| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

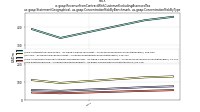

| Common Stock Value | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.02 | NA | NA | NA | |

| Weighted Average Number Of Diluted Shares Outstanding | 619.35 | 612.69 | 606.64 | NA | 597.78 | 593.93 | 588.52 | NA | 575.93 | 571.30 | 291.07 | NA | 183.45 | 180.34 | NA | |

| Weighted Average Number Of Shares Outstanding Basic | 619.35 | 612.69 | 606.64 | NA | 597.78 | 593.93 | 588.52 | NA | 575.93 | 571.30 | 291.07 | NA | 183.45 | 180.34 | NA | |

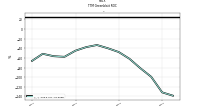

| Earnings Per Share Basic | -0.45 | -0.46 | -0.44 | -0.48 | -0.50 | -0.30 | -0.27 | -0.24 | -0.13 | -0.25 | -0.46 | -0.30 | -0.26 | -0.40 | NA | |

| Earnings Per Share Diluted | -0.45 | -0.46 | -0.44 | -0.48 | -0.50 | -0.30 | -0.27 | -0.24 | -0.13 | -0.25 | -0.46 | -0.30 | -0.26 | -0.40 | NA |

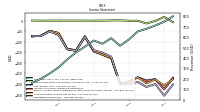

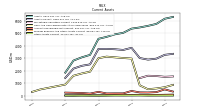

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

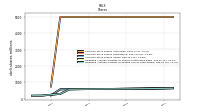

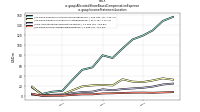

| Revenue From Contract With Customer Excluding Assessed Tax | 713.23 | 680.77 | 655.34 | 579.00 | 517.71 | 591.21 | 537.13 | 568.77 | 509.34 | 454.10 | 386.98 | 310.01 | 251.91 | 200.39 | 161.57 | |

| Revenues | 713.23 | 680.77 | 655.34 | 579.00 | 517.71 | 591.21 | 537.13 | 568.77 | 509.34 | 454.10 | 386.98 | 310.01 | 251.91 | 200.39 | 161.57 | |

| Interest Income Operating | 36.44 | 34.76 | 31.08 | NA | 12.76 | 4.20 | 0.24 | NA | 0.03 | 0.03 | 0.01 | NA | NA | NA | NA | |

| Cost Of Revenue | 163.58 | 162.03 | 151.84 | 142.43 | 126.44 | 143.16 | 135.63 | 151.99 | 130.01 | 116.93 | 97.94 | 78.62 | 65.82 | 53.67 | 41.79 | |

| Cost Of Goods And Services Sold | 163.58 | 162.03 | 151.84 | 142.43 | 126.44 | 143.16 | 135.63 | 151.99 | 130.01 | 116.93 | 97.94 | 78.62 | 65.82 | 53.67 | 41.79 | |

| Costs And Expenses | 1013.26 | 994.75 | 945.19 | 880.90 | 817.71 | 761.47 | 688.75 | 708.42 | 586.78 | 597.05 | 522.03 | 378.62 | 303.43 | 273.44 | 234.54 | |

| Research And Development Expense | 321.61 | 315.32 | 275.54 | 248.41 | 235.55 | 211.76 | 177.76 | 173.57 | 138.25 | 124.75 | 96.64 | 60.07 | 51.71 | 40.25 | 49.41 | |

| General And Administrative Expense | 97.51 | 96.20 | 97.57 | 79.70 | 81.17 | 78.68 | 57.77 | 59.38 | 51.58 | 97.68 | 94.38 | 31.91 | 16.17 | 18.71 | 30.56 | |

| Selling And Marketing Expense | 40.87 | 30.33 | 26.75 | 29.74 | 32.10 | 26.50 | 29.10 | 27.77 | 19.60 | 18.99 | 20.00 | 15.96 | 12.86 | 13.91 | 15.66 | |

| Operating Income Loss | -300.04 | -313.99 | -289.85 | -301.90 | -300.01 | -170.27 | -151.61 | -139.65 | -77.45 | -142.95 | -135.06 | -68.61 | -51.52 | -73.05 | -72.97 | |

| Interest Expense | 10.27 | 10.13 | 10.01 | 10.01 | 10.01 | 9.89 | 10.00 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Paid Net | NA | NA | NA | 19.38 | 0.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Allocated Share Based Compensation Expense | 220.02 | 212.36 | 184.90 | 169.46 | 161.36 | 146.39 | 112.30 | 120.22 | 89.32 | 81.66 | 50.74 | 16.20 | 13.30 | 7.41 | 42.26 | |

| Income Tax Expense Benefit | 0.68 | -1.24 | 0.73 | 3.20 | 0.35 | -0.28 | 0.28 | 0.66 | -1.00 | 0.02 | 0.00 | -6.68 | 0.02 | 0.01 | 0.00 | |

| Income Taxes Paid | NA | NA | NA | 0.07 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | -278.81 | -284.84 | -269.95 | -291.49 | -301.90 | -178.73 | -162.02 | -147.26 | -77.19 | -142.93 | -136.10 | -60.54 | -50.01 | -72.26 | -74.88 | |

| Other Comprehensive Income Loss Net Of Tax | -1.77 | -13.73 | -0.64 | -0.63 | 1.06 | 0.86 | -0.01 | -0.10 | -0.00 | 0.05 | 0.00 | 0.10 | -0.03 | -0.16 | 0.22 | |

| Net Income Loss | -277.16 | -282.78 | -268.31 | -289.93 | -297.80 | -176.44 | -160.20 | -143.30 | -74.00 | -140.13 | -134.22 | -58.74 | -48.61 | -71.52 | -74.38 | |

| Comprehensive Income Net Of Tax | -278.94 | -296.93 | -268.92 | -290.25 | -297.21 | -176.00 | -160.29 | -143.35 | -74.00 | -140.11 | -134.22 | -58.70 | -48.66 | -71.68 | -74.16 |

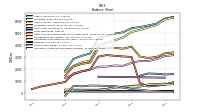

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

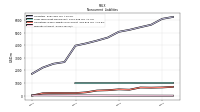

| Assets | 5754.13 | 5599.28 | 5471.46 | 5375.49 | 5038.32 | 4919.42 | 4715.83 | 4560.60 | 3272.28 | 3073.79 | 2816.08 | 1847.80 | NA | NA | NA | |

| Liabilities | 5634.28 | 5435.08 | 5226.28 | 5070.45 | 4613.73 | 4367.83 | 4148.37 | 3967.67 | 2666.45 | 2531.75 | 2224.49 | 1735.35 | NA | NA | NA | |

| Liabilities And Stockholders Equity | 5754.13 | 5599.28 | 5471.46 | 5375.49 | 5038.32 | 4919.42 | 4715.83 | 4560.60 | 3272.28 | 3073.79 | 2816.08 | 1847.80 | NA | NA | NA | |

| Stockholders Equity | 125.79 | 168.50 | 247.84 | 306.03 | 423.72 | 547.09 | 561.09 | 584.82 | 593.72 | 526.69 | 573.47 | -252.39 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets Current | 2969.46 | 2894.29 | 3018.07 | 3838.60 | 3668.08 | 3725.79 | 3754.01 | 3749.76 | 2511.60 | 2394.28 | 2172.83 | 1424.13 | NA | NA | NA | |

| Cash And Cash Equivalents At Carrying Value | 580.05 | 520.26 | 828.13 | 2977.47 | 3021.51 | 3075.47 | 3132.96 | 3004.30 | 1925.56 | 1780.26 | 1600.53 | 893.94 | NA | NA | 502.21 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 580.05 | 520.26 | 828.13 | 2977.47 | 3021.51 | 3075.47 | 3132.96 | 3004.30 | 1925.56 | 1780.26 | 1600.53 | 893.94 | 801.65 | 620.61 | NA | |

| Short Term Investments | 1576.29 | 1599.60 | 1412.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Marketable Securities Current | 1576.29 | 1599.60 | 1412.86 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Accounts Receivable Net Current | 285.31 | 257.36 | 265.25 | 379.35 | 185.83 | 186.82 | 179.73 | 307.35 | 168.76 | 217.01 | 233.78 | 246.99 | NA | NA | NA | |

| Other Assets Current | 10.96 | 8.66 | 19.50 | 16.47 | 12.78 | 15.00 | 5.58 | 4.42 | 2.19 | 5.22 | 0.87 | 8.67 | NA | NA | NA | |

| Prepaid Expense And Other Assets Current | 65.00 | 69.11 | 76.31 | 61.64 | 72.92 | 57.59 | 43.12 | 32.09 | 37.67 | 45.43 | 29.14 | 26.27 | NA | NA | NA | |

| Available For Sale Securities Debt Securities | 2993.99 | 2801.90 | 2816.17 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

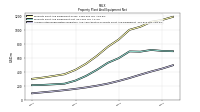

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

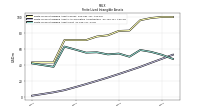

| Property Plant And Equipment Gross | 1111.04 | 1040.49 | 996.76 | 859.13 | 754.61 | 624.76 | 513.09 | 424.88 | 362.48 | 337.41 | 314.26 | 296.38 | NA | NA | NA | |

| Accumulated Depreciation Depletion And Amortization Property Plant And Equipment | 401.66 | 355.76 | 308.42 | 266.78 | 228.69 | 198.81 | 174.21 | 153.53 | 135.15 | 118.83 | 104.47 | 89.97 | NA | NA | NA | |

| Amortization Of Intangible Assets | 5.20 | 4.50 | 4.50 | 4.40 | 4.20 | 4.00 | 3.80 | 3.90 | 2.70 | 2.10 | 2.10 | NA | NA | NA | 2.10 | |

| Property Plant And Equipment Net | 709.38 | 684.73 | 688.34 | 592.35 | 525.93 | 425.95 | 338.88 | 271.35 | 227.33 | 218.58 | 209.79 | 206.41 | NA | NA | NA | |

| Long Term Investments | 959.26 | 904.90 | 850.93 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 141.80 | 134.34 | 134.34 | 134.34 | 130.45 | 130.45 | 118.07 | 118.07 | 118.07 | 59.57 | 59.57 | 59.57 | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 56.79 | 59.18 | 50.74 | 54.72 | 53.66 | 56.32 | 55.85 | 59.67 | 63.48 | 38.08 | 40.20 | 42.33 | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 56.22 | 58.60 | 50.17 | 54.14 | 53.08 | 55.74 | 55.28 | 59.09 | 62.91 | 37.51 | NA | 41.75 | NA | NA | NA | |

| Other Assets Noncurrent | 10.51 | 11.01 | 6.48 | 4.32 | 2.44 | 2.17 | 3.37 | 2.93 | 5.75 | 8.04 | 4.97 | 1.57 | NA | NA | NA | |

| Available For Sale Debt Securities Amortized Cost Basis | 3010.14 | 2816.92 | 2816.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

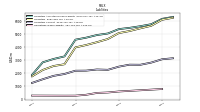

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

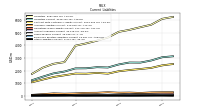

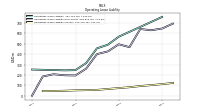

| Liabilities Current | 2795.14 | 2626.69 | 2633.74 | 2480.84 | 2238.16 | 2263.54 | 2174.73 | 2167.09 | 1917.59 | 1772.01 | 1510.36 | 1228.55 | NA | NA | NA | |

| Accounts Payable Current | 86.78 | 72.83 | 120.26 | 71.18 | 45.10 | 77.51 | 54.30 | 64.39 | 20.73 | 11.11 | 8.27 | 12.01 | NA | NA | NA | |

| Taxes Payable Current | 53.67 | 45.82 | 47.48 | 49.36 | 45.67 | 43.48 | 40.01 | 43.29 | NA | NA | NA | 19.12 | NA | NA | NA | |

| Accrued Liabilities Current | 260.39 | 216.27 | 247.95 | 236.01 | 273.83 | 231.20 | 223.32 | 180.77 | 157.92 | 182.08 | 122.28 | 65.39 | NA | NA | NA | |

| Other Liabilities Current | 16.99 | 10.93 | 9.87 | 5.83 | 11.62 | 12.33 | 10.02 | 8.75 | 35.87 | 42.01 | 27.17 | 23.69 | NA | NA | NA | |

| Contract With Customer Liability Current | 2208.53 | 2117.04 | 2037.70 | 1941.94 | 1750.86 | 1807.64 | 1747.29 | 1758.02 | 1621.19 | 1488.20 | NA | 1070.23 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | NA | NA | NA | 1290.62 | NA | NA | NA | 1329.70 | NA | NA | NA | NA | NA | NA | NA | |

| Long Term Debt Noncurrent | 1004.67 | 1004.34 | 989.31 | 988.98 | 988.66 | 988.35 | 988.03 | 987.72 | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | -5.93 | -4.30 | -2.66 | -0.99 | 0.88 | 4.50 | 6.37 | 8.11 | 12.11 | 15.35 | 18.12 | 20.01 | NA | NA | NA | |

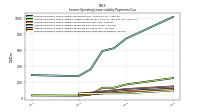

| Operating Lease Liability Noncurrent | 629.76 | 641.66 | 467.19 | 494.59 | 425.97 | 399.78 | 259.84 | 194.62 | 196.45 | 206.38 | 184.72 | 0.00 | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

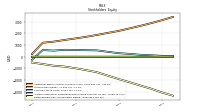

| Stockholders Equity | 125.79 | 168.50 | 247.84 | 306.03 | 423.72 | 547.09 | 561.09 | 584.82 | 593.72 | 526.69 | 573.47 | -252.39 | NA | NA | NA | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 119.85 | 164.20 | 245.18 | 305.04 | 424.59 | 551.59 | 567.46 | 592.92 | 605.83 | 542.04 | 591.59 | -232.38 | -237.45 | -204.24 | -144.07 | |

| Common Stock Value | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 | 0.02 | NA | NA | NA | |

| Additional Paid In Capital Common Stock | 2878.16 | 2641.93 | 2424.34 | 2213.60 | 2041.04 | 1867.20 | 1705.20 | 1568.64 | 1434.19 | 1293.16 | 1199.83 | 239.79 | NA | NA | NA | |

| Retained Earnings Accumulated Deficit | -2736.55 | -2459.40 | -2176.62 | -1908.31 | -1618.38 | -1320.58 | -1144.14 | -983.94 | -840.64 | -766.64 | -626.51 | -492.29 | NA | NA | NA | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -15.88 | -14.10 | 0.06 | 0.67 | 1.00 | 0.41 | -0.03 | 0.06 | 0.11 | 0.11 | 0.09 | 0.09 | NA | NA | NA | |

| Minority Interest | -5.93 | -4.30 | -2.66 | -0.99 | 0.88 | 4.50 | 6.37 | 8.11 | 12.11 | 15.35 | 18.12 | 20.01 | NA | NA | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 220.02 | 212.36 | 184.90 | 169.46 | 161.36 | 146.39 | 112.30 | 120.22 | 89.32 | 81.66 | 50.74 | 16.20 | 13.30 | 7.41 | 42.26 |

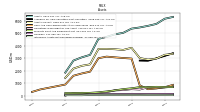

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

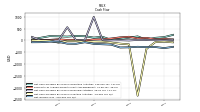

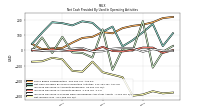

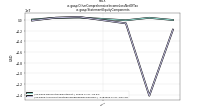

| Net Cash Provided By Used In Operating Activities | 112.70 | 28.39 | 173.78 | 119.22 | 67.14 | 26.50 | 156.44 | 122.22 | 181.17 | 191.25 | 164.47 | 179.00 | 185.21 | 116.60 | 43.53 | |

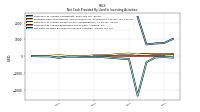

| Net Cash Provided By Used In Investing Activities | -68.72 | -357.46 | -2347.78 | -164.43 | -134.86 | -89.98 | -51.79 | -44.94 | -56.26 | -23.23 | -22.39 | -92.33 | -7.88 | -2.91 | 6.09 | |

| Net Cash Provided By Used In Financing Activities | 16.21 | 20.34 | 24.72 | 1.81 | 12.68 | 5.13 | 24.02 | 1001.56 | 20.39 | 11.67 | 564.51 | 5.50 | 3.66 | 4.71 | 151.10 |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | 112.70 | 28.39 | 173.78 | 119.22 | 67.14 | 26.50 | 156.44 | 122.22 | 181.17 | 191.25 | 164.47 | 179.00 | 185.21 | 116.60 | 43.53 | |

| Net Income Loss | -277.16 | -282.78 | -268.31 | -289.93 | -297.80 | -176.44 | -160.20 | -143.30 | -74.00 | -140.13 | -134.22 | -58.74 | -48.61 | -71.52 | -74.38 | |

| Profit Loss | -278.81 | -284.84 | -269.95 | -291.49 | -301.90 | -178.73 | -162.02 | -147.26 | -77.19 | -142.93 | -136.10 | -60.54 | -50.01 | -72.26 | -74.88 | |

| Increase Decrease In Accounts Receivable | 29.45 | -9.44 | -113.19 | 192.43 | -1.63 | 9.87 | -128.18 | 138.13 | -47.13 | -16.70 | -13.26 | 89.68 | -16.93 | 85.30 | -1.18 | |

| Increase Decrease In Accounts Payable | 2.28 | -16.73 | 18.31 | 18.63 | 2.30 | -6.87 | -3.77 | 23.60 | -2.54 | 3.10 | -0.78 | -1.68 | 7.15 | -1.66 | 0.67 | |

| Share Based Compensation | 220.02 | 212.36 | 184.90 | 169.46 | 161.36 | 146.39 | 112.30 | 120.22 | 89.32 | 81.66 | 50.74 | 16.20 | 13.30 | 7.41 | 42.26 | |

| Amortization Of Financing Costs | 0.33 | 0.33 | 0.32 | 0.32 | 0.32 | 0.31 | 0.31 | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | -68.72 | -357.46 | -2347.78 | -164.43 | -134.86 | -89.98 | -51.79 | -44.94 | -56.26 | -23.23 | -22.39 | -92.33 | -7.88 | -2.91 | 6.09 | |

| Payments To Acquire Property Plant And Equipment | 53.20 | 110.92 | 91.36 | 157.21 | 133.36 | 83.81 | 51.79 | 44.94 | 2.96 | 23.23 | 22.13 | 51.89 | 26.01 | 17.33 | 8.92 | |

| Payments To Acquire Investments | 761.15 | 702.56 | 2340.20 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | 16.21 | 20.34 | 24.72 | 1.81 | 12.68 | 5.13 | 24.02 | 1001.56 | 20.39 | 11.67 | 564.51 | 5.50 | 3.66 | 4.71 | 151.10 |

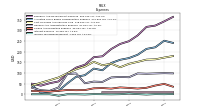

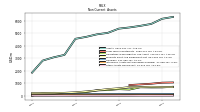

| 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

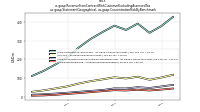

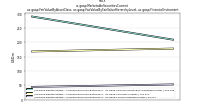

| Revenues | 713.23 | 680.77 | 655.34 | 579.00 | 517.71 | 591.21 | 537.13 | 568.77 | 509.34 | 454.10 | 386.98 | 310.01 | 251.91 | 200.39 | 161.57 | |

| Revenue From Contract With Customer Excluding Assessed Tax | 713.23 | 680.77 | 655.34 | 579.00 | 517.71 | 591.21 | 537.13 | 568.77 | 509.34 | 454.10 | 386.98 | 310.01 | 251.91 | 200.39 | 161.57 | |

| Service Life | NA | NA | NA | -15.20 | -111.00 | 40.90 | -82.50 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Sales Revenue Net | NA | NA | 655.34 | 579.00 | 517.71 | 591.21 | 537.13 | 568.77 | 509.34 | 454.10 | 386.98 | 310.01 | 251.91 | 200.39 | 161.57 | |

| Sales Revenue Net, Geographic Concentration Risk | 713.23 | 680.77 | NA | NA | 517.71 | 591.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| , Sales Revenue Net | NA | NA | 118.53 | 104.57 | 92.35 | 108.31 | 99.20 | 105.49 | 94.52 | 85.04 | 72.60 | 57.46 | 46.40 | 36.02 | 28.42 | |

| Asiapacific Including Australia And New Zealand, Sales Revenue Net | NA | NA | 65.13 | 56.69 | 48.57 | 53.01 | 45.99 | 46.57 | 37.53 | 33.05 | 28.31 | 23.51 | 19.06 | 15.26 | 12.69 | |

| Rest Of The World, Sales Revenue Net | NA | NA | 45.92 | 40.32 | 35.27 | 39.53 | 35.29 | 37.09 | 31.67 | 26.80 | 21.55 | 16.97 | 12.58 | 9.34 | 7.81 | |

| United States And Canada, Sales Revenue Net | NA | NA | 425.76 | 377.42 | 341.52 | 390.36 | 356.66 | 379.62 | 345.61 | 309.20 | 264.51 | 212.06 | 173.87 | 139.77 | 112.65 | |

| , Sales Revenue Net, Geographic Concentration Risk | 128.41 | 123.53 | NA | NA | 92.35 | 108.31 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Asiapacific Including Australia And New Zealand, Sales Revenue Net, Geographic Concentration Risk | 73.77 | 69.10 | NA | NA | 48.57 | 53.01 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Rest Of The World, Sales Revenue Net, Geographic Concentration Risk | 52.48 | 48.61 | NA | NA | 35.27 | 39.53 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| United States And Canada, Sales Revenue Net, Geographic Concentration Risk | 458.56 | 439.52 | NA | NA | 341.52 | 390.36 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Interest Income Operating | 36.44 | 34.76 | 31.08 | NA | 12.76 | 4.20 | 0.24 | NA | 0.03 | 0.03 | 0.01 | NA | NA | NA | NA |