| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 1.23 | 1.23 | 1.23 | 1.23 | 1.23 | 1.23 | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.21 | 1.21 | 1.21 | 1.20 | 1.22 | 1.22 | 1.22 | 1.22 | 1.25 | 1.25 | 1.26 | 1.28 | |

| Weighted Average Number Of Shares Outstanding Basic | 118.56 | 118.25 | 117.93 | NA | 117.79 | 117.56 | 117.35 | NA | 117.23 | 117.03 | 116.85 | NA | 116.75 | 116.59 | 117.28 | 118.24 | 118.21 | 118.58 | 120.88 | 121.81 | 122.12 | 124.62 | 126.07 | |

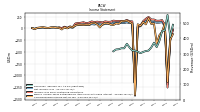

| Earnings Per Share Basic | -0.28 | -1.75 | -10.22 | 0.33 | 1.02 | 1.02 | 1.01 | 1.14 | 1.17 | 1.52 | 1.27 | 0.99 | 0.38 | 0.28 | -12.23 | 0.98 | 0.92 | 1.07 | 0.92 | 0.93 | 0.94 | 0.92 | 0.93 | |

| Earnings Per Share Diluted | -0.28 | -1.75 | -10.22 | 0.33 | 1.02 | 1.02 | 1.01 | 1.14 | 1.17 | 1.52 | 1.27 | 0.99 | 0.38 | 0.28 | -12.23 | 0.98 | 0.92 | 1.07 | 0.92 | 0.93 | 0.94 | 0.92 | 0.93 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 8.11 | 8.68 | 8.27 | 7.85 | 7.80 | 7.70 | 7.34 | 6.35 | 6.07 | 6.45 | 5.97 | 7.18 | 6.09 | 5.35 | 7.15 | 8.53 | 8.92 | 9.38 | 8.64 | 9.10 | 9.19 | 9.80 | 9.29 | |

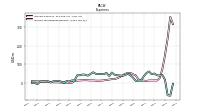

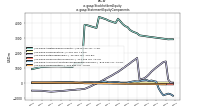

| Revenues | 489.89 | 411.81 | 554.18 | 454.07 | 448.66 | 384.86 | 343.72 | 372.19 | 341.43 | 320.88 | 318.17 | 312.03 | 304.16 | 312.93 | 320.43 | 320.77 | 340.64 | 365.43 | 335.62 | 336.26 | 329.55 | 328.15 | 316.33 | |

| Interest And Fee Income Loans And Leases | 310.39 | 408.97 | 430.69 | 404.99 | 346.55 | 293.29 | 267.76 | 263.66 | 246.72 | 244.53 | 241.54 | 242.20 | 240.81 | 247.85 | 262.28 | 263.40 | 275.98 | 284.24 | 274.23 | 272.52 | 264.06 | 260.30 | 251.09 | |

| Gain Loss On Investments | NA | NA | NA | -49.30 | 0.09 | -1.21 | 0.10 | 1.00 | 0.52 | 0.00 | 0.10 | 0.00 | 5.27 | 7.71 | 0.18 | 0.18 | 0.91 | 22.19 | 2.16 | 0.79 | 0.83 | 0.25 | 6.31 | |

| Interest Expense | 315.36 | 353.81 | 238.52 | 150.08 | 74.86 | 26.59 | 14.19 | 14.40 | 14.24 | 14.20 | 12.07 | 12.97 | 14.58 | 19.80 | 41.59 | 46.97 | 54.97 | 53.63 | 49.68 | 40.97 | 32.33 | 26.18 | 21.27 | |

| Interest Income Expense Net | 130.73 | 186.08 | 279.27 | 322.94 | 335.18 | 323.93 | 308.72 | 300.40 | 275.84 | 266.31 | 261.27 | 259.21 | 251.32 | 254.28 | 249.75 | 246.62 | 252.24 | 260.90 | 254.88 | 261.76 | 260.32 | 262.33 | 256.50 | |

| Interest Paid Net | 247.59 | 258.49 | 209.34 | 136.76 | 63.02 | 27.96 | 10.63 | 17.94 | 10.82 | 12.26 | 12.42 | 13.54 | 17.67 | 24.57 | 43.82 | 46.25 | 56.97 | 51.04 | 46.20 | NA | NA | NA | NA | |

| Income Loss From Continuing Operations | -23.34 | -197.41 | -1195.42 | NA | 131.62 | 122.36 | 120.13 | NA | 140.00 | 180.51 | 150.41 | NA | 45.50 | 33.20 | -1433.11 | 117.88 | 110.03 | 128.12 | 112.60 | 115.04 | 116.29 | 115.73 | 118.28 | |

| Income Tax Expense Benefit | -3.22 | -67.03 | -64.92 | 17.64 | 43.57 | 40.77 | 41.98 | 51.63 | 47.77 | 62.42 | 53.56 | 36.55 | 13.67 | 12.97 | 11.99 | 29.19 | 41.83 | 50.24 | 43.05 | 39.02 | 41.29 | 42.29 | 45.39 | |

| Income Taxes Paid Net | -0.05 | 0.36 | 0.79 | 6.50 | 14.72 | 73.90 | 2.14 | 41.24 | 20.62 | 71.44 | 2.71 | 21.28 | 89.10 | 1.83 | 2.02 | 34.03 | 21.20 | 65.53 | 2.78 | 36.05 | 39.25 | 19.48 | 3.79 | |

| Profit Loss | -23.34 | -197.41 | -1195.42 | 49.51 | 131.62 | 122.36 | 120.13 | 136.04 | 140.00 | 180.51 | 150.41 | 116.83 | 45.50 | 33.20 | -1433.11 | 117.88 | 110.03 | 128.12 | 112.60 | 115.04 | 116.29 | 115.73 | 118.28 | |

| Net Income Loss | -23.34 | -197.41 | -1195.42 | 49.51 | 131.62 | 122.36 | 120.13 | 136.04 | 140.00 | 180.51 | 150.41 | 116.83 | 45.50 | 33.20 | -1433.11 | 117.88 | 110.03 | 128.12 | 112.60 | 115.04 | 116.29 | 115.73 | 118.28 | |

| Comprehensive Income Net Of Tax | -123.22 | -235.16 | -1140.58 | 106.82 | -71.85 | -145.91 | -322.31 | 103.15 | 93.34 | 219.65 | 84.26 | 133.88 | 55.94 | 87.33 | -1420.85 | 100.65 | 132.85 | 163.93 | 155.94 | 152.82 | 94.77 | 105.33 | 69.03 | |

| Preferred Stock Dividends Income Statement Impact | 9.95 | 9.95 | 9.95 | 9.95 | 9.39 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | -33.29 | -207.36 | -1205.37 | 39.56 | 122.22 | 120.01 | 118.09 | 133.73 | 137.58 | 177.34 | 148.05 | 116.65 | 44.92 | 32.84 | -1434.05 | 116.42 | 108.66 | 126.94 | 111.44 | 113.82 | 114.86 | 114.39 | 117.16 | |

| Net Income Loss Available To Common Stockholders Diluted | -33.29 | -207.36 | -1205.37 | 39.56 | 122.22 | 122.36 | 120.13 | 136.04 | 140.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense After Provision For Loan Loss | 130.73 | 184.08 | 276.27 | 312.94 | 332.18 | 312.43 | 308.72 | 306.40 | 295.84 | 354.31 | 309.27 | 249.21 | 154.32 | 134.28 | 137.75 | 243.62 | 245.24 | 252.90 | 250.88 | 249.76 | 248.82 | 244.83 | 252.50 | |

| Noninterest Expense | 201.10 | 320.44 | 1573.00 | 226.83 | 195.62 | 183.65 | 167.43 | 176.11 | 159.42 | 151.75 | 150.14 | 135.68 | 133.40 | 126.97 | 1587.97 | 123.73 | 126.81 | 125.43 | 126.29 | 129.24 | 128.15 | 126.45 | 127.39 | |

| Noninterest Income | 43.81 | -128.08 | 36.39 | -18.96 | 38.62 | 34.35 | 20.82 | 57.38 | 51.34 | 40.37 | 44.83 | 39.85 | 38.25 | 38.86 | 29.10 | 27.18 | 33.43 | 50.89 | 31.06 | 33.53 | 36.91 | 39.64 | 38.56 | |

| Goodwill Impairment Loss | 0.00 | 0.00 | 1376.74 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 1470.00 | 0.00 | NA | 0.00 | 0.00 | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

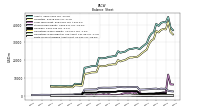

| Assets | 36877.83 | 38337.25 | 44302.98 | 41228.94 | 41404.59 | 40950.72 | 39249.64 | 40443.34 | 35885.68 | 34867.99 | 32856.53 | 29498.44 | 28426.72 | 27365.74 | 26143.27 | 26770.81 | 26724.63 | 26344.41 | 26324.14 | 25731.35 | 24782.13 | 24529.56 | 24149.33 | |

| Liabilities | 34478.56 | 35804.06 | 41531.50 | 37278.40 | 37528.65 | 36972.32 | 35599.04 | 36443.71 | 31967.24 | 31021.31 | 29202.40 | 25903.49 | 24940.49 | 23912.84 | 22752.88 | 21816.11 | 21804.52 | 21492.40 | 21533.16 | 20905.77 | 20040.44 | 19751.60 | 19281.84 | |

| Liabilities And Stockholders Equity | 36877.83 | 38337.25 | 44302.98 | 41228.94 | 41404.59 | 40950.72 | 39249.64 | 40443.34 | 35885.68 | 34867.99 | 32856.53 | 29498.44 | 28426.72 | 27365.74 | 26143.27 | 26770.81 | 26724.63 | 26344.41 | 26324.14 | 25731.35 | 24782.13 | 24529.56 | 24149.33 | |

| Stockholders Equity | 2399.28 | 2533.20 | 2771.48 | 3950.53 | 3875.95 | 3978.40 | 3650.59 | 3999.63 | 3918.43 | 3846.68 | 3654.14 | 3594.95 | 3486.23 | 3452.90 | 3390.39 | 4954.70 | 4920.11 | 4852.01 | 4790.98 | 4825.59 | 4741.69 | 4777.96 | 4867.49 | |

| Tier One Risk Based Capital | NA | NA | NA | 3503.20 | NA | NA | NA | 2657.57 | NA | NA | NA | 2403.72 | NA | NA | NA | 2306.97 | NA | NA | NA | 2255.59 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 6069.67 | 6698.15 | 6680.14 | 2240.22 | 2460.71 | 2389.90 | 2070.68 | 4057.23 | 3699.20 | 5858.09 | 5694.87 | 3160.66 | 2953.20 | 1921.14 | 612.26 | 637.62 | 736.00 | 607.74 | 556.88 | 385.77 | 381.79 | 451.56 | 547.80 | |

| Land | NA | NA | NA | 1.24 | NA | NA | NA | 1.24 | NA | NA | NA | 1.24 | NA | NA | NA | 1.24 | NA | NA | NA | 1.24 | NA | NA | NA | |

| Equity Securities Fv Ni | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.06 | 8.81 | 28.58 | 18.83 | 13.06 | 10.27 | 6.15 | 1.14 | 2.69 | 2.47 | 3.00 | 4.71 | 3.28 | NA | 4.89 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 4487.17 | 4708.52 | 4848.61 | 4843.49 | 5891.33 | 6780.65 | 9975.11 | 10694.46 | 9276.93 | NA | NA | 5235.59 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | NA | NA | NA | 149.28 | NA | NA | NA | 134.26 | NA | NA | NA | 121.22 | NA | NA | NA | 112.56 | NA | NA | NA | 104.97 | NA | NA | NA | |

| Furniture And Fixtures Gross | NA | NA | NA | 52.99 | NA | NA | NA | 50.51 | NA | NA | NA | 50.89 | NA | NA | NA | 47.58 | NA | NA | NA | 45.20 | NA | NA | NA | |

| Leasehold Improvements Gross | NA | NA | NA | 77.51 | NA | NA | NA | 66.14 | NA | NA | NA | 60.62 | NA | NA | NA | 55.34 | NA | NA | NA | 50.21 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | NA | NA | NA | 94.97 | NA | NA | NA | 87.53 | NA | NA | NA | 81.98 | NA | NA | NA | 73.97 | NA | NA | NA | 70.31 | NA | NA | NA | |

| Amortization Of Intangible Assets | 2.39 | 2.39 | 2.41 | 2.63 | 3.65 | 3.65 | 3.65 | 3.88 | 2.89 | 2.89 | 3.08 | 3.17 | 3.75 | 3.88 | 3.95 | 4.15 | 4.83 | 4.87 | 4.87 | 0.97 | 5.59 | 5.59 | 6.35 | |

| Property Plant And Equipment Net | 50.24 | 57.08 | 60.36 | 54.31 | 50.78 | 51.08 | 51.01 | 46.74 | 47.25 | 39.54 | 39.62 | 39.23 | 40.54 | 42.30 | 39.80 | 38.59 | 37.93 | 38.16 | 37.78 | 34.66 | 34.01 | 34.51 | 33.69 | |

| Goodwill | NA | NA | NA | 1376.74 | 1405.74 | 1405.74 | 1405.74 | 1405.74 | 1204.12 | 1204.12 | 1204.09 | 1078.67 | 1078.67 | 1078.67 | 1078.67 | 2548.67 | 2548.67 | 2548.67 | 2548.67 | 2548.67 | 2548.67 | 2548.67 | 2548.67 | |

| Finite Lived Intangible Assets Net | 24.19 | 26.58 | 28.97 | 31.38 | 34.01 | 37.66 | 41.31 | 44.96 | 15.53 | 18.42 | 21.31 | 23.64 | 26.81 | 30.56 | 34.45 | 38.39 | 42.55 | 47.38 | 52.25 | 57.12 | 62.11 | 67.69 | 73.28 | |

| Equity Securities Fv Ni | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.06 | 8.81 | 28.58 | 18.83 | 13.06 | 10.27 | 6.15 | 1.14 | 2.69 | 2.47 | 3.00 | 4.71 | 3.28 | NA | 4.89 | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 269.29 | 157.56 | 117.41 | 158.67 | 203.75 | 51.16 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 2013.30 | 2120.81 | 2157.06 | 2110.47 | 2060.85 | 2209.76 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities | NA | NA | NA | 2270.64 | 2266.10 | 2261.87 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 5443.68 | 5515.82 | 5591.77 | 5654.62 | 6769.94 | 7371.00 | 10494.10 | 10603.52 | 9140.32 | NA | NA | 4996.97 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | NA | 0.17 | 0.81 | 0.01 | NA | 0.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 269.29 | 157.56 | 117.41 | 158.67 | 203.75 | 51.16 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 2282.59 | 2278.20 | 2273.65 | 2269.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 918.20 | 937.89 | 928.11 | 889.21 | 881.61 | 895.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 1095.09 | 1182.92 | 1228.94 | 1221.26 | 1179.24 | 1313.81 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Taxes Payable Current | NA | NA | NA | 90.20 | NA | NA | NA | 36.30 | NA | NA | NA | 59.30 | NA | NA | NA | 30.80 | NA | NA | NA | 38.90 | NA | NA | NA | |

| Time Deposit Maturities Year One | NA | NA | NA | 4130.00 | NA | NA | NA | 1136.87 | NA | NA | NA | 1243.85 | NA | NA | NA | 2430.66 | NA | NA | NA | 1895.21 | NA | NA | NA | |

| Deposits | 26598.68 | 27897.08 | 28187.56 | 33936.33 | 34195.87 | 33968.15 | 33224.89 | 34997.76 | 30559.74 | 29647.03 | 28223.29 | 24940.72 | 23965.69 | 22928.58 | 19575.84 | 19233.04 | 19733.20 | 18805.76 | 19285.93 | 18870.50 | 17879.54 | 17929.19 | 18078.79 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 6294.52 | 6357.34 | 11881.71 | 1764.03 | 1864.82 | 1592.00 | 991.00 | NA | NA | 6.62 | 19.75 | 5.00 | 60.00 | 60.00 | 2295.00 | 1759.01 | 1253.03 | 1913.06 | 1481.09 | 1371.11 | 1513.17 | 1187.23 | 575.28 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

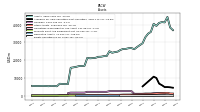

| Stockholders Equity | 2399.28 | 2533.20 | 2771.48 | 3950.53 | 3875.95 | 3978.40 | 3650.59 | 3999.63 | 3918.43 | 3846.68 | 3654.14 | 3594.95 | 3486.23 | 3452.90 | 3390.39 | 4954.70 | 4920.11 | 4852.01 | 4790.98 | 4825.59 | 4741.69 | 4777.96 | 4867.49 | |

| Common Stock Value | 1.23 | 1.23 | 1.23 | 1.23 | 1.23 | 1.23 | 1.22 | 1.22 | 1.22 | 1.22 | 1.22 | 1.21 | 1.21 | 1.21 | 1.20 | 1.22 | 1.22 | 1.22 | 1.22 | 1.25 | 1.25 | 1.26 | 1.28 | |

| Additional Paid In Capital | 2910.72 | 2911.27 | 2903.43 | 2927.90 | 2950.09 | 2970.65 | 2991.16 | 3013.40 | 3035.05 | 3056.52 | 3077.45 | 3100.63 | 3125.55 | 3148.09 | 3171.31 | 3306.01 | 3371.03 | 3435.68 | 3535.79 | 3722.72 | 3789.89 | 3920.72 | 4111.23 | |

| Retained Earnings Accumulated Deficit | -25.40 | 7.89 | 215.25 | 1420.62 | 1381.06 | 1258.84 | 1136.48 | 1016.35 | 880.30 | 740.31 | 559.80 | 409.39 | 292.56 | 247.06 | 213.85 | 1652.25 | 1534.37 | 1424.34 | 1296.22 | 1182.67 | 1067.63 | 951.35 | 835.61 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -873.68 | -773.80 | -736.06 | -790.90 | -848.21 | -644.75 | -376.48 | 65.97 | 98.86 | 145.52 | 106.38 | 172.52 | 155.47 | 145.04 | 90.92 | 78.66 | 95.89 | 73.07 | 37.26 | -6.08 | -43.85 | -22.34 | -11.94 | |

| Treasury Stock Value | 112.11 | 111.91 | 110.89 | 106.84 | 106.74 | 106.08 | 101.79 | 97.31 | 97.00 | 96.89 | 90.71 | 88.80 | 88.57 | 88.50 | 86.89 | 83.43 | 82.40 | 82.30 | 79.51 | 74.98 | 73.24 | 73.03 | 68.69 | |

| Stock Issued During Period Value New Issues | NA | NA | NA | NA | 498.50 | 498.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.66 | 104.95 | -20.99 | 202.88 | 227.53 | 137.36 | 134.21 | 110.64 | 161.71 | 83.90 | 146.70 | 140.94 | 68.92 | 158.45 | 115.57 | 135.06 | 167.61 | 128.09 | 151.89 | 144.21 | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | 713.40 | 5736.39 | 133.45 | -22.03 | -617.00 | -1626.42 | -1304.62 | -37.57 | -3196.60 | -1689.15 | -791.14 | -823.82 | -44.44 | 62.35 | -875.08 | -166.97 | -234.76 | 79.31 | -308.89 | -914.65 | -364.25 | -528.87 | 890.57 | |

| Net Cash Provided By Used In Financing Activities | -1374.54 | -5823.33 | 4327.45 | -401.33 | 460.27 | 1808.28 | -816.14 | 284.96 | 876.00 | 1768.47 | 3178.64 | 890.35 | 1007.58 | 1088.08 | 734.14 | -66.48 | 195.41 | -156.54 | 328.11 | 774.42 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 32.66 | 104.95 | -20.99 | 202.88 | 227.53 | 137.36 | 134.21 | 110.64 | 161.71 | 83.90 | 146.70 | 140.94 | 68.92 | 158.45 | 115.57 | 135.06 | 167.61 | 128.09 | 151.89 | 144.21 | NA | NA | NA | |

| Net Income Loss | -23.34 | -197.41 | -1195.42 | 49.51 | 131.62 | 122.36 | 120.13 | 136.04 | 140.00 | 180.51 | 150.41 | 116.83 | 45.50 | 33.20 | -1433.11 | 117.88 | 110.03 | 128.12 | 112.60 | 115.04 | 116.29 | 115.73 | 118.28 | |

| Profit Loss | -23.34 | -197.41 | -1195.42 | 49.51 | 131.62 | 122.36 | 120.13 | 136.04 | 140.00 | 180.51 | 150.41 | 116.83 | 45.50 | 33.20 | -1433.11 | 117.88 | 110.03 | 128.12 | 112.60 | 115.04 | 116.29 | 115.73 | 118.28 | |

| Share Based Compensation | 0.26 | 8.93 | 4.98 | NA | 9.65 | 9.70 | 7.56 | NA | 8.50 | 8.99 | 6.42 | 4.52 | 7.06 | 6.29 | 6.49 | 6.98 | 7.30 | 6.72 | 5.81 | 6.89 | 8.14 | 7.55 | 7.20 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 713.40 | 5736.39 | 133.45 | -22.03 | -617.00 | -1626.42 | -1304.62 | -37.57 | -3196.60 | -1689.15 | -791.14 | -823.82 | -44.44 | 62.35 | -875.08 | -166.97 | -234.76 | 79.31 | -308.89 | -914.65 | -364.25 | -528.87 | 890.57 | |

| Payments To Acquire Property Plant And Equipment | 2.86 | 0.01 | 9.24 | 7.05 | 2.65 | 3.14 | 7.29 | 2.18 | 10.53 | 2.61 | 1.94 | 1.52 | 1.24 | 5.47 | 4.30 | 4.11 | 2.37 | 3.00 | 5.62 | 3.13 | 1.92 | 3.33 | 4.00 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -1374.54 | -5823.33 | 4327.45 | -401.33 | 460.27 | 1808.28 | -816.14 | 284.96 | 876.00 | 1768.47 | 3178.64 | 890.35 | 1007.58 | 1088.08 | 734.14 | -66.48 | 195.41 | -156.54 | 328.11 | 774.42 | NA | NA | NA | |

| Payments Of Dividends Common Stock | 0.81 | 1.09 | 29.46 | 30.05 | 30.21 | 30.20 | 29.80 | 29.97 | 29.97 | 29.92 | 29.59 | 29.44 | 29.60 | 29.50 | 71.21 | 72.01 | 71.95 | 71.91 | 73.18 | 74.06 | 74.39 | 76.05 | 63.69 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

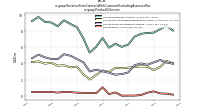

| Revenues | 489.89 | 411.81 | 554.18 | 454.07 | 448.66 | 384.86 | 343.72 | 372.19 | 341.43 | 320.88 | 318.17 | 312.03 | 304.16 | 312.93 | 320.43 | 320.77 | 340.64 | 365.43 | 335.62 | 336.26 | 329.55 | 328.15 | 316.33 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 8.11 | 8.68 | 8.27 | 7.85 | 7.80 | 7.70 | 7.34 | 6.35 | 6.07 | 6.45 | 5.97 | 7.18 | 6.09 | 5.35 | 7.15 | 8.53 | 8.92 | 9.38 | 8.64 | 9.10 | 9.19 | 9.80 | 9.29 | |

| Noninterest Income | 8.11 | 8.68 | 8.27 | 7.85 | 7.80 | 7.70 | 7.34 | 6.35 | 6.07 | 6.45 | 5.97 | 7.18 | 6.09 | 5.35 | 7.15 | 8.53 | 8.92 | 9.38 | 8.64 | 9.10 | 9.19 | 9.80 | 9.29 | |

| Other | 0.12 | 0.24 | 0.27 | 0.53 | 0.36 | 0.07 | -0.00 | -0.00 | -0.01 | 0.39 | 0.18 | 1.04 | 0.29 | 0.34 | 0.34 | 0.36 | 0.43 | 0.45 | 0.37 | 0.45 | 0.44 | 0.44 | 0.46 | |

| Other Commissions And Fees | 3.97 | 4.12 | 4.43 | 4.14 | 3.83 | 4.00 | 3.77 | 2.88 | 2.68 | 2.60 | 2.86 | 3.02 | 3.23 | 3.01 | 4.15 | 4.55 | 4.96 | 5.16 | 4.54 | 4.56 | 4.77 | 5.10 | 4.65 | |

| Service Charges On Deposit Accounts | 4.02 | 4.32 | 3.57 | 3.18 | 3.61 | 3.63 | 3.57 | 3.48 | 3.41 | 3.45 | 2.93 | 3.12 | 2.57 | 2.00 | 2.66 | 3.61 | 3.52 | 3.77 | 3.73 | 4.09 | 3.98 | 4.26 | 4.17 |