| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.94 | 0.94 | 0.94 | 0.94 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | |

| Earnings Per Share Basic | -1.43 | 0.48 | 0.60 | 0.66 | 0.77 | 0.77 | 0.74 | 0.71 | 0.90 | 0.95 | 1.02 | 0.73 | 0.71 | 0.71 | -1.41 | |

| Earnings Per Share Diluted | -1.43 | 0.48 | 0.60 | 0.66 | 0.77 | 0.77 | 0.73 | 0.70 | 0.89 | 0.95 | 1.01 | 0.72 | 0.71 | 0.70 | -1.41 | |

| Tier One Risk Based Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | |

| Capital To Risk Weighted Assets | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA | NA | 0.00 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Interest And Fee Income Loans And Leases | 176.77 | 177.03 | 182.85 | 180.96 | 184.46 | 174.20 | 164.46 | 150.60 | 157.42 | 157.03 | 152.37 | 155.22 | 163.50 | 167.46 | 133.34 | |

| Interest Expense | 70.40 | 74.51 | 65.30 | 52.73 | 36.38 | 17.91 | 10.46 | 6.71 | 6.29 | 6.98 | 9.76 | 11.34 | 12.63 | 15.45 | 13.83 | |

| Interest Income Expense Net | 146.79 | 149.55 | 160.09 | 168.61 | 181.40 | 181.11 | 172.76 | 161.84 | 170.72 | 169.07 | 160.93 | 161.65 | 168.20 | 166.55 | 130.29 | |

| Interest Paid Net | 81.55 | 71.93 | 61.32 | 44.14 | 30.51 | 12.00 | 12.71 | 3.93 | 9.02 | 8.13 | 10.72 | 10.89 | 13.83 | 15.13 | 14.44 | |

| Income Tax Expense Benefit | -56.49 | 15.97 | 20.85 | 22.87 | 26.20 | 25.97 | 25.71 | 22.73 | 30.57 | 32.77 | 35.34 | 22.26 | 22.80 | 23.95 | -40.32 | |

| Income Taxes Paid Net | 51.52 | 0.54 | 1.87 | -0.80 | 27.36 | 16.50 | 43.38 | -11.94 | 30.06 | 21.26 | 35.13 | 0.08 | NA | NA | NA | |

| Net Income Loss | -135.38 | 46.03 | 57.64 | 62.56 | 73.67 | 73.36 | 69.80 | 66.90 | 84.83 | 90.09 | 96.30 | 68.67 | 67.14 | 66.57 | -99.09 | |

| Comprehensive Income Net Of Tax | 53.63 | 32.87 | 44.90 | 65.08 | 89.54 | 7.27 | -0.98 | -69.47 | 75.79 | 64.74 | 138.01 | -6.81 | 81.77 | 54.01 | -85.28 | |

| Net Income Loss Available To Common Stockholders Basic | -134.76 | 45.21 | 56.64 | 61.74 | 72.73 | 72.45 | 68.94 | 66.22 | 83.95 | 89.15 | 95.27 | 68.00 | 66.51 | 65.95 | -99.31 | |

| Interest Income Expense After Provision For Loan Loss | 145.09 | 145.63 | 158.59 | 165.59 | 178.56 | 180.03 | 172.30 | 161.39 | 185.37 | 188.79 | 199.41 | 159.68 | 166.68 | 162.34 | -30.34 | |

| Noninterest Expense | 102.77 | 102.19 | 100.64 | 101.35 | 99.18 | 100.87 | 98.97 | 97.65 | 97.25 | 96.04 | 94.50 | 92.49 | 99.94 | 98.58 | 115.97 | |

| Noninterest Income | -234.19 | 18.55 | 20.54 | 21.19 | 20.50 | 20.16 | 22.19 | 25.89 | 27.28 | 30.10 | 26.73 | 23.74 | 23.19 | 26.76 | 6.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 19026.65 | 20275.72 | 20747.88 | 21361.56 | 21688.02 | 21619.20 | 21993.92 | 21622.30 | 21094.43 | 21005.21 | 20529.49 | 20173.30 | 19736.54 | 19844.24 | 20517.07 | |

| Liabilities | 16144.06 | 17420.19 | 17898.75 | 18530.40 | 18889.63 | 18883.81 | 19238.70 | 18839.28 | 18208.12 | 18167.10 | 17716.07 | 17470.20 | 16989.90 | 17156.15 | 17862.43 | |

| Liabilities And Stockholders Equity | 19026.65 | 20275.72 | 20747.88 | 21361.56 | 21688.02 | 21619.20 | 21993.92 | 21622.30 | 21094.43 | 21005.21 | 20529.49 | 20173.30 | 19736.54 | 19844.24 | 20517.07 | |

| Stockholders Equity | 2882.58 | 2855.53 | 2849.13 | 2831.16 | 2798.39 | 2735.40 | 2755.22 | 2783.02 | 2886.31 | 2838.12 | 2813.42 | 2703.10 | 2746.65 | 2688.09 | 2654.65 | |

| Tier One Risk Based Capital | 2084.19 | NA | NA | NA | 2179.49 | NA | NA | NA | 2016.54 | NA | NA | NA | 1811.28 | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 936.47 | 1400.28 | 1463.68 | 1424.90 | 1101.25 | 739.21 | 972.80 | 809.26 | 304.70 | NA | NA | NA | 880.77 | NA | NA | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 936.47 | 1400.28 | 1463.68 | 1424.90 | 1101.25 | 739.21 | 972.80 | 809.26 | 304.70 | 322.32 | 631.89 | 1554.67 | 880.77 | 1103.08 | 1341.73 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Property Plant And Equipment Gross | 133.81 | NA | NA | NA | 130.30 | NA | NA | NA | 127.03 | NA | NA | NA | 122.00 | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 77.14 | NA | NA | NA | 65.76 | NA | NA | NA | 55.12 | NA | NA | NA | 43.12 | NA | NA | |

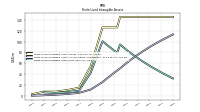

| Amortization Of Intangible Assets | 3.02 | 3.06 | 3.06 | 3.17 | 3.44 | 3.47 | 3.48 | 3.59 | 3.88 | 3.91 | 4.00 | 4.14 | 4.50 | 4.54 | 4.07 | |

| Property Plant And Equipment Net | 56.68 | 59.40 | 61.53 | 63.45 | 64.54 | 65.65 | 68.44 | 70.45 | 71.91 | 72.85 | 73.82 | 76.33 | 78.88 | 80.33 | 76.54 | |

| Goodwill | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 901.31 | 900.20 | 898.57 | 898.40 | 901.20 | |

| Intangible Assets Net Excluding Goodwill | 43.28 | 46.31 | 49.36 | 52.42 | 55.59 | 59.03 | 62.50 | 65.98 | 69.57 | 73.45 | 77.36 | 81.36 | 85.51 | 90.01 | 94.55 | |

| Finite Lived Intangible Assets Net | 43.30 | 46.30 | 49.40 | 52.40 | 55.60 | 59.00 | 62.50 | 66.00 | 69.60 | 73.50 | 77.40 | 81.40 | 85.50 | 90.00 | 94.60 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 246.73 | 384.50 | 279.39 | 254.13 | 291.05 | 330.31 | 234.64 | 110.43 | 1.65 | 2.23 | NA | NA | NA | NA | 0.00 | |

| Held To Maturity Securities Fair Value | 1485.51 | 1354.43 | 1458.29 | 1496.49 | 1097.10 | 1055.19 | 1156.50 | 886.05 | 384.42 | 169.15 | 19.82 | 23.00 | 25.01 | 29.40 | 34.18 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Gain | 2.69 | 1.06 | 0.07 | 1.60 | 0.04 | NA | 0.46 | 0.10 | 4.40 | 0.80 | 0.89 | 1.07 | 1.28 | 1.42 | 1.62 | |

| Held To Maturity Securities Accumulated Unrecognized Holding Loss | 246.73 | 384.50 | 279.39 | 254.13 | 291.05 | 330.31 | 234.64 | 110.43 | 1.65 | 2.23 | NA | NA | NA | NA | 0.00 | |

| Debt Securities Held To Maturity Excluding Accrued Interest After Allowance For Credit Loss | 1729.54 | 1737.87 | 1737.60 | 1749.03 | 1388.10 | 1385.50 | 1390.68 | 996.38 | 381.67 | 170.58 | NA | NA | 23.73 | NA | NA | |

| Held To Maturity Securities Debt Maturities After One Through Five Years Fair Value | 26.64 | 23.80 | 10.31 | 10.38 | 9.89 | 9.75 | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | |

| Held To Maturity Securities Debt Maturities After Five Through Ten Years Fair Value | 37.34 | 35.76 | 47.28 | 47.65 | 43.86 | 43.41 | 56.38 | 42.51 | NA | NA | NA | NA | NA | NA | 0.00 | |

| Held To Maturity Securities Debt Maturities After Ten Years Fair Value | 1421.52 | 1294.88 | 1400.70 | 1438.47 | 1043.34 | 1002.03 | 1100.12 | 843.54 | 384.42 | 169.15 | 19.82 | 23.00 | 25.01 | 29.40 | 34.18 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Deposits | 14995.63 | 16007.45 | 16539.88 | 17207.81 | 17352.40 | 17746.37 | 18084.61 | 17689.22 | 17115.59 | 17470.00 | 17015.10 | 16740.01 | 16214.18 | 16330.81 | 16976.69 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2882.58 | 2855.53 | 2849.13 | 2831.16 | 2798.39 | 2735.40 | 2755.22 | 2783.02 | 2886.31 | 2838.12 | 2813.42 | 2703.10 | 2746.65 | 2688.09 | 2654.65 | |

| Common Stock Value | 0.94 | 0.94 | 0.94 | 0.94 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | 0.93 | |

| Additional Paid In Capital | 2377.13 | 2371.94 | 2366.64 | 2361.83 | 2362.66 | 2357.73 | 2353.36 | 2348.73 | 2351.29 | 2347.63 | 2352.11 | 2348.45 | 2354.87 | 2351.53 | 2348.41 | |

| Retained Earnings Accumulated Deficit | 604.14 | 771.28 | 757.02 | 731.12 | 700.04 | 657.85 | 615.94 | 577.59 | 541.95 | 488.38 | 433.85 | 368.91 | 330.56 | 289.96 | 247.08 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -99.62 | -288.63 | -275.47 | -262.73 | -265.25 | -281.11 | -215.02 | -144.23 | -7.86 | 1.18 | 26.52 | -15.19 | 60.29 | 45.66 | 58.22 | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 4.77 | 5.35 | 4.54 | 4.73 | 4.75 | 4.34 | 4.30 | 5.53 | 3.35 | 3.35 | 3.46 | 3.10 | 3.11 | 2.90 | 2.54 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

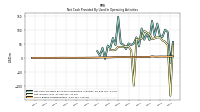

| Net Cash Provided By Used In Operating Activities | -17.51 | 92.08 | 101.24 | 75.17 | 77.83 | 122.82 | 78.00 | 132.38 | 63.54 | 86.25 | 65.12 | 105.30 | 41.19 | 73.29 | 51.90 | |

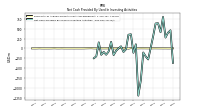

| Net Cash Provided By Used In Investing Activities | 796.09 | 408.76 | 636.95 | 630.10 | 309.48 | 13.26 | -278.73 | -204.10 | -103.80 | -811.92 | -1196.09 | 104.12 | -110.56 | 357.41 | 345.94 | |

| Net Cash Provided By Used In Financing Activities | -1242.38 | -564.25 | -699.40 | -381.63 | -25.27 | -369.67 | 364.27 | 576.28 | 22.64 | 416.11 | 208.19 | 464.48 | -152.94 | -669.35 | 409.85 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -17.51 | 92.08 | 101.24 | 75.17 | 77.83 | 122.82 | 78.00 | 132.38 | 63.54 | 86.25 | 65.12 | 105.30 | 41.19 | 73.29 | 51.90 | |

| Net Income Loss | -135.38 | 46.03 | 57.64 | 62.56 | 73.67 | 73.36 | 69.80 | 66.90 | 84.83 | 90.09 | 96.30 | 68.67 | 67.14 | 66.57 | -99.09 | |

| Depreciation Depletion And Amortization | 3.23 | 3.51 | 3.56 | 3.55 | 3.59 | 3.68 | 3.75 | 3.73 | 3.83 | 4.07 | 4.07 | 4.01 | 4.16 | 3.66 | 2.94 | |

| Deferred Income Tax Expense Benefit | 3.29 | -2.12 | -2.02 | 4.82 | 0.34 | -0.78 | -1.55 | 7.89 | -0.30 | 8.46 | 6.00 | 14.65 | 9.85 | -5.86 | -39.13 | |

| Share Based Compensation | 4.77 | 5.35 | 4.54 | 4.73 | 4.75 | 4.34 | 4.30 | 5.53 | 3.35 | 3.35 | 3.46 | 3.10 | 3.11 | 2.90 | 2.54 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 796.09 | 408.76 | 636.95 | 630.10 | 309.48 | 13.26 | -278.73 | -204.10 | -103.80 | -811.92 | -1196.09 | 104.12 | -110.56 | 357.41 | 345.94 | |

| Payments To Acquire Property Plant And Equipment | 1.00 | 1.47 | 1.67 | 2.46 | 2.52 | 0.92 | 1.74 | 2.31 | 2.97 | 3.22 | 1.64 | 1.47 | 2.72 | 7.49 | -4.04 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -1242.38 | -564.25 | -699.40 | -381.63 | -25.27 | -369.67 | 364.27 | 576.28 | 22.64 | 416.11 | 208.19 | 464.48 | -152.94 | -669.35 | 409.85 | |

| Payments Of Dividends | 31.65 | 31.65 | 31.61 | 31.36 | 31.35 | 31.34 | 31.33 | 31.14 | 31.14 | 31.23 | 31.23 | 28.29 | 26.44 | 23.59 | 14.99 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

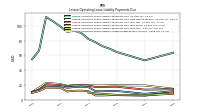

| Correspondent Clearing | 1.07 | 0.94 | 0.92 | 1.06 | 1.28 | 1.55 | 1.83 | 1.66 | 2.22 | 1.87 | 1.67 | 1.53 | 1.26 | 1.14 | 0.26 | |

| Debit Card | 0.84 | 0.92 | 0.91 | 0.80 | 1.05 | 0.81 | 0.94 | 0.84 | 0.77 | 0.83 | 1.10 | 0.79 | 0.78 | 0.94 | 0.46 | |

| Deposit Account | 2.65 | 2.67 | 2.67 | 2.63 | 2.69 | 2.70 | 2.69 | 2.62 | 2.59 | 2.38 | 2.22 | 2.03 | 2.00 | 1.59 | 1.40 | |

| Fiduciary And Trust | 9.39 | 9.36 | 9.36 | 11.03 | 9.72 | 9.95 | 10.35 | 11.58 | 11.61 | 11.45 | 7.90 | 7.22 | 7.30 | 6.96 | 2.40 | |

| Financial Service Other | 0.32 | 0.28 | 0.32 | 0.30 | 0.29 | 0.32 | 0.37 | 0.37 | 0.39 | 0.35 | 0.35 | 0.47 | 0.46 | 0.49 | 0.30 |