80 | 51.60 | 50.00 | 64.60 | 68.90 | 73.70 | 74.40 | 78.97 | 81.09 | 79.93 | 83.31 | 74.56 | 71.18 | 69.47 | 71.90 | NA | NA | NA | 60.38 | NA | NA | NA | |

| Other Liabilities Noncurrent | 107.40 | 110.50 | 100.60 | 99.50 | 95.10 | 95.40 | 102.90 | 95.20 | 98.82 | 104.08 | 104.61 | 106.13 | 97.95 | 41.58 | 39.96 | 40.70 | NA | NA | NA | 44.16 | NA | NA | NA | |

| Operating Lease Liability Noncurrent | NA | NA | NA | 12.30 | NA | NA | NA | 12.00 | 16.10 | 17.51 | 19.39 | 74.50 | 72.70 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

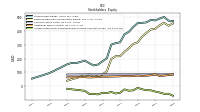

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 482.90 | 464.20 | 461.00 | 459.40 | 430.70 | 395.20 | 377.40 | 319.70 | 312.75 | 302.11 | 202.85 | 181.01 | 157.17 | 150.82 | 166.81 | 186.01 | 176.26 | 167.32 | 168.79 | 158.90 | NA | NA | NA | |

| Common Stock Value | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.30 | 85.32 | 85.32 | 85.32 | 85.32 | 85.32 | 85.32 | 85.32 | 85.03 | NA | NA | NA | 84.25 | NA | NA | NA | |

| Additional Paid In Capital | 78.90 | 75.30 | 73.90 | 76.40 | 74.00 | 72.10 | 72.90 | 71.40 | 69.89 | 69.57 | 68.36 | 68.50 | 65.31 | 64.13 | 62.93 | 65.56 | NA | NA | NA | 63.54 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | 412.70 | 387.70 | 360.00 | 319.00 | 306.80 | 276.30 | 249.10 | 217.80 | 218.01 | 197.00 | 107.94 | 84.41 | 75.50 | 66.50 | 84.28 | 78.30 | NA | NA | NA | 39.41 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -30.60 | -30.10 | -23.00 | -12.50 | -30.70 | -33.80 | -23.60 | -48.50 | -53.94 | -42.44 | -51.43 | -48.70 | -60.45 | -56.62 | -57.21 | -34.36 | NA | NA | NA | -19.63 | NA | NA | NA | |

| Treasury Stock Value | NA | NA | NA | NA | 4.70 | 4.70 | 6.30 | 6.30 | 6.55 | 7.34 | 7.34 | 8.52 | 8.52 | 8.52 | 8.52 | 8.52 | NA | NA | NA | 8.68 | NA | NA | NA | |

| Stock Issued During Period Value New Issues | NA | NA | -1.70 | NA | NA | -0.80 | NA | NA | NA | NA | NA | NA | NA | NA | 0.29 | NA | NA | 0.82 | NA | NA | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.60 | 2.60 | 2.10 | NA | 1.90 | 1.60 | 1.50 | NA | 1.12 | 1.22 | 1.02 | NA | 1.18 | 1.20 | -2.63 | NA | 2.02 | -5.74 | 3.55 | NA | NA | NA | NA |

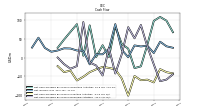

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

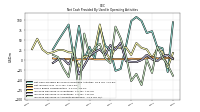

| Net Cash Provided By Used In Operating Activities | 67.50 | 98.10 | 108.10 | 97.70 | 34.20 | -23.10 | -27.80 | 23.93 | 36.20 | 83.26 | 1.80 | 32.93 | 1.74 | 85.71 | 4.91 | 88.84 | 68.54 | 47.96 | 26.17 | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -41.90 | -38.60 | -30.50 | -65.70 | -58.40 | -59.90 | -48.80 | -101.02 | -55.37 | -31.08 | -27.23 | -24.60 | -30.94 | -38.55 | -50.85 | -60.54 | -34.45 | -38.37 | -22.49 | NA | NA | NA | NA | |

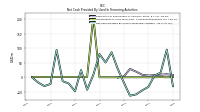

| Net Cash Provided By Used In Financing Activities | -44.20 | -58.20 | -62.50 | -18.10 | 29.30 | 86.70 | 51.40 | 80.89 | 8.96 | -42.17 | 25.62 | -47.31 | -20.87 | -12.84 | 94.56 | -22.30 | -29.48 | -17.17 | 0.34 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 67.50 | 98.10 | 108.10 | 97.70 | 34.20 | -23.10 | -27.80 | 23.93 | 36.20 | 83.26 | 1.80 | 32.93 | 1.74 | 85.71 | 4.91 | 88.84 | 68.54 | 47.96 | 26.17 | NA | NA | NA | NA | |

| Net Income Loss | 26.20 | 30.10 | 42.30 | 12.20 | 31.80 | 29.70 | 32.50 | 1.09 | 21.01 | 89.06 | 23.54 | 8.91 | 9.00 | -17.78 | 18.03 | 18.96 | 24.25 | 24.75 | 18.95 | 15.66 | 25.82 | 53.08 | 26.75 | |

| Depreciation Depletion And Amortization | 27.90 | 27.20 | 25.70 | 25.80 | 25.20 | 27.40 | 27.30 | 29.49 | 23.81 | 25.17 | 25.63 | 26.80 | 24.00 | 21.88 | 23.84 | 25.22 | 21.99 | 25.40 | 24.09 | NA | NA | NA | NA | |

| Increase Decrease In Other Operating Capital Net | 1.40 | 18.60 | -12.00 | 6.70 | 1.00 | 10.90 | -9.50 | 17.96 | 3.13 | -12.42 | 9.23 | 5.86 | 0.32 | -4.58 | 0.71 | 7.24 | 1.84 | 5.28 | 0.13 | NA | NA | NA | NA | |

| Increase Decrease In Accounts Receivable | 0.90 | -63.60 | -35.40 | -53.60 | 11.40 | 54.20 | 83.60 | -8.10 | 4.68 | 40.48 | 30.54 | 9.82 | 66.15 | -90.57 | 31.10 | -43.26 | -21.32 | 6.55 | 12.62 | NA | NA | NA | NA | |

| Increase Decrease In Inventories | 12.50 | -0.50 | -5.70 | -5.20 | -3.40 | 43.10 | 25.60 | 36.93 | 11.78 | 26.34 | 19.84 | 9.62 | -14.38 | -36.88 | 11.68 | -11.52 | 2.21 | 0.85 | -7.95 | NA | NA | NA | NA | |

| Share Based Compensation | 3.60 | 2.60 | 2.10 | 2.70 | 1.90 | 1.60 | 1.50 | 1.80 | 1.12 | 1.22 | 1.06 | 3.19 | 1.18 | 1.20 | -1.14 | 2.30 | 2.02 | 1.56 | 3.55 | NA | NA | NA | NA | |

| Amortization Of Financing Costs | 0.70 | 0.70 | 0.60 | 0.50 | 0.60 | 0.40 | 0.40 | 0.34 | 2.68 | 0.54 | 0.54 | 0.54 | 0.53 | 0.50 | 0.50 | 0.48 | 0.51 | 0.56 | 0.54 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -41.90 | -38.60 | -30.50 | -65.70 | -58.40 | -59.90 | -48.80 | -101.02 | -55.37 | -31.08 | -27.23 | -24.60 | -30.94 | -38.55 | -50.85 | -60.54 | -34.45 | -38.37 | -22.49 | NA | NA | NA | NA | |

| Payments To Acquire Productive Assets | 41.90 | 38.60 | 30.50 | 65.70 | 58.40 | 59.90 | 48.80 | 101.02 | 55.37 | 31.08 | 27.23 | 24.60 | 30.94 | 38.55 | 50.85 | 60.54 | 34.45 | 38.37 | 22.49 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -44.20 | -58.20 | -62.50 | -18.10 | 29.30 | 86.70 | 51.40 | 80.89 | 8.96 | -42.17 | 25.62 | -47.31 | -20.87 | -12.84 | 94.56 | -22.30 | -29.48 | -17.17 | 0.34 | NA | NA | NA | NA | |

| Payments Of Dividends | 1.20 | 1.20 | 1.30 | 1.20 | 1.30 | 1.30 | 1.20 | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 12.04 | 12.04 | 12.04 | 12.04 | 11.90 | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 9.40 | 20.20 | 29.30 | 4.10 | -0.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

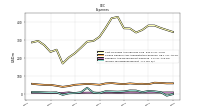

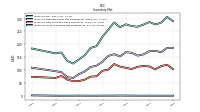

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

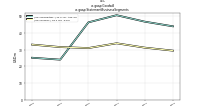

| Revenues | 466.20 | 458.80 | 500.70 | 462.10 | 543.10 | 541.20 | 484.50 | 392.68 | 393.07 | 400.98 | 360.08 | 315.69 | 282.04 | 202.65 | 336.01 | 322.43 | 370.19 | 399.02 | 384.71 | 385.96 | 393.95 | 391.59 | 406.70 | |

| Operating, Rubber | 315.80 | 309.30 | 338.70 | 315.80 | 373.50 | 359.30 | 306.90 | 245.10 | 242.85 | 244.73 | 215.92 | 188.28 | 178.41 | 108.26 | 216.23 | 207.67 | 247.37 | 259.73 | 253.13 | NA | NA | NA | NA | |

| Operating, Specialties | 150.40 | 149.50 | 162.00 | 146.30 | 169.60 | 181.90 | 177.60 | 147.58 | 150.22 | 156.24 | 144.16 | 127.41 | 103.63 | 94.39 | 119.78 | 114.76 | 122.82 | 139.28 | 131.59 | NA | NA | NA | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 466.20 | 458.80 | 500.70 | 462.10 | 543.10 | 541.20 | 484.50 | 392.68 | 393.07 | 400.98 | 360.08 | 315.69 | 282.04 | 202.65 | 336.01 | 322.43 | 370.19 | 399.02 | 384.71 | 385.96 | 393.95 | 391.59 | 406.70 | |

| Operating, Rubber | 315.80 | 309.30 | 338.70 | 315.80 | 373.50 | 359.30 | 306.90 | 245.10 | 242.85 | 244.73 | 215.92 | 188.28 | 178.41 | 108.26 | 216.23 | 207.67 | 247.37 | 259.73 | 253.13 | NA | NA | NA | NA | |

| Operating, Specialties | 150.40 | 149.50 | 162.00 | 146.30 | 169.60 | 181.90 | 177.60 | 147.58 | 150.22 | 156.24 | 144.16 | 127.41 | 103.63 | 94.39 | 119.78 | 114.76 | 122.82 | 139.28 | 131.59 | NA | NA | NA | NA |