| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Earnings Per Share Basic | 0.37 | 0.38 | 0.43 | 0.54 | 0.66 | 0.58 | 0.53 | 0.58 | 0.49 | 0.49 | 0.58 | 0.63 | 0.53 | 0.37 | 0.22 | 0.23 | 0.40 | 0.49 | 0.38 | 0.48 | 0.55 | 0.55 | 0.30 | 0.43 | 0.30 | 0.41 | 0.38 | 0.37 | |

| Earnings Per Share Diluted | 0.36 | 0.38 | 0.43 | 0.54 | 0.66 | 0.58 | 0.53 | 0.58 | 0.49 | 0.49 | 0.58 | 0.63 | 0.53 | 0.37 | 0.22 | 0.23 | 0.40 | 0.49 | 0.38 | 0.48 | 0.55 | 0.54 | 0.30 | 0.43 | 0.30 | 0.41 | 0.38 | 0.37 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue From Contract With Customer Excluding Assessed Tax | 13.67 | 14.20 | 14.58 | 15.09 | 12.88 | 13.69 | 13.79 | 14.62 | 13.88 | 14.18 | 15.36 | 14.14 | 13.06 | 12.72 | 9.31 | 10.44 | 10.82 | 10.94 | 11.01 | 8.58 | 9.36 | 9.41 | 9.40 | 9.12 | 9.18 | 9.42 | 9.17 | 8.71 | |

| Revenues | 13.67 | 14.20 | 14.58 | 15.09 | 12.88 | 13.69 | 13.79 | 14.62 | 13.88 | 14.18 | 15.36 | 14.14 | 13.06 | 12.72 | 9.31 | 10.44 | 10.82 | 10.94 | 11.01 | 8.58 | 9.36 | 9.41 | 9.40 | 9.12 | 9.18 | 9.42 | 9.17 | 8.71 | |

| Marketing And Advertising Expense | 1.10 | 1.13 | 1.38 | 1.23 | 1.50 | 1.37 | 1.22 | 1.10 | 1.36 | 0.78 | 0.93 | 0.88 | 1.63 | 0.77 | 0.63 | 1.37 | 1.06 | 1.10 | 1.08 | 0.88 | 1.07 | 0.95 | 0.85 | 0.97 | 1.20 | 0.91 | 0.94 | 0.86 | |

| Interest Expense | 68.38 | 61.96 | 50.79 | 35.23 | 23.11 | 12.24 | 6.81 | 6.46 | 7.78 | 8.37 | 9.64 | 10.53 | 11.41 | 11.47 | 11.71 | 16.15 | 17.50 | 19.50 | 19.09 | 17.40 | 16.59 | 15.47 | 14.04 | 13.05 | 11.70 | 11.68 | 11.39 | 10.88 | |

| Interest Expense Debt | 17.53 | 16.77 | NA | NA | 4.52 | 2.52 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Expense Net | 95.79 | 96.24 | 99.11 | 108.32 | 114.06 | 109.49 | 99.47 | 94.53 | 93.89 | 91.23 | 90.91 | 90.00 | 88.74 | 81.98 | 69.83 | 72.02 | 72.88 | 73.53 | 76.56 | 75.01 | 77.33 | 75.79 | 74.28 | 73.28 | 71.90 | 70.21 | 69.06 | 67.03 | |

| Income Tax Expense Benefit | 12.46 | 8.84 | 11.63 | 14.45 | 18.23 | 16.66 | 14.34 | 15.23 | 14.78 | 12.91 | 15.28 | 16.23 | 12.35 | 9.29 | 3.71 | 5.26 | 8.03 | 9.94 | 8.80 | 7.69 | 6.03 | 8.57 | 4.57 | 6.36 | 15.74 | 11.97 | 10.45 | 8.37 | |

| Income Taxes Paid | 7.60 | 12.27 | 25.63 | 0.96 | 25.40 | 17.89 | 7.20 | 0.56 | 16.31 | 22.95 | 17.94 | 0.27 | 13.98 | 17.70 | 4.72 | 0.12 | 13.36 | 9.78 | 11.26 | 0.10 | 0.44 | 10.69 | 0.51 | 3.62 | 13.15 | 11.92 | 15.39 | 0.10 | |

| Net Income Loss | 27.31 | 28.55 | 32.00 | 40.54 | 49.03 | 43.42 | 39.23 | 43.96 | 37.30 | 37.27 | 44.79 | 48.56 | 40.57 | 27.14 | 14.31 | 14.93 | 25.95 | 31.40 | 24.39 | 30.89 | 35.76 | 35.47 | 19.24 | 27.91 | 19.48 | 26.57 | 24.38 | 23.51 | |

| Comprehensive Income Net Of Tax | 81.25 | -4.02 | 17.66 | 57.44 | 58.48 | -19.27 | -4.62 | -30.85 | 36.41 | 30.94 | 45.89 | 43.88 | 44.89 | 27.68 | 12.17 | 26.05 | 23.01 | 34.19 | 33.45 | 38.14 | 48.04 | 30.77 | 16.03 | 18.87 | 14.12 | 27.14 | 25.64 | 24.37 | |

| Interest Income Expense After Provision For Loan Loss | 95.29 | 85.23 | 88.71 | 102.32 | 110.68 | 101.08 | 96.48 | 100.93 | 93.49 | 90.26 | 101.61 | 105.00 | 91.04 | 75.58 | 58.93 | 57.30 | 69.98 | 73.03 | 67.06 | 74.81 | 75.53 | 74.79 | 58.78 | 67.88 | 70.00 | 69.71 | 67.36 | 65.53 | |

| Noninterest Expense | 74.49 | 67.16 | 64.46 | 69.48 | 61.67 | 69.44 | 63.85 | 61.89 | 62.06 | 63.44 | 62.70 | 61.85 | 58.57 | 59.78 | 55.27 | 54.11 | 53.73 | 49.74 | 49.69 | 48.42 | 49.36 | 46.66 | 48.81 | 46.91 | 48.08 | 46.28 | 47.34 | 46.12 | |

| Noninterest Income | 18.97 | 19.32 | 19.39 | 22.15 | 18.27 | 28.45 | 20.93 | 20.15 | 20.65 | 23.36 | 21.16 | 21.64 | 20.45 | 20.63 | 14.37 | 16.99 | 17.73 | 18.05 | 15.83 | 12.19 | 15.62 | 15.92 | 13.84 | 13.31 | 13.30 | 15.11 | 14.82 | 12.46 |

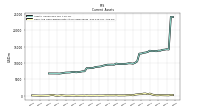

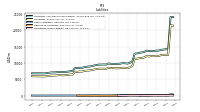

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 14210.81 | 14086.83 | 14029.60 | 13778.91 | 13783.44 | 13603.85 | 13715.90 | 13617.01 | 13781.20 | 13391.94 | 13216.95 | 13130.44 | 12919.74 | 12871.32 | 10513.54 | 10084.89 | 9808.58 | 9918.40 | 9938.25 | 9802.61 | 9725.77 | 9709.63 | 9732.91 | 9734.24 | 9845.27 | 9495.15 | 9539.28 | 9509.66 | |

| Liabilities | 12520.21 | 12463.85 | 12387.13 | 12138.83 | 12185.73 | 12052.86 | 12130.64 | 11995.88 | 12084.11 | 11712.52 | 11539.32 | 11483.21 | 11299.94 | 11269.75 | 9103.13 | 8672.30 | 8394.74 | 8520.56 | 8546.80 | 8428.80 | 8366.79 | 8378.04 | 8421.65 | 8429.36 | 8546.61 | 8194.97 | 8255.68 | 8242.57 | |

| Liabilities And Stockholders Equity | 14210.81 | 14086.83 | 14029.60 | 13778.91 | 13783.44 | 13603.85 | 13715.90 | 13617.01 | 13781.20 | 13391.94 | 13216.95 | 13130.44 | 12919.74 | 12871.32 | 10513.54 | 10084.89 | 9808.58 | 9918.40 | 9938.25 | 9802.61 | 9725.77 | 9709.63 | 9732.91 | 9734.24 | 9845.27 | 9495.15 | 9539.28 | 9509.66 | |

| Stockholders Equity | 1690.60 | 1622.97 | 1642.47 | 1640.08 | 1597.70 | 1550.98 | 1585.27 | 1621.13 | 1697.10 | 1679.42 | 1677.63 | 1647.23 | 1619.80 | 1601.57 | 1410.41 | 1412.59 | 1413.84 | 1397.83 | 1391.45 | 1373.82 | 1358.98 | 1331.59 | 1311.26 | 1304.89 | 1298.66 | 1300.17 | 1283.60 | 1267.09 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 180.19 | 189.20 | 208.80 | 233.78 | 186.44 | 183.07 | 277.46 | 428.33 | 685.16 | 505.29 | 710.15 | 687.57 | 532.35 | 510.14 | 453.76 | 370.58 | 186.75 | 260.86 | 207.69 | 197.85 | 142.66 | 149.12 | 141.95 | 133.51 | 190.83 | 148.78 | 153.40 | 158.09 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 180.25 | 189.27 | 208.87 | 233.85 | 186.51 | 184.87 | 277.53 | 433.15 | 712.46 | 505.29 | 710.15 | 687.57 | 532.35 | 510.14 | 453.76 | 370.58 | 186.75 | 260.86 | 207.69 | 197.85 | 142.66 | 149.12 | 141.95 | 133.51 | 190.83 | NA | NA | NA | |

| Land | 13.39 | NA | NA | NA | 14.42 | NA | NA | NA | 14.47 | NA | NA | NA | 13.63 | NA | NA | NA | 12.44 | NA | NA | NA | 12.44 | NA | NA | NA | 12.44 | NA | NA | NA | |

| Equity Securities Fv Ni | 1.27 | 1.21 | 1.24 | 1.20 | 1.15 | 1.06 | 1.10 | 1.26 | 1.32 | 1.27 | 1.09 | 1.03 | 0.97 | 0.87 | 0.81 | 0.69 | 0.82 | 0.73 | 0.75 | 0.72 | 0.64 | 0.72 | 0.69 | NA | 0.66 | NA | NA | NA |

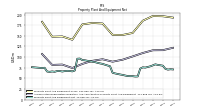

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 192.87 | NA | NA | NA | 196.14 | NA | NA | NA | 196.63 | NA | NA | NA | 185.55 | NA | NA | NA | 156.83 | NA | NA | NA | 152.06 | NA | NA | NA | 152.42 | NA | NA | NA | |

| Furniture And Fixtures Gross | 56.08 | NA | NA | NA | 55.88 | NA | NA | NA | 54.86 | NA | NA | NA | 52.13 | NA | NA | NA | 45.66 | NA | NA | NA | 44.60 | NA | NA | NA | 45.18 | NA | NA | NA | |

| Leasehold Improvements Gross | 45.15 | NA | NA | NA | 49.88 | NA | NA | NA | 47.38 | NA | NA | NA | 37.76 | NA | NA | NA | 35.75 | NA | NA | NA | 35.11 | NA | NA | NA | 35.24 | NA | NA | NA | |

| Construction In Progress Gross | 5.33 | NA | NA | NA | 1.01 | NA | NA | NA | 4.78 | NA | NA | NA | 9.67 | NA | NA | NA | 3.27 | NA | NA | NA | 1.56 | NA | NA | NA | 1.04 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 121.87 | NA | NA | NA | 116.35 | NA | NA | NA | 116.07 | NA | NA | NA | 109.60 | NA | NA | NA | 101.62 | NA | NA | NA | 93.94 | NA | NA | NA | 89.24 | NA | NA | NA | |

| Amortization Of Intangible Assets | 0.72 | 0.72 | 0.75 | 0.76 | 0.78 | 0.78 | 0.87 | 0.86 | 0.89 | 0.88 | 0.92 | 0.97 | 1.05 | 0.92 | 0.71 | 0.74 | 0.58 | 0.83 | 0.84 | 0.49 | 0.50 | 0.51 | 0.55 | 0.57 | 0.59 | 0.63 | 0.69 | 0.75 | |

| Property Plant And Equipment Net | 71.00 | 71.45 | 70.60 | 72.47 | 79.79 | 80.77 | 81.66 | 82.99 | 80.56 | 78.33 | 76.80 | 75.34 | 75.95 | 72.91 | 54.55 | 54.35 | 55.21 | 55.12 | 55.51 | 56.73 | 58.12 | 59.16 | 60.35 | 61.66 | 63.19 | 78.57 | 80.35 | 82.12 | |

| Goodwill | 443.62 | NA | NA | NA | 443.62 | NA | NA | NA | 444.42 | NA | NA | NA | 443.00 | NA | NA | NA | 420.56 | NA | NA | NA | 411.60 | NA | NA | NA | 411.60 | NA | NA | NA | |

| Intangible Assets Net Including Goodwill | 457.94 | 458.66 | 459.38 | 460.13 | 460.89 | 461.67 | 462.45 | 463.32 | 464.18 | 465.06 | 464.49 | 465.33 | 466.21 | 467.13 | 435.58 | 436.28 | 437.02 | 437.58 | 437.61 | 417.69 | 418.18 | 418.67 | 419.18 | 419.72 | 420.29 | 420.88 | 421.50 | 422.19 | |

| Equity Securities Fv Ni | 1.27 | 1.21 | 1.24 | 1.20 | 1.15 | 1.06 | 1.10 | 1.26 | 1.32 | 1.27 | 1.09 | 1.03 | 0.97 | 0.87 | 0.81 | 0.69 | 0.82 | 0.73 | 0.75 | 0.72 | 0.64 | 0.72 | 0.69 | NA | 0.66 | NA | NA | NA | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 10.76 | 27.37 | 14.06 | 10.91 | 14.75 | 24.55 | 12.59 | 7.74 | 0.96 | 0.71 | 0.41 | 1.02 | 0.07 | 0.06 | 0.02 | 0.16 | 0.13 | 0.14 | 0.25 | 1.08 | 4.02 | 7.03 | 5.72 | 5.70 | 1.91 | 1.85 | 2.17 | 4.16 | |

| Held To Maturity Securities Fair Value | 352.60 | 343.08 | 365.03 | 371.40 | 373.47 | 368.67 | 399.14 | 417.66 | 449.71 | 441.89 | 454.24 | 463.99 | 472.45 | 467.69 | 460.59 | 459.22 | 467.97 | 476.70 | 487.92 | 479.83 | 479.74 | 469.86 | 472.19 | 465.79 | 485.04 | 490.43 | 501.34 | 492.86 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 0.24 | 0.00 | 0.17 | 0.81 | 0.27 | 0.10 | 0.95 | 3.41 | 14.48 | 15.52 | 16.88 | 17.04 | 21.55 | 21.16 | 21.30 | 13.94 | 14.47 | 15.10 | 13.31 | 8.87 | 4.33 | 2.80 | 4.08 | 4.54 | 9.29 | 10.43 | 10.77 | 7.91 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 10.76 | 27.37 | 14.06 | 10.91 | 14.75 | 24.55 | 12.59 | 7.74 | 0.96 | 0.71 | 0.41 | 1.02 | 0.07 | 0.06 | 0.02 | 0.16 | 0.13 | 0.14 | 0.25 | 1.08 | 4.02 | 7.03 | 5.72 | 5.70 | 1.91 | 1.85 | 2.17 | 4.16 | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 363.08 | 370.42 | 378.89 | 381.46 | 387.92 | 393.07 | 410.75 | 421.96 | 436.15 | 427.04 | NA | NA | 450.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 168.35 | 162.28 | 166.60 | 161.33 | 151.10 | 145.43 | 148.68 | 152.91 | 155.09 | 163.78 | NA | 167.46 | 137.98 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities Within One Year Fair Value | 32.62 | 30.36 | 25.20 | 24.74 | 20.19 | 16.11 | 17.07 | 17.34 | 15.70 | NA | NA | NA | 21.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 129.45 | 130.09 | 148.12 | 156.16 | 168.04 | 172.78 | 191.23 | 194.74 | 209.67 | 211.12 | NA | 224.33 | 229.90 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 22.18 | 20.35 | 25.10 | 29.16 | 34.14 | 34.35 | 42.16 | 52.66 | 69.24 | 66.95 | NA | 72.16 | 82.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

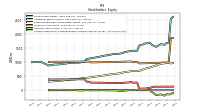

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time Deposit Maturities Year One | 1020.28 | NA | NA | NA | 584.15 | NA | NA | NA | 534.46 | NA | NA | NA | 886.02 | NA | NA | NA | 606.87 | NA | NA | NA | 584.48 | NA | NA | NA | 424.45 | NA | NA | NA | |

| Deposits | 10292.51 | 10141.40 | 10261.12 | 10297.36 | 10563.02 | 10685.60 | 10874.22 | 11366.09 | 11234.01 | 10836.62 | 10589.98 | 10297.51 | 9837.83 | 9559.24 | 7660.07 | 7210.76 | 7102.61 | 6961.37 | 6874.97 | 6903.46 | 6830.12 | 6719.74 | 6673.95 | 6756.58 | 6714.17 | 6591.22 | 6500.54 | 6529.87 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 1690.60 | 1622.97 | 1642.47 | 1640.08 | 1597.70 | 1550.98 | 1585.27 | 1621.13 | 1697.10 | 1679.42 | 1677.63 | 1647.23 | 1619.80 | 1601.57 | 1410.41 | 1412.59 | 1413.84 | 1397.83 | 1391.45 | 1373.82 | 1358.98 | 1331.59 | 1311.26 | 1304.89 | 1298.66 | 1300.17 | 1283.60 | 1267.09 | |

| Additional Paid In Capital | 989.06 | 988.00 | 986.15 | 984.09 | 981.14 | 978.36 | 976.07 | 972.55 | 969.82 | 967.20 | 965.47 | 963.56 | 962.45 | 960.86 | 1009.98 | 1008.58 | 1007.30 | 1028.13 | 1025.86 | 1023.67 | 1021.53 | 1019.05 | 1017.26 | 1014.47 | 1012.91 | 1010.25 | 1008.48 | 1005.96 | |

| Retained Earnings Accumulated Deficit | 974.54 | 964.80 | 954.40 | 940.53 | 918.16 | 886.33 | 860.98 | 839.81 | 814.53 | 794.71 | 775.24 | 748.57 | 718.09 | 694.24 | 685.51 | 686.40 | 695.27 | 682.54 | 666.41 | 657.38 | 651.10 | 627.80 | 606.42 | 600.59 | 586.13 | 586.58 | 573.35 | 561.65 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -141.12 | -195.06 | -162.49 | -148.15 | -165.04 | -174.49 | -111.80 | -67.95 | 6.86 | 7.76 | 14.08 | 12.98 | 17.66 | 13.33 | 12.79 | 14.94 | 3.82 | 6.76 | 3.98 | -5.08 | -12.34 | -24.61 | -19.91 | -16.70 | -7.46 | -0.71 | -1.28 | -2.54 | |

| Treasury Stock Value | 127.83 | 127.82 | 127.82 | 127.81 | 127.15 | 127.14 | 127.09 | 109.58 | 79.60 | 73.17 | 59.31 | 59.26 | 59.02 | 45.12 | 275.36 | 274.04 | 268.50 | 292.87 | 277.36 | 274.00 | 272.47 | 259.76 | 260.91 | 261.18 | 259.91 | 260.91 | 261.21 | 261.54 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

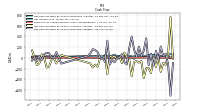

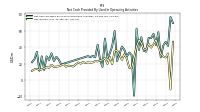

| Net Cash Provided By Used In Operating Activities | 46.32 | 41.68 | 27.33 | 58.07 | 42.44 | 56.06 | 50.68 | 51.13 | 34.39 | 35.42 | 51.95 | 36.42 | 62.29 | -19.03 | 30.30 | 33.36 | 28.29 | 36.74 | 40.52 | 31.37 | 22.96 | 59.52 | 41.03 | 32.21 | 26.70 | 50.30 | 15.83 | 24.39 | |

| Net Cash Provided By Used In Investing Activities | -132.17 | -92.99 | -263.95 | 19.51 | -170.85 | -0.36 | -283.92 | -192.44 | -191.85 | -377.09 | -58.40 | -90.60 | -57.78 | -79.31 | -343.90 | -26.99 | 23.20 | 96.53 | -99.55 | 22.69 | -27.17 | 31.15 | 8.47 | 34.26 | -305.12 | 21.74 | -17.25 | -5.70 | |

| Net Cash Provided By Used In Financing Activities | 76.84 | 31.70 | 211.64 | -30.23 | 130.05 | -148.36 | 77.63 | -138.01 | 364.63 | 136.80 | 29.03 | 209.40 | 17.70 | 154.72 | 396.79 | 177.46 | -125.60 | -80.10 | 68.86 | 1.13 | -2.25 | -83.49 | -41.06 | -123.78 | 320.47 | -76.65 | -3.27 | -4.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 46.32 | 41.68 | 27.33 | 58.07 | 42.44 | 56.06 | 50.68 | 51.13 | 34.39 | 35.42 | 51.95 | 36.42 | 62.29 | -19.03 | 30.30 | 33.36 | 28.29 | 36.74 | 40.52 | 31.37 | 22.96 | 59.52 | 41.03 | 32.21 | 26.70 | 50.30 | 15.83 | 24.39 | |

| Net Income Loss | 27.31 | 28.55 | 32.00 | 40.54 | 49.03 | 43.42 | 39.23 | 43.96 | 37.30 | 37.27 | 44.79 | 48.56 | 40.57 | 27.14 | 14.31 | 14.93 | 25.95 | 31.40 | 24.39 | 30.89 | 35.76 | 35.47 | 19.24 | 27.91 | 19.48 | 26.57 | 24.38 | 23.51 | |

| Deferred Income Tax Expense Benefit | 5.06 | 0.00 | -2.69 | 0.36 | 2.44 | -3.62 | -7.23 | 10.62 | 7.09 | -0.89 | -0.06 | 6.27 | -0.40 | 0.00 | -6.04 | -1.49 | 1.79 | 1.09 | -4.39 | 3.18 | 2.86 | 0.71 | -24.13 | 2.02 | 39.99 | -0.20 | -1.79 | 2.63 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

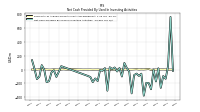

| Net Cash Provided By Used In Investing Activities | -132.17 | -92.99 | -263.95 | 19.51 | -170.85 | -0.36 | -283.92 | -192.44 | -191.85 | -377.09 | -58.40 | -90.60 | -57.78 | -79.31 | -343.90 | -26.99 | 23.20 | 96.53 | -99.55 | 22.69 | -27.17 | 31.15 | 8.47 | 34.26 | -305.12 | 21.74 | -17.25 | -5.70 | |

| Payments To Acquire Property Plant And Equipment | 1.59 | 2.94 | 2.35 | 0.61 | 1.53 | 1.94 | -2.90 | 8.84 | 5.46 | 2.68 | 3.82 | 1.85 | 5.85 | 3.41 | 1.90 | 1.66 | 2.09 | 1.44 | 0.77 | 0.59 | 1.20 | 0.82 | 0.64 | 0.50 | 1.54 | 0.58 | 0.52 | 0.59 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

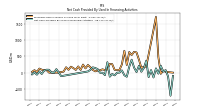

| Net Cash Provided By Used In Financing Activities | 76.84 | 31.70 | 211.64 | -30.23 | 130.05 | -148.36 | 77.63 | -138.01 | 364.63 | 136.80 | 29.03 | 209.40 | 17.70 | 154.72 | 396.79 | 177.46 | -125.60 | -80.10 | 68.86 | 1.13 | -2.25 | -83.49 | -41.06 | -123.78 | 320.47 | -76.65 | -3.27 | -4.90 | |

| Payments Of Dividends | 17.57 | 18.15 | 18.13 | 18.59 | 17.21 | 18.07 | 18.06 | 18.69 | 17.48 | 17.79 | 18.13 | 18.07 | 16.72 | 18.41 | 15.20 | 15.50 | 13.22 | 15.27 | 15.35 | 28.96 | 12.46 | 14.09 | 13.41 | 13.64 | 21.32 | 13.35 | 12.68 | 12.63 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 13.67 | 14.20 | 14.58 | 15.09 | 12.88 | 13.69 | 13.79 | 14.62 | 13.88 | 14.18 | 15.36 | 14.14 | 13.06 | 12.72 | 9.31 | 10.44 | 10.82 | 10.94 | 11.01 | 8.58 | 9.36 | 9.41 | 9.40 | 9.12 | 9.18 | 9.42 | 9.17 | 8.71 | |

| Insurance Commissions And Fees | 2.76 | 3.22 | 3.85 | 4.10 | 2.31 | 2.87 | 2.85 | 3.42 | 2.21 | 2.43 | 2.85 | 2.73 | NA | 1.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Wealth Management Fees | 6.84 | 6.99 | 6.92 | 6.92 | 6.60 | 6.79 | 7.02 | 7.47 | 7.84 | 7.92 | 7.86 | 7.13 | 6.66 | 6.85 | 5.98 | 6.25 | 6.10 | 6.08 | 6.24 | 4.08 | 4.38 | 4.57 | 4.60 | 4.40 | 4.29 | 4.59 | 4.51 | NA | |

| Banking | 4.07 | 3.98 | 3.81 | 4.07 | 3.98 | 4.04 | 3.91 | 3.73 | 3.83 | 3.82 | 4.65 | 4.28 | 4.60 | 4.17 | 3.34 | 4.19 | 4.73 | 4.86 | 4.77 | 4.50 | 4.97 | 4.84 | 4.80 | 4.72 | 4.89 | 4.83 | 4.66 | NA | |

| Debit Card | 0.75 | 0.74 | 0.76 | 0.71 | 0.75 | 0.76 | 0.85 | 0.77 | 0.88 | 0.91 | 2.10 | 1.78 | 1.81 | 1.69 | 1.26 | 1.21 | 1.46 | 1.47 | 1.49 | 1.31 | 1.55 | 1.49 | 1.56 | 1.40 | 1.48 | 1.43 | 1.49 | NA | |

| Deposit Account | 3.31 | 3.23 | 3.05 | 3.36 | 3.23 | 3.29 | 3.07 | 2.96 | 2.96 | 2.91 | 2.56 | 2.50 | 2.79 | 2.47 | 2.07 | 2.98 | 3.26 | 3.39 | 3.28 | 3.19 | 3.42 | 3.36 | 3.24 | 3.31 | 3.41 | 3.40 | 3.17 | NA | |

| Revenue From Contract With Customer Excluding Assessed Tax | 13.67 | 14.20 | 14.58 | 15.09 | 12.88 | 13.69 | 13.79 | 14.62 | 13.88 | 14.18 | 15.36 | 14.14 | 13.06 | 12.72 | 9.31 | 10.44 | 10.82 | 10.94 | 11.01 | 8.58 | 9.36 | 9.41 | 9.40 | 9.12 | 9.18 | 9.42 | 9.17 | 8.71 | |

| Insurance Commissions And Fees | 2.76 | 3.22 | 3.85 | 4.10 | 2.31 | 2.87 | 2.85 | 3.42 | 2.21 | 2.43 | 2.85 | 2.73 | NA | 1.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Wealth Management Fees | 6.84 | 6.99 | 6.92 | 6.92 | 6.60 | 6.79 | 7.02 | 7.47 | 7.84 | 7.92 | 7.86 | 7.13 | 6.66 | 6.85 | 5.98 | 6.25 | 6.10 | 6.08 | 6.24 | 4.08 | 4.38 | 4.57 | 4.60 | 4.40 | 4.29 | 4.59 | 4.51 | NA | |

| Banking | 4.07 | 3.98 | 3.81 | 4.07 | 3.98 | 4.04 | 3.91 | 3.73 | 3.83 | 3.82 | 4.65 | 4.28 | 4.60 | 4.17 | 3.34 | 4.19 | 4.73 | 4.86 | 4.77 | 4.50 | 4.97 | 4.84 | 4.80 | 4.72 | 4.89 | 4.83 | 4.66 | NA | |

| Debit Card | 0.75 | 0.74 | 0.76 | 0.71 | 0.75 | 0.76 | 0.85 | 0.77 | 0.88 | 0.91 | 2.10 | 1.78 | 1.81 | 1.69 | 1.26 | 1.21 | 1.46 | 1.47 | 1.49 | 1.31 | 1.55 | 1.49 | 1.56 | 1.40 | 1.48 | 1.43 | 1.49 | NA | |

| Deposit Account | 3.31 | 3.23 | 3.05 | 3.36 | 3.23 | 3.29 | 3.07 | 2.96 | 2.96 | 2.91 | 2.56 | 2.50 | 2.79 | 2.47 | 2.07 | 2.98 | 3.26 | 3.39 | 3.28 | 3.19 | 3.42 | 3.36 | 3.24 | 3.31 | 3.41 | 3.40 | 3.17 | NA |