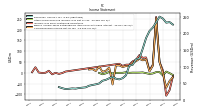

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Earnings Per Share Basic | -0.08 | 0.25 | 1.87 | 0.30 | 0.07 | 0.53 | 0.47 | 0.70 | 0.70 | 0.61 | 0.38 | 0.49 | 0.49 | 0.63 | 0.62 | -0.98 | 0.43 | 0.27 | 0.25 | 0.90 | 0.30 | 0.53 | 0.48 | 0.56 | 0.38 | 0.37 | 0.34 | 0.29 | 1.85 | 0.47 | -0.13 | -0.38 | -0.21 | -0.76 | 0.76 | 0.05 | 0.02 | 0.14 | 2.91 | 0.28 | 1.01 | 0.47 | -0.85 | 0.32 | 0.90 | |

| Earnings Per Share Diluted | -0.08 | 0.25 | 1.76 | 0.29 | 0.10 | 0.50 | 0.45 | 0.66 | 0.71 | 0.60 | 0.38 | 0.49 | 0.49 | 0.63 | 0.62 | -0.98 | 0.43 | 0.27 | 0.25 | 0.90 | 0.30 | 0.53 | 0.48 | 0.56 | 0.38 | 0.37 | 0.34 | 0.29 | 1.85 | 0.46 | -0.13 | -0.38 | -0.21 | -0.76 | 0.65 | 0.05 | 0.02 | 0.14 | 2.47 | 0.28 | 0.98 | 0.47 | -0.85 | 0.32 | 0.90 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

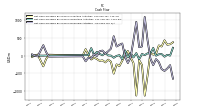

| Interest And Fee Income Loans And Leases | 246.82 | 244.80 | 226.99 | 211.97 | 197.57 | 175.92 | 143.32 | 117.70 | 88.83 | 78.39 | 66.96 | 60.62 | 60.67 | 57.17 | 59.38 | 66.44 | 61.27 | 56.56 | 54.24 | 46.20 | 43.68 | 41.96 | 39.46 | 34.87 | 33.97 | 32.33 | 30.71 | 31.73 | 30.60 | 30.96 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Realized Investment Gains Losses | 15.15 | 14.40 | 23.88 | 11.57 | 3.53 | 21.12 | 21.11 | 8.01 | 19.64 | 23.21 | 17.18 | 8.85 | 9.79 | 7.51 | 7.44 | 7.17 | 8.04 | 7.38 | 6.25 | 7.28 | 10.61 | 6.95 | 8.62 | 12.23 | 6.18 | 5.70 | 4.49 | 20.26 | 12.28 | 2.45 | 1.07 | 0.19 | NA | NA | NA | 0.16 | 5.24 | 0.45 | 0.00 | 0.07 | 0.31 | -9.11 | -0.25 | NA | 0.92 | |

| Interest Expense | 191.93 | 191.61 | 172.53 | 160.39 | 143.44 | 115.50 | 80.83 | 61.02 | 57.25 | 50.14 | 55.41 | 50.76 | 41.32 | 43.82 | 43.41 | 46.93 | 40.96 | 39.39 | 35.75 | 35.77 | 31.24 | 28.93 | 26.41 | 22.67 | 21.07 | 19.91 | 17.23 | 16.44 | 45.75 | 3.11 | 4.11 | 4.80 | 4.66 | 4.71 | 4.73 | 4.75 | 4.45 | 4.49 | 4.42 | 3.90 | 3.09 | 2.33 | 1.16 | 0.51 | 0.34 | |

| Interest Income Expense Net | 52.84 | 58.98 | 60.35 | 57.18 | 63.63 | 70.53 | 72.84 | 63.39 | 64.69 | 55.00 | 47.63 | 22.61 | 23.49 | 17.25 | 19.80 | 22.62 | 23.45 | 20.33 | 21.28 | 12.98 | 14.96 | 15.36 | 15.45 | 14.48 | 15.07 | 15.13 | 16.02 | 17.44 | 74.35 | -0.08 | 1.07 | 3.91 | 4.24 | 4.94 | 4.83 | 4.94 | 5.82 | 6.51 | 6.41 | 5.59 | 5.68 | 5.94 | 4.78 | 2.92 | 1.84 | |

| Interest Paid Net | 189.12 | 160.38 | 166.70 | 144.97 | 136.60 | 93.22 | 75.56 | 49.85 | 47.27 | 47.73 | 43.56 | 47.54 | 32.76 | 44.10 | 34.82 | 44.58 | 31.35 | 36.92 | 23.45 | 34.47 | 25.69 | 27.68 | 19.45 | 23.14 | 15.35 | 19.75 | 12.38 | 14.63 | 16.02 | 12.61 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Income Tax Expense Benefit | -2.38 | 4.03 | 5.14 | 0.39 | -3.21 | 4.78 | 10.32 | 17.85 | 6.87 | 6.54 | 7.00 | 8.68 | 4.27 | 6.55 | 5.50 | -7.94 | -1.95 | -2.65 | -2.96 | -3.00 | -2.74 | 0.90 | 0.67 | 2.56 | 0.08 | -0.34 | 1.07 | 1.03 | 9.40 | 1.80 | 0.06 | -1.60 | 1.91 | -0.25 | 2.90 | -0.15 | -0.85 | 0.00 | 0.00 | 0.00 | NA | NA | NA | NA | NA | |

| Income Taxes Paid Net | 1.47 | -0.11 | 0.51 | 0.13 | 2.03 | 13.28 | 13.76 | 0.10 | 1.14 | 11.82 | NA | NA | -2.60 | NA | NA | NA | -0.05 | 0.14 | 0.38 | -3.12 | -0.16 | 0.00 | 0.26 | 0.80 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Profit Loss | 10.88 | 47.18 | 253.37 | 36.98 | 13.68 | 66.25 | 58.97 | 64.26 | 53.59 | 46.53 | 30.90 | 28.95 | 27.56 | 35.36 | 34.66 | -51.52 | 20.93 | 12.43 | 11.24 | 30.45 | 9.49 | 17.57 | 15.88 | 18.52 | 12.73 | 12.37 | 11.15 | 9.56 | 26.07 | 4.18 | -1.12 | -3.38 | -1.83 | -6.71 | 6.71 | 0.42 | 0.22 | 1.28 | 25.87 | 2.48 | 9.00 | 4.15 | -7.57 | 1.97 | 2.65 | |

| Other Comprehensive Income Loss Cash Flow Hedge Gain Loss After Reclassification And Tax | -13.85 | 4.63 | 2.49 | -3.81 | -3.02 | 0.32 | 0.35 | 0.21 | 0.22 | 0.22 | 0.12 | 1.98 | 0.95 | 0.67 | -0.02 | -3.13 | 3.89 | -2.61 | -6.58 | -0.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Other Comprehensive Income Loss Net Of Tax | -12.09 | 3.39 | 3.17 | -3.03 | -4.93 | -1.71 | 1.92 | 0.98 | 0.74 | 0.90 | -0.12 | 2.97 | -0.03 | -0.04 | -0.35 | -3.43 | 4.18 | -2.61 | -6.58 | -0.42 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Comprehensive Income Net Of Tax | -2.25 | 49.02 | 252.01 | 32.16 | 6.51 | 61.54 | 57.98 | 64.46 | 53.95 | 46.66 | 30.31 | 31.19 | 26.88 | 34.52 | 33.51 | -53.81 | 24.50 | 9.55 | 4.59 | 29.06 | 8.26 | 16.93 | 15.30 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Preferred Stock Dividends Income Statement Impact | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 3.22 | 0.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 0.02 | 0.00 | |

| Net Income Loss Available To Common Stockholders Basic | 7.76 | 43.66 | 246.88 | 33.14 | 9.46 | 61.23 | 54.09 | 61.49 | 51.22 | 43.78 | 27.24 | 28.01 | 26.91 | 34.56 | 33.85 | -50.45 | NA | NA | NA | NA | 9.12 | 16.88 | 15.24 | 17.79 | 12.07 | 11.83 | 10.48 | 8.85 | 49.14 | 4.11 | -1.04 | -3.04 | -1.65 | -6.04 | 6.05 | 0.37 | 0.19 | 1.15 | 23.17 | 2.22 | 8.06 | 3.72 | -6.78 | 1.66 | 1.83 | |

| Interest Income Expense After Provision For Loan Loss | 46.15 | 71.13 | 40.92 | 63.91 | 29.77 | 67.10 | 77.23 | 61.85 | 63.73 | 53.42 | 42.12 | 22.62 | 23.75 | 21.48 | 20.39 | -17.18 | 22.32 | 19.64 | 19.93 | 12.46 | 13.83 | 14.56 | 15.85 | 14.32 | 14.56 | 14.66 | 15.86 | 16.21 | 13.88 | 17.30 | 18.86 | 21.38 | 21.65 | 21.93 | 18.64 | 19.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Noninterest Expense | 35.42 | 79.51 | 86.59 | 70.64 | 61.72 | 74.60 | 58.72 | 67.54 | 69.73 | 88.82 | 80.08 | 73.95 | 75.33 | 87.47 | 101.16 | 64.79 | 48.76 | 49.84 | 44.60 | 41.28 | 29.21 | 30.52 | 32.09 | 33.69 | 39.02 | 29.73 | 27.31 | 25.66 | 25.84 | 14.81 | 16.11 | 14.38 | 12.10 | 12.86 | 13.74 | 12.16 | 8.24 | 3.42 | 3.23 | 4.10 | 2.72 | 2.97 | 1.82 | 2.10 | 2.19 | |

| Noninterest Income | 0.60 | 59.59 | 304.18 | 44.10 | 42.42 | 78.53 | 50.77 | 87.81 | 66.45 | 88.47 | 75.86 | 88.97 | 83.41 | 107.91 | 120.93 | 22.52 | 45.42 | 39.98 | 32.96 | 56.27 | 22.12 | 18.98 | 19.72 | 25.22 | 37.27 | 18.72 | 18.20 | 15.79 | 6.10 | 16.84 | 11.46 | 5.66 | 13.13 | 8.94 | 17.43 | 9.38 | 4.73 | -1.81 | 22.69 | 0.99 | 6.03 | 1.17 | -10.53 | 1.16 | 2.99 |

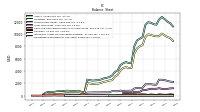

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Assets | 12441.22 | 12799.43 | 12383.05 | 11537.46 | 11620.98 | 11858.21 | 11937.32 | 11476.24 | 9534.03 | 9264.40 | 8976.89 | 8016.95 | 5372.10 | 5317.51 | 5460.93 | 5270.05 | 4977.02 | 4123.02 | 3840.32 | 3279.01 | 3036.84 | 2900.76 | 2812.98 | 2640.95 | 2523.50 | 2503.14 | 2446.92 | 2527.52 | 2605.27 | 588.63 | 565.35 | 802.67 | 775.14 | 779.10 | 782.65 | 813.39 | 792.40 | 721.62 | 713.16 | 698.22 | 620.08 | 559.55 | 607.86 | 491.74 | 201.65 | |

| Liabilities | 9794.45 | 10099.65 | 9671.62 | 9648.77 | 9722.38 | 9880.99 | 9966.89 | 9509.15 | 8245.07 | 8026.73 | 7680.15 | 6818.71 | 4537.89 | 4493.34 | 4647.89 | 4494.49 | 4132.23 | 3384.01 | 3092.92 | 2518.12 | 2472.77 | 2331.72 | 2248.42 | 2079.20 | 1968.04 | 1948.09 | 1894.11 | 1977.66 | 2053.16 | 421.84 | 399.19 | 631.83 | 597.36 | 595.93 | 589.20 | 623.15 | 599.01 | 524.90 | 514.16 | 521.52 | 442.31 | 382.32 | 430.34 | 300.48 | 136.51 | |

| Liabilities And Stockholders Equity | 12441.22 | 12799.43 | 12383.05 | 11537.46 | 11620.98 | 11858.21 | 11937.32 | 11476.24 | 9534.03 | 9264.40 | 8976.89 | 8016.95 | 5372.10 | 5317.51 | 5460.93 | 5270.05 | 4977.02 | 4123.02 | 3840.32 | 3279.01 | 3036.84 | 2900.76 | 2812.98 | 2640.95 | 2523.50 | 2503.14 | 2446.92 | 2527.52 | 2605.27 | 588.63 | 565.35 | 802.67 | 775.14 | 779.10 | 782.65 | 813.39 | 792.40 | 721.62 | 713.16 | 698.22 | 620.08 | 559.55 | 607.86 | 491.74 | 201.65 | |

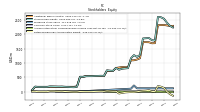

| Stockholders Equity | 2539.94 | 2592.11 | 2603.10 | 1780.13 | 1791.09 | 1866.98 | 1859.45 | 1851.44 | 1276.10 | 1210.18 | 1269.53 | 1159.69 | 815.40 | 805.27 | 794.60 | 757.93 | 825.41 | 719.75 | 728.03 | 741.15 | 544.83 | 549.57 | 545.33 | 542.02 | 536.07 | 535.72 | 533.42 | 511.01 | 513.10 | 165.51 | 148.77 | 153.00 | 159.22 | 164.06 | 173.29 | 170.42 | 173.24 | 176.23 | 178.27 | 158.29 | 159.25 | 158.76 | 159.03 | 171.34 | 45.04 |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash And Cash Equivalents At Carrying Value | 138.53 | 181.91 | 227.50 | 111.19 | 163.04 | 208.04 | 127.94 | 211.37 | 229.53 | 209.77 | 200.72 | 308.43 | 138.97 | 149.85 | 257.02 | 122.27 | 67.93 | 52.73 | 41.92 | 47.60 | 54.41 | 47.84 | 105.83 | 86.77 | 63.42 | 70.59 | 63.93 | 40.00 | 59.57 | 184.95 | 188.54 | 66.60 | 20.79 | 29.37 | 28.64 | 38.02 | 33.79 | 25.78 | 27.62 | 30.09 | 57.06 | 21.47 | 21.17 | 12.81 | 19.06 | |

| Cash Cash Equivalents Restricted Cash And Restricted Cash Equivalents | 262.51 | 311.99 | 388.95 | 246.70 | 297.03 | 319.30 | 245.06 | 300.08 | 323.33 | 284.82 | 272.03 | 372.03 | 200.48 | 223.75 | 349.38 | 223.99 | 127.98 | 105.14 | 102.04 | 120.87 | 94.97 | 66.71 | 120.94 | 109.20 | 75.09 | 86.65 | 81.49 | NA | 79.76 | NA | NA | NA | 57.71 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amortization Of Intangible Assets | 0.40 | 0.40 | 0.40 | 0.60 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.40 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.30 | 0.20 | 0.10 | 0.10 | 0.10 | NA | NA | NA | NA | NA | NA | NA | NA | -0.49 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.20 | 0.13 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Goodwill | 38.53 | 37.82 | 37.82 | 37.82 | 37.82 | 37.56 | 34.17 | 32.70 | 31.47 | 31.39 | 18.58 | 17.82 | 11.21 | 11.21 | 11.21 | 11.21 | 11.21 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 14.18 | 14.18 | 14.18 | 14.18 | 14.18 | 14.18 | 16.13 | 16.51 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Intangible Assets Net Excluding Goodwill | 17.75 | 17.94 | 17.52 | 16.87 | 16.31 | 13.62 | 14.06 | 14.44 | 14.84 | 15.26 | 6.34 | 6.66 | 6.99 | 7.32 | 7.65 | 7.98 | 8.31 | 2.68 | 2.76 | 2.84 | 2.92 | 3.00 | 3.09 | 3.18 | 3.26 | 3.36 | 3.45 | 3.54 | 3.64 | 4.29 | 4.49 | 4.68 | 4.88 | 5.08 | 5.27 | 5.47 | 5.67 | NA | NA | NA | NA | NA | NA | NA | NA | |

| Finite Lived Intangible Assets Net | 14.25 | 14.44 | 14.02 | 13.37 | 12.81 | 10.12 | 10.56 | 10.94 | 11.34 | 11.76 | 5.34 | 5.66 | 5.99 | 6.32 | 6.65 | 6.98 | 7.31 | NA | NA | NA | 1.92 | NA | NA | NA | 2.26 | NA | NA | NA | 3.64 | NA | NA | NA | 1.00 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Held To Maturity Securities Fair Value | 3.45 | 3.45 | 3.45 | 3.31 | 3.31 | NA | 9.60 | 17.05 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long Term Debt | 1110.04 | 1108.51 | 1221.85 | 1122.11 | 1120.42 | 1119.27 | 1021.52 | 902.10 | 897.10 | 626.86 | 626.18 | 625.47 | 442.78 | 442.08 | 441.45 | 440.77 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Deferred Income Tax Liabilities Net | 32.98 | 30.89 | 30.89 | 30.89 | 30.89 | 11.99 | 11.99 | 11.99 | 11.99 | 16.84 | 16.84 | 16.84 | 16.84 | 18.76 | 18.76 | 18.76 | 18.76 | 20.09 | 20.09 | 20.09 | 19.97 | 18.51 | 18.51 | 18.51 | 18.51 | NA | 0.12 | 0.63 | 0.63 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 98.46 | 99.30 | 99.96 | 100.20 | 99.15 | 101.88 | 102.61 | 107.29 | 4.49 | 19.12 | 18.86 | 19.06 | 18.81 | 18.90 | 18.45 | 17.63 | 19.37 | 19.26 | 19.38 | 19.74 | 19.24 | 19.47 | 19.23 | 19.74 | 19.39 | 19.34 | 19.39 | 38.85 | 39.01 | 1.28 | 17.39 | 17.85 | 18.55 | 19.11 | 20.15 | 19.82 | 20.15 | 20.49 | 20.73 | 18.41 | 18.52 | 18.46 | 18.49 | 19.93 | 20.10 |

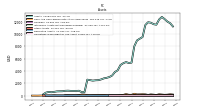

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stockholders Equity | 2539.94 | 2592.11 | 2603.10 | 1780.13 | 1791.09 | 1866.98 | 1859.45 | 1851.44 | 1276.10 | 1210.18 | 1269.53 | 1159.69 | 815.40 | 805.27 | 794.60 | 757.93 | 825.41 | 719.75 | 728.03 | 741.15 | 544.83 | 549.57 | 545.33 | 542.02 | 536.07 | 535.72 | 533.42 | 511.01 | 513.10 | 165.51 | 148.77 | 153.00 | 159.22 | 164.06 | 173.29 | 170.42 | 173.24 | 176.23 | 178.27 | 158.29 | 159.25 | 158.76 | 159.03 | 171.34 | 45.04 | |

| Stockholders Equity Including Portion Attributable To Noncontrolling Interest | 2638.40 | 2691.42 | 2703.06 | 1880.33 | 1890.23 | 1968.86 | 1962.07 | 1958.73 | 1280.60 | 1229.31 | 1288.38 | 1178.75 | 834.21 | 824.17 | 813.05 | 775.56 | 844.78 | 739.01 | 747.41 | 760.89 | 564.08 | 569.04 | 564.56 | 561.76 | 555.47 | 555.05 | 552.81 | 549.86 | 552.10 | 166.79 | 166.16 | 170.84 | 177.78 | 183.17 | 193.44 | 190.24 | 193.38 | 196.73 | 199.01 | 176.69 | 177.77 | 177.22 | 177.52 | 191.27 | 65.14 | |

| Common Stock Value | 0.02 | 0.02 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Additional Paid In Capital | 2321.99 | 2318.11 | 2313.85 | 1687.63 | 1684.07 | 1720.02 | 1723.58 | 1723.10 | 1161.85 | 1115.47 | 1090.16 | 1088.51 | 849.54 | 846.96 | 854.22 | 837.06 | 822.84 | 720.82 | 720.81 | 720.68 | 540.48 | 540.57 | 539.46 | 539.46 | 539.46 | 539.66 | 537.44 | 513.66 | 513.29 | 180.37 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.21 | 164.40 | 39.76 | |

| Retained Earnings Accumulated Deficit | 124.41 | 168.54 | 187.14 | -6.53 | 4.99 | 40.08 | 27.30 | 21.66 | 8.60 | -10.39 | -23.11 | -20.03 | -24.20 | -31.78 | -49.76 | -69.61 | 8.75 | 9.17 | 14.91 | 21.79 | 5.27 | 8.99 | 5.87 | 2.56 | -3.38 | -3.95 | -4.03 | -2.65 | -0.20 | -14.86 | -15.44 | -11.21 | -4.98 | -0.15 | 9.08 | 6.22 | 9.03 | 12.02 | 14.06 | -5.92 | -4.96 | -5.45 | -5.18 | 6.94 | 5.28 | |

| Accumulated Other Comprehensive Income Loss Net Of Tax | -17.86 | -5.93 | -9.28 | -12.35 | -9.37 | -4.50 | -2.81 | -4.70 | -5.73 | -6.28 | -7.16 | -7.04 | -9.95 | -9.92 | -9.88 | -9.54 | -6.18 | -10.25 | -7.70 | -1.33 | -0.92 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest | 98.46 | 99.30 | 99.96 | 100.20 | 99.15 | 101.88 | 102.61 | 107.29 | 4.49 | 19.12 | 18.86 | 19.06 | 18.81 | 18.90 | 18.45 | 17.63 | 19.37 | 19.26 | 19.38 | 19.74 | 19.24 | 19.47 | 19.23 | 19.74 | 19.39 | 19.34 | 19.39 | 38.85 | 39.01 | 1.28 | 17.39 | 17.85 | 18.55 | 19.11 | 20.15 | 19.82 | 20.15 | 20.49 | 20.73 | 18.41 | 18.52 | 18.46 | 18.49 | 19.93 | 20.10 | |

| Stock Issued During Period Value New Issues | 0.00 | 0.00 | 0.00 | 0.12 | 0.00 | 0.00 | 0.37 | 124.15 | 29.95 | 25.36 | 111.38 | NA | 0.00 | 0.00 | 0.00 | 13.41 | NA | NA | NA | NA | 0.00 | 0.09 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.00 | 0.00 | 118.86 | NA | |

| Adjustments To Additional Paid In Capital Sharebased Compensation Requisite Service Period Recognition Value | 3.37 | 3.62 | 3.69 | 4.95 | 1.99 | 0.17 | 0.26 | 3.65 | 1.97 | 0.11 | 1.82 | 0.52 | 3.96 | 0.32 | 0.23 | 0.89 | 0.35 | 0.10 | 0.29 | 0.73 | -0.05 | 0.08 | 0.21 | 0.08 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Minority Interest Decrease From Distributions To Noncontrolling Interest Holders | 0.02 | 0.07 | 0.00 | 0.10 | 4.17 | 1.39 | 6.84 | 1.92 | 0.08 | 0.00 | 0.15 | NA | 0.20 | 0.00 | 0.05 | NA | NA | NA | -0.01 | 0.02 | NA | NA | 0.06 | NA | NA | NA | NA | NA | NA | 0.02 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.37 | 0.88 | 0.46 | NA | NA | NA |

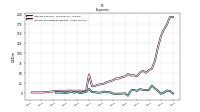

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

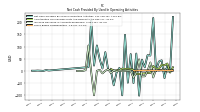

| Net Cash Provided By Used In Operating Activities | -29.65 | 43.54 | 38.15 | -0.91 | 216.99 | 62.97 | 64.44 | 14.74 | 46.13 | -101.50 | 71.13 | -50.20 | 69.15 | -48.29 | 148.04 | -100.01 | 12.47 | -6.86 | -59.06 | 1.06 | 5.09 | 76.98 | 10.00 | 48.22 | 104.28 | 21.73 | 211.02 | 15.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.68 | 3.41 | 0.13 | NA | |

| Net Cash Provided By Used In Investing Activities | 429.18 | 256.64 | 285.72 | 47.90 | 27.05 | 90.71 | -551.23 | -1122.96 | -265.83 | -121.88 | -1120.16 | -210.54 | -51.75 | 129.69 | 7.09 | -144.47 | -292.55 | -245.64 | -504.17 | -170.44 | -113.28 | -189.31 | -131.74 | -146.43 | -94.59 | -56.25 | -108.26 | 23.38 | 181.18 | 3.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 25.68 | -94.27 | -299.47 | NA | |

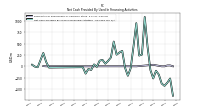

| Net Cash Provided By Used In Financing Activities | -429.01 | -377.14 | -181.62 | -97.31 | -266.31 | -79.44 | 431.76 | 1084.98 | 258.21 | 236.16 | 949.02 | 432.29 | -40.66 | -207.04 | -29.73 | 340.49 | 302.92 | 255.60 | 544.40 | 195.28 | 120.58 | 58.09 | 141.95 | 123.86 | -10.35 | 42.47 | -79.70 | -58.82 | -159.58 | -18.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -27.07 | 99.23 | 293.08 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Operating Activities | -29.65 | 43.54 | 38.15 | -0.91 | 216.99 | 62.97 | 64.44 | 14.74 | 46.13 | -101.50 | 71.13 | -50.20 | 69.15 | -48.29 | 148.04 | -100.01 | 12.47 | -6.86 | -59.06 | 1.06 | 5.09 | 76.98 | 10.00 | 48.22 | 104.28 | 21.73 | 211.02 | 15.46 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 1.68 | 3.41 | 0.13 | NA | |

| Profit Loss | 10.88 | 47.18 | 253.37 | 36.98 | 13.68 | 66.25 | 58.97 | 64.26 | 53.59 | 46.53 | 30.90 | 28.95 | 27.56 | 35.36 | 34.66 | -51.52 | 20.93 | 12.43 | 11.24 | 30.45 | 9.49 | 17.57 | 15.88 | 18.52 | 12.73 | 12.37 | 11.15 | 9.56 | 26.07 | 4.18 | -1.12 | -3.38 | -1.83 | -6.71 | 6.71 | 0.42 | 0.22 | 1.28 | 25.87 | 2.48 | 9.00 | 4.15 | -7.57 | 1.97 | 2.65 | |

| Increase Decrease In Accounts Receivable | 9.11 | 4.16 | 2.15 | 5.90 | -26.86 | 34.46 | 0.18 | -21.98 | -22.29 | 47.28 | -7.24 | -27.25 | 0.12 | 0.83 | -0.27 | -0.67 | 0.63 | -2.06 | 2.04 | -8.17 | 7.36 | 0.55 | -10.08 | 4.31 | 0.00 | -99.81 | -4.66 | 104.00 | 3.13 | 0.00 | -0.61 | -0.19 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Share Based Compensation | 1.36 | 2.30 | 2.00 | 1.85 | 1.34 | 2.00 | 2.10 | 1.96 | 1.71 | 1.80 | 0.77 | 1.58 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Investing Activities | 429.18 | 256.64 | 285.72 | 47.90 | 27.05 | 90.71 | -551.23 | -1122.96 | -265.83 | -121.88 | -1120.16 | -210.54 | -51.75 | 129.69 | 7.09 | -144.47 | -292.55 | -245.64 | -504.17 | -170.44 | -113.28 | -189.31 | -131.74 | -146.43 | -94.59 | -56.25 | -108.26 | 23.38 | 181.18 | 3.74 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 25.68 | -94.27 | -299.47 | NA |

| 2023-12-31 | 2023-09-30 | 2023-06-30 | 2023-03-31 | 2022-12-31 | 2022-09-30 | 2022-06-30 | 2022-03-31 | 2021-12-31 | 2021-09-30 | 2021-06-30 | 2021-03-31 | 2020-12-31 | 2020-09-30 | 2020-06-30 | 2020-03-31 | 2019-12-31 | 2019-09-30 | 2019-06-30 | 2019-03-31 | 2018-12-31 | 2018-09-30 | 2018-06-30 | 2018-03-31 | 2017-12-31 | 2017-09-30 | 2017-06-30 | 2017-03-31 | 2016-12-31 | 2016-09-30 | 2016-06-30 | 2016-03-31 | 2015-12-31 | 2015-09-30 | 2015-06-30 | 2015-03-31 | 2014-12-31 | 2014-09-30 | 2014-06-30 | 2014-03-31 | 2013-12-31 | 2013-09-30 | 2013-06-30 | 2013-03-31 | 2012-12-31 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Cash Provided By Used In Financing Activities | -429.01 | -377.14 | -181.62 | -97.31 | -266.31 | -79.44 | 431.76 | 1084.98 | 258.21 | 236.16 | 949.02 | 432.29 | -40.66 | -207.04 | -29.73 | 340.49 | 302.92 | 255.60 | 544.40 | 195.28 | 120.58 | 58.09 | 141.95 | 123.86 | -10.35 | 42.47 | -79.70 | -58.82 | -159.58 | -18.64 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | -27.07 | 99.23 | 293.08 | NA | |

| Payments Of Dividends Common Stock | 64.78 | 26.38 | 76.76 | 47.18 | 51.14 | 51.18 | 51.16 | 34.35 | 33.56 | 33.97 | 9.70 | 34.70 | 16.93 | 14.52 | 4.12 | 21.30 | 18.29 | 18.29 | 13.40 | 13.35 | 13.35 | 13.34 | 12.34 | 12.29 | 12.29 | 12.29 | 12.18 | 11.51 | 10.10 | 12.81 | 10.59 | 13.37 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | |

| Payments For Repurchase Of Common Stock | 0.00 | 0.01 | NA | NA | 33.15 | NA | NA | NA | NA | NA | 0.00 | 0.99 | 1.28 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA | 0.00 | 0.59 | 5.16 | NA |