| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.87 | 0.87 | 0.87 | 0.88 | 0.89 | 0.90 | 0.91 | 0.93 | 0.95 | 0.97 | 0.98 | 0.98 | 0.98 | 0.99 | 0.99 | 1.00 | 1.00 | 0.90 | 0.79 | 0.68 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.66 | 0.67 | 0.67 | 0.67 | 0.67 | 0.68 | 0.69 | 0.74 | 0.74 | 0.75 | 0.75 | 0.74 | 0.74 | 0.74 | 0.74 | 0.70 | 0.70 | 0.59 | 0.59 | 0.59 | 0.59 | 0.41 | 0.31 | |

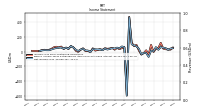

| Earnings Per Share Basic | 0.49 | 0.59 | 0.16 | 0.56 | -0.07 | 0.01 | -0.88 | -0.32 | -0.28 | -0.45 | 0.32 | 0.67 | 0.77 | 0.94 | 4.59 | -5.99 | 0.56 | 0.75 | 0.52 | 0.73 | 0.58 | 0.66 | 0.49 | 0.36 | 0.53 | 0.20 | 0.39 | 0.42 | 0.46 | 0.52 | -0.08 | 0.20 | 0.21 | 0.51 | 0.37 | 0.09 | 0.35 | 0.74 | 1.01 | 0.52 | 0.74 | 0.61 | 0.92 | 0.90 | 0.83 | 0.81 | 0.80 | 0.65 | |

| Earnings Per Share Diluted | 0.43 | 0.51 | 0.16 | 0.50 | -0.07 | 0.01 | -0.88 | -0.32 | -0.28 | -0.45 | 0.32 | 0.67 | 0.77 | 0.94 | 4.51 | -5.99 | 0.55 | 0.71 | 0.50 | 0.68 | 0.55 | 0.62 | 0.47 | 0.35 | 0.50 | 0.20 | 0.38 | 0.40 | 0.44 | 0.49 | -0.08 | 0.20 | 0.21 | 0.49 | 0.36 | 0.09 | 0.34 | 0.69 | 0.93 | 0.50 | 0.69 | 0.57 | 0.86 | 0.90 | 0.83 | 0.81 | 0.79 | 0.65 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues Net Of Interest Expense | 84.77 | 163.43 | 90.45 | 90.37 | 49.37 | 151.06 | 21.50 | 81.84 | 49.48 | 47.85 | 121.57 | 201.40 | 196.53 | 221.01 | 558.32 | -506.52 | 155.04 | 130.76 | 96.40 | 106.62 | 83.90 | 108.50 | 82.99 | 75.67 | 93.70 | 75.80 | 83.96 | 64.47 | 68.93 | 103.33 | 47.62 | 52.22 | 50.57 | 90.77 | 69.77 | 37.66 | 53.06 | 106.53 | 120.56 | 76.59 | 96.09 | 86.06 | 129.70 | 107.82 | 114.93 | 90.91 | 64.41 | 39.98 | |

| Interest Income Operating | 165.28 | 158.93 | 162.68 | 153.02 | 132.38 | 109.66 | 90.70 | 51.06 | 55.68 | 58.28 | 43.69 | 37.59 | 48.58 | 60.62 | 40.81 | 72.12 | 95.21 | 87.80 | 71.79 | 63.08 | 67.12 | 62.32 | 52.34 | 40.98 | 43.11 | 51.58 | 52.39 | 48.10 | 57.86 | 58.13 | 51.77 | 54.37 | 53.89 | 61.44 | 45.33 | 40.69 | 43.25 | 41.24 | 48.52 | 39.35 | 43.91 | 35.28 | 26.80 | 16.88 | 20.28 | 19.73 | 16.00 | 16.43 | |

| Gain Loss On Investments | 164.34 | -109.54 | -2.50 | 125.80 | 54.29 | -253.34 | -230.65 | -229.09 | 35.18 | 57.31 | 128.41 | 83.19 | 135.72 | 19.60 | 488.93 | -815.13 | 34.68 | 45.79 | 87.75 | 95.09 | 46.72 | 9.68 | 25.51 | 0.02 | 38.24 | 13.83 | 27.59 | 16.72 | 12.28 | 14.28 | -15.49 | -3.90 | 2.97 | 24.96 | 22.61 | 3.45 | 15.70 | 70.39 | 73.13 | 42.59 | 47.86 | 49.09 | 46.83 | 63.98 | NA | NA | NA | NA | |

| Other Income | 0.06 | 0.13 | 0.14 | 0.14 | 0.71 | 0.20 | 0.19 | 0.25 | 0.24 | 0.17 | 0.17 | 0.13 | 0.10 | 0.15 | 2.00 | 0.25 | 0.36 | 0.81 | 2.39 | 1.48 | 1.63 | 1.78 | 1.92 | 1.90 | 2.11 | 2.23 | 2.42 | 2.01 | 1.88 | 2.23 | 2.06 | 2.28 | 2.19 | 2.55 | 1.89 | 1.66 | 2.57 | 2.36 | 2.65 | 1.32 | 1.54 | 1.24 | 0.91 | 0.69 | NA | NA | 0.06 | NA | |

| Operating Expenses | 44.45 | 45.01 | 43.60 | 51.56 | 54.85 | 60.69 | 61.37 | 63.78 | 68.99 | 88.51 | 107.77 | 110.37 | 122.64 | 98.82 | 90.26 | 77.91 | 95.77 | 82.63 | 63.03 | 56.75 | 57.70 | 56.84 | 40.70 | 37.84 | 47.76 | 51.64 | 52.13 | 41.87 | 55.06 | 58.31 | 55.78 | 41.17 | 43.64 | 45.67 | 44.68 | 41.48 | 41.12 | 48.60 | 47.25 | 40.31 | 41.36 | 50.00 | 61.79 | 63.12 | 59.61 | 40.23 | 26.43 | 22.07 | |

| Interest Expense | 185.52 | 183.92 | 187.39 | 179.14 | 154.68 | 114.08 | 78.15 | 63.51 | 73.74 | 75.49 | 79.20 | 76.31 | 69.64 | 59.02 | 61.05 | 81.07 | 92.58 | 84.23 | 65.90 | 54.74 | 53.68 | 46.61 | 40.06 | 34.82 | 35.49 | 40.28 | 38.43 | 37.18 | 40.84 | 40.33 | 36.59 | 32.00 | 31.46 | 37.76 | 29.74 | 25.75 | 21.93 | 22.02 | 21.86 | 19.77 | 20.34 | 19.50 | 14.14 | 11.24 | 9.98 | 8.28 | 6.70 | 6.67 | |

| Interest Income Expense Net | -20.25 | -24.99 | -24.71 | -26.12 | -22.30 | -4.42 | 12.55 | -12.45 | -18.06 | -17.20 | -35.52 | -38.72 | -21.06 | 1.61 | -20.24 | -8.95 | 2.63 | 3.57 | 5.90 | 8.34 | 13.44 | 15.71 | 12.28 | 6.16 | 7.62 | 11.30 | 13.96 | 10.92 | 17.02 | 17.80 | 15.17 | 22.36 | 22.43 | 23.68 | 15.59 | 14.94 | 21.32 | 19.22 | 26.65 | 19.57 | 23.57 | 15.78 | 12.65 | 5.64 | 10.30 | 11.45 | NA | NA | |

| Interest Paid Net | 156.25 | 196.74 | 176.02 | 189.35 | 124.44 | 108.72 | 72.61 | 62.90 | 66.16 | 72.97 | 68.12 | 91.61 | 69.61 | 51.67 | 64.18 | 104.76 | 92.57 | 83.09 | 55.47 | 67.47 | 46.10 | 42.44 | 49.78 | 32.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -12.59 | 57.00 | 22.23 | -21.90 | -10.14 | 78.47 | 30.87 | 37.19 | -2.62 | -4.70 | -24.30 | 19.43 | -8.98 | 22.65 | 3.44 | 10.25 | 0.67 | -21.87 | -10.86 | -3.66 | -15.42 | 5.10 | 5.86 | 9.65 | 5.11 | 4.77 | 3.05 | -6.13 | -17.31 | 9.61 | -2.89 | -3.45 | -8.78 | 6.29 | -2.98 | -11.33 | -14.57 | 2.98 | -1.91 | -1.58 | 2.03 | -3.64 | 13.41 | 2.64 | 16.07 | 18.59 | 8.41 | 5.52 | |

| Income Taxes Paid Net | 0.38 | 2.00 | NA | NA | -1.81 | 0.01 | -4.00 | -0.01 | -0.34 | 0.04 | 1.58 | 0.49 | 0.62 | 4.94 | NA | NA | -1.15 | 0.01 | 0.13 | 0.00 | 0.43 | 0.01 | 0.89 | 0.00 | -2.06 | -0.48 | 0.16 | 0.03 | 0.91 | 0.00 | 0.21 | 0.17 | 0.42 | 0.30 | 0.21 | 0.19 | 0.22 | -0.01 | -6.82 | 0.04 | -3.06 | -7.10 | 0.49 | 0.47 | 3.35 | NA | NA | NA | |

| Profit Loss | 52.91 | 61.42 | 24.62 | 60.70 | 4.66 | 11.91 | -70.73 | -19.13 | -16.89 | -35.95 | 38.09 | 71.60 | 82.88 | 99.55 | 464.62 | -594.67 | 58.60 | 70.00 | 44.23 | 53.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 52.91 | 61.42 | 24.62 | 60.70 | 4.66 | 11.91 | -70.73 | -19.13 | -16.89 | -35.95 | 38.09 | 71.60 | 82.88 | 99.55 | 464.62 | -594.67 | 58.60 | 70.00 | 44.23 | 53.53 | 41.62 | 46.56 | 36.42 | 28.19 | 40.84 | 19.39 | 28.78 | 28.74 | 31.17 | 35.41 | -5.27 | 14.50 | 15.71 | 38.81 | 28.07 | 7.51 | 26.51 | 54.95 | 75.21 | 37.87 | 52.70 | 39.70 | 54.50 | 53.30 | 49.24 | 40.38 | 29.57 | 19.06 | |

| Preferred Stock Dividends Income Statement Impact | 10.46 | 10.46 | 10.45 | 10.46 | 10.46 | 10.46 | 10.46 | 10.46 | 10.45 | 7.97 | 6.24 | 6.23 | 6.24 | 6.23 | 6.24 | 6.23 | 6.24 | 6.23 | 6.23 | 6.23 | 6.24 | 6.24 | 6.23 | 6.23 | 6.24 | 6.12 | 2.34 | 0.57 | 0.00 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss Available To Common Stockholders Basic | 42.33 | 50.82 | 14.07 | 50.10 | -5.88 | 1.35 | -81.29 | -29.69 | -27.42 | -44.00 | 31.78 | 65.25 | 76.56 | 93.13 | 457.48 | -600.96 | 52.27 | 63.60 | 37.89 | 47.11 | 35.18 | 40.09 | 30.02 | 21.75 | 34.37 | 13.04 | 26.21 | 27.87 | 30.87 | 35.07 | -5.57 | 14.08 | 15.37 | 38.45 | 27.63 | 6.93 | 26.04 | 54.64 | 74.78 | 37.47 | 52.60 | 39.33 | 54.05 | 52.78 | 48.75 | 39.86 | 29.36 | 19.06 | |

| Net Income Loss Available To Common Stockholders Diluted | 48.61 | 57.17 | 14.07 | 56.46 | -5.88 | 1.35 | -81.29 | -29.69 | -27.42 | -44.00 | 31.78 | NA | 76.56 | 93.13 | 458.21 | -600.96 | 55.96 | 66.32 | 40.60 | 50.00 | 37.84 | 42.75 | 32.68 | 24.41 | 36.56 | 13.04 | 28.40 | 30.05 | 39.59 | 37.25 | -5.57 | 14.08 | 17.48 | 40.57 | 29.75 | 6.93 | 28.73 | 57.03 | 77.29 | 39.95 | 54.80 | 41.78 | 55.88 | NA | 49.24 | 40.38 | 29.57 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

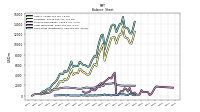

| Assets | 13113.89 | 13223.34 | 13384.92 | 15357.23 | 13921.56 | 13945.94 | 13217.28 | 12387.51 | 13772.71 | 13868.60 | 13598.11 | 12522.25 | 11492.01 | 10455.07 | 9083.72 | 11918.49 | 11771.35 | 10744.61 | 9465.79 | 7555.99 | 7813.36 | 7267.58 | 6676.85 | 5790.49 | 5604.93 | 5785.04 | 6010.24 | 6002.95 | 6357.50 | 6618.90 | 5767.56 | 5820.44 | 5826.92 | 5592.23 | 6677.37 | 5737.41 | 4904.30 | 4604.81 | 4869.74 | 4227.54 | 4310.92 | 4249.23 | 3443.38 | 2927.16 | 2559.66 | 2328.72 | 1890.74 | 1378.02 | |

| Liabilities | 11156.80 | 11274.26 | 11453.43 | 13386.50 | 11958.75 | 11928.61 | 11146.64 | 10165.58 | 11405.19 | 11389.27 | 11254.72 | 10165.11 | 9195.15 | 8173.80 | 6848.44 | 10095.12 | 9320.44 | 8525.00 | 7521.85 | 5828.40 | 6247.23 | 5709.02 | 5131.36 | 4248.23 | 4060.35 | 4174.48 | 4555.41 | 4544.36 | 5006.39 | 5263.98 | 4406.73 | 4405.94 | 4330.81 | 4077.80 | 5152.08 | 4195.25 | 3326.12 | 3016.77 | 3292.59 | 2684.26 | 2843.80 | 2754.47 | 2199.20 | 1704.73 | 1358.33 | 1144.52 | 1085.07 | 782.06 | |

| Liabilities And Stockholders Equity | 13113.89 | 13223.34 | 13384.92 | 15357.23 | 13921.56 | 13945.94 | 13217.28 | 12387.51 | 13772.71 | 13868.60 | 13598.11 | 12522.25 | 11492.01 | 10455.07 | 9083.72 | 11918.49 | 11771.35 | 10744.61 | 9465.79 | 7555.99 | 7813.36 | 7267.58 | 6676.85 | 5790.49 | 5604.93 | 5785.04 | 6010.24 | 6002.95 | 6357.50 | 6618.90 | 5767.56 | 5820.44 | 5826.92 | 5592.23 | 6677.37 | 5737.41 | 4904.30 | 4604.81 | 4869.74 | 4227.54 | 4310.92 | 4249.23 | 3443.38 | 2927.16 | 2559.66 | 2328.72 | 1890.74 | 1378.02 | |

| Stockholders Equity | 1957.09 | 1949.08 | 1931.50 | 1970.73 | 1962.82 | 2017.33 | 2070.64 | 2221.94 | 2367.52 | 2479.33 | 2343.39 | 2357.14 | 2296.86 | 2281.27 | 2235.28 | 1823.37 | 2450.91 | 2219.61 | 1943.93 | 1727.59 | 1566.13 | 1558.56 | 1545.49 | 1542.26 | 1544.59 | 1610.57 | 1454.83 | 1458.59 | 1351.11 | 1354.92 | 1360.83 | 1414.50 | 1496.11 | 1514.43 | 1525.30 | 1542.16 | 1578.17 | 1588.04 | 1577.16 | 1543.28 | 1467.11 | 1494.77 | 1244.18 | 1222.43 | 1201.34 | 1184.20 | 805.67 | 595.96 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash | 281.08 | 236.40 | 238.81 | 118.67 | 111.87 | 58.93 | 332.01 | 187.88 | 58.98 | 131.74 | 68.62 | 92.84 | 57.70 | 278.49 | 346.01 | 1099.38 | 104.06 | 113.65 | 77.68 | 68.54 | 59.84 | 88.93 | 63.03 | 102.17 | 77.65 | 99.52 | 69.89 | 120.05 | 34.48 | 139.07 | 95.70 | 66.97 | 58.11 | 89.30 | 114.70 | 65.67 | 76.39 | 46.49 | 37.90 | 11.87 | 27.41 | 100.06 | 27.64 | 19.38 | 33.76 | 67.81 | 27.97 | 16.41 | |

| Short Term Investments | 128.34 | 150.06 | 242.04 | 292.15 | 252.27 | 352.34 | 88.82 | 236.47 | 168.00 | 116.13 | 44.89 | 108.38 | 127.30 | 81.62 | 273.59 | 137.96 | 90.84 | 74.89 | 76.73 | 29.75 | 74.85 | 26.74 | 39.48 | 71.04 | 18.40 | 5.65 | 77.37 | 19.88 | 122.09 | 33.35 | 16.88 | 47.50 | 41.87 | 31.52 | 32.42 | 44.95 | 139.90 | 37.45 | 104.45 | 91.34 | 92.40 | 80.94 | 73.24 | NA | 39.02 | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 780.23 | 1290.25 | 1443.56 | 804.45 | 951.12 | 529.93 | 121.53 | 139.27 | 4487.61 | 4026.17 | 3347.31 | NA | NA | NA | NA | NA | 2159.29 | 1646.35 | 1915.46 | 1295.95 | 1011.43 | 1086.84 | 1363.89 | 737.29 | 661.72 | 571.70 | 582.66 | 780.18 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 198.33 | NA | NA | NA | 153.60 | NA | NA | NA | 17.22 | NA | NA | NA | 29.42 | NA | NA | NA | 2.08 | NA | NA | NA | 37.69 | NA | NA | NA | 27.17 | NA | NA | NA | 20.68 | NA | NA | NA | 35.17 | NA | NA | NA | 52.84 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

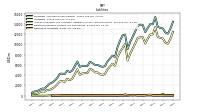

| Stockholders Equity | 1957.09 | 1949.08 | 1931.50 | 1970.73 | 1962.82 | 2017.33 | 2070.64 | 2221.94 | 2367.52 | 2479.33 | 2343.39 | 2357.14 | 2296.86 | 2281.27 | 2235.28 | 1823.37 | 2450.91 | 2219.61 | 1943.93 | 1727.59 | 1566.13 | 1558.56 | 1545.49 | 1542.26 | 1544.59 | 1610.57 | 1454.83 | 1458.59 | 1351.11 | 1354.92 | 1360.83 | 1414.50 | 1496.11 | 1514.43 | 1525.30 | 1542.16 | 1578.17 | 1588.04 | 1577.16 | 1543.28 | 1467.11 | 1494.77 | 1244.18 | 1222.43 | 1201.34 | 1184.20 | 805.67 | 595.96 | |

| Common Stock Value | 0.87 | 0.87 | 0.87 | 0.88 | 0.89 | 0.90 | 0.91 | 0.93 | 0.95 | 0.97 | 0.98 | 0.98 | 0.98 | 0.99 | 0.99 | 1.00 | 1.00 | 0.90 | 0.79 | 0.68 | 0.61 | 0.61 | 0.61 | 0.61 | 0.61 | 0.66 | 0.67 | 0.67 | 0.67 | 0.67 | 0.68 | 0.69 | 0.74 | 0.74 | 0.75 | 0.75 | 0.74 | 0.74 | 0.74 | 0.74 | 0.70 | 0.70 | 0.59 | 0.59 | 0.59 | 0.59 | 0.41 | 0.31 | |

| Additional Paid In Capital Common Stock | 1923.44 | 1923.13 | 1921.71 | 1940.30 | 1947.27 | 1960.32 | 1972.85 | 2000.11 | 2081.76 | 2120.46 | 2138.42 | 2137.93 | 2096.91 | 2111.85 | 2119.58 | 2126.26 | 2127.89 | 1901.85 | 1647.19 | 1431.89 | 1285.53 | 1284.54 | 1282.97 | 1281.12 | 1290.93 | 1362.32 | 1489.12 | 1487.52 | 1377.17 | 1380.50 | 1389.96 | 1406.35 | 1469.72 | 1468.74 | 1483.39 | 1482.25 | 1479.70 | 1470.19 | 1468.79 | 1466.35 | 1384.47 | 1383.08 | 1132.16 | 1131.23 | 1129.86 | 1128.39 | 767.51 | 564.82 | |

| Retained Earnings Accumulated Deficit | -508.69 | -516.40 | -532.56 | -511.93 | -526.82 | -485.37 | -444.60 | -320.58 | -256.67 | -183.58 | -95.72 | -81.48 | -100.73 | -131.28 | -185.00 | -603.60 | 22.32 | 17.15 | -3.75 | -4.69 | -19.72 | -26.29 | -37.80 | -39.17 | -46.67 | -52.12 | -35.00 | -29.64 | -26.72 | -26.25 | -29.81 | 7.47 | 25.65 | 44.95 | 41.16 | 59.16 | 97.73 | 117.11 | 107.63 | 76.20 | 81.94 | 110.98 | 111.43 | 90.61 | 70.89 | 55.23 | 37.75 | 30.83 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

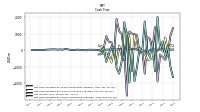

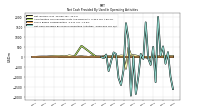

| Net Cash Provided By Used In Operating Activities | 533.01 | 63.64 | 2019.74 | -1276.21 | 508.97 | -402.05 | -69.47 | 1747.03 | -104.84 | 153.55 | -999.17 | -1869.26 | 19.02 | -1955.30 | 902.68 | 1705.25 | -653.47 | -1416.56 | -1059.95 | 144.90 | 227.69 | -210.16 | -713.76 | 122.49 | -59.95 | -4.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Investing Activities | -82.21 | 193.14 | -9.91 | -122.74 | -524.77 | -557.60 | -588.53 | -196.57 | -2.43 | 104.75 | 59.80 | 930.88 | -1253.75 | 747.54 | 1094.81 | -603.96 | -334.26 | 285.22 | -831.10 | 175.47 | -742.15 | -272.65 | -181.92 | -227.57 | 266.14 | 286.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Cash Provided By Used In Financing Activities | -406.11 | -259.19 | -1889.69 | 1405.76 | 68.74 | 686.56 | 802.14 | -1421.56 | 34.51 | -195.18 | 915.14 | 973.51 | 1013.95 | 1140.24 | -2750.86 | -105.97 | 978.14 | 1167.32 | 1900.19 | -311.68 | 485.38 | 508.71 | 856.55 | 129.60 | -228.06 | -252.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 533.01 | 63.64 | 2019.74 | -1276.21 | 508.97 | -402.05 | -69.47 | 1747.03 | -104.84 | 153.55 | -999.17 | -1869.26 | 19.02 | -1955.30 | 902.68 | 1705.25 | -653.47 | -1416.56 | -1059.95 | 144.90 | 227.69 | -210.16 | -713.76 | 122.49 | -59.95 | -4.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Net Income Loss | 52.91 | 61.42 | 24.62 | 60.70 | 4.66 | 11.91 | -70.73 | -19.13 | -16.89 | -35.95 | 38.09 | 71.60 | 82.88 | 99.55 | 464.62 | -594.67 | 58.60 | 70.00 | 44.23 | 53.53 | 41.62 | 46.56 | 36.42 | 28.19 | 40.84 | 19.39 | 28.78 | 28.74 | 31.17 | 35.41 | -5.27 | 14.50 | 15.71 | 38.81 | 28.07 | 7.51 | 26.51 | 54.95 | 75.21 | 37.87 | 52.70 | 39.70 | 54.50 | 53.30 | 49.24 | 40.38 | 29.57 | 19.06 | |

| Profit Loss | 52.91 | 61.42 | 24.62 | 60.70 | 4.66 | 11.91 | -70.73 | -19.13 | -16.89 | -35.95 | 38.09 | 71.60 | 82.88 | 99.55 | 464.62 | -594.67 | 58.60 | 70.00 | 44.23 | 53.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.78 | 1.42 | 0.84 | 1.16 | 1.18 | 0.96 | 1.14 | 1.03 | 0.47 | -0.80 | 1.01 | 1.74 | 0.69 | 0.55 | 0.87 | 0.19 | 1.18 | 1.32 | 1.42 | 1.62 | 1.00 | 1.57 | 1.86 | 0.90 | 1.04 | 0.74 | 1.60 | 1.53 | 1.61 | 1.13 | 1.97 | 1.05 | 1.37 | 1.29 | 1.14 | 2.54 | 1.40 | 1.40 | 1.14 | 1.81 | 1.39 | 1.97 | 1.25 | 1.45 | 1.49 | 1.66 | 1.38 | 0.88 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -82.21 | 193.14 | -9.91 | -122.74 | -524.77 | -557.60 | -588.53 | -196.57 | -2.43 | 104.75 | 59.80 | 930.88 | -1253.75 | 747.54 | 1094.81 | -603.96 | -334.26 | 285.22 | -831.10 | 175.47 | -742.15 | -272.65 | -181.92 | -227.57 | 266.14 | 286.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -406.11 | -259.19 | -1889.69 | 1405.76 | 68.74 | 686.56 | 802.14 | -1421.56 | 34.51 | -195.18 | 915.14 | 973.51 | 1013.95 | 1140.24 | -2750.86 | -105.97 | 978.14 | 1167.32 | 1900.19 | -311.68 | 485.38 | 508.71 | 856.55 | 129.60 | -228.06 | -252.55 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments Of Dividends Common Stock | 34.80 | 34.80 | 35.35 | 35.66 | 42.23 | 42.83 | 43.69 | 44.80 | 45.67 | 46.10 | 46.11 | 46.09 | 39.59 | 39.79 | 25.00 | 47.19 | 42.87 | 37.05 | 32.26 | 28.82 | 28.82 | 28.82 | 28.82 | 29.14 | 31.18 | 31.65 | 31.65 | 31.66 | 31.80 | 32.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 1.48 | 0.00 | 19.45 | 7.56 | 14.25 | 13.50 | 28.42 | 31.83 | 39.16 | 17.18 | NA | NA | 15.65 | 8.28 | 7.56 | 5.78 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 10.72 | 72.47 | 16.42 | 0.00 | 2.31 | 4.94 | 10.60 | 18.36 | 64.47 | 0.38 | 15.96 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | 2012-09-30 | 2012-06-30 | 2012-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest Income Operating | 165.28 | 158.93 | 162.68 | 153.02 | 132.38 | 109.66 | 90.70 | 51.06 | 55.68 | 58.28 | 43.69 | 37.59 | 48.58 | 60.62 | 40.81 | 72.12 | 95.21 | 87.80 | 71.79 | 63.08 | 67.12 | 62.32 | 52.34 | 40.98 | 43.11 | 51.58 | 52.39 | 48.10 | 57.86 | 58.13 | 51.77 | 54.37 | 53.89 | 61.44 | 45.33 | 40.69 | 43.25 | 41.24 | 48.52 | 39.35 | 43.91 | 35.28 | 26.80 | 16.88 | 20.28 | 19.73 | 16.00 | 16.43 | |

| Variable Interest Entity Primary Beneficiary, Subordinate Mortgage Backed Securities | 18.52 | 9.51 | 13.64 | 15.17 | 14.68 | 16.00 | 15.74 | 12.85 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Correspondent Production | 16.44 | 14.66 | 25.71 | 36.93 | 32.63 | 27.86 | 23.39 | 19.18 | 30.77 | 38.98 | 32.52 | 22.80 | 29.34 | 26.07 | 15.96 | 31.41 | 41.58 | 33.24 | 25.84 | 20.32 | 23.61 | 22.46 | 17.82 | 11.17 | 12.33 | 16.02 | 12.82 | 11.36 | 16.71 | 14.85 | 13.41 | 9.02 | 10.12 | 13.75 | 9.00 | 7.11 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Sensitive Strategies | 26.22 | 26.23 | 25.15 | 21.39 | 18.42 | 12.41 | 5.92 | 2.06 | 1.07 | 0.62 | 0.40 | 0.65 | 0.56 | 0.66 | 1.13 | 6.56 | 9.02 | 12.42 | 9.64 | 8.26 | 10.15 | 8.68 | 8.75 | 10.21 | 12.00 | 15.95 | 20.74 | 20.32 | 26.44 | 29.77 | 23.83 | 29.95 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Rate Sensitive Strategies | 120.85 | 114.43 | 108.66 | 92.08 | 80.37 | 68.15 | 60.90 | 29.11 | 22.69 | 18.26 | 10.06 | 13.52 | 17.69 | 33.52 | 23.59 | 33.24 | 43.74 | 41.49 | 35.86 | 34.08 | 32.94 | 30.57 | 25.42 | 19.43 | 18.67 | 19.43 | 18.67 | 16.10 | 14.53 | 13.35 | 14.40 | 15.27 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate | 1.76 | 3.60 | 3.17 | 2.62 | 0.96 | 1.23 | 0.49 | 0.71 | 1.15 | 0.43 | 0.71 | 0.63 | 0.98 | 0.38 | 0.14 | 0.92 | 0.87 | 0.64 | 0.45 | 0.43 | 0.42 | 0.61 | 0.35 | 0.17 | 0.12 | 0.18 | 0.15 | 0.32 | 0.20 | 0.18 | 0.13 | 0.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Revenues Net Of Interest Expense | 84.77 | 163.43 | 90.45 | 90.37 | 49.37 | 151.06 | 21.50 | 81.84 | 49.48 | 47.85 | 121.57 | 201.40 | 196.53 | 221.01 | 558.32 | -506.52 | 155.04 | 130.76 | 96.40 | 106.62 | 83.90 | 108.50 | 82.99 | 75.67 | 93.70 | 75.80 | 83.96 | 64.47 | 68.93 | 103.33 | 47.62 | 52.22 | 50.57 | 90.77 | 69.77 | 37.66 | 53.06 | 106.53 | 120.56 | 76.59 | 96.09 | 86.06 | 129.70 | 107.82 | 114.93 | 90.91 | 64.41 | 39.98 | |

| Variable Interest Entity Primary Beneficiary, Credit Risk Transfer Agreement | 61.97 | 46.57 | 76.24 | 60.49 | 20.22 | 11.34 | -39.97 | -35.40 | 43.17 | 74.00 | 98.19 | 154.20 | 163.77 | 57.31 | 481.13 | -1000.36 | 78.73 | 87.92 | 58.99 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Variable Interest Entity Primary Beneficiary, Subordinate Mortgage Backed Securities | 6.73 | 0.24 | NA | NA | 3.30 | -4.54 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Correspondent Production | 17.09 | 15.19 | 7.85 | 16.11 | 23.67 | 27.26 | 33.60 | 26.54 | 30.31 | 79.36 | 82.20 | 107.06 | 136.97 | 150.52 | 197.56 | 112.17 | 87.56 | 71.97 | 49.39 | 33.84 | 30.97 | 34.70 | 20.90 | 19.04 | 35.31 | 34.39 | 31.50 | 30.78 | 42.66 | 62.06 | 38.23 | 25.79 | 27.99 | 30.42 | 22.76 | 18.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Credit Sensitive Strategies | 61.02 | 41.52 | 72.05 | 58.03 | 11.19 | -2.93 | -62.34 | -52.69 | 38.83 | 63.08 | 82.66 | 138.55 | 141.06 | 52.82 | 460.05 | -959.26 | 39.97 | 54.99 | 35.79 | 61.11 | 22.34 | 39.95 | 37.37 | 10.60 | 46.90 | 20.53 | 40.17 | 25.80 | 14.19 | 29.78 | 3.38 | 18.91 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Rate Sensitive Strategies | 5.54 | 104.47 | 8.30 | 14.64 | 13.71 | 126.39 | 50.22 | 107.41 | -20.81 | -95.02 | -44.01 | -44.84 | -82.47 | 17.35 | -100.50 | 340.18 | 26.64 | 3.15 | 9.63 | 11.23 | 30.17 | 33.24 | 24.38 | 45.83 | 11.38 | 20.70 | 12.14 | 7.56 | 11.87 | 11.47 | 6.03 | 7.29 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Corporate | 1.12 | 2.25 | 2.26 | 1.58 | 0.79 | 0.35 | 0.02 | 0.57 | 1.15 | 0.43 | 0.71 | 0.63 | 0.98 | 0.32 | 1.22 | 0.39 | 0.87 | 0.65 | 1.58 | 0.44 | 0.42 | 0.61 | 0.35 | 0.20 | 0.12 | 0.18 | 0.15 | 0.33 | 0.20 | 0.18 | 0.13 | 0.14 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |